Interest Rates Are Falling: 1 Super Stock to Buy Hand Over Fist Right Now

According to the Federal Home Loan Mortgage Corp. (Freddie Mac), the U.S. 30-year fixed mortgage rate hit 7.79% in October 2023, which was the highest level since 2000. It crushed the borrowing power of consumers, and it also made existing homeowners hesitant to sell for fear of abandoning their existing lower rate.

As a result, high interest rates decimated the housing market. U.S. existing home sales came in at 3.9 million annualized units in July, down a whopping 40% from the recent peak of 6.6 million from 2021. But the tide appears to be turning, because the 30-year fixed mortgage rate is down to 6.2% in anticipation of a slate of interest rate cuts from the Federal Reserve.

Real estate technology stock Redfin (NASDAQ: RDFN) soared 32% so far this year as investors price in an improving housing market on the back of lower rates. It’s still down significantly from its all-time high, so here’s why it’s not too late to add it to your portfolio.

Redfin spent the past two years preparing for this moment

Almost half of Redfin’s revenue came from iBuying in 2021, which involved purchasing homes from willing sellers with the intention of flipping them for a profit. However, the company deemed that business too risky when interest rates shot higher in 2022 as the Federal Reserve sought to tame inflation, so it closed it down that year.

Now, Redfin is focusing on its portfolio of services, which include brokering, mortgages, and closing services. The company employs 1,719 lead brokers who helped represent 0.77% of all homes sold across the U.S. during the second quarter of 2024 (ended June 30). Plus, more than one-quarter of Redfin’s customers also used Redfin for their mortgages during the second quarter, which helped the company squeeze additional revenue from each of those transactions.

Redfin focuses on volume, so it charges a listing fee of just 1.5%, which is much lower than the industry standard of around 2.5%. Plus, repeat customers are rewarded for their loyalty with listing fees of as little as 1% — and they accounted for 37% of the company’s sales in Q2.

Redfin’s services carry a much higher gross profit margin than iBuying (29% compared to around 1%), which is helping the company improve its bottom line even in the face of a tumultuous housing market. The company managed to break even on an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) basis in Q2, which was a big improvement from the $6.9 million loss it generated in the year-ago period.

Redfin expects to be “significantly profitable” in the years ahead, which will enable it to invest more aggressively in growth by hiring more agents and expanding its services. The company launched a new program called Redfin Next earlier this year, which allows agents to earn higher commissions in exchange for giving up their fixed salary. This option will be available to all agents from 2025, and it could significantly improve the company’s bottom line by reducing fixed costs.

Redfin stock is up 32% in 2024, but it still looks cheap

“The time has come for policy to adjust.” Those were the words of Fed Chairman Jerome Powell in August, which suggests rate cuts are on the way. In fact, according to the CME Group‘s FedWatch tool, experts are predicting the Fed could slash 125 basis points off the federal funds rate (overnight interest rate) by the end of this year alone. The recent decline in the 30-year fixed mortgage rate further supports a decisive move by the Fed.

That’s likely a key reason for the 32% surge in Redfin stock this year. However, it’s still down 85% from its all-time high, which was set during the housing boom in 2021, and it remains cheap relative to history.

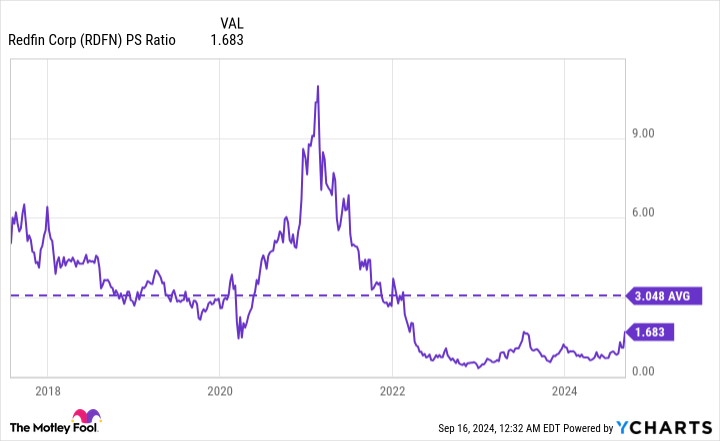

Redfin has generated $1 billion in trailing-12-month revenue, and based on the company’s market capitalization of $1.7 billion, its stock trades at a price-to-sales (P/S) ratio of 1.7:

Redfin’s P/S ratio has ticked higher from its rock bottom lows of 0.6 from earlier this year, but it’s still far below its peak of around 10. It’s also trading under its average P/S ratio of 3, dating back to when the stock first came public in 2017. Therefore, Redfin stock might still have plenty of upside in the tank, but an improving housing market will be critical to maintaining its upward momentum.

As long as mortgage rates continue to trend lower, Redfin will likely be a great addition to any stock portfolio.

Should you invest $1,000 in Redfin right now?

Before you buy stock in Redfin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Redfin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Redfin. The Motley Fool recommends CME Group and recommends the following options: short November 2024 $13 calls on Redfin. The Motley Fool has a disclosure policy.

Interest Rates Are Falling: 1 Super Stock to Buy Hand Over Fist Right Now was originally published by The Motley Fool

Leave a Reply