Micron Stock Sinks as Morgan Stanley Warns About Memory Chip Sector

Kyle Green / Bloomberg via Getty Images

Key Takeaways

-

Morgan Stanley cut its price target for Micron Technology and warned about the future of the memory chip sector.

-

The bank said it sees “chillier conditions from here” for the stock group.

-

The analysts expect the sector’s growth to peak and reverse in the coming quarters.

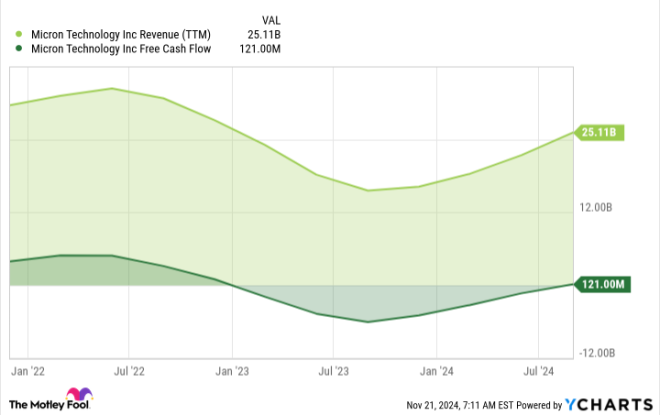

Micron Technology (MU) stock was one of the biggest decliners in the S&P 500 Monday after Morgan Stanley slashed its price target to $100 from $140 and gave a downbeat assessment of the memory chip sector.

The bank warned that although it’s difficult to predict cyclical peaks, “both NAND and DRAM are losing steam, and our inflection signposts suggest chillier conditions from here.”

The analysts wrote in a report to clients that while memory chip demand is still moving up, “the rate of change is approaching a peak as supply catches up to demand.”

Morgan Stanley Sees Sector’s Earnings Growth Reversing

They added that they see the sector’s earnings growth reaching the top and then reversing in the coming quarters, with a nearly 30% price-to-book (P/B) ratio contraction, “and a higher chance of investors resetting positions.”

The analysts argued that even if valuations look good as stock prices fall, it doesn’t make sense to buy the dips because they anticipate “better entry points in the future.”

Shares of Micron Technology fell 4.5% Monday afternoon to $87.10. They are up about 2% in 2024.

Read the original article on Investopedia.

Leave a Reply