Dow Jones Futures: Stock Market Reverses Lower Despite Big Fed Rate Cut; What To Do Now

Dow Jones futures rose modestly overnight, along with S&P 500 futures and Nasdaq futures, after volatile market action following the Federal Reserve rate cut.

The stock market initially jumped Wednesday afternoon as the Fed cut rates by 50 basis points, with the S&P 500 and Dow Jones hitting record high. But the major indexes erased strong gains to close modestly lower, even as Fed Chief Jerome Powell signaled more easing along with an economic soft landing.

↑

X

Fed Cuts Interest Rates By Half Point: What Traders Should Do Now

Nvidia (NVDA) fell back from its 50-day line. Apple (AAPL) rose but hit key resistance. Tesla (TSLA) flirted with an early entry but closed lower. Meta Platforms (META) also flirted with buy points before backing off.

Arista Networks (ANET) and DoorDash (DASH) are in buy zones.

Nvidia stock and DoorDash are on IBD Leaderboard. Nvidia and Arista stock are on the IBD 50.

Dow Jones Futures Today

Dow Jones futures rose 0.3% vs. fair value. S&P 500 futures climbed 0.5%. Nasdaq 100 futures popped 0.8%.

The Japanese yen weakened vs. the dollar. A strengthening of the yen — an unwinding of the yen-carry trade — has been a drag on U.S. and global markets in the past couple of months.

The 10-year Treasury yield rose a few basis points to 3.73%.

Crude oil futures fell 1%.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Fed Rate Cut And Powell’s ‘Commitment’

The Fed cut rates for the first time since the Covid crisis, with a big, half-point move. Gov. Michelle Bowman was the lone official dissenter, favoring a quarter-point cut. Shortly before the Fed decision, markets saw a 59% chance of a 50-basis-point cut and 45% for 25 basis points.

The “dot plot” of policymakers signaled a total of 100 basis points of easing in 2024, meaning 50 basis points over the November and December meetings. Markets had almost fully priced in 100 basis points of cuts for the year, with a majority expecting 125 basis points.

For 2025, policymakers see another 100 basis points of Fed rate cuts, bringing the key rate down to a 3.25%-3.5% range.

Powell, speaking after the central bank announcement, signaled he still envisions a soft landing, with continued, modest economic growth. He said the Fed isn’t behind the curve, with Wednesday’s big move “a sign of our commitment not to get behind.”

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally finished slightly lower with the major indexes losing solid advances after the Fed rate decision and Powell’s comments.

The Dow Jones Industrial Average fell 0.25% in Wednesday’s stock market trading and the S&P 500 index lost 0.3% after both set record intraday highs. The Nasdaq composite shed 0.3%. The small-cap Russell 2000 rose a fraction, erasing big intraday gains.

Keep in mind that the stock market had rallied over the past week in anticipation of a Fed rate cut, possibly a big move. So it’s not a shock to see the major indexes give up gains.

U.S. crude oil prices dipped 0.4% to $70.91 a barrel.

The 10-year Treasury yield rose 4 basis points to 3.685%. The two-year yield, more closely tied to Fed policy, edged up 1 basis point to 3.6%.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) climbed 0.5%. The iShares Expanded Tech-Software Sector ETF (IGV) fell 0.9%. The VanEck Vectors Semiconductor ETF (SMH) lost 1.1%. Nvidia stock is the largest SMH holding by far.

Reflecting more-speculative story stocks, ARK Innovation ETF (ARKK) rose 0.3% and ARK Genomics ETF (ARKG) dipped 0.2%. Tesla stock is a major holding across Ark Invest’s ETFs. Cathie Wood also has built up a big stake in NVDA stock.

SPDR S&P Metals & Mining ETF (XME) retreated 0.4%. The SPDR S&P Homebuilders ETF (XHB) and the Health Care Select Sector SPDR Fund (XLV) slipped 0.2%.

The Energy Select SPDR ETF (XLE) advanced 0.2%. The Industrial Select Sector SPDR Fund (XLI) nudged down 0.1%. The Financial Select SPDR ETF (XLF) gave up 0.3%.

Time The Market With IBD’s ETF Market Strategy

Tesla Stock

Tesla stock dipped 0.3% to 227.20 on Wednesday after briefly topping an aggressive entry of 235 Wednesday afternoon. TSLA stock has a 271 consolidation buy point, according to MarketSurge.

Tesla has a busy October ahead, with third-quarter deliveries (likely on Oct. 2), the robotaxi event on Oct. 10, and Q3 earnings on Oct. 16. Meanwhile, China EV maker Nio (NIO) will formally launch its Onvo L60 crossover on Thursday, with the Model Y rival is getting lot of buzz.

Nvidia Stock

Nvidia stock fell 1.9% to 113.42, now clearly below the 50-day moving average after hitting resistance at the key level intraday once again.

It has a 131.26 buy point from an ungainly handle. Investors could use last week’s high of 120.79 as an aggressive entry.

But right now NVDA stock needs to get back above the 50-day. It’s a bad sign for AI stocks, the Nasdaq and the broader market rally if Nvidia can’t get back above its 50-day.

Apple Stock

Apple rose 1.8% to 220.69, but backed off its 50-day line. The Dow Jones tech titan has a 237.23 buy point, but could have some early entries at 23.292 or even lower. But first AAPL stock has to retake the 50-day, even amid reports of lackluster orders for the new iPhone 16.

Meta Stock

Meta Platforms stock edged up 0.3% to 537.95. Intraday, shares got to 544.20, just above a 542.81 buy point and almost above a 544.23 alternate entry from a three-weeks-tight pattern.

Stocks In Buy Zones

Arista Networks stock gave up most of its intraday gains, closing up 0.2% to 361.71. That’s moving a little higher above a 358.68 buy point from a hard-to-spot handle.

DoorDash stock climbed 2% to 132.48, back above a 131.21 cup-with-handle buy point. Shares fell down to the 21-day line intraday Tuesday, but closed in the upper half of their range.

What To Do Now

The stock market was volatile after the Fed announcement and Powell’s comments. That is why IBD cautioned investors not too aggressive if the market initially looked on strong on the Fed news.

The market may continue to assess the big Fed news through Thursday or even Friday. Overnight futures point in that direction.

So investors may want to be cautious about new buys in the very short term, though there are stocks that are actionable.

Stepping back, the broader picture is positive. The S&P 500 and Dow Jones are at record highs while the Nasdaq is recovering.

Definitely be ready to act. Have your watchlists and exit strategies up to date.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Catch The Next Big Winning Stock With MarketSurge

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

The Gross Law Firm Reminds Shareholders of a Lead Plaintiff Deadline of September 30, 2024 in FIVE Lawsuit – FIVE

NEW YORK, Sept. 18, 2024 (GLOBE NEWSWIRE) — The Gross Law Firm issues the following notice to shareholders of Five Below, Inc. FIVE.

Shareholders who purchased shares of FIVE during the class period listed are encouraged to contact the firm regarding possible lead plaintiff appointment. Appointment as lead plaintiff is not required to partake in any recovery.

CONTACT US HERE:

https://securitiesclasslaw.com/securities/five-below-loss-submission-form/?id=103180&from=3

CLASS PERIOD: March 20, 2024 to July 16, 2024

ALLEGATIONS: According to the complaint, defendants provided investors with false and/or materially misleading information about FIVE’s financial strength and operations, including its outlook for the first quarter and full year 2024. This information included FIVE’s statement that net sales are expected to be in the range of $826 million to $846 million based on opening approximately 55 to 60 new stores in the first quarter. Further, FIVE claimed that net sales for the full year are expected to be in the range of $3.97 billion to $4.07 billion based on opening between 225 and 235 new stores. Investors discovered that these statements were false and/or materially misleading when, on June 5, 2024, FIVE announced disappointing first quarter 2024 sales result and cut its full year 2024 guidance stating, “Net sales are expected to be in the range of $3.79 billion to $3.87 billion based on opening approximately 230 new stores.” At the same time, FIVE claimed that for the second quarter, “Net sales are expected to be in the range of $830 million to $850 million based on opening approximately 60 new stores.” In response to the disclosure, FIVE’s stock price declined $14.07/per share within the span of just one day. On July 16, 2024, FIVE announced the resignation of Joel Anderson from his positions as President and Chief Executive Officer, as well as from his seat on the Company’s Board of Directors. Concurrently, FIVE projected a decrease of 6% to 7% in comparable sales for the fiscal second quarter ending August 3, 2024. Following this news, FIVE’s stock price dropped over 25% on July 17, 2024.

DEADLINE: September 30, 2024 Shareholders should not delay in registering for this class action. Register your information here: https://securitiesclasslaw.com/securities/five-below-loss-submission-form/?id=103180&from=3

NEXT STEPS FOR SHAREHOLDERS: Once you register as a shareholder who purchased shares of FIVE during the timeframe listed above, you will be enrolled in a portfolio monitoring software to provide you with status updates throughout the lifecycle of the case. The deadline to seek to be a lead plaintiff is September 30, 2024. There is no cost or obligation to you to participate in this case.

WHY GROSS LAW FIRM? The Gross Law Firm is a nationally recognized class action law firm, and our mission is to protect the rights of all investors who have suffered as a result of deceit, fraud, and illegal business practices. The Gross Law Firm is committed to ensuring that companies adhere to responsible business practices and engage in good corporate citizenship. The firm seeks recovery on behalf of investors who incurred losses when false and/or misleading statements or the omission of material information by a company lead to artificial inflation of the company’s stock. Attorney advertising. Prior results do not guarantee similar outcomes.

CONTACT:

The Gross Law Firm

15 West 38th Street, 12th floor

New York, NY, 10018

Email: dg@securitiesclasslaw.com

Phone: (646) 453-8903

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

10% Owner Of Impinj Makes $20.00M Buy

A notable insider purchase on September 16, was reported by SYLEBRA CAPITAL LLC, 10% Owner at Impinj PI, based on the most recent SEC filing.

What Happened: LLC demonstrated confidence in Impinj by purchasing 4,264,393 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the transaction is $20,000,003.

In the Tuesday’s morning session, Impinj‘s shares are currently trading at $186.62, experiencing a down of 0.0%.

About Impinj

Impinj Inc operates a platform that enables wireless connectivity to everyday items by delivering each item’s identity, location, and authenticity to business and consumer applications. Its platform includes endpoint integrated circuits (ICs) product, a miniature radios-on-a-chip, which attach to and identify their host items; and connectivity layer that comprises readers, gateways, and reader ICs to wirelessly identify, locate, authenticate, and engage endpoints via RAIN, as well as provide power to and communicate bidirectionally with endpoint ICs. Geographically, the company has a business presence in the Americas, Asia Pacific, Europe, Middle East and Africa, of which key revenue is derived from the operations in the Asia Pacific region.

Impinj’s Financial Performance

Revenue Growth: Impinj’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 19.2%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Key Profitability Indicators:

-

Gross Margin: With a high gross margin of 56.12%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Impinj exhibits below-average bottom-line performance with a current EPS of 0.36.

Debt Management: Impinj’s debt-to-equity ratio surpasses industry norms, standing at 2.51. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 643.52 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 17.4 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 177.31, Impinj demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Breaking Down the Significance of Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Impinj’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

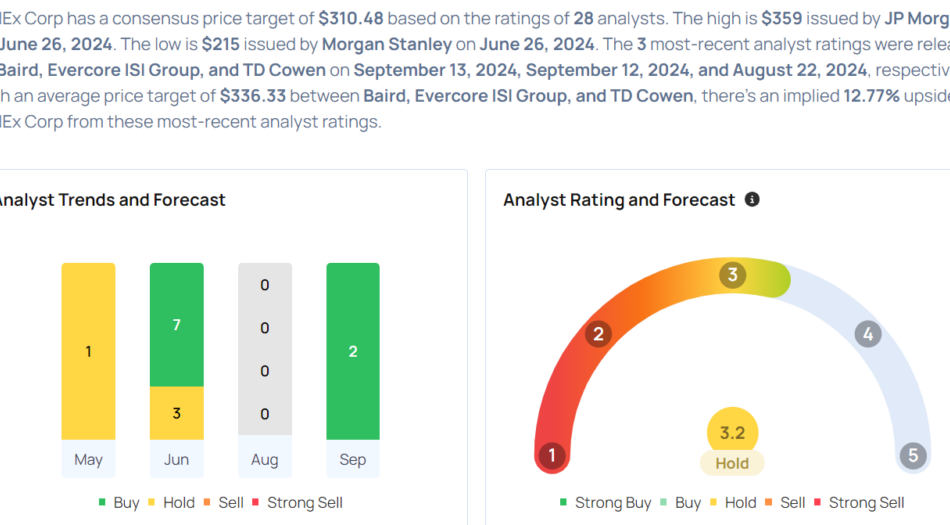

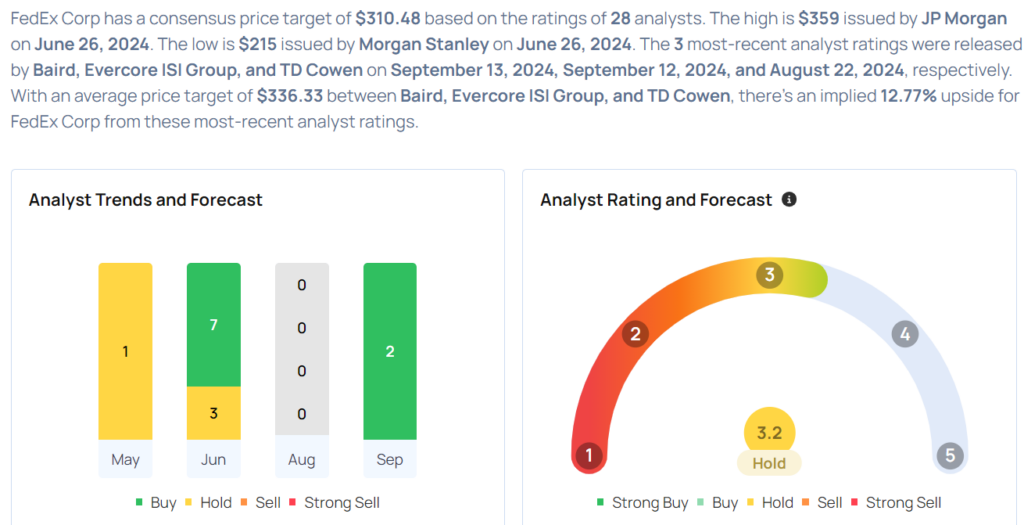

FedEx Gears Up For Q1 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

FedEx Corporation FDX will release earnings results for its first quarter, after the closing bell on Thursday, Sept. 19.

Analysts expect the company to report quarterly earnings at $4.83 per share, up from $4.55 per share in the year-ago period. The company projects to report revenue of $21.99 billion for the quarter, according to data from Benzinga Pro.

On Sept. 6, the Equal Employment Opportunity Commission (EEOC) sued FedEx, saying the global shipping and logistics company violated federal law by discriminating against its employees with disabilities.

FedEx shares rose 1.6% to close at $297.34 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Evercore ISI Group analyst Jonathan Chappell maintained an Outperform rating and cut the price target from $339 to $335 on Sept. 12. This analyst has an accuracy rate of 73%.

- Argus Research analyst John Eade maintained a Buy rating and raised the price target from $325 to $335 on June 27. This analyst has an accuracy rate of 74%.

- Raymond James analyst Patrick Tyler Brown maintained an Outperform rating and boosted the price target from $300 to $335 on June 26. This analyst has an accuracy rate of 80%.

- Wells Fargo analyst Christian Wetherbee maintained an Equal-Weight rating and raised the price target from $275 to $300 on June 26. This analyst has an accuracy rate of 74%.

- Stephens & Co. analyst Daniel Imbro reiterated an Overweight rating with a price target of $325 on June 26. This analyst has an accuracy rate of 78%.

Considering buying FDX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Expands Beyond China To India, Southeast Asia, Analyst Warns Of Margin Impact

Apple Inc. AAPL is doubling down on its “China+1” strategy, and the tech giant’s supply chain shake-up is more than just a whisper in the wind.

Apple’s India Ramp-Up Is Crucial

JPMorgan analyst Samik Chatterjee reveals that Apple’s production in India is gearing up to hit 20-25% of total iPhone units by 2027. While iPhone assembly margins in India are currently lower, they are “expected to improve over time as the scale of operations increase.”

The ramp-up in India is crucial, as it reflects Apple’s effort to diversify production away from China amid rising geopolitical tensions.

50% Of AirPods, Apple Watch Production To Move Outside China

Chatterjee’s analysis highlights that “AirPods and Apple Watch production outside China is increasing rapidly,” with projections showing non-Mainland China production exceeding 50% by 2024 for AirPods, and by 2027 for the Apple Watch.

This shift is part of Apple’s broader strategy to bolster production in Southeast Asia, notably in Vietnam, where lower-volume products like AirPods and the Apple Watch are finding a new home.

Yet, the supply chain transition is not without its hurdles. Component supply chains remain “largely in Mainland China,” and the overall relocation of components is “happening quite slowly.”

Key Beneficiaries Of The Supply Chain Shift

The shift is more pronounced in assembly, where Hon Hai Precision Industry Co Ltd and Luxshare Precision Industry Co Ltd are poised to benefit significantly from Apple’s diversification strategy. “We have seen strong growth for Hon Hai’s component revenue YTD, driven by increasing component supply in Apple products,” noted Chatterjee. Luxshare, in particular, is gaining ground and consolidating market share amid the ongoing shift in production.

Pegatron Corp, on the other hand, “should see muted revenue momentum, given the market share shift in the iPhone assembly business.”

Segmentation In iPhone EMS Landscape

The move to Southeast Asia and India is expected to create segmentation in the iPhone EMS landscape, with India’s contribution to iPhone assembly ramping up but facing initial challenges in margins due to lower scale.

The tech giant is also managing “a mild ramp-up in southeastern Asia” for MacBook assembly and a slower pace for iPad diversification, the analyst notes.

As Apple continues to reshape its supply chain, the benefits of this strategy are clear, though the transition involves navigating some bumpy roads. Investors should keep an eye on the evolving production dynamics and the impact on margins as Apple’s “China+1” strategy unfolds.

Read Next:

Photo: PradeepGaurs/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Steelcase Stock Falls After Q2 Revenue Miss: Details

Steelcase Inc. SCS shares are falling after the company reported its second-quarter financial results after Wednesday’s closing bell. Here’s a look at the details from the report.

The Details: Steelcase reported quarterly earnings of 39 cents per share, which beat the analyst consensus estimate of 37 cents. Quarterly revenue of $855.8 million missed the analyst consensus estimate of $864.1 million by 0.96%.

The company saw growth in the Americas, driven by higher volume from large corporate, education and government customers, while International business declined, primarily driven by continued weakness in China.

“Our business continued to improve this quarter as our adjusted earnings grew 26% and we drove 3% order growth in the Americas,” said Sara Armbruster, president and CEO. “Our education business had especially strong results this quarter, which reflected the benefits of our strategy to diversify the customers and markets we serve.

Read Next: NVIDIA, Salesforce Announce Strategic AI Collaboration: What To Know

Outlook: Steelcase sees third-quarter revenue in a range of $785 million to $810 million and adjusted earnings of between 21 cents and 25 cents per share.

SCS Price Action: According to Benzinga Pro, Steelcase shares are down 10.21% after-hours at $12.67 at the time of publication Wednesday.

Read Also:

Photo: Oleg Gamulinskii from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Defends 0.5% Interest Rate Drop As 'Right Thing For The Economy,' Doubles Down On Fed's Cautious, Data-Driven Approach

Federal Reserve Chair Jerome Powell defended the decision to cut interest rates by 50 basis points Wednesday, calling it “the right thing for the economy” to support a strong labor market and prevent undue harm.

The Fed’s large rate cut, which brought interest rates down to the 4.75%-5% range, marks the first reduction in more than four years.

“The time to support the labor market is when it’s strong, not when you begin to see layoffs,” Powell stated during the press conference, underscoring the importance of preemptive action to safeguard the economy.

Labor Market In Stronger Focus

Powell suggested the Fed is now placing greater emphasis on labor market conditions, as the balance between its dual mandates — maximum employment and price stability — has become more closely aligned.

Labor market conditions have softened, he said, noting that payroll job creation has slowed in recent months.

The situation “bears close watching,” Powell said, adding that the labor market, while still relatively strong, has returned to levels similar to those of 2017-2018, rather than the peak strength seen in 2019.

Powell highlighted the Fed’s patient approach to reducing the policy rate, contrasting it with other central banks that have cut rates multiple times.

He said that this cautiousness has paid off, allowing the Fed to have confidence that inflation is “moving sustainably under 2%.”

“We’ve been very patient about reducing the policy rate. We’ve waited … and I think that patience has really paid dividends,” he said.

Fed Sticks To Meeting-By-Meeting Approach

The 50-basis-point rate cut should not be viewed as a signal of a new pace of policy easing, but rather as a necessary adjustment given economic conditions, the Fed chair said.

Powell stressed the importance of a meeting-by-meeting approach, with no preset course for future rate adjustments. He made it clear the September decision does not indicate a rush to lower rates further.

The Fed remains open to adjusting the pace of cuts based on economic data, indicating flexibility to go “quicker if that’s appropriate”; “slower if that’s appropriate”; or even to “pause if that’s appropriate.”

In response to questions about whether the Fed was behind the curve of the rate-cut cycle, Powell defended the timing of the rate cut. “We don’t think we’re behind,” he said.

“We think this is timely, but I think you can take this as a sign of our commitment not to get behind.”

Powell stressed the importance of upcoming labor and inflation data, including two jobs reports and inflation data, in guiding policy decisions ahead of the next November meeting,

Powell Addresses Criticism Of Fed’s Timing

Powell firmly rejected speculations about political motivations behind the larger rate cut, as it comes ahead of the November presidential elections.

“The things we do really affect economic conditions for the most part with a lag.” He reiterated that the Fed’s primary responsibility is to support the economy on behalf of the American people, taking each decision seriously and without political filters.

“We’re not serving any politician, any political figure, any cause, any issue, nothing. It’s just maximum employment and price stability on behalf of all Americans,” he added.

Read Next:

Photo courtesy of the Federal Reserve.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is The Fed Playing With Fire? 'We See Greater Risk Of An Overheating Economy' As They Cut Rates, Veteran Investor Warns

Three things in life seem certain as of Wednesday, Sept. 18: death, taxes, and the Federal Reserve’s announcing a cut to the fed funds rate at its imminent Federal Open Market Committee (FOMC) meeting.

What remains uncertain is the size of the cut and its potential effects on the U.S. economy — particularly its impact on inflation, which still hovers above the Fed’s 2% target.

Investor sentiment, as tracked by the CME FedWatch tool, currently assigns a 63% probability to a 50-basis-point rate cut just hours before the FOMC’s decision. The remaining 37% anticipate a more conservative 25-basis-point reduction.

Wall Street analysts, however, are taking a more cautious stance. The consensus strongly favors a smaller rate cut, citing the potential risks of a more aggressive easing policy and noting political considerations, as September is the final meeting before the upcoming Presidential elections.

Traditionally, the Fed kicks off a rate-cutting cycle with a half-point reduction. Still, many argue that this time is different, as the economy doesn’t appear to be on the brink of recession.

Nonetheless, the future path seems relatively clear to most observers: the Fed is widely expected to continue trimming rates in the coming meetings and into 2025.

Is The Fed Playing With Fire?

In a recent note to investors, veteran investor Ed Yardeni warns that the Fed might be “playing with an economy on fire.”

Consider the most recent economic data: The Atlanta Fed’s GDPNow tracking model recently raised its estimate for third-quarter GDP growth to 3% (seasonally adjusted annual rate), up from 2.5%. This would signal an acceleration of the U.S. economy’s growth, following the 2.8% surge recorded in the second quarter.

“We see more risk of an overheating economy as the Fed lowers rates than an anemic one requiring monetary support,” Yardeni states.

Personal consumption expenditures are projected to rise by 3.7% this quarter, a figure Yardeni deems “hardly recessionary.”

He also praised the latest retail sales report for August, which exceeded expectations, remarking, “As long as U.S. consumers are earning, they are spending.”

Falling gas prices, Yardeni explains, act as a de facto stimulus for consumers — what they save at the pump, they are likely to spend elsewhere.

Economic Boom, Stock Market Meltup Ahead?

Further supporting Yardeni’s view is the New York Fed’s recent quarterly household spending survey, released Monday. The survey revealed that nominal household spending increased from 4.6% year-over-year in April to 5.0% in August, with spending growth spread across various education levels and income groups.

“We believe this data series faultily understates income growth,” Yardeni notes.

Overall, Yardeni takes a positive stance on the economy. “The labor market is growing, real wage growth is outpacing inflation thanks to productivity gains, and incomes and net wealth are sources of spending rather than credit,” he commented.

Lowering interest rates “too much, too quickly could trigger an economic boom,” resulting in rapid real GDP growth but escalating inflation risks, according to Yardeni.

With the central bank seemingly on the verge of a significant easing cycle, Yardeni warns, “We see greater risk of an overheating economy than a recession.”

“It could also trigger a 1990s style meltup in the stock market,” he adds.

On Tuesday, a day prior to the Fed’s rate decision, the S&P 500 index, as tracked by the SPDR S&P 500 ETF Trust SPY, briefly hit record highs.

Now Read:

Image: Ronald Plett from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Has Nvidia Stock Peaked? These Words From the CEO May Suggest What's Next

Over the last two years, the prospects of artificial intelligence (AI) have become a bellwether for the technology industry. Among a long list of AI investment opportunities, semiconductor companies have emerged as some of the most lucrative.

Since ChatGPT took the world by storm in November 2022, shares of Nvidia (NASDAQ: NVDA) have gained a jaw-dropping 760% as of this writing. In fact, the company’s market cap briefly eclipsed $3 trillion.

It really wasn’t too long ago that Nvidia was seen as a niche opportunity among a broader sea of technology companies. And yet, today, Nvidia is the third-largest in the world as measured by market cap, making it more valuable than Amazon, Alphabet, Meta Platforms, Tesla, and Berkshire Hathaway.

With AI looking like the next generational opportunity for investors, Nvidia may appear the most lucrative choice of all, given its influential role and seemingly unstoppable potential. However, a recent remark from Nvidia CEO Jensen Huang has me questioning just how much longer the stock can soar.

What did Jensen Huang just say?

Last week, investment bank Goldman Sachs hosted the Communacopia + Technology Conference, where analysts were granted rare access to Huang to ask questions related to Nvidia’s product roadmap, customer use cases, and broader industry trends.

Considering Nvidia has consistently blown out Wall Street’s expectations over the last couple of years, you’d think most questions presented to Huang would focus on the prospects of more record growth. But one analyst actually took a different approach: The analyst asked Huang what he’s worried about despite Nvidia’s market-leading position and strong secular tailwinds fueling its business.

Here was Huang’s response:

Well, our company works with every AI company in the world today. We’re working with every single data center in the world today. I don’t know one data center, one cloud service provider, one computer maker we’re not working with. And so what comes with that is … [an] enormous responsibility and we have a lot of people on our shoulders and everybody is counting on us and demand is so great that delivery of our components and our technology and our infrastructure and software is really emotional for people, because it directly affects their revenues, it directly affects their competitiveness. And so we probably have more emotional customers today than — and deservedly so. And if we could fulfill everybody’s needs, then the emotion would go away but it’s very emotional. It’s really tense. We’ve got a lot of responsibility on our shoulder and we’re trying to do the best we can.

I know that’s a jam-packed, run-on sentence. And candidly, there are a lot of themes in there that suggest Nvidia is in a good spot.

But the explanation above doesn’t inspire the same sense of confidence in me that it might for other investors. Instead, it makes me a little nervous.

Why does this make me nervous?

Nvidia’s roster of chipsets, called graphics processing units (GPUs), includes its highly touted A100, H100, and new Blackwell series. As it stands today, some industry research suggests Nvidia holds 88% of the AI chip market.

Huang really wasn’t exaggerating when he said, “Everybody is counting on us.” Considering the release of the Blackwell chips was recently delayed due to a design flaw, Huang’s remarks about customers being emotional make a lot of sense.

It’s these ideas that have me concerned. Nvidia is no longer just viewed as another semiconductor stock. Rather, the company itself is largely seen as a barometer for the health of the overall AI market. Given this change in perception and the pressure to deliver that comes with it, I’m beginning to think Nvidia’s stock price action is increasingly vulnerable.

Said another way, even if Nvidia delivers a strong quarter of growth, investor expectations are becoming so sky-high that good may not be good enough. When you layer on top just how much influence Nvidia has in the chip space, it’s natural to think it’s only a matter of time before even the slightest hiccup could take a material toll on the share price.

Has Nvidia stock peaked?

I cannot say with any justifiable certainty whether Nvidia stock is headed higher or not. What I do believe with strong conviction is that shares of Nvidia are unlikely to rise by another 700%. Even in the long run, I think such a move is doubtful.

There are already several reasons to be wary of Nvidia’s long-term growth prospects. At the moment, nearly half of the company’s revenue is concentrated in just four customers. Yet, many of these customers are spending significant sums to make their own chips and migrate away from Nvidia.

The combination of rising competition, decelerating revenue and margin trends, and the immense (and unrealistic) expectations that Nvidia will continue to deliver top-tier products and business results in perpetuity brings me to the opinion that Nvidia stock may have peaked.

While further gains are probably in store, I think these will be short-lived. Ultimately, I think Nvidia stock will normalize sooner than many are anticipating. For that reason, investors should consider all pieces of the puzzle before pouring into the semiconductor darling going forward.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Goldman Sachs Group, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Has Nvidia Stock Peaked? These Words From the CEO May Suggest What’s Next was originally published by The Motley Fool

Nvidia Just Made a 147% Profit Betting on This AI Stock

It’s difficult to make a 147% return in a matter of months, but that’s what Nvidia (NASDAQ: NVDA) achieved with a multimillion-dollar investment this year. The investment was one of many AI companies Nvidia decided to back. All were companies that it has worked with in the past, so it presumably knows them quite well. Despite the huge profit, Nvidia appears to be holding on to its fairly recent stock purchases. Investors looking for maximum growth should consider jumping in.

This AI stock could have 1,000% more upside

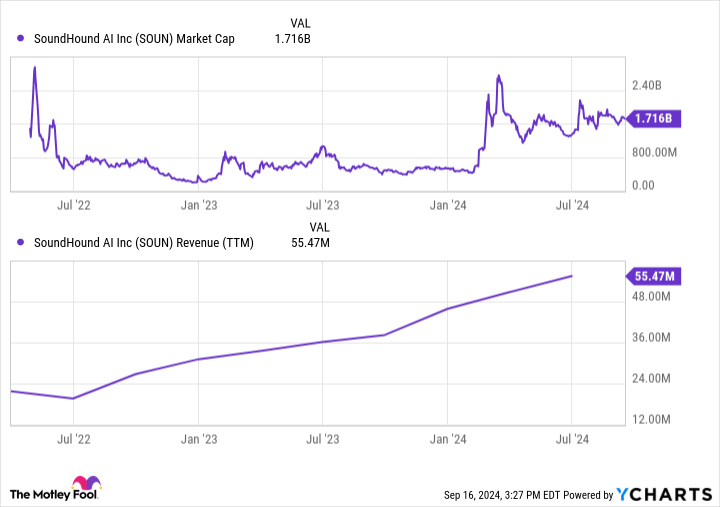

Less than a year ago, Nvidia plowed $3.7 million into SoundHound AI (NASDAQ: SOUN) stock. Shares have risen by 147% since then, but there’s reason to believe they could rise another 10 times in value over the long term. But before you invest, there are a few things you need to consider.

At its core, SoundHound AI is a company focused on bringing AI to everything sound-related. From voice assistants to drive-thru ordering, anytime you chat with a speaker, SoundHound AI wants its technology to be there. With more than a decade in operation, the company has amassed more than 200 patents and an impressive customer list that has continued to grow.

In 2022, for example, it signed a seven-year contract with Hyundai to power its voice-driven AI capabilities. Drivers will be able to chat with their vehicles not only to send messages, get directions, or toggle the air conditioning but also to check in on maintenance issues and discuss how the vehicle has been performing. It’s impressive stuff. Over the next few years, that giant user manual sold with new cars could be replaced with a simple conversation — one conducted directly between you and the vehicle.

SoundHound AI has signed several vehicle manufacturers as customers. But it’s also in other industries, including restaurants and fast-food chains. Applebee’s and White Castle, for instance, are piloting the technology to improve order times and reduce overhead costs. This is perhaps one of the most popular ways we will all be interacting with AI technologies in the near future.

Despite its sizable tech portfolio, growing customer base, and sizable end markets — not to mention Nvidia’s backing — SoundHound’s market cap remains just under $2 billion. To rise 1,000% in value, the company would need to reach a valuation of around $20 billion. That’s not much of a stretch in the volatile AI industry, which could be one of the largest growth opportunities in a generation.

Shares trade at a price of 22 times sales, but over the last two years, revenue has grown by more than 150%. If it can replicate these growth rates, shares would trade between 5 and 6 times 2026 revenue. That’s a much more palatable valuation, although it will take some patience and execution to get there.

Should you invest in SoundHound?

Clearly, SoundHound AI’s end markets alone would support a $20 billion valuation. According to management, the voice AI market has a total addressable market size of at least $140 billion. SoundHound AI’s unique technology can be used across a variety of industries, and its early head start bodes well for its ability to capture a growing share of an otherwise growing opportunity.

But there’s a reason SoundHound still trades at a paltry $1.7 billion market cap. The company remains unprofitable, meaning it continually needs to seek financing in order to stay solvent. This limits its ability to invest in research and development, which is perhaps its most valuable use of funds long term.

Research and development spending last year was only around $56 million — a 30% reduction in its peak spending levels in 2023. Big tech companies, including Apple and Alphabet, are investing billions of dollars in this space. Long-term competition will be intense, and it’s not clear whether SoundHound AI has the capital to survive, let alone thrive.

If you’re looking for a speculative growth stock with huge long-term potential, SoundHound AI could be for you. Nvidia’s backing is certainly a plus. But volatility should remain high, and the potential downside is sizable as well. This is truly a boom or bust investment option for risk-tolerant investors only.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Just Made a 147% Profit Betting on This AI Stock was originally published by The Motley Fool