The Next Big Thing? 3 Emerging Tech Stocks to Buy and Hold for the Next 5 Years

Stocks like Nvidia have gotten most of the attention over the past 18 months, but nothing goes up forever on Wall Street. Eventually, the stock’s big move is over, and it’s time to find the next big winner.

These three Motley Fool contributors set out to do precisely that.

Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) emerged as top ideas. These companies have compelling growth potential yet are still early enough to make investors a ton of money over the coming years.

Consider buying and holding these three up-and-coming top tech stocks for the next five years.

Palantir’s excellent year continues

Jake Lerch (Palantir Technologies): There’s one name that immediately comes to mind when I think about emerging tech stocks I want to buy and hold: Palantir Technologies.

First off, Palantir really is firing on all cylinders. Recently, news broke that Palantir will join the S&P 500. And while I’m personally excited since I predicted that Palantir would join the benchmark index, it’s even better for the company, as the announcement sent Palantir shares soaring by 14%. Shares of Palantir have now more than doubled year to date, meaning that when Palantir officially joins the index on Sept. 23, it will likely become the index’s second-best performing stock — trailing only Nvidia.

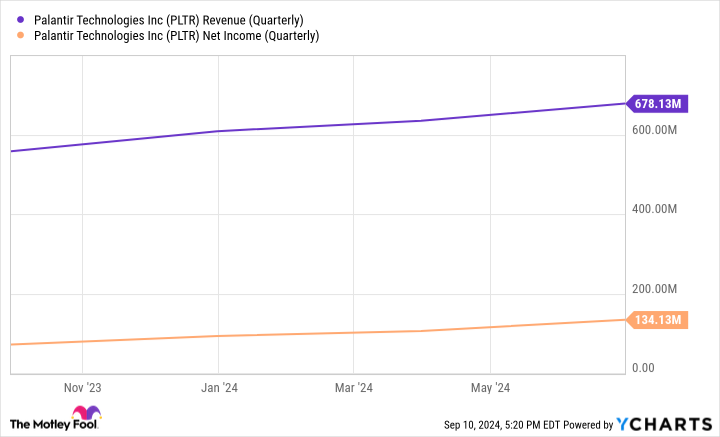

This exceptional stock performance is due to Palantir’s fantastic growth. In its most recent quarter (the three months ended on June 30), the company reported $678 million in revenue, up 27% from a year earlier. It also reported $134 million in net income, representing a year-over-year improvement of 87%.

Similarly, Palantir’s customer count and free cash flow are surging. The company has closed more than 27 deals worth more than $10 million as demand for its AI-powered platform continues to rise.

In short, an excellent 2024 has led to Palantir’s inclusion in the S&P 500. That might soon make this once-unknown stock a household name. However, there’s still time for investors to get their hands on Palantir’s stock. As of this writing, Palantir’s stock has yet to reclaim its all-time high of $45, set back in 2021.

Considering how well the company is executing, investors may look back on 2024 as a great time to invest in Palantir stock.

Affirm’s Buy Now, Pay Later Apple partnership could make shareholders a lot of money

Justin Pope (Affirm): Buy now, pay later company Affirm jumps off the page as an obvious long-term winner. The company uses algorithms to lend money one transaction at a time, helping borrowers avoid running up a balance. Affirm is so confident that its customers will pay them back that the company doesn’t charge late fees.

Such a consumer-friendly business model (the company makes money on interest and merchant fees) has built an 18.7 million user base. Users can shop directly through the Affirm app or use the Affirm Card, which links to their bank account and lets shoppers split purchases into buy now, pay later loans.

More than 300,000 merchants work with Affirm, including partnerships with giant retailers like Amazon and Shopify. This has helped Affirm accelerate its revenue growth since early last year to nearly 50%:

Now, Affirm is taking it up a notch. In June, Apple announced it would end its buy now, pay later product and use Affirm instead. Affirm will integrate directly into Apple Pay, exposing Affirm to the estimated 153 million iOS users in the United States.

As the Apple deal adds to its already-blazing growth, Affirm should grow leaps and bounds over the next five years. The stock is down 77% from its 2021 highs, but it’s hard to see that lasting; the company recently turned its first operating profit and should make strides toward bottom-line profitability over the coming years.

Stellar growth and improving financials could force Wall Street to view the stock in a new light, making Affirm a rising star with big-time investment potential.

Those who missed Amazon may have a second chance with this stock

Will Healy (MercadoLibre): Many investors missed the burgeoning e-commerce opportunity in Amazon as it transformed itself from an online bookseller to a tech conglomerate driven by e-commerce and the cloud.

However, as Amazon grew, many investors missed the explosive growth of the e-commerce giant south of the border, MercadoLibre. MercadoLibre’s addressable market stretches from Tijuana to Tierra del Fuego, and like Amazon, it began as an online seller. Nonetheless, the unique business challenges of Latin America forced it into other businesses.

Unlike the U.S., Latin America is a cash-based society where hundreds of millions of consumers lack a bank account or credit card. To solve this problem, it created Mercado Pago to develop digital financial instruments that would enable online shopping. The concept was so successful that MercadoLibre opened it to customers and businesses who did not shop on its e-commerce site.

Likewise, fulfillment and shipping options are limited in Latin America. Thus, the company formed Mercado Envios to fulfill orders and ship products. In the process, it introduced same-day and next-day shipping in areas where it did not previously exist.

At a market cap of around $100 billion, it is a small fraction of Amazon’s $1.9 trillion size. Still, that smaller size makes faster growth easier, so much so that the revenue for the first half of 2024 grew 39% yearly to $9.4 billion.

Also, keeping a lid on expense growth helped the company earn $875 million in the first six months of 2024, an 89% increase in net income from year-ago levels.

More investors have taken notice of the stock, and consequently, it has risen by more than 40% over the last 12 months and trades near record highs.

Despite this success, it sells at a P/E ratio of 73. Still, thanks to its massive profit growth, its PEG ratio is just under 0.9. That metric arguably makes MercadoLibre a reasonably priced stock investors should consider while it still has a comparatively small market cap.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon, MercadoLibre, and Nvidia. Justin Pope has positions in Affirm. Will Healy has positions in MercadoLibre, Palantir Technologies, and Shopify. The Motley Fool has positions in and recommends Amazon, Apple, MercadoLibre, Nvidia, Palantir Technologies, and Shopify. The Motley Fool has a disclosure policy.

The Next Big Thing? 3 Emerging Tech Stocks to Buy and Hold for the Next 5 Years was originally published by The Motley Fool

This Stock-Split Stock Just Ran Into Trouble. Here's Why It's Still a Buy.

Super Micro Computer (NASDAQ: SMCI) posted a fantastic first half of the year. Thanks to demand from artificial intelligence (AI) customers, in just one quarter, the company delivered sales that surpassed what it used to generate in a full year as recently as 2021. The S&P 500 and Nasdaq-100 even welcomed this 30-year-old tech company to join. And Supermicro’s share price reflected all this good news, climbing 188% to outperform market darling Nvidia.

In fact, the stock had reached such high levels — peaking at more than $1,100 early in the year — that in August, the company announced a stock split planned for later this month. This sort of operation involves the issuance of additional shares to current holders to bring down the per-share price, opening up the investment opportunity to a broader range of investors.

But in recent weeks, the story has lost some of its sparkle. A short report by Hindenburg Research alleging troubles at Supermicro hit the stock badly — it’s dropped 16% since the report’s late-August release. Separately, Supermicro delayed filing its 10-K annual report, another element that’s weighed on the shares. Despite these challenges, Supermicro still makes a great buy right now. Let’s find out why.

Hindenburg’s short position

First, let’s consider the bad news. In its report, Hindenburg alleged “glaring accounting red flags,” “evidence of undisclosed related party transactions,” and other potential issues. But it’s important to keep one thing in mind. Hindenburg holds a short position in Supermicro, meaning it will benefit if the stock declines. This bias makes it difficult to rely on Hindenburg as a source of information about the company.

Another point to keep in mind is that Supermicro addressed the report, saying it “contains false or inaccurate statements.” So, I wouldn’t base a decision on whether to buy or sell Supermicro on the Hindenburg report. Instead, it’s better to consider what we know, such as the company’s path so far, details from recent earnings reports, and market potential.

I mentioned that Supermicro has been around for quite some time, but it’s only over the past few years that its earnings have truly taken off. That’s because AI customers are busy building out their data centers, and they’re rushing to Supermicro for its workstations, servers, and other products.

Supermicro’s strategy

Why Supermicro? The company is able to quickly build products to suit a customer’s needs, including the very latest technology. This is because Supermicro uses building block technology, meaning its products contain a lot of common parts. Supermicro also works closely with top chip designers to immediately integrate their new releases into its products.

This has helped the equipment maker reach record revenue in recent quarters. On top of this, Supermicro may be at the start of a new high-growth opportunity thanks to its ability to solve a big problem with today’s AI data centers: the accumulation of heat. Supermicro makes direct liquid cooling (DLC) elements to handle this and sees demand here set to take off. The company predicts 25% to 30% of new data centers will use this technology in the coming 12 months and Supermicro will dominate the market.

Considering the AI market is forecast to reach more than $1 trillion by the end of the decade, it’s clear that heat could become a problem — and Supermicro may see a huge wave of growth from its expertise in DLC.

Finally, Supermicro recently said that though it’s delaying its 10-K filing, it doesn’t expect any major changes to its fourth-quarter or fiscal-year results. That’s another element that should ease our minds.

So, Supermicro offers us a solid track record, a strategy that sets it apart, and potential for growth ahead. In addition, due to the recent headwinds, the stock has fallen into dirt cheap territory at only about 13x forward earnings estimates. And that’s why now is a great time for long-term investors to consider scooping up shares of this company that may be heading for a whole new wave of growth.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

This Stock-Split Stock Just Ran Into Trouble. Here’s Why It’s Still a Buy. was originally published by The Motley Fool

The Ultimate Growth Stock to Buy With $200 Right Now

If you’re looking for a growth stock to help you build wealth for retirement, it’s not enough to just pick a stock of any growing company that is regularly hitting new highs. There are other important qualities you want to look for.

Obviously, you want a company with outstanding growth prospects, but it’s also beneficial to invest in a business that has a loyal base of customers that regularly spend money with the company. This adds resiliency to the business, especially during recessions and bear markets.

One company that immediately comes to mind is Amazon (NASDAQ: AMZN). Here are three reasons why.

1. Repeat revenue from millions of customers

Amazon has millions of retail customers that regularly use their Prime membership to order multiple items every month. Statista estimates the U.S. Prime member count at 167 million, and over 200 million worldwide, with an estimated 42% of U.S. Prime members making between two and four purchases every month. That’s a big reason why Amazon has grown into a massive business with $604 billion in trailing-12-month revenue as of June 30, 2024.

Over the last four quarters, Amazon generated $42 billion from subscriptions and $237 billion from its online store. The company has continued to expand its same-day delivery and grocery delivery to Prime members, which shows the potential to find more ways to increase purchase frequency and grow revenue.

Amazon also generates repeat revenue from its enterprise cloud service. Amazon Web Services (AWS) is the top cloud computing provider in the world, with millions of customers in over 190 countries. AWS contributes less than 20% of Amazon’s total revenue, but importantly, it’s the most profitable business, contributing around two-thirds of the company’s operating profit.

2. Amazon has tremendous growth opportunities

Amazon’s online store and cloud business have a huge market to expand into that can keep the company growing for decades.

The global e-commerce market is set to reach $6 trillion this year, according to eMarketer. It’s expected to reach $8 trillion by 2028, so Amazon has the benefit of chasing a growing market.

As for AWS, the opportunity is even more lucrative for shareholders. Revenue from AWS grew 19% year over year last quarter, reaching $98 billion in trailing-12-month revenue. However, it’s estimated that at least 80% of enterprise data has yet to move from on-premises servers to the cloud.

With that much opportunity, AWS could grow into a very large business one day — potentially Amazon’s largest revenue source. The high margins from cloud services would significantly increase Amazon’s profitability and send the stock higher.

3. The stock has great upside potential

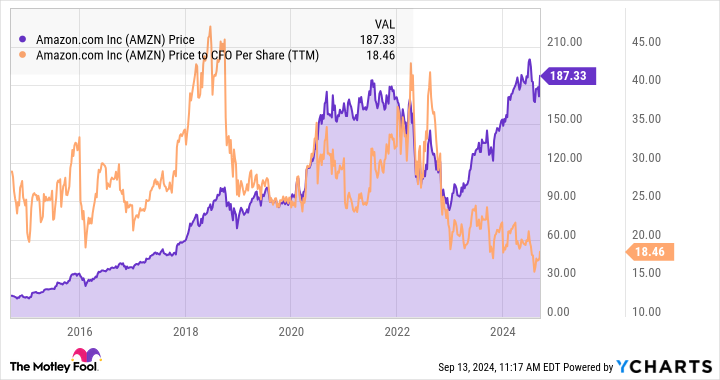

Amazon always looks expensive on the basis of price-to-earnings. That’s because management doesn’t manage the business to maximize earnings per share but to maximize long-term cash flows from operations.

Using Amazon’s cash from operations (CFO) per share, the stock trades at a price-to-CFO multiple of 18.4. Despite the stock doubling in value in the last five years, it is trading at the lowest P/CFO valuation in over 10 years.

Amazon’s cash from operations has tripled in the last five years to $107 billion. In the chart, notice how the stock has soared in value as it followed the growth in the company’s cash from operations, but the shares continue to trade within the same range on a P/CFO basis. With the opportunities Amazon has in e-commerce and cloud services, its cash from operations will continue to grow over time, and that likely means more new highs for the share price.

The stock is currently trading slightly off its recent high of $201, so for an investor that only has a few hundred dollars, now is a great opportunity to buy it.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock to Buy With $200 Right Now was originally published by The Motley Fool

China's homeowners are rushing to pay off mortgages early as outlook on the economy dims

Li Wen, a human resources director at a state-owned enterprise in Nanchang, Jiangxi province, paid off an outstanding 200,000 yuan (US$28,170) on her home loan ahead of schedule in January, soon after she received her annual bonus at work.

The 36-year-old had been repaying her loans, totalling 600,000 yuan, in advance for the past few years, even after the interest rate was reduced to 4.3 per cent from the original 5.39 per cent following a few rounds of rate cuts since last year.

“Depositing the money in banks does not do anything for me,” Li said. “Deposit rates are far lower, and we do not have any ideal high-yield investment options.”

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

“I would rather pay my loans earlier to save the interest cost, especially when salary and job cuts are getting common.”

Li’s concerns are shared by many homeowners in China, who had bought homes in a red-hot market in high hopes of appreciation, before prices started to slide.

A construction site in Beijing. Photo: Agence France-Presse alt=A construction site in Beijing. Photo: Agence France-Presse>

The Chinese property market, once a major pillar of the national economy, has been in the doldrums since August 2020, when the government put in place a policy dubbed “the three red lines”, aimed at curbing a borrowing binge by property developers.

Since then, some homeowners, suffering from heavy loan burdens and an uncertain economic outlook, sold their homes. Others, like Li, saved up and took advantage of interest rate cuts to pay down mortgages or home loans.

This year, the People’s Bank of China has twice lowered the five-year loan prime rate, which commercial banks use as a benchmark to adjust their mortgage rates, by a total of 35 basis points to 3.85 per cent. The central bank has also lifted the lower cap for mortgages on new and second-hand homes nationwide.

That led dozens of Chinese cities to cut their mortgage rates to 3.2 per cent, and some others to below 3 per cent. The average rate for newly issued mortgages was 3.45 per cent in June, down from 4.27 per cent last September, according to government data.

Homeowners seized the chance.

In each month last year, an average of 450 billion yuan worth of mortgages was paid off prematurely, according to data compiled by Australia and New Zealand Banking Group (ANZ). That number rose to 600 billion yuan in the first seven months of this year, equivalent to 15 per cent of China’s retail sales or 12 per cent of the population’s disposable income during the period.

Residential buildings in Beijing. Photo: Bloomberg alt=Residential buildings in Beijing. Photo: Bloomberg>

Outstanding mortgages in China dropped to 37.79 trillion yuan as of the end of June, the lowest level in almost three years, official data showed.

Amid calls to reduce the rate gap between existing and new mortgages, China could slash rates on outstanding mortgages by up to 50 basis points as early as this month, working up to a total reduction of 80 basis points by next year, according to a recent report from Bloomberg, citing unnamed sources.

The prospective relief measures lifted the hopes of some homeowners. “Once that is implemented, I will relax my budget and withdraw my application for early mortgage payments,” wrote one user on Xiaohongshu, an Instagram-like Chinese social media platform also known as Red.

“A further reduction on the outstanding mortgage rate will decrease costs for existing homeowners and spur consumption and investment,” said Chen Wenjing, director of market research at China Index Academy. “It will also ease the wait-and-see sentiment dragged on by expectations of further rate cuts, and shore up consumption, including home purchases.”

But while such measures may bring a short-term rebound in consumption, in the long run it may do little to boost the property market, according to some analysts.

“If this mortgage rate cut materialised, we believe the potential impact would be quite limited in spurring demand in China’s property market,” said Ricky Tsang, a director at S&P Global Ratings.

“The loan burdens of existing homeowners may be lessened with a rate cut, [but] demand for property is still constrained by the weakening economy and decline in home prices,” he said.

A building project under construction in Beijing. Photo: EPA-EFE alt=A building project under construction in Beijing. Photo: EPA-EFE>

While a reduction of 80 basis points is “generally in line” with expectation, said Xing Zhaopeng, a senior China strategist at ANZ, “the effect may be limited”.

“It may help decrease early mortgage payments, but it is not enough to bring the property market back to normal,” he said, citing the low rental yields across the country – about 3 per cent in major second and third-tier cities, and around 2 per cent in first-tier cities – as one of the major hurdles for home purchase.

Buyers also remain cautious about plunging home prices.

Prices of new homes in China declined by the most in nine years last month, sinking 5.7 per cent from a year ago, according to official data released on Saturday. Meanwhile, contracted sales generated by the top 100 Chinese developers plunged 10 per cent in August from a month earlier, and 27 per cent from a year earlier, according to China Real Estate Information Corporation.

“If there is no major stimulus to reverse the expectation on home prices and lift rental yields to a level higher than mortgage rates, China’s properties may remain uninvestable,” said ANZ’s Xing.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Michaël Van De Poppe Predicts Massive Bitcoin Surge, Says Price May Soar By 890%

Crypto analyst Michaël van de Poppe has forecast that Bitcoin BTC/USD could potentially skyrocket by a staggering 890% in the current cycle, reaching a value between $300,000 and $600,000.

What Happened: Van de Poppe shared his optimistic prediction with his 724,700 followers on social media platform X.

He expressed his belief that Bitcoin’s current market value is significantly underpriced and could witness a substantial surge if investors consider the digital asset as a safe haven against geopolitical uncertainties, banking instability, and currency debasement.

Van de Poppe also pointed out a potential breakout in the TOTAL3 chart, which monitors the market capitalization of all crypto assets excluding Bitcoin, Ethereum ETH/USD, and stablecoins. He observed a bullish divergence on the weekly time frame with the relative strength index (RSI), indicating a possible reversal could be on the horizon.

Also Read: Is Bitcoin Really Out Of The Danger Zone? Crypto Analyst Predicts Potential Dip

A breakout in the TOTAL3/BTC ratio would suggest that the broader altcoin market is outperforming Bitcoin.

At the time of writing, Bitcoin was trading at $60,013.74, up by almost 10% in the last seven days.

Why It Matters: Van de Poppe’s prediction, if realized, could signify a monumental shift in the crypto market. Bitcoin’s potential surge could attract a new wave of investors, further solidifying its position as a leading digital asset.

Additionally, a breakout in the TOTAL3/BTC ratio could indicate a growing interest in altcoins, potentially leading to a more diversified crypto market.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Black-Owned Coffee Chain In Oakland Files For Bankruptcy Amid Multiple Lawsuits

Red Bay Coffee Roasters has officially filed for Chapter 11 Bankruptcy. The Black-owned coffee chain in Oakland will begin this process as multiple lawsuits against the company wage on.

San Francisco Business Times reported that Red Bay filed in late August. The notable franchise, which boast five stores across the Bay Area, stated that Covid-19’s impact and the ongoing lawsuits played the biggest roles. Specifically, the paperwork noted “spiraling costs and related uncertainties” surrounding the lawsuits as a push toward Chapter 11 protections.

The owner and current debtor-in-possession, Keba Konte, founded Red Bay in his garage in 2014. In his declaration for first-day motions filed on Sept. 5, Konte released his asset valuation at $251,000. He also listed his liabilities at $3.3 million, with two loans valued at $550,000 each. On the other hand, the company had a net loss of more than $850,000 in a six-month period starting January 2024.

Through its expansion, Konte appointed the space as unapologetically welcoming to Black and Brown people, hosting panels and workshops to uplift its local community. Red Bay has also featured exclusive coffee blends that shed light on social causes, one most recently dedicated to the conflict in Democratic Republic of Congo conflict as well as sickle cell disease awareness. However, lawsuits accusing the employees of sexual harassment and wage theft have stunted the company.

In 2018, a former employee sued Red Bay, alleging that several coworkers engaged in sexual harassment against them. The employee further claims that they were demoted and then fired for retaliation. Moreover, they accused the business of not paying the full amount of wages owed.

A former landlord also filed another lawsuit against Red Bay. The filing stated the franchise breached a contract surrounding one of its now-defunct locations in Southern California. To add to their legal woes, the filing also claimed Equal Employment Opportunity Commissions (EEOC) launched an investigation into their business practices based on claims made by a former employee. THe EEOC has yet to confirm the investigation given federal policies.

As the Oakland-based chain enters bankruptcy, the future of its five operating storefronts remain in limbo.

RELATED CONTENT: Coffee Choice May Predict Election

Fed rate cut: Experts warn big moves would be a mistake

Wall Street’s great debate — a Fed rate cut — is back in the spotlight.

This time, it’s not whether the Jerome Powell led central bank will act at its September meeting, but rather, the size of the cut: 25 basis points or 50.

The case for a 50 basis point reduction has grown louder in recent weeks, as a weakening jobs market has prompted calls for more aggressive Fed action to avoid further economic deterioration.

Yet despite the handwringing and doomsday scenarios, strategists and economists told me this week a 50 basis point cut would send the wrong message to the market — one that signals the central bank is too late to act.

“A 50 basis point cut would reek of panic, and it’s almost like we’re totally behind the curve at this point,” BMO Capital Markets senior economist Jennifer Lee warned.

She added, “We’re tapping on the brakes… But the fact that the US economy has held up all this time speaks to the resilience of it all.”

Lee points to the upwardly revised second quarter GDP, resilient consumer spending, and lack of mass layoffs among factors supporting her call for a more measured approach, adding a soft landing is “in the cards.”

A larger cut could also raise the alarm for investors. Yardeni Research’s Eric Wallerstein told me a jumbo cut would likely spark volatility and signal the economy is “heading in the wrong direction.”

“For everyone who’s asking for a 50 basis point cut, I think they should really reconsider the amount of volatility that would cause in short-term funding markets,” Wallerstein said.

The pair of veteran assessments is in line with Goldman Sachs chief economist Jan Hatzius, who told Yahoo Finance executive editor Brian Sozzi this week he expects a series of 25 basis point rate cuts (though didn’t completely rule out a 50 basis point cut next week).

With less than a week until the Fed decision, traders are pricing in near-even odds of a 25 versus 50 basis point cut. As of Friday, the probability of a 50 basis point cut rose to 49%, up from 30% one week ago.

At the heart of the rate cut debate is the risk of a recession, a concern that’s plagued Wall Street for years.

Long-time market strategist Jim Paulsen told me on Opening Bid (video above; listen here) the ongoing fear of recession isn’t necessarily a reflection of deteriorating economic prints. Rather, it’s attributable to multiple factors: the shock of the pandemic, the polarizing political environment, and the breakdown of recession forecasting tools.

“Every recession tool that we’ve ever used to predict recessions has blown up or just has quit working,” Paulsen warned. ”We’re left rudderless on how to assess recession risk.”

The inverted yield curve, slowing rates of money supply growth, and the Conference Board’s Leading Economic Index (LEI) have all signaled a recession, leaving Wall Street anxious.

While it’s unlikely the Federal Reserve’s rate cut decision on Wednesday will resolve Wall Street’s ongoing recession debate, it should offer some near-term clarity for investors.

If the market pros are right, the size of the rate cut could signal whether the economy is at greater risk of weakening, which could potentially rattle financial markets and sway recession calls firmly in one direction.

Buckle up.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

China touts home-grown chip lithography machines amid semiconductor self-sufficiency drive

The Chinese government is promoting two domestically made chip-making machines that it says have achieved significant advances, as the country strives towards technology self-sufficiency amid US sanctions.

The lithography machines, which print highly complex circuit patterns onto silicon wafers, “have achieved significant technological breakthroughs, own intellectual property rights but have yet to perform on the market”, according to the Ministry of Industry and Information Technology (MIIT), which did not name the companies behind the two machines.

One of the deep ultraviolet (DUV) lithography machines operates at a wavelength of 193 nanometres (nm), with a resolution below 65nm and an overlay accuracy below 8nm, according to a new list of “major technological equipment” published by the MIIT earlier this week. The other DUV machine has a wavelength of 248nm, with 110nm resolution and 25nm overlay accuracy, according to the list.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The two machines are still far behind the most advanced options available on the market. One of Dutch equipment maker ASML Holding’s most advanced DUV machines, for instance, can operate at a resolution of below 38nm with an overlay accuracy of 1.3nm.

DUV machines also lag behind extreme ultraviolet (EUV) machines, which use light with a wavelength of just 13.5nm – almost 14 times sharper than DUV’s 195nm.

China has spent years pursuing technology self-sufficiency in semiconductors, but its progress in producing the lithography systems required to reliably mass produce advanced chips remains slow.

An engineer works on a deep-ultraviolet lithography system at ASML in Veldhoven, Netherlands, on June 16, 2023. Photo: Reuters alt=An engineer works on a deep-ultraviolet lithography system at ASML in Veldhoven, Netherlands, on June 16, 2023. Photo: Reuters>

Nearly all of the country’s lithography machines still come from the ASML, which has already cut off Chinese clients’ access to its cutting-edge EUV machines and is facing increased pressure from the US to withhold its DUV machines from China-based customers.

State-owned enterprise Shanghai Micro Electronics Equipment Group (SMEE), the country’s best hope to develop its own advanced lithography systems, still lags far behind its global peers such as ASML. The company, which was added to a trade blacklist by the US in December 2022, would need breakthroughs across multiple technologies and supplier networks to overcome restrictions, according to experts.

But SMEE has made some progress despite sanctions. The company in March last year filed a patent for “EUV radiation generators and lithography equipment”, according to corporate registry data published earlier this week.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Trump Stumbles Again Over Health Care Issues Involving Abortion And Obamacare

In his recent debate with Vice President Kamala Harris, former President Donald Trump‘s stance on key health care issues, including the Affordable Care Act (ACA) and abortion, came under intense scrutiny. His responses, often vague and contradictory, highlighted his ongoing struggle with these critical topics.

What Happened: Trump’s handling of the ACA, also known as ObamaCare, and his inconsistent positions on abortion were brought into sharp focus during the debate.

Trump remained noncommittal about his plans for both subjects, leading Republican strategist Chuck Coughlin to comment that Trump “absolutely stepped on every possible land mine in both of those.”

According to the report by The Hill, On the subject of ObamaCare, Trump hinted at a potential attempt to repeal the law again but did not commit to having a replacement plan. He criticized the law as “lousy,” but reluctantly pledged to manage it “as good as it can be run” until a better and cheaper option is available.

Trump’s lack of a concrete plan to replace ObamaCare if repealed was also exposed during the debate. “I have concepts of a plan. I’m not president right now,” Trump said.

Also Read: Trump Vs Harris: New Poll Reveals Post-Debate Swing Towards This Candidate In Key State

Coughlin found Trump’s comments revealing, stating, “I think it spoke to the reason McCain gave the thumbs down is they never had an alternative plan.”

Trump’s shifting positions on abortion were also on display during the debate. He avoided committing to vetoing a national abortion ban and made several false claims about Democrats’ stance on abortion.

Read Also

Why It Matters: These issues are crucial in the upcoming election, with Democrats focusing on health care and polls indicating voters’ interest in plans to lower health costs.

Trump’s inconsistent positions on these issues could potentially impact his campaign. The debate has brought these topics to the forefront, and the public will be watching closely to see how Trump’s positions evolve in the lead up to the election.

Read Next

Trump Vs Harris: New Polls Reveal This Candidate Is Outperforming In Swing States

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.