Should Invesco Dividend Achievers ETF Be on Your Investing Radar?

Designed to provide broad exposure to the Large Cap Value segment of the US equity market, the Invesco Dividend Achievers ETF PFM is a passively managed exchange traded fund launched on 09/15/2005.

The fund is sponsored by Invesco. It has amassed assets over $697.06 million, making it one of the average sized ETFs attempting to match the Large Cap Value segment of the US equity market.

Why Large Cap Value

Large cap companies usually have a market capitalization above $10 billion. Overall, they are usually a stable option, with less risk and more sure-fire cash flows than mid and small cap companies.

Value stocks have lower than average price-to-earnings and price-to-book ratios. They also have lower than average sales and earnings growth rates. While value stocks have outperformed growth stocks in nearly all markets when you consider long-term performance, growth stocks are more likely to outpace value stocks in strong bull markets.

Costs

Expense ratios are an important factor in the return of an ETF and in the long term, cheaper funds can significantly outperform their more expensive counterparts, other things remaining the same.

Annual operating expenses for this ETF are 0.53%, making it one of the more expensive products in the space.

It has a 12-month trailing dividend yield of 1.65%.

Sector Exposure and Top Holdings

It is important to delve into an ETF’s holdings before investing despite the many upsides to these kinds of funds like diversified exposure, which minimizes single stock risk. And, most ETFs are very transparent products that disclose their holdings on a daily basis.

This ETF has heaviest allocation to the Information Technology sector–about 21.40% of the portfolio. Financials and Healthcare round out the top three.

Looking at individual holdings, Apple Inc accounts for about 4.31% of total assets, followed by Microsoft Corp and Broadcom Inc.

The top 10 holdings account for about 26.99% of total assets under management.

Performance and Risk

PFM seeks to match the performance of the NASDAQ US Broad Dividend Achievers Index before fees and expenses. The NASDAQ US Broad Dividend Achievers Index is designed to identify a diversified group of dividend-paying companies which have increased their annual dividend for 10 or more consecutive fiscal years.

The ETF has gained about 16.28% so far this year and it’s up approximately 23.33% in the last one year (as of 09/16/2024). In the past 52-week period, it has traded between $35.25 and $46.01.

The ETF has a beta of 0.83 and standard deviation of 13.92% for the trailing three-year period, making it a medium risk choice in the space. With about 426 holdings, it effectively diversifies company-specific risk.

Alternatives

Invesco Dividend Achievers ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, PFM is a great option for investors seeking exposure to the Style Box – Large Cap Value segment of the market. There are other additional ETFs in the space that investors could consider as well.

The Schwab U.S. Dividend Equity ETF SCHD and the Vanguard Value ETF VTV track a similar index. While Schwab U.S. Dividend Equity ETF has $60.01 billion in assets, Vanguard Value ETF has $125.50 billion. SCHD has an expense ratio of 0.06% and VTV charges 0.04%.

Bottom-Line

While an excellent vehicle for long term investors, passively managed ETFs are a popular choice among institutional and retail investors due to their low costs, transparency, flexibility, and tax efficiency.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forget Nvidia, Buy This Magnificent Stock Instead

It’s no secret that Nvidia‘s (NASDAQ: NVDA) stock price has surged in recent years thanks largely to its association with artificial intelligence (AI), particularly the massive spending being done to expand data center computing power. Along with the price surge has come a surge in valuation for the stock.

If you are the type of investor who doesn’t like buying hot stocks at hefty valuations but still wants some exposure to the spending jump related to AI and data centers, Johnson Controls (NYSE: JCI) might be the answer. Here’s why this heating, ventilation, and air-conditioning (HVAC) specialist offers a great AI-related alternative to high-priced Nvidia.

Wall Street upgrades Johnson Controls

Johnson Controls stock received some positive ratings from heavyweight Wall Street investment companies recently. Bank of America analysts upgraded the stock to a buy rating and increased the price target to $80 (from $76), while Morgan Stanley analysts initiated coverage on Johnson Controls with an $85 price target and an overweight rating.

Analysts at both firms mentioned positive indicators involving end-market exposure for Johnson Controls. Bank of America’s analyst asserted that Johnson Controls will generate 14% of its revenue from data centers this year. At the same time, Morgan Stanley’s analyst said the company’s solutions help building owners create efficiency gains — a good theme as property owners seek to cut costs.

The AI/data center angle is relevant to the HVAC sector. Robust HVAC solutions are needed to maintain a controlled environment in data centers so equipment can perform optimally.

That’s one reason why HVAC companies’ shares have generally outperformed this year. However, Johnson Controls has underperformed its immediate peers, Trane Technologies (NYSE: TT) and Carrier Global (NYSE: CARR).

It also trades at a valuation discount to its peers.

Opportunities for a new CEO

One reason the stock underperformed the competition was management’s patchy record with guidance. Johnson Controls missed its own estimates on earnings in 2022 and sales in 2023. That pattern continued in its fiscal 2024 (which ended Sept. 30, 2024). During its fiscal Q2 earnings call in May, management maintained its guidance for full-year organic sales growth in the mid-single-digit range, only to cut it to approximately 3% in its Q3 report released on July 31.

It’s unclear if the company’s disappointing execution is why activist hedge funds are taking positions in the stock. Still, we know George Oliver announced he would retire as CEO in conjunction with that same third-quarter report. Hopefully, its next leader will be able to take advantage of the company’s significant growth opportunities.

Why Johnson Controls can outperform

While organic sales growth of 3% isn’t what investors expected this year, the company’s orders and backlog continue to grow. Oliver noted “strong demand for our data center solutions,” and asserted, “We have built a leading position in data centers in North America, due to a unique and compelling customer value proposition.”

Alongside the growth in data center demand to support the computing power needs of AI, Johnson Controls has an excellent growth opportunity coming from the trend of retrofitting buildings as owners strive to cut costs and reduce their carbon footprint. These efficiency gains are also being driven by the increasing use of digital technology in buildings, and the company continues to see strong adoption of its OpenBlue digital platform.

Restructuring to focus on its core business

A third catalyst that could lift its stock price comes from the company restructuring to focus on its core commercial and industrial HVAC business, not least by agreeing to sell its residential and light commercial HVAC business to Bosch in a transaction valued at $8.1 billion. (Johnson Controls will receive $6.7 billion.)

Alongside the sale of its air distribution technologies business, Johnson Controls will divest businesses responsible for about 20% of its overall sales, becoming a much more focused company in the process.

A stock to buy

After those divestitures, an even larger share of the company’s revenue will come from data centers and AI, while the underlying growth from the race to net zero will continue to support order and backlog growth.

Johnson Controls may not be as exciting a stock as Nvidia, but the company looks undervalued given its potential. Investors can expect good returns from the stock if management delivers on the opportunities outlined above.

Should you invest $1,000 in Johnson Controls International right now?

Before you buy stock in Johnson Controls International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson Controls International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool recommends Johnson Controls International. The Motley Fool has a disclosure policy.

Forget Nvidia, Buy This Magnificent Stock Instead was originally published by The Motley Fool

Market Whales and Their Recent Bets on APP Options

Financial giants have made a conspicuous bearish move on AppLovin. Our analysis of options history for AppLovin APP revealed 62 unusual trades.

Delving into the details, we found 32% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $468,792, and 50 were calls, valued at $6,373,260.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $42.5 and $150.0 for AppLovin, spanning the last three months.

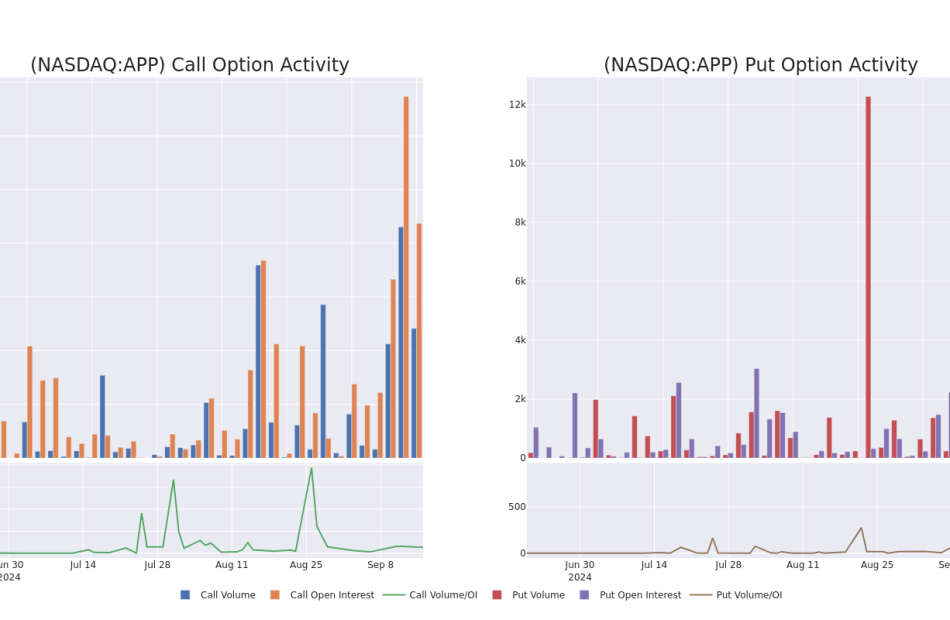

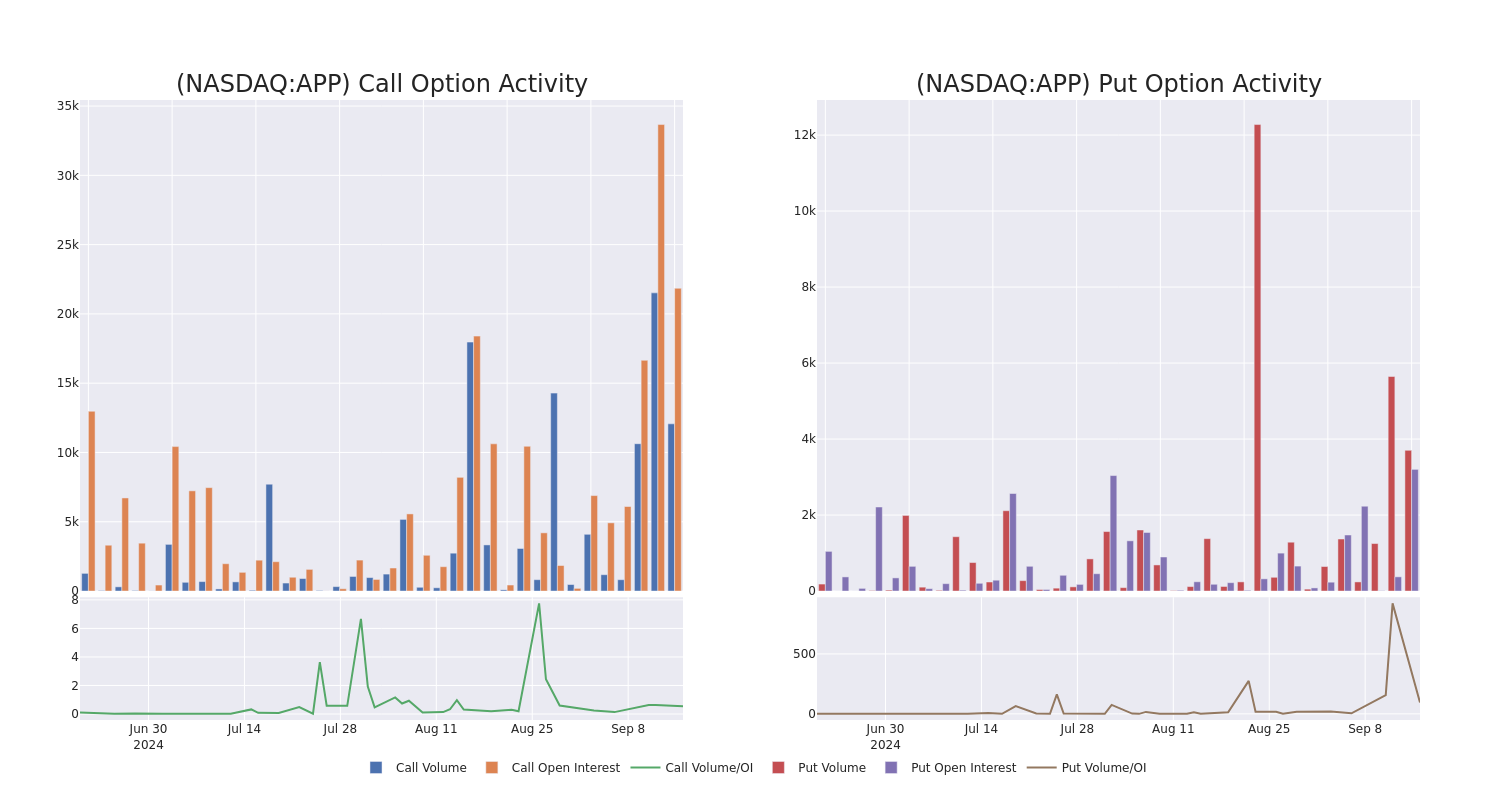

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for AppLovin’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AppLovin’s whale activity within a strike price range from $42.5 to $150.0 in the last 30 days.

AppLovin Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | TRADE | BEARISH | 09/20/24 | $35.9 | $34.5 | $34.88 | $80.00 | $2.8M | 1.6K | 1.1K |

| APP | CALL | TRADE | BEARISH | 09/20/24 | $35.9 | $34.2 | $34.87 | $80.00 | $958.9K | 1.6K | 1.1K |

| APP | CALL | SWEEP | BEARISH | 10/18/24 | $11.0 | $10.8 | $10.84 | $110.00 | $217.2K | 1.7K | 1.2K |

| APP | CALL | TRADE | BULLISH | 10/25/24 | $8.6 | $8.2 | $8.5 | $115.00 | $85.0K | 141 | 215 |

| APP | CALL | TRADE | BULLISH | 10/18/24 | $29.5 | $29.2 | $29.5 | $87.50 | $73.7K | 705 | 25 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company’s software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

Current Position of AppLovin

- With a volume of 6,848,266, the price of APP is up 3.22% at $116.2.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 51 days.

What The Experts Say On AppLovin

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $111.0.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for AppLovin, targeting a price of $108.

- An analyst from BTIG persists with their Buy rating on AppLovin, maintaining a target price of $150.

- An analyst from Benchmark has decided to maintain their Sell rating on AppLovin, which currently sits at a price target of $66.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on AppLovin with a target price of $120.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for AppLovin, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Broadcom, Taiwan Semiconductor, and Arm Holdings Fell on Monday

Shares of Broadcom (NASDAQ: AVGO), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Arm Holdings (NASDAQ: ARM) were down 3.3%, 2.5%, and 4.3% on Monday as of 11:30 a.m. ET. Shares of all three were down even more earlier in the morning.

All three of these companies are key suppliers to the Apple iPhone. This morning, a notable Asia-based Apple analyst wrote that initial orders for the iPhone 16 were weaker than expected. So, all three of these stocks fell in sympathy on the news.

So much for the iPhone “Supercycle?”

This morning, TF International Securities analyst Ming-Chi Kuo wrote a blog post on Medium outlining a pessimistic early take on the iPhone 16. Kuo wrote that based on early channel checks with suppliers and pre-order data scraped from Apple’s websites, he estimates Apple’s first weekend preorder sales were just 37 million. That would be down 12.7% from last year, with the difference being lower “Pro” model preorders relative to 2023.

That may have surprised some who were expecting an iPhone “Supercycle,” due to the introduction Apple’s artificial intelligence (AI) platform, Apple Intelligence. However, Kuo points out that Apple Intelligence won’t be available at launch this month, so that could explain the low preorders for the Pro model. The first Apple Intelligence features won’t be available until the release of iOS 18.1 in October. And even then, all of the AI features discussed at the June WWDC conference likely won’t be available at that point.

In addition to the Apple Intelligence explanation, Kuo also believes a weak Chinese economy and intense domestic Chinese competition have played a role in tepid iPhone preorders. China accounted for 17.2% of Apple’s total revenue last quarter.

TSMC, the largest foundry in the world, makes Apple’s A-series phone processors, which are based on the Arm architecture. Broadcom also uses TSMC and designs the film bulk acoustic resonator (FBAR), Wi-Fi, Bluetooth, and fast-charging chips in the iPhone. So Apple is a key customer of all three companies. Hence the uniform downturn in shares today after each had a strong week last week.

iPhone rumors always abound this time of year

Before you abandon these stocks en masse, you should be aware this is the time of year when all sorts of Apple rumors and tea-leaf readings emerge from analysts based in Asia. Sometimes they turn out to be true, but other times, they don’t.

Furthermore, with short-term interest rates still high, consumers may be holding off on large-ticket purchases, like a new iPhone, unless necessary. Beyond deep-pocketed early adopters, it’s possible many are holding off on preordering a phone until they hear and see what friends and others are experiencing with Apple Intelligence. As noted, those features won’t be introduced until October.

Therefore, even if preorders are weak today, the rollout of Apple Intelligence and the likely interest rate cuts beginning this week could be catalysts for the iPhone later during the holiday season. So, I would regard today’s news as noise. But should demand remain weak even after rate cuts and Apple Intelligence is introduced, that may be more of a reason to worry.

Meanwhile, each of these Apple suppliers also have strong AI growth potential outside the iPhone. Broadcom makes the key networking chips for AI data centers, as well as custom ASICs for several cloud giants’ self-designed AI accelerators. Arm was also upgraded last week on the prospects for increased edge AI data center penetration. Meanwhile, TSMC recently reported strong August sales figures, likely on the back of strong AI-related data center GPU orders.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Billy Duberstein and/or his clients have positions in Apple, Broadcom, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Why Broadcom, Taiwan Semiconductor, and Arm Holdings Fell on Monday was originally published by The Motley Fool

Nvidia, Meta, Apple, and Microsoft Could Help This Stock-Split ETF Turn $200,000 Into $1 Million

Roughly 70% of top executives believe artificial intelligence (AI) will transform the way their organizations create value over the next three years, according to a survey by consulting firm PwC published earlier this year. In PwC’s report, it projects AI technology will add a whopping $15.7 trillion to the global economy by 2030.

Events like the dot-com boom and bust in the late 1990s and early 2000s suggest that picking winners and losers in new industries like AI won’t be easy. Not every AI company will survive, let alone thrive. That’s why buying an AI-focused exchange-traded fund (ETF) can be a great option for investors. It can offer exposure to a broad variety of AI stocks neatly packaged into one security, and it is far less susceptible to catastrophic losses if one or two fail.

The iShares Expanded Tech Sector ETF (NYSEMKT: IGM) owns 281 different stocks, but it holds a high concentration of the most popular AI names.

The iShares ETF recently completed a stock split

The iShares ETF delivered a compound annual return of 20.2% over the last 10 years, crushing the 13.2% average annual gain in the S&P 500 index over the same period.

The powerful returns propelled the ETF to a price per share of more than $510 in March, which made it somewhat inaccessible to smaller investors. As a result, iShares executed a 6-for-1 stock split, which increased the number of shares in circulation sixfold and organically reduced the price per share by a proportional amount. Now, investors can buy the ETF for roughly $92.

The ETF has large holdings in leading AI stocks like Meta Platforms, Apple, Microsoft, and Nvidia, which are likely to continue driving its gains. Here’s how those stocks can help this ETF turn a $200,000 investment into $1 million over the long term — but don’t worry, investors with any starting balance can earn a fivefold return if this scenario plays out.

Every popular technology stock, packed into one ETF

As I mentioned at the top, the iShares ETF holds 281 different stocks. It was established in 2001 so it has helped investors navigate several technology cycles from the internet to cloud computing to enterprise software.

AI is the dominant theme in the tech sector right now. The top four holdings in the iShares ETF account for 34.3% of the total value of its entire portfolio, and each of them has a dominant presence in AI:

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Meta Platforms |

9.01% |

|

2. Apple |

8.99% |

|

3. Microsoft |

8.36% |

|

4. Nvidia |

7.94% |

Data source: iShares. Portfolio weightings are accurate as of Sept. 12, 2024, and are subject to change.

Meta Platforms might be a social media giant, but it has also built the most popular open-source large language model (LLM), called Llama. It’s at the foundation of new AI features on Facebook and Instagram like Meta AI, a chatbot that can answer complex questions and generate images. Llama will enable the company to roll out AI agents for businesses in the future, which will be capable of handling incoming messages from customers, and potentially even processing sales.

Apple recently developed Apple Intelligence in partnership with OpenAI, which will launch on the iOS 18 operating system later this year. It will give iPhone, iPad, and Mac users new writing tools that can rapidly summarize and generate text content for messages and emails. Plus, the Siri voice assistant will be upgraded with the knowledge of ChatGPT, making it more capable than ever before. With 2.2 billion active devices worldwide, Apple could become the largest distributor of AI to consumers.

Microsoft is a multifaceted AI company. It developed a virtual assistant called Copilot, which is embedded in many of its flagship software products like Windows, 365 (Word, PowerPoint, and Excel), Edge, and Bing. Microsoft is also a leading provider of AI services through its Azure cloud platform. Businesses can access ready-made LLMs on Azure to help them deploy AI into their operations, and they can also tap into Microsoft’s data centers to develop their own AI applications.

Finally, none of the above would be possible without Nvidia’s graphics processors (GPUs) for the data center. The company can’t keep up with demand for its chips, which is driving a surge in its revenue and earnings. That trend looks set to continue for at least the next year as Nvidia begins shipping a new generation of GPUs based on its Blackwell architecture, which will enable developers to create the most advanced AI apps to date.

Outside of those top four holdings, the iShares ETF has positions in a number of other important AI stocks like Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Oracle, and Advanced Micro Devices. But it also owns small stakes in leading technology stocks like Netflix, Salesforce, and Palo Alto Networks, which are using AI even though it isn’t their core product.

Turning $200,000 into $1 million

The iShares ETF has generated a compound annual return of 10.9% since its inception in 2001. As I touched on earlier, it delivered an accelerated annual return of 20.2% over the last 10 years, because that’s the period in which technologies like the smartphone, cloud computing, enterprise software, and AI experienced widespread adoption.

The below table shows how long it could take the ETF to turn an investment of $200,000 into $1 million based on a range of returns:

|

Starting Balance |

Compound Annual Return |

Time to Reach $1 Million |

|---|---|---|

|

$200,000 |

10.9% |

16 years |

|

$200,000 |

15.5% (midpoint) |

12 years |

|

$200,000 |

20.2% |

9 years |

Calculations by author.

It will be extremely difficult for the ETF to sustain a return of more than 20% over the long term. Its top four holdings have a combined market capitalization of $10.8 trillion, and each one is likely to experience decelerating revenue growth over time because of its sheer size. Meta, for example, already has 3.2 billion daily active users, so the company will inevitably hit a growth ceiling unless the world’s population expands significantly. Apple and Microsoft are in similar positions, serving at least 1 billion customers each already.

However, even if the ETF reverts back to its average annual gain of 10.9%, it can still deliver a fivefold return for investors over 16 years. The ETF could unlock greater returns if new tech companies emerge and create significant value, or if the AI industry becomes larger than firms like PwC expect (which is a real possibility).

But the reverse is also true. If AI fails to live up to the hype, stocks like Meta, Nvidia, Apple, and Microsoft could suffer declines that will drive a period of poor performance for the iShares ETF. That’s a good argument for owning the ETF as part of a balanced portfolio.

Should you invest $1,000 in iShares Trust – iShares Expanded Tech Sector ETF right now?

Before you buy stock in iShares Trust – iShares Expanded Tech Sector ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares Expanded Tech Sector ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Palo Alto Networks, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia, Meta, Apple, and Microsoft Could Help This Stock-Split ETF Turn $200,000 Into $1 Million was originally published by The Motley Fool

Despite Fast-Paced Momentum, Bridgeline Digital Is Still a Bargain Stock

Momentum investing is essentially the opposite of the tried-and-tested Wall Street adage — “buy low and sell high.” Investors following this investing style typically avoid betting on cheap stocks and waiting long for them to recover. They believe instead that one could make far more money in lesser time by “buying high and selling higher.”

Who doesn’t like betting on fast-moving trending stocks? But determining the right entry point isn’t easy. Often, these stocks lose momentum once their valuation moves ahead of their future growth potential. In such a situation, investors find themselves loaded up on expensive shares with limited to no upside or even a downside. So, going all-in on momentum could be risky at times.

It could be safer to invest in bargain stocks that have been witnessing price momentum recently. While the Zacks Momentum Style Score, which pays close attention to trends in a stock’s price or earnings, is pretty useful in identifying great momentum stocks, our ‘Fast-Paced Momentum at a Bargain’ screen comes handy in spotting fast-moving stocks that are still attractively priced.

There are several stocks that currently pass through the screen and Bridgeline Digital, Inc. BLIN is one of them. Here are the key reasons why this stock is a great candidate.

Investors’ growing interest in a stock is reflected in its recent price increase. A price change of 21.9% over the past four weeks positions the stock of this company well in this regard.

While any stock can see a spike in price for a short period, it takes a real momentum player to deliver positive returns for a longer time frame. BLIN meets this criterion too, as the stock gained 6.4% over the past 12 weeks.

Moreover, the momentum for BLIN is fast paced, as the stock currently has a beta of 1.94. This indicates that the stock moves 94% higher than the market in either direction.

Given this price performance, it is no surprise that BLIN has a Momentum Score of A, which indicates that this is the right time to enter the stock to take advantage of the momentum with the highest probability of success.

In addition to a favorable Momentum Score, an upward trend in earnings estimate revisions has helped BLIN earn a Zacks Rank #2 (Buy). Our research shows that the momentum-effect is quite strong among Zacks Rank #1 and #2 stocks. That’s because as covering analysts raise their earnings estimates for a stock, more and more investors take an interest in it, helping its price race to keep up.

Most importantly, despite possessing fast-paced momentum features, BLIN is trading at a reasonable valuation. In terms of Price-to-Sales ratio, which is considered as one of the best valuation metrics, the stock looks quite cheap now. BLIN is currently trading at 0.74 times its sales. In other words, investors need to pay only 74 cents for each dollar of sales.

So, BLIN appears to have plenty of room to run, and that too at a fast pace.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Icahn Enterprises Blasted Nearly 15% Higher on Monday

On news that a potentially resource-draining lawsuit against the company had been dismissed, units of master limited partnership Icahn Enterprises (NASDAQ: IEP) leaped almost 15% in price on Monday. This occurred on a rather sleepy trading session for stocks, with the S&P 500 index only bumping 0.1% higher.

A good day in court

Before market open, Icahn Enterprises announced — no doubt with immense satisfaction — that a district court judge had dismissed the suit. In the legal action, the company’s chairman and namesake Carl Icahn was accused of defrauding its unitholders in order to obtain significant amounts of personal loans.

That accusation came shortly after a report published by short-seller Hindenburg Research that said Icahn and company management had committed a range of transgressions.

The famed activist investor, who owns 85% of Icahn Enterprises, was quoted by his company as saying after the verdict, “We are pleased that the spurious claims of various unscrupulous characters, working together in a coordinated and clandestine network, have been debunked.”

The company and Icahn also took the opportunity to assert that the veteran investor has no intention of selling Icahn Enterprises units. Following the publication of a recent financial prospectus by the company, speculation had been rife that Icahn would raise money via unit sales.

Doubts will remain

Icahn Enterprises’ unit price took a lasting hit after the Hindenburg Research report was disseminated by the market. This indicates that more than a few market players take the allegations seriously. While the ruling by the court is indisputably positive for the company, it’s probable that some of those doubts will linger, and limit the potential for future pops in the price.

Should you invest $1,000 in Icahn Enterprises right now?

Before you buy stock in Icahn Enterprises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Icahn Enterprises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Icahn Enterprises Blasted Nearly 15% Higher on Monday was originally published by The Motley Fool

Stock market today: World shares are mostly higher as Wall Street gears up for an interest rate cut

Shares mostly advanced in Europe and Asia on Tuesday as world markets awaited an expected interest rate cut by the Federal Reserve.

Oil prices were mixed and U.S. futures edged higher.

Apart from the Federal Reserve’s most anticipated meeting in years, which wraps up on Wednesday, traders also were awaiting U.S. retail sales data that will provide a glimpse into the state of the economy.

Germany’s DAX rose 0.% to 18,704.36 and the CAC 40 in Paris climbed 0.5% to 7,485.77. In London, the FTSE 100 surged 0.7% to 8,338.42.

The futures for the S&P 500 and the Dow Jones Industrial Average edged 0.2% higher.

In Asian trading, Tokyo’s Nikkei index fell 1% to 36,203.22 and the Hang Seng in Hong Kong advanced 1.4% to 17,660.02.

Markets in mainland China and South Korea were closed.

Australia’s S&P/ASX 200 gained 0.2% to 8,140.90.

Markets have been eagerly awaiting the decision by the Fed, which is expected to cut its key rate for the first time in more than four years after keeping rates high to tamp down inflation. The main question is how much relief for the economy the Fed will deliver.

“The warning is that markets steeped in rich policy expectations are ripe for volatility,” Mizuho Bank said in a commentary. “Accordingly, it may be best to be braced for (policy) curveballs that could potentially force market re-pricing.”

On Monday, the Dow rose 0.6% to surpass its prior all-time high set a few weeks ago. It closed at 41,622.08.

The S&P 500 index, which is much more comprehensive and widely followed on Wall Street, ticked up by 0.1%, ending at 5,633.09.

The Nasdaq composite slipped 0.5% to 17,592.13 as big technology stocks and other market superstars gave back a bit of their big gains from recent years.

Most stocks rose, and Oracle’s 5.1% gain helped lead the market. The software company continued a strong run that began last week with a better-than-expected profit report.

Traders are shifting bets toward a larger-than-usual rate cut by the Fed of half a percentage point, according to data from CME Group. The difference between a half-point cut and a quarter may sound academic, but it can have far-ranging effects. Lower rates relieve pressure on the economy, but they can also fuel inflation.

Inflation has eased substantially from its peak two summers ago, and the Fed has said it can now focus on supporting the slowing job market and economy. Some critics say it may be moving too late, increasing the risk of a possible recession.

In other dealings, the dollar fell to 140.56 Japanese yen from 140.61 yen. The yen has strengthened against teh dollar with expectations that the Bank of Japan will persist in raising rates after keeping them near zero for years, although it is expected to stand pat at its policy meeting this week.

“The Bank of Japan’s upcoming policy meeting is expected to reaffirm its commitment to gradual rate hikes, which could further bolster the yen soon,” Luca Santos, currency analyst at ACY Securities, said in a commentary.

The euro rose to $1.1140 from $1.1135.

U.S. benchmark crude oil rose 10 cents to $70.20 a barrel. Brent crude, the international standard, shed 2 cents to $72.73 a barrel.

3 Dividend Aristocrats Yielding Up To 4.8% To Buy In September

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Are you looking for reliable income stocks to add to your portfolio this month? Dividend Aristocrats – companies with at least 25 consecutive years of dividend growth – offer some of the most compelling opportunities due to their stability and consistent payouts.

Let’s check out three dividend aristocrats, including two real estate investment trusts (REITs), that you could buy today.

Check It Out:

Chubb Ltd

Chubb (NYSE:CB) is a leading global insurance company in 54 countries and territories. It provides a wide range of insurance products, including commercial and personal property insurance, personal accident and supplemental health insurance, and life insurance.

Chubb currently pays a quarterly dividend of $0.91 per share, which equates to an annualized dividend of $3.64 per share and gives it a yield of about 1.3% at the time of this writing.

While Chubb’s yield is low compared to other dividend payers, it makes up for this with its status as a dividend aristocrat. It has raised its annual dividend payment for 30 consecutive years, and its 5.8% hike in February has it on track for 2024 to mark the 31st consecutive year with an increase.

Essex Property Trust

Essex Property Trust (NYSE:ESS) is one of the United States’ largest owners and managers of apartment communities. As of June 30, its portfolio comprised 255 apartment communities containing over 62,000 apartment units across select West Coast markets.

Keep Reading:

Essex currently pays a quarterly dividend of $2.45 per share, which equates to an annualized dividend of $9.80 per share and gives it a yield of about 3.15% at the time of this writing.

In addition to its high yield, Essex is one of the top dividend-growers in the real estate industry. It has raised its annual dividend payment for 29 consecutive years, and its 6.1% hike in February has it on track for 2024 to mark the 30th consecutive year with an increase.

NNN REIT, Inc.

NNN REIT, Inc. (NYSE:NNN) owns and manages high-quality retail properties across 49 states, including convenience stores, car washes, restaurants, and drugstores. As of June 30, its portfolio comprised 3,548 properties in 49 states containing over 36 million square feet of gross leasable area.

NNN REIT currently pays a quarterly dividend of $0.58 per share, which equates to an annualized dividend of $2.32 per share and gives it a yield of about 4.8% at the time of this writing.

NNN REIT has the third-longest streak of annual dividend increases in the real estate industry. Its streak currently stands at 34 consecutive years of increases, and its 2.7% hike in July has it on track for 2024 to mark the 35th consecutive year with an increase.

Looking For Higher-Yield Opportunities?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For instance, the Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000. Benzinga Readers: Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article 3 Dividend Aristocrats Yielding Up To 4.8% To Buy In September originally appeared on Benzinga.com

ROSEN, LEADING INVESTOR COUNSEL, Encourages Vicor Corporation Investors to Secure Counsel Before Important September 23 Deadline in Securities Class Action – VICR

NEW YORK, Sept. 16, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Vicor Corporation VICR between April 26, 2023 and February 22, 2024, both dates inclusive (the “Class Period”), of the important September 23, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Vicor common stock during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Vicor class action, go to https://rosenlegal.com/submit-form/?case_id=27447 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than September 23, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants created the false and/or materially misleading impression that Vicor had secured a significant deal for its H100 product that, according to analysts, was Nvidia Corporation. These statements proved incorrect when first, on October 24, 2023, Vicor conspicuously failed to discuss the deal and then later, on February 22, 2024, when the Company issued a press release announcing its end of year earnings and flagged a sharp reversal in new contracts and sales. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Vicor class action, go to https://rosenlegal.com/submit-form/?case_id=27447 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.