ARTIS REAL ESTATE INVESTMENT TRUST ANNOUNCES QUARTERLY CASH DISTRIBUTION

WINNIPEG, MB, Sept. 16, 2024 /CNW/ – Artis Real Estate Investment Trust (“Artis” or the “REIT”) AX announced that its trustees have declared a quarterly cash distribution of $0.449875 per Series E preferred unit (“Series E Unit”) of Artis for the quarter ending September 30, 2024. The cash distributions will be made on September 27, 2024, to Series E Unitholders of record on September 27, 2024.

As at the date hereof, there are an aggregate of 2,965,109 Series E Units issued and outstanding.

Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States. Artis’s vision is to become a best-in-class real estate asset management and investment platform focused on value investing.

Suite 600 – 220 Portage Avenue

Winnipeg, MB R3C 0A5

T 204.947.1250 F 204.947.0453

www.artisreit.com

AX.UN on the TSX

SOURCE Artis Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c8814.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c8814.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Saylor's MicroStrategy Plans Another $700M Convertible Note Issuance

-

MicroStrategy proposed to issue $700 million of convertible senior notes, with $500 million to be used to redeem a previous tranche of notes.

-

The remainder of the money could be used to buy additional bitcoin.

Nasdaq-listed bitcoin development firm MicroStrategy (MSTR) announced Monday that it intends to offer $700 million aggregate principal amount of convertible senior notes due 2028.

The company plans to use the proceeds of the offering to redeem $500 million worth of senior secured notes with 6.125% annual yield maturing in 2028, the press release said. It will use the rest of the proceeds to purchase more bitcoin {{BTC}} and for general corporate uses.

The firm also plans to grant to the initial purchasers of the notes an option to buy up to an additional $105 million aggregate principal amount of notes within a 13-day period starting on the issuance date of the first notes. The company said it may redeem for cash all or a portion of the notes on or after December 20, 2027, subject to certain conditions.

The company, led by Executive Chairman Michael Saylor, started purchasing bitcoin in 2020, adopting it as a reserve asset for its treasury. Since then, it has become the largest corporate buyer of bitcoin, accumulating 244,800 BTC, worth roughly $14.2 billion at current prices. Only days ago, MicroStrategy disclosed the purchase of an additional $1.1 billion worth of bitcoin, leaving it with $900 million available under a previous offering.

Recently, other public companies such as Semler Scientific and Japanese investment adviser Metaplanet have followed MicroStrategy’s footprints to issue debt to accumulate bitcoin.

MSTR shares slid 4.9% during regular trading today alongside a sizable decline in the price of bitcoin. Shares are down another 1.6% in after hours trading. They remain higher by about 300% on a year-over-year basis.

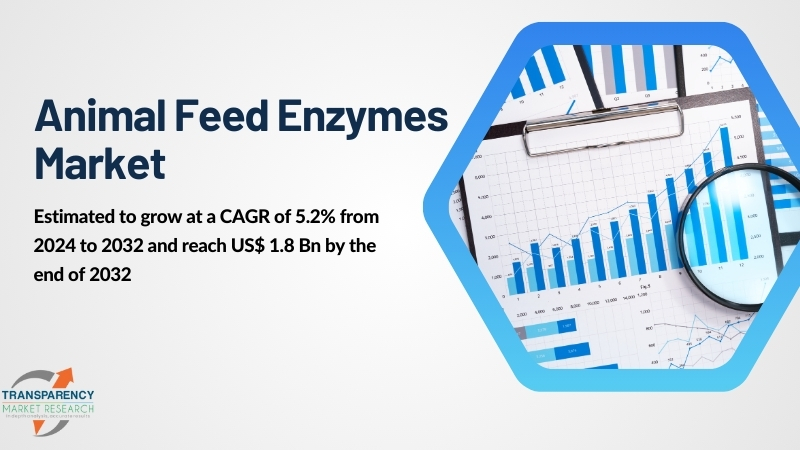

Animal Feed Enzymes Market Size to be Worth USD 1.8 billion by 2032, Growing at CAGR of 5.2% | Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 16, 2024 (GLOBE NEWSWIRE) — The global animal feed enzymes market (pasar enzim pakan ternak) is estimated to flourish at a CAGR of 5.2% from 2024 to 2032. Transparency Market Research projects that the overall sales revenue for animal feed enzymes is estimated to reach US$ 1.8 billion by the end of 2032.

The emergence of novel feed ingredients and additives is reshaping the market landscape. With ongoing research into alternative protein sources and sustainable feed components, there’s a growing need for enzymes that can effectively break down complex nutrients and improve digestibility.

The integration of digital technologies in livestock management is creating opportunities for innovative enzyme solutions. With the advent of precision farming techniques and data-driven decision-making tools, there’s a growing demand for enzymes that can support optimal nutrient utilization and health outcomes for livestock.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/animal-feed-enzymes.html

Key Findings of the Market Report

- Powder form dominates the animal feed enzymes market due to its ease of handling, storage, and accurate dosage administration.

- Phytase emerges as the leading product type segment in the animal feed enzymes market due to its widespread use in improving phosphorus utilization.

- Poultry leads the animal feed enzymes market due to its large-scale production and high demand for feed efficiency and performance enhancement.

Animal Feed Enzymes Market Growth Drivers & Trends

- Increasing demand for high-quality meat products drives adoption of feed enzymes to enhance feed efficiency and animal performance.

- Rising concerns over antibiotic use in animal feed propel the shift towards enzyme-based solutions.

- Technological advancements in enzyme production and formulation contribute to market expansion.

- Growing awareness of environmental sustainability encourages the adoption of enzymes to reduce livestock emissions and waste.

- Government regulations promoting animal welfare and food safety drive the market towards innovative feed solutions.

Global Animal Feed Enzymes Market: Regional Profile

- North America, driven by the United States and Canada, commands a significant market share owing to a robust livestock industry and a strong emphasis on animal nutrition.

- Technological advancements, coupled with a growing demand for high-quality meat products, fuel the adoption of feed enzymes to enhance animal performance and feed efficiency. Stringent regulations promoting sustainable farming practices further propel market growth in the region.

- Western Europe, led by countries like Germany, France, and the Netherlands, showcases a mature market with a focus on animal welfare and environmental sustainability.

- The region’s stringent regulations on antibiotic use in animal feed stimulate the adoption of enzymes as alternative solutions for enhancing digestibility and nutrient absorption in livestock diets. Increasing consumer awareness regarding food safety and quality drives the demand for enzyme-supplemented animal feeds.

- In East Asia, countries such as China, Japan, and South Korea witness rapid industrialization and urbanization, driving the expansion of the livestock sector.

- Rising disposable incomes and a growing demand for meat products amplify the need for efficient feed solutions, positioning animal feed enzymes as key components for improving feed conversion rates and reducing environmental impacts. Government initiatives to modernize agricultural practices and enhance food security contribute to the burgeoning market growth in the region.

Email Directly Here with Detail Information: sales@transparencymarketresearch.com

Animal Feed Enzymes Market: Competitive Landscape

The global animal feed enzymes market is witnessing intense competition driven by a surge in demand for enhanced feed efficiency and animal health. Key players such as Novozymes, DSM, AB Enzymes, and BASF dominate the landscape, offering a diverse portfolio of enzymes tailored to meet specific nutritional requirements.

Technological advancements and strategic collaborations characterize the competitive arena, with companies focusing on product innovation and expansion into emerging markets. Stringent regulations regarding feed quality and safety propel market players to invest in research and development, aiming to deliver superior enzyme solutions that optimize feed utilization and support sustainable animal production practices. Some prominent players are as follows:

- BASF SE

- Biolaxi Corporation

- Cargill, Incorporated

- DuPont de Nemours Inc.

- Novus International

- BIOMIN Holding GmbH

- Alltech Inc.

- Koninklijke DSM N.V.

- BioResource International,Inc.

- Novozymes

- AB Enzymes GmbH

- Bluestar Adisseo Co. Ltd.

- Enmex, S.A. de C.V.

- Kemin Industries

Product Portfolio

- BIOMIN Holding GmbH specializes in providing cutting-edge solutions for animal nutrition and health. With a focus on natural feed additives and mycotoxin risk management, BIOMIN ensures optimal animal performance and welfare. Through ongoing research and technological innovation, BIOMIN remains at the forefront of the feed industry, enhancing sustainability and profitability for farmers worldwide.

- Alltech Inc. is a global leader in animal health and nutrition, offering a comprehensive range of innovative products and solutions. With a commitment to science-based solutions, Alltech enhances animal performance, health, and welfare while promoting sustainability throughout the agricultural industry. Trusted by farmers worldwide, Alltech continues to drive positive change in animal nutrition.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1375<ype=S

Animal Feed Enzymes Market: Key Segments

By Form

By Product Type

- Phytase

- Carbohydrase

- Protease

By Animal Type

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

By Region

- North America

- Latin America

- Eastern Europe

- Western Europe

- Middle East & Africa

- South Asia

- East Asia

- Oceania

More Trending Reports by Transparency Market Research –

- Edible Insects for Animal Feed Market – The global edible insects for animal feed market (serangga yang dapat dimakan untuk pasar pakan ternak) is projected to advance at a CAGR of 38.9% from 2022 to 2031.

- Animal Feed Additives Market – The global animal feed additives market (pasar aditif pakan ternak) is projected to expand at a CAGR of 5.2% during the forecast period from 2021 to 2031.

- Philippines Starch Derivatives Market – The Philippines starch derivatives market (pasar turunan pati) is projected to grow at a CAGR of 5.3% from 2024 to 2034.

- Mushroom Market – The global mushroom market (pasar jamur) is estimated to grow at a CAGR of 8.4% from 2024 to 2032.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The $22.6 Trillion Crisis Neither Harris Nor Trump Mentioned, But It's The Top Concern For Millions Of Working Americans

There’s a massive $22.6 trillion crisis looming over American workers, and surprisingly, it’s barely making a ripple in the presidential debates. Social Security and Medicare – the lifelines of millions of Americans – are hanging by a thread, yet the candidates seem more interested in catchy sound bites than addressing this financial catastrophe.

Don’t Miss:

In Tuesday’s debate between Vice President Kamala Harris and former President Donald Trump, much was said about various issues, but not a word about the crumbling state of the U.S. federal budget. Trump’s outlandish comment, “They’re eating the pets,” went viral, but what millions of Americans care about more is how they’ll survive when Social Security runs dry.

According to the Social Security Administration trustees, the fund faces a $22.6 trillion shortfall. That’s not just a number – it’s the equivalent of $172,000 for every household in the country. Without significant changes, the Social Security Trust Fund is expected to run out of money by 2035. At that point, benefits could be slashed by 24.6%, leaving retirees in a serious bind.

Trending: The average American couple has saved this much money for retirement — How do you compare?

“The reality is, if we don’t act soon, Social Security will be a thing of the past,” warned one financial expert. And the numbers back that up. The Committee for a Responsible Federal Budget (CRFB) estimates that an average dual-income couple could lose about $16,500 a year in benefits if nothing is done.

According to Google Trends, Social Security was the most-searched issue during election week. One would expect this topic to be front and center during the debate, but the candidates didn’t dive into it. Harris and Trump insist they want to protect Social Security, but the specifics remain unclear.

Harris advocates for higher taxes on the wealthy, saying, “We need to ensure millionaires and billionaires pay their fair share.” The Biden administration has also pushed for a Social Security tax on incomes up to $400,000 for individuals and $450,000 for married couples filing jointly.

Trump, on the other hand, has been less specific. He denies Democrats’ accusations that he plans to cut benefits while vowing to cut taxes if reelected.

But Social Security isn’t the only elephant in the room. Medicare is facing its crisis, with a $2.4 trillion shortfall in the fund that pays for Medicare Part A benefits covering hospital bills – and that’s just the tip of the iceberg.

Trending: Teens may never need wisdom teeth removed thanks to this MedTech Company – Be an early investor for just $300 for 100 shares!

The future costs for Medicare Part B and Part D – covering doctor visits and prescription drugs – are rising even faster, and those costs are largely funded through taxes and government borrowing.

Last year alone, Medicare taxes brought in $367 billion, but the program spent $1 trillion. By 2048, taxes are projected to cover only one-fifth of the program’s costs. Where’s the rest of the money going to come from? More borrowing and even more taxes.

The U.S. national debt is already a staggering $34 trillion, and it’s expected to keep growing. For perspective, in 2000, the debt was $3.4 trillion – yes, it’s grown tenfold in just a generation.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article The $22.6 Trillion Crisis Neither Harris Nor Trump Mentioned, But It’s The Top Concern For Millions Of Working Americans originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

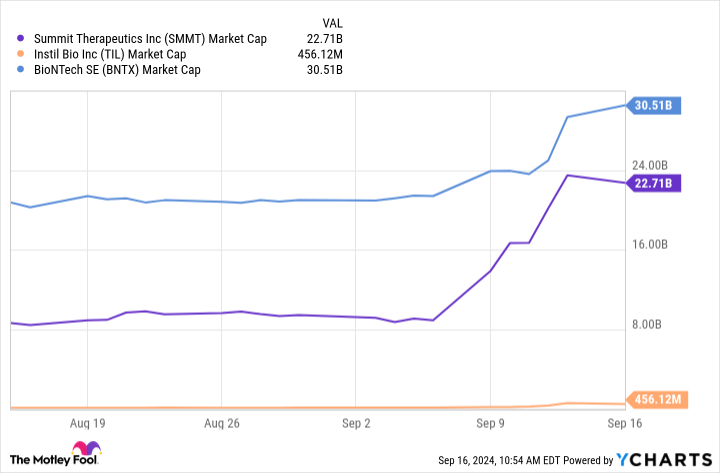

Here's Why Everyone's Talking About Summit Therapeutics

September has been an exciting time for investors with their fingers on the pulse of cancer drug development. In a nutshell, it looks like the world’s top-selling cancer therapy could have a serious competitor.

Sales of Keytruda from Merck reached $25 billion last year thanks to its position as a standard first line of treatment for most patients newly diagnosed with the most common form of lung cancer.

Biotech investors have been buzzing with enthusiasm for Summit Therapeutics (NASDAQ: SMMT) and its lead candidate, ivonescimab. Recently announced results from a clinical trial with frontline lung cancer patients showed ivonescimab reduced their risk of disease worsening by 49% compared to Keytruda monotherapy. That’s a big deal for Summit and a pair of companies that are also developing candidates similar to ivonescimab, Instil Bio (NASDAQ: TIL) and BioNTech (NASDAQ: BNTX).

Why Instil Bio and BioNTech are along for the ride

Keytruda is an antibody that binds to programmed death receptors (PD-1) on the surface of immune cells. This checkpoint is supposed to keep those cells from destroying healthy tissue, but tumor cells often hijack the system. By displaying a programmed death ligand (PD-L1) on their surface, tumor cells often shut down immune systems before they can do their job.

Keytruda is sometimes dosed in combination with a vascular endothelial growth factor (VEGF) inhibitor called Avastin. Instead of delivering two therapies, ivonescimab from Summit Therapeutics, IMM2510 from Instil Bio, and BNT327 from BioNTech are all bispecific antibodies that inhibit VEGF and the PD-1 checkpoint simultaneously.

|

Bispecific Antibody |

Chinese Owner |

Development Partner |

PD-1 Target |

VEGF Target |

Development Stage |

|---|---|---|---|---|---|

|

Ivonescimab |

Akeso |

Summit Therapeutics |

PD-1 |

VEGF-A |

Approved in China. Phase 3 in U.S. |

|

IMM2510 |

ImmuneOnco |

Instil Bio |

PD-L1 |

Multiple VEGF ligands |

Phase 2 |

|

BNT327 |

Biotheus |

BioNTech |

PD-L1 |

VEGF-A |

Phase 3 |

Table by author. Data sources: Summit Therapeutics, Instil Bio, and BioNTech.

Shares of Instil Bio and BioNTech have risen sharply since Summit shared phase 3 results that show a strong progression-free survival benefit versus Keytruda. While their candidates are similar to Summit’s, there are significant differences that could make them more or less effective.

In terms of market value, Instil Bio was circling the drain when Summit began announcing success with its bispecific PD-1/VEGF drug. Since Instil started from such a low point, the clinical-stage biotech’s stock price was able to shoot more than 500% higher in response to Summit’s news.

Time to buy?

Summit Therapeutics acquired rights to ivonescimab outside of China and Australia. With Keytruda sales up around $25 billion annually, it’s not hard to imagine blockbuster sales for a therapy that outperformed it in the important lung cancer setting.

There are a lot of expectations for ivonescimab already baked into Summit Health’s stock price. At last glance, it boasted a $22.7 billion market cap that could come crashing down if subsequent data for ivonescimab is anything less than spectacular.

While ivonescimab outperformed Keytruda monotherapy, Merck’s drug is usually combined with chemotherapy to treat lung cancer. We still don’t know how well ivonescimab stands up to Keytruda and other PD-1 drugs when they’re combined with chemotherapy.

Another important uncertainty regarding Summit is ivonescimab’s performance versus Keytruda plus Avastin. In theory, a bispecific antibody should be more effective than two traditional antibodies dosed simultaneously, but we can’t be certain without another clinical trial.

If investors want to bet on a bispecific PD-1/VEGF antibody, Instil Bio could be the better option. IMM2510 is in a much earlier stage of development, but Instil’s market cap of about $456 million at recent prices is tiny for a company that could have a blockbuster lung cancer drug in its pipeline.

Should you invest $1,000 in Summit Therapeutics right now?

Before you buy stock in Summit Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Summit Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Summit Therapeutics. The Motley Fool recommends BioNTech Se. The Motley Fool has a disclosure policy.

Here’s Why Everyone’s Talking About Summit Therapeutics was originally published by The Motley Fool

Why AT&T Stock Was a Market-Beater Today

The broader stock market might not have had a thrilling Monday, but there was plenty of action and interest in AT&T (NYSE: T) shares. The telecom company was the subject of hot speculation in the satellite broadcasting world, and investors bid up its share price by nearly 3% on the scuttlebutt. This was more than sufficient to crush the S&P 500 index’s performance, as the indicator closed only marginally higher.

An old merger idea revived?

After market hours Friday, Bloomberg reported that AT&T and its business partner TPG are holding discussions on a merger of their DirecTV satellite unit with Dish, currently owned by EchoStar. Citing unnamed “people familiar with the matter,” the financial news agency added that the talks are currently in an early stage.

Bloomberg said that unnamed spokespeople from both DirecTV and Bloomberg declined comment. TPG and EchoStar representatives also turned down similar requests.

DirecTV and Dish are the two largest satellite TV providers in this country. A merger would create a business with roughly 20 million customers, according to Bloomberg.

This is not the first time a tie-up of the two satellite entities has been floated. In 2002, the pair attempted a merger, but the U.S. Justice Department quashed it on antitrust grounds.

It’s a streaming world these days

These are not salad days for the satellite TV industry, as it’s largely been overshadowed by streaming video. Subscription plans in the highly competitive streaming space can be very inexpensive compared to traditional pay TV offerings like satellite; presumably, a marriage of DirecTV and Dish would result in synergies that could bring down costs (and reduce those subscription rates).

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why AT&T Stock Was a Market-Beater Today was originally published by The Motley Fool

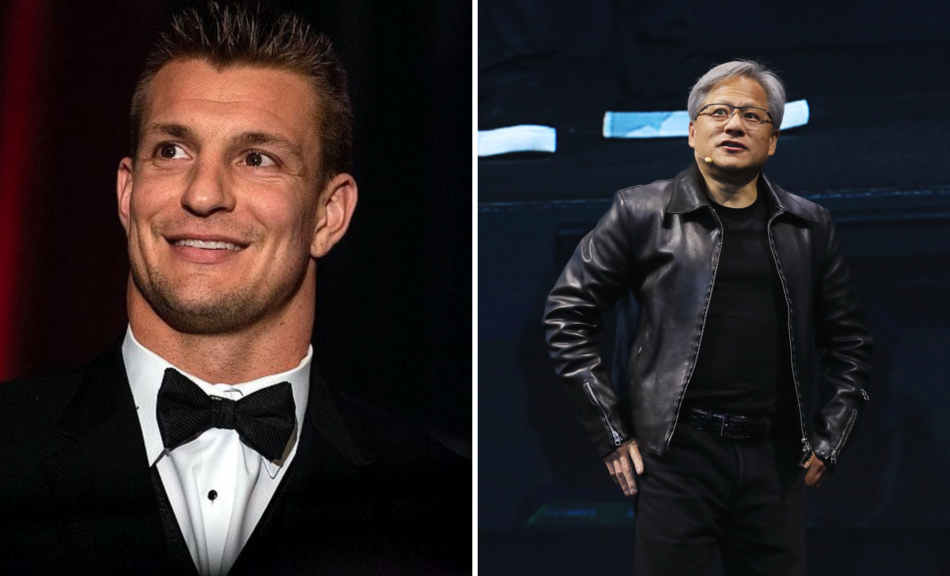

Gronk Spike? Did Rob Gronkowski Save The Stock Market? New Chart Shows Potential, But Jensen Huang Would Like A Word

Rob Gronkowski is best known for his time in the National Football League, but his recent call of timing the bottom in the stock market might be a welcome sign during the often losing month of September.

What Happened: Gronkowski offered a sense of urgency to get stock market prices back up last week after the S&P 500, which is tracked by the SPDR S&P 500 ETF Trust SPY, started the week down.

The former NFL star, who won four Super Bowls during his 11-year NFL career with the New England Patriots and Tampa Bay Buccaneers, was featured in a live television interview sharing his financial takes.

“I want to bring the stock market back. I heard it’s down right now with the election thing and everything that’s going on. So I’m here at Cantor Fitzgerald to do some trades. I want to do the biggest trades of the day and bring that stock market so it’s just moving back, you know, back up to the sky,” Gronkowski said.

Tker founder Sam Ro shared the chart below on Gronkowski’s comments and the S&P 500 move shortly after.

What followed in the days after Gronkowski spoke was the S&P 500 trading higher. The index was up Wednesday, Thursday and Friday. On Monday, the S&P 500 also traded up.

So was Gronkowski the good luck charm the stock market needed as September came in with a whimper?

Not exactly.

Wednesday saw the release of CPI data and the stock market reacted negatively with the S&P 500 going down 1.6% before finishing the day 1.1% higher, as shared by Freedom Capital Markets Chief Global Strategist Jay Woods in his weekly newsletter.

Woods said Wednesday marked the largest intraday comeback since November 2022, which he said is coincidentally “about the same time this current bull market began.”

The market strategist, like many financial experts and analysts, attributed the rally on Wednesday to positive comments from NVIDIA Corp NVDA CEO Jensen Huang while speaking at the day’s Goldman Sachs Communacopia and Technology Conference.

“That led to an 8% rally in one of the most influential stocks in the market and continued to rally the rest of the week. In fact, the semiconductor and technology sectors had their best week of the year,” Woods said.

Woods said Gronkowski timed the market “just right.”

“I’ll let the readers decide if it was more of a Jensen Huang-led rally or Gronk. Either way, the markets held the lows set a week ago Friday and finished last week at its highs.”

Did You Know?

Why It’s Important: While the chart above points to Gronkowskis’ timing, the likely reason for the stock market optimism last week was Nvidia and Huang.

Huang spoke of strong AI demand, no Blackwell (AI chip) delays and the potential return on investment for companies buying products from Nvidia.

The comments sparked optimism for Nvidia and the overall stock market.

The SPDR S&P 500 ETF is now up 4.2% from its low of $539.96 on Sept. 11. With a closing price of $562.84 on Monday (Sept. 16), the stock market index ETF is now almost even with the August closing price of $563.68.

The weak open to September could soon be a thing of the past thanks to Huang and Gronkowski.

Read Next:

Photo: Ron Gronkowski, Public Domain, Chairman of the Joint Chiefs of Staff from Washington D.C, U.S. via Wikimedia Commons; Jensen Huang via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Artificial Intelligence (AI) Colossus Nvidia Plummet 98%?

For the better part of two years, no trend has excited investors more on Wall Street than the rise of artificial intelligence (AI).

The lure of AI is twofold. First, there’s the ability for AI-driven software and systems to learn over time without human intervention. The capacity for software and systems to become more proficient at their tasks, or perhaps even learn new jobs/skill sets, gives this technology utility in almost every sector and industry around the globe.

The other reason investors can’t seem to get enough of AI stocks is the eye-popping addressable market attached to this game-changing technology. According to the researchers at PwC, AI is forecast to add $15.7 trillion to the global economy by 2030, with these gains coming from a combination of consumption-side benefits and productivity improvements.

With a seemingly limitless ceiling for AI and an addressable market that dwarfs pretty much every other next-big-thing innovation for three decades, it’s not a surprise to see investors flock to AI colossus Nvidia (NASDAQ: NVDA). Just be mindful that not everyone on Wall Street expects Nvidia to maintain its lofty valuation.

Nvidia’s ascent has been virtually textbook

When 2022 came to a close, Nvidia had a $360 billion market cap and was an important, but not critical, company in the tech sector. Less than 18 months later, it briefly became the largest publicly traded company in the world, with a peak market cap of $3.46 trillion.

Nvidia’s historic gains are a reflection of the otherworldly demand for its H100 graphics processing unit (GPU) used in high-compute data centers. Based on estimates from the analysts at TechInsights, Nvidia has accounted for a roughly 98% share of the GPUs shipped to data centers in 2022 and 2023. In other words, its hardware is being relied on as the undisputed preferred choice for training large language models (LLMs) and running generative AI solutions.

In addition to its hardware being in high demand, Nvidia’s CUDA software platform is doing its part to keep enterprises loyal to its ecosystem of products and services. CUDA is the toolkit developers use to build LLMs and maximize the computing capacity of their Nvidia GPUs.

There’s also plenty of excitement surrounding future innovation. Nvidia’s next-generation Blackwell chip, which will be far more energy-efficient than its predecessor, is set for its debut in the coming months. CEO Jensen Huang also teased the release of his company’s Rubin GPU architecture in 2026, which will run on a new processor, known as Vera. Investing in innovation makes it likely that Nvidia will maintain its No. 1 spot in terms of AI-GPU computing capacity.

Despite this array of positives, big-time Nvidia bears do exist.

Could Nvidia plunge 98%?

Perhaps no Nvidia skeptic has been more vocal on Wall Street than financial writer and economist Harry Dent.

In an interview with Fox News Digital in June, Dent highlighted that the mammoth increase in money supply has set the U.S. economy and stock market up for disaster. He referred to the current market as the “bubble of all bubbles,” with Nvidia expected to be a victim of an upcoming crash. Dent pegged Nvidia’s potential decline at 98%. Dent further opined,

This bubble has been going for 14 years. Instead of most bubbles [going] five to six, it’s been stretched higher, longer. So you’d have to expect a bigger crash than we got in 2008 to ’09.

As an Nvidia bear myself, I don’t expect it to come anywhere close to a 98% downdraft.

Although we have witnessed a couple of next-big-thing market leaders eventually plummet by 98%, including Canopy Growth following the hype in cannabis stocks, and 3D Systems, which has lost just shy of 98% of its value after 3D-printing buzz failed to materialize, a 98% peak-to-trough loss for a market leader is rare.

Furthermore, Nvidia had other established sales channels in place prior to its AI revenue windfall. It’s a leading provider of GPUs used in gaming and cryptocurrency mining, and should enjoy steady gains from its virtualization software segment. While these now-ancillary operations won’t offset substantial weakness if the AI bubble were to burst, they’d almost certainly keep Nvidia from losing 98% of its value.

But even though a 98% decline isn’t in the cards, a sizable drop that could extend beyond 75% is quite possible.

Dent is right about one thing: History

Although Harry Dent’s call for a 98% plunge in Nvidia may be out in left field, he did hit the nail right on the head when discussing history. While history doesn’t repeat to a “t” on Wall Street, it does have a tendency to rhyme.

Since the advent of the internet roughly three decades ago, every highly touted innovation, technology, and trend has worked its way through an early stage bubble-bursting event. Though the timing of when the music stops will differ in every instance, the end result is always the same — market leaders getting pummeled.

Without fail, investors overestimate the utility and uptake of game-changing innovations and technologies. While artificial intelligence appears to have a bright long-term future, the fact that most businesses lack a well-defined game plan to profit in the near-term from their AI investments is a pretty clear indication that investor expectations are vastly outpacing real-world utility. In other words, it points to the formation of an AI bubble.

The vast majority of market-leading businesses for game-changing innovations over the last 30 years have shed 75% or more of their value on a peak-to-trough basis.

There are other potential concerns, too. For instance, insiders have been selling stock for 45 months without a single insider purchase. Though there are benign reasons for selling stock, such as for tax purposes, there’s only one reason to purchase shares on the open market — you think they’ll increase in value. No insider has bought shares of Nvidia on the open market since Chief Financial Office Colette Kress in December 2020.

It’s also logical to expect Nvidia’s monopoly like AI-GPU market share to come under pressure in the quarters that lie ahead. The interesting thing is that internal competition might be even more worrisome than the AI-GPUs its rivals are bringing to market.

Nvidia’s four largest customers by net sales are all internally developing AI-GPUs for use in their data centers. Even with Nvidia’s chips having superior computing capacity, these four customers will likely be incented to utilize their own hardware over Nvidia’s. This is a recipe for fewer orders in the future.

Although a 98% decline is highly unlikely for Nvidia, a steep drop still appears very likely.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends 3d Systems. The Motley Fool has a disclosure policy.

Will Artificial Intelligence (AI) Colossus Nvidia Plummet 98%? was originally published by The Motley Fool

Recent Price Trend in Recruit Holdings Co. is Your Friend, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Recruit Holdings Co., Ltd.

RCRRF is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. RCRRF is quite a good fit in this regard, gaining 24.3% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 15.2% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, RCRRF is currently trading at 97% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in RCRRF may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

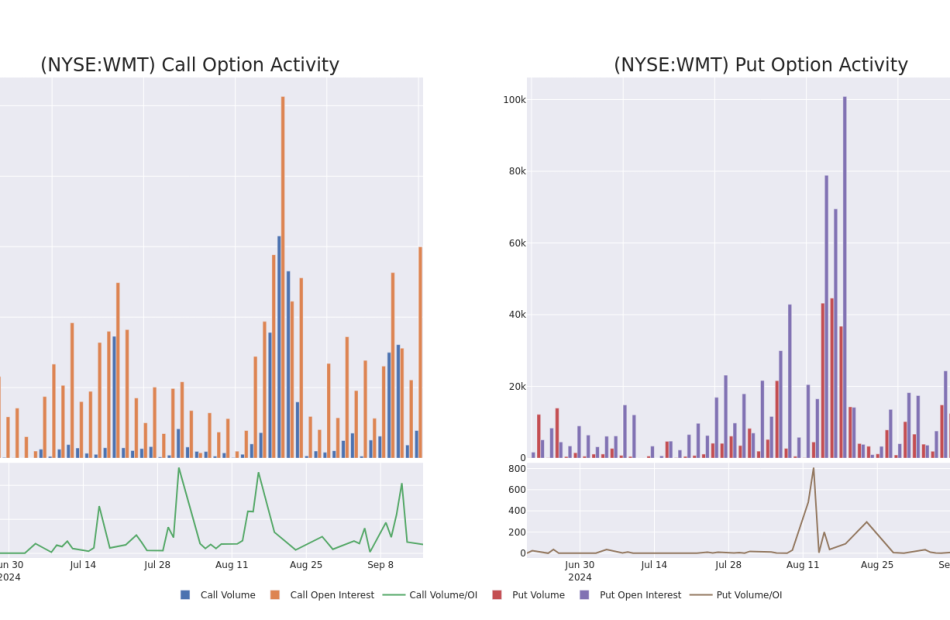

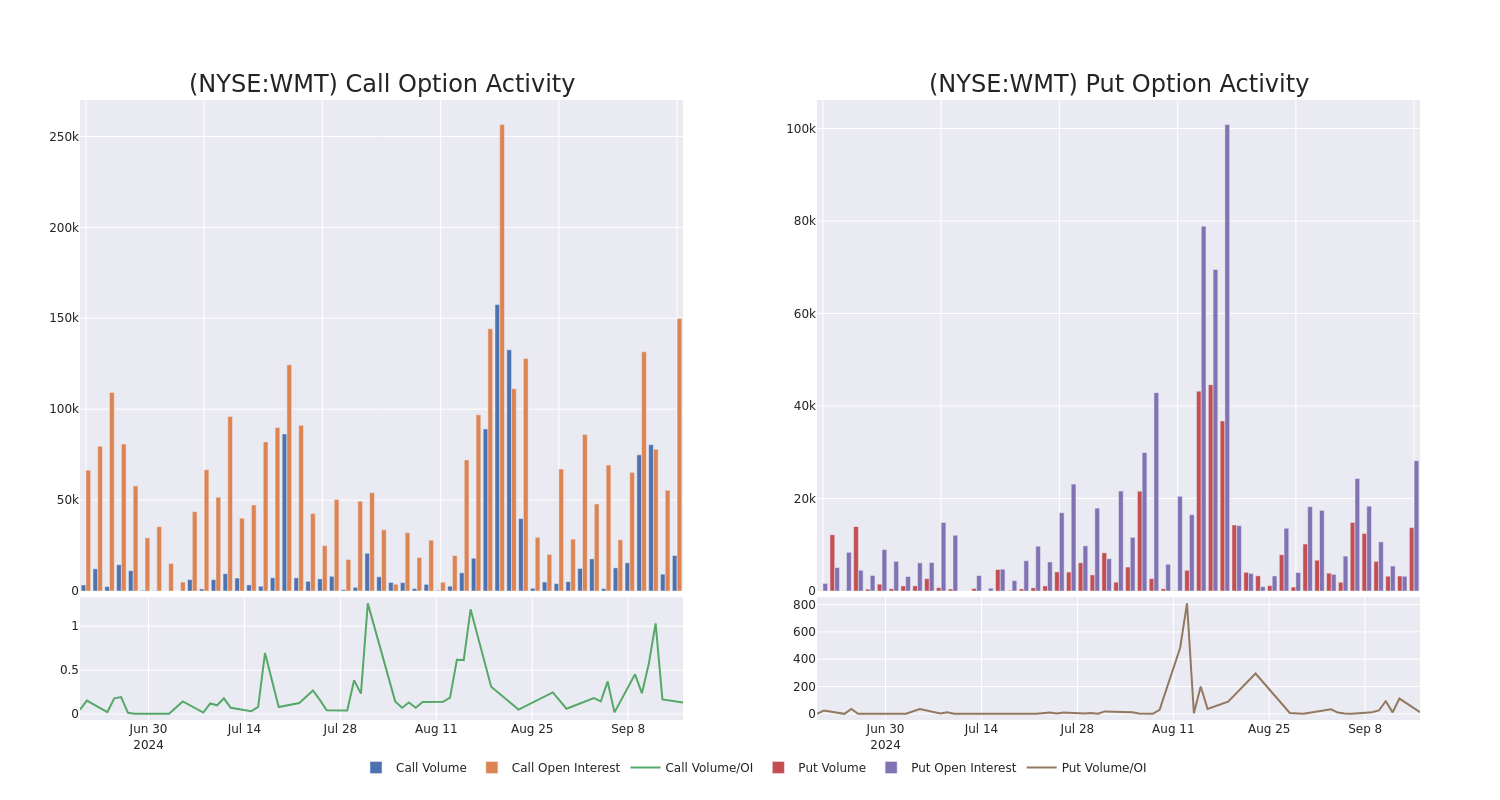

Walmart Unusual Options Activity For September 16

Deep-pocketed investors have adopted a bearish approach towards Walmart WMT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 52 extraordinary options activities for Walmart. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 28% leaning bullish and 55% bearish. Among these notable options, 11 are puts, totaling $538,393, and 41 are calls, amounting to $2,894,884.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $46.67 to $115.0 for Walmart over the recent three months.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walmart’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walmart’s whale trades within a strike price range from $46.67 to $115.0 in the last 30 days.

Walmart Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | TRADE | BEARISH | 03/21/25 | $22.15 | $21.95 | $22.02 | $60.00 | $220.2K | 481 | 330 |

| WMT | CALL | SWEEP | BULLISH | 03/21/25 | $22.5 | $21.95 | $21.95 | $60.00 | $219.5K | 481 | 130 |

| WMT | CALL | TRADE | BULLISH | 01/17/25 | $21.6 | $21.6 | $21.6 | $60.00 | $216.0K | 6.2K | 251 |

| WMT | CALL | SWEEP | BULLISH | 01/17/25 | $21.65 | $21.35 | $21.53 | $60.00 | $215.3K | 6.2K | 151 |

| WMT | CALL | TRADE | BULLISH | 01/17/25 | $21.5 | $21.5 | $21.5 | $60.00 | $215.0K | 6.2K | 451 |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Having examined the options trading patterns of Walmart, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Walmart

- Trading volume stands at 15,333,543, with WMT’s price down by -0.05%, positioned at $80.56.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 59 days.

Expert Opinions on Walmart

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $85.0.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Walmart with a target price of $80.

- An analyst from Jefferies has decided to maintain their Buy rating on Walmart, which currently sits at a price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walmart options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.