Maternity Health Insurance Market to Reach $269.3 Billion, Globally, by 2032 at 7.9% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Maternity Health Insurance Market by Mode (Online and Offline), and Distribution Channel (Direct from Insurer, Insurance Brokers and Agencies, Banks and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the maternity health insurance market was valued at $135.3 billion in 2023, and is estimated to reach $269.3 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A324225

Prime determinants of growth

The notable factors positively affecting the maternity health insurance market include a rise in the adoption of insurance services among individuals and an increase in development strategies by public and private companies which propel the market growth. However, enforcement of strong rules by banks and financial institutions for providing insurance services can hinder the market growth. Furthermore, technological advancements in insurance services offer lucrative market opportunities for the market players.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $135.3 billion |

| Market Size in 2032 | $269.2 billion |

| CAGR | 7.9% |

| No. of Pages in Report | 350 |

| Segments Covered | Mode, Distribution Channel, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/4epJJhv

The online segment held the highest market share in 2023

Based on the mode, the online segment held the highest market share in 2023. This growth is attributed to several factors, including the increasing adoption of digital channels by consumers, the convenience of online platforms, and the ability to compare different insurance plans easily. The COVID-19 pandemic accelerated digital transformation, pushing more customers to utilize online services for purchasing insurance products.

The banks segment held the highest market share in 2023

Based on the distribution channel, the banks segment held the highest market share in 2023. This dominance is due to the extensive reach and trust that banks have established with their customers over the years. Banks are able to leverage their existing customer base, robust distribution networks, and established financial advisory services to effectively market and sell insurance plans.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A17046

North America held the highest market share in 2023

Based on region, North America held the highest market share in terms of revenue in 2023, and is expected to boost in terms of revenue throughout the forecast timeframe. Well-developed infrastructure is accelerating the adoption of the most recent technologies, including maternity health insurance in North America.

Players: –

- Progressive Corporation

The report provides a detailed analysis of these key players in the global maternity health insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Industry Development:

- On May 2024, Transcarent launched an AI-driven solution, to simplify healthcare navigation. The newly introduced AI chatbot, developed on the ChatGPT framework, is designed to address common health maternity health insurance inquiries, including cost estimates for medical services, deductible queries, and provider recommendations.

- On May 2024, Everest Insurance unveiled its Australian insurance operations following approval from the Australian Prudential Regulation Authority.

- On May 2023, the Insurance Regulatory and Development Authority of India (IRDAI) launched a bundled product that will provide life, health, casualty, and property cover in a single policy at an affordable price.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A17046

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the maternity health insurance market forecast segments, current trends, estimations, and dynamics of the maternity health insurance market analysis from 2023 to 2032 to identify the prevailing maternity health insurance market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the maternity health insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global maternity health insurance market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global maternity health insurance market trends, key players, market segments, application areas, and market growth strategies.

Student Loan Market Key Segments:

By Mode

By Distribution Channel

- Insurance Brokers and Agencies

- Banks

By Region

- North America (U.S., Canada)

- Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- Latin America (Brazil, Colombia, Argentina, Rest of Latin America)

- MEA (Saudi Arabia, South Africa, UAE, Rest of MEA)

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Group Health Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Plan Type, By Enterprise Size, By Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2021-2031

Spain Health Insurance Third Party Administrator Market Size, Share, Competitive Landscape and Trend Analysis Report, by Insurance Service Type, Product Type, Enterprise Size, Distribution Channel : Country Opportunity Analysis and Industry Forecast, 2023-2032

Disability Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Insurance Type, by End User, by Coverage Type : Global Opportunity Analysis and Industry Forecast, 2021-2031

Insurance Third Party Administrator Market Size, Share, Competitive Landscape and Trend Analysis Report, by Service Type, By End User, By Enterprise Size : Global Opportunity Analysis and Industry Forecast, 2023-2032

Parametric Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Industry Vertical : Global Opportunity Analysis and Industry Forecast, 2024-2033

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Not BlackRock, But Revolut And Robinhood Will Infuse New Life Into DeFi, Expert Says

Paul Frambot, CEO and founder of lending protocol Morpho, believes the future growth of Decentralized Finance (DeFi) is largely dependent on fintech pioneers such as Revolut and Robinhood HOOD.

What Happened: In an interview with DL News, Frambot said that the next phase of financial infrastructure development will be driven by the most tech-savvy players in the finance sector. He referred to DeFi as an “artificial casino” where speculation is the primary driver of yields,

Morpho, backed by venture capital firms such as a16z and Ribbit Capital, launched Optimiser in 2021. This software layer is designed to maximize yields. However, since its launch, DeFi’s total TVL (invested deposits) has seen a 56% drop, leading to fierce competition for resources among developers and builders.

Frambot believes that leading fintechs like Revolut, Robinhood and eToro, all of which have integrated crypto into their offerings, could be the saving grace for DeFi. He is hopeful that these and other fintechs can boost DeFi’s appeal to mainstream users.

He also pointed out the potential for DeFi in payment processing, where fintechs currently rely on the same outdated “rails” as traditional financial players. Frambot anticipates more fintechs will seek DeFi partnerships in the near future.

Why It Matters: Robinhood, in particular, has been making significant strides in the crypto market. The company’s crypto strategy is successful in attracting millennials, leading to a 161% spike in crypto-based transaction revenue.

Robinhood’s efforts in expanding its crypto team, broadening its crypto trading services to the European Union, and acquiring Bitstamp for $200 million could potentially increase its operating income to approximately $900 million in 2024, as per Bernstein analysts.

Furthermore, Robinhood has recently integrated Solana into its Web3 wallet, marking another milestone in the company’s ongoing efforts to expand its digital asset offerings.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Retailer High Tide Reports Q3 Results

High Tide Inc. HITI reported its third-quarter financial results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: High Tide reported quarterly GAAP earnings of 74 cents per share and revenue of $97 million, which beat the consensus estimate of $92 million.

Read Next: NVIDIA, Micron, SMCI Stocks Are Down Monday: What’s Going On?

The company said gross profit margin for the quarter was 27%, compared to 28% in the same period last year and sequentially, and the quarter represented High Tide’s 18th consecutive quarter of positive Adjusted EBITDA.

“Over the last year, the High Tide team has presented investors with compelling proof points as to how we’re different than other retailers, and our third quarter results offer even further evidence of this. Our numbers continue to drive home the fact that we are a well-managed, innovative company that has grown responsibly while continuing to build value for shareholders,” said Raj Grover, CEO of High Tide.

HITI Price Action: According to Benzinga Pro, High Tide shares are up 8.68% after-hours at $2.38 at the time of publication Monday.

Read Also:

Photo: Courtesy of High Tide, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Mark Zuckerberg's Meta Banishes Russian State Media Globally To Counter Foreign Influence: RT And Related Entities 'Are Now Banned From Our Apps Globally'

Meta Platforms Inc META has banned RT, Rossiya Segodnya, and other Russian state media from its platforms. The ban, announced on Monday, marks an escalation in Meta’s efforts to combat foreign interference.

What Happened: The decision follows accusations that these outlets employed deceptive tactics for covert influence operations online, reported Reuters.

This action represents a significant escalation in Meta’s efforts against Russian state media, which previously included blocking ads and limiting post reach.

Meta stated, “After careful consideration, we expanded our ongoing enforcement against Russian state media outlets. Rossiya Segodnya, RT and other related entities are now banned from our apps globally for foreign interference activity.”

The enforcement will roll out over the coming days across Facebook, Instagram, WhatsApp, and Threads, according to the report.

The ban follows recent U.S. money laundering charges against two RT employees for allegedly attempting to influence the 2024 election.

U.S. Secretary of State Antony Blinken recently urged countries to treat RT’s activities like covert intelligence operations. RT has criticized the U.S. actions, accusing the United States of trying to hinder its journalistic operations.

Why It Matters: The ban on Russian state media by Meta comes amid ongoing tensions between the U.S. and Russia, particularly in the digital space.

In 2023, Russia’s restrictions on Western social media platforms like Facebook, Instagram, and X led to a reported loss of over $4 billion from its economy.

According to a study by Top10VPN, Russia experienced 1,353 hours of internet shutdowns during the first year of the Ukraine invasion, affecting 113 million internet users.

Meta’s actions are part of a broader effort to combat disinformation and covert influence operations. Earlier this year, Meta took down numerous Facebook accounts linked to covert influence campaigns from countries including China, Iran, Russia, and Israel.

These campaigns reportedly used artificial intelligence tools to spread disinformation, as highlighted in Meta’s quarterly threat report.

Additionally, Meta has faced pressure from various governments to regulate content on its platforms. In August, Meta CEO Mark Zuckerberg revealed that the company faced pressure from President Joe Biden administration’s officials to censor certain COVID-19 content.

Zuckerberg expressed regret for not opposing the pressure sooner, as noted in a letter addressed to the House Judiciary Committee.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Micron Stock Sinks as Morgan Stanley Warns About Memory Chip Sector

Kyle Green / Bloomberg via Getty Images

Key Takeaways

-

Morgan Stanley cut its price target for Micron Technology and warned about the future of the memory chip sector.

-

The bank said it sees “chillier conditions from here” for the stock group.

-

The analysts expect the sector’s growth to peak and reverse in the coming quarters.

Micron Technology (MU) stock was one of the biggest decliners in the S&P 500 Monday after Morgan Stanley slashed its price target to $100 from $140 and gave a downbeat assessment of the memory chip sector.

The bank warned that although it’s difficult to predict cyclical peaks, “both NAND and DRAM are losing steam, and our inflection signposts suggest chillier conditions from here.”

The analysts wrote in a report to clients that while memory chip demand is still moving up, “the rate of change is approaching a peak as supply catches up to demand.”

Morgan Stanley Sees Sector’s Earnings Growth Reversing

They added that they see the sector’s earnings growth reaching the top and then reversing in the coming quarters, with a nearly 30% price-to-book (P/B) ratio contraction, “and a higher chance of investors resetting positions.”

The analysts argued that even if valuations look good as stock prices fall, it doesn’t make sense to buy the dips because they anticipate “better entry points in the future.”

Shares of Micron Technology fell 4.5% Monday afternoon to $87.10. They are up about 2% in 2024.

Read the original article on Investopedia.

ROSEN, GLOBAL INVESTOR COUNSEL, Encourages lululemon athletica inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – LULU

NEW YORK, Sept. 16, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of lululemon athletica inc. LULU between December 7, 2023 and July 24, 2024, both dates inclusive (the “Class Period”), of the important October 7, 2024 lead plaintiff deadline.

SO WHAT: If you purchased lululemon securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the lululemon class action, go to https://rosenlegal.com/submit-form/?case_id=27808 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 7, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and misleading statements and/or failed to disclose that: (1) lululemon was struggling with inventory allocation issues and color palette execution issues; (2) as a result, lululemon’s Breezethrough product launch underperformed; (3) as a result of the foregoing, lululemon was experiencing stagnating sales in the Americas region; and (4) as a result of the foregoing, defendants’ positive statements about lululemon’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the lululemon class action, go to https://rosenlegal.com/submit-form/?case_id=27808 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ARTIS REAL ESTATE INVESTMENT TRUST ANNOUNCES MONTHLY CASH DISTRIBUTION

WINNIPEG, MB, Sept. 16, 2024 /CNW/ – Artis Real Estate Investment Trust (“Artis” or the “REIT”) AX announced that its trustees have declared a monthly cash distribution of $0.05 per trust unit (“Unit”) of Artis for the month of September, 2024. The cash distributions will be made on October 15, 2024, to Unitholders on record as of September 30, 2024.

As at the date hereof, there are an aggregate of 103,896,351 Units issued and outstanding.

Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States. Artis’s vision is to become a best-in-class real estate asset management and investment platform focused on value investing.

Suite 600 – 220 Portage Avenue

Winnipeg, MB R3C 0A5

T 204.947.1250 F 204.947.0453

www.artisreit.com

AX.UN on the TSX

SOURCE Artis Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c6858.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c6858.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uh-Oh! Alphabet Is Selling Its Stake in 2 Historically High-Flying Artificial Intelligence (AI) Stocks

Five weeks ago, what can arguably be described as the most important data release of the third-quarter occurred — and I’m not talking about the July inflation report.

No later than 45 calendar days following the end to a quarter (Aug. 14 in the latest instance), institutional investors with at least $100 million in assets under management are required to file Form 13F with the Securities and Exchange Commission. A 13F provides a clear-cut rundown of which stocks Wall Street’s brightest, and often richest, investors bought and sold in the latest quarter. Even though these snapshots are up to 45 days old when filed, it offers invaluable insight into the stocks, industries, sectors, and trends have the attention of money managers.

However, 13F filings are a necessity for more than just investment institutions. Some of Wall Street’s largest and most-successful companies hold sizable stakes in other businesses, including Nvidia, and are required to file a 13F on a quarterly basis.

One such company, which has nearly $2 billion invested across 42 stocks, is Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), the parent of search engine Google, streaming platform YouTube, and autonomous ride-hailing service Waymo, among other ventures.

Alphabet is a search engine juggernaut… and much more!

Most investors are familiar with Alphabet because of its world-leading Google search engine.

In August, Google accounted for a mammoth 90.48% share of worldwide search, per GlobalStats. In fact, Google has held at least a 90% monthly share of global internet search dating back more than nine years. This makes it the undisputed go-to for businesses wanting to target users with their message(s) and affords parent Alphabet unbelievable ad-pricing power.

You’re probably also familiar with YouTube, the second most-visited social media site on the planet, with approximately 2.5 billion monthly active users. The launch of Shorts — short-form videos lasting 60 seconds or less — in the latter half of 2020 provided an additional opportunity for the company to capitalize on ad revenue.

I’d be remiss if I didn’t also mention that Alphabet’s Google Cloud is the world’s No. 3 cloud infrastructure service platform by spending, with 10% of the market, per Canalys, as of the June-ended quarter. Following years of losses, Google Cloud shifted to recurring profits in 2023 and hasn’t looked back. Since cloud-service margins often outpace advertising margins, this segment should be a key cash-flow driver for Alphabet throughout the remainder of the decade.

But Alphabet is also an investor. It has nearly a quarter of its portfolio invested in development, security, and operations software developer GitLab, and more than 16% of invested assets tied up in Arm Holdings. Arm generates its revenue via licenses and royalties from chipmakers that use its designs to produce central processing units, graphics processing units, and other hardware.

However, it’s not what Alphabet holds that’s raising eyebrows. Rather, it’s the two core artificial intelligence (AI) stocks it’s been selling in consecutive quarters.

CrowdStrike Holdings

The first AI stock Alphabet’s investment managers have shown the door in back-to-back quarters is cybersecurity solutions provider CrowdStrike Holdings (NASDAQ: CRWD). After reducing its stake in CrowdStrike by a third during the March-ended quarter, Alphabet slashed its remaining position by another 50% (427,894 shares) in the June-ended quarter. CrowdStrike is now Alphabet’s fourth-largest position, down from No. 2, where it began 2024.

Valuation is the likely culprit behind this selling activity. Even though CrowdStrike has blown the door off of Wall Street’s consensus growth forecasts for years, it was trading at nosebleed price-to-sales (P/S) and forward price-to-earnings (P/E) ratios. Locking in gains was likely deemed a prudent move.

The more recent concern with CrowdStrike — albeit one that occurred in July, which wouldn’t be detailed by the latest round of Form 13Fs — is a botched update to its Falcon security platform that caused significant downtime for select industries and customers. It’s not uncommon for these snafus to cost cybersecurity companies revenue in the short run.

On the bright side, CrowdStrike’s error was self-inflicted and had nothing to do with a cyberattack. Prior to this July outage, businesses had demonstrated a willingness to pay a premium for CrowdStrike’s services given its history of protecting against breaches.

What’s more, CrowdStrike has mastered the art of the add-on sale within the cybersecurity arena. In less than seven years, it went from a single-digit percentage of its customers purchasing four or more cloud-module subscriptions to 65% of its clients using five or more cloud modules, as of the July ended quarter.

The cherry on top for CrowdStrike is that cybersecurity solutions have evolved into a basic need service. No matter how well or poorly the U.S. economy is performing, businesses with an online or cloud-based presence need to protect their data.

With the cloud-native Falcon platform only growing more effective over time, thanks to AI, Alphabet’s brightest investment minds may regret their decision to sell a collective two-thirds of their stake in CrowdStrike.

DexCom

The other AI stock that Alphabet’s investment team has been dumping for two straight quarters is medical-device giant DexCom (NASDAQ: DXCM). After shedding slightly north of 51% of its stake in the maker of continuous glucose monitoring systems (CGMs) in the first quarter, Alphabet sold another 42.1% of its position (753,836 shares) in the second quarter. This former No. 1 holding of Alphabet has slipped to No. 6 and now accounts for about 6% of invested assets.

Similar to CrowdStrike, valuation has long been the glaring red flag with DexCom. Although it’s been growing sales at a relatively steady rate of around 20% for years, DexCom’s P/S and forward P/E ratios have always been eyebrow-raising.

The more-pressing concern of late for DexCom is what might happen to its business as a result of glucagon-like peptide-1 (GLP-1) agonist drugs hitting the market. GLP-1 therapies have been shown to reduce weight in patients taking them, and obesity is a common co-morbidity for people with diabetes. Although studies have shown that patients on GLP-1 drugs are more likely to use CGMs, DexCom’s second-quarter operating results, which were reported in July (i.e., after 13Fs were filed), did little to quell these concerns.

DexCom lost 40% of its value in the blink of an eye after lowering the midpoint of its full-year sales guidance by about $250 million and highlighting a laundry list of challenges during the quarter. CEO Kevin Sayer pointed to lower revenue per user and the company restructuring its sales team as key reasons for this shortfall. In particular, Sayer believes a lack of sales team coverage in select geographic areas led to the company’s new patient count coming up short.

If there’s a silver lining here, it’s that DexCom is one of the two leading providers of CGM devices, and should, in theory, benefit from the sheer number of people diagnosed with diabetes in the U.S. and worldwide climbing.

DexCom can also lean on its various AI solutions to differentiate itself and provide value to its users. This includes everything from glucose control for its infusion pumps to helping users with dietary assessments to optimize their blood glucose levels.

But the nature of DexCom’s earnings miss is concerning, to say the least. Color me not surprised if Alphabet continues to purge DexCom from its investment portfolio in the September-ended quarter.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 755% — a market-crushing outperformance compared to 165% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and CrowdStrike made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, CrowdStrike, GitLab, and Nvidia. The Motley Fool recommends DexCom. The Motley Fool has a disclosure policy.

Uh-Oh! Alphabet Is Selling Its Stake in 2 Historically High-Flying Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

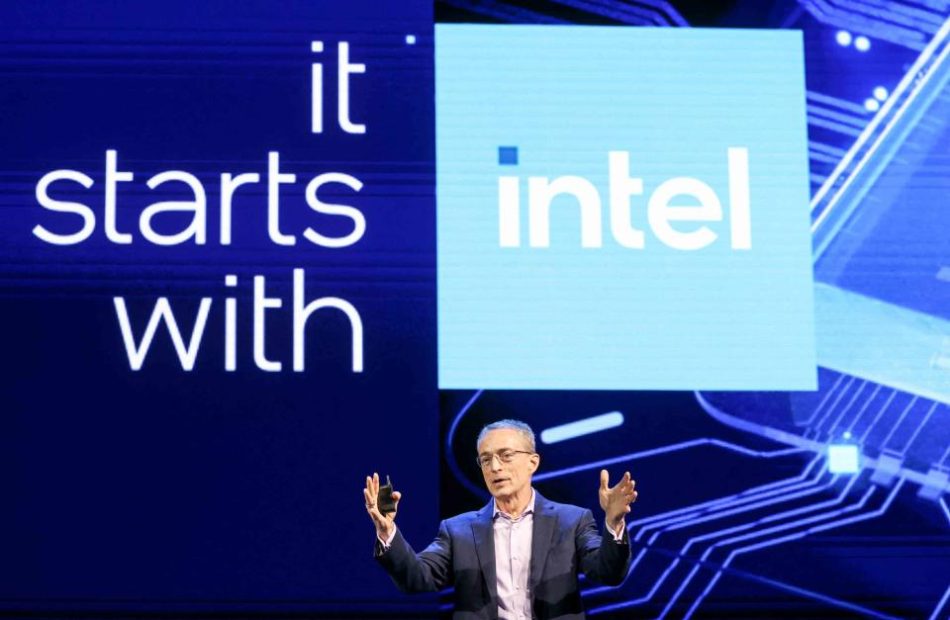

Watch These Intel Price Levels as Stock Surges After CEO Provides Business Update

Shares Surged Nearly 8% in Extended Trading on Monday

Key Takeaways

-

Intel shares surged nearly 8% in extended trading on Monday, adding to big gains during regular trading, after the embattled chipmaker’s CEO Pat Gelsinger provided an update on the company’s plans to slash costs and turn around its business.

-

Although the shares hit a new multi-year low this month, they have made a partial recovery to currently trade near their September high, potentially forming a hammer, a candlestick pattern that suggests a bullish reversal.

-

Investors should monitor important support levels on Intel’s monthly chart at $20, $17, and $14, while watching key resistance areas at $25 and $35.

Intel (INTC) shares surged in extended trading on Monday after the embattled chipmaker’s CEO Pat Gelsinger provided an update on the company’s plans to slash costs and turn around its business.

Gelsinger said in a note to employees released after the closing bell that Intel has made progress in lowering costs through layoffs, trimming its real estate footprint, and selling part of its stake in its Altera programmable chip unit, among other steps. The company also plans to turn its chipmaking arm into a separate subsidiary and said it would produce chips for Amazon (AMZN), as well as the U.S. military.

Intel shares rose 7.9% in after-hours trading to $22.56. The stock had risen more than 6% during regular trading hours following a report from Bloomberg on the contract to produce custom chips for the military. Even with Monday’s gains, the stock has shed more than half its value since the start of the year.

Below, we’ll take a closer look at Intel’s monthly chart and use technical analysis to identify key historical price levels worth watching.

Potential Hammer Candlestick Forming

After encountering significant selling pressure at the closely watched 50-day moving average (MA) in December last year, Intel shares have trended sharply lower, falling as much as 64% since that time. Importantly, trading volumes have increased during the stock’s sell-off, indicating conviction behind the move.

Although the shares hit a new multi-year low this month, they have made a partial recovery to currently trade near their September high, potentially forming a hammer—a candlestick pattern that suggests a bullish reversal.

Looking ahead, investors should monitor several key price levels on Intel’s chart that will likely gain close attention.

Important Support Levels to Watch

Firstly, it’s worth keeping a close eye on the $20 area, a price level the stock reclaimed on Monday. This location on the chart finds a confluence of support from the psychological round number and a horizontal line that connects a range of historical trading levels in the chipmaker’s stock from 1997 to 2012. Confirmation of a September hammer pattern at this key level would register a significant win for the bulls.

However, a continuation of Intel’s downtrend could see the shares fall to around $17, where they would likely find support from a period of consolidation in the stock between 1997 and 1998, an area that also closely aligns with troughs in 2006 and 2010.

Longer-term weakness may bring the $14 region into play, an area on the chart where buy-and-hold investors would likely seek entry points near prominent swing lows that formed during the dotcom bubble correction of 2002 and great recession in 2009.

Key Overhead Levels to Monitor

If an upside reversal takes place in Intel shares, investors should initially keep an eye on the $25 level, a key overhead area where the stock could run into resistance from a horizontal line linking multiple peaks and troughs between 1997 and February last year.

A move above this area could see the shares climb to $35, where they may encounter selling pressure near a trendline joining a series of price action from 1999 to October 2023 with the closely-aligned 200-day moving average.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above securities.

Read the original article on Investopedia.

Intel’s Latest Plans Send Its Stock Soaring—What You Need To Know

I-HWA CHENG / Contributor / Getty Images

Intel CEO Pat Gelsinger.

Key Takeaways

-

Intel shares surged in extended trading Monday after CEO Pat Gelsinger offered an update on the company’s turnaround plans.

-

Gelsinger said Intel has made progress in lowering costs through layoffs, trimming its real estate footprint, and selling part of its stake in Altera, among other moves.

-

The company also plans to turn its chipmaking arm into a separate subsidiary and said it would produce chips for Amazon, as well as the U.S. military.

Intel (INTC) shares surged in extended trading Monday after CEO Pat Gelsinger offered an update on the chipmaker’s plans to cut costs and bolster its business, with investors awaiting signs of a turnaround for its stock.

Shares were up over 8% shortly after the closing bell, after gaining 6% during the regular trading session. Even with those gains, though, Intel’s shares have lost more than half their value since the start of the year.

Intel Plans To Turn Intel Foundry Into Separate Subsidiary

Gelsinger said Intel has made progress in lowering expenses through layoffs, trimming its real estate footprint, and selling part of its stake in its Altera programmable chip unit, among other steps to cut costs.

The company also said it plans to turn Intel Foundry, which makes chips for other companies, into a separate subsidiary, a move that Intel said will give it greater independence, allow it to seek financing independently, and help Intel “optimize the capital structure of each business.” Recent reports had suggested that Intel might sell the operation.

Intel To Make Chips for Amazon, US Military

Intel also announced multibillion-dollar agreements to produce custom chips for Amazon (AMZN), as well as the U.S. military. The Pentagon news was first reported by Bloomberg.

“This news, combined with our [Amazon Web Services] announcement, demonstrates the continued progress we are making to build a world-class foundry business,” Gelsinger said in a release.

Gelsinger added the chipmaker will still be moving forward with projects in Arizona, Oregon, New Mexico and Ohio, adding that Intel remains “well-positioned to scale up production around the world based on market demand.”

Read the original article on Investopedia.