Kessler Topaz Meltzer & Check, LLP Reminds LULU Investors of October 7, 2024 Deadline in Securities Fraud Class Action and Urges Investors with Losses to Contact the Firm

RADNOR, Pa., Sept. 16, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of New York against lululemon athletica inc. (“lululemon”) LULU on behalf of investors who purchased or otherwise acquired lululemon securities between December 7, 2023 and July 24, 2024, inclusive (the “Class Period”). The case is assigned to the Honorable Andrew Lamar Carter Jr. The lead plaintiff deadline is October 7, 2024.

CONTACT KESSLER TOPAZ MELTZER & CHECK, LLP:

If you suffered lululemon losses, you may CLICK HERE or go to: https://www.ktmc.com/new-cases/lululemon-athletica-inc?utm_source=PR&utm_medium=link&utm_campaign=lulu&mktm=r

Please CLICK HERE to view our video or copy and paste this link into your browser: https://youtu.be/5eEcTpJdRdc

You can also contact attorney Jonathan Naji, Esq. by calling (484) 270-1453 or by email at info@ktmc.com.

DEFENDANTS’ ALLEGED MISCONDUCT:

The complaint alleges that, throughout the Class Period, Defendants made materially false and/or misleading statements and/or failed to disclose that: (1) lululemon was struggling with inventory allocation issues and color palette execution issues; (2) the company’s Breezethrough product launch underperformed; (3) as a result, lululemon was experiencing stagnating sales in the Americas region; and (4) as a result of the foregoing, Defendants’ positive statements about the company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

THE LEAD PLAINTIFF PROCESS:

lululemon investors may, no later than October 7, 2024, seek to be appointed as a lead plaintiff representative of the class through Kessler Topaz Meltzer & Check, LLP or other counsel, or may choose to do nothing and remain an absent class member. A lead plaintiff is a representative party who acts on behalf of all class members in directing the litigation. The lead plaintiff is usually the investor or small group of investors who have the largest financial interest and who are also adequate and typical of the proposed class of investors. The lead plaintiff selects counsel to represent the lead plaintiff and the class and these attorneys, if approved by the court, are lead or class counsel. Your ability to share in any recovery is not affected by the decision of whether or not to serve as a lead plaintiff.

Kessler Topaz Meltzer & Check, LLP encourages lululemon investors who have suffered significant losses to contact the firm directly to acquire more information.

CLICK HERE TO SIGN UP FOR THE CASE OR GO TO: https://www.ktmc.com/new-cases/lululemon-athletica-inc?utm_source=PR&utm_medium=link&utm_campaign=lulu&mktm=r

ABOUT KESSLER TOPAZ MELTZER & CHECK, LLP:

Kessler Topaz Meltzer & Check, LLP prosecutes class actions in state and federal courts throughout the country and around the world. The firm has developed a global reputation for excellence and has recovered billions of dollars for victims of fraud and other corporate misconduct. All of our work is driven by a common goal: to protect investors, consumers, employees and others from fraud, abuse, misconduct and negligence by businesses and fiduciaries. The complaint in this action was not filed by Kessler Topaz Meltzer & Check, LLP. For more information about Kessler Topaz Meltzer & Check, LLP please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Jonathan Naji, Esq.

(484) 270-1453

280 King of Prussia Road

Radnor, PA 19087

info@ktmc.com

May be considered attorney advertising in certain jurisdictions. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SENIX Tools Wins a 2024 Pro Tool Innovation Award

Huntersville, NC September 16, 2024 –(PR.com)– YAT USA Inc. | SENIX Tools received a prestigious 2024 Pro Tool Innovation Award for the CSPX6-M X6 60V Pole Saw. A distinguished panel of judges, including contractors, construction business owners, tradespeople, and media professionals, has completed the vote tally for the world’s most innovative products in the construction and outdoor power equipment industry. Now in its 12th year, the Pro Tool Innovation Awards have highlighted a remarkable range of groundbreaking power tools, hand tools, tool accessories, and fasteners. Leading industry manufacturers submitted products, showcasing an extraordinary array of innovation. The PTIA judges had the following to say about the CSPX6-M X6 60V Pole Saw:

“The SENIX 10″ 60V brushless pole saw uses a unique 3-stage extension to vary the length from its minimum length all the way up to 14 feet. The brushless motor gives you ample cutting power, and an onboard digital readout provides feedback and information. You also get an eco-mode to help maximize runtime by lowering the chain speed. This tool looks like a great fit for homeowners and those looking for a simple yet comprehensive tool for trimming branches and smaller limbs that are just out of reach.”

Innovation comes in many forms. Pro Tool Innovation Award winners push boundaries, often introducing features no one has ever seen, creating new battery-powered solutions, redefining the capabilities of compact tools, or designing products at a lower price without compromising performance,” stated Noelle Howe, Content Manager for the Awards. “The work of teams and individuals who dare to think outside the box is evident throughout the Pro Tool Innovation Awards,” she added.

The PTIA judges underwent a rigorous evaluation process spanning several dozen man-hours, sifting through hundreds of cutting-edge power tools, hand tools, fasteners, products, and accessories. The selection of winners was based on various critical factors. The awarded products stood out for their innovative features, superior power delivery, revolutionary ergonomics, technological advancements, jobsite safety improvements, or exceptional value. The 2024 Pro Tool Innovation Award winners exemplify the companies and products that drive the construction, landscaping, automotive, and manufacturing industries forward, meriting recognition for their role in advancing their respective fields.

This year, over 100 different manufacturers and brands submitted nearly 400 products in dozens of categories, all vying for a 2024 Pro Tool Innovation Award.

Reflecting on the 12th annual Pro Tool Innovation Awards, Executive Director Clint DeBoer expressed admiration for the industry’s ongoing innovation. “This marks our 12th year of hosting the PTIA Awards, and each year we witness an increasing level of innovation from both large and small companies.” DeBoer added, “Every Pro Tool Innovation Award celebrates a product developed by passionate people who, like us, believe the standard we’re used to is no longer good enough.”

In 2024, top innovators continued making significant advances in battery-powered technology, continuing the shift away from traditional corded and gas tools and equipment. Many of these cutting-edge products, praised for their heightened efficiency, improved safety, and enhanced jobsite productivity, have challenged the traditional boundaries between battery and gas. Manufacturers of tool accessories and fasteners have also embraced these new developments.

The annual PTIA Awards have become a sought-after platform for professionals and consumers alike, eager to discover groundbreaking products. The program has been crucial in spotlighting the rapid advancements in the battery-powered technology sector.

For further information about YAT USA Inc. | SENIX Tools, please contact:

Gustavo Alvarado – Marketing Director

senix.info@yatusa.com

10506 Bryton Corporate Center Drive #500

Huntersville, NC 28078

1-800-261-3981

Visit protoolinnovationawards.com for more about the Pro Tool Innovation Awards.

Contact Information:

YAT USA In. | SENIX Tools

Gustavo Alvarado

800-261-3981

Contact via Email

senixtools.com

Read the full story here: https://www.pr.com/press-release/920525

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Climb Global is on the Move, Here's Why the Trend Could be Sustainable

When it comes to short-term investing or trading, they say “the trend is your friend.” And there’s no denying that this is the most profitable strategy. But making sure of the sustainability of a trend to profit from it is easier said than done.

Often, the direction of a stock’s price movement reverses quickly after taking a position in it, making investors incur a short-term capital loss. So, it’s important to ensure that there are enough factors — such as sound fundamentals, positive earnings estimate revisions, etc. — that could keep the momentum in the stock going.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

Climb Global Solutions

CLMB is one of the several suitable candidates that passed through the screen. Here are the key reasons why it could be a profitable bet for “trend” investors.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. CLMB is quite a good fit in this regard, gaining 60.9% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 7.5% over the past four weeks ensures that the trend is still in place for the stock of this computer software reseller.

Moreover, CLMB is currently trading at 92% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in CLMB may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forget Walmart: The Biggest Retail Stock Split of the Year Has Arrived

Since the advent of the internet roughly three decades ago, investors have consistently had a next-big-thing innovation or game-changing technology to captivate their attention. However, 2024 has been somewhat unique in that two trends are vying for recognition at the same time.

While there’s no denying that the rise of artificial intelligence (AI) has helped lift all three major stock indexes to record-closing highs, the excitement surrounding stock splits has played an equally important role in sending the valuations of select prominent businesses higher in 2024.

Think of stock splits as a tool on the proverbial utility belt of publicly traded companies that they can use to adjust their share price. Just keep in mind that this tool is purely cosmetic. Altering a company’s share price and outstanding share count by the same factor has no impact on its market cap or operating performance.

While there are two types of stock splits — forward and reverse — investors overwhelmingly favor forward-stock splits. Forward splits, which are designed to lower a company’s share price to make it more nominally affordable for retail investors without access to fractional-share purchases through their broker, are usually conducted by businesses out-executing their peers.

Since 2024 began, a little over a dozen top-tier companies with sustained competitive advantages have announced or completed a stock split — all but one of which is of the forward-split variety.

Following the close of trading today, the next phenomenal business will step forward and take its place among the “Class of 2024” stock-split stocks, and in the process knock retail juggernaut Walmart (NYSE: WMT) out of the spotlight.

Walmart kicked off stock-split euphoria in late January

Despite tech stocks galore ascending to the heavens on the heels of the AI revolution, it was Walmart that opened the floodgates to major stock-split announcements this year.

In late January, Walmart’s board approved a 3-for-1 forward split — the largest in the company’s history and its 12th split since going public in October 1970 — to make shares more affordable for the company’s employees. Per CEO Doug McMillon, “Sam Walton believed it was important to keep our share price in a range where purchasing whole shares, rather than fractions, was accessible to all of our associates.”

When this split was completed after the close of trading on Feb. 23, Walmart’s share price fell from $175.56 to $58.52, while its outstanding share count increased by a factor of three.

Chief among Walmart’s competitive advantages is its size. Having deep pockets and the ability to buy products in bulk, thereby lowering its per-unit cost for each item, has allowed it to consistently undercut local stores and even regional/national grocery chains on price. Walmart understands the importance of its value proposition with consumers and has consistently won on this front for decades.

Walmart is also enjoying tangible benefits from its e-commerce push. The convenience of prepared pickups and deliveries has hit home with busy consumers, leading to e-commerce sales growth of 22% in the U.S. in the fiscal second quarter (ended July 26, 2024), and 18% in international markets.

But Walmart is yesterday’s news on the stock-split front. A dominant retailer that’s embraced e-commerce, and has seen its shares skyrocket more than 12,000% since its initial public offering (IPO) in 1993, is ready to take center stage for the retail industry.

This skyrocketing retail specialist — up 12,600% since its IPO — is conducting its biggest stock split to date

In mid-July, leading footwear and apparel retailer Deckers Brands (NYSE: DECK) announced plans to conduct a 6-for-1 forward split. This marks only the second time since its IPO that it’s conducting a forward split, with the other being a 3-for-1 split in July 2010.

Former CEO Dave Powers, who retired last month but had led Deckers Brands for the previous eight years, had this to say about his company’s board approving the historic 6-for-1 split:

The trading price of our common stock has risen significantly over the past several years as a result of our strong financial performance and the execution of our strategic plan. We believe effecting the forward stock split will make the shares of our common stock more affordable and attractive to a broader group of potential investors, including our employees, and increase the liquidity of the trading of the shares of our common stock.

The effective date for this split is (drum roll) following the close of trading today, Monday, Sept. 16. When Deckers Brands’ stock opens for trading tomorrow, it’ll be at the split-adjusted price of closer to $156, instead of the $935.07 it closed at on Sept. 13.

As I alluded earlier, one of the longtime keys to Deckers’ success has been its e-commerce push. As of the most-recent quarter, ending June 30, the company reported $310.6 million in direct-to-consumer (DTC) sales, which is up nearly 22% from the prior-year period. More importantly, DTC sales accounted for close to 38% of total revenue, which compares to less than 32% of net sales in the same quarter three years ago.

This almost six-percentage-point improvement might not sound like much, but it’s increasingly made Deckers Brands an inventory-light businesses. Not having to tie up its cash in inventory and manufacturing has led to superior margins for the company.

The strength of the company’s brands has played a key role in its long-term success, as well. Though it owns around a half-dozen major brands, the best-known include Ugg, Hoka, and Teva. Hoka ($420.5 million in the latest quarter), Ugg ($195.5 million), and Teva ($48.4 million) account for the lions’ share of sales.

But the most-exciting aspect of Deckers’ strategy has been its international expansion. E-commerce is still just getting off the ground in international markets, which affords the company a sustained double-digit, high-margin growth opportunity.

The icing on the cake is that Deckers Brands is a debt-free company with north of $1.4 billion in cash and cash equivalents. It has the financial flexibility to make deals happen, just as it did when it purchased Ugg in 1995 and Hoka in 2012.

While this sizable stock split is long overdue, it can also be argued that Deckers Brands has some work to do to grow into its current valuation. Although the company’s stock is absolutely deserving of a premium given the momentum it’s enjoyed from DTC growth, its international push, and its top-tier branding, shares are trading at 26 times forward-year earnings. This might not seem like a steep price to pay, but consensus annualized earnings growth over the next five years is a more modest 11.4%.

In other words, Deckers Brands will likely need to blow the doors off of Wall Street’s and its own growth forecasts if its stock is to head even higher.

Should you invest $1,000 in Deckers Outdoor right now?

Before you buy stock in Deckers Outdoor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Deckers Outdoor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.

Forget Walmart: The Biggest Retail Stock Split of the Year Has Arrived was originally published by The Motley Fool

I'm A Single 57-Year-Old With No Debt, $1.3 Million In Savings, And $65,000 Pension – Can I Retire Early?

A recent post on the Bogleheads Forum illuminated a common dilemma for those nearing retirement: deciding whether to retire early.

A 57-year-old user, currently single and living in a low-cost-of-living area with no debt and a paid-off home, is contemplating retirement. With a current net worth of approximately $1.3 million, the user is trying to determine the right time to retire.

Don’t Miss:

Financial Overview

The user’s financial situation includes:

• $750K in a 457(b) plan

• $275K in a Roth IRA

• $275K in after-tax accounts

• $30K in savings

All investments, except savings, are allocated in a 60/40 portfolio. The user plans to rely on a pension of $65K annually starting at age 60, which includes a 3% cost-of-living adjustment after the first four years. Social Security benefits of $6K annually are expected to begin at age 70.

The current spending is around $60K per year, though the user only spends $40K and is looking to add some extra cash for more enjoyable activities.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Key Concerns:

See Also: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

The Bogleheads forum responses offered various perspectives and reassurances:

Forum members assured the user that their financial situation is secure enough to support early retirement. The pension, despite its lack of inflation adjustment in the initial years, along with existing investments, should comfortably cover expenses.

Regarding boredom, suggestions ranged from finding fulfilling activities and hobbies to maintaining flexible plans. Volunteering and other hobbies like playing guitar were noted as great ways to stay engaged.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Several users emphasized that retiring is deeply personal and not purely financial. They advised considering whether the current work is enjoyable or a source of stress. The consensus was that if financial concerns are minimal and personal fulfillment is prioritized, retiring now could be a wise choice.

Overall, the majority agreed that the user is financially prepared to retire and should focus on what will bring personal satisfaction.

Retiring is as much about personal readiness and happiness as it is about finances. As one forum member aptly noted, “The only thing you can’t buy is more time, so would you rather spend it working or doing whatever YOU want?”

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article I’m A Single 57-Year-Old With No Debt, $1.3 Million In Savings, And $65,000 Pension – Can I Retire Early? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elizabeth Warren Urges Fed To Slash Rates By 0.75%; Veteran Investor Warns Even 0.5% Cut Could 'Reduce Trump's Chances Of Winning'

The Federal Reserve’s upcoming meeting on Sept. 18 is shrouded in uncertainty, with market participants debating whether the central bank will cut rates by 0.25% or opt for a more aggressive 0.5% reduction.

Adding another layer of complexity to the Fed’s rate decision, three U.S. senators—Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper—sent a letter to the Fed on Monday urging a jumbo cut of 75 basis points.

“We write today to urge the Federal Reserve (Fed) to cut the federal funds rate, currently at a two-decade-high of 5.3 percent, by 75 basis points (bps) at the Federal Open Market Committee (FOMC) meeting on Sept. 17 and 18, 2024,” the senators wrote.

They warned that if the Fed remains “too cautious in cutting rates, it would needlessly risk our economy heading towards a recession.”

According to market-implied odds tracked by CME FedWatch, there’s a 60% probability of a 50-basis-point cut and a 40% chance of a smaller 25-basis-point cut.

There’s no chance the Fed will opt for a 75-basis-point cut, a move that has historically been reserved for crisis situations, such as the Great Financial Crisis in January 2008 or the 100-basis-point cut in March 2020.

While a 75 basis point cut seems unrealistic at this stage, some market experts are beginning to suggest that a decision to cut by 50 basis points could carry political implications, especially for President Trump’s re-election prospects.

Fed In High-Stake Rate Cut Decision As Presidential Elections Loom

Veteran market analyst Ed Yardeni indicates that the economic and political implications of monetary policy decisions are too significant to ignore.

While he highlights that “the Fed is apolitical,” – as officials have often claimed – a more aggressive 50-basis-point rate cut could potentially “reduce Trump’s chances of winning” in the upcoming election.

Federal Reserve Chairman Jerome Powell has been clear about the Fed’s independence, stating in a July 31 press conference: “We would never try to make policy decisions based on the outcome of an election that hasn’t happened yet… That would just be a line we would never cross. We don’t want to be involved in politics in any way.”

However, Yardeni indicates that some members of the FOMC may not be entirely indifferent to the political landscape, especially given former President Donald Trump‘s contentious relationship with the Fed.

Yardeni speculates, “some members of the FOMC strongly dislike Donald Trump,” particularly since Trump is more likely than Harris to challenge the Fed’s independence.

According to an aggregation of the latest polls conducted in September, Kamala Harris holds an average lead of slightly more than 2 percentage points over Trump, standing at 48.8% compared to Trump’s 46.35%, with 4.85% of voters still undecided.

Betting odds tracked by Polymarket show a tight race, with Harris assigned a 50% chance of winning and Trump at 49%. This narrow margin makes any economic changes between now and Election Day crucial in swaying undecided voters.

The Powell factor

Yardeni also hints at Powell’s personal motivations, noting that his term as Fed Chair expires on May 15, 2026.

If Trump wins re-election, the likelihood of Powell being reappointed seems low. In contrast, if Harris wins, Powell might have a shot at retaining his role, though a more liberal candidate like Lael Brainard could also be in contention.

Yardeni highlights Powell’s recent shift from “inflation hawk to employment dove” at the August Jackson Hole symposium, suggesting this may be part of a strategy to align with political winds that favor his reappointment.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

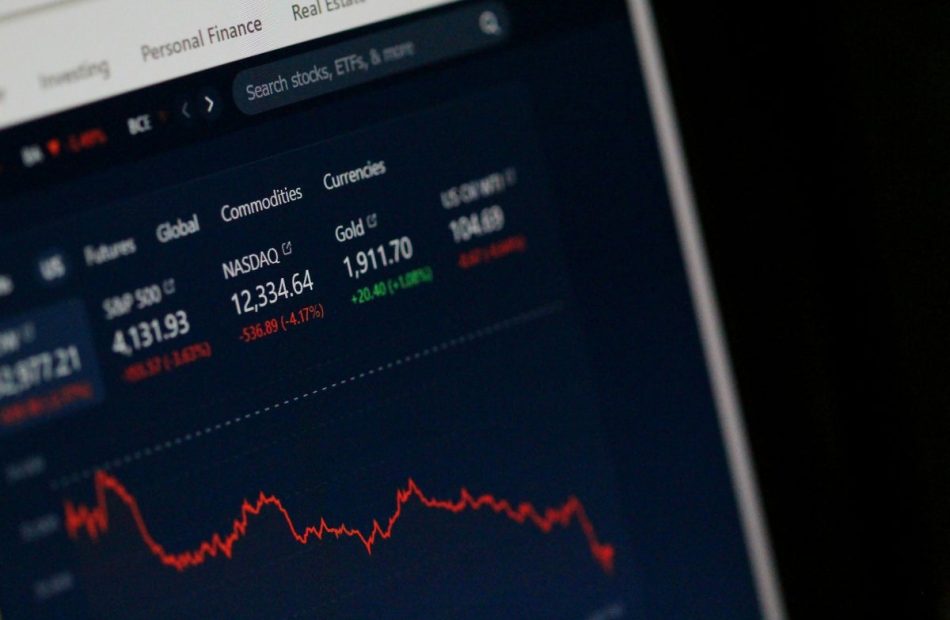

Investors Bet On 50-Basis-Point Rate Cut, Wall Street Analysts Urge Caution: 'This Is A Low-Conviction Fed'

The Federal Reserve is set to cut the federal funds rate for the first time in over four years at the upcoming Federal Open Market Committee meeting on Wednesday. The size of the cut is a subject of debate as the meeting approaches.

The key options on the table are either a 25-basis-point cut or a more aggressive 50-basis-point cut. As of Monday morning, investors and speculators slightly lean toward the larger 50-basis-point cut.

Recent Media Articles Push Market Expectations Toward 0.5% Cut

Currently, market participants are leaning slightly toward the latter. According to CME Group’s FedWatch tool, Fed futures are pricing in a 65% probability of a 50-basis-point cut as of 8:00 a.m. Monday, up significantly from just 30% a week ago.

Similarly, betting markets tracked by Polymarket are now assigning a 58% chance of a half-point cut, up from a mere 9% last Thursday.

Communication from Federal Reserve officials prior to the pre-FOMC blackout period, initially suggested a 25 basis point cut to 5.00-5.25%.

Yet, recent media reports indicating it’s a close call have since shifted market expectations toward the possibility of a larger 50 basis point cut.

Notably, Wall Street Journal reporter Nick Timiraos and Bloomberg Opinion columnist Bill Dudley have published articles driving market sentiment towards the half-a-percentage-point option.

The WSJ article stated that the FOMC “are confronting questions over whether to cut by a traditional 0.25 percentage point or by a larger 0.5 point.”

Dudley, a former president of the Federal Reserve Bank of New York, argued the logic for a 50-basis-point cut is “compelling.”

He stressed that the Fed’s dual mandate—price stability and maximum sustainable employment—has come into closer balance. This suggests that monetary policy should be neutral. Yet, current short-term interest rates remain significantly above neutral. That’s a disparity Dudley believes should be corrected quickly with an outsized cut.

Wall Street Analysts Predict a 25-Basis-Point Cut

Analysts at Bank of America and Goldman Sachs are forecasting a more modest 25 basis point cut.

Bank of America rates strategist Mark Cabana, CFA expects a 25-basis-point reduction at the September FOMC meeting, noting that Fed officials did not signal a larger cut before the blackout period. Additionally, recent U.S. inflation data has been slightly firm.

“This is a low-conviction Fed, and the policy path will hinge on the data rather than forward guidance. On balance, we expect the market to interpret the September FOMC as delivering a neutral to dovish cut,” Cabana stated.

He also anticipates 75 basis points of cuts in 2024, suggesting two additional 25-basis-point reductions in November and December.

Similarly, Goldman Sachs economist David Mericle expects a 25-basis-point cut.

A larger cut would be “somewhat out of keeping with usual Fed practice,” Mericle says. They are typically delivered during an obvious crisis or a significant spike in unemployment.

Assuming the FOMC delivers the 25-basis-point cut on Wednesday, Mericle expects the median dot plot to indicate three additional 25-basis-point cuts in 2024. He expects quarterly cuts thereafter.

Now Read

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

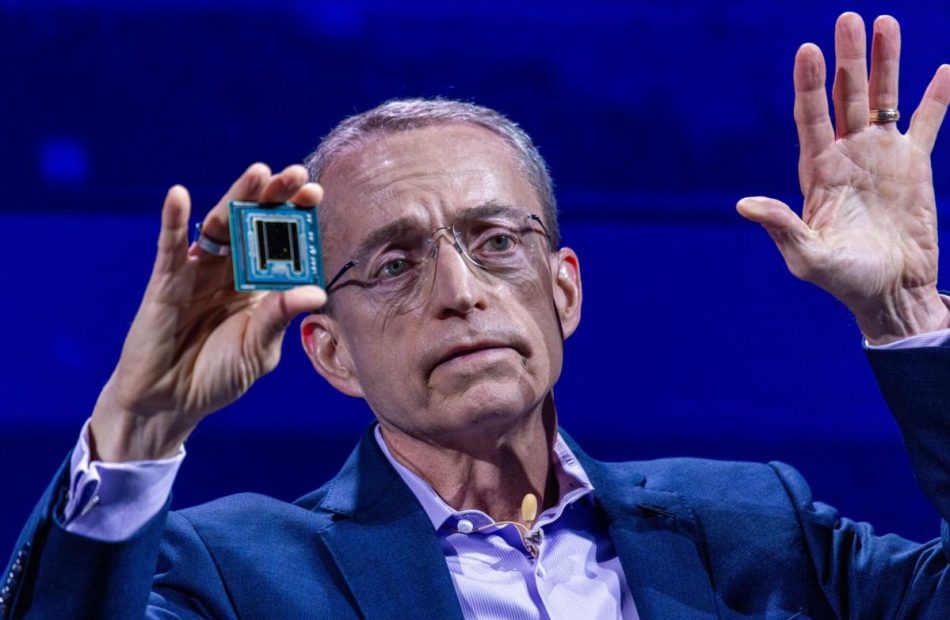

Intel to Make Custom AI Chip for Amazon, Delay German Plant

(Bloomberg) — Intel Corp. Chief Executive Officer Pat Gelsinger has landed Amazon.com Inc.’s AWS as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker.

Most Read from Bloomberg

Intel and AWS will coinvest in a custom semiconductor for artificial intelligence computing – what’s known as a fabric chip – in a “multiyear, multibillion-dollar framework,” according to a statement Monday. The work will rely on Intel’s 18A process, an advanced chipmaking technology.

The shares jumped more than 8% in late trading after the announcement. They had been down 58% this year, closing at $20.91 on Monday.

“Today’s announcement is big,” Gelsinger said in an interview. “This is a very discerning customer who has very sophisticated design capabilities.”

The news was part of a flurry of announcements that followed a pivotal board meeting last week. Intel also is postponing new factories in Germany and Poland, but remains committed to its US expansion in Arizona, New Mexico, Oregon and Ohio.

Gelsinger, who embarked on a bold comeback effort for Intel in 2021, has had to scale back some of his ambitions in the name of efficiency. With sales shrinking and losses piling up, the company announced plans last month to slash 15,000 workers, find $10 billion in cost savings and suspend Intel’s dividend. Now he’s going further to rein in expansion plans, especially overseas.

The Poland and Germany construction projects will be paused for about two years depending on market demand. Another one in Malaysia will be completed but only put into operation when conditions support it, Intel said.

At last week’s three-day board meeting, executives presented options on how to conserve cash while keeping Gelsinger’s turnaround plan on track. The CEO’s effort hinges on transforming Intel into a so-called foundry, a chipmaker that manufacturers products for outside customers. The Santa Clara, California-based company has been slow to line up customers for the project — and a high-profile client such as Amazon represents a notable win.

Intel also is looking to speed up efforts to execute the $10 billion in cost savings and focus its products better on AI computing, an area where rival Nvidia Corp. has excelled. It’s also looking to pare its real estate globally by about two-thirds by the end of the year.

And the company reiterated plans to sell part of its stake in Altera Corp. to private equity investors. The business, which Intel bought in 2015, was separated from its operations last year with the goal of taking it public.

Amazon Web Services is the largest provider of cloud computing, and it could help build confidence that Intel can compete with the likes of foundry leader Taiwan Semiconductor Manufacturing Co. AWS has used Intel processors over the years, but has been shifting more toward in-house designs — the very products that Intel may now help manufacture.

Microsoft Corp., another major cloud-computing provider, announced plans in February to use Intel for some of its in-house chips as well.

Another change: Intel’s foundry operations, referred to as IFS, will be further separated from the rest of the company and become a wholly owned subsidiary. That move is aimed in part at convincing prospective customers — some of whom compete with Intel — that they are dealing with an independent supplier. Bloomberg reported earlier on a potential foundry separation.

“We still have things to learn about becoming a foundry,” Gelsinger said in the interview. “I need lots of customers.”

In another win, Intel said earlier Monday that it’s eligible to receive as much as $3 billion in US government funding to manufacture chips for the military. The effort, called the Secure Enclave, aims to establish a steady supply of cutting-edge chips for defense and intelligence purposes. That news helped send the shares up 6.4% in regular trading Monday.

The Secure Enclave award is separate from a possible $8.5 billion Chips and Science Act grant that Intel is set to receive to support factories across four US states. The projects include a facility in New Albany, Ohio, that Intel has said could become the world’s largest chipmaking operation.

Intel still has a long way to go to win back Wall Street’s full confidence. After years of losing ground to rivals and seeing its technological edge slip, the Silicon Valley pioneer is valued at less than $90 billion. It no longer ranks as one of the top 10 chip companies on that basis. Nvidia, meanwhile, now has a market capitalization of about $2.9 trillion.

Intel shocked investors with a bleak financial report last month, triggering the biggest single-day stock decline in decades. Analysts described the announcement as Intel’s worst-ever earnings report.

Gelsinger, in a letter to employees, acknowledged that the chipmaker’s performance has drawn negative scrutiny — and spurred speculation over what might happen to the company. The only way to “quiet our critics” will be to deliver results and execute better, he said. Today’s announcements are a step toward that, he said.

“Is it good enough? No. Is it substantial? Yes,” he said in the interview. “I’ve reupped my commitment. We’re going to finish a seminal assignment.”

–With assistance from Mackenzie Hawkins.

(Updates with more from announcements starting in ninth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Peter Schiff Says Unlikely That Fed Rate Cuts Will Lower Borrowing Costs, Predicts Rising Mortgage Rates And Dollar Collapse — Suggests 100 Basis Points Rate Hike As Cure

Economist Peter Schiff has cautioned that the upcoming rate cuts by the Federal Reserve may not lower borrowing costs, according to a post on X on Monday.

What Happened: Schiff, known for his skepticism towards Bitcoin BTC/USD, stated that mortgage rates have likely already hit their lowest point and are expected to rise.

He added that the Federal Reserve would likely return to quantitative easing (QE) to try and halt this increase.

Schiff warned that such actions would “crush the dollar and reignite #inflation.”

Schiff wrote, “Rate hike, maybe 100 basis points. Plus, announce an expansion of QT,” in response to a user query on what he would do if he had control over the Federal Reserve’s decisions.

The Federal Open Market Committee is scheduled to meet on September 18. While a rate cut is anticipated, the exact size remains uncertain.

See Also: Nasdaq, S&P 500 Futures Sag In Fed Decision Week: What’s Going On

Why It Matters: The Federal Reserve’s upcoming meeting has been a focal point for market participants, with significant debate surrounding the size of the anticipated rate cut.

Sen. Elizabeth Warren (D-Mass.), along with Sen. Sheldon Whitehouse (D-R.I.) and Sen. John Hickenlooper (D-CO), urged the Fed to slash rates by 75 basis points, citing the current federal funds rate at a two-decade high of 5.3%.

Investors are also speculating on the size of the cut, with a slight lean towards a 50-basis-point reduction, according to CME Group’s FedWatch tool, which showed a 65% probability for this outcome as of Monday morning.

Adding to the complexity, former President Donald Trump has expressed that there should be no rate cuts before the 2024 presidential election.

Moreover, some analysts argue that rate cuts may not automatically boost the stock market, as the Federal Reserve’s actions might be more reactive to weakening growth rather than proactive measures to stimulate the economy.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump is days away from being able to dump his Trump Media stock for a massive payday

-

Donald Trump can sell his Trump Media stock soon, potentially scoring a huge payout.

-

The lockup period for Trump Media shares ends September 25, or earlier if some conditions are met.

-

Trump’s stake in Trump Media is worth about $2 billion, over half his total net worth.

Donald Trump is just days away from being eligible for a huge payout.

The potential source of the wealth is the Republican presidential nominee’s company Trump Media, which owns his platform, Truth Social. The entity first began trading on the Nasdaq in March under the ticker DJT.

As part of a “lockup agreement,” which is common practice in initial public offerings, Trump has been barred from selling his shares in the company for 180 days.

That countdown clock is now ticking down.

The lockup period, as explained in the company’s regulatory filings, is scheduled to end on September 25, but it could also end as early as September 20 if certain conditions are met.

To be freed up on the earlier date, the share price needs to remain above $12 for 20 trading days within the 30-day period that began on August 23. Despite the stock falling to around $16 this past week — its lowest point on record — that condition has been met. Shares have plummeted 60% since mid-July.

Trump owns almost 60% of the company, and with the company’s current valuation at around $3.3 billion, that means his stake totals about $2 billion.

His stake in the company makes up more than half of his total net worth, according to Forbes, which estimates Trump is worth about $3.7 billion.

It’s not clear if Trump intends to sell his stock or not, and in an SEC filing, Trump Media explains that if a large shareholder even indicates plans to sell, it could negatively affect the share prices.

“These sales, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price” of the stock, the filing says.

There’s also the matter of Trump not wanting to cash in his holdings with DJT stock at record lows. In recent months the share price has been correlated with Trump’s polling numbers, so any sort of recovery in election odds could lead to a stock rebound — and a more attractive payout package.

And on Friday, Trump insisted he wouldn’t sell off.

“No, I’m not selling. No, I love it,” Trump said during a press conference in California. That sent shares briefly skyrocketing.

Still, Trump could probably use the money right now.

Earlier this year, Judge Arthur Engoron ordered Trump and executives at the Trump Organization to pay out $454 million plus interest in their New York civil fraud trial. So far, Trump has paid $175 million for an appeal bond, but if he loses his appeal, he’ll be on the hook for hundreds of millions more.

On top of that, Trump had already burned through $100 million in lawyer’s fees by March this year, according to a report by The New York Times.

Trump Media has had a tumultuous ride since entering the public market. With help from meme stock mania, the company’s stock soared to $70 a share when it first went public, shooting Trump Media’s market cap to $9 billion and raising the Republican nominee’s net worth to $7 billion.

The company boasted an eye-watering valuation despite reporting paltry earnings and high expenditures.

But Trump Media’s stock has been in free-fall ever since. And although Trump insisted he won the debate against Kamala Harris, the market resoundingly reacted as if he lost, making it ultimately responsible for DJT’s last leg down to record lows.

Read the original article on Business Insider