Wood Preservative Chemicals Market Size is Expected to Reach USD 3.2 Billion by 2034, Fueled by Growing Furniture Demand with 3.4% CAGR: Transparency Market Research

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 16, 2024 (GLOBE NEWSWIRE) — The wood preservative chemicals market (목재 방부제 시장) was valued at US$ 2.1 billion in 2023. According to estimates, the market will grow at a CAGR of 3.4% from 2024 to 2034, reaching US$ 3.2 billion by then.

The demand for wood preservatives to shield wooden structures from rot, decay, and insect damage is rising as construction activities worldwide, especially in emerging nations, expand. Treated wood products are consumed in large quantities by the furniture industry. Due to the rising demand for furniture, particularly in emerging economies, effective wood preservatives will be increasingly needed to prolong its life and durability.

Government organizations like the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) in the United States control the chemicals used as wood preservatives. Various organizations assess the safety of preservatives in commercial products and their potential environmental effects. The approval process includes evaluating any environmental and public health risks.

Download Sample PDF Brochure: https://www.transparencymarketresearch.com/wood-preservation-chemicals.html

Key Findings of the Market Report

- Based on the product, chromated arsenicals are expected to increase demand for wood preservative chemicals.

- In terms of technology, the waterborne segment will drive wood preservative chemical demand.

- Construction activities increase, leading to an increase in wood product demand.

- In terms of revenue, the Asia Pacific region had the highest growth rate in 2023

Global Wood Preservative Chemicals Market: Growth Drivers

- As people become more aware of the environmental effects of traditional wood preservatives, there is a movement toward sustainable and environmentally friendly alternatives. Thus, wood preservatives that are more environmentally friendly are developed through research and development by the industry.

- Several governments worldwide are restricting the use of wood preservatives to reduce pollutants and health hazards derived from harmful chemicals. Complying with these rules often requires adopting safer wood preservation chemicals.

- Technological developments continue to lead to the creation of increasingly potent and effective wood preservation compounds. These developments could lead to better delivery systems, application techniques, and formulations, raising the general effectiveness of wood treatment products.

- Maintaining and restoring wood structures takes a lot of preservatives, and there is an increasing focus on sustainable practices and preserving existing structures. These goods contribute to the lifespan extension of old wooden constructions, like bridges and ancient buildings.

Global Wood Preservative Chemicals Market: Regional Landscape

- Asia Pacific governments are investing heavily in constructing public buildings, utilities, and transportation networks. To maintain the structural integrity and long life of wooden structures, such as utility poles, railroad sleepers, and bridges, wood preservative chemicals are required.

- China, Vietnam, and Indonesia are major producers and exporters of furniture and woodworking products in this region. As these sectors expand, there is an ever-increasing need for wood preservatives to prevent rot, pests, and fungal growth.

- The Asia Pacific wood preservative industry is impacted by harsher laws governing the use of dangerous chemicals and growing environmental consciousness. Research and development are motivated by the need for environmentally friendly and low-toxic preservatives.

- Due to its technological inventiveness, the area is still researching and developing wood preservation technology. New developments in wood protection, like nano-coatings, micronized formulations, and green chemical techniques, provide more efficient and eco-friendly options.

- As many Asian Pacific nations strive to preserve biodiversity and natural resources, sustainable forestry techniques are becoming increasingly important. In addition to extending the life of harvested wood, preservatives reduce the need for new logging and contribute to sustainable forest management.

Global Wood Preservative Chemicals Market: Competitive Landscape

Recent trends in the wood preservative chemicals market include advancements in the construction industry and eco-friendly preservatives. Partnerships and acquisitions are two of the most common ways for industry leaders to expand their businesses.

They are investing in producing sustainable products as part of their commitment to meeting sustainability standards. Wood preservative chemical manufacturers promote their brands in global markets by implementing cutting-edge marketing strategies.

Key Market Players

- BASF SE

- Viance

- Koppers Inc.

- Lonza

- Lanxess

- Troy Group, Inc.

- Safeguard Europe Limited

- Rütgers Organics GmbH

- Rio Tinto

- Kurt Obermeier GmbH

- Janssen PMP

Key Developments

- In January 2022, Versalis (Eni) and Novamont partnered with specialty chemical company LANXESS in a joint venture to develop sustainable preservatives based on renewable raw materials. LANXESS’ Matrìca plant at Porto Torres provides the raw materials for the new series of industrial preservatives LANXESS seeks to manufacture using vegetable oils.

- In April 2024, A wholly owned subsidiary of Koppers Holdings, Koppers Utility and Industrial Products Inc. (UIP), completed the acquisition of Brown Wood Preserving Company’s assets. A cash payment of approximately $100 million was made for Brown Wood and certain affiliated companies (Brown Wood). Koppers UIP will take over the pressure-treated wood utility pole company Brown Wood.

Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=1113<ype=S

Global Wood Preservative Chemicals Market: Segmentation

Product

- Chromated Arsenicals

- Creosote

- Copper-based

- Alkaline Copper Quaternary

- Ammoniacal Copper Arsenite

- Copper Azole

- Copper Napthenate

- Others

Technology

- Waterborne

- Oil Borne

- Organic Solvent Borne

- Others

End User

- Furniture & Decking

- Marine

- Construction

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Have a Look at More Valuable Insights of Chemicals And Materials

- Vinyl Sulfone Market: TMR projections state that vinyl sulfone market will expand at a growth rate of CAGR of 3.3% during the forecast period from 2022 to 2031. The global vinyl sulfone market (비닐술폰 시장) is extrapolated to reach US$ 2.8 Bn by the end of 2031 from US$ 2.0 Bn in 2021.

- Sonochemical Coatings Market: The sonochemical coatings market (초음파화학 코팅 시장) is poised to witness a 13.5% CAGR from 2022 to 2031. According to a recent market study, the global market for sonochemical coatings is predicted to reach US$ 6 billion by 2031.

- North America Hydraulic Fluid Connectors Market : The North America hydraulic fluid connectors market is estimated to grow at a CAGR of 6.3% from 2024 to 2034 and reach US$ 1.7 Billion by the end of 2034.

- ASEAN Energy Management Digital Solutions Market – The ASEAN energy management digital solutions market (에너지 관리 디지털 솔루션 시장) is estimated to advance at a CAGR of 15.9% from 2023 to 2031 and reach US$ 3.1 Billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock Warns on Bonds, Saying Fed Rate Bets Are Overdone

(Bloomberg) — BlackRock Inc. strategists turned underweight short-dated US Treasuries from overweight, saying the extent of Federal Reserve interest-rate cuts the market is betting on is unlikely to pan out.

Most Read from Bloomberg

Wei Li, the firm’s chief investment strategist, said speculation that the Fed waited too long to ease and will now be forced to cut at an accelerated pace to shore up the economy is misplaced. In an interview with Bloomberg TV, she said she expects the Fed will lower rates by 25 basis points on Wednesday.

“We think markets are a bit excessive in pricing the depth of the rate-cut cycle,” Li said. “The cutting cycle is starting, but maybe not as deep as markets seem to be pricing.”

The yield on the policy-sensitive two-year note traded near the lowest since September 2022 on Monday — a rally that doesn’t tempt Li.

The strategist favors Treasuries with intermediate maturities known as the belly of the curve, in the five- to 10-year range, because of the relatively high yields.

Swaps tied to the Fed’s decision on Wednesday are now pricing in more than a 50% chance of a half-point cut, after virtually discounting the possibility entirely last week. Investors expect around 118 basis points of cuts by the end of December. By the end of 2025 they see the benchmark below 3%.

Ebbing inflation and softening employment data have reignited the debate over whether the central bank should ease rates gradually or “go big” — the preferred option of former New York Fed President and Bloomberg Opinion columnist Bill Dudley.

While Li acknowledges recession risks may have increased, she said her base case is still for the US economy to slow down rather than to contract. At the same time, policymakers remain wary of “persistent” inflation in some parts of the economy, she said.

“We are talking about job creation averaging 164K in the last six months,” she said. “This is still a pretty robust pace.”

(Adds Dudley view in 7th paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Monarch Private Capital and Invenergy Close Nearly $170 Million Tax Equity Financing for Samson Solar Energy Center II

ATLANTA, Sept. 16, 2024 (GLOBE NEWSWIRE) — Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of tax credit projects, and Invenergy, a leading developer, owner and operator of sustainable energy solutions, are pleased to announce the successful closing of nearly $170 million in tax equity financing for the Samson Solar Energy Center II project, located in Lamar County, Texas. The project, developed by Invenergy, will bring significant economic benefits to the region, including construction jobs, substantial landowner payments, and more than $27 million in local taxes and payments to the county and local school district throughout the life of the project.

The Samson Solar Energy Center II is a 200-megawatt (MW) solar power facility slated to begin commercial operations later this year. Once completed, Samson II will generate enough clean electricity to power over 40,000 homes. The project is part of Invenergy’s Samson Solar Energy Center, a five-phase, 1,310-MW development that is the largest solar energy center in Texas. Collectively, the Samson Solar Energy Center will produce enough energy to power 300,000 homes and help advance Texas’s leadership in clean energy.

“We’re proud to have worked with Invenergy on the tax equity solution for the Samson Solar Energy Center II,” said Bryan Didier, Partner & Managing Director of Renewable Energy at Monarch Private Capital. “This investment is another important milestone for our team, and we’re excited to partner with Invenergy on a project that is providing skilled jobs and clean energy to a community that has experienced economic hardship.”

Brian Bortman, Senior Vice President of Finance & Capital Markets at Invenergy, added, “The tax equity financing of Samson II marks another significant milestone for our flagship project. This innovative transaction is a testament to Invenergy’s strong financial partnerships and our unmatched capabilities to accelerate clean, reliable energy at scale.”

Marathon Capital acted as the exclusive financial advisor to Invenergy on the transaction.

“Securing the tax equity investment for Samson Energy Center II was a significant step towards advancing the broader Samson Solar Energy Center project,” said Greg Andiorio, Managing Director, Tax Credit Advisory at Marathon Capital. “It was a pleasure to work with the Invenergy and Monarch teams on this important transaction.”

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

About Invenergy

Invenergy is accelerating cleaner, more reliable, affordable energy. Invenergy and its affiliated companies develop, build, own, and operate large-scale renewable and other clean energy generation, transmission and storage facilities in the Americas, Europe, and Asia. Headquartered in Chicago, Invenergy has regional development offices in the United States, Canada, Mexico, Spain, Japan, Poland, and Scotland.

Invenergy and its affiliated companies have successfully developed more than 31,000 megawatts of projects that are in operation, construction or contracted, including wind, solar, transmission infrastructure and natural gas power generation and advanced energy storage projects.

About Marathon Capital

Marathon Capital is the largest independent investment bank dedicated to servicing the clean economy. Throughout its 25-year history, the firm has played a pivotal role in many of the groundbreaking and transformative transactions for new and emerging sectors, consistently delivering exceptional results for its clients. The firm is a leading global financial adviser across M&A, equity capital markets, debt capital markets, tax credits, offtake, and energy transition. Marathon Capital is headquartered in Chicago, with offices in New York, Houston, San Francisco, San Diego, London, and Calgary with local presence in Madrid and Seoul. www.marathoncapital.com

CONTACT

Jane Rafeedie

Monarch Private Capital

jrafeedie@monarchprivate.com

470-283-8431

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4544f881-3e9c-4fbb-b4e9-c738b19caa7c

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

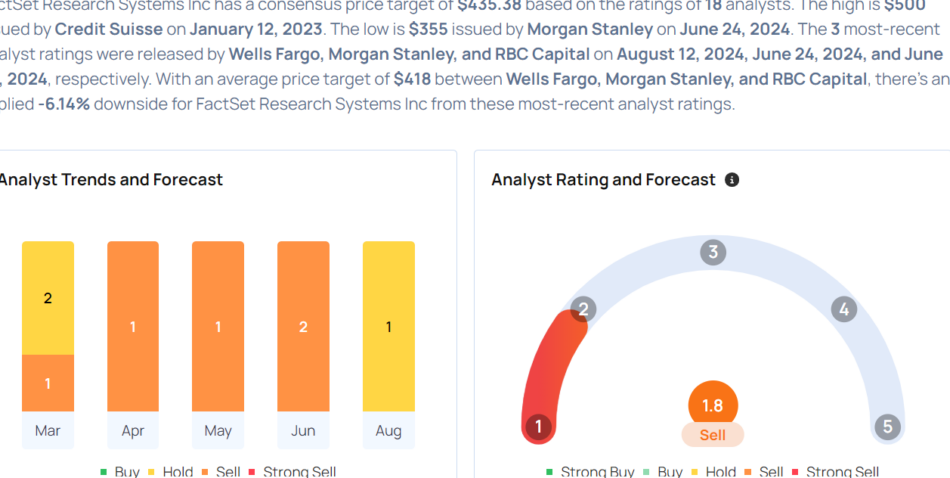

FactSet Research Likely To Report Higher Q4 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

FactSet Research Systems Inc. FDS will release earnings results for its fourth quarter, before the opening bell on Thursday, Sept. 19.

Analysts expect the Norwalk, Connecticut-based company to report quarterly earnings at $3.62 per share, down from $2.93 per share in the year-ago period. FactSet Research is projected to post revenue of $546.81 million, compared to $535.8 million a year earlier, according to data from Benzinga Pro.

On Aug. 5, FactSet named Kristina Karnovsky as Head of the Dealmakers and Wealth Group.

FactSet Research shares rose 1.3% to close at $445.36 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Toni Kaplan maintained an Underweight rating and raised the price target from $350 to $355 on June 24. This analyst has an accuracy rate of 74%.

- RBC Capital analyst Ashish Sabadra reiterated a Sector Perform rating with a price target of $464 on June 24. This analyst has an accuracy rate of 70%.

- Wolfe Research analyst Scott Wurtzel initiated coverage on the stock with an Underperform rating and a price target of $430 on April 11. This analyst has an accuracy rate of 69%.

- BMO Capital analyst Jeffrey Silber maintained a Market Perform rating and increased the price target from $447 to $458 on March 25. This analyst has an accuracy rate of 73%.

- Stifel analyst Shlomo Rosenbaum reiterated a Hold rating with a price target of $469 on March 22. This analyst has an accuracy rate of 72%.

Considering buying FDS stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

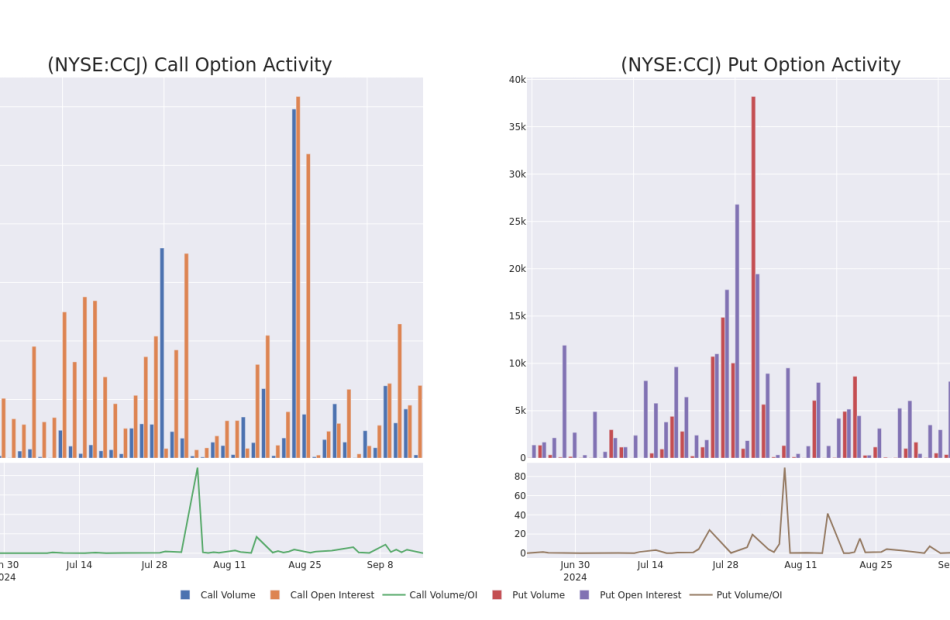

Spotlight on Cameco: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bullish stance on Cameco CCJ.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Cameco.

This isn’t normal.

The overall sentiment of these big-money traders is split between 80% bullish and 10%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $161,618, and 7 are calls, for a total amount of $270,928.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $33.0 to $65.0 for Cameco over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Cameco’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cameco’s whale activity within a strike price range from $33.0 to $65.0 in the last 30 days.

Cameco Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | PUT | SWEEP | BULLISH | 09/19/25 | $6.4 | $6.25 | $6.25 | $40.00 | $83.8K | 55 | 198 |

| CCJ | CALL | SWEEP | BULLISH | 01/17/25 | $6.4 | $6.15 | $6.4 | $37.00 | $63.3K | 1.8K | 103 |

| CCJ | CALL | SWEEP | BEARISH | 01/16/26 | $9.45 | $9.2 | $9.2 | $40.00 | $45.9K | 3.3K | 5 |

| CCJ | PUT | SWEEP | BULLISH | 09/19/25 | $6.4 | $6.3 | $6.3 | $40.00 | $39.6K | 55 | 63 |

| CCJ | PUT | SWEEP | BULLISH | 09/19/25 | $6.35 | $6.25 | $6.25 | $40.00 | $38.1K | 55 | 260 |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

Following our analysis of the options activities associated with Cameco, we pivot to a closer look at the company’s own performance.

Current Position of Cameco

- With a trading volume of 1,250,887, the price of CCJ is up by 0.41%, reaching $40.49.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 43 days from now.

What Analysts Are Saying About Cameco

In the last month, 1 experts released ratings on this stock with an average target price of $80.0.

- An analyst from Scotiabank persists with their Outperform rating on Cameco, maintaining a target price of $80.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cameco options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bio-based Malonic Acid Market Size & Share to Surpass USD 6.6 billion, at a CAGR of 8.9 % by 2031 | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 16, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global Bio-based Malonic Acid market (バイオベースのマロン酸市場) was worth US$ 3.1 Bn in 2022 and is expected to reach US$ 6.6 Bn by the year 2031 at a CAGR of 8.9 % between 2023 and 2031.

This sustainable production process reduces CO₂ emissions and eliminates the use of toxic inputs like chloroacetic acid and sodium cyanide2. Bio-based malonic acid is used in various industries, including pharmaceuticals, flavors, fragrances, and specialty materials.

Bio-based Malonic Acid Market at a Glance

Bio-based malonic acid is a versatile chemical with a wide range of applications, particularly in the production of specialty chemicals, pharmaceuticals, and biodegradable polymers. As a platform chemical, it is used as an intermediate in the synthesis of various compounds, including flavors, fragrances, and vitamins. In the pharmaceutical industry, bio-based malonic acid plays a crucial role in the production of active pharmaceutical ingredients (APIs) and the other medicinal compounds. Additionally, it is increasingly used in the production of biodegradable plastics and polymers, aligning with the global shift towards sustainable materials.

One of the primary drivers is the increasing demand for sustainable and eco-friendly chemicals. As industries worldwide seek to reduce their carbon footprint and move away from fossil fuel-based products, bio-based malonic acid, derived from renewable resources, presents an attractive alternative. This trend is particularly strong in regions with stringent environmental regulations and growing consumer awareness about sustainability, which is pushing companies to adopt greener manufacturing practices.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/bio-based-malonic-acid-market.html

Another major factor contributing to market growth is the expanding pharmaceutical and specialty chemicals industries. The rising demand for high-quality, bio-based intermediates in the production of APIs and specialty chemicals is boosting the adoption of bio-based malonic acid. Its application in the development of biodegradable polymers is also gaining traction, especially as the global push for reducing plastic waste intensifies. The material’s biodegradability and lower environmental impact compared to traditional petrochemical-derived acids make it highly desirable in various applications.

Prominent Players

Lygos and DMC Biotechnologies are some of the leading players operating in the global market.

Bio-based Malonic Acid Market Regional Insights

- Asia Pacific generated the largest market value in 2023. The region is also expected to maintain its dominance during the forecast period.

Asia Pacific region is witnessing rapid growth in the bio-based malonic acid market, driven by several key factors. One of the primary drivers is the region’s increasing focus on sustainability and environmental conservation. Governments and industries across Asia Pacific are implementing stricter environmental regulations to reduce carbon emissions and reliance on fossil fuels.

Bio-based malonic acid, derived from renewable resources, aligns with these sustainability goals, making it an attractive alternative to petrochemical-based acids. Countries such as China, Japan, and South Korea are leading the charge, with significant investments in green technologies and bio-based chemicals, thus boosting the demand for bio-based malonic acid.

Another significant factor is the robust growth of the pharmaceutical and specialty chemicals industries in Asia Pacific. As these industries expand, there is a growing need for high-quality, sustainable intermediates like bio-based malonic acid. The region is a major hub for pharmaceutical manufacturing, with countries like India and China playing pivotal roles in the global supply chain. The increasing demand for active pharmaceutical ingredients (APIs) and the other specialty chemicals in these markets is driving the adoption of bio-based malonic acid, which is used in the synthesis of various pharmaceutical compounds and specialty products.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/bio-based-malonic-acid-market.html

Bio-based Malonic Acid Market Segmentation

Feedstock

- Corn Stover

- Sugarcane Molasses

- Beet Molasses

- Others

Application

- Chemical Intermediate

- Natural Preservative Additive

- Pesticides Production

- Active Pharmaceutical Ingredient

- Biodegradable Thermoplastic

- Flavors & Fragrances

- Others

End-use

- Paints & Coatings

- Electrical & Electronics

- Food & Beverages

- Agriculture

- Pharmaceutical

- Packaging

- Cosmetic

- Others

More Trending Reports by Transparency Market Research –

Calcium Chloride Market (Calciumchlorid-Markt) Expected to Achieve USD 2.3 billion by 2031 with a 5.3% CAGR from 2023 | Insights from TMR Research

Chloromethane Market (Marché du chlorométhane) Set to Surge at 4.4% CAGR, to Reach USD 5.4 billion by 2031 | Transparency Market Research, Inc.

Sodium Cyanide Market (سوق سيانيد الصوديوم) is Anticipated to Register a 5.2% CAGR until 2031, Reaching US$ 4 billion: Report from TMR

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Adobe Outperforms Q3 Estimates But Adjusts Its Guidance To A Challenging Environment

Last Thursday, Adobe Inc ADBE reported its third quarter results, surpassing Wall Street’s estimates for both the top and bottom line. However, Adobe’s stock got punished for a lighter-than-expected fourth quarter guidance that sparked fears of smaller rivals taking business from software companies like Adobe and Salesforce Inc CRM.

Fiscal third quarter highlights

For the quarter ended on August 30th, Adobe reported revenue grew 11% to $5.41 billion, topping $5.37 billion that LSEG expected. The biggest line of business, Digital Media, that is home to Creative Cloud subscriptions that use generative artificial intelligence called Firefly, grew 11% YoY, bringing in sales of $3.98billion. Within the digital media segment, creative revenue grew 10% YoY to $3.19 billion while Document Cloud grew 18% YoY to $807 million.

The total subscription revenue amounted to $5.18 billion, rising 11% YoY.

Digital Experience segment reported revenue rose 10% to $1.35 billion.

Net income rose to $1.68 billion with adjusted earnings amounting to $4.65, surpassing $4.53 that LSEG estimated.

Adobe demonstrated the strenght from its cash-generation capabilities, $2.02 billion, bringing in cash of $2.02 billion from its operations.

Adobe adjusted its outlook to a tough economy.

Taking into account current macroeconomic conditions and expected seasonal strength, Adobe adjusted its outlook. For the fourth fiscal quarter, Adobe guided for revenue between $5.5 billion and $5.55 billion, which fell short of FactSet’s estimate of $5.6 billion. Digital Media is projected to bring in $4.09 billion to $4.12 billion while Digital Experience segment is expected to report revenue between $1.36 billion and $1.38 billion. Adjusted profit is expected to range between $4.63 and $4.68 per share.

Adobe continues to empower its users with the technology of tomorrow.

Throughout the third quarter, Adobe outperformed across its key business segmens. More importantly, Adobe continues to integrarte AI across its portfolio. AI-powered enhancements, particularly Adobe Firefly, fueled the increased customer engagement and retention across Creative Cloud, Document Cloud, and Experience Cloud. However, the lighter than expected forecast sparked fears that AI gains will take longer to monetize, especially in the pressured buying environment.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hydrolysis Stabilizers Market is Projected to Grow at a 5.4% CAGR, Expected to Hit US$ 794.1 Million by 2034 | Fact.MR

Rockville, MD , Sept. 16, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Hydrolysis Stabilizers Market is estimated to reach a valuation of US$ 469.3 million in 2024 and is expected to grow at a CAGR of 5.4% during the forecast period of (2024 to 2034).

The hydrolysis stabilizers market has emerged as an imperative element for the fulfilment of many industries, most of all when it concerns manufacturing and processing related to polymers. These additives are prepared with great care to save the polymers from their degradation due to hydrolysis, which is a water-based chemical reaction that degrades the structural properties and functional abilities of materials. Hydrolysis stabilizers have become even more vital with increasing industry demands for the production of quality and long-lasting products.

The market dynamics are significantly influenced by the growing application of polymers across packaging, automotive, construction, and electronics. Concurrently, the growth in environmental concerns, coupled with increasingly severe regulations, has shifted interest toward the development of green and sustainable hydrolysis stabilizers. This has, in turn, triggered innovative development in design related to bio-based and nontoxic formulations and opened up new opportunities for market growth.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10363

Key Takeaways from Market Study:

- The global hydrolysis stabilizers market is projected to grow at 5.4% CAGR and reach US$ 794.1 million by 2034

- The market created an opportunity of US$ 324.7 million between 2024 to 2024

- North America is a prominent region that is estimated to hold a market share of 31.5% in 2024

- Polyurethane (PU) under resin type is estimated to grow at a CAGR of 5.5% creating an absolute $ opportunity of US$ 81.6 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 190.2 million collectively

“The hydrolysis stabilizers market is poised for steady growth, driven by increasing demand in polymer-intensive industries. Key trends include a shift towards eco-friendly formulations and expanding applications in emerging economies. While raw material price volatility poses challenges, opportunities lie in innovative product development and strategic partnerships,” says a Fact.MR analyst.

Key Companies Profiled:

BASF SE; Songwon International; Lanxess; Clariant; Solvay SA; Akzo Nobel N.V.; Wacker Chemie AG; Evonik Industries AG; Nouryon; Addivant; Baerlocher GmbH; PMC Group, Inc.; Albemarle Corporation; Adeka Corporation.; Other Prominent Players.

Hydrolysis Stabilizers Market News:

- In Aug 2024, Lanxess has introduced new hydrolysis stabilizers, a series of additives that provides higher polymer resistance in applications where moisture prevails. The newest product line will be oriented for industries like automotive and construction, where material strength is required.

- In July 2024, To speed up developments in hydrolysis stabilizers, Lanxess has entered into a strategic partnership with an important research institution based in Italy.

- In August 2024, LANXESS has managed to make considerable progress in improving the efficacy of bio-based polyesters, primarily PLA, by using its Stabaxol® hydrolysis stabilizers.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10363

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global hydrolysis stabilizers market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of resin type (Polyurethane (PU), Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), Thermoplastic Polyurethane (TPU), Thermoplastic Polyester Elastomer (TPE-E), Ethylene Vinyl Acetate (EVA), Bio-based Polyesters (PLA & PHA), Others), by application (Electrical and Electronics, Automotive and Transportation, Industrial Applications, Consumer Goods, Construction and Building Materials, Textile and Clothing, Medical and Healthcare) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Hydrolysis Stabilizers Industry Research:

- By Resin Type :

- Polyurethane (PU)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Thermoplastic Polyurethane (TPU)

- Thermoplastic Polyester Elastomer (TPE-E)

- Ethylene Vinyl Acetate (EVA)

- Bio-based Polyesters (PLA & PHA)

- Others

- By Application :

- Electrical and Electronics

- Cable Sheathing

- Injection-Molded Parts for Electronics

- Other Applications

- Automotive and Transportation

- Auxiliary Springs in Cars

- Drive Belts

- Automotive Seals and Gaskets

- Other Applications

- Industrial Applications

- Surface Coatings of Rollers

- Sieves Used in Paper Manufacture

- Industrial Membranes and Seals

- Other Applications

- Consumer Goods

- Shoe Systems

- Sporting Equipment

- Other Applications

- Construction and Building Materials

- Weatherproofing Membranes

- Sealants and Adhesives

- Other Applications

- Textile and Clothing

- Waterproof Fabrics

- High-Performance Fibers

- Other Applications

- Medical and Healthcare

- Medical Tubing

- Implantable Devices

- Other Applications

- Electrical and Electronics

- By End-Use Industry :

- Packaging

- Automotive

- Consumer Goods

- Furniture

- Construction

- Others

- By Form :

Check out More Related Studies Published by Fact.MR Research:

Gimbal Stabilizers Market: According to latest research by Fact.MR, gimbal stabilizers market is set to witness steady growth during 2021-2031 with expected CAGR of approximately 5.4%. Demand for gimbal stabilizers will witness steady recovery in short-term, with optimistic growth outlook in the long-run.

Ligament Stabilizers Market: The global ligament stabilizers market is valued at US$ 2.66 billion in 2023. Worldwide sales of ligament stabilizers are expected to increase at a CAGR of 5% and reach a market valuation of US$ 4.33 billion by the end of 2033.

Ultraviolet Stabilizers Market: The valuation of the global ultraviolet stabilizers market is US$ 1.4 billion for 2023. Global demand for ultraviolet stabilizers is expected to reach an industry value of US$ 2.4 billion by 2033-end, increasing at a CAGR of 5.3% over the next ten years.

Polyurethane in Automotive Filter Market: The global polyurethane in automotive filters market is estimated at USD 791 Million in 2022 and is forecast to reach USD 1.2 Billion by 2032, growing with a CAGR of 4.5% from 2022 to 2032.

Polyurethane Dispersion Market: Based on the analysis by Fact.MR, the global polyurethane dispersion market is valued to be US$ 2.5 billion in 2023 and it is anticipated to grow at a CAGR of 7.7% to reach US$ 5.2 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jumps Over 200 Points; NY Empire State Manufacturing Index Increases In September

U.S. stocks traded mixed this morning, with the Dow Jones jumping over 200 points on Monday.

Following the market opening Monday, the Dow traded up 0.54% to 41,618.01 while the NASDAQ fell 0.69% to 17,562.23. The S&P 500 also fell, dropping, 0.06% to 5,622.81.

Check This Out: This Analyst With 86% Accuracy Rate Sees Around 9% Upside In RH – Here Are 5 Stock Picks For Last Week From Wall Street’s Most Accurate Analysts

Leading and Lagging Sectors

Energy shares jumped by 1.7% on Monday.

In trading on Monday, information technology shares fell by 1.4%.

Top Headline

The NY Empire State Manufacturing Index rose to 11.5 in September, recording the highest level since April 2022, versus -4.7 in August and market estimates of -3.9.

Equities Trading UP

- NuCana plc NCNA shares shot up 170% to $6.85 after the company announced final data from the Phase 2 NuTide:701 study at the ESMO Congress on NUC-7738 in combination with pembrolizumab for patients with metastatic melanoma who were refractory to or had relapsed on prior PD-1 inhibitor therapy.

- Shares of Bone Biologics Corporation BBLG got a boost, surging 47% to $1.18.

- Dermata Therapeutics, Inc. DRMA shares were also up, gaining 42% to $2.2500.

Equities Trading DOWN

- Dunxin Financial Holdings Limited DXF shares dropped 21% to $0.1053.

- Shares of Immutep Limited IMMP were down 25% to $1.98. Immutep’s Efti in combination with MSD’s KEYTRUDA leads to efficacy with favourable safety in first line head and neck cancer.

- NWTN Inc. NWTN was down, falling 19% to $0.7098.

Commodities

In commodity news, oil traded up 1.4% to $69.59 while gold traded down 0.1% at $2,608.10.

Silver traded up 0.7% to $31.28 on Monday, while copper rose 0.6% to $4.2630.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.1%, Germany’s DAX fell 0.3% and France’s CAC 40 fell 0.2%. Spain’s IBEX 35 Index rose 0.1%, while London’s FTSE 100 fell 0.02%.

The Eurozone recorded a trade surplus of EUR 21.2 billion in July, higher than market estimates of EUR 14.9 billion. Wages in the Eurozone increased 4.5% year-over-year in the second quarter, while hourly labor costs climbed by 4.7% year-over-year in the quarter. Italy reported a trade surplus of EUR 6.743 billion in July versus a year-ago surplus of EUR 6.108 billion.

Asia Pacific Markets

Asian markets closed mostly higher on Monday, with Hong Kong’s Hang Seng Index gaining 0.31% and India’s BSE Sensex gaining 0.12%.

Total passenger vehicle sales in India declined 1.6% year-over-year to 308,779 in August versus a 1.9% decline in the prior month.

Economics

The NY Empire State Manufacturing Index rose to 11.5 in September, recording the highest level since April 2022, versus -4.7 in August and market estimates of -3.9.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

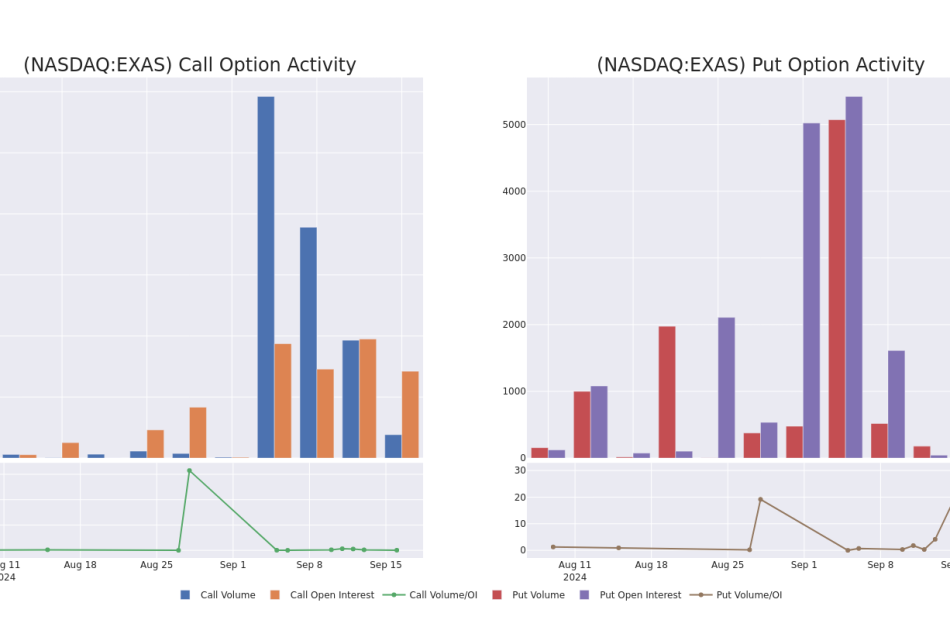

Exact Sciences Unusual Options Activity For September 16

Investors with a lot of money to spend have taken a bullish stance on Exact Sciences EXAS.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with EXAS, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for Exact Sciences.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 33%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $117,000, and 8, calls, for a total amount of $372,081.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $85.0 for Exact Sciences during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Exact Sciences options trades today is 1016.57 with a total volume of 2,211.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Exact Sciences’s big money trades within a strike price range of $55.0 to $85.0 over the last 30 days.

Exact Sciences Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXAS | PUT | TRADE | BULLISH | 11/15/24 | $4.3 | $3.9 | $3.9 | $65.00 | $117.0K | 10 | 300 |

| EXAS | CALL | SWEEP | BEARISH | 09/20/24 | $3.0 | $2.4 | $2.4 | $67.50 | $59.0K | 4.1K | 1.1K |

| EXAS | CALL | SWEEP | NEUTRAL | 10/18/24 | $14.7 | $14.5 | $14.6 | $55.00 | $58.3K | 1.8K | 279 |

| EXAS | CALL | TRADE | BEARISH | 01/17/25 | $3.3 | $2.4 | $2.75 | $85.00 | $55.0K | 131 | 201 |

| EXAS | CALL | TRADE | BEARISH | 01/17/25 | $11.7 | $10.4 | $10.9 | $62.50 | $52.3K | 421 | 52 |

About Exact Sciences

Exact Sciences Corporation, headquartered in Madison, Wisconsin, provides cancer screening and diagnostic test products in the United States and internationally. Exact’s Cologuard screening test, a noninvasive stool-based DNA test, is a pre-cancer screening test for colorectal cancer. The company also competes in the precision oncology market with Oncotype DX, a suite of tissue-based genomic tests for estimating recurrence risk and likelihood of benefit from chemotherapy for breast and colon cancer, and OncoExTra, a liquid-based comprehensive genomic profiling test. It is developing liquid biopsy tests for molecular residual disease, colorectal cancer screening, and multicancer screening, too.

Exact Sciences’s Current Market Status

- With a trading volume of 3,695,220, the price of EXAS is up by 1.8%, reaching $66.72.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 44 days from now.

What The Experts Say On Exact Sciences

In the last month, 3 experts released ratings on this stock with an average target price of $78.33333333333333.

- An analyst from Wells Fargo downgraded its action to Overweight with a price target of $75.

- Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Exact Sciences, targeting a price of $75.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Exact Sciences, targeting a price of $85.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Exact Sciences, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.