The Next Big Thing? 3 Emerging Tech Stocks to Buy and Hold for the Next 5 Years

Stocks like Nvidia have gotten most of the attention over the past 18 months, but nothing goes up forever on Wall Street. Eventually, the stock’s big move is over, and it’s time to find the next big winner.

These three Motley Fool contributors set out to do precisely that.

Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) emerged as top ideas. These companies have compelling growth potential yet are still early enough to make investors a ton of money over the coming years.

Consider buying and holding these three up-and-coming top tech stocks for the next five years.

Palantir’s excellent year continues

Jake Lerch (Palantir Technologies): There’s one name that immediately comes to mind when I think about emerging tech stocks I want to buy and hold: Palantir Technologies.

First off, Palantir really is firing on all cylinders. Recently, news broke that Palantir will join the S&P 500. And while I’m personally excited since I predicted that Palantir would join the benchmark index, it’s even better for the company, as the announcement sent Palantir shares soaring by 14%. Shares of Palantir have now more than doubled year to date, meaning that when Palantir officially joins the index on Sept. 23, it will likely become the index’s second-best performing stock — trailing only Nvidia.

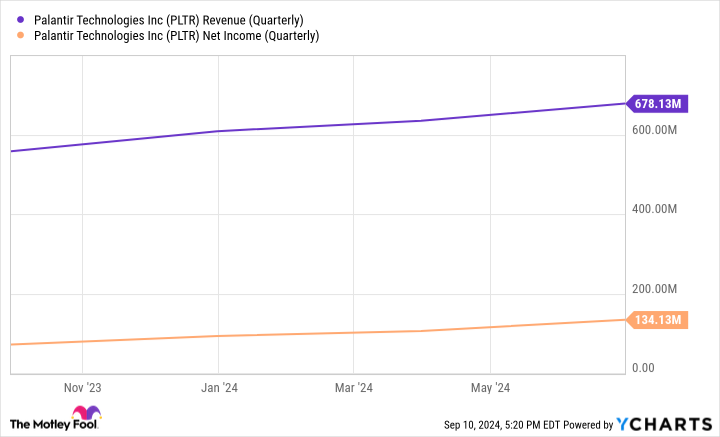

This exceptional stock performance is due to Palantir’s fantastic growth. In its most recent quarter (the three months ended on June 30), the company reported $678 million in revenue, up 27% from a year earlier. It also reported $134 million in net income, representing a year-over-year improvement of 87%.

Similarly, Palantir’s customer count and free cash flow are surging. The company has closed more than 27 deals worth more than $10 million as demand for its AI-powered platform continues to rise.

In short, an excellent 2024 has led to Palantir’s inclusion in the S&P 500. That might soon make this once-unknown stock a household name. However, there’s still time for investors to get their hands on Palantir’s stock. As of this writing, Palantir’s stock has yet to reclaim its all-time high of $45, set back in 2021.

Considering how well the company is executing, investors may look back on 2024 as a great time to invest in Palantir stock.

Affirm’s Buy Now, Pay Later Apple partnership could make shareholders a lot of money

Justin Pope (Affirm): Buy now, pay later company Affirm jumps off the page as an obvious long-term winner. The company uses algorithms to lend money one transaction at a time, helping borrowers avoid running up a balance. Affirm is so confident that its customers will pay them back that the company doesn’t charge late fees.

Such a consumer-friendly business model (the company makes money on interest and merchant fees) has built an 18.7 million user base. Users can shop directly through the Affirm app or use the Affirm Card, which links to their bank account and lets shoppers split purchases into buy now, pay later loans.

More than 300,000 merchants work with Affirm, including partnerships with giant retailers like Amazon and Shopify. This has helped Affirm accelerate its revenue growth since early last year to nearly 50%:

Now, Affirm is taking it up a notch. In June, Apple announced it would end its buy now, pay later product and use Affirm instead. Affirm will integrate directly into Apple Pay, exposing Affirm to the estimated 153 million iOS users in the United States.

As the Apple deal adds to its already-blazing growth, Affirm should grow leaps and bounds over the next five years. The stock is down 77% from its 2021 highs, but it’s hard to see that lasting; the company recently turned its first operating profit and should make strides toward bottom-line profitability over the coming years.

Stellar growth and improving financials could force Wall Street to view the stock in a new light, making Affirm a rising star with big-time investment potential.

Those who missed Amazon may have a second chance with this stock

Will Healy (MercadoLibre): Many investors missed the burgeoning e-commerce opportunity in Amazon as it transformed itself from an online bookseller to a tech conglomerate driven by e-commerce and the cloud.

However, as Amazon grew, many investors missed the explosive growth of the e-commerce giant south of the border, MercadoLibre. MercadoLibre’s addressable market stretches from Tijuana to Tierra del Fuego, and like Amazon, it began as an online seller. Nonetheless, the unique business challenges of Latin America forced it into other businesses.

Unlike the U.S., Latin America is a cash-based society where hundreds of millions of consumers lack a bank account or credit card. To solve this problem, it created Mercado Pago to develop digital financial instruments that would enable online shopping. The concept was so successful that MercadoLibre opened it to customers and businesses who did not shop on its e-commerce site.

Likewise, fulfillment and shipping options are limited in Latin America. Thus, the company formed Mercado Envios to fulfill orders and ship products. In the process, it introduced same-day and next-day shipping in areas where it did not previously exist.

At a market cap of around $100 billion, it is a small fraction of Amazon’s $1.9 trillion size. Still, that smaller size makes faster growth easier, so much so that the revenue for the first half of 2024 grew 39% yearly to $9.4 billion.

Also, keeping a lid on expense growth helped the company earn $875 million in the first six months of 2024, an 89% increase in net income from year-ago levels.

More investors have taken notice of the stock, and consequently, it has risen by more than 40% over the last 12 months and trades near record highs.

Despite this success, it sells at a P/E ratio of 73. Still, thanks to its massive profit growth, its PEG ratio is just under 0.9. That metric arguably makes MercadoLibre a reasonably priced stock investors should consider while it still has a comparatively small market cap.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon, MercadoLibre, and Nvidia. Justin Pope has positions in Affirm. Will Healy has positions in MercadoLibre, Palantir Technologies, and Shopify. The Motley Fool has positions in and recommends Amazon, Apple, MercadoLibre, Nvidia, Palantir Technologies, and Shopify. The Motley Fool has a disclosure policy.

The Next Big Thing? 3 Emerging Tech Stocks to Buy and Hold for the Next 5 Years was originally published by The Motley Fool

Leave a Reply