Bausch + Lomb Surges 14.5%: Is This an Indication of Further Gains?

Bausch + Lomb BLCO shares ended the last trading session 14.5% higher at $17.80. The jump came on an impressive volume with a higher-than-average number of shares changing hands in the session. This compares to the stock’s 2.8% loss over the past four weeks.

Bausch + Lomb scored a strong price increase on investors’ optimism surrounding a Financial Times report stating that the company is contemplating a sale to address challenges related to its spin-off from the parent company Bausch Health. Private equity firms are likely to be among those interested in the deal, according to the report.

This company is expected to post quarterly earnings of $0.16 per share in its upcoming report, which represents a year-over-year change of -27.3%. Revenues are expected to be $1.17 billion, up 15.8% from the year-ago quarter.

Earnings and revenue growth expectations certainly give a good sense of the potential strength in a stock, but empirical research shows that trends in earnings estimate revisions are strongly correlated with near-term stock price movements.

For Bausch + Lomb, the consensus EPS estimate for the quarter has remained unchanged over the last 30 days. And a stock’s price usually doesn’t keep moving higher in the absence of any trend in earnings estimate revisions. So, make sure to keep an eye on BLCO going forward to see if this recent jump can turn into more strength down the road.

The stock currently carries a Zacks Rank #3 (Hold).

Bausch + Lomb is a member of the Zacks Medical Services industry. One other stock in the same industry, Alignment Healthcare ALHC, finished the last trading session 3.2% lower at $11.51. ALHC has returned 36.7% over the past month.

Alignment Healthcare’s consensus EPS estimate for the upcoming report has changed -7.8% over the past month to -$0.14. Compared to the company’s year-ago EPS, this represents a change of +26.3%. Alignment Healthcare currently boasts a Zacks Rank of #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

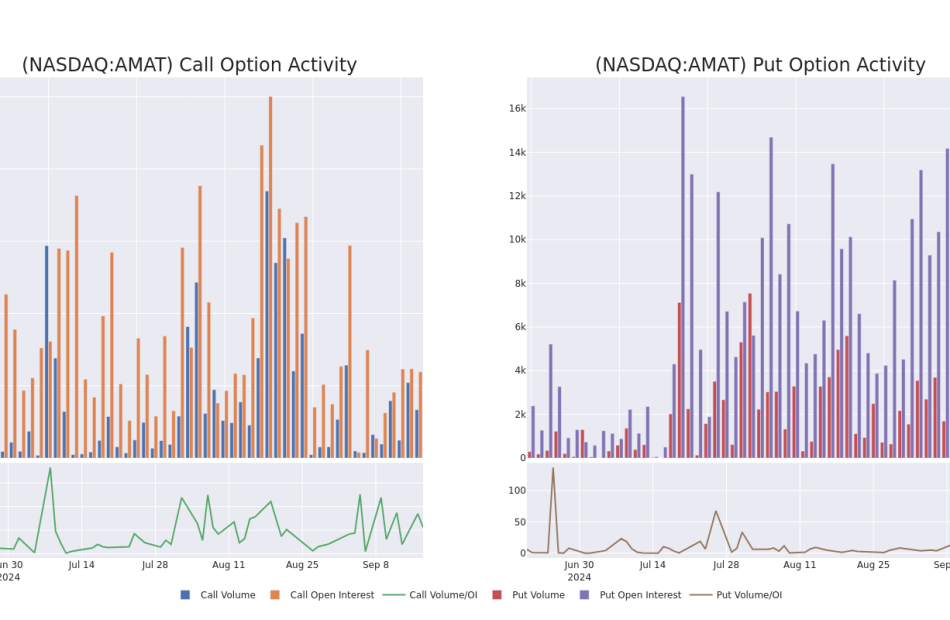

Applied Mat Unusual Options Activity

Financial giants have made a conspicuous bearish move on Applied Mat. Our analysis of options history for Applied Mat AMAT revealed 23 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 65% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $231,435, and 20 were calls, valued at $2,281,061.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $260.0 for Applied Mat over the last 3 months.

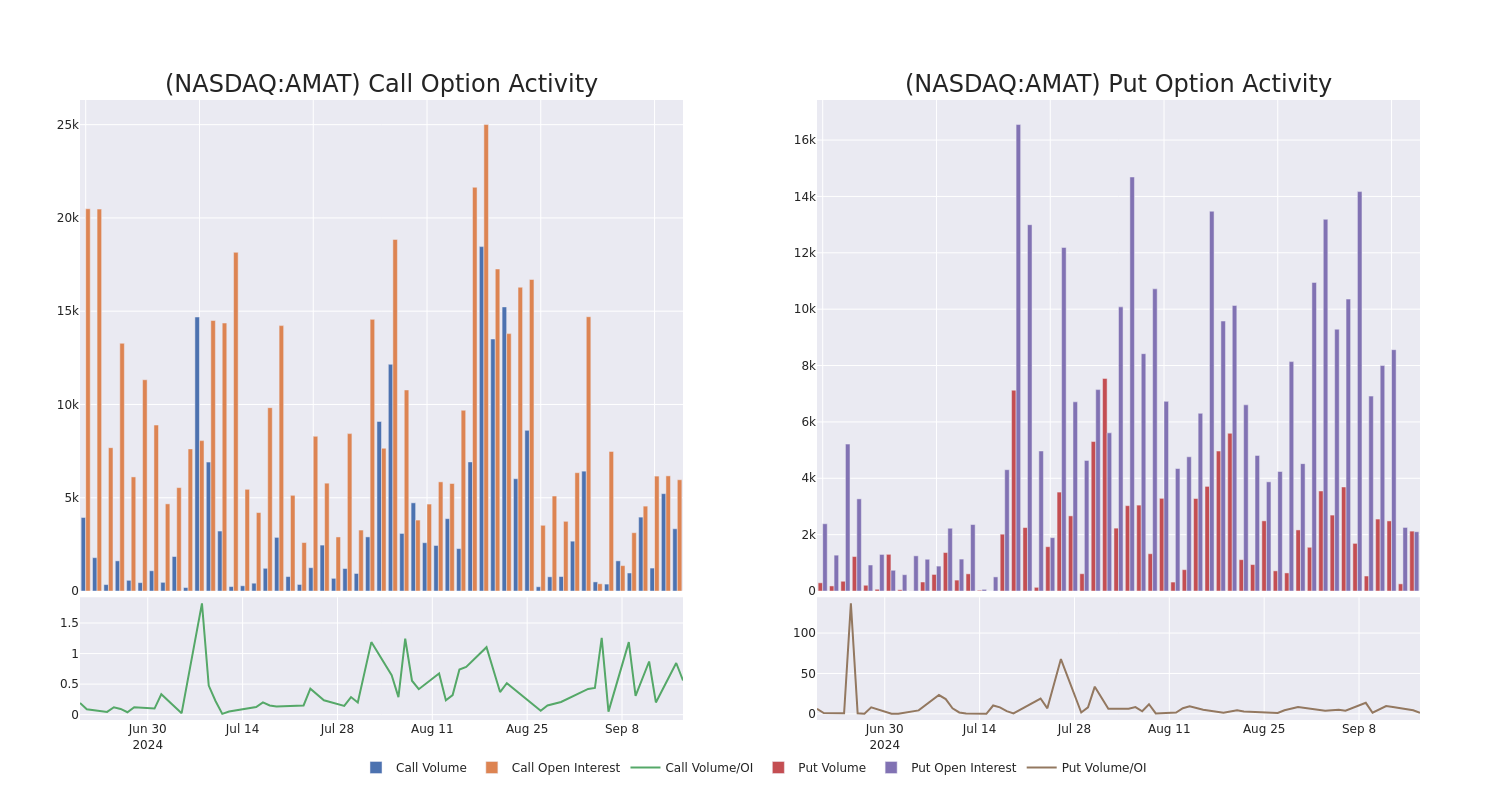

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Applied Mat’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat’s whale trades within a strike price range from $150.0 to $260.0 in the last 30 days.

Applied Mat Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | TRADE | BULLISH | 10/18/24 | $8.2 | $7.95 | $8.19 | $190.00 | $818.9K | 1.2K | 130 |

| AMAT | CALL | TRADE | BULLISH | 06/20/25 | $52.6 | $52.35 | $52.6 | $150.00 | $263.0K | 228 | 50 |

| AMAT | CALL | SWEEP | BULLISH | 09/27/24 | $4.35 | $4.3 | $4.35 | $190.00 | $217.5K | 232 | 1.1K |

| AMAT | CALL | SWEEP | BEARISH | 11/15/24 | $9.3 | $9.1 | $9.1 | $200.00 | $182.0K | 1.0K | 201 |

| AMAT | PUT | SWEEP | BEARISH | 09/20/24 | $1.54 | $1.31 | $1.54 | $185.00 | $107.6K | 1.5K | 1.4K |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Where Is Applied Mat Standing Right Now?

- Currently trading with a volume of 2,810,644, the AMAT’s price is up by 0.04%, now at $187.65.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 58 days.

Professional Analyst Ratings for Applied Mat

3 market experts have recently issued ratings for this stock, with a consensus target price of $204.0.

- Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Applied Mat with a target price of $210.

- An analyst from Citigroup persists with their Buy rating on Applied Mat, maintaining a target price of $217.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Applied Mat, targeting a price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Applied Mat, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Underfloor Heating Market to Reach $8.1 Billion, Globally, by 2030 at 6.7% CAGR: Allied Market Research

Wilmington, Delaware , Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Underfloor Heating Market by Product Type (Hydronic and Electric), System (Heating and Control), Installation (New Installations and Retrofit Installation), and End Use (Residential, Commercial and Industrial): Global Opportunity Analysis and Industry Forecast, 2024-2030″. According to the report, the underfloor heating market was valued at $5.2 billion in 2023, and is estimated to reach $8.1 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A06488

Prime determinants of underfloor heating market growth

The global underfloor heating market is experiencing growth due to several factors such as an increase in urban migration, rapid expansion of multi-story residential buildings, and stringent government regulations towards the ban of gas boilers. However, upfront cost hinders market growth. Moreover, the rapid development of the construction sector in developed and developing countries will provide opportunities for underfloor heating market growth.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2030 |

| Base Year | 2023 |

| Market Size in 2023 | $5.2 billion |

| Market Size in 2033 | $8.1 billion |

| CAGR | 6.7% |

| No. of Pages in Report | 340 |

| Segments Covered | Product Type, System, Installation, Application, and Region |

| Drivers | Stringent government regulations towards the ban of gas boilers |

| The increasing urban migration and rapid expansion of multi-story buildings |

The hydronics segment is expected to grow faster throughout the forecast period.

Based on product type, hydronics dominate the market in 2023. A hydronic underfloor heating system consists of a network of pipes running under the floor. Hot water heated by a boiler flows through the network of pipes to heat the substrate and therefore heat the room. It uses water or a mix of water and an anti-freeze substance such as propylene glycol. It can use a single source or a combination of energy sources to help manage energy costs such as combined heat and power plants heated by natural gas, fossil fuels, electricity, solar thermal, and biofuels. It is much more efficient and with much lower running costs than electric underfloor heating systems, while the initial purchase cost of the system will be significantly higher than an electric system and also require regular maintenance. The shifting trends towards the demand for improved living standards and rising awareness among people to reduce bills. Efforts of government and corporate industries towards improving air quality along with increasing demand for high level of comfort will further augment the development of the market.

Procure Complete Report (340 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/underfloor-heating-market

The heating segment is expected to grow faster throughout the forecast period.

The heating segment dominates the global underfloor heating market in 2023. Heating systems of underfloor heating consist of actuators and thermostats to provide comfort to individuals. Actuators play a major role as a gate for opening and closing to allow water to flow through each circuit. The thermostat plays a huge role in the demand for actuators while regulating the heat in the entire system. The increasing harsh climatic conditions across the globe and the need for comfort among individuals have led to the application of heating systems in residential and commercial buildings.

The new installation segment is expected to grow faster throughout the forecast period.

The new installation segment dominates the global underfloor heating market. New installation means the installation of fresh underfloor heating systems with related equipment, insulation, and other materials in the ongoing construction projects. The government initiatives to invest in the development of smart cities with green buildings in major developing and developed countries have increased the demand for new installations of underfloor heating. The development of new technologies in the heating system and control systems with an increase in the demand from customer’s living standards has increased the demand for underfloor heating. The increase in urban migration due to the rapid industrialization near the coastal areas has led to a surge in the development of the construction sector. The presence of spending power of individuals to improve living standards has a positive impact on the underfloor heating market.

The residential segment is expected to grow faster throughout the forecast period.

The residential segment dominates the global underfloor heating market. Residential is also one of the end-users, where underfloor heating equipment has surged in the market, which can be attributed to the growing awareness among individuals about the benefits brought by it. Underfloor heating can be considered to be an ideal need for new buildings and also becoming more popular for renovations because of new product innovations in this area. The rise in population and increase in the construction of residential buildings with the favorable support of government policies have a positive impact on the development of the underfloor heating market.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A06488

The Europe segment dominated the market in 2023

Europe occupies the largest part of the underfloor heating market and consists of countries such as Germany, France, the UK, Italy, Spain, and the rest of Europe. Intense R&D activities and awareness of people regarding the prospects of heating systems in the construction sector, especially in cold regions, have shown a positive impact on the growth of the underfloor heating market. The ongoing large-scale renovations and government policies regarding the ban on gas boiler installation in new homes by 2025 have stimulated the electric underfloor heating market growth. The presence of cold countries in this region, and the people’s demand for comfort in their dwelling places has increased the demand for underfloor heating systems in the forecast period. The increase in awareness among the people regarding the advantages of the radiant heat produced from underfloor heating to provide a comfortable life at a low cost is a major factor driving the growth of the market.

Leading Market Players: –

- Danfoss

- Daikin

- Emerson Electric Co.

- Honeywell

- Mitsubishi Electric Corporation

- Pentair Plc

- Robert Bosch

- Siemens

- Schneider Electric

- Thermosoft International

The report provides a detailed analysis of these key players in the underfloor heating market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Industry:

Electric Water Heater Market Size, Share, Competitive Landscape and Industry Forecast, 2021-2030

Combined Heat Power Market: Global Analysis and Industry Forecast, 2021–2030

Heat Exchanger Market Size, Share, Competitive Landscape and Trend Analysis, 2020-2030

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Web: https://www.alliedmarketresearch.com/reports-store/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Adhesion Barrier Market to Reach $1.5 Billion, Globally, by 2033 at 7.8% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Adhesion Barrier Market by Type (Synthetic Adhesion Barrier and Natural Adhesion Barrier), Application (General/Abdominal Surgeries, Gynecological Surgeries, Cardiovascular Surgeries, Orthopedic Surgeries, Neurological Surgeries and Other Applications), and End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the adhesion barrier market was valued at $0.7 billion in 2023, and is estimated to reach $1.5 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Request Sample of the Report on Adhesion Barrier Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A09554

Prime determinants of growth

Alarming increase in the prevalence of chronic diseases has emerged as a primary driving force behind the expansion of the adhesion barrier market. Notable increase has been witnessed in the incidence of chronic health conditions such as cardiovascular diseases, diabetes, cancer, and gastrointestinal disorders. These conditions often necessitate surgical interventions for treatment, whether for disease management, symptom alleviation, or curative purposes. Moreover, the growing number of surgical procedures performed to address chronic diseases has led to a higher incidence of post-operative complications, including the formation of adhesions. Adhesions, abnormal tissue connections that can develop between internal organs or tissues following surgery, pose significant risks to patient health and can lead to complications such as bowel obstructions, infertility, and chronic pain.

In response to the heightened awareness of these complications, there has been an increased demand for adhesion prevention products among healthcare providers and surgeons. Adhesion barriers play a crucial role in reducing the likelihood of adhesion formation post surgery, thereby minimizing patient morbidity, improving surgical outcomes, and enhancing the quality of life for individuals with chronic diseases.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2035 |

| Base Year | 2023 |

| Market Size in 2023 | $0.7 billion |

| Market Size in 2035 | $1.5 billion |

| CAGR | 7.8% |

| No. of Pages in Report | 280 |

| Segments Covered | Product Type, Application, End User, and Region |

| Drivers |

|

| Opportunities |

|

| Restraint |

Want to Explore More, Connect to our Analyst –

https://www.alliedmarketresearch.com/connect-to-analyst/A09554

Segment Highlights

The adhesion barrier market is segmented into product type, application, end user, and region. By product type, the market is divided into synthetic adhesion barrier and natural adhesion barrier. Depending on application, it is segregated into general/abdominal surgeries, gynecological surgeries, cardiovascular surgeries, orthopedic surgeries, neurological surgeries, and other applications. On the basis of end user, it is fragmented into hospitals, specialty clinics, and ambulatory surgical centers.

By product type, the synthetic adhesion barrier segment is expected to dominate market share in 2023, due to the fact that synthetic barriers are engineered to provide a controlled barrier between tissues, effectively preventing adhesion formation without interfering with the body’s natural healing processes. Their standardized composition and manufacturing processes ensure reproducible results, instilling confidence among surgeons and healthcare providers in their efficacy. Depending on application, the general/abdominal surgeries segment was the major shareholder in 2023, due to the fact that general/abdominal surgeries are associated with a higher risk of post-operative adhesion formation compared to surgeries in other body parts. On the basis of end user, the hospital segment acquired the maximum share in 2023. This is attributed to the fact that within hospital settings, a diverse array of surgical procedures is performed across various medical specialties, ranging from routine appendectomies to complex cardiac surgeries. This broad spectrum of surgeries translates to a consistent and substantial demand for adhesion prevention products to mitigate the risk of post-operative complications, including adhesions. Furthermore, hospitals possess the necessary infrastructure, resources, and skilled surgical teams to support the utilization of adhesion barriers effectively. Surgeons, nurses, and operating room staff are trained in the proper application of these products, ensuring their appropriate use during surgical procedures.

Regional Outlook

North America holds a significant share of the market, driven by advanced healthcare systems, high adoption rates of innovative medical technologies, and increasing surgical volumes. The presence of key market players and ongoing R&D activities contribute to the region’s dominance. In Europe, stringent regulatory frameworks and emphasis on patient safety propel the adoption of adhesion prevention products, particularly in countries with robust healthcare systems and high healthcare expenditure.

Asia-Pacific is witnessing rapid growth attributed to expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing demand for surgical interventions. Latin America and the Middle East & Africa are also experiencing growth driven by rising healthcare expenditure, increasing awareness about adhesion-related complications, and efforts to enhance surgical outcomes. However, the market growth in these regions may be constrained by economic challenges, healthcare disparities, and regulatory hurdles.

Key Market Players

- Integra LifeSciences Holdings Corporation

- Atrium Medical Corporation

The report provides a detailed analysis of these key players in the global adhesion barrier market. These players have adopted different strategies such as product launch, acquisition, and partnership to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A09554

Recent Developments in Adhesion Barrier Market Worldwide

- In June 2022, CGBIO launched Mediclore, an anti-adhesion agent in Indonesia. Mediclore inhibits adhesion by changing from sol to gel form by body temperature when applied to the body.

- In January 2021, Integra LifeSciences Holdings Corporation announced the acquisition of the Acell Inc.

- In October 2021, Toray Industry Inc. entered into a partnership with ASKA Pharmaceuticals Co., Ltd. to develop and commercialize adhesion barrier. Under the agreement, Toray and ASKA will jointly develop the product to obtain a marketing approval of the product in Japan. Upon the approval, Toray will manufacture the product, as ASKA will exclusively market it in Japan.

Trending Reports in Healthcare Industry:

Drug Screening Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Digital Pathology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Antinuclear Antibody Test Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Consumer Healthcare Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meta Is Leaving Its Austin Office, Guess What Big Tech Company Is Moving In

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The office real estate picture in Austin, TX is constantly changing but one company’s loss may be another company’s gain. Meta (NASDAQ:META) is leaving behind its lease in The Domain, a mixed-use neighborhood that includes several office towers.

Meta leased Domain 12, a 15-story glass tower, but as of Jan. 1, 2026, IBM will be taking over 320,000 square feet of office space. The property includes a cafe, outdoor terraces, a fitness center and bike storage. The new lease will extend the lease maturity from 2031 to 2040.

Check It Out:

IBM has a long history with the area now called the Domain. The original 235-acre IBM research campus was sold in 1999 for $60 million and IBM leased back part of the property. IBM announced that it would be relocating to a new campus by 2027. The company was planning to lease space in OneTerra, a 507,200-square-foot office project being developed by Hines Real Estate. In a statement, IBM said, “IBM remains committed to investing in new experiences for our clients and employees in this market.”

The move is a win for Cousins Properties (NYSE:CUZ), an office REIT that owns the building. Cousins’ Domain portfolio comprises 2.5 million square feet and is currently over 99% leased. “The Domain provides a highly amenitized experience that leading companies recognize as a critical tool to drive employee recruitment, retention and culture. We are thrilled to see growing customer demand for lifestyle office properties in Austin,” said Colin Connolly, President and Chief Executive Officer of Cousins Properties.

Keep Reading:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

Meta has been changing its relationship with office properties in Austin and elsewhere. Over the past several years, it has tried to leave around one million square feet of office space in Austin. In 2022, it announced it would not be moving into the 586,000-square-foot space it leased at the recently completed Sixth & Guadalupe Tower, currently the tallest in Austin at 865 feet. Last year, the company also put 120,000 square feet at 300 West Sixth Street into the sublease pool. It still has 320,000 square feet of space at the Third + Shoal building.

Meta’s office footprint is also shrinking in Bellevue, WA, where it has leased several properties, some of which are now up for sublease. Last year, it subleased its space in Fremont, CA, to a pharmaceutical company. It listed its 435,000-square-foot space at 181 Fremont in San Francisco for sublease in 2023 and potential interested tenants have included TikTok and Zendesk.

The Austin office market has been experiencing a lot of supply coming online at the same time that many companies are reconsidering their relationship with office space. Many tech companies have at least some footprint in the booming state capital but some have been reducing or scaling back their efforts. In recent months, as much as 20% of Austin’s office space has been vacant. Deals are still getting done but are often smaller leases under 100,000 square feet as companies reconsider their relationship with large headquarters.

Invest In Texas

Ready to be part of the Texas market without having to buy or manage property? Cityfunds by Nada are city-specific portfolios of home equity investments. The portfolios contain fractional shares of unique homes in growth areas, diversified for stability. The home equity investments are obtained at below current market rates and are resilient to market interest rate fluctuations, making them a stable and attractive choice for investors, regardless of market conditions. Each city is structured as a REIT for home equity investments, allowing investors to gain exposure to the home equity market. Nada offers funds in Austin, Dallas, and Houston, making it an easy way to invest in Texas’s boom markets. Get started today.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Meta Is Leaving Its Austin Office, Guess What Big Tech Company Is Moving In originally appeared on Benzinga.com

Recent Price Trend in Great Lakes Dredge & Dock is Your Friend, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Great Lakes Dredge & Dock

GLDD is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. GLDD is quite a good fit in this regard, gaining 11.6% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 7.9% over the past four weeks ensures that the trend is still in place for the stock of this provider of dredging and dock-contracting services.

Moreover, GLDD is currently trading at 84% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in GLDD may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

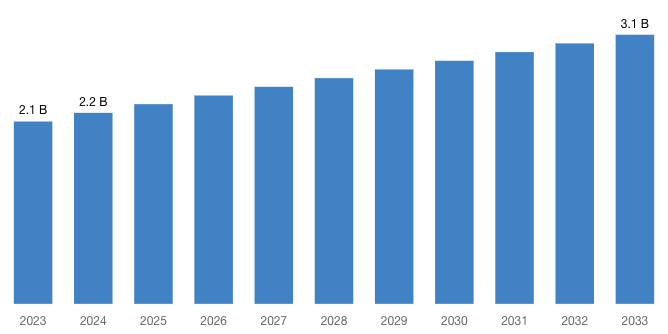

[Latest] Global Sanitary Pumps and Valves Market Size/Share Worth USD 3.1 Billion by 2033 at a 3.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Sept. 17, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Sanitary Pumps and Valves Market Size, Trends and Insights By Type (Centrifugal, Positive Displacement, Other), By Pump Power Source (Air, Electric), By End-User (Processed Foods, Dairy, Non-Alcoholic Beverages, Alcoholic Beverages, Pharmaceuticals, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Sanitary Pumps and Valves Market size & share was valued at approximately USD 2.1 Billion in 2023 and is expected to reach USD 2.2 Billion in 2024 and is expected to reach a value of around USD 3.1 Billion by 2033, at a compound annual growth rate (CAGR) of about 3.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Sanitary Pumps and Valves Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52014

Sanitary Pumps and Valves Market: Overview

Sanitary valves are used to direct, manage, and control the flow of hygienic materials and solutions. They are made to guarantee that items intended for direct human consumption are processed with the highest standards of sanitation and cleanliness.

Specialized equipment used to move clean liquids and scurries through industrial pipe networks is known as sanitary pumps and valves. Pump valves allow the fluid flow via the pump to be controlled. The global upsurge in industrial operations and increased awareness of cleanliness across various industries are credited with the market’s expansion.

Prominent drivers of the sanitary pump and valve market include industrial expansion across a range of industries, including dairy, processed foods, drinks, and pharmaceuticals, all on a global basis.

The delivery of uncontaminated products to end customers and manufacturers’ increased awareness of hygiene standards in end-use industries are two further factors driving the need for sanitary pumps and valves in hygiene-centrist sectors.

To maintain safety and sanitary standards in end-use products and industries, governmental or affiliated authorities have formulated strict laws and regulations in response to the growing awareness. These legal frameworks can be thought of as engines driving the global sanitary pump and valve industry’s growth.

Request a Customized Copy of the Sanitary Pumps and Valves Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52014

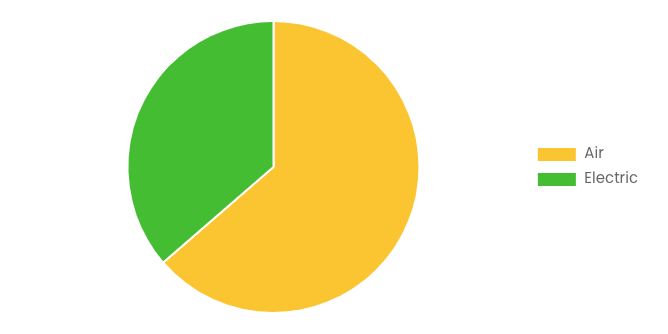

By type, the positive displacement segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033.

The use of sanitary pumps and valves is becoming more important as a result of industries’ growing awareness of safety and hygiene issues. Positive displacement pumps have grown because they are made to work well and dependably in these kinds of applications.

By pump power source, the electric segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Electric sanitary pumps provide accurate pressure and overflow rate control, guaranteeing dependable operation. In quiet industrial spaces or laboratories, for example, when noise level is a concern, electric sanitary pumps can function more silently than some other types of pumps.

By end-user, the pharmaceuticals segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. To guarantee product quality and purity, the pharmaceutical business must uphold strict cleanliness requirements.

In Asia Pacific due to the region’s fast industrialization, sanitary pumps and valves are in high demand across a range of sectors, including manufacturing, processing, and packaging. Through programs and policies designed to encourage the industry’s expansion, the government supports the development of the sanitary pumps and valves sector.

Alfa Laval is a leading global supplier of products and solutions for heat transfer, separation and fluid handling through our key products – heat exchangers, separators, pumps and valves.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 2.2 Billion |

| Projected Market Size in 2033 | USD 3.1 Billion |

| Market Size in 2023 | USD 2.1 Billion |

| CAGR Growth Rate | 3.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Pump Power Source, End-User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Sanitary Pumps and Valves report is available upon request; please contact us for more information.)

Request a Customized Copy of the Sanitary Pumps and Valves Market Report @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Sanitary Pumps and Valves report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Sanitary Pumps and Valves Market Report @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

CMI has comprehensively analyzed Sanitary Pumps and Valves Market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict an in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this global sanitary pumps and valves market.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Sanitary Pumps and Valves market and what is its expected growth rate?

- What are the primary driving factors that push the Sanitary Pumps and Valves market forward?

- What are the Sanitary Pumps and Valves Industry’s top companies?

- What are the different categories that the Sanitary Pumps and Valves Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Sanitary Pumps and Valves market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Sanitary Pumps and Valves Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

Sanitary Pumps and Valves Market: Regional Analysis

By Region, Sanitary Pumps and Valves Market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa. Asia Pacific led the Sanitary Pumps and Valves Market in 2023 with a market share of 43.6% and is expected to keep its dominance during the forecast period 2024-2033.

The Asia Pacific market for sanitary pumps and valves is further divided into South Korea, Australia, China, Japan, India, and the Rest of Asia Pacific. As one of the most developed economies in the world, Japan has a large demand from a variety of process sectors for sanitary pumps and valves.

Throughout the projection period, the sanitary pumps and valves market is anticipated to increase at a faster rate due to the expansion of the processed food, chemicals, and pharmaceutical industries—three sectors that significantly contribute to Japan’s economy. The nation’s demands for food are mostly met by imports.

Japan can rely on the US to provide it with safe, high-quality processed foods. Over the past two decades, frozen foods and health-conscious items have become more popular and consumed.

The expansion of the processed food sector in the nation is likewise due to the rising demand for convenient and ready-to-eat meal alternatives. Sanitary pumps and valves are being more widely used in the processed food industry as a result of these causes.

Request a Customized Copy of the Sanitary Pumps and Valves Market Report @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Sanitary Pumps and Valves Market Size, Trends and Insights By Type (Centrifugal, Positive Displacement, Other), By Pump Power Source (Air, Electric), By End-User (Processed Foods, Dairy, Non-Alcoholic Beverages, Alcoholic Beverages, Pharmaceuticals, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

List of the prominent players in the Sanitary Pumps and Valves Market:

- Alfa Laval

- Fristam Pumpen KG (GmbH & Co.)

- GEA Group Aktiengesellschaft

- SPX FLOW Inc.

- Dover Corporation

- Evoguard GmbH

- Verder International B.V.

- IDEX Corporation

- Xylem

- Graco Inc.

- ITT INC.

- Inoxpa S.A.U.

- Flowserve Corporation

- KSB SE & Co. KGaA

- Spirax-Sarco Engineering plc

- Adamant Valves

- Ampco Pumps Company

- Axiflow Technologies Inc.

- CSF Inox S.P.A.

- Dixon Valve & Coupling Company LLC.

- Others

Click Here to Access a Free Sample Report of the Global Sanitary Pumps and Valves Market @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Oil Immersed Power Transformer Market: Oil Immersed Power Transformer Market Size, Trends and Insights By Installation (Pad Mounted, Pole Mounted, Substation Installation), By Phase (Single Phase, Three Phase), By Voltage (Low, Medium, High), By End Users (Industrial, Residential, Commercial, Utilities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Hydraulic Motors Market: Hydraulic Motors Market Size, Trends and Insights By Product Type (Gear Motor, Vane Motor, Axial Piston Motors, Radial Piston Motors), By Speed (Low-Speed (< 500 Rpm), High-Speed (>500 Rpm)), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By Application (Mining & Construction, Oil & Gas, Agriculture & Forestry, Automotive, Packaging, Machine Tool, Material Handling, Aerospace & Defense, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Spiral Freezer Market: Spiral Freezer Market Size, Trends and Insights By Application (Meat Processing, Bakery, Seafood, Others), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Business (Aftermarket, OEM), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Water Desalination Equipment Market: Water Desalination Equipment Market Size, Trends and Insights By Source (Sea water, Brackish water, River water, Others), By Technology (Reverse Osmosis (RO), Multi-stage Flash (MSF) distillation, Multi-effect Distillation (MED), Others), By Application (Drinking Water Supply, Process Water, Irrigation Water, Others), By End Users (Municipal, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Industrial Refrigeration Equipment Market: Industrial Refrigeration Equipment Market Size, Trends and Insights By Type (Compressors, Condensers, Evaporators, Controls, Others), By Application (Refrigerated Warehousing, Food & Beverage Processing, Pharmaceuticals and Chemicals, Others), By Capacity (Small, Medium, Large), By End-User Industry (Food & Beverage, Healthcare, Chemical, Logistics, Retail, Hospitality, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Retail Robotics Market: Retail Robotics Market Size, Trends and Insights By Type (Mobile Robotics, Stationary Robotics, Semi-Autonomous), By Deployment (Cloud/Web-Based, In-Premise, Third Party Deployment Server), By Application (Delivery Robots, Inventory Robots, In-Store Service Robots, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Modular Exhibition Stand Market: Modular Exhibition Stand Market Size, Trends and Insights By Type (Modular Linear Stands, Modular Corner Stands, Modular Peninsula Stands, Modular Island Stands), By Application (Trade Shows, Product Launches, Conferences & Seminars, Others), By Material (Metal, Plastic, Wood, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Water and Gas Valve Market: Water and Gas Valve Market Size, Trends and Insights By Type (Ball Valves, Diaphragm Valves, Gate Valves, Mixing Valves, Butterfly Valves, Plug Valves, Others), By Application (Residential, Commercial, Industrial), By End Use Industry (Water and Waste Water Management, Chemical, Power Generation, Construction, Food and Beverage, Pharmaceutical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Sanitary Pumps and Valves Market is segmented as follows:

By Type

- Centrifugal

- Positive Displacement

- Other

By Pump Power Source

By End-User

- Processed Foods

- Dairy

- Non-Alcoholic Beverages

- Alcoholic Beverages

- Pharmaceuticals

- Others

Click Here to Get a Free Sample Report of the Global Sanitary Pumps and Valves Market @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Sanitary Pumps and Valves Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Sanitary Pumps and Valves Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Sanitary Pumps and Valves Market? What Was the Capacity, Production Value, Cost and PROFIT of the Sanitary Pumps and Valves Market?

- What Is the Current Market Status of the Sanitary Pumps and Valves Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Sanitary Pumps and Valves Market by Considering Applications and Types?

- What Are Projections of the Global Sanitary Pumps and Valves Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Sanitary Pumps and Valves Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Sanitary Pumps and Valves Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Sanitary Pumps and Valves Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Sanitary Pumps and Valves Industry?

Click Here to Access a Free Sample Report of the Global Sanitary Pumps and Valves Market @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

Reasons to Purchase Sanitary Pumps and Valves Market Report

- Sanitary Pumps and Valves Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Sanitary Pumps and Valves Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Sanitary Pumps and Valves Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Sanitary Pumps and Valves Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Sanitary Pumps and Valves market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Sanitary Pumps and Valves Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Sanitary Pumps and Valves market analysis.

- The competitive environment of current and potential participants in the Sanitary Pumps and Valves market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Sanitary Pumps and Valves market should find this report useful. The research will be useful to all market participants in the Sanitary Pumps and Valves industry.

- Managers in the Sanitary Pumps and Valves sector are interested in publishing up-to-date and projected data about the worldwide Sanitary Pumps and Valves market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Sanitary Pumps and Valves products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Sanitary Pumps and Valves Market Report @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Sanitary Pumps and Valves Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/sanitary-pumps-and-valves-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Are The Five Best Stocks To Buy Now Or Add To A Watchlist

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Netflix (NFLX), Meta Platforms (META), Freshpet (FRPT), Broadcom (AVGO) and Shift4 (FOUR) are prime candidates.

↑

X

Stocks Hit Pause Button As Fed Looms; Mr. Cooper, The Bancorp, Vistra In Focus

Inflation and the Federal Reserve tightening rates aggressively worried investors last year. But the market confounded expectations for difficulties and turned in an outstanding performance in 2023. More moderate gains were expected for 2024, but the benchmark S&P 500 turned in very strong gains for the first half of the year amid growing confidence that the Fed will reach its goal of a soft landing.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The IBD Methodology offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

Using such an approach can help give you an edge over the benchmark S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base and then buy it once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base. More information on what a base is, and how charts can be used to win big on the stock market, can be found here.

Don’t Forget The Stock Market Direction When Buying Stocks

A key part of investing is to keep track of the market. Most stocks, even the very best, follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The stock market turned in stunning gains in 2023 and has been building on those gains so far this year, for the most part. The S&P 500 and the Nasdaq got smacked below the key 50-day moving average after July’s jobs report spooked investors. While there was more choppy action at the start of September, the Nasdaq and the S&P 500 have now recaptured the important technical benchmark.

The stock market is looking bullish again despite recent wobbles. Investors should be looking to buy high-quality issues with good growth prospects. The selections below are among the best stocks to buy or watch now. The IBD 50 is also a rich hunting ground.

Nevertheless, it remains crucial to stay on top of sell signals. Any stock that falls 7% or 8% from your purchase price should be jettisoned. Also beware of sharp breaks below the 50-day or 10-week moving average.

Things can change quickly when it comes to the stock market. Make sure to keep a close eye on the market trend page here.

Best Stocks To Buy Or Watch

- Netflix

- Meta Platforms

- Freshpet

- Broadcom

- Shift4

Now let’s look at Netflix stock, Meta Platforms, Freshpet, Broadcom and Shift4 in more detail. An important consideration is that these best stocks to buy and watch all boast impressive relative strength.

Netflix Stock

Netflix stock is currently just below a cup-base buy point of 697.49, according to MarketSurge analysis. It is actionable as high as 732.36. It is currently breaking a downtrend, which offers an early entry.

NFLX has been getting support at the 21-day exponential moving average as well as the 50-day line. In addition, the relative strength line sits near fresh highs, a bullish sign. It had been bending higher as it formed the right side of the pattern.

Overall performance is strong, which is reflected in NFLX’s near-perfect IBD Composite Rating of 98. Earnings performance is also mighty, with its EPS Rating also standing at 98.

Indeed, earnings have grown by an average of 597% over the past three quarters, impressive performance by any standard. EPS is seen rising 59% in 2024 and then slowing to 20% growth in 2025.

Revenue growth has accelerated for four straight quarters.

Institutional sponsorship has increasing of late, with the stock’s Accumulation/Distribution Rating coming in at B-.

NFLX stock has been benefiting from the company’s moves to crack down on password sharing and to offer a cheaper ad-supported tier of service.

Netflix has grown tremendously from its roots as a subscription DVD-by-mail service. It is now the leader in digital streaming, offering subscription video-on-demand service in over 190 countries.

It produces its own content, with hits including “Stranger Things,” “The Crown,” “Squid Game” and “Bridgerton.” But content costs are coming down as rivals license more shows to Netflix once again.

Also, the firm is moving beyond its wheelhouse of movies and shows and into the live events arena.

Earlier this year it announced a deal with TKO Group (TKO) to carry the WWE’s flagship pro wrestling program “Raw” starting in January 2025. The 10-year deal is worth over $5 billion.

Netflix has also announced that it will stream two NFL games on Christmas Day this year. Plus, it will stream at least one Christmas Day football game in 2025 and in 2026.

The addition of live content will help attract advertisers to Netflix, Argus Research analyst Joseph Bonner said.

Netflix stock currently sits at the summit of the competitive Leisure-Movies & Related industry group.

Meta Platforms Stock

The social media stock is offering an early entry as it clears its 50-day and 21-day lines and breaks a downtrend.

It has also formed a consolidation with an ideal entry point of 542.81, MarketSurge analysis shows. Additionally, a three-weeks-tight pattern formed, which offers a slightly higher buy point of 544.23, though this could evolve into a proper base in time.

Overall performance for META is very strong, earning it an IBD Composite Rating of 93 out of 99. Meta stock has spiked nearly 51% so far this year.

Earnings performance is strong at the moment for the Facebook parent, netting it an EPS Rating of 96 out of 99. EPS has grown by an average of 114% over the past three quarters, easily above the growth levels sought by investors following The IBD Methodology.

Wall Street expects improvement in 2024, with full-year earnings per share seen rising 37%. EPS growth is seen slowing to 14% in 2025.

Meta stock is showing leadership, with shares currently sitting in first place in the competitive Internet-Content industry group. As if that wasn’t enough, META has been added to the prestigious IBD Leaderboard list of top stocks.

In total, 47% of META stock is currently held by funds, according to MarketSurge data. A number of noteworthy funds are backers, including the Fidelity Contrafund (FCNTX) and the MFS Growth Fund (MFEGX).

Meta Platforms has a robust roster of social media properties including Facebook, Instagram and WhatsApp.

The firm is betting big on the nascent space of artificial intelligence. The firm told investors it expected to spend $37 billion to $40 billion on capital expenditures this year, up from its previous range of $35 billion to $40 billion. The company also said it expects “significant capital expenditures growth” for 2025.

Those investments will focus mostly on building advanced data-center capacity to support training and deploying AI algorithms.

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Freshpet Stock

FRPT stock is in the buy zone above a consolidation buy point of 136.35, MarketSurge analysis shows. It is buyable as high as 143.17 from this entry.

This is a second-stage pattern for FRPT. This is a bonus as early-stage bases are more likely to post good gains.

The pet food stock dug in amid recent broader volatility and got support at its 21-day line. Its relative strength line is near recent highs.

The Bedminster, N.J.-based pet food specialist makes steam-cooked, grain-free and antioxidant-rich meals for dogs and cats. Freshpet exclusively focuses on “fresh” pet food made with fresh meat, vegetables and fruits.

Freshpet has clawed its way to the top of the Packaged Food industry group. Stock market performance is particularly strong, with the stock up about 62% so far in 2024. This means it is comfortably outperforming the benchmark S&P 500.

The pet play is also in the top 6% of issues in terms of price performance over the past 12 months.

The stock holds a strong IBD Composite Rating of 91. Earnings performance is the weakest part of the picture, with FPRT stock holding an EPS Rating of 73 out of a best-possible 99.

Wall Street expects significant improvement on this front, though. Freshpet is seen swinging from a full-year loss of 62 cents per share to a profit of 73 cents in 2024. EPS is then seen popping 80% next year.

Big Money is a strong backer of Freshpet. In total, 75% of shares are held by funds, according to MarketSurge data. An additional 4% is held by management.

Institutions have been net buyers of late, with the stock’s Accumulation/Distribution Rating coming in at A-. Noteworthy holders include the well-respected Virtus KAR Mid-Cap Growth Fund Class A Fund (PHSKX).

FRPT stock is a member of the IBD Leaderboard list of top stocks.

Broadcom Stock

The chip stock offered an early entry last week as it matched a trendline and clears the 50-day line. Shares pulled back on Sept. 16, but investors. could use Friday’s high of 168.08 as a new aggressive entry, or the short-term high of 172.42.

In addition, the stock is shooting for a consolidation-pattern entry point of 185.16, according to MarketSurge analysis. This is a third-stage base, which counts as midstage.

The stock is seeing its relative strength line bend upward, though it remains off recent highs.

Shares plunged on Sept. 6 following Broadcom’s fiscal Q3 earnings report, but roared back after finding support at the 200-day line.

Excellent all-around performance is reflected in AVGO’s near-perfect IBD Composite Rating of 98. Earnings performance is excellent here, with Broadcom holding an EPS Rating of 93 out of 99

Broadcom’s stock price has swollen by 47% so far this year. This is easily above the benchmark S&P 500’s lift.

Institutions have been net buyers of AVGO stock of late, with its Accumulation/Distribution Rating coming in at B-. Currently, 42% of its shares are held by funds, according to MarketSurge data.

Broadcom serves as an alternative artificial intelligence play for those who believe Nvidia (NVDA) is overvalued. It is a leader in custom chips that companies also need to implement all the power that AI brings to data centers, networks and even connected devices like smartphones.

Bernstein analyst Stacy Rasgon is rating AVGO as one of his top picks in the semiconductor sector. While sentiment around AI chip stocks “has taken a pause,” Rasgon said, “demand clearly has not.” He has a price target of 195 on Broadcom stock.

As if that wasn’t enough, Broadcom is on two different exclusive IBD lists, the Big Cap 20 and Tech Leaders.

These Stocks Eye Buy Points As Market Rallies

Shift4 Stock

Shift4 is testing a cup-with-handle entry of 83.64. The 5% buy zone here runs as high as 87.82.

This is a midstage base, which is neutral. Its latest pattern was formed in over 25 weeks, MarketSurge analysis shows.

FOUR stock has been actionable as it rebounded off the rising 10-week line on its weekly chart.

The stock’s relative strength line is off recent highs. However, it is starting to bend higher once again, an encouraging sign.

Overall performance is very strong. This is reflected in FOUR stock holding an IBD Composite Rating of 95 out of 99.

Earnings performance is key to this, with its EPS Rating coming in at 96 out of 99.

Its price performance is not quite so impressive, though Shift4 is still among the top 15% of issues in terms of price performance over the past 12 months.

Wall Street is expecting ongoing progress at the firm. Earnings are seen rising 32% this year before slowing to still impressive growth of 28% in 2025, according to MarketSurge data.

Big Money has been loading up on FOUR stock of late. This is reflected in its Accumulation/Distribution Rating of A-.

Overall ownership is very strong, with funds owning 69% of the firm’s shares. A further 1% is owned by banks.

The lauded Alger Small Cap Growth Fund (ALSCX) is among the noteworthy holders.

The Allentown, Pa.-based digital payments processor garners most of its revenue from customers in the hotel and restaurant industries as well as casinos. Shift4 has expanded into sports stadiums, airlines and charities, as well as food and beverage companies.

Amid intensified competition in the restaurant sector, the company has expanded internationally.

After exploring strategic options in early 2024, Shift4 ended talks to be acquired in late February, analysts say.

Instead, it has been on an acquisition spree of its own. In August it announced the acquisition of Givex, a provider of gift cards, loyalty programs and point-of-sale solutions. Shift4 also acquired point-of-sale company Revel Systems for $250 million in June.

Please follow Michael Larkin on X, formerly known as Twitter, at @IBD_MLarkin for more analysis of growth stocks.

YOU MIGHT ALSO LIKE:

7 Best Stocks For Magnificent Earnings Growth Next Year

Join IBD Live Each Morning For Stock Tips Before The Open

MarketSurge: Research, Charts, Data And Coaching All In One Place

This Is The Ultimate Warren Buffett Stock, But Should You Buy It?

Operation Safe Spaces Announces Town Hall At Relativity Fest 2024

MINNEAPOLIS, Sept. 17, 2024 (GLOBE NEWSWIRE) — Operation Safe Spaces (OSS), a task force that fosters and encourages safe environments to promote a culture of mutual respect for all genders in the global legal and legal technology industries, announces a Town Hall session titled “Operation Safe Spaces: A Working Session on Reporting, Safety, and Education Initiatives” at Relativity Fest 2024. Relativity Fest 2024 is September 25-27 at the Hyatt Regency Chicago.

OSS is a dedicated task force committed to cultivating respect for all within the legal community and supporting setting up environments at professional gatherings where everyone can feel safe. All Relativity Fest attendees are invited to a collaborative workshop to develop practical solutions related to reporting, safety and education.

In this session, the task force members will be introduced and the session coordinators will provide an overview of the OSS mission and ongoing initiatives. Participants will then be divided into groups to focus on reporting, safety and education topics to generate potential initiatives for the OSS task force working groups to develop further. All voices are encouraged to participate in this crucial conversation.

The goal of OSS and the town hall is to identify and shape initiatives that the OSS task force can potentially advance to strengthen inclusivity and safety in our community.

Town Hall coordinators are:

• OSS President Esther Birnbaum

• OSS Vice President Blair Cohen

• OSS Training/Education Working Group Co-chair Shana Pederson

What: Operation Safe Spaces Town Hall

Who: All Relativity Fest attendees are welcome.

Where: Grand Hall GH

When: Wednesday, September 25, 3:30 p.m. to 4:15 p.m.

To learn more about Operation Safe Spaces, visit https://www.womeninediscovery.org/OSS.

About Operation Safe Spaces

Operation Safe Spaces (OSS) is a dedicated task force committed to fostering safe environments and cultivating a culture of mutual respect within the legal community. OSS sets new standards through educational programs, reporting infrastructure, resource allocation, media press kits and initiatives, conference certification protocols and guidelines to ensure safe spaces in all professional gatherings.

Contact:

Amy Juers

Edge Marketing, Inc.

ajuers@edgemarketinginc.com

651.247.7872

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If Fed Cuts Interest Rates, Credit Card APRs 'Are Still Going To Be High' For Now, Economist Says

Consumers’ wallets should get some relief if the Federal Reserve lowers rates this week, but it won’t be a huge help, according to Benjamin Ayers, senior economist with Nationwide Insurance NWFAX.

“It should put some downward pressure on auto rates, mortgage rates, loan rates, but on the other side of the coin, it should put upward pressure on CD rates and saving rates that you get out there,” Ayers told Benzinga.

Lowering the Fed interest rate by only 25 or 50 basis points will not mean much for consumers in the short term, he adds.

“It’s nice but if you can’t afford a mortgage at the current level, that’s not going to change if it goes down by 25 basis points. It’s more kind of the start of a process,” he said.

“Six months, a year, 18 months from now, you’re going to see much lower rates, and that’ll really help to juice things, but in the near term, it’s going to have a pretty negligible impact for most people,” Ayers says.

A rate cut of 25 or 50 basis points doesn’t mean rates that affect consumers’ wallets will drop expectedly, said Matt Schulz, LendingTree, Inc.‘s TREE chief credit analyst.

“While lower rates are certainly a good thing for those struggling with debt, the truth is that this one rate cut isn’t really going to make much of a difference for most people,” he said.

“It doesn’t change the fact that the best thing people can do to lower interest rates is to take matters into their own hands.”

He said the average rate on a new credit card offer should stay at a record high of 24.92% for some time if the Fed lowers rates.

“While they’ll almost certainly fall from record highs in coming months, no one should expect dramatically reduced credit card bills anytime soon,” he said.

“Barring the Fed unexpectedly stomping on the gas pedal when it comes to lowering rates, credit card APRs are still going to be high for the foreseeable future.”

A $5,000 credit card balance would take 27 months and $1,528 in interest to pay off at 24.92% if monthly payments of $250 were made. If the interest rate went down by 0.25% because of a 0.25% Fed rate cut, the interest paid over 27 months would fall by $22, resulting in savings of less than a dollar a month, Schulz noted.

Schulz said auto loan rates will get lower, too, if the Fed reduces rates, but consumers should still shop around for financing from other places besides dealerships because their rates are typically much higher.

Saving rates have already started falling and may keep doing so, but consumers don’t need to panic, he said.

“Yields aren’t going to fall off a cliff immediately after the Fed cuts rates,” he said.

Price Action: Mortgage lenders and credit card companies trended upward into Monday’s late-afternoon trading.

- Bank of America Corporation BAC rose 1.31% to $39.15

- Rocket Companies, Inc. RKT gained 3.87% to $20.38

- Discover Financial Services DFS went up 1.98% to $133.93

- Capital One Financial Corporation COF went up 1.82% to $141.50

Read Now:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.