Stanley Black Exhibits Bright Prospects, Headwinds Persist

Stanley Black & Decker, Inc.‘s SWK cost-reduction program is expected to aid its bottom line and drive margin performance in the quarters ahead. The program comprises a series of initiatives to resize the organization, reduce inventory and optimize the supply chain with the goal of repositioning it to pursue sustainable long-term growth.

In the first six months of 2024 and since the inception of the program, SWK realized pre-tax run rate savings of $295 million and $1.3 billion, respectively. The savings were driven by lower headcount, reductions of indirect spending and supply-chain transformation.

Stanley Black has been divesting non-core operations to drive growth. In April 2024, the company divested its STANLEY Infrastructure (Infrastructure) business to Epiroc AB for a cash consideration of $760 million. The divestment will help the company to focus on its core businesses, reduce debt and support capital-allocation priorities.

It remains focused on rewarding its shareholders through dividend payments and share buybacks. In the first six months of 2024, the firm paid dividends of $243.6 million, up 1.7% year over year. It also bought back shares worth $7.7 million. In July 2024, SWK hiked its quarterly dividend by a penny to 82 cents per share.

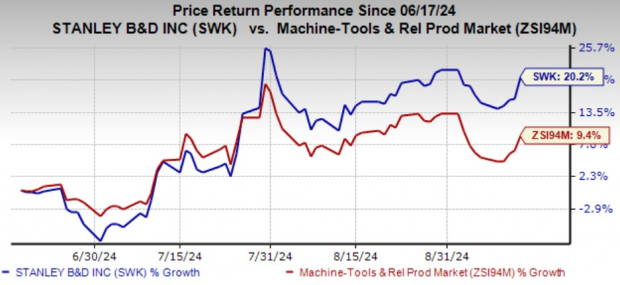

SWK’s Price Performance

Image Source: Zacks Investment Research

In the past three months, the Zacks Rank #3 (Hold) company has gained 20.2% compared with the industry’s 9.4% growth.

Despite the positives, lower consumer outdoor and do-it-yourself market demand is a concern for the Tools & Outdoor segment. Within the segment, the power tools business has been experiencing weaknesses due to reduced demand for consumer tools. Weakening automotive end markets, owing to headwinds in the global automotive OEM light vehicle production, are another setback.

Further, the low liquidity level remains a concern. Exiting the second quarter, the company’s cash and cash equivalents were $318.5 million, lower than the short-term borrowings of $492.4 million. Its current maturities of long-term debt totaled $500.1 million. This implies that SWK does not have sufficient cash to meet its current debt obligations. Also, the stock looks more leveraged than the industry. Its long-term debt/capital ratio is currently 0.39, higher than 0.36 of the industry.

Stocks to Consider

Some better-ranked companies from the same space are discussed below.

Flowserve Corporation FLS currently carries a Zacks Rank #2 (Buy).

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company CR presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.2%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply