Here's Why Everyone's Talking About Summit Therapeutics

September has been an exciting time for investors with their fingers on the pulse of cancer drug development. In a nutshell, it looks like the world’s top-selling cancer therapy could have a serious competitor.

Sales of Keytruda from Merck reached $25 billion last year thanks to its position as a standard first line of treatment for most patients newly diagnosed with the most common form of lung cancer.

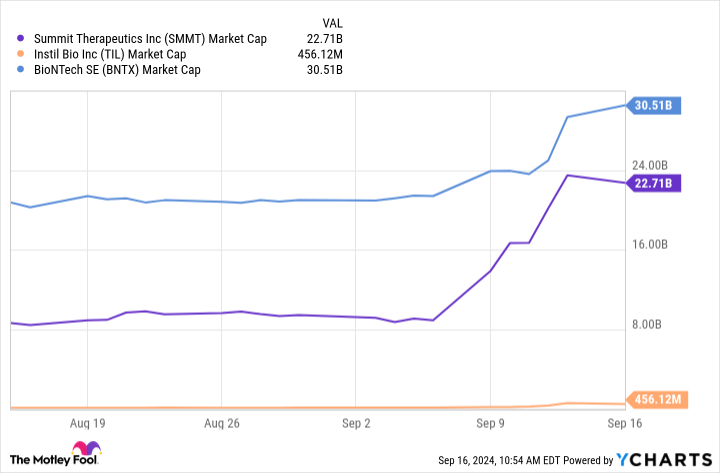

Biotech investors have been buzzing with enthusiasm for Summit Therapeutics (NASDAQ: SMMT) and its lead candidate, ivonescimab. Recently announced results from a clinical trial with frontline lung cancer patients showed ivonescimab reduced their risk of disease worsening by 49% compared to Keytruda monotherapy. That’s a big deal for Summit and a pair of companies that are also developing candidates similar to ivonescimab, Instil Bio (NASDAQ: TIL) and BioNTech (NASDAQ: BNTX).

Why Instil Bio and BioNTech are along for the ride

Keytruda is an antibody that binds to programmed death receptors (PD-1) on the surface of immune cells. This checkpoint is supposed to keep those cells from destroying healthy tissue, but tumor cells often hijack the system. By displaying a programmed death ligand (PD-L1) on their surface, tumor cells often shut down immune systems before they can do their job.

Keytruda is sometimes dosed in combination with a vascular endothelial growth factor (VEGF) inhibitor called Avastin. Instead of delivering two therapies, ivonescimab from Summit Therapeutics, IMM2510 from Instil Bio, and BNT327 from BioNTech are all bispecific antibodies that inhibit VEGF and the PD-1 checkpoint simultaneously.

|

Bispecific Antibody |

Chinese Owner |

Development Partner |

PD-1 Target |

VEGF Target |

Development Stage |

|---|---|---|---|---|---|

|

Ivonescimab |

Akeso |

Summit Therapeutics |

PD-1 |

VEGF-A |

Approved in China. Phase 3 in U.S. |

|

IMM2510 |

ImmuneOnco |

Instil Bio |

PD-L1 |

Multiple VEGF ligands |

Phase 2 |

|

BNT327 |

Biotheus |

BioNTech |

PD-L1 |

VEGF-A |

Phase 3 |

Table by author. Data sources: Summit Therapeutics, Instil Bio, and BioNTech.

Shares of Instil Bio and BioNTech have risen sharply since Summit shared phase 3 results that show a strong progression-free survival benefit versus Keytruda. While their candidates are similar to Summit’s, there are significant differences that could make them more or less effective.

In terms of market value, Instil Bio was circling the drain when Summit began announcing success with its bispecific PD-1/VEGF drug. Since Instil started from such a low point, the clinical-stage biotech’s stock price was able to shoot more than 500% higher in response to Summit’s news.

Time to buy?

Summit Therapeutics acquired rights to ivonescimab outside of China and Australia. With Keytruda sales up around $25 billion annually, it’s not hard to imagine blockbuster sales for a therapy that outperformed it in the important lung cancer setting.

There are a lot of expectations for ivonescimab already baked into Summit Health’s stock price. At last glance, it boasted a $22.7 billion market cap that could come crashing down if subsequent data for ivonescimab is anything less than spectacular.

While ivonescimab outperformed Keytruda monotherapy, Merck’s drug is usually combined with chemotherapy to treat lung cancer. We still don’t know how well ivonescimab stands up to Keytruda and other PD-1 drugs when they’re combined with chemotherapy.

Another important uncertainty regarding Summit is ivonescimab’s performance versus Keytruda plus Avastin. In theory, a bispecific antibody should be more effective than two traditional antibodies dosed simultaneously, but we can’t be certain without another clinical trial.

If investors want to bet on a bispecific PD-1/VEGF antibody, Instil Bio could be the better option. IMM2510 is in a much earlier stage of development, but Instil’s market cap of about $456 million at recent prices is tiny for a company that could have a blockbuster lung cancer drug in its pipeline.

Should you invest $1,000 in Summit Therapeutics right now?

Before you buy stock in Summit Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Summit Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Summit Therapeutics. The Motley Fool recommends BioNTech Se. The Motley Fool has a disclosure policy.

Here’s Why Everyone’s Talking About Summit Therapeutics was originally published by The Motley Fool

Leave a Reply