Roblox Unusual Options Activity For September 17

Deep-pocketed investors have adopted a bullish approach towards Roblox RBLX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RBLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 21 extraordinary options activities for Roblox. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 61% leaning bullish and 38% bearish. Among these notable options, 8 are puts, totaling $401,501, and 13 are calls, amounting to $581,946.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $60.0 for Roblox over the last 3 months.

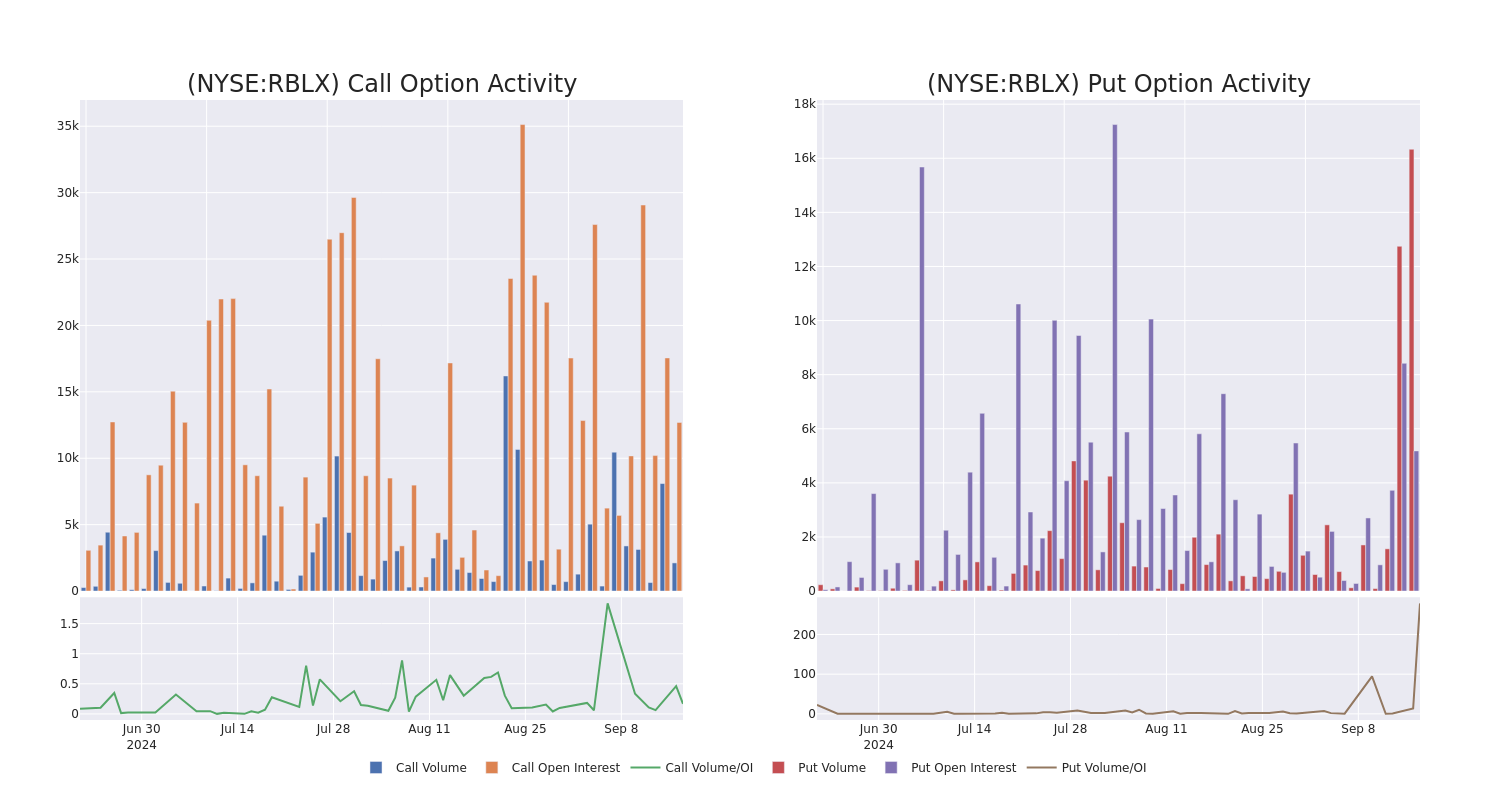

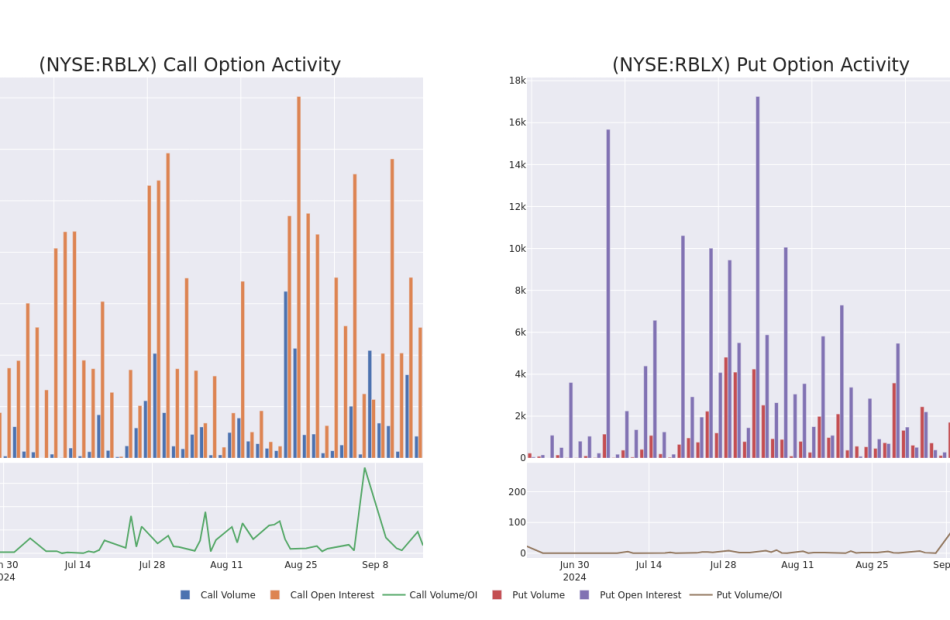

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Roblox’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Roblox’s substantial trades, within a strike price spectrum from $25.0 to $60.0 over the preceding 30 days.

Roblox Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BEARISH | 11/15/24 | $3.15 | $3.05 | $3.15 | $45.00 | $94.5K | 1.4K | 1.4K |

| RBLX | CALL | SWEEP | BEARISH | 01/17/25 | $21.75 | $21.7 | $21.75 | $25.00 | $82.7K | 1.8K | 40 |

| RBLX | CALL | TRADE | BULLISH | 06/20/25 | $3.7 | $3.45 | $3.6 | $60.00 | $72.0K | 515 | 200 |

| RBLX | PUT | SWEEP | BULLISH | 11/01/24 | $3.1 | $3.0 | $3.0 | $47.00 | $67.2K | 49 | 5.1K |

| RBLX | PUT | SWEEP | BULLISH | 10/18/24 | $1.63 | $1.53 | $1.53 | $45.00 | $61.2K | 3.0K | 74 |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

Current Position of Roblox

- Currently trading with a volume of 3,246,470, the RBLX’s price is down by -0.35%, now at $46.08.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 50 days.

What The Experts Say On Roblox

1 market experts have recently issued ratings for this stock, with a consensus target price of $51.0.

- Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Roblox, targeting a price of $51.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Roblox, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply