President & CEO Of Brady Sold $916K In Stock

A substantial insider sell was reported on September 16, by Russell Shaller, President & CEO at Brady BRC, based on the recent SEC filing.

What Happened: Shaller’s recent move involves selling 12,547 shares of Brady. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $916,934.

As of Tuesday morning, Brady shares are down by 0.0%, currently priced at $74.59.

Get to Know Brady Better

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Brady: A Financial Overview

Negative Revenue Trend: Examining Brady’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -0.73% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Exploring Profitability:

-

Gross Margin: The company maintains a high gross margin of 51.56%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Brady’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.16.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.12.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: Brady’s P/E ratio of 18.33 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.7, Brady’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Brady’s EV/EBITDA ratio, surpassing industry averages at 12.21, positions it with an above-average valuation in the market.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should First Trust Rising Dividend Achievers ETF Be on Your Investing Radar?

Launched on 01/07/2014, the First Trust Rising Dividend Achievers ETF RDVY is a passively managed exchange traded fund designed to provide a broad exposure to the Large Cap Value segment of the US equity market.

The fund is sponsored by First Trust Advisors. It has amassed assets over $11.71 billion, making it one of the larger ETFs attempting to match the Large Cap Value segment of the US equity market.

Why Large Cap Value

Companies that fall in the large cap category tend to have a market capitalization above $10 billion. They tend to be stable companies with predictable cash flows and are usually less volatile than mid and small cap companies.

Carrying lower than average price-to-earnings and price-to-book ratios, value stocks also have lower than average sales and earnings growth rates. Looking at their long-term performance, value stocks have outperformed growth stocks in almost all markets. They are however likely to underperform growth stocks in strong bull markets.

Costs

Expense ratios are an important factor in the return of an ETF and in the long term, cheaper funds can significantly outperform their more expensive counterparts, other things remaining the same.

Annual operating expenses for this ETF are 0.49%, putting it on par with most peer products in the space.

It has a 12-month trailing dividend yield of 1.83%.

Sector Exposure and Top Holdings

Even though ETFs offer diversified exposure which minimizes single stock risk, it is still important to look into a fund’s holdings before investing. Luckily, most ETFs are very transparent products that disclose their holdings on a daily basis.

This ETF has heaviest allocation to the Financials sector–about 42% of the portfolio. Information Technology and Consumer Discretionary round out the top three.

Looking at individual holdings, D.r. Horton, Inc. DHI accounts for about 2.41% of total assets, followed by Mueller Industries, Inc. MLI and Aflac Incorporated AFL.

The top 10 holdings account for about 22.38% of total assets under management.

Performance and Risk

RDVY seeks to match the performance of the NASDAQ US Rising Dividend Achievers Index before fees and expenses. The NASDAQ US Rising Dividend Achievers Index is designed to provide access to a diversified portfolio of companies with a history of paying dividends.

The ETF has added roughly 12.45% so far this year and was up about 23.75% in the last one year (as of 09/17/2024). In the past 52-week period, it has traded between $43.44 and $58.75.

The ETF has a beta of 1.11 and standard deviation of 19.70% for the trailing three-year period, making it a medium risk choice in the space. With about 51 holdings, it effectively diversifies company-specific risk.

Alternatives

First Trust Rising Dividend Achievers ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, RDVY is a great option for investors seeking exposure to the Style Box – Large Cap Value segment of the market. There are other additional ETFs in the space that investors could consider as well.

The Schwab U.S. Dividend Equity ETF SCHD and the Vanguard Value ETF VTV track a similar index. While Schwab U.S. Dividend Equity ETF has $60.60 billion in assets, Vanguard Value ETF has $126.51 billion. SCHD has an expense ratio of 0.06% and VTV charges 0.04%.

Bottom-Line

Passively managed ETFs are becoming increasingly popular with institutional as well as retail investors due to their low cost, transparency, flexibility and tax efficiency. They are excellent vehicles for long term investors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Could Head Higher As Traders Look Forward To Retail Sales Data Ahead Of Fed Decision, Tech Stocks On The Mend: Strategist Flags This As Best-Case Scenario For Market This Week

U.S. stocks are priming for a positive start on Tuesday ahead of the release of the key August retail sales report. Traders could throng the tech space as they seek to take advantage of the recent pullback. The market and experts are divided over the magnitude of a rate cut, but a 25 basis-point cut could trigger an initial negative reaction. That said, most believe that the state of the labor market and economy could take preeminence over the rate trajectory, going forward.

The August retail sales data could be on traders’ radar on Tuesday. Fund manager Louis Navellier said a disappointing report could tilt the scales toward a bigger cut on Wednesday. Wharton professor and Wisdom Tree Senior Economist Jeremy Siegel said he would like the Fed to move quickly. But so far, the market is comfortable with the Fed funds rate reaching the three handle by the middle of next year, he added.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.61% |

| S&P 500 | +0.38% |

| Dow | +0.29% |

| R2K | +0.36% |

In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust (NYSE: SPY added 0.38% to $564.99 and the Invesco QQQ ETF (NASDAQ: QQQ) gained 0.58% to $476, according to Benzinga Pro data.

Cues From Last Session:

Wall Street closed Tuesday’s session on a mixed note, with Apple, Inc. AAPL leading the tech-heavy Nasdaq Composite lower, while the S&P 500 and the Dow Industrials closed in the green. The positive close by the broader gauge took the index’s winning streak to six sessions, with better-than-expected regional manufacturing data giving the thrust on a day when it traded below the unchanged line for much of the session.

The S&P 500 Index is now a step closer to its all-time closing high of 5,667.20 reached on July 16.

Energy, financials, material and utility stocks gained ground, while IT stocks came under significant selling pressure.

| Index | Performance (+/) | Value |

| Nasdaq Composite | 0.52% | 17,592.13 |

| S&P 500 Index | +0.13% | 5,633.09 |

| Dow Industrials | +0.55% | 41,622.08 |

| Russell 2000 | +0.31% | 2,189.17 |

Insights From Analysts:

Despite market expectation for a 50 basis-point cut, Morgan Stanley analyst Seth Carpenter said he expects a more modest 0.25% reduction. The economist expects the FOMC statement to acknowledge further progress on inflation and risks to the labor market. The dot-plot chart, which is part of the Summary of Economic Projections, will show that the number of cuts this year will be three instead of the previously suggested one.

Chairman Jerome Powell may not commit to a cadence for cuts but suggest future rate moves will be data-dependent, the economist said. In all, Carpenter anticipates three 25 basis-point reductions this year.

Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson believes that the labor/growth data will be more important to how stocks ultimately trade over the next three to six months. If the labor/growth data strengthen from here, a series of 25 basis-point rate cuts into the middle of next year can further support valuations in a “late cycle” context, he said.

But he warned that the market can trade with a risk-off tone if the labor data weakens from here, regardless of whether the Fed’s first move is 25 or 50 basis points.

The best-case scenario for equities this week is a 50 basis-point cut without triggering either growth concerns or any remnants of the yen carry trade unwind, the strategist said, adding that defensives and large-caps tend to outperform cyclicals and small-caps, respectively, both before and after the first cut.

See Also: How To Trade Futures

Upcoming Economic Data:

- The Commerce Department is scheduled to release its August retail sales report at 8:30 a.m. EDT. Economists, on average, estimate a 0.2% month-over-month drop in retail sales, reversing some of the 1% gain in July. Retail sales, excluding autos, may have risen 0.2%, slower than July’s 0.4% growth.

- The Federal Reserve’s industrial production report, due at 9:15 a.m. EDT, is widely expected to show a 0.2% month-over-month increase for August following a 0.6% drop in July.

- The Commerce Department will release its business inventories report at 10 a.m. EDT. The consensus estimate calls for a steady pace of 0.2% month-over-month growth for July.

- The National Association of Home Builders housing market index for September is expected to come in at 40, up from 39 in July. The metric, which measures homebuilders’ confidence, is scheduled to be released at 10 a.m. EDT.

- The Treasury is set to auction 20-year bonds at 1 p.m. EDT.

Stocks In Focus:

- Intel Corp. INTC rose over 6% in premarket trading after the company announced an agreement to supply custom artificial intelligence chips to Amazon, Inc.’s AMZN AWS.

- Viasat Inc. VSAT fell over 5.60%, reacting to a negative analyst action.

- Microsoft Corporation MSFT climbed over 1.50% after the company announced a $60 billion stock buyback plan and a 10% dividend hike.

Commodities, Bonds And Global Equity Markets:

Crude oil and gold futures pulled back after Monday’s strong gains, with the latter holding above the $2,600 mark despite the modest decline, and the benchmark 10-year Treasury note edged down slightly 3.619% ahead of Wednesday’s Fed decision. Bitcoin BTC/USD climbed past the $59K mark.

The global markets turned higher in anticipation of a Fed rate cut, with most major markets in Asia ending higher for the day. The Japanese market, which reopened after Monday’s public holiday, retreated amid the yen’s strength, and the New Zealand market extended its post-central bank meeting losses. The Chinese and South Korean markets remained closed for public holidays.

European stocks were solidly higher in early trading.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why Momentum in UniCredit Should Keep Going

When it comes to short-term investing or trading, they say “the trend is your friend.” And there’s no denying that this is the most profitable strategy. But making sure of the sustainability of a trend to profit from it is easier said than done.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

UniCredit S.p.A. Unsponsored ADR

UNCRY is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. UNCRY is quite a good fit in this regard, gaining 11.5% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 1.5% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, UNCRY is currently trading at 91.1% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in UNCRY may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

British American Tobacco Options Trading: A Deep Dive into Market Sentiment

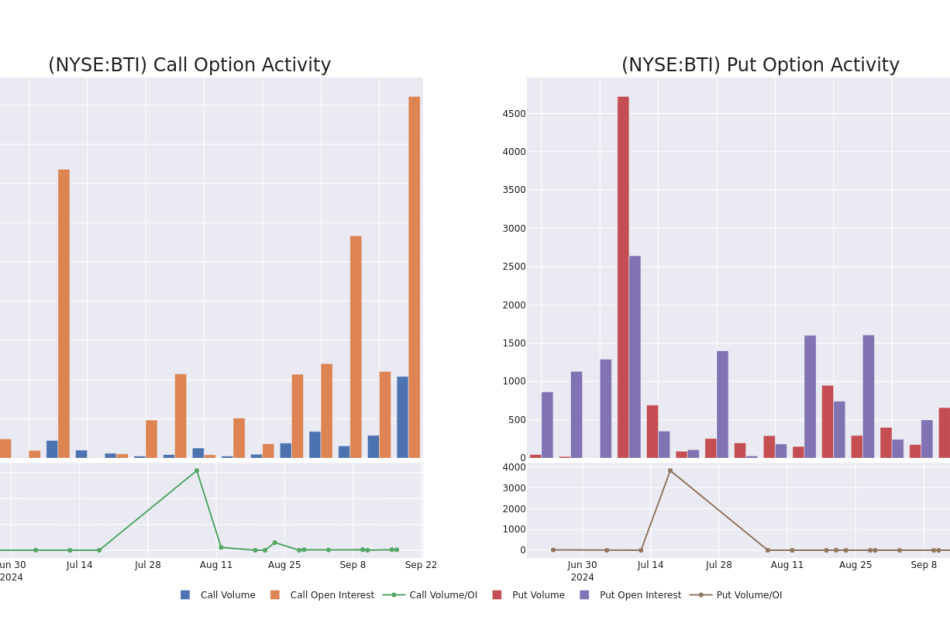

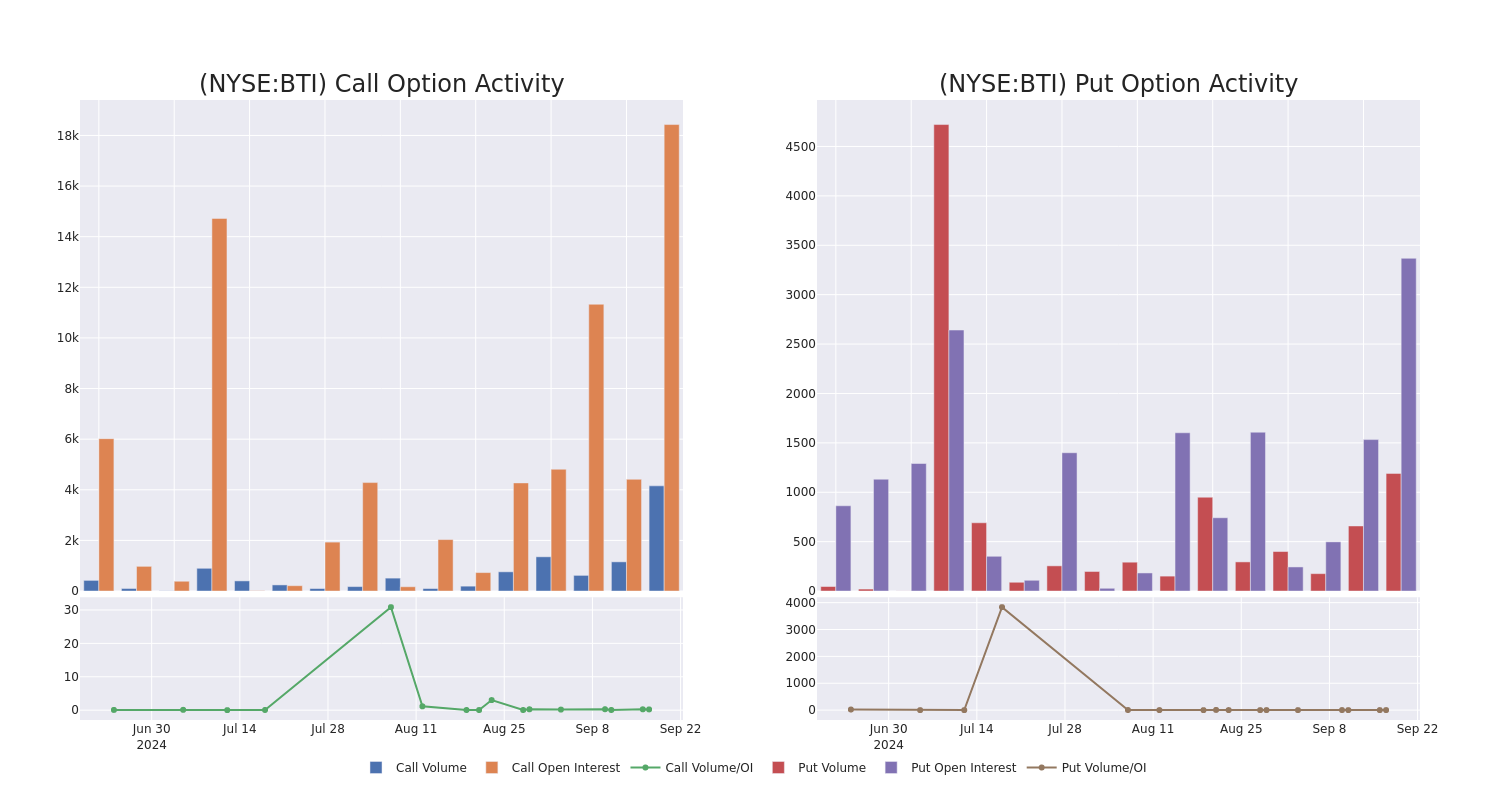

Financial giants have made a conspicuous bullish move on British American Tobacco. Our analysis of options history for British American Tobacco BTI revealed 14 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $109,361, and 11 were calls, valued at $501,442.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.0 to $40.0 for British American Tobacco over the recent three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for British American Tobacco options trades today is 2179.8 with a total volume of 5,347.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for British American Tobacco’s big money trades within a strike price range of $32.0 to $40.0 over the last 30 days.

British American Tobacco Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTI | CALL | SWEEP | BULLISH | 12/20/24 | $0.9 | $0.85 | $0.9 | $39.00 | $90.0K | 738 | 1.1K |

| BTI | CALL | TRADE | BULLISH | 09/20/24 | $4.2 | $4.1 | $4.2 | $34.00 | $78.9K | 4.1K | 630 |

| BTI | CALL | TRADE | BEARISH | 01/16/26 | $2.0 | $1.7 | $1.8 | $40.00 | $54.1K | 2.6K | 301 |

| BTI | PUT | SWEEP | BEARISH | 10/18/24 | $0.7 | $0.65 | $0.66 | $37.00 | $53.1K | 596 | 939 |

| BTI | CALL | TRADE | BULLISH | 01/16/26 | $4.2 | $3.7 | $4.01 | $35.00 | $40.1K | 3.5K | 293 |

About British American Tobacco

The second-largest tobacco company by volume, British American Tobacco sold 555 billion cigarettes in 2023. Its leading brands are Dunhill, Kent, Pall Mall, Lucky Strike, and Rothmans in cigarettes. Its ownership of the Camel, Natural American Spirit, and Newport brands are limited to the us. In next-generation products, the company has the Vuse brand in vaping, Glo in heated tobacco, and Velo in modern oral tobacco. The company also owns a 25.5% stake in ITC limited, the largest Indian cigarette company.

Following our analysis of the options activities associated with British American Tobacco, we pivot to a closer look at the company’s own performance.

Present Market Standing of British American Tobacco

- With a volume of 5,754,079, the price of BTI is down -3.43% at $38.01.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest British American Tobacco options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meat Processing Equipment Market to Reach $13.6 Billion, Globally, by 2034 at 7.4% CAGR: Allied Market Research

Wilmington, Delaware , Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Meat Processing Equipment Market by Type (Cutting Equipment, Blending Equipment, Filling Equipment, Tenderizing Equipment, Dicing Equipment, Grinding Equipment, Smoking Equipment, Massaging Equipment and Others), Meat Type (Processed Pork, Processed Beef, Processed Mutton and Others), and Application (Fresh Processed Meat, Precooked Meat, Raw Cooked Meat, Cured Meat, Dry Meat, Raw Fermented Sausages and Others): Global Opportunity Analysis and Industry Forecast, 2024-2034″. According to the report, the meat processing equipment market was valued at $6.3 billion in 2023, and is estimated to reach $13.6 billion by 2034, growing at a CAGR of 7.4% from 2024 to 2034.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A01970

Prime determinants of growth

The growth of the global meat processing equipment market has been driven by several major factors. An increase in meat consumption worldwide led to a higher demand for efficient processing equipment. The meat processing industry witnessed technological advancements, including automation and improved hygiene standards, which enhanced production efficiency and product quality. Change in consumer preferences toward convenience foods and ready-to-eat meat products boosted the demand for advanced processing equipment. The rise in disposable income levels in emerging economies supported greater meat consumption, further driving the meat processing equipment market growth. In addition, stringent government regulations regarding food safety and quality prompted meat processing companies to adopt state-of-the-art equipment to comply with standards. The growing focus on reducing labor costs and increasing productivity also encouraged the adoption of automated meat processing equipment. Furthermore, the increase in awareness regarding foodborne illnesses and the need for hygienic meat processing practices contributed to the meat processing equipment market expansion.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2034 |

| Base Year | 2023 |

| Market Size in 2023 | $6.3 billion |

| Market Size in 2034 | $13.6 billion |

| CAGR | 7.4% |

| No. of Pages in Report | 290 |

| Segments Covered | Type, Meat Type, Application, And Region. |

| Drivers | Increase in global meat consumption |

| Advancements in food safety regulations | |

| Technological innovations in automation | |

| Rise in demand for processed and convenience foods | |

| Expansion of the food service industry | |

| Opportunities | Adoption of smart and IoT-enabled processing equipment. |

| Expansion into emerging markets | |

| Development of sustainable and eco-friendly processing solutions. | |

| Restraints | High initial investment costs |

| Stringent regulatory standards |

The cutting equipment segment held the highest market share in 2023

Based on the type, the cutting equipment segment held the highest market share in 2023. The demand for cutting equipment in the meat processing equipment market has been high owing to the need for precision and efficiency in meat processing. Manufacturers have responded by developing equipment capable of producing uniform cuts, which enhanced product quality and reduced waste. Cutting equipment also addressed labor shortages and rise in labor costs by offering automated solutions that increased productivity. Moreover, the popularity of convenience foods required equipment that could quickly and accurately portion meat products, has further driven the demand for advanced cutting technologies in the market.

Procure Complete Report (306 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/meat-processing-equipment-market

The processed pork segment held the highest market share in 2023

Based on meat type, the processed pork segment held the highest market share in 2023. Processed pork held a high market share in the meat processing equipment market due to its widespread popularity and versatility. The global demand for pork products, such as bacon, sausages, and ham, remained consistently high, encouraging the need for specialized meat processing equipment. Manufacturers focused on developing equipment tailored to efficiently handle large volumes of pork, enhancing production capacity. The diverse range of processed pork products catered to various culinary preferences and cultural dishes, is expected to further boost the demand for dedicated pork processing equipment.

The fresh processing meat segment held the highest market share in 2023

Based on the application, the fresh processing meat segment held the highest market share in 2023. The high application of meat processing equipment in fresh processing meat applications arises from the need for efficiency and safety in handling perishable products. Fresh meat required precise cutting and packaging to maintain its quality and extend shelf life. Manufacturers developed advanced equipment to meet these requirements, ensuring quick processing and reducing contamination risks. Moreover, the increase in consumer demand for fresh, minimally processed meat products has driven the market, necessitating equipment that preserved natural textures and flavors. In addition, enhanced processing technologies allowed for faster operations, minimizing spoilage and supporting the growing fresh meat segment in the global meat processing equipment market.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A01970

North America led the market share in 2023

Based on region, North America held the highest market share in terms of revenue in 2023 owing to the robust meat production and consumption levels in the region. Factors such as technological advancements, a focus on food safety, and the popularity of convenience food has fueled the demand for the meat processing equipment market. The presence of large meat producers and processors, who sought efficient and high-capacity equipment, further boosted the market growth in North America. Moreover, brands such as JBT Corporation, Marel, and Heat and Control operated extensively in North America, offering advanced meat processing equipment that catered to the diverse processing needs of the meat industry, thus driving growth in the region.

Players: –

- Welbilt, Inc.

- GEA Group AG

- The Middleby Corporation

- Heat and Control, Inc.

- Marel

- Key Technology, Inc.

- JBT Corporation

- Illinois Tool Works Inc. (ITW)

- Bettcher Industries, Inc.

- Equipamientos Cárnicos S.L. (Mainca)

The report provides a detailed analysis of these key players in the global meat processing equipment market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to highlight the competitive scenario.

Recent Industry Dev

- In July 2024, Ross Industries launched the AMS 400 Membrane Skinner, targeting craft and medium-sized meat processors to enhance efficiency and product quality.

- In March 2024, Ross Industries unveiled the RVS 120 Vertical Chute Slicer, designed to enhance slicing precision in meat processing.

- In July 2022, JBT Corporation acquired Alco-food-machines GmbH & Co. KG (Alco) to expand the product offering in meat processing equipment.

Trending Reports in Industry:

Cold Food Packaging Market Size, Share Analysis and Industry Forecast, 2023 – 2033

Meat-Based Flavors Market Growth Analysis and Industry Forecast, 2023 – 2032

Frozen Shrimp Market Size, Share Analysis and Growth Forecast, 2023 – 2030

Frozen Food Packaging Market Analysis and Industry Forecast, 2023 – 2033

Cattle Feed Market Size, Share Analysis and Forecast, 2023 – 2032

Frozen Fish Market Analysis and Industry Forecast, 2023 – 2033

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Web: https://www.alliedmarketresearch.com/reports-store/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Interest Rates Are Falling: 1 Super Stock to Buy Hand Over Fist Right Now

According to the Federal Home Loan Mortgage Corp. (Freddie Mac), the U.S. 30-year fixed mortgage rate hit 7.79% in October 2023, which was the highest level since 2000. It crushed the borrowing power of consumers, and it also made existing homeowners hesitant to sell for fear of abandoning their existing lower rate.

As a result, high interest rates decimated the housing market. U.S. existing home sales came in at 3.9 million annualized units in July, down a whopping 40% from the recent peak of 6.6 million from 2021. But the tide appears to be turning, because the 30-year fixed mortgage rate is down to 6.2% in anticipation of a slate of interest rate cuts from the Federal Reserve.

Real estate technology stock Redfin (NASDAQ: RDFN) soared 32% so far this year as investors price in an improving housing market on the back of lower rates. It’s still down significantly from its all-time high, so here’s why it’s not too late to add it to your portfolio.

Redfin spent the past two years preparing for this moment

Almost half of Redfin’s revenue came from iBuying in 2021, which involved purchasing homes from willing sellers with the intention of flipping them for a profit. However, the company deemed that business too risky when interest rates shot higher in 2022 as the Federal Reserve sought to tame inflation, so it closed it down that year.

Now, Redfin is focusing on its portfolio of services, which include brokering, mortgages, and closing services. The company employs 1,719 lead brokers who helped represent 0.77% of all homes sold across the U.S. during the second quarter of 2024 (ended June 30). Plus, more than one-quarter of Redfin’s customers also used Redfin for their mortgages during the second quarter, which helped the company squeeze additional revenue from each of those transactions.

Redfin focuses on volume, so it charges a listing fee of just 1.5%, which is much lower than the industry standard of around 2.5%. Plus, repeat customers are rewarded for their loyalty with listing fees of as little as 1% — and they accounted for 37% of the company’s sales in Q2.

Redfin’s services carry a much higher gross profit margin than iBuying (29% compared to around 1%), which is helping the company improve its bottom line even in the face of a tumultuous housing market. The company managed to break even on an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) basis in Q2, which was a big improvement from the $6.9 million loss it generated in the year-ago period.

Redfin expects to be “significantly profitable” in the years ahead, which will enable it to invest more aggressively in growth by hiring more agents and expanding its services. The company launched a new program called Redfin Next earlier this year, which allows agents to earn higher commissions in exchange for giving up their fixed salary. This option will be available to all agents from 2025, and it could significantly improve the company’s bottom line by reducing fixed costs.

Redfin stock is up 32% in 2024, but it still looks cheap

“The time has come for policy to adjust.” Those were the words of Fed Chairman Jerome Powell in August, which suggests rate cuts are on the way. In fact, according to the CME Group‘s FedWatch tool, experts are predicting the Fed could slash 125 basis points off the federal funds rate (overnight interest rate) by the end of this year alone. The recent decline in the 30-year fixed mortgage rate further supports a decisive move by the Fed.

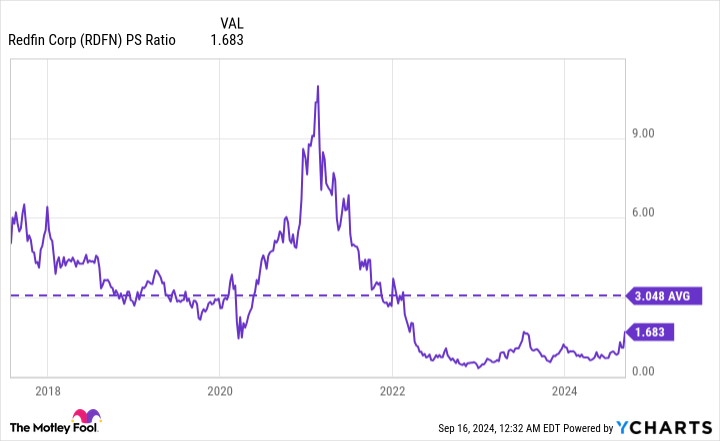

That’s likely a key reason for the 32% surge in Redfin stock this year. However, it’s still down 85% from its all-time high, which was set during the housing boom in 2021, and it remains cheap relative to history.

Redfin has generated $1 billion in trailing-12-month revenue, and based on the company’s market capitalization of $1.7 billion, its stock trades at a price-to-sales (P/S) ratio of 1.7:

Redfin’s P/S ratio has ticked higher from its rock bottom lows of 0.6 from earlier this year, but it’s still far below its peak of around 10. It’s also trading under its average P/S ratio of 3, dating back to when the stock first came public in 2017. Therefore, Redfin stock might still have plenty of upside in the tank, but an improving housing market will be critical to maintaining its upward momentum.

As long as mortgage rates continue to trend lower, Redfin will likely be a great addition to any stock portfolio.

Should you invest $1,000 in Redfin right now?

Before you buy stock in Redfin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Redfin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Redfin. The Motley Fool recommends CME Group and recommends the following options: short November 2024 $13 calls on Redfin. The Motley Fool has a disclosure policy.

Interest Rates Are Falling: 1 Super Stock to Buy Hand Over Fist Right Now was originally published by The Motley Fool

You Won't Believe What Larry Ellison and Elon Musk Said to Nvidia CEO Jensen Huang

Larry Ellison is the chairman of Oracle (NYSE: ORCL), which is currently building some of the fastest and most cost efficient data centers in the world for developing artificial intelligence (AI). Elon Musk, on the other hand, runs Tesla (NASDAQ: TSLA), which is building AI-powered self-driving software for its electric vehicles. He also runs SpaceX, X (formerly Twitter), and a new AI start-up called xAI.

Ellison and Musk need tens of thousands of graphics processors (GPUs) for their data centers in order to bring AI to life, and Nvidia (NASDAQ: NVDA) supplies the best chips in the industry.

At Oracle’s financial analyst meeting on Sept. 12, Ellison told the audience that he and Musk recently went to dinner with Nvidia CEO Jensen Huang at the Nobu restaurant in Palo Alto. The two, who are among the richest people on Earth, found themselves begging Huang for something money simply can’t buy at the moment. Here’s how it went down.

The arms race for GPUs

Oracle currently has 162 data centers either live or under construction, but it believes that number could eventually top 2,000 because the demand for computing power from AI developers is soaring. Some of Oracle’s largest data centers feature clusters of more than 32,000 GPUs, but next year the company will offer a cluster of 131,072 GPUs from Nvidia’s latest Blackwell lineup.

Oracle designed unique RDMA (random direct memory access) networking technology that can move data from one point to another more quickly than traditional Ethernet networks, and since developers pay for computing power by the minute, this can significantly reduce costs. That’s why leading AI start-ups like OpenAI, Cohere, and even Musk’s xAI are using Oracle’s infrastructure.

In its recent fiscal 2025 first quarter (ended July 31), the Oracle Cloud Infrastructure (OCI) segment generated $2.2 billion in revenue, a whopping 45% jump from the year-ago period. However, it could be growing even faster if not for supply constraints — in other words, Oracle simply can’t get its hands on enough GPUs for its data centers.

Not only is Oracle battling other cloud giants like Microsoft, Amazon, and Alphabet for GPU allocations from Nvidia, but tech companies like Tesla and Meta Platforms are also soaking up supply to develop AI for their own purposes. Tesla is trying to bring a cluster of 50,000 GPUs online this year to enhance its self-driving software, which requires a substantial amount of computing power.

Meta, on the other hand, used around 16,000 of Nvidia’s flagship H100 GPUs to train its Llama 3.1 large language model (LLM), but the company plans to increase its capacity to a mind-boggling 600,000 H100 equivalents by the end of this year. That will pave the way for Llama 4, which CEO Mark Zuckerberg says could set the benchmark for the industry in 2025.

Ellison and Musk are begging for more GPUs

Please take our money … take more of it. You’re not taking enough. … We need you to take more of our money. Please.

— Ellison’s and Musk’s comments to Jensen Huang over dinner, according to Ellison.

Ellison and Musk were practically begging Huang for more GPUs, but no amount of money in the world can buy the numbers they require right now because Nvidia simply can’t keep up with demand. Oracle and Tesla aren’t even Nvidia’s biggest customers!

Oracle spent $6.9 billion on capital expenditures (capex) during fiscal 2024 (ended April 30), and it expects to spend double that in fiscal 2025. Most of the money will go toward buying chips and building data centers. Tesla plans to spend over $10 billion on capex this calendar year on the whole, which will also go toward the 50,000 GPU cluster I mentioned earlier.

Those numbers are modest compared to what other tech giants are spending. Microsoft allocated $55.7 billion to capex during its fiscal 2024 (ended June 30), and it plans to spend even more in fiscal 2025. Amazon’s capex spending, on the other hand, could top $60 billion in calendar 2024.

Therefore, it’s no surprise that Nvidia generated $26.3 billion in data center revenue during its recent fiscal 2025 second quarter (ended July 28), a 154% increase from the year-ago period. Ellison says the wave of AI spending could continue for the next 10 years as companies and nation states battle for tech supremacy when it comes to AI, so Nvidia’s data center revenue probably has plenty of growth left in the tank.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

You Won’t Believe What Larry Ellison and Elon Musk Said to Nvidia CEO Jensen Huang was originally published by The Motley Fool

'I Was Blown Away' — Donald Trump Credits Sons For Introducing Him To Crypto, Marvels At NFT Collection Success

Former President Donald Trump on Monday opened up about his growing interest in cryptocurrencies, attributing much of it to his experience with NFTs and the influence of his children.

What Happened: When asked what initially got him intrigued, Trump said that the unexpected success of his NFT collection was a key factor.

“We thought it would take six months, maybe a year, to sell,” he said during a Twitter Spaces event, recalling his surprise at how fast the collection sold out.

“It was like almost immediately,” Trump said, noting that the payments made in crypto played a significant role in his realization of its importance.

The former president launched his first NFT collection in December 2022, featuring 45,000 digital trading cards that sold out within hours. This success led to subsequent releases, with Trump noting they’ve now completed four NFT collections.

Though many initially doubted the project, it sold out swiftly, generating millions. Trump’s comments during the Twitter Spaces event shed light on how this experience shifted his view of digital assets.

“I was blown away. I just wasn’t overly interested in [crypto] to be honest…But so many people paid with crypto, and it opened my eyes,” he said.

Also Read: Contrarian Trader Bets $200K To Win $6.5M On This Unlikely Fed Rate Cut Scenario

He also credited his children, particularly his son Barron Trump, for helping him understand crypto. “My kids, they really understood it right from the beginning. Barron talks about his wallets; he’s got four wallets or something, and I’m saying, ‘What is it that he knows?’ But he gets it.”

While Trump acknowledged that cryptocurrencies, particularly Bitcoin BTC/USD, have faced regulatory hurdles in the U.S., he emphasized America’s need to lead in the space. “If we don’t do it, China is going to do it…It’s bigger than they realize. The value of it is gigantic, and we have to be the biggest,” Trump said.

Why It Matters: The discussion took place just a day after an alleged assassination attempt on Trump at his Trump International Golf Club on Sunday.

Shots were fired at the property, with authorities believing Trump was the intended target. The FBI is investigating, and a suspect has been detained.

Trump recently launched World Liberty Financial, a decentralized finance (DeFi) platform aimed at promoting dollar-pegged stablecoins to ensure U.S. financial dominance.

Trump emphasized that crypto is essential for the future of finance, signaling a significant shift from his earlier skepticism about digital currencies.

His sons, Barron, Eric and Donald Junior have been heavily involved in the project, with Barron listed as the Chief DeFi Visionary.

What’s Next: Trump’s increasing interest in cryptocurrencies and digital assets will likely be a key talking point at Benzinga’s Future of Digital Assets event on Nov. 19, where industry leaders will discuss the broader impact of regulatory frameworks, NFTs, and innovations in the crypto space.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Capital REIT Announces September 2024 Distribution

TORONTO, Sept. 16, 2024 /CNW/ – First Capital REIT (“First Capital”) FCR announced today that it will make a cash distribution of $0.072 per REIT unit for the month of September, representing approximately $0.86 per REIT unit on an annualized basis. The distribution will be paid on October 15, 2024 to unitholders of record as at September 30, 2024.

About First Capital REIT FCR

First Capital owns, operates and develops grocery-anchored, open-air centres in neighbourhoods with the strongest demographics in Canada.

www.fcr.ca

TSX: FCR.UN

SOURCE First Capital Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c1343.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c1343.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.