Is Pfizer's 5.7% Dividend Yield Worth the Risk?

High-yield dividend stocks offer two key benefits. They provide regular cash flow through dividend payments and, when dividends are consistently reinvested, have often outperformed the S&P 500 over extended periods.

High yields, however, warrant scrutiny. They often result from falling share prices or overly generous payout policies. The payout ratio, which measures the proportion of earnings distributed as dividends, is a critical metric. Ratios exceeding 75% can signal unsustainability, potentially leading to dividend cuts and subsequent stock price declines.

Pharmaceutical giant Pfizer (NYSE: PFE) stands out in this context. The company currently offers a mouthwatering 5.7% dividend yield — the highest among major drug manufacturers and one of the highest in the entire healthcare sector. However, Pfizer’s payout ratio of 436% raises significant concerns about sustainability.

Is Pfizer’s high dividend worth the risk? Let’s dig deeper to find out.

A pharmaceutical powerhouse facing challenges

Pfizer is a global pharmaceutical giant with an impressive portfolio of over 350 marketed medicines, 113 experimental candidates in clinical trials, and a presence in more than 200 countries. Despite this commanding position, the company’s stock has recently stumbled, plummeting 52% from its three-year high.

This significant decline primarily stems from the sales slump of Pfizer’s once-booming COVID-19 franchise. However, amid this key challenge, Pfizer’s current valuation may present an intriguing opportunity for both bargain hunters and yield-seeking investors.

Delving into the specifics, Pfizer’s shares now trade at a mere 9.6 times 2026 projected earnings, a notable discount in the typically premium-laden pharmaceutical sector. This attractive valuation, combined with the stock’s high dividend yield and Pfizer’s entrenched market position, creates a compelling value proposition for investors with a long-term horizon.

Dividend sustainability concerns

Pfizer’s 5.7% dividend yield, while attractive, raises significant sustainability concerns. The company’s payout ratio has skyrocketed to 436%, far exceeding the 75% threshold that typically signals potential dividend instability. This ratio is not only alarmingly high in absolute terms but also stands out as the highest among Pfizer’s big pharma and blue chip biotech peers.

Context is crucial, however. The pharmaceutical industry often experiences periods of elevated payout ratios due to its capital-intensive nature and the finite patent protection for branded medications. These factors can lead to temporary spikes in this metric. Indeed, the average payout ratio among Pfizer’s peer group is 141% — already quite high but still dwarfed by Pfizer’s 436%.

Wall Street’s reaction to these figures has been decidedly bearish. Pfizer’s shares have declined by 14% over the prior 12 months, reflecting investor skepticism about its ability to maintain its current dividend levels. This negative sentiment persists despite Pfizer’s strong commercial performance in the first half of the year, including several successful new drug launches.

Management’s stance and prospects

During Pfizer’s 2024 second-quarter conference call, management reaffirmed its commitment to maintaining and growing the dividend as a top priority. This stance is supported by the company’s 15-year streak of consecutive dividend increases and no reductions since the $68 billion Wyeth acquisition in 2009.

To bolster this commitment, Pfizer has implemented a cost-saving plan targeting $4 billion in net savings by year-end. This initiative aims to improve free cash flows and support short-term dividend sustainability.

Looking ahead, Pfizer’s pipeline includes several potential blockbuster cancer drugs, notably vepdegestrant for breast cancer and sigvotatug vedotin for lung cancer. If successful in clinical trials, these high-value medications could generate over $1 billion in annual sales.

Successful launches of these drugs could significantly boost Pfizer’s top-line growth and earnings power in the latter half of the decade. This improved financial performance could help bring the company’s payout ratio closer to its historical average of around 50%.

The verdict: A calculated risk worth considering

While nothing is guaranteed in investing, the market’s pessimistic outlook on Pfizer’s near-term prospects may be overdone. Management’s steadfast commitment to dividend growth, cost-cutting measures, and a promising drug pipeline suggest the potential for a turnaround.

Pfizer’s shares also currently trade at a steep discount relative to many of its big pharma peers, potentially providing a margin of safety for investors buying at current levels. While the elevated payout ratio is a concern, the company’s strong market position, diverse product portfolio, and proven innovation engine offer some reassurance that this situation will ultimately prove temporary.

Given these factors, Pfizer screens as an intriguing option for investors seeking high-yield opportunities. However, as with all high-yield stocks, monitoring the company’s financial health and dividend coverage will remain crucial.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

George Budwell has positions in Pfizer. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Is Pfizer’s 5.7% Dividend Yield Worth the Risk? was originally published by The Motley Fool

Stanley Black Exhibits Bright Prospects, Headwinds Persist

Stanley Black & Decker, Inc.‘s SWK cost-reduction program is expected to aid its bottom line and drive margin performance in the quarters ahead. The program comprises a series of initiatives to resize the organization, reduce inventory and optimize the supply chain with the goal of repositioning it to pursue sustainable long-term growth.

In the first six months of 2024 and since the inception of the program, SWK realized pre-tax run rate savings of $295 million and $1.3 billion, respectively. The savings were driven by lower headcount, reductions of indirect spending and supply-chain transformation.

Stanley Black has been divesting non-core operations to drive growth. In April 2024, the company divested its STANLEY Infrastructure (Infrastructure) business to Epiroc AB for a cash consideration of $760 million. The divestment will help the company to focus on its core businesses, reduce debt and support capital-allocation priorities.

It remains focused on rewarding its shareholders through dividend payments and share buybacks. In the first six months of 2024, the firm paid dividends of $243.6 million, up 1.7% year over year. It also bought back shares worth $7.7 million. In July 2024, SWK hiked its quarterly dividend by a penny to 82 cents per share.

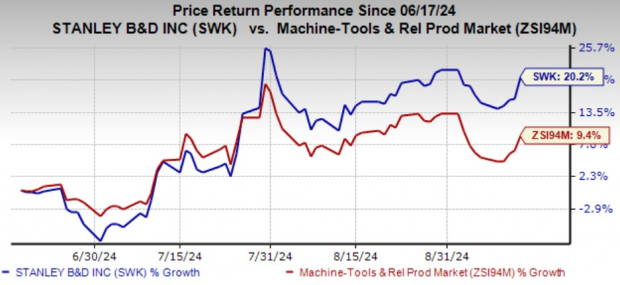

SWK’s Price Performance

Image Source: Zacks Investment Research

In the past three months, the Zacks Rank #3 (Hold) company has gained 20.2% compared with the industry’s 9.4% growth.

Despite the positives, lower consumer outdoor and do-it-yourself market demand is a concern for the Tools & Outdoor segment. Within the segment, the power tools business has been experiencing weaknesses due to reduced demand for consumer tools. Weakening automotive end markets, owing to headwinds in the global automotive OEM light vehicle production, are another setback.

Further, the low liquidity level remains a concern. Exiting the second quarter, the company’s cash and cash equivalents were $318.5 million, lower than the short-term borrowings of $492.4 million. Its current maturities of long-term debt totaled $500.1 million. This implies that SWK does not have sufficient cash to meet its current debt obligations. Also, the stock looks more leveraged than the industry. Its long-term debt/capital ratio is currently 0.39, higher than 0.36 of the industry.

Stocks to Consider

Some better-ranked companies from the same space are discussed below.

Flowserve Corporation FLS currently carries a Zacks Rank #2 (Buy).

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company CR presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.2%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TeraWulf Unusual Options Activity For September 16

Investors with a lot of money to spend have taken a bullish stance on TeraWulf WULF.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with WULF, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for TeraWulf.

This isn’t normal.

The overall sentiment of these big-money traders is split between 77% bullish and 22%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $200,000, and 8, calls, for a total amount of $321,625.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $3.5 and $5.0 for TeraWulf, spanning the last three months.

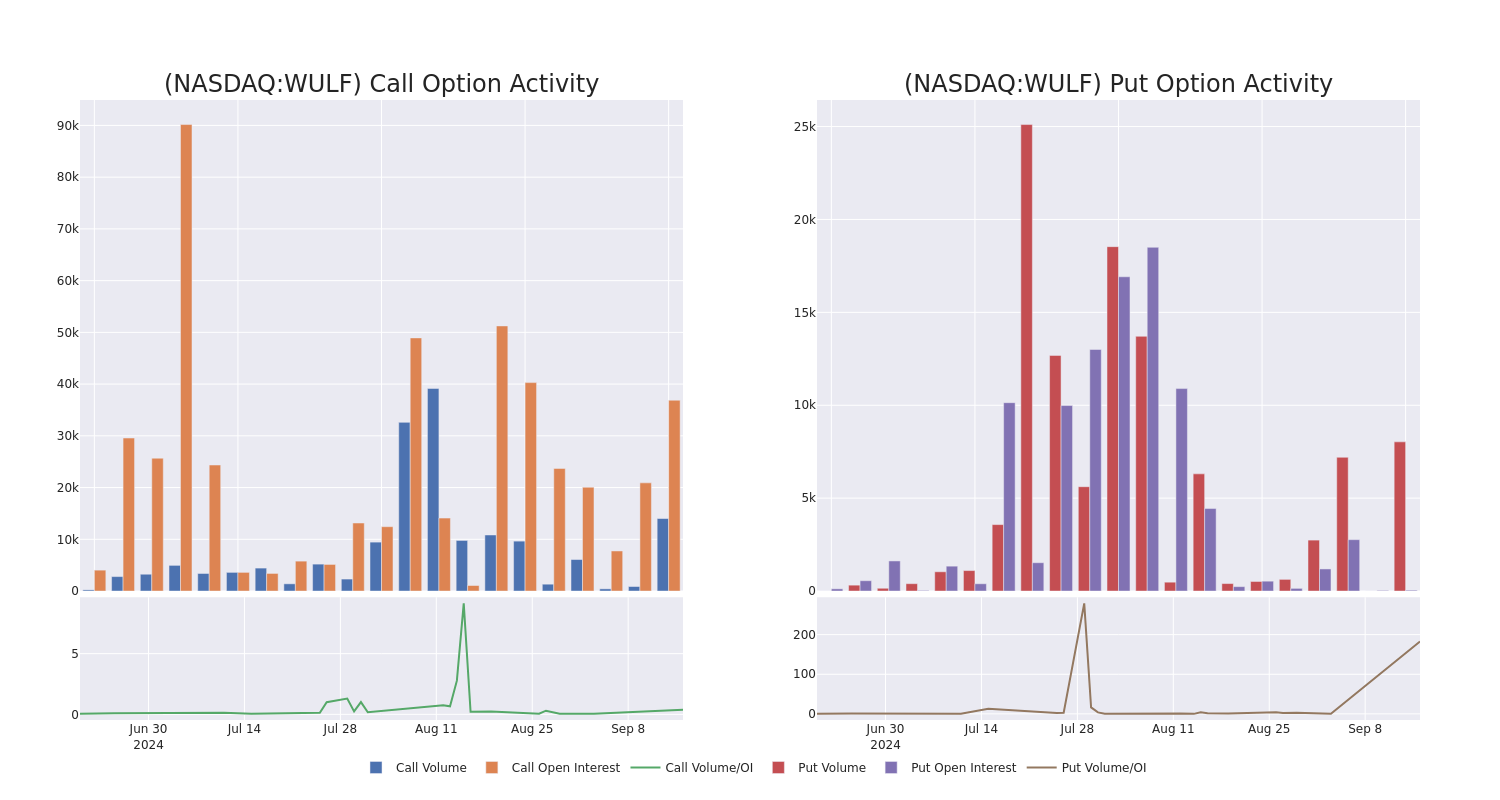

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for TeraWulf’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of TeraWulf’s whale trades within a strike price range from $3.5 to $5.0 in the last 30 days.

TeraWulf Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WULF | PUT | SWEEP | BULLISH | 10/25/24 | $0.35 | $0.25 | $0.25 | $3.50 | $200.0K | 44 | 8.0K |

| WULF | CALL | TRADE | BEARISH | 01/17/25 | $1.1 | $1.05 | $1.05 | $4.00 | $91.6K | 23.1K | 2.4K |

| WULF | CALL | SWEEP | BULLISH | 11/15/24 | $0.5 | $0.35 | $0.49 | $5.00 | $49.8K | 7.4K | 1.0K |

| WULF | CALL | TRADE | BULLISH | 09/20/24 | $0.15 | $0.1 | $0.15 | $4.00 | $40.0K | 5.3K | 2.7K |

| WULF | CALL | SWEEP | BEARISH | 09/20/24 | $0.15 | $0.1 | $0.15 | $4.00 | $34.1K | 5.3K | 4.9K |

About TeraWulf

TeraWulf Inc is a digital asset technology company that is engaged in digital infrastructure and sustainable energy development. The company’s primary focus is supporting environmentally conscious bitcoin mining operations by developing and operating facilities within the United States. The company’s bitcoin mining facilities are powered by clean, affordable, and reliable energy sources. The company’s primary source of revenue stems from the mining of bitcoin conducted at the company’s mining facility sites. Additionally, the company occasionally generates revenue through the provision of miner hosting services to third-party entities.

In light of the recent options history for TeraWulf, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of TeraWulf

- With a volume of 11,506,554, the price of WULF is down -6.25% at $3.98.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 56 days.

Professional Analyst Ratings for TeraWulf

3 market experts have recently issued ratings for this stock, with a consensus target price of $7.333333333333333.

- An analyst from B. Riley Securities persists with their Buy rating on TeraWulf, maintaining a target price of $6.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $10.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $6.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for TeraWulf with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Could You Be The Next Homeowner To Get Their Policy Dropped Due To Drone Surveillance?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Home insurance is becoming more expensive and difficult to purchase nationwide, and now homeowners have a new concern: drone flights. As the cost of providing coverage continues to rise, insurers are taking more steps to limit their potential losses. One of those steps is using drones to inspect policyholders’ properties. This is leading to a rash of homeowners receiving cancellation notices due to drone footage.

Trending Now:

Imagine being a homeowner who has dutifully paid your premiums for decades and never filed a claim. You might think this would make you the perfect policyholder. Then one day, you go to the mailbox and find a cancellation notice from your home insurance company. What is more shocking than the cancellation itself is the grainy photo of your roof taken by a drone being cited as the reason for the cancellation.

This recently happened to Daytona Beach, Florida resident Mike Arman. He told the New York Post his policy was canceled after his insurance company flew a drone over his house and took photos that caused them to claim his roof looked “deteriorated.” At least, that’s the explanation Arman’s insurance broker gave him, but Arman is still frustrated by the experience for several reasons.

First, Mike had been a policyholder in good standing for over 50 years. Second, he felt that the photo the drone took of his roof, which motivated the cancellation, was of low quality. He told the New York Post that the picture itself looked like it had been taken from a significant distance by a “far-off satellite.” However, the real kicker for Mike Arman is that his roof was only six years old.

In most cases, the life span of roofs like the one Arman had installed on his home is between 20-30 years. Naturally, he figured there must have been some mistake, so he contacted his insurer and asked them to send someone out to evaluate his roof in person. After the insurance company told him they “didn’t do house calls,” Arman sent his insurance company documentation proving his roof’s relatively young age.

Unfortunately for Arman, none of that mattered to his insurer, who carried through with their cancellation a few months later. The cancellation came at just about the most inopportune moment possible. Florida has been suffering through a full-scale insurance crisis, characterized by major insurers leaving the state and the remaining insurers raising premium prices at a near-geometric rate.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

It has left millions of Florida homeowners like Arman with no viable insurance option besides the state-sponsored Citizens Insurance Company. This time, Arman figured he would be proactive and hire an inspector to certify his roof. Despite receiving approval from his home inspector, Arman got another nasty surprise in the mail as soon as his Citizens policy came up for renewal.

It turns out Citizens uses drones to inspect homes too, and after a flyover at his home, they decided to increase his premiums by 25%. To insurance companies and their shareholders, this policy of inspecting homes via drone seems like good business. Drone technology allows them to “visit” more homes than they ever could in person, and with the increased cost of covering claims, proactively cutting risk allows them to continue functioning.

On the other hand, homeowners like Arman feel like their insurers are “spying” on them and that the cancellation process lacks any real transparency. Mark Friedlander of the Insurance Information Institute (an industry-funded think tank) disagrees. He told Realtor.com that aerial photography “is a much less intrusive way to inspect your home than sending an individual to your property,” and he also believes it is more accurate.

Friedlander concludes that drones can sometimes make mistakes, but he says (without citing any data to back his conclusions up) that aerial surveillance is “10-20 times more accurate” than inspections done by human eyes. On the other hand, homeowners are shocked to find out that cancellations via aerial surveillance photos are even legal.

Albert Fox Cahn, who founded the Surveillance Technology Oversight Project, told the New York Post that “There’s a need for updated insurance regulations. State law hasn’t caught up with the technology.” In the meantime, he recommends homeowners get proactive about removing potential hazards from their yards in preparation for drone surveillance. He said, “Don’t wait until you get a letter saying that your policy won’t be renewed.”

You Can Profit From Real Estate Without Owning Property

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields and you don’t have to own property to do it…

The Arrived Homes investment platform has created a Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Could You Be The Next Homeowner To Get Their Policy Dropped Due To Drone Surveillance? originally appeared on Benzinga.com