3 High-Yield Dividend Stocks Down by More Than 39% to Buy Now and Hold at Least a Decade

With the major stock market indices up near all-time highs, finding stocks that pay satisfying dividend yields isn’t nearly as easy as it used to be. Before you give up, though, consider Brookfield Renewable Partners (NYSE: BEP), Royalty Pharma (NASDAQ: RPRX), and Bristol Myers Squibb (NYSE: BMY).

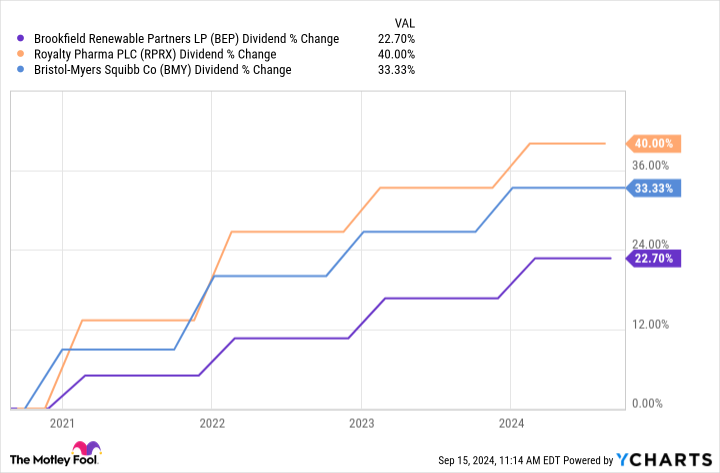

Since 2020, these three dividend payers have increased their quarterly payouts between 22.7% and 40% higher. Despite the increased payments, their stock prices are way down from the all-time highs they reached in 2021.

Rising dividend payments coupled with sinking share prices is a recipe for high yields. At recent prices, these stocks offer dividend yields that are way above average. Here’s why investors can look forward to steadily climbing payouts from these three exceptional stocks for at least another 10 years.

Brookfield Renewable Partners

If you’re looking for businesses that can steadily raise their payouts, the utilities sector is right up your alley. Instead of focusing on fossil fuels, though, consider Brookfield Renewable Partners. At recent prices, it offers a 5.4% dividend yield. That’s more than four times the average yield of dividend payers in the benchmark S&P 500 index.

The stock is down about 37% from an all-time high it reached a few years ago, but its dividend payout is up by about 22.7% since 2020. At recent prices, it offers a juicy 5.4% yield.

As its name implies, Brookfield Renewable invests in sources of hydroelectric, wind, solar, and nuclear power. Investors seeking a steadily growing source of income love this stock because its customers tend to sign contracts that last decades and include inflation-adjusted rate increases.

In addition to steadily climbing demand for electricity from consumers, Brookfield Renewable investors can look forward to steady gains driven by a long development pipeline for corporate customers. In the second quarter alone, it inked agreements to deliver an additional 2,700 gigawatt hours per year of generation, around 90% of which was contracted to corporate customers.

Royalty Pharma

Sales for individual products can be highly unpredictable, but overall spending on prescription drugs is rising steadily. Americans spent $405 billion on prescription drugs in 2022, which was 8.4% more than they spent a year earlier.

With a financial stake in more than 35 commercial-stage products, Royalty Pharma is arguably the safest way to bet on steadily rising demand for new drugs.

Shares of Royalty Pharma are down about 38% from the all-time high they reached in 2021 even though its dividend payout has risen by 40% since 2020. At recent prices, the stock offers a 3% dividend yield.

This specialty financier’s recent results are a lot more encouraging than you’d expect after looking at its stock chart. Second-quarter royalty receipts jumped 11% higher year over year. The company expects royalty receipts to reach at least $2.7 billion this year, or 9% more than it reported last year.

Royalty Pharma isn’t resting on the 35 commercial-stage products that are already generating revenue. In the first half of 2024, the company announced about $2 billion worth of new transactions. They can’t all be zingers, but there are probably enough blockbusters in its rapidly growing portfolio to keep pushing its needle forward in the decade ahead.

Bristol Myers Squibb

Shares of Bristol Myers Squibb, a pharma giant more than a century old, have fallen about 39.4% from their peak a few years ago. The stock is down even though the company has raised its dividend every year since 2009.

A rapidly growing portfolio will allow Bristol Myers Squibb to raise its dividend in the years ahead, too. In the first half of 2023, five drugs in Bristol Myers Squibb’s portfolio rose more than 10% year over year. The company is also recording sales for three new cancer therapies that earned approval from the FDA in 2024. Breyanzi is a cellular therapy for advanced lymphoma, Krazati is a targeted colon cancer treatment, and Augtyro is approved to treat just about anyone with solid tumors driven by an NTRK gene mutation.

Any day now, Bristol Myers Squibb could also receive a green light for a highly anticipated anti-psychotic treatment called KarXT. If approved, it will be the first anti-psychotic drug that doesn’t act on dopamine receptors. With far fewer side effects that make adherence to recommended dosage schedules a challenge, KarXT sales are expected to top $10 billion annually at their peak.

Bristol Myers Squibb’s dividend raises in recent years haven’t been small ones. The drugmaker’s quarterly payout is up by 46% since 2019. At recent prices, the stock offers a big 4.9% dividend yield. With a large slate of recently launched drugs, and potential blockbusters in late-stage development, this company could keep raising its payout for another 15 years.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks Down by More Than 39% to Buy Now and Hold at Least a Decade was originally published by The Motley Fool

Tecnoglass Is a Great Choice for 'Trend' Investors, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Tecnoglass

TGLS is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. TGLS is quite a good fit in this regard, gaining 56.6% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 13.4% over the past four weeks ensures that the trend is still in place for the stock of this architectural glass maker.

Moreover, TGLS is currently trading at 97.1% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in TGLS may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Monday Maneuvers: Ark Invest Continues To Offload Robinhood And Palantir Shares

On Monday, Cathie Wood-led Ark Invest made significant trades, with Robinhood Markets Inc HOOD and Palantir Technologies Inc PLTR being the most prominent.

The HOOD Trade: Ark Invest’s Ark Fintech Innovation ETF ARKF fund sold 18,961 shares of Robinhood in a trend that continues from the previous week. This move follows Robinhood’s recent agreement to a $3.9 million settlement with California’s Department of Justice over its past ban on Bitcoin BTC/USD cryptocurrency withdrawals.

Despite this, Robinhood has been transitioning from a meme stock trading platform to a more mature and competitive player against traditional brokerages. Based on Robinhood’s closing price of $22.21 on the same day, the value of the trade is approximately $421,123.

The PLTR Trade: Ark Invest’s ARK Innovation ETF ARKK fund sold 4,407 shares of Palantir. The firm had been offloading Palantir shares last week as well.

This sale after Palantir’s stock soared by 14.08% following the announcement that the company will join the S&P 500 index. Based on Palantir’s closing price of $36.31 on the same day, the value of the trade is approximately $160,018.

Other Key Trades:

- Ark Invest’s ARKG fund bought shares of Guardant Health Inc (GH).

- Ark Invest’s ARKG fund sold shares of Veracyte Inc (VCYT). Ark Invest’s ARKK fund bought shares of Shopify Inc (SHOP).

- Ark Invest’s ARKK fund sold shares of Roku Inc (ROKU). Ark Invest’s ARKQ fund sold shares of Materialise NV (MTLS).

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morgan Stanley lays out the stock market's best-case scenario for this week's Fed decision — and 2 areas to buy after the cut

-

Ideally the Fed will cut rates by a half-point without triggering growth worries, Morgan Stanley says.

-

CIO Mike Wilson noted that the bond market is acting like the Fed is behind the curve.

-

He said defensive and quality stocks are worth owning after the rate cut on Wednesday.

Wall Street is bracing for a pivotal interest-rate-cut announcement on Wednesday, and there’s still uncertainty around how far the Federal Reserve will go.

As of Monday morning, the CME FedWatch tool showed the market is pricing in a 59% chance of a 50-basis-point cut. According to new research from Morgan Stanley, that would be the best possible outcome for stocks. But there’s a caveat: it has to cut a half-point and keep the market from worrying about economic growth.

“In the very short-term, we think the best case scenario for equities this week is that the Fed can deliver a 50bp rate cut without triggering either growth concerns or any remnants of the yen carry trade unwind—i.e., purely an “insurance cut” ahead of macro data that is assumed to stabilize,” chief investment officer Mike Wilson wrote in a Monday note.

In the months leading to the Federal Reserve’s policy meeting this week, deteriorating labor data has persuaded investors that the central bank needs to start reducing borrowing costs to avert an economic cooldown.

In Morgan Stanley’s view, the Fed might want to cut by 50 basis points, as the bond market indicates that monetary policy is behind the curve: if interest rates stay for higher for longer, they risk rupturing something in the economy.

At the same time, some analysts have noted that an aggressive cut could be the Fed’s way of acknowledging trouble in the economy.

Ahead of the rate cut, Morgan Stanley suggested that investors increase exposure to two stock cohorts that have historically outperformed in similar environments: defensive and high-quality.

Part of the reason is due to rising growth concerns. Although the S&P 500 index is signaling high conviction that the Fed will deliver a soft landing and 15% earnings-per-share growth into 2025, market internals show a different story: investors are piling into defensive stocks in fear of a deceleration.

In this context, the performance defensive over cyclicals has been the strongest since the last recession, Wilson noted. Defensive stocks include sectors such as utilities and consumer staples — groups that are less reliant on macroeconomic conditions to perform well.

“Defensives tend to outperform cyclicals fairly persistently both before and after the cut. Large caps also tend to outperform small caps both before and after the Fed’s first rate cut. These last 2 factor dynamics are supportive of our defensive and large cap bias as Fed cuts often come in a later cycle environment,” Morgan Stanley said.

Read the original article on Business Insider

GTLB Class Action Alert – Shareholder Rights Law Firm Robbins LLP Reminds Stockholders of the Lead Plaintiff Deadline in the GitLab Inc. Class Action Lawsuit

SAN DIEGO, Sept. 16, 2024 (GLOBE NEWSWIRE) —

Robbins LLP reminds investors that a shareholder filed a class action on behalf of all investors who purchased or otherwise acquired GitLab Inc. GTLB securities between June 6, 2023 and March 4, 2024. GitLab is a global software company that designs and develops software solutions.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that GitLab Inc. (GTLB) Misled Investors Regarding Demand for its Product

According to the complaint, during the class period, defendants created the false impression that they possessed reliable information pertaining to the Company’s ability to develop and incorporate AI throughout the software development cycle to optimize code generation thereby increasing market demand and making all levels of software development more affordable and properly monetizing its AI features. In truth, there was weak market demand for Gitlab’s touted AI features and the Company was incurring an increasing amount of expenses involving JiHu, its joint venture in China, as well as the annual company-wide summit. Defendants misled investors by continually highlighting its AI-driven innovations to develop software more efficiently and drive market share demands.

Plaintiff alleges that on March 4, 2024, GitLab issued a press release reporting strong Q1 2024 results and then immediately followed this with a disclosure announcing lower than expected full-year guidance for 2025. GitLab attributed it to time needed to “build pipeline and close deals on new products.” On this news, the price of GitLab’s common stock declined from $74.47 per share on March 4, 2024, to $58.84 per share on March 5, 2024, a decline of about 21%.

What Now: You may be eligible to participate in the class action against GitLab Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by November 4, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against GitLab Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0b88c72f-afbc-4f12-932d-44bb72bd4f8d

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fathom Holdings Settles Commission Lawsuits

CARY, N.C., Sept. 16, 2024 /PRNewswire/ — Fathom Realty, a wholly owned subsidiary of Fathom Holdings Inc. FTHM, a national, technology-driven, end-to-end real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings for brokerages and agents, today announced that it has reached a nationwide settlement related to claims asserted in Burnett v. The National Association of Realtors., et al.

While we believe the settlement amount is immaterial in GAAP terms, Fathom Holdings is disclosing the details in the spirit of transparency. As part of the settlement, Fathom Realty will pay $500,000 into a settlement fund within 5 days after the settlement is formally approved by the court, $500,000 on or before October 1st, 2025, and $1,950,000 on or before October 1st, 2026. The Company believes that it has, and will generate, adequate funds to make these payments without compromising its business.

Fathom Realty has also agreed to adhere to the rule changes put forth by the National Association of REALTORS.

“Fathom Realty was founded on the principle of delivering unparalleled support to our agents. We believe that this settlement represents the most prudent way forward, enabling our agents to focus on their clients without the distraction of prolonged litigation,” stated Fathom Holdings CEO, Marco Fregenal. “Our unwavering commitment to providing excellent service to our agents, clients, and customers remains steadfast. As we proceed, it is important to note that this settlement is not an admission of liability or an acknowledgment of the validity of any claims made against us. We continue to assert that Fathom never participated in any conspiracy to inflate commissions and continue to believe that due to our flat-fee model, there was no incentive to join any such conspiracy. Entering into a settlement now has the benefits of avoiding ongoing legal fees and removing the demand on the executive team’s time, allowing us to focus on growing our business and ensuring our agents continue to have the opportunity to excel in their service to clients.”

About Fathom Holdings Inc.

Fathom Holdings Inc. is a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings to brokerages and agents by leveraging its proprietary cloud-based software, intelliAgent. The Company’s brands include Fathom Realty, Encompass Lending, intelliAgent, LiveBy, Real Results, and Verus Title. For more information, visit www.FathomInc.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains “forward-looking statements,” made pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including: liquidity risk and the possibility the Company might have to raise more money; risks related to acquisitions and the integration of acquisition; risks related to general economic conditions, including interest rates; risks in effectively managing rapid growth in our business; reliance on key personnel; competitive risks; and the other risk factors set forth from time to time in our SEC filings, copies of which are available on the SEC’s website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Contact:

Matt Glover

Gateway Group, Inc.

949-574-3860

FTHM@gateway-grp.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-settles-commission-lawsuits-302249468.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-settles-commission-lawsuits-302249468.html

SOURCE Fathom Holdings Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

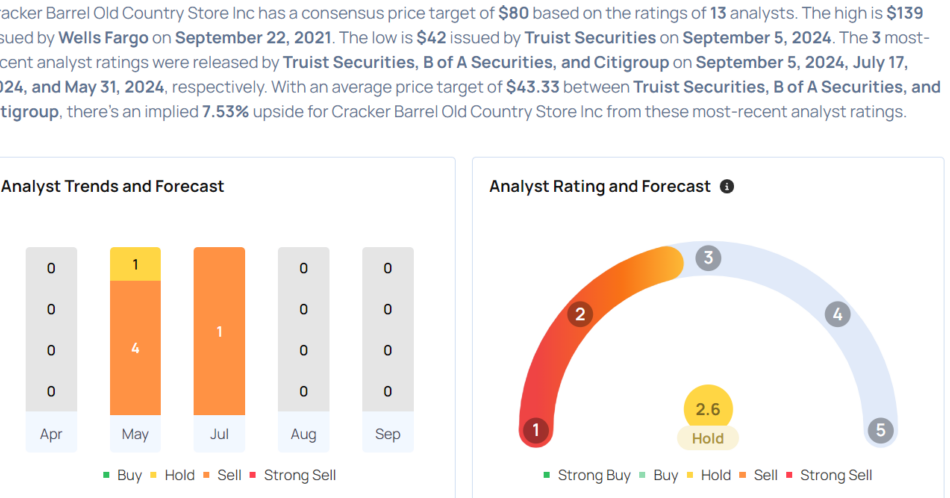

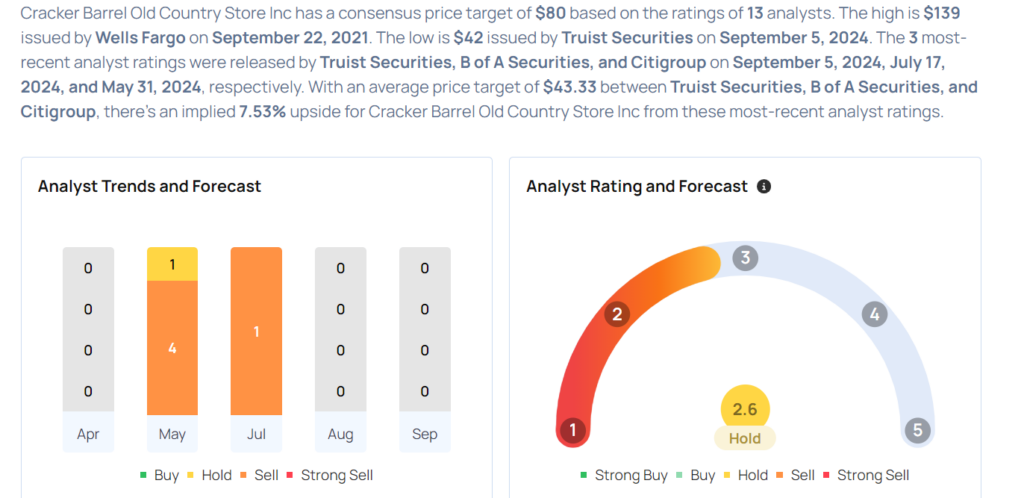

Cracker Barrel Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Cracker Barrel Old Country Store, Inc. CBRL will release earnings results for its fourth quarter, before the opening bell on Thursday, Sept. 19.

Analysts expect the Lebanon, Tennessee-based company to report quarterly earnings at $1.10 per share, down from $1.79 per share in the year-ago period. Cracker Barrel projects to report quarterly revenue of $897.38 million for the quarter, compared to $836.73 million a year earlier, according to data from Benzinga Pro.

On July 18, Cracker Barrel named Sarah Moore as new Chief Marketing Officer.

Cracker Barrel shares rose 3.1% to close at $40.45 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Truist Securities analyst Jake Bartlett maintained a Hold rating and cut the price target from $46 to $42 on Sept. 5. This analyst has an accuracy rate of 74%.

- Argus Research analyst Jim Kelleher downgraded the stock from Buy to Hold on Aug. 6. This analyst has an accuracy rate of 73%.

- B of A Securities analyst Sara Senatore maintained an Underperform rating and cut the price target from $48 to $46 on July 17. This analyst has an accuracy rate of 61%.

- Citigroup analyst Jon Tower maintained a Sell rating and cut the price target from $48 to $42 on May 31. This analyst has an accuracy rate of 70%.

- Piper Sandler analyst Brian Mullan maintained a Neutral rating and cut the price target from $75 to $70 on March 4. This analyst has an accuracy rate of 78%.

Considering buying CBRL stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Pfizer Stock Going to $36? 1 Wall Street Analyst Thinks So.

It was a rock star during the coronavirus pandemic, but Pfizer (NYSE: PFE) hasn’t been the most exciting company in 2024. Its stock has become something of a value play, at least according to one analyst who released a fresh research note based on meetings with company management. He feels the stock has upside potential that’s comfortably in the double-digit percentages. Here’s why.

An enthusiastic bull

BMO Capital’s Evan David Seigerman recently reiterated his outperform (i.e., buy) recommendation on Pfizer. He also maintained his $36-per-share price target on the well-known healthcare stock, which anticipates a gain of nearly 20% over the next 12 months. The meetings that led to the recommendation came in the form of non-deal roadshows hosted by BMO that included private conferences between company managers and institutional investors.

Of these, Seigerman wrote, “We came away from the meetings with a sense of motivated self-awareness,” on Pfizer’s part. He feels the company has a sensible strategy to regain its footing somewhat after the years of the COVID-19 pandemic when Comirnaty (co-developed with German peer BioNTech) was a vaccine used to fight the disease.

Solid potential

Seigerman’s takeaway from those meetings is that Pfizer will emphasize the development of pipeline drugs in segments such as oncology and weight loss, and elevate the importance of profit and loss management, among other measures.

Might such efforts reap gains in the very near future? Collectively, the analysts tracking the stock seem to think so. On average, they’re modeling a nearly 5% growth in revenue for the full-year 2024, to over $61 billion. Profitability should see a more dramatic improvement, with an estimated 43% year-over-year leap to $2.63 per share.

I feel that the sluggishness in Pfizer’s stock price derives from investors expecting another Comirnaty, and being impatient that the company hasn’t lately developed a new world-beating product. Yet its pipeline looks busy, and there are more than a few drugs that could make quite the impact if and when commercialized. I’d agree with Seigerman that this stock is undervalued, and more than worthy of a buy.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends BioNTech Se. The Motley Fool has a disclosure policy.

Is Pfizer Stock Going to $36? 1 Wall Street Analyst Thinks So. was originally published by The Motley Fool

Dow Jumps Over 200 Points Ahead Of Fed Meeting: Investor Sentiment Improves But Fear & Greed Index Remains In 'Neutral' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, while the index remained in the “Neutral” zone on Monday.

U.S. stocks settled higher on Monday, with the Dow Jones index gaining more than 200 points during the session. Major indices recorded gains last week, with the S&P 500 gaining 4% and the Nasdaq adding 5.9%. The Dow also climbed 2.6% last week.

Apple Inc. AAPL shares fell 2.8% on Monday following reports suggesting that the company is experiencing lower-than-expected demand for the iPhone 16 series. Shares of Nvidia Corp. NVDA fell around 2% during the session.

The Fed is scheduled to meet Tuesday and Wednesday and is widely expected to cut interest rates.

On the economic data front, the NY Empire State Manufacturing Index rose to 11.5 in September, recording the highest level since April 2022, versus -4.7 in August and market estimates of -3.9.

Most sectors on the S&P 500 closed on a positive note, with communication financials, energy, and materials stocks recording the biggest gains on Monday. However, information technology and consumer discretionary stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 228 points to 41,622.08 on Monday. The S&P 500 rose 0.13% to 5,633.09, while the Nasdaq Composite fell 0.52% at 17,592.13 during Monday’s session.

Investors are awaiting earnings results from Ferguson Enterprises Inc. FERG today.

What is CNN Business Fear & Greed Index?

At a current reading of 50.7, the index remained in the “Neutral” zone on Monday, versus a prior reading of 47.5.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ocean Power Technologies, Inc. Announces First Quarter Fiscal 2025 Results

MONROE TOWNSHIP, N.J., Sept. 16, 2024 (GLOBE NEWSWIRE) — Ocean Power Technologies, Inc. (“OPT” or “the Company”) OPTT, today announced financial results for its fiscal first quarter ended July 31, 2024 (“Q125”), which included year over year reductions in operating expenses, operating loss, and cash burn.

Recent Financial and Operational Highlights:

Operating expenses of $4.9 million for Q125 decreased 39% as compared to operating expenses of $8.1 million for the same period in the prior year (“Q124”) reflecting previously disclosed restructuring and streamlining activities. Use of cash for operating activities of $6.1 million for Q125 decreased 23% as compared to operating expenses of $8.0 million for Q124 reflecting previously disclosed restructuring and streamlining activities.

- The Company’s pipeline at approximately $92 million, as of July 31, 2024, is the largest in the Company’s history, continues to grow, and reflects an increase in defense and security activity as well as an expansion of commercial opportunities. This compared to approximately $85 million for Q124.

- The Company’s backlog at July 31, 2024 was 5.3 million, a 71% increase over the backlog of $3.1 million at July 31, 2023, reflecting our previously announced efforts in Latin America and the Middle East.

- In September 2024 we announced that we had received a further contract by the Naval Postgraduate School (NPS) in Monterey, California. This contract, which supports revenue generation in the near-term, adds to the deployment of OPT’s PowerBuoy® as part of an ongoing initiative to enhance maritime domain awareness and connectivity in Monterey Bay and demonstrate the use of PowerBuoys® for multi-domain drone and communication integration. Building on the success of the previously announced NPS contract, which included installing AT&T 5G technology on a PowerBuoy®, this new order focuses on integrating advanced subsea sensors into a PowerBuoy® equipped with OPT’s latest Merrows™ suite for AI capable seamless integration of Maritime Domain Awareness (MDA) across platforms and utilizing communication technologies from AT&T for NPS. The PowerBuoy® will provide carbon free, renewable energy for continuous, autonomous monitoring and data collection in one of the world’s most strategically significant maritime environments.

- In August 2024 we announced the signing of the latest of four new reseller agreements targeted at supporting global critical services. These agreements include opportunities for partnering with allied nations in areas like the South China Sea, previously announced efforts in Latin America and the Middle East and serving global commercial markets. These partnerships provide leverage to proactively serve the demand for our autonomous maritime technologies in geographies remote from OPT. We believe these partnerships will diversify our geographical market and further accelerate our growth and drive new revenue streams.

- In August 2024 we announced a patent pending for our docking and recharging buoy technology, specifically designed for the WAM-V. This advanced system has already been successfully demonstrated, showcasing its potential to revolutionize the operational efficiency and endurance of autonomous surface vessels. This development aligns with our broader strategy to enhance the functionality and versatility of our Merrows™ Platform bringing artificial intelligence capable solutions to the ocean, thereby expanding our market reach, and supporting a greater range of customer needs.

- In July 2024 we announced the signing of a reseller agreement with Geos Telecom, a prominent provider of maritime communication and navigation solutions in Costa Rica. This partnership marks a significant expansion of our presence in the Latin American market. We believe this agreement not only enhances our footprint in Latin America but also enables us to deliver advanced USV capabilities to a new customer base.

- In July we announced we had been awarded a contract for immediate delivery of a PowerBuoy equipped with Merrows™ in the Midde East. We had previously announced our selection as a preferred supplier for our Merrows™ equipped buoys in the region. We believe this order for a solar and wind powered system highlights our ability to provide carbon free, renewable Merrows™ platforms in most all marine environments across the globe. Offering field tested technology solutions as complementary building blocks makes it possible for our customers to integrate WAM-Vs and PowerBuoys into their operations and to put configurable ocean intelligence into their hands.

- In July 2024 we announced the signing of a reseller agreement with Survey Equipment Services, Inc. (“SES”), a specialist in the supply of Marine Survey and Navigation equipment. The agreement focuses on the provision of WAM-Vs, in the USA. This agreement allows us to leverage SES’s offering of survey and navigation equipment and deploy WAM-Vs to SES’s customer base. This partnership serves to further accelerates our growth and enables additional revenue stream.

- In July 2024 we announced a partnership with Unique Group (“Unique”), a UAE headquartered global innovator in subsea technologies and engineering, offering multiple products and services to customers in a range of industry sectors. Unique has more than 600 employees and 20 operational bases around the world. Unique Group will collaborate to deploy our WAM-V in the UAE and other countries in the Gulf Collaboration Council (“GCC”) region. Integrating our commercially available vehicles with Unique’s leading position in the offshore energy industry in the UAE will accelerate the adoption of USVs in the region. Working with Unique Group will further facilitate our efforts to deploy USVs globally.

- In June 2024 we announced the signing of an OEM agreement with Teledyne Marine, a division of Teledyne Technologies Inc. (“Teledyne”), a key supplier in maritime technologies inclusive of connectors, instruments, and vehicles. This strategic partnership aims to enhance our product offerings and drive innovation within the industry providing customers with a turnkey system. This agreement allows us to leverage Teledyne’s best-in-class offerings to deliver superior sensor and ocean technology products to our customers. We believe this partnership will accelerate our growth and enable additional revenue streams.

- In June 2024 we announced we had launched our Global 24/7 Service Support (“Services”). We were already servicing its Artificial Intelligence Capable Maritime Domain Awareness Solution, Merrows™, in regions such as Latin America and Sub-Saharan Africa. The new Services offering gives customers the opportunity for 24/7 support with tiered options to maintain operations around the globe. This new Services offering enables our customers to choose from a menu of options and determine the most cost-effective way to operate our PowerBuoys and USVs. It also positions us to add additional recurring revenues to our ongoing growth.

Recent Technological Advancements:

- In September 2024 we announced that we completed more than four months of offshore testing of our Next Generation PowerBuoy® (“PB”) in the Atlantic Ocean off New Jersey. The solar and wind power equipped Next Generation PB was equipped with OPT’s proprietary Artificial Intelligence capable Merrows™ suite of solutions. The system maintained 100% data uptime and the state of charge of the batteries remained over 90% throughout the deployment. During the deployment, several Intelligence, Surveillance, and Reconnaissance demonstrations for potential customers were completed.

- In May 2024 the Company announced it was approaching 15MWh of renewable energy production from its family of PB. The recent launch of its Next Generation PB off the coast of New Jersey has materially accelerated average energy production by combining solar, wind, and wave energy production capabilities. The energy generation numbers are based on deployments in the Atlantic, Pacific, Mediterranean, and North Sea. OPT has demonstrated and delivered use cases as a proven solution for Anti-Submarine Warfare, Intelligence, Surveillance, and Reconnaissance, USV Charging, and Environmental Sensing. These numbers show that non-grid connected marine energy production is not just for the R&D community but is a commercially available solution.

Management Commentary – Philipp Stratmann, OPT’s President and Chief Executive Officer

“We continue to make progress on our path towards profitability as evidenced by the continued growth in our pipeline, backlog, revenues, and gross margin. We have also made significant progress in stemming our losses, as evidenced by a material decrease in our operating costs. The previously announced substantial cessation of our R&D efforts and the realignment of our headcount to focus on execution has led to a reduction in payroll and engineering related expenditures, and we will continue to see further benefits of these efforts going forward. Our efforts to increase our backlog and pipeline in the defense and national security industry are paying off. Our recent contract wins with large government prime contractors enable us to provide autonomous vehicles and renewable energy buoys to various U.S. Government Agencies. In addition to these contract wins, we continue to deliver for our commercial customers, especially in the field of autonomous survey operations, enabling them to lower costs and carbon emissions. Additionally, our geographic footprint continues to expand, and we are seeing significant opportunities for growth in Latin America and the Middle East. Lastly, we continue to explore opportunities that will accelerate shareholder value generation, for example through resellers and partnerships in overseas locations, as we execute on our stated strategy, including cost optimization, accelerated revenue growth, partnerships, or other mechanisms.

FINANCIAL HIGHLIGHTS – Q125

Income Statement:

- Revenues for Q125 were $1.3 million, consistent with revenue recognized for Q124. Beginning in Q225, we expect higher levels of revenues and contributed backlog and bookings growth as near-term opportunities are realized. Trailing twelve-month revenue at July 31, 2024 was $5.6 million, a 70% increase over the trailing twelve-month revenue of $3.3 million at July 31, 2023.

- Gross profit and margin for Q125 was $0.5 million and 34%, respectively, as compared to $0.7 million and 52%, respectively, for Q124 reflecting an increase in lower margin pass through revenue for Q125.

- Operating expenses were $4.9 million in Q125, down from $8.1 million in Q124 and reflecting previously disclosed restructuring and streamlining activities.

- Net loss was $4.5 million for Q125, as compared to a net loss of $7.0 million for Q124. The year-over-year decrease in net loss was primarily driven by the decrease in operating expenses noted above.

Balance Sheet and Cash Flow

- Combined cash, restricted cash, cash equivalents and short-term investments as of July 31, 2024, was $3.3 million, consistent with the yearend balance at April 30th, 2024.

- Bank debt remained at $0 as of July 31, 2024.

- Net cash used in operating activities for the nine months ended Q125 was $6.1 million, compared to $8.0 million for the same period in the prior year. This reflects the decrease in operating expenses noted above, partially offset by the payment of the earnout related to our autonomous vehicles business due to the business exceeding expectations, investment in inventory to satisfy growing backlog, and payment of employment bonuses that were accrued during fiscal year 2024.

Conference Call & Webcast

As previously announced, a conference call to discuss OPT’s financial results will be held tomorrow morning, Tuesday September 17, 2024, at 9:00 a.m. Eastern Time. Philipp Stratmann, CEO, and Bob Powers, CFO will host the call.

- The dial-in numbers for the conference call are 877-407-8291 or 201-689-8345.

- Live webcast: Webcast | Ocean Power Technologies FY2025 Q1 Earnings Conference Call (choruscall.com)

- Call Replay: Call replay will be available by telephone approximately two hours after the call’s completion. You may access the replay by dialing 877-660-6853 from the U.S. or 201-612-7415 for international callers and using the Conference ID 13748550.

- Webcast Replay: The archived webcast will be on the OPT investor relations section of its website

About Ocean Power Technologies

OPT provides intelligent maritime solutions and services that enable safer, cleaner, and more productive ocean operations for the defense and security, oil and gas, science and research, and offshore wind markets. Our PowerBuoy® platforms provide clean and reliable electric power and real-time data communications for remote maritime and subsea applications. We also provide WAM-V® autonomous surface vessels (ASVs) and marine robotics services. The Company’s headquarters is located in Monroe Township, New Jersey and has an additional office in Richmond, California. To learn more, visit www.OceanPowerTechnologies.com.

Non-GAAP Measures: Pipeline

Pipeline is not a term recognized under United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining pipeline may not be comparable to the methodologies used by other companies. Pipeline is a representation of the journey potential customers take from the moment they become aware of our products and service to the moment they become a paying customer. The sales pipeline is divided into a series of phases, each representing a different milestone in the customer journey. It is a tool we use to track sales progress, identify potential roadblocks, and make data-driven decisions to improve our sales performance. Revenue estimates derived from our pipeline can be subject to change due to project accelerations, cancellations or delays due to various factors. These factors can also cause revenue amounts to be realized in periods and at levels different than originally projected.

Forward-Looking Statements

This release may contain forward-looking statements that are within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by certain words or phrases such as “may”, “will”, “aim”, “will likely result”, “believe”, “expect”, “will continue”, “anticipate”, “estimate”, “intend”, “plan”, “contemplate”, “seek to”, “future”, “objective”, “goal”, “project”, “should”, “will pursue” and similar expressions or variations of such expressions. These forward-looking statements reflect the Company’s current expectations about its future plans and performance. These forward-looking statements rely on a number of assumptions and estimates that could be inaccurate and subject to risks and uncertainties. Actual results could vary materially from those anticipated or expressed in any forward-looking statement made by the Company. Please refer to the Company’s most recent Forms 10-Q and 10-K and subsequent filings with the U.S. Securities and Exchange Commission for further discussion of these risks and uncertainties. The Company disclaims any obligation or intent to update the forward-looking statements in order to reflect events or circumstances after the date of this release.

Financial Tables Follow

Additional information may be found in the Company’s Quarterly Report on Form 10-Q that has been filed with the U.S. Securities and Exchange Commission. The Form 10-Q is accessible at www.sec.gov or the Investor Relations section of the Company’s website (www.OceanPowerTechnologies.com/investor-relations).

Ocean Power Technologies, Inc., and Subsidiaries

Consolidated Balance Sheets

(in thousands, except share data)

| July 31, 2024 | April 30, 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 3,182 | $ | 3,151 | ||||

| Accounts receivable | 963 | 796 | ||||||

| Contract assets | 477 | 18 | ||||||

| Inventory | 5,681 | 4,831 | ||||||

| Other current assets | 785 | 1,747 | ||||||

| Total current assets | 11,088 | 10,543 | ||||||

| Property and equipment, net | 3,613 | 3,443 | ||||||

| Intangibles, net | 3,589 | 3,622 | ||||||

| Right-of-use assets, net | 2,198 | 2,405 | ||||||

| Restricted cash, long-term | 154 | 154 | ||||||

| Goodwill | 8,537 | 8,537 | ||||||

| Total assets | $ | 29,179 | $ | 28,704 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 1,741 | $ | 3,366 | ||||

| Earnout payable | 450 | 1,130 | ||||||

| Accrued expenses | 1,579 | 1,787 | ||||||

| Right-of-use liabilities, current portion | 926 | 774 | ||||||

| Contract liabilities | 445 | 302 | ||||||

| Total current liabilities | 5,141 | 7,359 | ||||||

| Deferred tax liability | 203 | 203 | ||||||

| Right-of-use liabilities, less current portion | 1,525 | 1,798 | ||||||

| Total liabilities | 6,869 | 9,360 | ||||||

| Commitments and contingencies (Note 14) | ||||||||

| Shareholders’ Equity: | ||||||||

| Preferred stock, $0.001 par value; authorized 5,000,000 shares, none issued or outstanding; 100,000 designated as Series A | — | — | ||||||

| Common stock, $0.001 par value; authorized 100,000,000 shares, issued 95,661,806 shares and 61,352,731 shares, respectively; outstanding 95,573,789 shares and 61,264,714 shares, respectively | 96 | 61 | ||||||

| Treasury stock, at cost; 88,017 and 88,017 shares, respectively | (369 | ) | (369 | ) | ||||

| Additional paid-in capital | 334,659 | 327,276 | ||||||

| Accumulated deficit | (312,031 | ) | (307,579 | ) | ||||

| Accumulated other comprehensive loss | (45 | ) | (45 | ) | ||||

| Total shareholders’ equity | 22,310 | 19,344 | ||||||

| Total liabilities and shareholders’ equity | $ | 29,179 | $ | 28,704 | ||||

Ocean Power Technologies, Inc., and Subsidiaries

Consolidated Statements of Operations

(in thousands, except per share data)

| Three months ended July 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | 1,301 | $ | 1,272 | ||||

| Cost of revenues | 854 | 609 | ||||||

| Gross margin | 447 | 663 | ||||||

| Operating expenses | 4,920 | 8,103 | ||||||

| Gain from change in fair value of consideration | — | (62 | ) | |||||

| Operating loss | (4,473 | ) | (7,378 | ) | ||||

| Interest income, net | 3 | 339 | ||||||

| Other income | 17 | — | ||||||

| Loss before income taxes | (4,453 | ) | (7,039 | ) | ||||

| Income tax benefit | — | — | ||||||

| Net loss | (4,453 | ) | (7,039 | ) | ||||

| Basic and diluted net loss per share | $ | (0.05 | ) | $ | (0.12 | ) | ||

| Weighted average shares used to compute basic and diluted net loss per common share | 81,951,002 | 58,723,076 | ||||||

Ocean Power Technologies, Inc., and Subsidiaries

Consolidated Statements of Cash Flows

(in thousands)

| Three months ended July 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (4,453 | ) | $ | (7,039 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation of fixed assets | 204 | 71 | ||||||

| Amortization of intangible assets | 33 | 40 | ||||||

| Amortization of right of use assets | 207 | 135 | ||||||

| (Accretion of discount)/amortization of premium on investments | — | (106 | ) | |||||

| Change in contingent consideration liability | — | (62 | ) | |||||

| Stock based compensation | 259 | 401 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (167 | ) | 15 | |||||

| Contract assets | (459 | ) | (141 | ) | ||||

| Inventory | (850 | ) | (686 | ) | ||||

| Other assets | 962 | 375 | ||||||

| Accounts payable | (1,625 | ) | 345 | |||||

| Earnout payable | (50 | ) | (500 | ) | ||||

| Accrued expenses | (207 | ) | (540 | ) | ||||

| Right-of-use liabilities | (121 | ) | (127 | ) | ||||

| Contract liabilities | 144 | (171 | ) | |||||

| Net cash used in operating activities | $ | (6,123 | ) | $ | (7,990 | ) | ||

| Cash flows from investing activities: | ||||||||

| Redemptions of short-term investments | — | 11,718 | ||||||

| Purchases of short-term investments | — | (6,612 | ) | |||||

| Purchases of property and equipment | (374 | ) | (133 | ) | ||||

| Net cash (used in)/provided by investing activities | $ | (374 | ) | $ | 4,973 | |||

| Cash flows from financing activities: | ||||||||

| Cash paid for tax withholding related to shares withheld | — | (2 | ) | |||||

| Proceeds from issuance of common stock – At The Market offering, net of issuance costs | $ | 6,528 | $ | — | ||||

| Net cash provided by/(used in) financing activities | $ | 6,528 | $ | (2 | ) | |||

| Net increase/(decrease) in cash, cash equivalents and restricted cash | $ | 31 | $ | (3,019 | ) | |||

| Cash, cash equivalents and restricted cash, beginning of period | $ | 3,305 | $ | 7,103 | ||||

| Cash, cash equivalents and restricted cash, end of period | $ | 3,336 | $ | 4,084 | ||||

| Supplemental disclosure of noncash investing and financing activities: | ||||||||

| Common stock issued related to bonus and earnout payments | $ | 630 | $ | 1,250 | ||||

Contact Information Investors: 609-730-0400 x401 or InvestorRelations@oceanpowertech.com Media: 609-730-0400 x402 or MediaRelations@oceanpowertech.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.