British American Tobacco Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on British American Tobacco. Our analysis of options history for British American Tobacco BTI revealed 14 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $109,361, and 11 were calls, valued at $501,442.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.0 to $40.0 for British American Tobacco over the recent three months.

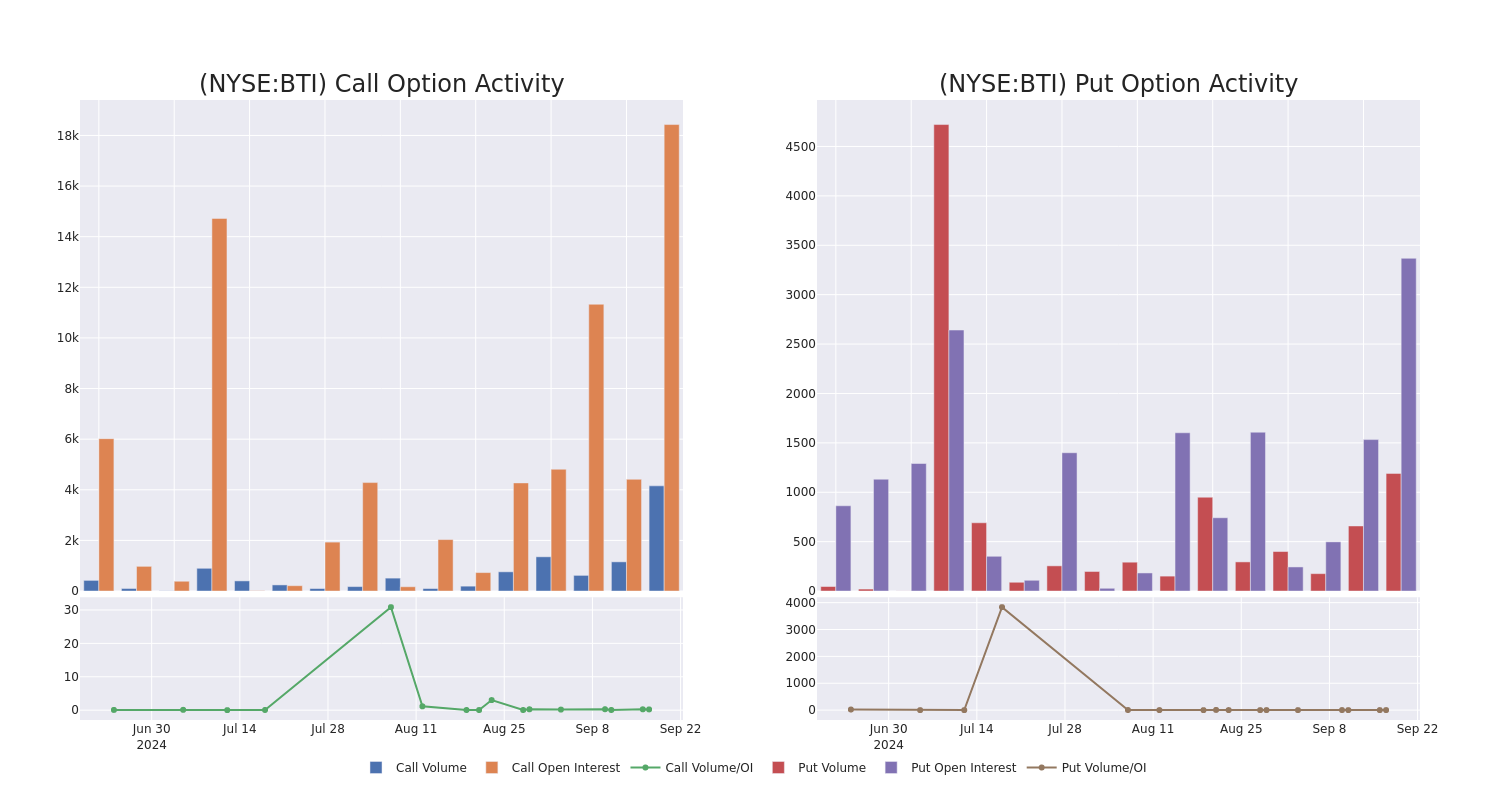

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for British American Tobacco options trades today is 2179.8 with a total volume of 5,347.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for British American Tobacco’s big money trades within a strike price range of $32.0 to $40.0 over the last 30 days.

British American Tobacco Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTI | CALL | SWEEP | BULLISH | 12/20/24 | $0.9 | $0.85 | $0.9 | $39.00 | $90.0K | 738 | 1.1K |

| BTI | CALL | TRADE | BULLISH | 09/20/24 | $4.2 | $4.1 | $4.2 | $34.00 | $78.9K | 4.1K | 630 |

| BTI | CALL | TRADE | BEARISH | 01/16/26 | $2.0 | $1.7 | $1.8 | $40.00 | $54.1K | 2.6K | 301 |

| BTI | PUT | SWEEP | BEARISH | 10/18/24 | $0.7 | $0.65 | $0.66 | $37.00 | $53.1K | 596 | 939 |

| BTI | CALL | TRADE | BULLISH | 01/16/26 | $4.2 | $3.7 | $4.01 | $35.00 | $40.1K | 3.5K | 293 |

About British American Tobacco

The second-largest tobacco company by volume, British American Tobacco sold 555 billion cigarettes in 2023. Its leading brands are Dunhill, Kent, Pall Mall, Lucky Strike, and Rothmans in cigarettes. Its ownership of the Camel, Natural American Spirit, and Newport brands are limited to the us. In next-generation products, the company has the Vuse brand in vaping, Glo in heated tobacco, and Velo in modern oral tobacco. The company also owns a 25.5% stake in ITC limited, the largest Indian cigarette company.

Following our analysis of the options activities associated with British American Tobacco, we pivot to a closer look at the company’s own performance.

Present Market Standing of British American Tobacco

- With a volume of 5,754,079, the price of BTI is down -3.43% at $38.01.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest British American Tobacco options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply