Strength Seen in Foghorn Therapeutics: Can Its 9.5% Jump Turn into More Strength?

Foghorn Therapeutics Inc. FHTX shares rallied 9.5% in the last trading session to close at $9.72. This move can be attributable to notable volume with a higher number of shares being traded than in a typical session. This compares to the stock’s 43.2% gain over the past four weeks.

Last month, the company announced robust financial results for the second quarter of 2024. Studies on the company’s pipeline candidates for treating various oncology indications are progressing well. This might have been driving the share price rally.

This company is expected to post quarterly loss of $0.41 per share in its upcoming report, which represents a year-over-year change of -20.6%. Revenues are expected to be $7.01 million, down 59.9% from the year-ago quarter.

Earnings and revenue growth expectations certainly give a good sense of the potential strength in a stock, but empirical research shows that trends in earnings estimate revisions are strongly correlated with near-term stock price movements.

For Foghorn Therapeutics, the consensus EPS estimate for the quarter has been revised 7% lower over the last 30 days to the current level. And a negative trend in earnings estimate revisions doesn’t usually translate into price appreciation. So, make sure to keep an eye on FHTX going forward to see if this recent jump can turn into more strength down the road.

The stock currently carries a Zacks Rank #2 (Buy).

Foghorn Therapeutics belongs to the Zacks Medical – Drugs industry. Another stock from the same industry, United Therapeutics UTHR, closed the last trading session 0.6% lower at $339.12. Over the past month, UTHR has returned 5.6%.

For United Therapeutics, the consensus EPS estimate for the upcoming report has changed +0.1% over the past month to $6.33. This represents a change of +17.7% from what the company reported a year ago. United Therapeutics currently has a Zacks Rank of #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Recent Price Trend in Advantest is Your Friend, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Advantest Corp.

ATEYY is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. ATEYY is quite a good fit in this regard, gaining 25.5% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 2.5% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, ATEYY is currently trading at 82.4% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in ATEYY may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

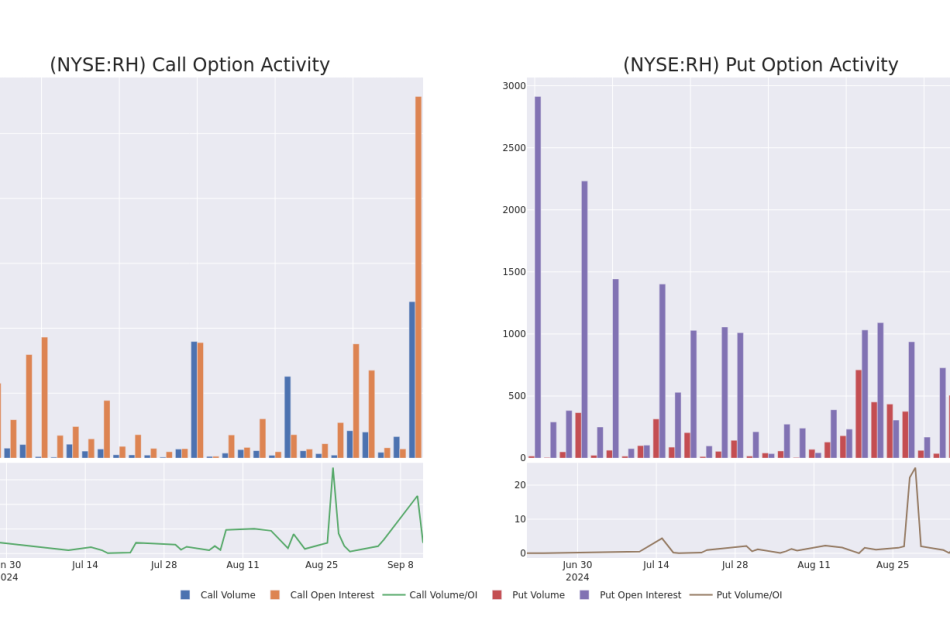

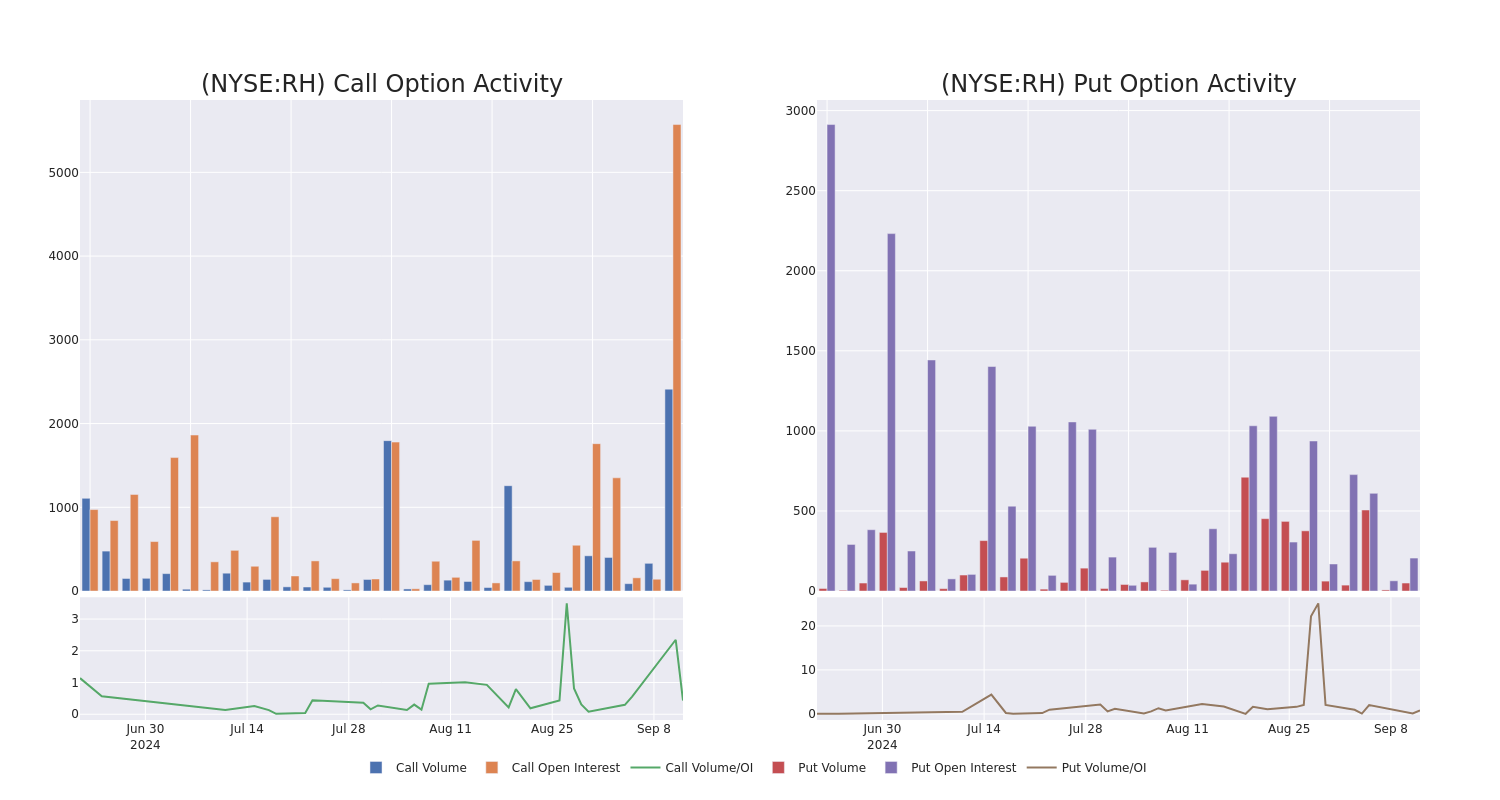

Looking At RH's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards RH RH, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RH usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 79 extraordinary options activities for RH. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 27% leaning bullish and 40% bearish. Among these notable options, 29 are puts, totaling $1,348,035, and 50 are calls, amounting to $7,143,684.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $250.0 to $430.0 for RH during the past quarter.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for RH’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across RH’s significant trades, within a strike price range of $250.0 to $430.0, over the past month.

RH 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | CALL | TRADE | BULLISH | 10/18/24 | $12.8 | $12.4 | $12.7 | $360.00 | $3.1M | 188 | 28 |

| RH | PUT | SWEEP | BULLISH | 01/17/25 | $40.3 | $40.2 | $40.2 | $340.00 | $241.2K | 48 | 62 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $21.4 | $21.0 | $21.0 | $400.00 | $174.6K | 728 | 244 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $22.7 | $22.5 | $22.58 | $400.00 | $99.0K | 728 | 97 |

| RH | PUT | SWEEP | BEARISH | 09/20/24 | $7.7 | $7.7 | $7.7 | $330.00 | $77.0K | 23 | 745 |

About RH

RH is a luxury retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, children, and is growing the presence of its hospitality business (with 17 restaurant locations). RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels, and is positioned to broaden its total addressable market over the next decade by expanding abroad, and with its World of RH digital platform (highlighting offerings outside of home furnishings), along with future offerings in color, bespoke furniture, architeture, media, and more.

After a thorough review of the options trading surrounding RH, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

RH’s Current Market Status

- With a trading volume of 1,450,635, the price of RH is up by 3.94%, reaching $334.55.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 80 days from now.

What The Experts Say On RH

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $326.6.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for RH, targeting a price of $375.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on RH, which currently sits at a price target of $320.

- Consistent in their evaluation, an analyst from Wedbush keeps a Neutral rating on RH with a target price of $310.

- An analyst from JP Morgan has decided to maintain their Overweight rating on RH, which currently sits at a price target of $338.

- An analyst from Telsey Advisory Group persists with their Market Perform rating on RH, maintaining a target price of $290.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for RH with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China hit hard by new Dutch export controls on ASML chip-making equipment

Mainland semiconductor factories could face significant production challenges, as the Netherlands bans Dutch chip tool giant ASML Holding from servicing some of its most reliable equipment in China, according to industry insiders.

Earlier this month, Dutch foreign trade and development minister Reinette Klever announced a change to the country’s export controls, requiring ASML to apply for licences to sell its 1970i and 1980i immersion deep ultraviolet (DUV) machines to China-based customers.

In addition, ASML is required to apply for a licence to service, as well as provide spare parts and software updates, for immersion lithography systems previously sold to Chinese customers that have since come under restriction, according to a Reuters report, citing a Dutch government statement.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The move is intended to align Dutch rules with tightened US trade restrictions that went into effect last November, targeting China on national security grounds. The curbs by Washington covered the 1970i and 1980i. The Chinese commerce ministry objected to The Hague’s decision.

The ASML headquarters and factory in Veldhoven, Netherlands. Photo: Bloomberg alt=The ASML headquarters and factory in Veldhoven, Netherlands. Photo: Bloomberg>

ASML, which holds a virtual monopoly in the world’s most advanced chip-making tools, said in a statement that the rule change was “technical” and not expected to have any impact on its financial outlook for this year. It declined to comment on the servicing of newly restricted equipment in China when reached by the Post.

Maintenance service is crucial to maintaining good production yields at foundries. Service engineers are required to stand by 24/7 in case of machine failure. In China, the 1980i has become a workhorse for many semiconductor plants due to its versatility, which enables it to cover various manufacturing nodes, according to semiconductor professionals with experience in mainland foundries.

The short-term impact of losing access to servicing could be huge for the Chinese chip industry, according to a person familiar with ASML’s operations, who declined to be named discussing private business matters.

Since ASML entered the Chinese market in 1988, it has installed over 1,000 machines there, including lithography tools and inspection solutions, Shen Bo, the company’s China manager, said in an interview with state-run China Daily in September last year. ASML has not said how many of those machines are covered by Dutch export controls.

Roger Dassen, chief financial officer of ASML, said in a post-earnings conference call in July that the company still had “eyes on the tools” in fabrication plants operated by Chinese customers.

Lithography machines are used for printing circuit patterns onto silicon wafers. Photo: Reuters alt=Lithography machines are used for printing circuit patterns onto silicon wafers. Photo: Reuters>

Still, maintenance is a smaller issue compared to the lack of new advanced lithography machines. Performing maintenance and finding spare parts are relatively less difficult than making lithography systems from scratch, said the source close to ASML.

Mainland China, ASML’s second-largest market by revenue in 2023 after Taiwan, has become the subject of expanding export controls on lithography systems since 2019.

ASML is barred from shipping to China its most advanced EUV systems, necessary for making chips smaller than 7-nanometres, as well as immersion DUV systems, including the 2100i, 2050i, 2000i, 1970i and 1980i, without a Dutch licence.

Current licences tied to blacklisted Chinese companies will no longer be renewed, and future licence applications will be denied, according to Paul Van Gerven, an editor at Dutch tech magazine Bits&Chips. “Should the Dutch start pushing back, the US will most likely introduce additional restrictions of its own.”

The export of dry DUV equipment – older-generation machines that use air instead of water to improve resolution when printing highly complex circuit patterns onto silicon wafers – is unrestricted for now, Van Gerven added.

During the second quarter, ASML’s shipments to mainland Chinese customers totalled 2.35 billion euros (US$2.5 billion), or nearly half of its worldwide systems sales. ASML said in its 2023 annual report that it was only able to fill 50 per cent of orders from China due to a heavy backlog.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Adeia to Present Groundbreaking Research on Preventing Unauthorized Broadband Sharing at SCTE TechExpo24

SAN JOSE, Calif., Sept. 16, 2024 (GLOBE NEWSWIRE) — Adeia ADEA, a leading innovator in the media and semiconductor industries, today announced that it will present cutting-edge research on detecting and preventing unauthorized broadband sharing at the upcoming SCTE TechExpo24, September 24-26. The presentation, “How to Address Unauthorized Broadband Sharing,” will be delivered on September 24 by Adeia’s chief technology officer, Serhad Doken, who co-authored the paper together with Dr. Dhananjay Lal, vice president of advanced R&D at Adeia.

With broadband providers facing an urgent and increasing challenge from password sharing, Adeia’s research offers multiple innovative solutions leveraging artificial intelligence, machine learning, and advanced RF techniques. These methods help service providers protect their revenue streams while enhancing consumer cybersecurity.

Key highlights of the presentation include an in-depth analysis of the broadband sharing landscape and its impact on service providers and an overview of distinct implementation methods, including clustering and machine learning algorithms for detecting suspicious accounts, Wi-Fi sensing techniques to create dynamic household maps, device ranging methods to identify out-of-home connections, attestation processes for continuous authentication, and RF signal control for precise coverage management.

“Unauthorized broadband sharing represents a significant challenge for service providers, potentially leading to substantial revenue losses and increased cybersecurity risks,” said Doken. “Our research presents a comprehensive toolkit of advanced technologies that can help providers address these issues effectively while maintaining a positive customer experience.”

The presentation at SCTE TechExpo24 underscores Adeia’s commitment to developing innovative solutions that address critical challenges in the telecommunications industry. By combining expertise in AI, machine learning, and RF engineering, Adeia continues to drive technological advancements that promise a brighter future for both service providers and consumers.

About Adeia Inc.

Adeia is a leading R&D company that accelerates the adoption of innovative technologies in the media and semiconductor industries. Adeia’s fundamental innovations underpin technology solutions that are shaping and elevating the future of digital entertainment and electronics. Adeia’s intellectual property (IP) portfolios power the connected devices that touch the lives of millions of people around the world every day as they live, work and play. For more, please visit www.adeia.com.

For Information Contact:

Investor Relations

Chris Chaney

IR@adeia.com

Media Relations

JoAnn Yamani

press@adeia.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Second-Tier Economic Data Tuesday Could Sway The Fed's Rate Decision: It 'Will Be A Trading Catalyst'

Often considered an afterthought compared to the juggernauts of economic indicators — such as the Consumer Price Index (CPI) inflation and job market report — retail sales data rarely moves the needle for Federal Reserve policymakers.

But this Tuesday, the August retail sales numbers could mean something as they land just before the Fed’s two-day Federal Open Market Committee (FOMC) meeting, where a pivotal interest rate decision is on deck for Wednesday.

A rate cut on Wednesday is already a done deal; the real uncertainty is how big that will be. The markets are currently placing their bets on a 60% chance of a 50-basis-point cut and a 40% chance of a more modest 25 basis-point reduction, as per CME FedWatch tool.

Bank of America economist Stephen Juneau doesn’t believe recent economic data justify a large rate cut. Yet, he conceded that “a very weak retail sales report could drive the Fed to start large.” According to Juneau, a -1% figure with downward revisions would qualify as “very weak.”

The investment bank forecasts a 0.3% monthly decline in overall retail sales, sharply below the more optimistic Bloomberg consensus of a 0.2% increase.

If BofA’s gloomy predictions come to pass, it could be enough to tilt the Fed’s hand toward a heftier rate cut.

Bank of America highlighted that the uncertainty around this FOMC meeting is unprecedented, at least since 2015.

“The market uncertainty over 25bp or 50bp means that the meeting will be a trading catalyst,” analysts wrote.

To help traders navigate these stormy waters, BofA unveiled a matrix for different retail sales and FOMC outcomes.

If retail sales come in strong and the Fed takes a dovish stance, it’s time to own cyclicals. However, if sales are weak and the Fed leans hawkish, it might be wise to retreat into defensives.

| FOMC Dovish | FOMC Hawkish | |

|---|---|---|

| Retail Sales: ‘Strong‘ | Very positive: Own cyclicals | Positive: Own growth |

| Retail Sales: ‘In Line‘ | Positive: Own cyclicals | Negative: Own growth |

| Retail Sales: ‘Weak‘ | Slightly negative: Own defensives | Negative: Own defensives |

“Rate-sensitive sectors-manufacturing and housing have certainly been adversely affected by the Fed’s actions,” the investment bank stated.

These rate-sensitive sectors have borne the brunt of the Fed’s previous rate hikes. It’s been 23 months since the ISM Manufacturing PMI last posted two consecutive months above 50, marking the second-longest slump on record. The housing market isn’t faring much better, with existing home sales plunging nearly 40% year-over-year at their lowest point.

According to Bank of America, easing rate pressure should lead to at least a modest pickup in manufacturing and housing activity, potentially boosting earnings growth for the S&P 500 into 2025.

In light of this view, analysts indicated: “We prefer sectors that can benefit from easing rate pressure. We are overweight Financials, Consumer Discretionary, Real Estate and Utilities.”

Utilities, as tracked by the Utilities Select Sector SPDR Fund XLU, were upgraded from Market-Weight to Overweight earlier this month, reflecting a more bullish outlook on quality and income-generating companies.

Read Now:

This image was created using artificial intelligence MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peter Schiff At Odds With Bernie Sanders Over Taxing Rich, Calls Upon Democrats To Cut Taxes: 'They're Already Paying 40% Of The Federal Income Tax'

The Democrats’ call for taxing the rich hasn’t gone well with economist and gold bull Peter Schiff, who suggested the party should approach the problem the other way around.

What Happened: Democrats clamor for the rich to pay their fair share of taxes but they are already paying 40% of the federal income tax, said Schiff in a post on Sunday. “That means the rich already pay far more than their fair share,” he said.

If the rich were to pay their fair share of taxes, the Democrats should cut their taxes, he added.

Schiff also said 40% of Americans pay no federal income tax at all. “Are Democrats going to insist that the poor start paying their fair share?” he asked.

To a question from one of his followers regarding some corporations such as Amazon paying taxes at a far lower rate, the economist said their shareholders pay taxes and many of Amazon’s shareholders aren’t rich, he said.

See Also: Best Growth Stocks Right Now

Why It’s Important: Vice President Kamala Harris, who replaced President Joe Biden on the Democratic ticket, has come under criticism for her proposal to impose unrealized capital gains tax, which is dubbed Harris’ billionaire minimum tax. The new proposal calls upon Americans with net wealth above $100 million to pay a minimum effective tax rate of 25% on an expanded measure of income that includes their unrealized capital gains, according to the Tax Foundation.

Commenting on the proposal, the nonpartisan, tax policy non-profit said the proposal would “take the tax code in the wrong direction by imposing a complicated tax on a narrow segment of high-earning taxpayers in a way that’s never been tried.”

“This proposal would add new compliance burdens for taxpayers and administrative challenges for the IRS while weakening the US economy by raising the tax burden on saving and entrepreneurship,” it added.

Sen. Bernie Sanders (I-Vt) said in a recent interview that about 60% of Americans are living paycheck to paycheck and the gap between the rich and poor is growing wider. He also opined that Harris should go higher than the 28% she has proposed. “When you have got three people on top earning more wealth than the bottom half of American society, where billionaires pay an effective tax rate lower than truck drivers or nurses, yeah, you can substantially raise taxes on the billionaire class and the people on top,” he said.

Republican candidate Donald Trump’s tax proposals are considered to be far more business-friendly, as he has pledged to reduce the tax rates and make up for the shortfall through income generated out of additional tariffs. However, economists caution regarding the tariffs stoking import price inflation and in turn economy-wide inflationary pressure.

The iShares TIPS Bond ETF TIP, an ETF tracking the investment results of an index composed of inflation-protected U.S. Treasury bonds, ended Friday’s session up 0.34% at $110.44, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why not to get too excited about a September rate cut

Cambridge, MA, Sept. 16, 2024 (GLOBE NEWSWIRE) — The unprecedented 2020-2024 interest rate cycle marked the fastest pivot from an active easing to tightening by policymakers in advanced economies since the 1970s. What followed was the most globally synchronized, aggressive rate tightening in the last 55 years — and it was also the longest period policymakers held rates at their peaks.

Even if the Federal Reserve pivots to cutting interest rates, rates may not fall to levels typical of the last 15 years during this rate cycle. This would leave consumers and businesses in a world of higher rates, sending a ripple effect throughout the U.S. economy, and prompting more difficult tradeoffs, suggests a new paper “Rate Cycles” by MIT Sloan School of Management professor of global economics and management Kristin Forbes and colleagues.

Presented at the European Central Bank’s (ECB) annual Forum on Central Banking in Sintra, Portugal, in July, the findings have implications for policymakers and investors alike. A week before the Federal Reserve’s latest monetary policy meeting, investors expect policymakers to cut interest rates for the first time in four years, lowering them from their 23-year high as inflation eases. Based on the Fed’s latest projections, some anticipate that rates will drift lower from there, eventually settling in at around 2.5% to 3%. But rates may also not fall that much.

“It’s not clear that rates need to fall to pre-2008 levels, even if the market is expecting them to,” Forbes said. “If so, we’re going to have to adjust to a world of higher interest rates, and it may be painful. There could be a big reckoning.”

Along with Jongrim Ha and Ayhan Kose from the World Bank, Forbes analyzed cycles in interest rates in 24 advanced economies from 1970 to 2024, looking at how rate cycles have evolved over time. The paper and its findings are novel because, while many researchers have dissected business cycles, Forbes believes they are the first to apply an in-depth business cycle analysis to interest rate cycles.

The researchers found that after the recent unprecedented swings in economic activity and aggressive central bank responses, growth and labor markets now seem to be stabilizing despite interest rates remaining at high levels not seen since before the 2008 financial crisis.

If rates do remain high, homeowners looking to sell, but holding out for cheaper rates, may find it more difficult to relocate. Companies that financed debt when interest rates were lower would pay more as they refinance. The federal government, for its part, is already paying substantially more interest on its debt, and it’s an expense that will only grow as deficits show no signs of abating. To compensate, taxes might go up, or federal spending fall — or both.

At the same time, rates at higher levels can provide some benefits to the economy if it makes consumers and businesses borrow more efficiently. People may be more cautious to take on debt, only borrowing if they’re confident about the return on investment. Younger Americans might have a harder time getting student loans or buying a home, but older ones with savings would benefit from higher rates. Overall, Americans might save more.

The researchers also discovered that during the 2020-2024 interest rate cycle, the impact of global shocks was not only bigger than home-grown factors, but had their largest impact on rates since the 1970s. This makes it even more challenging for central bankers who focus on stabilizing prices at home. Part of the shocks were well-documented global supply shocks, including supply chain disruptions around the pandemic and a spike in food and energy prices after Russia invaded Ukraine in 2022.

Forbes and her colleagues found that global demand shocks were also significant, yet they were largely underappreciated. Consumers who had saved their money and were ready to spend found that supply was lagging behind. In the coming years, policymakers will increasingly find themselves responding to global shocks, and distinguishing between supply and demand shocks will be critical, Forbes said.

“Policymakers will need to go one step further and not assume that they’re dealing with a global supply shock just because it originates outside their borders,” she said. “It could very well be a global demand shock, and there’s a very different response for each.”

With supply shocks, policymakers usually don’t need to raise interest rates as much in response, according to the researchers. On the other hand, they should respond more forcefully when they encounter demand-driven shocks. Teasing apart global and domestic forces as the drivers of shocks in individual economies is crucial, too, and the researchers discovered that supply shocks play a much greater role in the Euro area than they do in the United States.

Going forward, central bankers need to fully commit themselves to looking at multiple models as they set interest rates. “They need to look at a range of prices and be open to a variety of explanations and risks as they conduct monetary policy,” Forbes said, especially as she sees the current cycle as a cautionary tale. “Just because central banks’ strategy of starting late and then acting aggressively worked this time, it does not necessarily mean it will work in the future.”

Matthew Aliberti MIT Sloan School of Management 7815583436 malib@mit.edu

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Are Selling Nvidia Stock and Buying This Supercharged AI Index Fund Instead

Nvidia has been a spectacular investment in recent years. The stock has skyrocketed more than 700% since January 2023 amid excitement surrounding artificial intelligence (AI). But excitement is a double-edged sword. Numerous companies are now designing custom AI chips, and some investors are concerned Nvidia will lose market share.

The following hedge fund billionaires have navigated the situation by selling shares of Nvidia in the second quarter, and redeploying capital into the Invesco QQQ Trust (NASDAQ: QQQ), a growth-focused index fund that tracks the Nasdaq-100 index.

-

Cliff Asness at AQR Capital sold 1.3 million shares of Nvidia, shrinking his stake by 8%. He also bought 9,254 shares of the Invesco QQQ Trust, increasing his position 332%.

-

Steven Cohen at Point72 Asset Management sold 409,042 shares of Nvidia, reducing his stake by 16%. He also bought 1,500 shares of the Invesco QQQ Trust, increasing his position 150%.

-

Israel Englander at Millennium Management sold 676,242 shares of Nvidia, reducing his stake 5%. He also bought 81,616 shares of the Invesco QQQ Trust, increasing his position by 557%.

-

Ken Griffin at Citadel Advisors sold 9.2 million shares of Nvidia, slashing his stake 79%. He also purchased 2.8 million shares of the Invesco QQQ Trust, increasing his position by 585%.

-

David Shaw at D.E. Shaw sold 12.1 million shares of Nvidia, cutting his stake 52%. He also started a small position in the Invesco QQQ Trust.

Importantly, these trades do not signal a complete lack of confidence in Nvidia. Not only do all five fund managers still have positions in the chipmaker, but also Nvidia is the third largest position in the Invesco QQQ Trust.

Having said that, their decision to buy the index fund is sensible because it diversifies their portfolios across more technology stocks likely to benefit from the AI boom. Here’s what investors should know about the Invesco QQQ Trust.

The Invesco QQQ Trust provides heavy exposure to technology stocks

The Invesco QQQ Trust measures the performance of the Nasdaq-100, an index that tracks the 100 largest non-financial companies on the Nasdaq Stock Exchange. The index fund is heavily weighted toward the information technology sector. The 10 largest holdings are listed by weight:

-

Apple: 8.9%

-

Microsoft: 8.3%

-

Nvidia: 7.7%

-

Broadcom: 5.1%

-

Amazon: 5.1%

-

Meta Platforms: 4.8%

-

Alphabet: 4.6%

-

Tesla: 2.9%

-

Costco Wholesale: 2.7%

-

Netflix: 2%

Many investors see Nvidia as a paragon of artificial intelligence (AI) stocks because the company dominates the market for data center graphics processing units (GPUs), chips that are the gold standard in speeding up complex workloads such as training machine learning models. But several other companies in that list are well positioned to monetize AI.

For instance, Microsoft, Amazon, and Alphabet have the three largest public clouds in the world. That means they should be major beneficiaries as businesses invest in the cloud infrastructure and platform services required to train AI models and develop AI applications.

Similarly, Broadcom helps customers like Alphabet and Meta Platforms design custom AI chips, and it recently won a major deal with OpenAI. That bodes well for the company because Morgan Stanley analysts expect the custom AI chip market to grow more quickly than the GPU market through the end of the decade.

Finally, Tesla is dedicated to developing full self-driving (FSD) software, and the company plans to monetize its FSD platform through subscription sales and robotaxi services.

The Invesco QQQ Trust produced supercharged returns over the past 20 years

The Invesco QQQ Trust has been an excellent long-term investment. The index fund returned 1,490% over the past 20 years, compounding at 14.8% annually. By comparison, the S&P 500 (SNPINDEX: ^GSPC) returned 641% during the same period, compounding at 10.5% annually.

The downside of the Invesco QQQ Trust is volatility. The fund is highly concentrated in technology stocks, such that weakness in that market sector can cause it to nosedive. The Invesco QQQ Trust has a 10-year beta of 1.12, meaning it moved 1.12 percentage points for every 1-percentage-point movement in the S&P 500.

Volatility cuts both ways. On one hand, the Invesco QQQ Trust more than doubled the return of the S&P 500 during the past two decades. On the other hand, the Invesco QQQ Trust declined much more sharply than the S&P 500 during the most recent bear market. Specifically, the index fund suffered a maximum drawdown of 35%, while the S&P 500 never fell more than 24%.

The last item of note is the expense ratio. The Invesco QQQ Trust has an expense ratio of 0.2%, meaning investors will pay $2 per year on every $1,000 invested in the index fund. That’s below the industry average of 0.36%, according to Morningstar.

Here is the bottom line: The Invesco QQQ Trust is a growth-focused index fund that tracks several companies well positioned to benefit from the artificial intelligence boom, including Nvidia. The index fund’s concentration in technology stocks makes it volatile, but that volatility has been an asset over the past two decades, given its outperformance compared to the S&P 500.

I think the Invesco QQQ Trust will continue to outperform over the next decade as the AI boom unfolds. Patient investors comfortable with risk and volatility should consider buying a small position today. And shareholders should lean into market weakness by adding to their position during significant pullbacks.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Netflix, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaires Are Selling Nvidia Stock and Buying This Supercharged AI Index Fund Instead was originally published by The Motley Fool

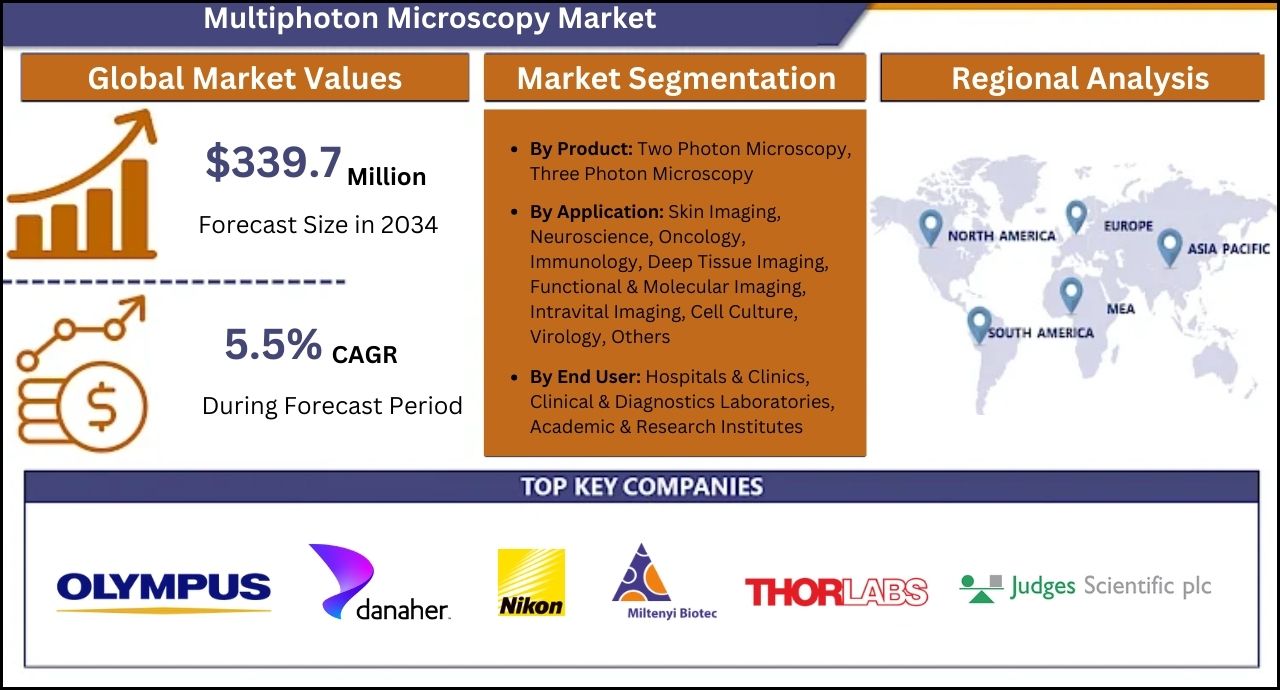

Multiphoton Microscopy Market Sales to Surge at 5.5% CAGR, Reaching US$ 339.7 Million by 2034 | Fact.MR

Rockville, MD, Sept. 16, 2024 (GLOBE NEWSWIRE) — As stated in the recently updated report by Fact.MR, a market research and competitive intelligence provider, the global multiphoton microscopy market is evaluated to reach US$ 198.9 million in 2024, and the market is further projected to progress at a CAGR of 5.5% between 2024 and 2034.

Strong imaging methods such as multiphoton microscopy are becoming more popular all over the world because of their growing use in several scientific fields. The need for this cutting-edge approach is rising in a variety of sectors, including materials science and neurology, as it provides researchers with previously unattainable insights into living tissues and materials.

The method is essential to biomedical research because it produces three-dimensional and high-resolution photographs of deep tissue structures with little harm. Its increasing use is mostly due to its applicability in stem cell research, cancer research, and medication development.

Multiphoton microscopes are now more widely used in laboratories worldwide due to technical improvements that have improved their accessibility and use. The appeal of this approach is further enhanced by its ability to observe biological processes over an extended period and its compatibility with several other imaging modalities. The widespread use of technology in academics with constant commercial development and rising funding is securing a position as a pivotal tool in contemporary scientific inquiry.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=3405

Key Takeaways from Market Study:

- The global multiphoton microscopy market is forecasted to reach US$ 339.7 million by the end of 2034.

- In the East Asian region, the market in Japan is analyzed to advance at a CAGR of 6% between 2024 and 2034.

- East Asia is evaluated to hold a share of 22.4% in 2024 with a valuation of US$ 44.5 million in 2024.

- The market in Canada in North America is approximated to advance at a CAGR of 6% through 2034.

- Among different end users of multiphoton microscopy, hospitals and clinics are estimated to hold a share of 33.8% in 2024.

“The ability to image living specimens for extended periods is helping doctors to study organisms, which is driving demand for multiphoton microscopy in the medical field,” says a Fact.MR analyst.

Leading Players Driving Innovation in Multiphoton Microscopy Market:

Sutter Instrument; Olympus Corporation; Bruker; Leica Microsystems (Danhar); Femtonics Ltd.; Nikon; ZEISS; Lavision Biotech; Thorlabs, Inc; Semrock; Scientifica (Judges Scientific plc); Becker & Hickl GmbH.

Development of Small and Portable Multiphoton Microscopy Increasing Convenience in Studies Anywhere and Anytime:

The depth and speed of imaging have been greatly increased by the introduction of femtosecond lasers that are more steady and strong. Tissue-induced aberrations are currently being compensated for by novel adaptive optics systems, significantly improving picture quality in thick specimens.

Real-time 3D reconstructions and automatic feature recognition are possible by the revolutionary advancement of image processing and analysis through the integration of artificial intelligence and machine learning algorithms. Furthermore, the development of multicolor multiphoton imaging systems makes it possible to visualize several cellular components at once, increasing the technique’s usefulness in intricate biological research.

The development of small, portable multiphoton microscopes due to miniaturization efforts has made in-vivo imaging possible in therapeutic settings. Researchers from a wide range of fields are now more easily utilizing multiphoton microscopy with these advancements, automation, and enhanced user interfaces. Multiphoton microscopy is becoming an increasingly important tool for cutting-edge research in the scientific community worldwide as these technical breakthroughs push the frontiers of biological imaging.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=3405

Multiphoton Microscopy Industry News:

- In March 2022, Bruker unveiled the Ultima Investigator Plus, a brand-new modular platform made specifically for deep tissue fluorescence imaging with the Ultima line of multiphoton microscopes.

- The AXE R MP multiphoton confocal microscope, developed by high-tech microscopy system pioneer Nikon Instruments Inc., was released in December 2021. It can take fast, accurate, high-quality, wide-angle photographs at a high speed while residing deep within living organisms.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the multiphoton microscopy market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product (two photon microscopy, three photon microscopy), by application (skin imaging, neuroscience, oncology, immunology, deep tissue imaging, functional & molecular imaging, intravital imaging, cell culture, virology), end user (hospitals & clinics, clinical & diagnostics laboratories, academic & research institutes), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR Research:

Microscopy Devices Market: stands at a value of US$ 9.9 billion in 2023 and is estimated to exhibit expansion at 6.9% CAGR over the next ten years. As such, worldwide microscopy device shipments are forecasted to reach US$ 19.3 billion by 2033-end.

Automated Microscopy Market: is forecasted to magnify at a CAGR of 7.2% and increase from a market valuation of US$ 6 billion in 2022 to US$ 8.5 billion by the end of 2027.

Acoustic Microscopy Market: is estimated at US$ 1.29 billion in 2023 and is projected to reach a market valuation of US$ 2.2 billion by 2033. The global demand for acoustic microscopy technologies is predicted to increase at a CAGR of 5.5% from 2023 to 2033.

Blood Cancer Diagnostics Market: reached a valuation of US$ 15.05 Billion, and is likely to register a Y-o-Y growth rate of 5.6% in 2022, closing at US$ 15.95 Billion. Furthermore, across the 2022-2032 period of assessment, growth is expected to accelerate at a whopping 6.0% CAGR, reaching US$ 28.57 Billion.

Lung Cancer Diagnostics Market: reaching a value of US$ 2.98 billion in 2024. The global lung cancer diagnostics market size has been projected to expand at a CAGR of 6.1% and end up at US$ 5.4 billion by 2034

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Follow Us: LinkedIn | Twitter | Blog

Contact: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583 Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.