TeraWulf Unusual Options Activity For September 16

Investors with a lot of money to spend have taken a bullish stance on TeraWulf WULF.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with WULF, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for TeraWulf.

This isn’t normal.

The overall sentiment of these big-money traders is split between 77% bullish and 22%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $200,000, and 8, calls, for a total amount of $321,625.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $3.5 and $5.0 for TeraWulf, spanning the last three months.

Volume & Open Interest Development

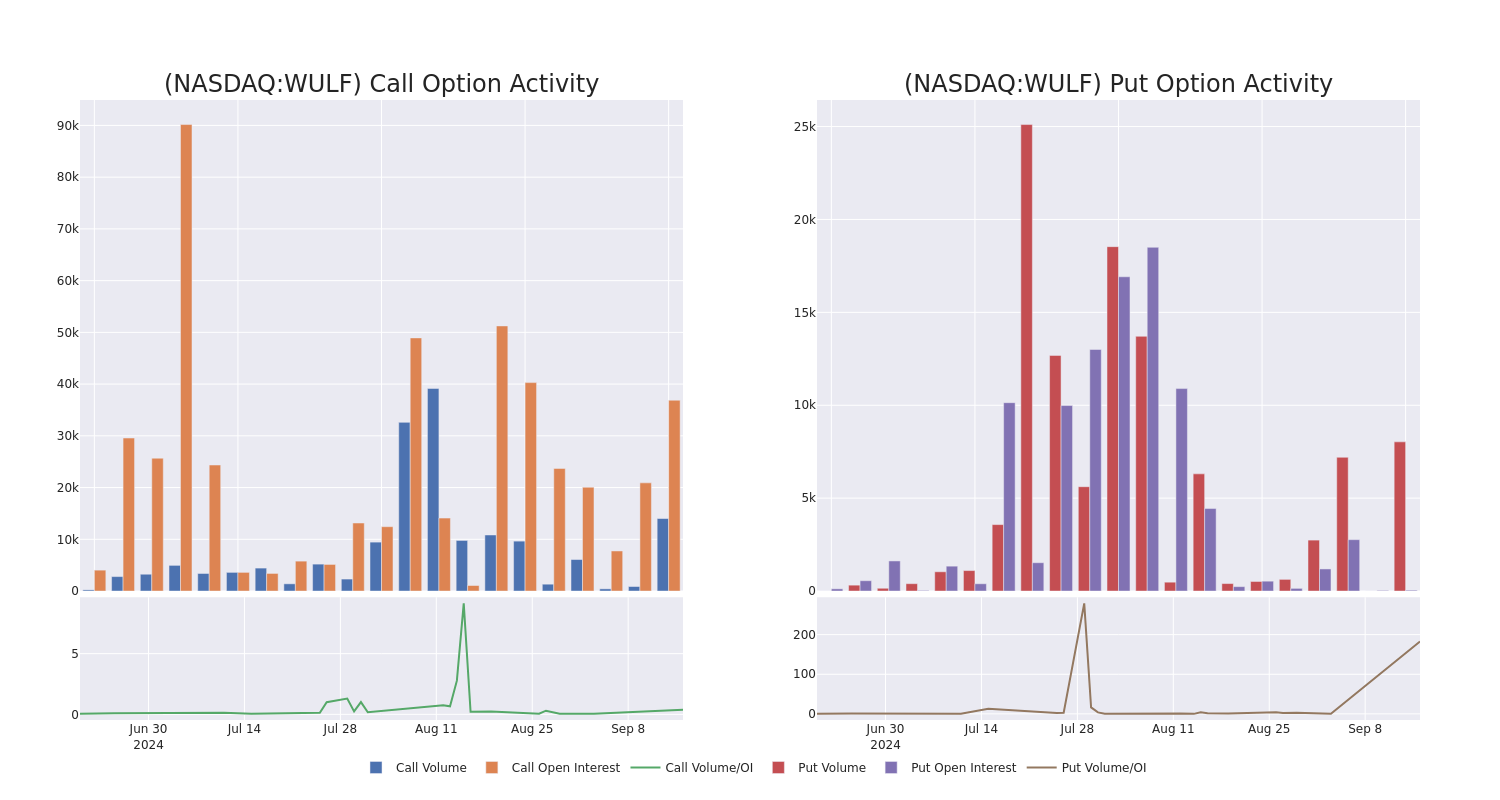

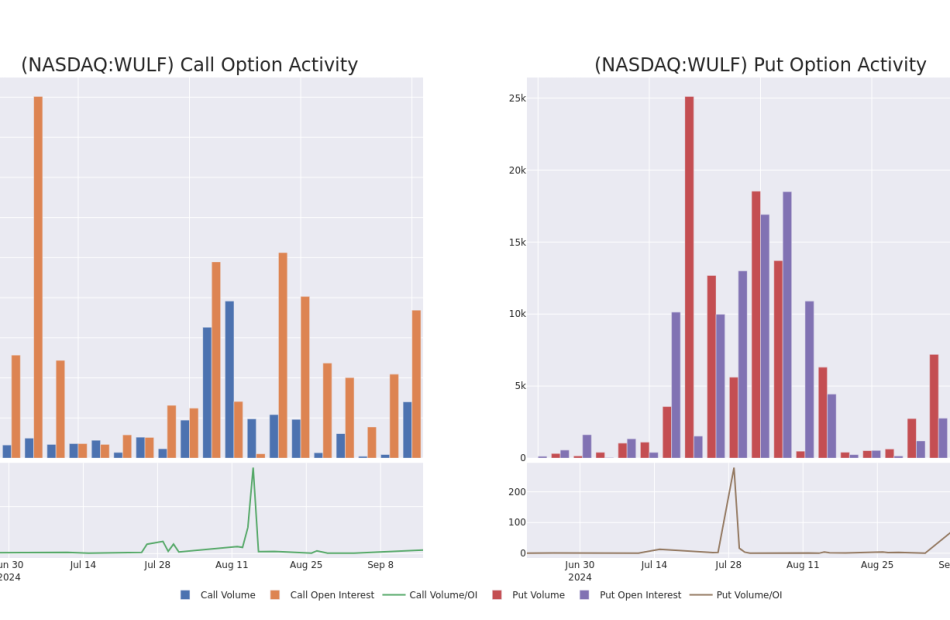

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for TeraWulf’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of TeraWulf’s whale trades within a strike price range from $3.5 to $5.0 in the last 30 days.

TeraWulf Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WULF | PUT | SWEEP | BULLISH | 10/25/24 | $0.35 | $0.25 | $0.25 | $3.50 | $200.0K | 44 | 8.0K |

| WULF | CALL | TRADE | BEARISH | 01/17/25 | $1.1 | $1.05 | $1.05 | $4.00 | $91.6K | 23.1K | 2.4K |

| WULF | CALL | SWEEP | BULLISH | 11/15/24 | $0.5 | $0.35 | $0.49 | $5.00 | $49.8K | 7.4K | 1.0K |

| WULF | CALL | TRADE | BULLISH | 09/20/24 | $0.15 | $0.1 | $0.15 | $4.00 | $40.0K | 5.3K | 2.7K |

| WULF | CALL | SWEEP | BEARISH | 09/20/24 | $0.15 | $0.1 | $0.15 | $4.00 | $34.1K | 5.3K | 4.9K |

About TeraWulf

TeraWulf Inc is a digital asset technology company that is engaged in digital infrastructure and sustainable energy development. The company’s primary focus is supporting environmentally conscious bitcoin mining operations by developing and operating facilities within the United States. The company’s bitcoin mining facilities are powered by clean, affordable, and reliable energy sources. The company’s primary source of revenue stems from the mining of bitcoin conducted at the company’s mining facility sites. Additionally, the company occasionally generates revenue through the provision of miner hosting services to third-party entities.

In light of the recent options history for TeraWulf, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of TeraWulf

- With a volume of 11,506,554, the price of WULF is down -6.25% at $3.98.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 56 days.

Professional Analyst Ratings for TeraWulf

3 market experts have recently issued ratings for this stock, with a consensus target price of $7.333333333333333.

- An analyst from B. Riley Securities persists with their Buy rating on TeraWulf, maintaining a target price of $6.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $10.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $6.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for TeraWulf with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply