Jefferies Says These 2 Utility Stocks Could Benefit From the Rising Demand for Data Centers

Utility companies have been under pressure from high inflation in recent years, facing both customer pushback over rising prices and the burden of higher interest rates, which have driven up credit costs, further adding to the providers’ debt burden.

Utility investors can take heart, however, as long-term trends are bullish for utility stocks. Demand for electricity is growing, powered in part by the AI boom, and its dependence on power-hungry data centers, and in part by the advent of electric vehicles, with their own demands on the power grid.

Watching the electric utility sector from Jefferies, analyst Julien Dumoulin-Smith sees utility stocks as a good choice for investors.

“It is impossible to understate the transformation underway with the proliferation of data centers,” Dumoulin-Smith said. “The unregulated merchants can capture outsized profits and cash flows. There are a wide range of demand growth projections from various parties with the consensus being roughly 2-4% annual demand growth through 2030 driven predominately by data centers. Data center demand is forecasted by BCG and others to represent 6-8% of total US demand vs 2-3% currently.”

The analyst has taken this general stance and used it to back up two specific recommendations on utility stocks, based on the rising demand for data centers. Opening up the TipRanks database, we’ve found that his picks hold Strong Buy consensus ratings from the Street. Let’s give them a closer look.

Talen Energy (TLN)

First up is Talen Energy, an independent power and infrastructure company – and one of the largest such companies in North America. Talen focuses on delivering safe and reliable power generation, with the most value per megawatt of energy produced. The company’s power generation portfolio includes a full range of assets: nuclear, natural gas, oil, and coal. These power generation operations are anchored by the company’s Susquehanna nuclear power plant, the sixth-largest such plant operating in the US. In addition to Susquehanna, Talen operates power generation and other facilities across five states – Massachusetts, New Jersey, Pennsylvania, Maryland, and Montana – and produces up to 10.7 gigawatts of power.

Talen’s Susquehanna plant, capable of delivering clean and reliable power 24 hours per day, seven days per week, has led the way for the company to become a leader in providing energy for data centers. Talen describes this niche as a ‘unique opportunity for growth,’ as data centers are notoriously power-hungry. The company has a track record of delivering clean power on demand, and of expanding its generating capabilities to meet expanding demand, the two prerequisites for meeting the power needs of data centers and their AI applications.

In the company’s last reported quarter, 2Q24, Talen posted a top line of $489 million. This revenue total was up an impressive 62.5% year-over-year, and supported an EPS of $7.60. Also of note, Talen reported an adjusted free cash flow for 1H24 of $165 million. We should note here that the company’s stock has been a huge winner in 2024, having gained 160% for the year-to-date.

This power company’s success in finding and filling a niche have caught the attention of analyst Dumoulin-Smith. In his coverage of the company for Jefferies, he writes, “TLN’s PJM-based, generation-only portfolio is well positioned to benefit from a variety of Power trends, including the rising electricity demand notably from data centers and the growing value of firm capacity. These trends translate into multiple sources of potential upside that could drive both increased profitability and multiple expansion. While TLN is not the only IPP destined to profit from these market phenomenons, some of the company’s characteristics make it susceptible to maximize relative upside. Beyond that, TLN has high visibility on substantial earnings growth in the next few years, driven by the dramatic increase in capacity prices.”

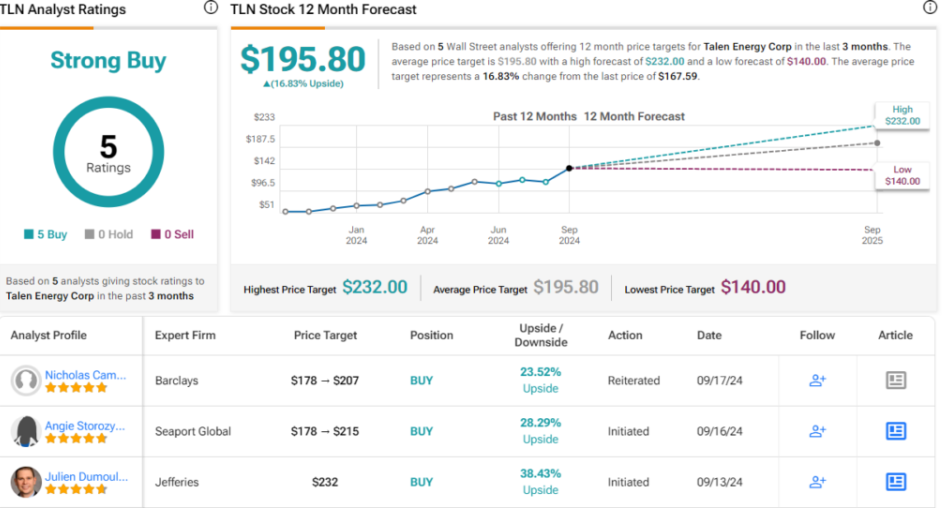

Talen has earned a Buy rating from Dumoulin-Smith, whose $232 price target on the stock implies additional gains of 38.5% are in the cards for the next 12 months. (To watch Dumoulin-Smith’s track record, click here)

The Street view is also upbeat here, with a Strong Buy consensus rating based on 5 unanimously positive recent analyst reviews. The stock’s $167.59 trading price and $195.8 average target price together point toward a one-year upside potential of 17%. (See Talen stock forecast)

Vistra Energy (VST)

Next up is Vistra Energy, a Texas-based power company that generates electricity at utility scales. Vistra is the largest competitive power generation company working in the US, and can produce approximately 41,000 megawatts of electricity – enough to power 20 million homes. The company operates in all of the nation’s major competitive wholesale markets, and has a reputation for focusing on reliability, affordability, and sustainability. Vistra’s power generation portfolio features natural gas, coal, nuclear, and solar facilities, and even includes battery facilities for energy storage. The company is expanding its zero-carbon generation footprint, and operates the nation’s second-largest fleet of competitive nuclear power plants. Vistra employs over 6,800 people nationwide, and provides energy to more than 5 million customers.

On the retail side, Vistra’s environmentally conscious customers can choose from more than 50 renewable energy and conservation-focused plans. These are available across 16 states plus DC, and are provided through Vistra’s network of 6 retail power supply brands. The company is best known as an electric utility, but it can also provide customers with natural gas services.

Vistra’s core business, power generation and supply, brought the company $3.85 billion in revenues during its last reported quarter, 2Q24. This was up from $3.19 billion in 2Q23, a year-over-year gain of more than 20%, although the 2Q24 number missed the forecast by $110 million. At the bottom line, the company realized a net income of $467 million, down from $476 million one year prior. Cash flow from operations in the quarter came to just under $1.2 billion. The company finished Q2 with $3.85 billion in available liquidity, a total that included cash and cash equivalents of $1.62 billion.

From the standpoint of Dumoulin-Smith, there is plenty to recommend Vistra to investors. He writes of the company, “As one of the largest and most diversified IPPs, VST is well geared to the upside on multiple fronts, including the general increase in power and capacity prices, higher plant utilization, as well as potential above-market contracts with data centers. As we project outsized growth over the forecast period, we still see value in the stock, which continues to trade at a discount to peers, at 15%+ FY27 FCF yield.”

Getting into specifics, the top analyst goes onto explain the quality of Vestra’s power generation assets, adding, “From a data center-related growth perspective, VST owns a large fleet of CCGTs across Texas and PJM, as well as four nuclear plants also in the same two regions. The breadth of the fleet means a greater ability to cater to specific customer needs, which should translate into higher contract signing success and overall more favorable terms.”

All things considered, the Jefferies analyst puts a Buy rating here, complemented by a $99 price target that shows his confidence in an 11% gain on the one-year horizon.

The Street generally has given this stock a unanimous Strong Buy consensus rating, based on 6 positive analyst reviews set in recent weeks. The shares are trading for $89.4 and the $108.17 average price target points toward a 12-month gain of 21%, even more bullish than the Jefferies view. (See Vistra stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Leave a Reply