This Is What Whales Are Betting On FedEx

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

Looking at options history for FedEx FDX we detected 28 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $613,166 and 16, calls, for a total amount of $1,167,212.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $330.0 for FedEx over the last 3 months.

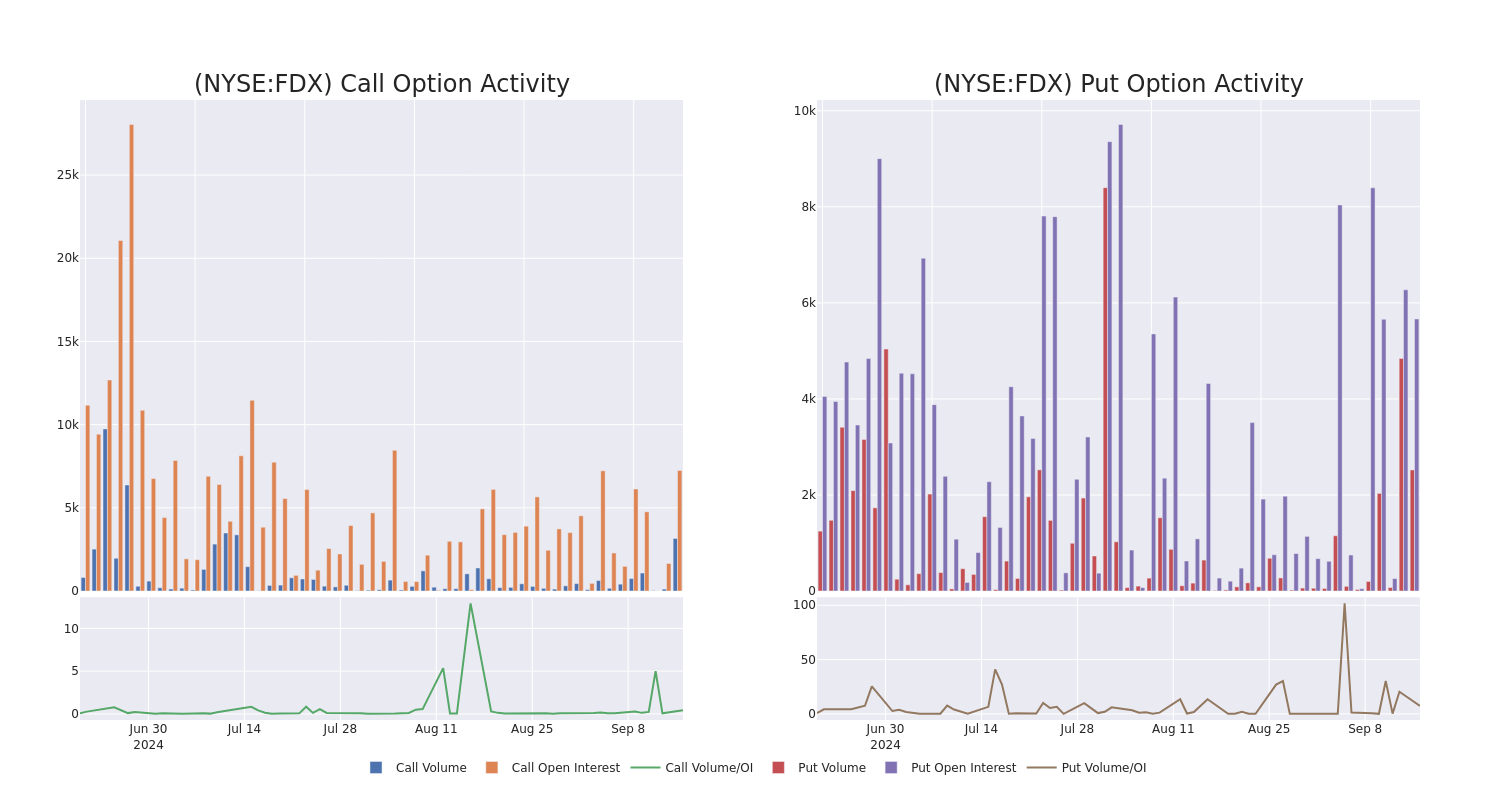

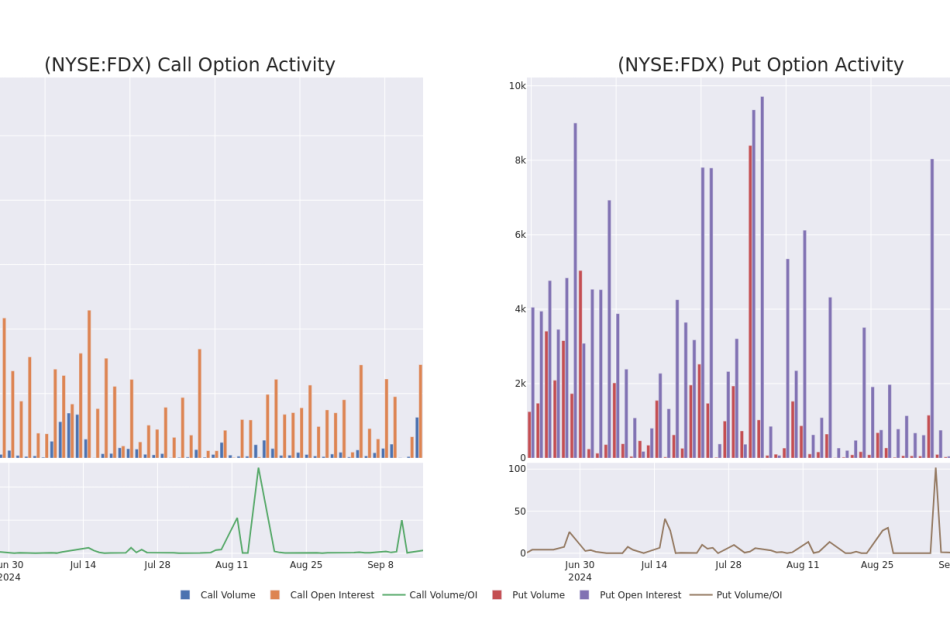

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of FedEx stands at 614.86, with a total volume reaching 5,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in FedEx, situated within the strike price corridor from $240.0 to $330.0, throughout the last 30 days.

FedEx Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | TRADE | BEARISH | 10/18/24 | $6.65 | $6.4 | $6.4 | $310.00 | $163.2K | 725 | 270 |

| FDX | CALL | SWEEP | BEARISH | 10/18/24 | $15.05 | $14.85 | $14.85 | $290.00 | $118.8K | 610 | 85 |

| FDX | CALL | SWEEP | BULLISH | 12/20/24 | $13.4 | $12.2 | $13.27 | $310.00 | $107.0K | 368 | 85 |

| FDX | PUT | SWEEP | BULLISH | 09/20/24 | $10.2 | $10.0 | $10.0 | $290.00 | $100.0K | 3.4K | 125 |

| FDX | CALL | SWEEP | BEARISH | 09/20/24 | $3.95 | $3.8 | $3.8 | $310.00 | $94.3K | 1.5K | 353 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world’s largest express package provider. In its fiscal 2024, which ended May 2024, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting the firm’s presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

After a thorough review of the options trading surrounding FedEx, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of FedEx

- Currently trading with a volume of 567,279, the FDX’s price is up by 2.14%, now at $292.52.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 3 days.

Expert Opinions on FedEx

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $336.3333333333333.

- An analyst from TD Cowen downgraded its action to Buy with a price target of $334.

- An analyst from Baird persists with their Outperform rating on FedEx, maintaining a target price of $340.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for FedEx, targeting a price of $335.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply