VP At Reynolds Consumer Prods Sells $576K Of Stock

Chris Mayrhofer, VP at Reynolds Consumer Prods REYN, reported an insider sell on September 16, according to a new SEC filing.

What Happened: Mayrhofer’s recent move involves selling 18,000 shares of Reynolds Consumer Prods. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $576,100.

Reynolds Consumer Prods‘s shares are actively trading at $31.69, experiencing a down of 0.56% during Tuesday’s morning session.

About Reynolds Consumer Prods

Reynolds Consumer Products Inc is a provider of household products. The firm is engaged in the production and sales of cooking products, waste and storage products, and tableware. It operates through four reportable segments namely, Reynolds Cooking and Baking, Hefty Waste and Storage, Hefty Tableware, and Presto Products. Reynolds Cooking and Baking segment produce branded and store brand aluminum foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, butcher paper, plastic wrap, baking cups, oven bags and slow cooker liners.

Financial Milestones: Reynolds Consumer Prods’s Journey

Negative Revenue Trend: Examining Reynolds Consumer Prods’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -1.06% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 27.53%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Reynolds Consumer Prods’s EPS reflects a decline, falling below the industry average with a current EPS of 0.46.

Debt Management: Reynolds Consumer Prods’s debt-to-equity ratio is below the industry average at 0.91, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 18.64, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.81 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Reynolds Consumer Prods’s EV/EBITDA ratio at 11.7 suggests potential undervaluation, falling below industry averages.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Transaction Codes Worth Your Attention

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Reynolds Consumer Prods’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ravi Venkatesan Takes a Bullish Stance: Acquires $50K In Cantaloupe Stock

On September 17, a substantial insider purchase was made by Ravi Venkatesan, Chief Executive Officer at Cantaloupe CTLP, as per the latest SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Venkatesan increased their investment in Cantaloupe by purchasing 8,000 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $50,400.

The latest market snapshot at Tuesday morning reveals Cantaloupe shares down by 1.17%, trading at $6.28.

Delving into Cantaloupe’s Background

Cantaloupe Inc operates in the small ticket electronic payments industry. It provides wireless, cashless, micro-transactions, and networking services within the unattended Point of Sale (POS) market. Its products and services portfolio consists of ePort Cashless devices, eSuds, EnergyMisers, and Value-added services which include Loyalty and Prepaid, Intelligent Vending, and others. The company offers services to different industries covering car wash, taxi and transportation, laundry, vending, kiosk, amusement, and arcade. The company derives revenue from the sale or lease of equipment and services to the small ticket, unattended POS market, and the majority of its revenue is derived from subscription and transaction fees.

Financial Insights: Cantaloupe

Revenue Growth: Cantaloupe displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 13.22%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 37.3%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Cantaloupe exhibits below-average bottom-line performance with a current EPS of 0.03.

Debt Management: Cantaloupe’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.26.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: Cantaloupe’s current Price to Earnings (P/E) ratio of 42.33 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.75 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Cantaloupe’s EV/EBITDA ratio stands at 16.17, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Breaking Down the Significance of Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Cantaloupe’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SharkNinja's Stock Surges 103% in YTD: Should You Jump Onboard?

SharkNinja, Inc. SN has been riding high on its focus on continued product innovation, new category launches, and international expansion. Its shares skyrocketed 102.8% in the year-to-date (YTD) period, strongly outpacing the Zacks Furniture industry’s 32.3% rally and the S&P 500 index’s increase of 17.8%.

SharkNinja, with a market cap of $14.45 billion, is a high-growth product design and technology company known for its household and lifestyle appliances under the Shark and Ninja brands across 33 subcategories across 32 markets.

The company’s three-pronged growth strategy — focusing on existing categories, exploring new categories, and expanding internationally — is expected to fuel significant growth and create numerous opportunities. Its four core areas of focus are — disruptive innovation, global agile supply chain, always on 360-degree marketing, and omni-channel distribution.

Image Source: Zacks Investment Research

SN shares have also outperformed similar companies like Cricut, Inc. CRCT, Whirlpool Corporation WHR and Helen of Troy Limited HELE, which lost 7.5%, 18.2% and 51.4% YTD.

Technical Indicators Substantiating SN Stock’s Growth

SN stock is currently trading above its 50-day simple moving average, signaling a bullish trend.

Image Source: Zacks Investment Research

This technical strength highlights positive market sentiment and confidence in SN’s financial stability and prospects.

Factors Solidifying SharkNinja’s Stock Rally

Product Innovation to Fuel Future Growth: SN’s growth relies heavily on continuous product innovation, focusing on expanding its current offerings and exploring adjacent categories. To maintain its rapid innovation, the company will need to sustain significant investment in Research and Development (R&D).

In 2024, SN plans to launch 25 new products, including four new subcategories. Key launches so far include the Shark FlexBreeze portable fan (January), Ninja FrostVault cooler (March), and Ninja Slushi frozen beverage system (July). A new beauty segment product is scheduled for the fourth quarter. Looking ahead, SN is preparing to enter new categories, with potential launches such as power-operated lawn and garden tools, portable heaters, gas-powered grills, ovens, and steamers, as indicated by recent trademark filings.

International Expansion Substantiates Growth Potential: SN’s international expansion strategy is gaining momentum, with 46% growth in its international segment in the second quarter. The company has built solid relationships with key retailers and accumulated local expertise over the years.

Strong growth opportunities are emerging in markets like the Nordics, Benelux, Poland, Italy, Spain, Mexico, and the Middle East. SN plans to enter Brazil in the fourth quarter, focusing on its beauty and motorized kitchen appliances. With further opportunities in Latin America and a proven international strategy, SN is well-positioned for long-term top-line growth.

Flexible Supply Chain Shields Freight & Tariff Headwinds: SharkNinja has successfully managed a dynamic supply chain by securing long-term freight contracts with a diverse range of carriers, helping the company avoid capacity constraints and related cost spikes. Additionally, SharkNinja has been proactively diversifying its sourcing to mitigate the impact of rising tariffs on Chinese imports.

The company remains committed to eliminating all Chinese exposure for U.S.-bound products by the end of 2025. With ongoing capacity expansion in Southeast Asia, SharkNinja is accelerating efforts to safeguard its supply chain and ensure long-term growth stability.

Omni-Channel Strategy Drives Growth: SN has consistently prioritized reaching consumers across all shopping channels. As consumer shopping behaviors evolve, the company has adapted its omnichannel strategy to meet these changes. SN continues to invest in expanding its sales teams to meet rising consumer demand and strengthen relationships with both physical and online retailers. The success of this strategy depends on several factors, including retailer satisfaction with product sales and profitability, SN’s ability to innovate, and its capacity to maintain and expand into more product categories.

SN’s Estimate Movement

The Zacks Consensus Estimate for SN’s EPS has increased over the past 60 days. This depicts that there is solid upside potential for the stock. SN delivered a trailing four-quarter earnings surprise of 14.3%, on average.

Image Source: Zacks Investment Research

Impressively, SN currently flaunts a Growth Score of A.

Potential Risks for SN Stock

The above-mentioned factors are strongly in favor of SharkNinja’s stock growth, but some potential risks are worth considering while making an investment strategy.

SharkNinja remains cautious of macroeconomic factors such as consumer confidence, demographic shifts, employment levels, inflation, and other economic indicators that could affect its performance. Additionally, the company’s sales are influenced by seasonality, with the first and second quarters being particularly impactful.

SN Stock Not so Cheap

SN’s stock is currently overvalued compared to its industry, as shown in the chart below. This high price-to-earnings ratio could indicate that the stock is overvalued in its industry, suggesting stretched valuation for SN.

Image Source: Zacks Investment Research

Final Thoughts

SharkNinja continues to outperform in a challenging market, driven by its focus on newness and innovation that resonates with increasingly value-conscious consumers. While other industry peers face uncertainty, SharkNinja’s first-half 2024 results have exceeded expectations. The company’s growth across its four major product categories, alongside supply chain optimizations, sourcing strategies, and regional expansion, positions it for continued success despite broader industry challenges.

Image Source: Roadshow Presentation

Although the macroeconomic risk associated with the high-interest rate environment cautions investors, upward revisions in earnings estimates reinforce SN’s Zacks Rank #2 (Buy). This makes SN an attractive addition to investors’ portfolios at present.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Retail Sales Rise 0.1% In August, More Than Expected, Trimming Odds Of Larger Fed Rate Cut (CORRECTED)

Editor’s note: This story has been updated to correct the headline and to reflect that odds of a larger Federal Reserve interest rate cut fell after Tuesday’s economic data. The story has been updated with additional information on Federal Reserve rate cut probabilities.

U.S. retail sales rose more than expected by 0.1% month-over-month in August, signaling a resilient consumer spending momentum in the middle of the third quarter.

Retail sales slowed significantly from July’s upwardly revised growth; however, as they increased more than anticipated, this could boost the chances of a smaller interest rate cut when the Federal Open Market Committee releases its interest rate decision Wednesday.

Before the retail sales data was released, market-implied probabilities pointed to a 67% chance of a 50-basis-point rate cut, compared to a 33% likelihood of a smaller 25-basis-point cut, according to CME’s FedWatch tool. As of midday Tuesday, FedWatch shows a 63% chance of a larger 50-basis-point cut and a 37% chance of a 25-basis-point cut.

August Retail Sales Report: Key Highlights

- Retail sales rose by 0.1% on a monthly basis in August, beating the expected 0.2% decline as per TradingEconomics’ consensus.

- July’s retail sales growth was upwardly revised from 1% to 1.1%.

- On a year-over-year basis, retail sales eased from the upwardly revised 2.9% in July to 2.1% in August.

- Excluding motor vehicles and parts, sales grew by 0.1% month-over-month, below the 0.4% growth in July and missing the expected 0.2% increase.

- When excluding gasoline, motor vehicles, and parts, sales rose by 0.2% month-over-month in August, a slowdown from the 0.4% gain in July, and below the expected 0.3%

- Among spending categories, the largest monthly gains were recorded in miscellaneous store retailers, up 1.7%, and nonstore retailers, up 1.4%.

- Conversely, gasoline station, electronics and appliance stores experienced the steepest monthly decline, with sales dropping by 1.2% and 1.1% respectively.

Market Reactions: Dollar Strengthens, Treasury Yields Rise

The U.S. Dollar Index (DXY) – as tracked by the Invesco DB USD Index Bullish Fund ETF UUP – strengthened following the retail sales report, driven by rising Treasury yields.

Yields on the policy-sensitive 2-year Treasury note surged by about 5 basis points to 3.59%, indicating falling odds for a larger Fed rate cut.

Stocks inched higher during Tuesday’s premarket trading, with futures on the S&P 500 up 0.4% at 08:50 a.m. in New York. Nasdaq 100 futures were 0.6% higher.

On Monday, tech stocks closed in the red, with the Invesco QQQ Trust, Series 1 QQQ falling 0.4%, dragged down by chipmakers as the iShares Semiconductor ETF SOXX tumbled 1.3%

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Bill Gates' Trust Loaded Up on Warren Buffett's Favorite Stock in Q2. Should You Buy It Too?

Bill Gates and Warren Buffett have a lot in common despite their age difference. Both are multibillionaires. They’re philanthropists. Both enjoy playing bridge. And they’re both investors.

The two wealthy men now share even more in common on the investing front. The Bill & Melinda Gates Foundation Trust loaded up on Buffett’s favorite stock in the second quarter of 2024. Should you buy this stock, too?

Buffett’s favorite stock looks like Gates’ favorite these days

There’s not much of a mystery about the identity of Buffett’s favorite stock. He owns 15.1% of the aggregate economic interest in Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) Class A and Class C shares. This stake is worth roughly $146 billion right now.

Berkshire Hathaway also looks like it might be Gates’ favorite stock these days. In Q2, his trust bought an additional 7.32 million shares of the conglomerate, increasing its stake by a whopping 42%.

Sure, Microsoft, the company Gates co-founded, remains the largest holding in the Bill & Melinda Gates Foundation Trust’s portfolio. However, the trust sold more than 1.6 million shares of the tech giant in Q2.

Gates’ trust didn’t buy any stock besides Berkshire Hathaway during the second quarter. Its only other transaction was exiting a position in online used car retailer Carvana.

Why did Gates’ trust load up on Berkshire Hathaway stock?

Neither Gates nor anyone else associated with the charitable trust that he and his former wife founded commented on the big purchase of Berkshire Hathaway shares in Q2. However, we can make some pretty good guesses as to why the trust opted to load up on the stock.

I suspect one key reason behind the increased stake is the diversification that Berkshire Hathaway offers. The conglomerate operates over 60 businesses spanning a wide range of industries. It owns positions in over 40 other publicly traded companies with very little overlap with the other stocks in the Bill & Melinda Gates Foundation Trust’s portfolio.

Another likely factor for the hefty purchase is the long-term performance of Berkshire Hathaway stock. Gates’ trust first initiated a position in Berkshire in the second quarter of 2010. Since then, Berkshire’s share price has skyrocketed more than 460%.

Between 1965 (the year Buffett took control of Berkshire Hathaway) and 2023, the holding company delivered a compounded annual gain of 19.8%. By comparison, the S&P 500‘s compounded annual gain during the period was a much lower 10.2%. Berkshire is also handily outperforming the S&P 500 so far in 2024.

Should you buy Berkshire Hathaway stock, too?

It isn’t a good idea to base your investment decisions blindly on what billionaires or their charitable trusts do. However, in this case, I think many investors could do well following in the footsteps of Buffett and Gates.

Granted, Berkshire Hathaway isn’t a good pick for every investor. If you’re looking for income, you’ll be out of luck. Berkshire has never paid a dividend in its history. Also, even though Buffett is a famous value investor, his favorite stock isn’t especially cheap. Although Berkshire’s forward earnings multiple of 19.3 is less expensive than the S&P 500, it’s not low enough to attract the favor of most value investors.

But the diversification and long-term performance offered by Berkshire Hathaway are hard to beat for long-term growth investors. Berkshire has also built a massive cash stockpile of around $277 billion that could enable Buffett and his team to aggressively buy solid stocks at a discount when the next major market sell-off comes.

Buffett’s and (arguably) Gate’s favorite stock doesn’t have to be your favorite stock. However, I suspect Berkshire Hathaway will continue its winning ways for a long time to come.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keith Speights has positions in Berkshire Hathaway and Microsoft. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates’ Trust Loaded Up on Warren Buffett’s Favorite Stock in Q2. Should You Buy It Too? was originally published by The Motley Fool

Steel Dynamics Expects Lower Q3 Earnings Amid Pricing Pressures

Steel Dynamics, Inc. STLD has issued earnings guidance for the third quarter of 2024 in the $1.94-$1.98 per share range. This represents a decline from the company’s second-quarter 2024 earnings of $2.72 per share and its third-quarter 2023 earnings of $3.47.

STLD’s steel operations profitability is expected to be significantly lower than the second quarter due to reduced average realized pricing in the flat rolled operations. Approximately 80% of this business is contract-based, linked to lagging pricing indices. However, flat rolled steel prices have stabilized and are showing improvement, with underlying demand remaining consistent.

The metals recycling division’s earnings for the third quarter of 2024 are anticipated to be in line with second-quarter results, as steady volumes offset the impact of slightly lower realized pricing.

Demonstrating continued confidence in the company’s earnings outlook and cash flow, Steel Dynamics repurchased $307 million worth of its common stock through Sept. 11, 2024.

Shares of Steel Dynamics have gained 13.1% in the past year against a 14.3% decline in its industry.

Image Source: Zacks Investment Research

STLD’s Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and Eldorado Gold Corporation EGO, each sporting a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14 per share, indicating a rise of 15.3% from the year-ago level. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days.The stock has rallied around 95% in the past year.

The Zacks Consensus Estimate for Carpenter Technology’s current-year earnings is pegged at $6.06 per share, indicating a rise of 27.9% from the year-ago level. CRS’ earnings beat the consensus estimate in each of the trailing four quarters, with the average surprise being 15.9%. The stock has surged nearly 108.8% in the past year.

The Zacks Consensus Estimate for Eldorado Gold’s current-year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO beat the consensus estimate in each of the trailing four quarters, with the average earnings surprise being 430.3%. The company’s shares have surged nearly 75.3% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

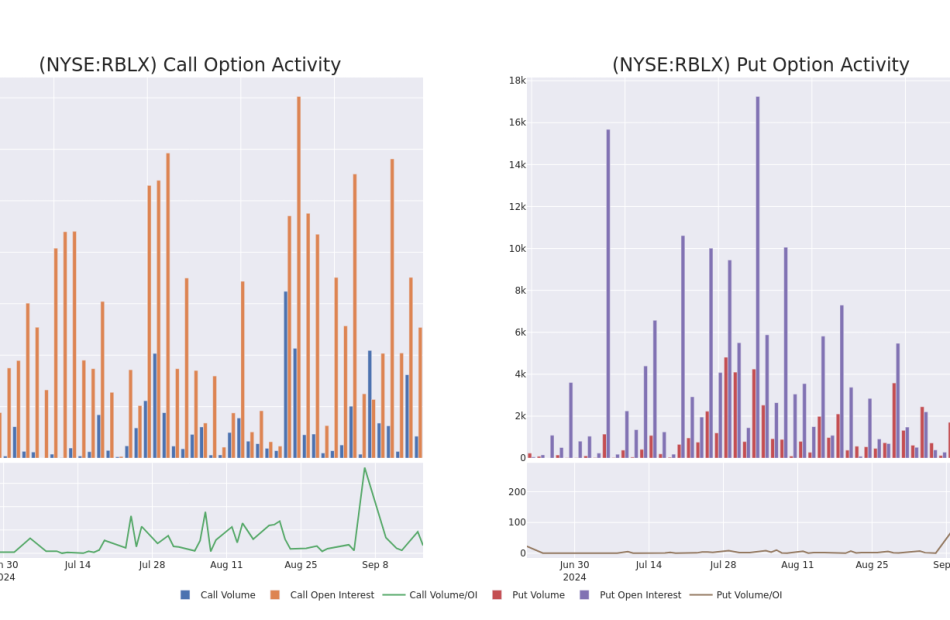

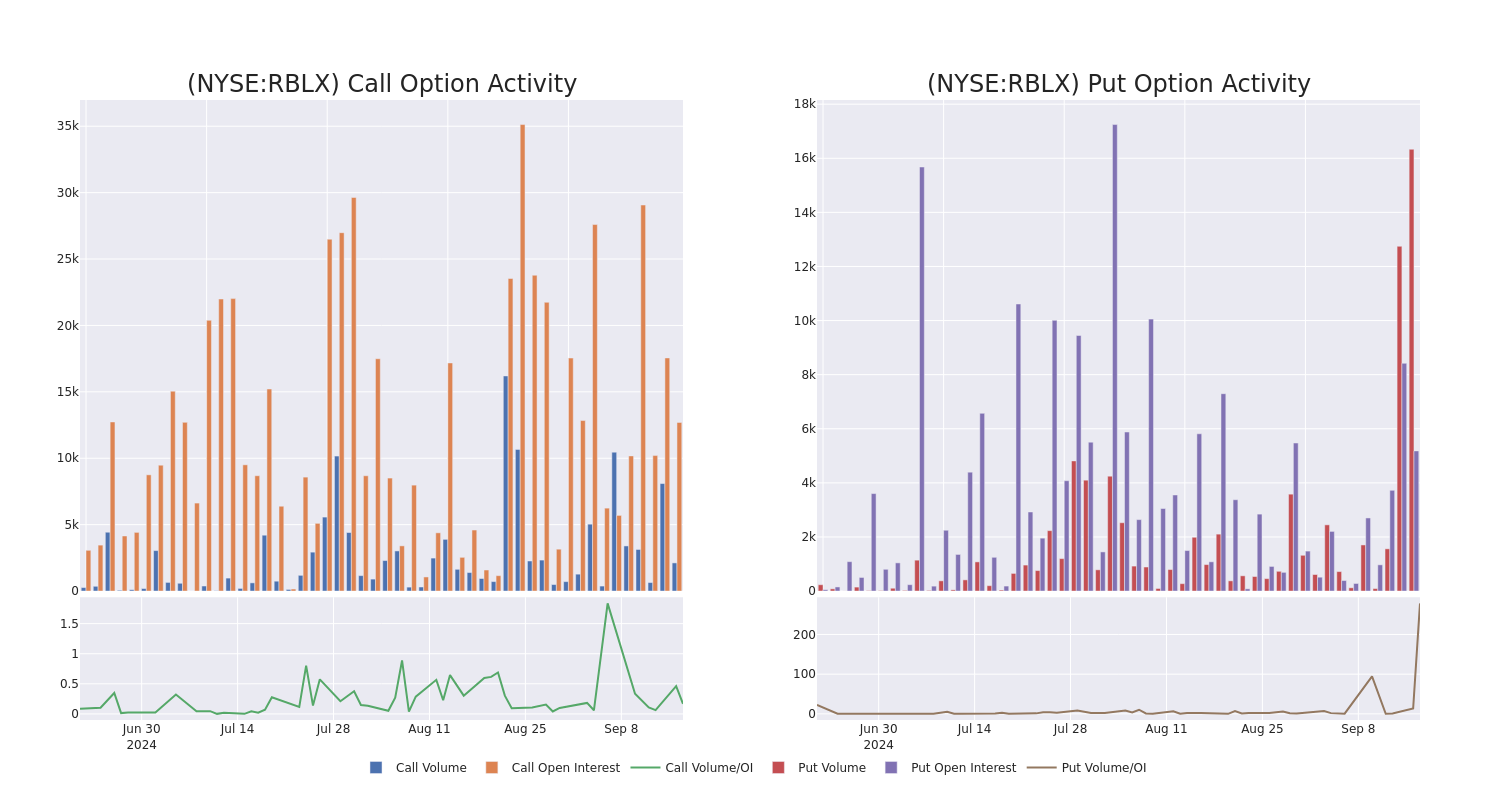

Roblox Unusual Options Activity For September 17

Deep-pocketed investors have adopted a bullish approach towards Roblox RBLX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RBLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 21 extraordinary options activities for Roblox. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 61% leaning bullish and 38% bearish. Among these notable options, 8 are puts, totaling $401,501, and 13 are calls, amounting to $581,946.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $60.0 for Roblox over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Roblox’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Roblox’s substantial trades, within a strike price spectrum from $25.0 to $60.0 over the preceding 30 days.

Roblox Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BEARISH | 11/15/24 | $3.15 | $3.05 | $3.15 | $45.00 | $94.5K | 1.4K | 1.4K |

| RBLX | CALL | SWEEP | BEARISH | 01/17/25 | $21.75 | $21.7 | $21.75 | $25.00 | $82.7K | 1.8K | 40 |

| RBLX | CALL | TRADE | BULLISH | 06/20/25 | $3.7 | $3.45 | $3.6 | $60.00 | $72.0K | 515 | 200 |

| RBLX | PUT | SWEEP | BULLISH | 11/01/24 | $3.1 | $3.0 | $3.0 | $47.00 | $67.2K | 49 | 5.1K |

| RBLX | PUT | SWEEP | BULLISH | 10/18/24 | $1.63 | $1.53 | $1.53 | $45.00 | $61.2K | 3.0K | 74 |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

Current Position of Roblox

- Currently trading with a volume of 3,246,470, the RBLX’s price is down by -0.35%, now at $46.08.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 50 days.

What The Experts Say On Roblox

1 market experts have recently issued ratings for this stock, with a consensus target price of $51.0.

- Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Roblox, targeting a price of $51.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Roblox, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

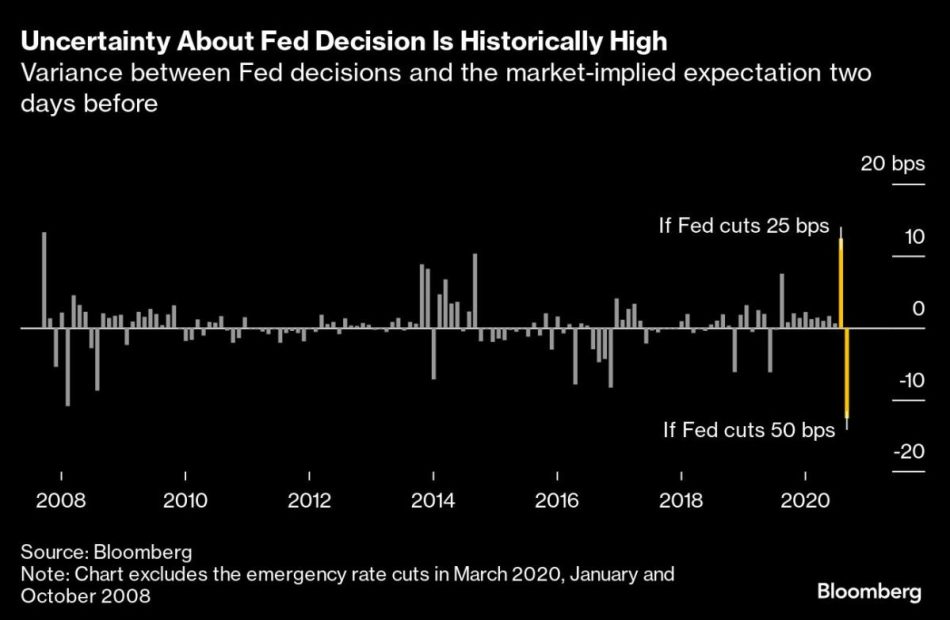

'What The Fed Wants And What The Market Wants Are Two Different Things,' Expert Says As Investors Brace For 50 Basis Points Rate Cut

In a recent discussion, Morgane Delledonne, head of investment strategy at Global X ETFs, shed light on the Federal Reserve’s interest rate policy and its effect on the markets.

What Happened: Delledonne, in an interview with CNBC on Monday, highlighted the gap between the Federal Reserve’s goals and the expectations of the market.

“What the Fed wants and what the market wants are two different things,” she explained.

She pointed out that the Federal Reserve heavily depends on economic data, which currently suggests a robust economy despite some weakening in the job market. However, Delledonne emphasized that core inflation continues to remain high.

Delledonne opined that the Fed is unlikely to risk the downward inflation trend by being overly aggressive.

“I don’t see the balance of risks pointing to a 50 basis points cut,” she said. She also suggested that such a move by the Fed could signal to the market that a recession risk is imminent.

Why It Matters: The Federal Reserve’s interest rate policy significantly influences the financial markets. The Federal Reserve was set to cut the federal funds rate for the first time in over four years. The market participants were leaning towards a larger 50-basis-point cut, with a 65% probability.

Furthermore, the performance of the S&P 500 following the Federal Reserve’s rate cuts largely depends on whether the economy is in a recession or not. The stock markets typically experienced significant declines after the Fed’s initial rate cut during recessionary periods.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Illustration created using artificial intelligence via MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Churn as Traders Split on Size of Fed Cut: Markets Wrap

(Bloomberg) — Stocks drifted near all-time highs ahead of the Federal Reserve decision, with traders split on the size of an interest-rate cut.

Most Read from Bloomberg

The S&P 500 closed little changed after briefly crossing the threshold of a record amid an increase in US retail sales. Economically sensitive industries once again outperformed tech. Treasury yields edged up, with shorter maturities leading the move. The market-implied odds the Fed announces a 50-basis-point reduction on Wednesday were around 55%.

A survey conducted by 22V Research showed investors who expect a 25 basis-point reduction are split on whether that cut would deliver a “risk-on” or “risk-off” reaction. Meantime, those betting on 50 basis points think a smaller Fed move would be “risk-off.”

“If the Fed doesn’t initiate its easing cycle with 50 basis points, surely a 25 basis-point move will be enveloped by a dovish tone,” according to Quincy Krosby at LPL Financial. Ryan Detrick at Carson Group said “a larger cut out of the gate makes a lot of sense” given that now the big concern is the potential for a quickly slowing labor market.

Steve Sosnick at Interactive Brokers still believes the Fed should lean to 25 basis points, but notes that years of trading experience have taught him to respect the message of the market. And that message has been saying 50, he said.

Sosnick noted there will likely be widespread disappointment if the Fed opts for 25 basis points. He says equity markets always crave more liquidity, and at the same time, bond markets have all but priced in an aggressive rate cutting path for future meetings. So the smaller cut would bias against both.

The Nasdaq 100 and Dow Jones Industrial Average also closed little changed. The Russell 2000 of smaller firms gained 0.7%. Treasury 10-year yields advanced two basis points to 3.64%. The dollar rose.

The Fed will either cut 50 basis points or opt for a 25 basis-point reduction, but signal that they will be more aggressive going forward, according to Matt Maley at Miller Tabak.

Still, he says, that does not guarantee that the stock market and/or bond market will rally in a meaningful way. Maley says the Fed will likely try to convey that a more dovish stance is not seen as something that means they’re suddenly worried about an imminent recession.

“Therefore, given that the stock market is approaching overbought territory, we could still get a ‘sell the news’ reaction to the Fed this week,” he added.

Kristina Hooper at Invesco expects the Fed to cut by 25 basis points as a bigger reduction would raise alarm bells about the state of the US economy.

“Recall that the Fed started a brief easing cycle with a 50 basis point cut in March 2020 with the global pandemic upon us; it would be very hard to argue that the situation is so dire now,” she noted.

What Fed Chair Jerome Powell says in his press conference about the state of the US economy could help build confidence for those worried about a recession in the near term, Hooper added.

“In addition, it will be valuable to hear Powell’s thoughts on the expected path of rate cuts — in particular, what conditions could trigger a change of course, either a moderation or acceleration in easing,” she noted. “These are just things you can’t glean from the dot plot, so the press conference is ‘must see TV’ in my view.”

Corporate Highlights:

-

Microsoft Corp. raised its quarterly dividend 10% and unveiled a new $60 billion stock-buyback program, matching the size of a repurchase plan three years ago.

-

Intel Corp. made a raft of announcements, spurring optimism that the chipmaker’s turnaround plan is starting to bear fruit.

-

Salesforce Inc. is unveiling a pivot in its artificial intelligence strategy this week at its annual Dreamforce conference, now saying that its AI tools can handle tasks without human supervision and changing the way it charges for software.

-

Newmont Corp., the world’s biggest gold miner, said it’s on track to raise $2 billion — if not more — from selling smaller mines and development projects.

-

JPMorgan Chase & Co. is in discussions with Apple Inc. about taking over a credit card portfolio that rival Goldman Sachs Group Inc. has been trying to ditch.

-

Snap Inc. Chief Executive Officer Evan Spiegel unveiled a new version of the company’s Spectacles smart glasses, revitalizing an effort to build an advanced augmented reality product that may one day replace or rival the smartphone.

-

Ozempic, the blockbuster diabetes shot made by Novo Nordisk A/S, is “very likely” to be one of the next drugs targeted for a price cut in bargaining with the US government’s Medicare program, a company executive said.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 4 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average was little changed

-

The MSCI World Index was little changed

-

S&P 500 Equal Weighted Index rose 0.2%

-

Bloomberg Magnificent 7 Total Return Index rose 0.4%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.1% to $1.1117

-

The British pound fell 0.4% to $1.3163

-

The Japanese yen fell 1.1% to 142.22 per dollar

Cryptocurrencies

-

Bitcoin rose 4% to $59,953.71

-

Ether rose 3.4% to $2,352.4

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.64%

-

Germany’s 10-year yield advanced two basis points to 2.14%

-

Britain’s 10-year yield advanced one basis point to 3.77%

Commodities

-

West Texas Intermediate crude rose 1.8% to $71.34 a barrel

-

Spot gold fell 0.5% to $2,568.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Singapore's DBS Bank Launches Bitcoin And Ethereum Options Trading For Institutional Clients

Singapore’s largest bank DBS on Tuesday announced its launch of over-the-counter (OTC) cryptocurrency options trading and structured notes, becoming the first Asian-headquartered bank to offer financial products tied to Bitcoin BTC/USD and Ethereum ETH/USD prices.

What Happened: These products, available from Q4 2024, are tailored for institutional investors and accredited wealth clients looking to expand their exposure to the digital asset class while managing risk.

DBS’ move comes at a time when interest in digital assets has surged.

In a release, Jacky Tai, Group Head of Trading and Structuring at DBS said professional investors are increasingly allocating to digital assets in their portfolios and that these financial products provide trusted, institutional-grade access to the digital asset ecosystem, allowing clients to better manage their portfolios.

Also Read: Contrarian Trader Bets $200K To Win $6.5M On This Unlikely Fed Rate Cut Scenario

By offering options trading, clients holding Bitcoin or Ethereum with DBS can hedge against volatility and potentially earn yield through advanced options structures, such as put options.

The timing of this launch coincides with significant growth in the cryptocurrency market in 2024.

DBS Digital Exchange (DDEx) reported a near tripling in the value of digital assets traded in Singapore dollar terms in the first five months of the year, with a 36% increase in active trading clients and a 50% surge in cryptocurrency market capitalization.

What’s Next: These developments will likely be discussed further at Benzinga’s Future of Digital Assets event on Nov. 19, where industry leaders will explore how innovations like DBS’ new offerings are helping institutional clients tap into the growing digital asset space.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.