Lilly Gets FDA Approval for Eczema Drug Ebglyss

Eli Lilly and Company LLY announced that the FDA has granted approval to its IL-13 inhibitor Ebglyss (lebrikizumab) for treating moderate-to-severe atopic dermatitis, also called eczema. Ebglyss is approved for use in adults and children aged 12 and above who weigh at least 40 kgs and whose moderate-to-severe atopic dermatitis is not well controlled with topical prescription medicines.

Ebglyss was approved in the European Union in 2023 and in Japan in January this year. The drug generated sales of $7.5 million in the first half of 2024.

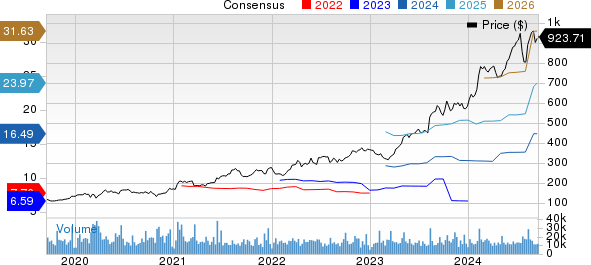

Year to date, Lilly’s stock has risen 58.5% compared with the industry’s 25.2% growth. The stock has also outperformed the sector as well as the S&P 500.

LLY Stock Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

More on LLY’s Ebglyss

Ebglyss’ approval in the United States was based on data from ADvocate 1, ADvocate 2 and ADhere studies. Data from these studies showed that patients treated with Ebglyss experienced significant skin clearance as early as four weeks and meaningful itch relief as early as two weeks. Many people living with eczema experience poor long-term disease control and severe itch despite treatment with topicals. Ebglyss offers such patients a new first-line biologic treatment option for treating their moderate-to-severe eczema. The injection will be launched in the United States in the coming weeks.

In the United States and some countries other than Europe, Lilly owns exclusive development and commercialization rights to Ebglyss. However, in Europe, it has out-licensed rights to develop and commercialize Ebglyss for the treatment of dermatology indications to its partner Almirall.

Lilly’s Several New Drug Approvals in Past Year

Lilly gained approvals for some other new drugs in the past year, with the most important being Mounjaro and Zepbound. Mounjaro and Zepbound include the same compound, tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). Mounjaro was approved in May 2022 for type II diabetes. Zepbound was launched in November 2023 to treat obesity.

Despite a short time on the market, Mounjaro and Zepbound have become key top-line drivers for Lilly in 2024, with demand rising rapidly. Mounjaro and Zepbound generated sales of almost $6.7 billion in the first half of 2024, accounting for around 44% of the company’s total revenues.

Other than Mounjaro and Zepbound, other new drug approvals include Omvoh for ulcerative colitis and BTK inhibitor Jaypirca for mantle cell lymphoma and chronic lymphocytic leukemia. Lilly expects its new drugs — Mounjaro, Omvoh, Zepbound, Ebglyss and Jaypirca — to drive its top line in the second half of 2024.

In July, Lilly won a long-awaited FDA approval for Kisunla (donanemab) for treating early symptomatic Alzheimer’s disease. Lilly believes Kisunla can generate blockbuster sales. Kisunla is only the second drug on the market to treat Alzheimer’s disease after Biogen BIIB and its Japan-based partner Eisai’s Leqembi.

Lilly’s Zacks Rank and Other Stocks to Consider

Lilly sports a Zacks Rank #1 (Strong Buy).

In the past 60 days, 2024 earnings estimates for Pfizer have improved from $2.38 per share to $2.62 per share. For 2025, earnings estimates have improved from $2.75 per share to $2.85 per share over the same timeframe. Pfizer shares have risen 1.6% year to date.

Pfizer’s earnings beat estimates in each of the last four quarters. PFE delivered a four-quarter average earnings surprise of 69.82%

Estimates for Novartis’ 2024 earnings have risen from $7.31 to $7.50 per share over the past 60 days. For 2025, earnings estimates have increased from $8.21 to $8.29 per share over the same timeframe. Year to date, Novartis stock has risen 14.5 %.

Novartis beat estimates in three of the last four quarters while missing in one, delivering a four-quarter average earnings surprise of 1.26%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply