Noteworthy Insider Activity: Linda Harty Invests $240K In Chart Industries Stock

Linda Harty, Director at Chart Industries GTLS, disclosed an insider purchase on September 16, based on a new SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Harty purchased 5,000 shares of Chart Industries. The total transaction amounted to $240,229.

Chart Industries‘s shares are actively trading at $120.83, experiencing a up of 3.02% during Tuesday’s morning session.

Discovering Chart Industries: A Closer Look

Chart Industries provides a variety of cryogenic equipment for storage, distribution, and other processes within the industrial gas and liquefied natural gas industries. It also provides natural gas processing solutions for the natural gas industry and specialty products that serve a variety of spaces, including hydrogen, biofuels, cannabis, and water treatment. The firm acquired Howden in a significant deal in early 2023, roughly doubling the size of the company.

Understanding the Numbers: Chart Industries’s Finances

Revenue Growth: Over the 3 months period, Chart Industries showcased positive performance, achieving a revenue growth rate of 14.56% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company faces challenges with a low gross margin of 33.8%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Chart Industries’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.23.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.48, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 52.36 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.48 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 11.48, Chart Industries’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Chart Industries’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

REGAL REXNORD CORPORATION HOSTS 2024 INVESTOR CONFERENCE, INTRODUCES NEW THREE YEAR FINANCIAL TARGETS

MILWAUKEE, Sept. 17, 2024 /PRNewswire/ — Regal Rexnord Corporation RRX is hosting its 2024 Investor Day today at The Mandarin Oriental Hotel in New York City beginning at 8:30 AM ET. A live webcast of the event will be accessible on the Company’s investor relations website at investors.regalrexnord.com.

CEO Louis Pinkham, CFO Rob Rehard, and other members of the executive leadership team will discuss the Company’s strategic growth objectives, including plans to accelerate profitable organic sales growth, continue to expand adjusted gross margins and adjusted EBITDA margins, grow free cash flow, and drive significant potential value creation through various capital deployment initiatives.

In conjunction with today’s event, the Company is maintaining its previously announced annual 2024 guidance, including sales of $6.2 billion, GAAP diluted earnings per share in a range of $3.70 to $4.10, and adjusted diluted earnings per share* in a range of $9.40 to $9.80. However, based on recent performance, the Company now believes that the lower half of the outlook range is more likely.

The Company is also introducing the following financial targets for the 2024 to 2027 period:

- Organic net sales growth at a CAGR of 2% to 5%

- Adjusted gross margins** rising to ~40% exiting 2025 and remaining steady thereafter

- Adjusted EBITDA margins** rising to ~25% exiting 2025 and remaining steady thereafter

- Adjusted diluted earnings per share** growth at a low double digit CAGR

- Adjusted free cash flow margins** in the low- to mid-teens by 2027

- Net leverage** declining to ~2.5x in 2025 and to 1.5–2.0x by 2027

Commenting on the Company’s three-year outlook, CEO Louis Pinkham said: “We see many opportunities to create significant value for shareholders by capitalizing on the strengths of our enterprise, which over the last five years we have dramatically transformed, through organic and inorganic actions, to be increasingly durable, high-margin, and cash generative. As we will discuss in some detail at our investor meeting today, our teams are working on a wide range of compelling initiatives to accelerate organic growth. We also see a clear path to top quartile gross, EBITDA and cash flow margins, ROIC expansion, and meaningful opportunities to create value through de-levering and, over time, inorganic growth. In short, we believe Regal Rexnord presents a highly compelling value creation opportunity, underpinned by lots of controllable execution.”

Supplemental Materials

Supplemental materials and additional information will be accessible on Regal Rexnord’s Investor website: https://investors.regalrexnord.com. The Company intends to disseminate important information about the Company to its investors on the Investors section of its website: https://investors.regalrexnord.com. Investors are advised to look at Regal Rexnord’s website for future important information about the Company.

About Regal Rexnord

Regal Rexnord’s 30,000 associates around the world help create a better tomorrow by providing sustainable solutions that power, transmit and control motion. The Company’s electric motors and air moving subsystems provide the power to create motion. A portfolio of highly engineered power transmission components and subsystems efficiently transmits motion to power industrial applications. The Company’s automation offering, comprised of controls, actuators, drives, and precision motors, controls motion in applications ranging from factory automation to precision control in surgical tools.

The Company’s end markets benefit from meaningful secular demand tailwinds, and include factory automation, food & beverage, aerospace, medical, data center, warehouse, alternative energy, residential and commercial buildings, general industrial, construction, metals and mining, and agriculture.

Regal Rexnord is comprised of three operating segments: Industrial Powertrain Solutions, Power Efficiency Solutions, and Automation & Motion Control. Regal Rexnord is headquartered in Milwaukee, Wisconsin and has manufacturing, sales and service facilities worldwide. For more information, including a copy of our Sustainability Report, visit RegalRexnord.com.

* Non-GAAP Financial Measure, See Appendix for Reconciliation to the most directly comparable GAAP financial measure.

** Regal Rexnord does not provide a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures on a forward-looking basis because it is unable to predict certain adjustment items without unreasonable effort.

Forward Looking Statements

All statements in this communication, other than those relating to historical facts, are “forward-looking statements.” Forward-looking statements can generally be identified by their use of terms such as “anticipate,” “believe,” “confident,” “estimate,” “expect,” “intend,” “plan,” “may,” “will,” “project,” “forecast,” “target, ” “would,” “could,” “should,” and similar expressions, including references to assumptions. Forward-looking statements are not guarantees of future performance and are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. Forward-looking statements include, but are not limited to, statements about expected market or macroeconomic trends, future strategic plans and future financial and operating results. Important factors that could cause actual results to differ materially from those presented or implied in the forward-looking statements in this communication include, without limitation: the possibility that the Company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the sale of the Industrial Motors and Generators businesses, the acquisition of Altra Industrial Motion Corp. (“Altra Transaction”), and the merger with the Rexnord Process & Motion Control business (the “Rexnord PMC business”) within the expected time-frames or at all and to successfully integrate Altra Industrial Motion Corp. (“Altra”) and the Rexnord PMC business; the Company’s substantial indebtedness as a result of the Altra Transaction and the effects of such indebtedness on the Company’s financial flexibility; the Company’s ability to achieve its objectives on reducing its indebtedness on the desired timeline; dependence on key suppliers and the potential effects of supply disruptions; fluctuations in commodity prices and raw material costs; any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; unanticipated operating costs, customer loss or business disruption; the Company’s ability to retain key executives and employees; uncertainties regarding our ability to execute restructuring plans within expected costs and timing; challenges to the tax treatment that was elected with respect to the merger with the Rexnord PMC business and related transactions; actions taken by competitors and our ability to effectively compete in the increasingly competitive global electric motor, drives and controls, power generation and power transmission industries; our ability to develop new products based on technological innovation, such as the Internet of Things and artificial intelligence, and marketplace acceptance of new and existing products; dependence on significant customers and distributors; risks associated with climate change and uncertainty regarding our ability to deliver on our sustainability commitments and/or to meet related investor, customer and other third party expectations relating to our sustainability efforts; risks associated with global manufacturing, including risks associated with public health crises and political, societal or economic instability, including instability caused by ongoing geopolitical conflicts; issues and costs arising from the integration of acquired companies and businesses; prolonged declines in one or more markets; risks associated with excess or obsolete inventory charges, including related write-offs or write-downs; economic changes in global markets, such as reduced demand for products, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external factors that the Company cannot control; product liability, asbestos and other litigation, or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; the Company’s ability to identify and execute on future M&A opportunities, including significant M&A transactions; the impact of any such M&A transactions on the Company’s results, operations and financial condition, including the impact from costs to execute and finance any such transactions; unanticipated costs or expenses that may be incurred related to product warranty issues; infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party technologies; effects on earnings of any significant impairment of goodwill; losses from failures, breaches, attacks or disclosures involving information technology infrastructure and data; costs and unanticipated liabilities arising from rapidly evolving laws and regulations; and other factors that can be found in our filings with the SEC, including our most recent periodic reports filed on Form 10-K and Form 10-Q, which are available on our Investor Relations website. Forward-looking statements are given only as of the date of this communication and we disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Measures

(Unaudited)

(Dollars in Millions, Except per Share Data)

We prepare our financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We also periodically disclose certain financial measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events that may be considered “non-GAAP” financial measures. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP.

In this release, we disclose certain non-GAAP forward-looking information, including adjusted targets such as gross margin, EBITDA margin, diluted earnings per share, free cash flow margin and net leverage. We believe that these forward-looking non-GAAP financial measures are useful measures for providing investors with additional information regarding our financial targets. The Company believes that a quantitative reconciliation of this forward-looking information to the most comparable financial measure calculated and presented in accordance with GAAP cannot be made available without unreasonable efforts. A reconciliation of this non-GAAP financial measure would require the Company to predict the timing and likelihood of future restructurings and other charges. Neither these forward-looking measures, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of the most directly comparable forward-looking GAAP measure is not provided.

In addition to these non-GAAP measures, we use the term “organic sales growth” to refer to the increase in our sales between periods that is attributable to organic sales. “Organic sales” refers to GAAP sales from existing operations, excluding any sales from acquired businesses recorded prior to the first anniversary of the acquisition and excluding any sales from divested businesses recorded prior to the first anniversary of the exit, and excluding the impact of foreign currency translation. The impact of foreign currency translation is determined by translating the respective period’s organic sales using the currency exchange rates that were in effect during the prior year periods.

|

Appendix

|

||||

|

2024 ADJUSTED ANNUAL GUIDANCE |

||||

|

Unaudited |

||||

|

Minimum |

Maximum |

|||

|

2024 GAAP Diluted EPS Annual Guidance |

$ 3.70 |

$ 4.10 |

||

|

Intangible Amortization |

3.92 |

3.92 |

||

|

Restructuring and Related Costs (a) |

0.68 |

0.68 |

||

|

Share-Based Compensation Expense |

0.51 |

0.51 |

||

|

Operating Lease Asset Step Up |

0.01 |

0.01 |

||

|

Impairments and Exit Related Costs |

0.02 |

0.02 |

||

|

Loss on Sale of Businesses |

0.06 |

0.06 |

||

|

Gain on Sale of Assets |

(0.01) |

(0.01) |

||

|

Transaction and Integration Related Costs (b) |

0.26 |

0.26 |

||

|

Discrete Tax Items |

0.25 |

0.25 |

||

|

2024 Adjusted Diluted EPS Annual Guidance |

$ 9.40 |

$ 9.80 |

||

|

(a) Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges.

(b) Primarily relates to (1) legal, professional service, and rebranding costs associated with the sale of the industrial motors and generators businesses and (2) legal, professional service and integration costs associated with the Altra Transaction. |

||||

![]() View original content:https://www.prnewswire.com/news-releases/regal-rexnord-corporation-hosts-2024-investor-conference-introduces-new-three-year-financial-targets-302249433.html

View original content:https://www.prnewswire.com/news-releases/regal-rexnord-corporation-hosts-2024-investor-conference-introduces-new-three-year-financial-targets-302249433.html

SOURCE Regal Rexnord Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insecticides Market Size is Expected to Reach USD 32.8 billion, Advancing at a CAGR of 5.5% by 2034: Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 17, 2024 (GLOBE NEWSWIRE) — The global insecticides market (세계 살충제 시장) is estimated to flourish at a CAGR of 5.5% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for insecticides is estimated to reach US$ 32.8 billion by the end of 2034.

With changing climate patterns, there’s a growing need for insecticides resilient to environmental fluctuations. Companies are investing in research to develop insecticides capable of withstanding extreme weather conditions, ensuring consistent pest control and crop protection.

Escalating pest resistance to conventional insecticides necessitates the development of novel solutions. Innovations in mode of action and formulation techniques are vital to overcome resistance challenges and maintain effective pest control strategies.

The integration of digital technologies such as precision agriculture and remote sensing revolutionizes pest monitoring and management. Advanced analytics and data-driven insights enable farmers to optimize insecticide application, reducing wastage and enhancing efficacy.

Increasing consumer awareness about environmental and health impacts drives demand for eco-friendly insecticides. Manufacturers are responding by investing in research and development of bio-based and organic insecticide alternatives, catering to the growing preference for sustainable agricultural practices.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/insecticides-market.html

Collaboration between academia, industry, and government institutions fosters innovation in insecticide development. Joint research initiatives and knowledge-sharing platforms accelerate the discovery and commercialization of novel insecticide solutions, driving market growth and competitiveness.

Insecticides Market: Competitive Landscape

In the fiercely competitive insecticides market, industry giants such as Bayer AG, Syngenta, and BASF SE dominate, leveraging extensive R&D and global distribution networks. These key players offer a diverse portfolio of insect control solutions, including chemical and biological formulations, to combat pests effectively. Emerging contenders like FMC Corporation and Corteva Agriscience intensify competition by focusing on innovation and sustainability.

Market consolidation through mergers and acquisitions further shapes the competitive landscape, driving companies to differentiate through product efficacy, safety profiles, and environmental sustainability. With rising demand for crop protection and increasing pest resistance, the Insecticides Market continues to evolve with dynamic strategies and technological advancements. Some prominent players are as follows:

- Bayer AG

- BASF SE

- Dow

- Syngenta

- FMC Corporation

- Nufarm Limited

- PI Industries

- Sumitomo Chemical Co. Ltd.

- UPL

- ADAMA

Product Portfolio

- Syngenta offers a comprehensive portfolio of crop protection products and seeds, engineered to enhance agricultural productivity and sustainability. With a focus on innovation and research, Syngenta provides farmers worldwide with cutting-edge solutions to address evolving challenges in crop management and food security.

- Nufarm Limited specializes in developing and manufacturing crop protection products and seed technologies tailored to meet the needs of farmers globally. Through continuous innovation and strategic partnerships, Nufarm strives to provide effective and sustainable solutions that support agricultural productivity, profitability, and environmental stewardship.

Key Findings of the Market Report

- Pyrethrin & pyrethroid products dominate the insecticides market due to their effectiveness, low toxicity to humans, and broad-spectrum pest control capabilities.

- Cereals & grains lead the insecticides market, with significant demand for pest control to protect staple crops and ensure food security.

- North America leads the insecticides market, driven by advanced agricultural practices, extensive use of genetically modified crops, and stringent regulatory standards.

Insecticides Market Growth Drivers & Trends

- Increasing global population and urbanization spur demand for insecticides to safeguard food production.

- Adoption of integrated pest management practices promotes sustainable insecticide usage and reduces environmental impact.

- Technological advancements drive innovation in safer and more effective insecticide formulations.

- Regulatory pressure encourages the development of bio-based and organic insecticides.

- Expansion of agriculture in emerging economies amplifies market opportunities for insecticide manufacturers.

Global Insecticides Market: Regional Profile

- In North America, particularly the United States, a sophisticated agricultural sector and extensive adoption of genetically modified crops drive significant demand for insecticides.

- Key players like Bayer AG and Corteva Agriscience dominate the market, offering advanced formulations to combat a wide range of pests. Stringent regulatory standards ensure product safety and environmental sustainability, shaping market trends towards integrated pest management practices.

- In Europe, countries like Germany, France, and Spain adhere to stringent regulatory frameworks, fostering a shift towards safer and more sustainable insecticide solutions.

- This trend is fueled by growing environmental concerns and increasing consumer demand for organic produce. Companies such as BASF SE and Syngenta lead innovation in biological and bio-based insecticides, aligning with European Union regulations on pesticide use and residues.

- In the Asia Pacific region, rapid urbanization, expanding population, and rising disposable incomes drive demand for insecticides to protect crops and ensure food security.

- Countries like China and India witness robust market growth, supported by government initiatives to modernize agriculture and enhance productivity. Local players and multinational corporations like Sumitomo Chemical and UPL Limited cater to diverse agricultural landscapes, offering tailored solutions to address regional pest challenges and crop protection needs.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/insecticides-market.html

Insecticides Market: Key Segments

By Product

- Organochlorine

- Organophosphate

- Carbamate

- Pyrethrin & Pyrethroid

- Others

By Crop

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Others

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

Chloromethane Market (クロロメタン市場) Set to Surge at 4.4% CAGR, to Reach USD 5.4 billion by 2031 | Transparency Market Research, Inc.

Calcium Chloride Market (سوق كلوريد الكالسيوم) Expected to Achieve USD 2.3 billion by 2031 with a 5.3% CAGR from 2023 | Insights from TMR Research

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jefferies Says These 2 Utility Stocks Could Benefit From the Rising Demand for Data Centers

Utility companies have been under pressure from high inflation in recent years, facing both customer pushback over rising prices and the burden of higher interest rates, which have driven up credit costs, further adding to the providers’ debt burden.

Utility investors can take heart, however, as long-term trends are bullish for utility stocks. Demand for electricity is growing, powered in part by the AI boom, and its dependence on power-hungry data centers, and in part by the advent of electric vehicles, with their own demands on the power grid.

Watching the electric utility sector from Jefferies, analyst Julien Dumoulin-Smith sees utility stocks as a good choice for investors.

“It is impossible to understate the transformation underway with the proliferation of data centers,” Dumoulin-Smith said. “The unregulated merchants can capture outsized profits and cash flows. There are a wide range of demand growth projections from various parties with the consensus being roughly 2-4% annual demand growth through 2030 driven predominately by data centers. Data center demand is forecasted by BCG and others to represent 6-8% of total US demand vs 2-3% currently.”

The analyst has taken this general stance and used it to back up two specific recommendations on utility stocks, based on the rising demand for data centers. Opening up the TipRanks database, we’ve found that his picks hold Strong Buy consensus ratings from the Street. Let’s give them a closer look.

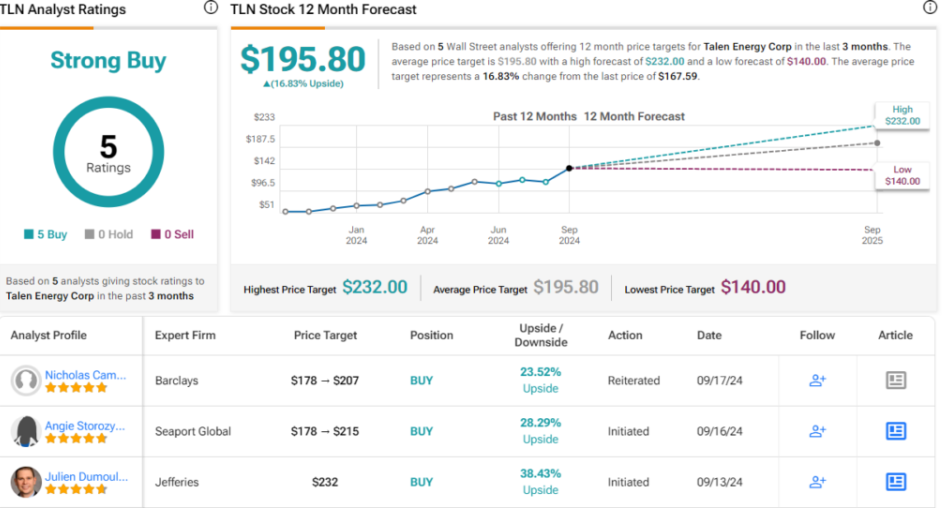

Talen Energy (TLN)

First up is Talen Energy, an independent power and infrastructure company – and one of the largest such companies in North America. Talen focuses on delivering safe and reliable power generation, with the most value per megawatt of energy produced. The company’s power generation portfolio includes a full range of assets: nuclear, natural gas, oil, and coal. These power generation operations are anchored by the company’s Susquehanna nuclear power plant, the sixth-largest such plant operating in the US. In addition to Susquehanna, Talen operates power generation and other facilities across five states – Massachusetts, New Jersey, Pennsylvania, Maryland, and Montana – and produces up to 10.7 gigawatts of power.

Talen’s Susquehanna plant, capable of delivering clean and reliable power 24 hours per day, seven days per week, has led the way for the company to become a leader in providing energy for data centers. Talen describes this niche as a ‘unique opportunity for growth,’ as data centers are notoriously power-hungry. The company has a track record of delivering clean power on demand, and of expanding its generating capabilities to meet expanding demand, the two prerequisites for meeting the power needs of data centers and their AI applications.

In the company’s last reported quarter, 2Q24, Talen posted a top line of $489 million. This revenue total was up an impressive 62.5% year-over-year, and supported an EPS of $7.60. Also of note, Talen reported an adjusted free cash flow for 1H24 of $165 million. We should note here that the company’s stock has been a huge winner in 2024, having gained 160% for the year-to-date.

This power company’s success in finding and filling a niche have caught the attention of analyst Dumoulin-Smith. In his coverage of the company for Jefferies, he writes, “TLN’s PJM-based, generation-only portfolio is well positioned to benefit from a variety of Power trends, including the rising electricity demand notably from data centers and the growing value of firm capacity. These trends translate into multiple sources of potential upside that could drive both increased profitability and multiple expansion. While TLN is not the only IPP destined to profit from these market phenomenons, some of the company’s characteristics make it susceptible to maximize relative upside. Beyond that, TLN has high visibility on substantial earnings growth in the next few years, driven by the dramatic increase in capacity prices.”

Talen has earned a Buy rating from Dumoulin-Smith, whose $232 price target on the stock implies additional gains of 38.5% are in the cards for the next 12 months. (To watch Dumoulin-Smith’s track record, click here)

The Street view is also upbeat here, with a Strong Buy consensus rating based on 5 unanimously positive recent analyst reviews. The stock’s $167.59 trading price and $195.8 average target price together point toward a one-year upside potential of 17%. (See Talen stock forecast)

Vistra Energy (VST)

Next up is Vistra Energy, a Texas-based power company that generates electricity at utility scales. Vistra is the largest competitive power generation company working in the US, and can produce approximately 41,000 megawatts of electricity – enough to power 20 million homes. The company operates in all of the nation’s major competitive wholesale markets, and has a reputation for focusing on reliability, affordability, and sustainability. Vistra’s power generation portfolio features natural gas, coal, nuclear, and solar facilities, and even includes battery facilities for energy storage. The company is expanding its zero-carbon generation footprint, and operates the nation’s second-largest fleet of competitive nuclear power plants. Vistra employs over 6,800 people nationwide, and provides energy to more than 5 million customers.

On the retail side, Vistra’s environmentally conscious customers can choose from more than 50 renewable energy and conservation-focused plans. These are available across 16 states plus DC, and are provided through Vistra’s network of 6 retail power supply brands. The company is best known as an electric utility, but it can also provide customers with natural gas services.

Vistra’s core business, power generation and supply, brought the company $3.85 billion in revenues during its last reported quarter, 2Q24. This was up from $3.19 billion in 2Q23, a year-over-year gain of more than 20%, although the 2Q24 number missed the forecast by $110 million. At the bottom line, the company realized a net income of $467 million, down from $476 million one year prior. Cash flow from operations in the quarter came to just under $1.2 billion. The company finished Q2 with $3.85 billion in available liquidity, a total that included cash and cash equivalents of $1.62 billion.

From the standpoint of Dumoulin-Smith, there is plenty to recommend Vistra to investors. He writes of the company, “As one of the largest and most diversified IPPs, VST is well geared to the upside on multiple fronts, including the general increase in power and capacity prices, higher plant utilization, as well as potential above-market contracts with data centers. As we project outsized growth over the forecast period, we still see value in the stock, which continues to trade at a discount to peers, at 15%+ FY27 FCF yield.”

Getting into specifics, the top analyst goes onto explain the quality of Vestra’s power generation assets, adding, “From a data center-related growth perspective, VST owns a large fleet of CCGTs across Texas and PJM, as well as four nuclear plants also in the same two regions. The breadth of the fleet means a greater ability to cater to specific customer needs, which should translate into higher contract signing success and overall more favorable terms.”

All things considered, the Jefferies analyst puts a Buy rating here, complemented by a $99 price target that shows his confidence in an 11% gain on the one-year horizon.

The Street generally has given this stock a unanimous Strong Buy consensus rating, based on 6 positive analyst reviews set in recent weeks. The shares are trading for $89.4 and the $108.17 average price target points toward a 12-month gain of 21%, even more bullish than the Jefferies view. (See Vistra stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Vibratory Hammer Market to Surpass US$ 1.12 Billion, Expanding at 5.6% CAGR by 2034 | Fact.MR Analysis

Rockville, MD , Sept. 17, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, through its newly published market analysis, reveals that revenue from the global Vibratory Hammer Market is approximated to reach US$ 649.4 million in 2024 and subsequently advance at a CAGR of 5.6% through 2034.

The expansion of infrastructure and the number of urban construction projects are driving up demand for vibratory hammers. They are used in marine construction, building foundation construction, and environmental remediation. The global market is expanding steadily due to the increasing need for roads, buildings, railroads, and other infrastructure with population growth.

These infrastructure developments and urbanization are the factors driving the vibratory hammer market. In addition, these hammers are adaptable for installation and dismantling as they are used to extract piles. Lower levels of vibration and noise make the workplace safer by reducing the risks of workers’ exposure to loud noises.

The expansion of the equipment rental industry has made vibratory hammers more accessible to contractors without any need for higher capital investments. Since operator training is easily accessible and consumers are becoming more aware of the benefits of vibratory hammers, the market is growing even more. In addition, more foreign direct investment (FDI) in the building sector is fueling demand for state-of-the-art machinery.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10351

Key Takeaways from the Market Study:

- The global market for vibratory hammers is analyzed to reach a value of US$ 1.12 billion by the end of 2034.

- India is evaluated to reach a market valuation of US$ 75.3 million in 2024.

- China is projected to contribute a market share of 61.2% in East Asia in 2024.

- Demand for vibratory hammers in Japan is estimated to reach US$ 44.6 million in 2024.

- The market in the South Asia & Pacific region is projected to advance at 5.9% CAGR through 2034.

- Sales from cranes-mounted vibratory hammers are forecasted to reach US$ 515.2 million by 2034.

“The vibratory hammer market is driven by the growing demand for buildings, railroads, roads, and other infrastructure projects worldwide,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Vibratory Hammer Market:

Key players in the vibratory hammer market are ABI Equipment Limited, Hydraulic Power Systems, Inc., American Piledriving Equipment, ThyssenKrupp, Xuzhou Hercules Machine Manufacture Co., Ltd., PTC (Fayat Group), Shinsegae Power Equip Industrial Co., Ltd, OMS Pile Driving Equipment GmbH, Liebherr Group, MOVAX Oy, Dieseko Group B.V., Yongan Machinery Co., Ltd, Les Produits Gilbert Inc., Hercules Machinery Corporation, Guangdong Liyuan Hydraulic Machinery Company Ltd.

High-Frequency Vibrations Produced by Hammers Hasten Pile Driving and Shorten Project Duration:

Construction projects involving harbors, airports, railroads, bridges, and canals are using crane hammers. They are also utilized in infrastructure projects pertaining to the building of pipelines, the stabilization of soil, the reinforcement of urban areas, and the treatment of wastewater. These hammers generate high-frequency vibrations that speed up pile driving and reduce project time. These hammers are suitable for a wide range of projects and are used on a variety of pile types (such as steel, concrete, and others) in a range of soil conditions.

Vibratory Hammer Industry News:

- In order to create models that are stronger, lighter, and more effective, major players in the vibratory hammer industry are funding research and development. More advanced features like automatic controls and remote monitoring are starting to become commonplace. They are also concentrating on ecologically friendly designs and techniques, such lowering noise and vibration levels, in order to comply with regulations and appeal to environmentally conscious customers.

- In this new market analysis, Fact.MR offers comprehensive details on the pricing points of top vibratory hammer manufacturers located worldwide, as well as sales growth, production capacity, and technological breakthroughs.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10351

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the vibratory hammer market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the vibratory hammer market based on mounting (crane mounted, excavator mounted), centrifugal force (0 to 1000kn, 1001 to 2000kn, 2001 to 3000kn, 3001 to 4000kn, 4001kn & above), by end-use industry (construction, residential, non-residential, infrastructural, offshore, oil & gas, wind), and across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA)

Segmentation of Vibratory Hammer Market Research:

By Mounting :

- Crane Mounted

- Excavator Mounted

By Centrifugal Force :

- 0 to 1000KN

- 1001 to 2000KN

- 2001 to 3000KN

- 3001 to 4000KN

- 4001 KN & Above

By End-Use Industry :

- Construction

- Residential

- Non-Residential

- Infrastructural

- Offshore

- Oil & Gas

- Wind

Check out More Related Studies Published by Fact.MR:

Soil Compaction Machines Market: Sales are estimated at US$ 5.4 billion and are forecasted to climb to US$ 10.6 billion by 2033-end. The global soil compaction machines market is projected to expand at a robust 6.8% CAGR over the next ten years.

Power Hammer Market: Size was valued at US$ 843.4 million in 2023 and has been forecasted to expand at a CAGR of 5.4% to climb to US$ 1.5 billion by the end of 2034.

Piling Machine Market: Size is estimated at US$ 5.42 billion in 2024 and is predicted to reach a size of US$ 8.34 billion by 2034-end, expanding at a CAGR of 4.4% between 2024 and 2034.

Hydraulic Breakers Rental Market: Demand is expanding and is poised to grow at a rate of 6.0% during the forecast period and reach a valuation of US$ 698.2 million in 2033 from US$ 389.9 million in 2023.

Cordless Power Tools Market: Sales reached a global total of US$15.3 billion. The market is anticipated to expand at a rate of 9.1% a year between 2023 and 2033, when it is expected to have reached a valuation of US$ 39.2 billion.

Fastening Power Tool Market: Size is expected to be worth US$ 3.5 billion globally. By2034, the market is projected to have grown at a 6.4% CAGR and reach US$ 6.5 billion.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: American Electric Power Co Inc

Summary

American Electric Power is a major U.S. investor-owned electric utility with generation, transmission, and distribution operations and eight utility subsidiaries. The company’s vertically integrated utilities and distribution utilities deliver electricity to more than 5.6 million customers in 11 states in the Midwest and Southeast. AEP ranks among the nation’s largest generators of electricity, with about 23,000 megawatts of generating capacity and 225,000 distribution lines. AEP also owns the nation’s largest electricity transmission system, with 40,000 system miles.

In 2023, vertical utilities accounted for about 60% of total annual revenue, while transmission and distribution utilities accounted for about 30%.

With the 2H23 sale of its competitive generating plant, Cardinal 1, in Ohio, the company has exited the wholesale generation business and left the Ohio competitive electricity market. AEP’s 2023 owned generation mix is approximately 4

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

MARWEST APARTMENT REAL ESTATE INVESTMENT TRUST ANNOUNCES MONTHLY CASH DISTRIBUTION

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

WINNIPEG, MB, Sept. 16, 2024 /CNW/ – Marwest Apartment Real Estate Investment Trust (“Marwest Apartment REIT” or the “REIT”) MAR announced that its Trustees have declared a monthly cash distribution of $0.0013 per trust unit (“Trust Unit”) of the REIT for the month of September 2024, representing a cash distribution per Trust Unit of $0.0156 on an annualized basis. The cash distributions will be made on October 15, 2024 to Unitholders on record as of September 30, 2024.

As at the date hereof, there are an aggregate of 8,856,403 Units, and 10,642,435 Exchangeable Units issued and outstanding.

About Marwest Apartment REIT

The REIT is an unincorporated open-ended trust governed by the laws of the Province of Manitoba. The REIT was formed to provide Unitholders with the opportunity to invest in the Canadian multi-family rental sector through the ownership of high-quality income-producing properties, with an initial focus on stable markets throughout Western Canada.

Marwest REIT’s management team and Trustees have over 100 years of combined experience in multi-residential real estate. They bring a strong combination of development, construction, management, and financing experience, along with significant governance expertise. The REIT has an external asset and property management agreement through the Marwest Group of Companies. The Marwest Group of Companies is a fully integrated real estate group that specializes in development, construction, and property management. Now in its third generation of operations, the Marwest Group has developed over 12,000 units, and currently manages over 2,500 units, providing the REIT with an array of top calibre tools, industry know-how and strong relationships. Marwest Apartment REIT will continue to benefit from the expertise and strong infrastructure that is currently in place through the Marwest Group.

Forward-looking Statements

The information in this news release includes certain information and statements about the REIT’s current monthly cash distribution policy that constitute forward‐looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward‐looking statements. A number of factors could cause actual results to differ materially from these forward‐looking statements. The declaration and/or payment of future cash distributions will be dependent upon a number of factors, including but not limited to the financial performance, financial condition and financial requirements of the REIT. Although management of the REIT believes that the expectations reflected in forward‐ looking statements are reasonable, it can give no assurances that the expectations of any forward‐ looking statements will prove to be correct. Except as required by law, the REIT disclaims any intention and assumes no obligation to update or revise any forward‐looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward‐looking statements or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

The Trust Units are not registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold within the United States or to or for the account or benefit of U.S. persons, except in certain transactions exempt from the registration requirements of the U.S. Securities Act. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, securities of the REIT in the United States or in any other jurisdiction.

SOURCE Marwest Apartment Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c9555.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c9555.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Senior Vice President Of EastGroup Props Makes $303K Sale

Revealing a significant insider sell on September 16, Richard Reid Dunbar, Senior Vice President at EastGroup Props EGP, as per the latest SEC filing.

What Happened: Dunbar opted to sell 1,650 shares of EastGroup Props, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The transaction’s total worth stands at $303,589.

EastGroup Props‘s shares are actively trading at $190.26, experiencing a down of 0.0% during Tuesday’s morning session.

Delving into EastGroup Props’s Background

EastGroup Properties Inc is an equity real estate investment trust. It is engaged in the development, acquisition, and operation of industrial properties in Sunbelt markets throughout the United States, predominantly in the states of Florida, Texas, Arizona, California, and North Carolina. The company manages a portfolio of industrial properties. The vast majority of these properties are multi-tenant business distribution buildings that provide large warehousing and office space for customers. The company derives its revenue in the form of rental income.

EastGroup Props: Financial Performance Dissected

Revenue Growth: EastGroup Props’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 13.73%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 72.44%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): EastGroup Props’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.15.

Debt Management: With a below-average debt-to-equity ratio of 0.61, EastGroup Props adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 39.64 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 14.77 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 24.59, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of EastGroup Props’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Hiebler Jessica M Cashes Out $50K In T. Rowe Price Gr Stock

It was reported on September 16, that Hiebler Jessica M, Principal Accounting Officer at T. Rowe Price Gr TROW executed a significant insider sell, according to an SEC filing.

What Happened: M’s decision to sell 484 shares of T. Rowe Price Gr was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $50,689.

During Tuesday’s morning session, T. Rowe Price Gr shares down by 0.0%, currently priced at $105.86.

All You Need to Know About T. Rowe Price Gr

T. Rowe Price provides asset-management services for individual and institutional investors. It offers a broad range of no-load us and international stock, hybrid, bond, and money market funds. At the end of July 2024, the firm had $1.587 trillion in managed assets, composed of equity (51%), balanced (34%), fixed-income and money market (12%), and alternative (3%) offerings. Approximately two thirds of managed assets are held in retirement-based accounts, which provides T. Rowe Price with a somewhat stickier client base than most of its peers. The firm also manages private accounts, provides retirement planning advice, and offers discount brokerage and trust services. The company is primarily a us-based asset manager, deriving just under 9% of its AUM from overseas.

T. Rowe Price Gr: A Financial Overview

Revenue Growth: T. Rowe Price Gr’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 7.65%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 52.59%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 2.11, T. Rowe Price Gr showcases strong earnings per share.

Debt Management: T. Rowe Price Gr’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.03.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: T. Rowe Price Gr’s P/E ratio of 12.5 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 3.49, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 7.61 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of T. Rowe Price Gr’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nucor Announces Guidance for the Third Quarter of 2024 Earnings

CHARLOTTE, N.C., Sept. 17, 2024 /PRNewswire/ — Nucor Corporation NUE today announced guidance for its third quarter ending September 28, 2024. Nucor expects third quarter earnings to be in the range of $0.87 to $0.97 per diluted share. After adding back certain one-time non-cash charges totaling approximately $0.43 per diluted share, described below, we expect third quarter adjusted earnings per diluted share to be in the range of $1.30 to $1.40. Nucor reported net earnings of $2.68 per diluted share in the second quarter of 2024 and $4.57 per diluted share in the third quarter of 2023.

One-Time Non-Cash Charges

Reflected in the third quarter of 2024 non-adjusted earnings guidance range are estimated one-time non-cash pre-tax charges of approximately $123 million, or $0.43 per diluted share, related to the impairment of certain non-current assets in the raw materials and steel products segments.

Third Quarter of 2024 Commentary

Excluding the previously mentioned one-time charges, the largest driver for the expected decrease in earnings in the third quarter of 2024 as compared to the second quarter of 2024 is the decreased earnings of the steel mills segment, due primarily to lower average selling prices. The steel products segment is expected to have decreased earnings in the third quarter of 2024 as compared to the second quarter of 2024 due to lower average selling prices and lower volumes. Earnings in the raw materials segment are expected to decrease in the third quarter of 2024 as compared to the second quarter of 2024.

During the third quarter, Nucor has repurchased approximately 2.5 million shares at an average price of $156.07 per share (approximately 11.0 million shares year-to-date at an average price of $172.36 per share). Nucor has returned approximately $2.29 billion to stockholders in the form of share repurchases and dividend payments year-to-date.

Third Quarter of 2024 Earnings Release and Conference Call

Nucor will release its earnings after the markets close on Monday, October 21, 2024, and will host a conference call the morning of Tuesday, October 22, 2024 at 10:00 a.m. Eastern Time to review the Company’s third quarter results. The event will be broadcast on the internet, and instructions on how to access will be sent closer to the call.

About Nucor

Nucor and its affiliates are manufacturers of steel and steel products, with operating facilities in the United States, Canada and Mexico. Products produced include: carbon and alloy steel — in bars, beams, sheet and plate; hollow structural section tubing; electrical conduit; steel racking; steel piling; steel joists and joist girders; steel deck; fabricated concrete reinforcing steel; cold finished steel; precision castings; steel fasteners; metal building systems; insulated metal panels; overhead doors; steel grating; wire and wire mesh; and utility structures. Nucor, through The David J. Joseph Company, also brokers ferrous and nonferrous metals, pig iron and hot briquetted iron / direct reduced iron; supplies ferro-alloys; and processes ferrous and nonferrous scrap. Nucor is North America’s largest recycler.

Non-GAAP Financial Measures

The Company uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this news release, adjusted earnings per diluted share. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable financial measure calculated and presented in accordance with GAAP.

We define adjusted earnings per diluted share as net earnings attributable to Nucor stockholders, adding back the per diluted share impact of one-time charges, including those related to the impairment of certain non-current assets in the raw materials and steel products segment, divided by our estimated diluted average shares outstanding. Please note that other companies might define their non-GAAP financial measures differently than we do.

Management presents the non-GAAP financial measure of adjusted earnings per diluted share in this news release because it considers it to be an important supplemental measure of performance. Management believes that this non-GAAP financial measure provides additional insight for analysts and investors evaluating the Company’s financial and operational performance by providing a consistent basis of comparison across periods.

Forward-Looking Statements

Certain statements contained in this news release are “forward-looking statements” that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. The words “anticipate,” “believe,” “expect,” “intend,” “project,” “may,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and, although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this news release. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: (1) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to general market conditions, and in particular, prevailing market steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) the availability and cost of electricity and natural gas, which could negatively affect our cost of steel production or result in a delay or cancellation of existing or future drilling within our natural gas drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the United States; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long-lived assets; (8) uncertainties and volatility surrounding the global economy, including excess world capacity for steel production, inflation and interest rate changes; (9) fluctuations in currency conversion rates; (10) significant changes in laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs, capital expenditures and operating costs or cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; (13) our safety performance; (14) our ability to integrate businesses we acquire; and (15) any pandemic or public health situation. These and other factors are discussed in Nucor’s regulatory filings with the United States Securities and Exchange Commission, including those in “Item 1A. Risk Factors” of Nucor’s Annual Report on Form 10-K for the year ended December 31, 2023. The forward-looking statements contained in this news release speak only as of this date, and Nucor does not assume any obligation to update them, except as may be required by applicable law.

![]() View original content:https://www.prnewswire.com/news-releases/nucor-announces-guidance-for-the-third-quarter-of-2024-earnings-302250036.html

View original content:https://www.prnewswire.com/news-releases/nucor-announces-guidance-for-the-third-quarter-of-2024-earnings-302250036.html

SOURCE Nucor Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.