Crown LNG Announces Receipt of Nasdaq Notification Regarding Nasdaq Listing Rule 5550

LONDON, Sept. 17, 2024 (GLOBE NEWSWIRE) — Crown LNG Holdings Limited (“Crown” or “Crown LNG”), a leading provider of LNG liquefaction and regasification terminal technologies for harsh weather locations, today announced that on September 3, 2024, the Company received a notification letter (the “Notification Letter”) from the Listings Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) regarding a failure to meet Nasdaq’s minimum bid price requirements. The Notification Letter advised that for the last 30 consecutive business the minimum closing bid price per share for the Company’s common stock was below the $1.00 per share requirement for continued listing under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). This press release is issued pursuant to Nasdaq Listing Rule 5810(b), which requires prompt disclosure of receipt of a deficiency notification.

The Notification Letter has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Capital Market.

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company has a compliance period of 180 calendar days, or until March 3, 2025 (the “Compliance Period”), to regain compliance with the Bid Price Rule. If at any time during the Compliance Period, the closing bid price per share of the Company’s common stock is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company a written confirmation of compliance and the matter will be closed, unless the Staff exercises its discretion to extend this 10 day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H).

In the event the Company does not regain compliance by March 3, 2025, the Company may be eligible for an additional 180 calendar day period to regain compliance. To qualify, the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. If the Company chooses to implement a reverse stock split, it must complete the split no later than ten business days prior to the expiration of the second compliance period.

The Company intends to monitor the closing bid price of its common stock and may, if appropriate, consider available options to regain compliance with the Bid Price Rule, which could include effecting a reverse stock split. However, there can be no assurance that the Company will be able to regain compliance with the Bid Price Rule.

About Crown LNG Holdings Limited

Crown LNG is a leading provider of offshore LNG liquefaction and regasification terminal infrastructure solutions for harsh weather locations, which represent a significant addressable market for bottom-fixed, gravity based (“GBS”) liquefaction and floating storage regasification units, as well as associated green and blue hydrogen, ammonia and power projects. Through this approach, Crown aims to provide lower carbon sources of energy securely to under-served markets across the globe. Visit www.crownlng.com/investors for more information.

Contacts For Crown LNG Investors Caldwell Bailey ICR, Inc. CrownLNGIR@icrinc.com Media Zach Gorin ICR, Inc. CrownLNGPR@icrinc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Small Caps, Bitcoin Rally As Traders Await Fed Rate Cut; Treasury Yields, US Dollar Tick Up On Strong Retail Sales: What's Driving Markets Tuesday?

Wall Street experienced a slightly positive session Tuesday, supported by investor optimism as the Federal Open Market Committee (FOMC) kicked off its two-day meeting, expected to deliver the first interest rate cut in over four years on Wednesday.

The session’s notable performers were small caps, with the Russell 2000 index surging about 1.3%, targeting its highest close since early August and outperforming larger-cap indices.

Among industries, solar, clean energy and regional banks led gains as traders eyed pockets of the markets that would benefit from lower interest rates.

On the macro front, August retail sales provided an upside surprise, growing by 0.1% month-over-month compared to the expected 0.2% decline. This stronger-than-anticipated data slightly reduced the likelihood of a more aggressive 50-basis-point rate cut, with market-implied probabilities for such a move slipping from 67% to 63%, according to the CME FedWatch Tool.

Short-dated Treasury yields rose as expectations for a substantial rate cut moderated. Meanwhile, the dollar strengthened, gaining 0.2%.

In the commodities market, gold retreated 0.7% from Monday’s record-high close. Oil prices increased by 1.3% following escalating geopolitical tensions in the Middle East.

Reports indicate a coordinated attack in Lebanon led to thousands of pagers linked to Hezbollah militants being detonated, resulting in numerous casualties within the Iran-backed organization.

Additionally, Iran’s ambassador to Lebanon is reportedly injured, though the official responsibility for the attack remains unclaimed.

Bitcoin BTC/USD jumped over 4%, buoyed by positive ETF inflows, signaling renewed investor interest in the digital asset space as interest rates shift.

| Major Indices | Price | 1-day %chg |

| Russell 2000 | 2,220.44 | 1.3% |

| S&P 500 | 5,642.79 | 0.2% |

| Nasdaq 100 | 19,441.83 | 0.1% |

| Dow Jones | 41,636.05 | 0.0% |

According to Benzinga Pro platform:

- The SPDR S&P 500 ETF Trust SPY was 0.1% higher to $563.44.

- The SPDR Dow Jones Industrial Average DIA inched 0.1% up to $417.61.

- The tech-heavy Invesco QQQ Trust Series QQQ also rose 0.1% to $473.60.

- The iShares Russell 2000 ETF IWM rose 1.2% to $220.28.

- The Energy Select Sector SPDR Fund XLE outperformed, up 1.2%. The Health Care Select Sector SPDR Fund XLV lagged, down 0.9%.

- Moderna Inc. MRNA surged over 6% after receiving approval from Health Canada for its updated SPIKEVAX COVID-19 vaccine, designed to target the KP.2 sub-lineage of SARS-CoV-2 in individuals aged six months and older.

- GE Vernova Inc. GEV climbed 3.5% following an upgrade from Bank of America, which raised its rating on the stock from Neutral to Buy and increased the price target from $200 to $300.

- Hewlett Packard Enterprise Co HPE advanced nearly 5% after Bank of America also upgraded its rating from Neutral to Buy and boosted the price target from $21 to $24.

Read Now:

The image was created using artificial intelligence MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Abercrombie & Fitch Co.

Analyst Profile

Kristina Ruggeri

Analyst: Generalist

Kristina began working with Argus Research in 2019. She is responsible for covering selected Consumer Discretionary and Consumer Staples Stocks and has nearly 20 years of experience in the financial services industry. Kristina began her career at Price Waterhouse where she audited asset managers, broker dealers, and banks. Later she joined J.P. Morgan as a financial analyst. In 1994, Kristina joined Bankers Trust Company where she managed the daily operations of several equity derivative funds and later implemented tools to mitigate risk and improve workflow processes. Prior to working with Argus, Kristina was a Senior Director at S&P Global where she led key competitive intelligence and market research initiatives and executed programs to better understand client needs. Kristina earned a BS in Accounting and a minor in Spanish from Bucknell University. She holds an MBA in Finance from New York University’s Stern School of Business and is a Certified Public Accountant. Kristina is also a certified teacher in the State of New Jersey and devotes time to working with elementary and middle school-aged students.

Unpacking the Latest Options Trading Trends in AutoZone

Investors with a lot of money to spend have taken a bearish stance on AutoZone AZO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AZO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for AutoZone.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 41%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $148,330, and 9 are calls, for a total amount of $868,830.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2400.0 to $3400.0 for AutoZone over the recent three months.

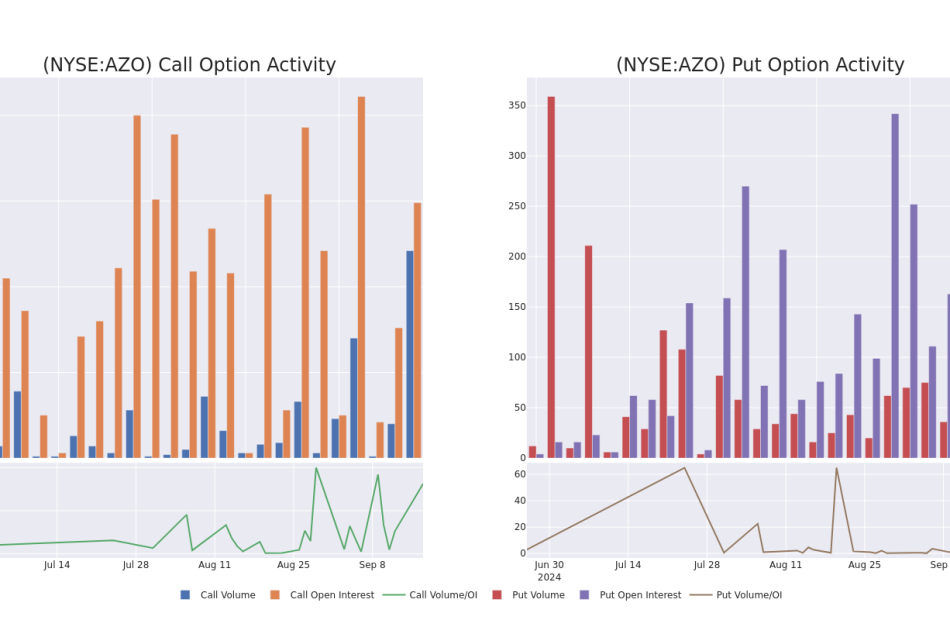

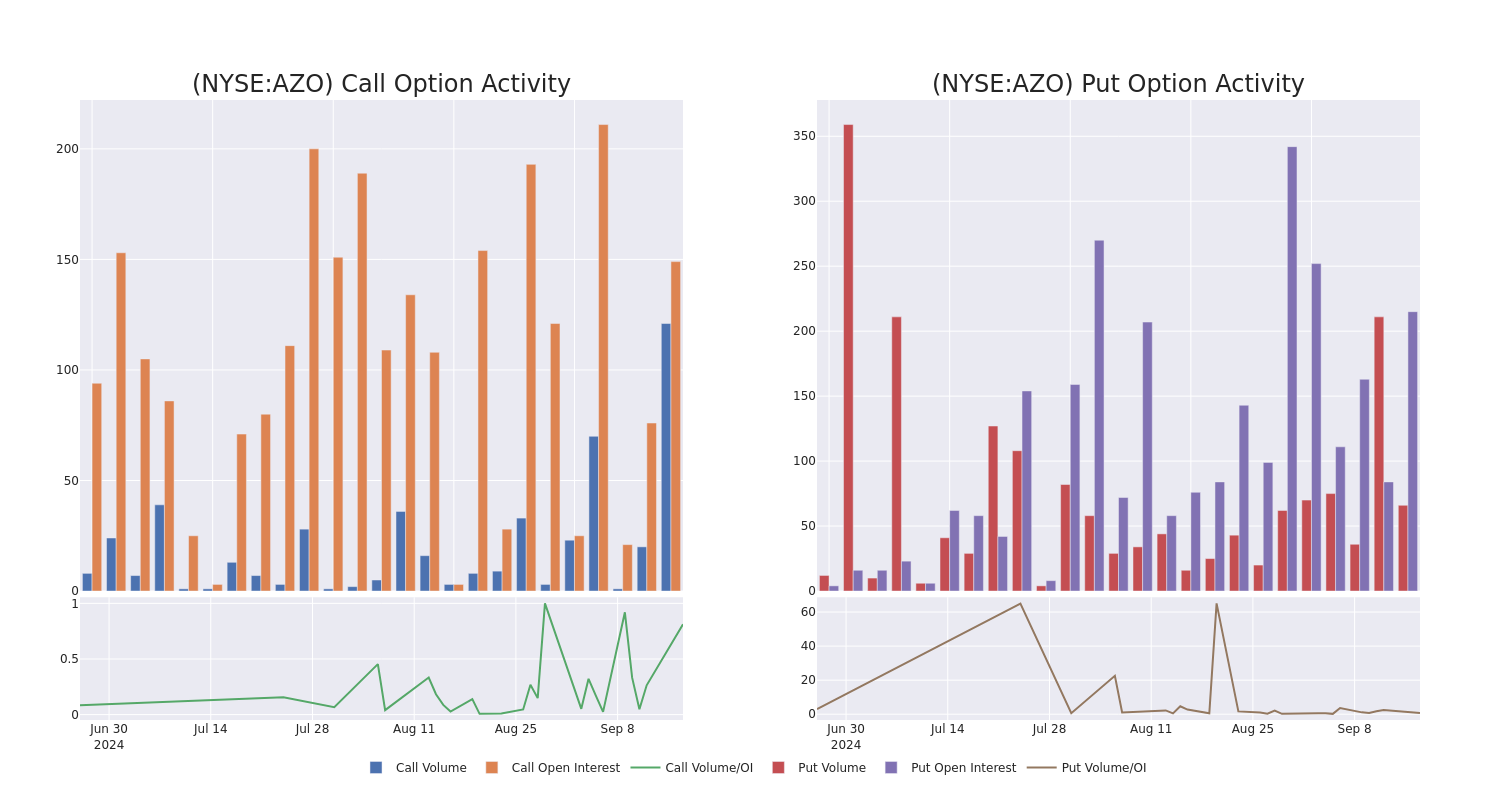

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AutoZone’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AutoZone’s whale trades within a strike price range from $2400.0 to $3400.0 in the last 30 days.

AutoZone 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $94.4 | $89.3 | $89.7 | $3400.00 | $179.4K | 90 | 38 |

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $95.2 | $89.3 | $91.1 | $3400.00 | $163.9K | 90 | 18 |

| AZO | CALL | SWEEP | BEARISH | 01/17/25 | $95.6 | $89.6 | $89.6 | $3400.00 | $161.2K | 90 | 56 |

| AZO | CALL | TRADE | BULLISH | 12/19/25 | $312.0 | $294.0 | $312.0 | $3350.00 | $93.6K | 4 | 3 |

| AZO | CALL | TRADE | BULLISH | 03/21/25 | $786.0 | $774.8 | $786.0 | $2400.00 | $78.6K | 0 | 1 |

About AutoZone

AutoZone operates as a leading retailer of aftermarket automotive parts in the United States. The firm operates over 6,300 stores domestically, serving both the do-it-yourself and commercial (do-it-for-me) end markets. Through its vast store footprint and distribution network, AutoZone manages a wide array of stock-keeping units applicable to numerous vehicle makes and models, providing its consumers with ample product availability. The firm drives traffic by providing superior and convenient customer service as AutoZone’s team of knowledgeable staff assists consumers with diagnosing a vehicle’s problem, selecting the necessary part for replacement, and in some instances, installation. The company also operates internationally, with over 750 stores in Mexico and more than 100 in Brazil.

After a thorough review of the options trading surrounding AutoZone, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is AutoZone Standing Right Now?

- Currently trading with a volume of 60,141, the AZO’s price is down by -0.58%, now at $3083.16.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 7 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AutoZone with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk And Oracle's Larry Ellison 'Begged' Jensen Huang For Nvidia GPUs At A Dinner: 'Please Take Our Money'

Larry Ellison and Elon Musk recently implored Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang for additional GPUs during a dinner at Nobu Palo Alto.

What Happened: During a meeting with analysts last week, Ellison, co-founder and CTO of Oracle Corp. (NYSE:ORCL), revealed that he and Tesla Inc. (NASDAQ:TSLA) CEO Musk “begged” Huang for more GPUs.

Don’t Miss:

Ellison humorously recounted, “Please take our money. By the way, I got dinner. No, no, take more of it. We need you to take more of our money please.”

The dinner’s outcome was positive, according to Ellison, who said, “It went ok. I mean, it worked.” Ellison, whose fortune is estimated at $206 billion, according to Forbes, has a history of anticipating technological shifts and positioning Oracle to benefit from them.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

Oracle has maintained a strong relationship with Nvidia, which dominates the artificial intelligence chip market. The company is heavily investing in GPU technology for AI applications, with revenues up 7% to $13.3 billion in the first quarter of fiscal 2025.

Similarly, Tesla relies on Nvidia GPUs to train its neural networks for self-driving technology. Ellison emphasized the importance of being the first to build the most capable neural network, stating, “It’s a big deal.”

Trending: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million.

Why It Matters: The global supply of high-performance memory chips is expected to remain constrained throughout 2024, driven by the soaring demand for artificial intelligence technology. Leading memory chip suppliers like SK Hynix and Micron Technology Inc. are already facing shortages, with stock for 2025 nearly depleted.

See Also: The startup behind White Castle’s favorite Robot Fry Cook announces a next-generation fast food robot – Here’s how to get a share for under $5 today.

In May, Musk acknowledged and praised Nvidia’s impressive market cap, which had reached $2.55 trillion, making it the third most-valued global corporation.

In June, Musk justified his decision to divert Nvidia chips meant for Tesla to his other ventures, X and xAI, explaining that the existing factory space was already allocated to vehicle, battery, and cell production.

The demand for Nvidia’s RTX 4090 graphics cards has also surged, leading to a supply crisis exacerbated by U.S. sanctions on advanced chips to China.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Elon Musk And Oracle’s Larry Ellison ‘Begged’ Jensen Huang For Nvidia GPUs At A Dinner: ‘Please Take Our Money’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why big banks are obsessed with 1995

Does this sound familiar?

The rate of inflation was slowing along with spending by US consumers. So, the Fed cut interest rates by a quarter in July. It did it again in December — and again in January.

That was 1995 — and those interest rate cuts sparked the beginning of one of the best multiyear periods for banks in US history. An index broadly tracking the sector would finish the year up over 40%, outperforming the S&P 500 (GSCP). And that outperformance would hold for two more years.

Can 1995 happen again for the big banks? As it stands now, it might be a moonshot scenario for 2025 as the Fed contemplates rate cuts. But that hasn’t stopped Wall Street from thinking about that glorious year — and what it would take to see such a winning streak again.

So far, the industry is off to a decent start when it comes to chasing that dream.

This year, the same banking industry index (^BKX) is up more than 14%, while a regional bank-focused index is up 8%. True, both trail some major indexes. But an even wider financial sector index, the Financial Select Sector SPDR Fund (XLF), which has roughly a little less than a quarter of exposure to the country’s biggest banks, is up 19%.

“History isn’t likely to repeat, but it may rhyme,” Mike Mayo, a Wells Fargo analyst who covers the country’s largest banks, said of the 1995 comparison. Though Mayo isn’t counting on next year being as good as that mystical year, he does see similarities.

On the three occasions (1995, 1998, and 2019) where the Fed cut interest rates and a recession didn’t follow, bank stocks on average sold off initially after the first cut, then rallied several weeks after —outperforming the S&P 500, according to analysis from Wells Fargo Securities.

But a wider review of the past six rate-cutting cycles (including three that were followed by recessions) shows the industry’s outperformance doesn’t usually last long. Only in 1995 did banks rally more than the broader stock market for longer than three months after the first rate cut.

Back then, it wasn’t just monetary policy that lined up right for banks.

Rough start

The industry started the year off in rough shape. Major institutions failed: That included the municipality of Orange County, Calif., declaring bankruptcy in December of ’94 and British merchant bank Barings, which collapsed in February of 1995. Banks with big trading desks had taken serious losses from a bond market wipeout the year before — and commercial real estate lenders were still seeing loan losses from a crisis that began in the late ’80s.

Meanwhile, real US GDP even slipped below 1% over the first half of the year. And yields on the longer-term 10-year Treasury plunged by 250 basis points.

Yet, crucially, those longer-term yields remained higher than short-term notes. That allowed banks, which borrow at short-term rates and lend at long-term rates, to profit by a wider margin from the difference.

And it wasn’t just interest rates that sparked higher bank profits in 1995.

US bank regulation was also entering a period of loosening, starting with a federal law signed by then-President Bill Clinton the year before. That law eliminated restrictions that stopped banks from opening branches across state lines, setting the stage for a period of deregulation that would eventually give rise to the country’s mega-banks like Wells Fargo (WFC) and Bank of America (BAC).

Regulating like it’s 1995 again?

Without going too far, Wells Fargo’s Mayo said, “It looks like the regulatory pendulum may be swinging back that way.”

While bank regulation has tightened since the Trump administration, big banks have more recently grown bolder in confronting regulators over disagreements. The Supreme Court also struck down the so-called Chevron doctrine, which gave regulators deference in more legally ambiguous court disputes.

Last week, regulators also unveiled new bank capital rules that signaled a backpedal from what was initially a more stringent set of increases.

What is so different this time compared to ’95 is that the current shift in monetary policy follows one of the longest periods of low interest rates in US history. Along with the rush of deposits flooding into banks during the pandemic, that unusually long, and easy, period left many lenders poorly positioned when adjusting to significant rate increases, said Allen Puwalski, chief investment officer and co-portfolio manager at Cybiont Capital.

“There’s no argument that the falling rates are good for banks. I’m just not sure that it’s for the same reasons that it was in ’95,” Puwalski added.

For next year to be anywhere near as good as it was for banks 29 years ago, the Fed will first need to pull off the so-called soft landing scenario, managing to bring down inflation without causing an economic downturn. And even if it’s not going to look as good for banks as 1995, that is exactly what happened back then.

“There are plenty of things that could go wrong,” former Federal Reserve Bank of Boston president Eric Rosengren told Yahoo Finance. “But I think it’s a high enough probability that it’s still reasonable to talk about a soft landing.”

Dream — or fever dream?

For now, 2025 looks like a mixed bag when it comes to bank earnings. Lenders that benefited from high rates are likely to see less profits, while those that lagged are expecting a boost.

Even without a US recession, a repeat of 1995 would still require loan growth and the continued revival of investment banking.

At a Barclays conference last week, some bank executives, including Bank of America CEO Brian Moynihan and PNC (PNC) CEO Bill Demchak, reiterated their expectations for better earnings in 2025.

Others didn’t.

JPMorgan Chase (JPM) COO Daniel Pinto told investors that analysts are “a bit too optimistic” about how much the bank will earn in 2025.

“Over the course of the quarter, our credit challenges have intensified,” Russell Hutchinson, CFO of Ally Financial (ALLY), said of the bank’s retail auto business the same day.

Gerard Cassidy, a RBC Capital Markets analyst, expects banks to see higher revenues next year but also more credit problems.

“We do expect to see incrementally higher loan loss provisions in the next 12 months, in our view,” Cassidy added.

This much is clear: Though betting on banks having another 1995 next year may ultimately prove risky or foolish, the industry is shifting once again. For now, the arrows seem pointed in the right direction.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

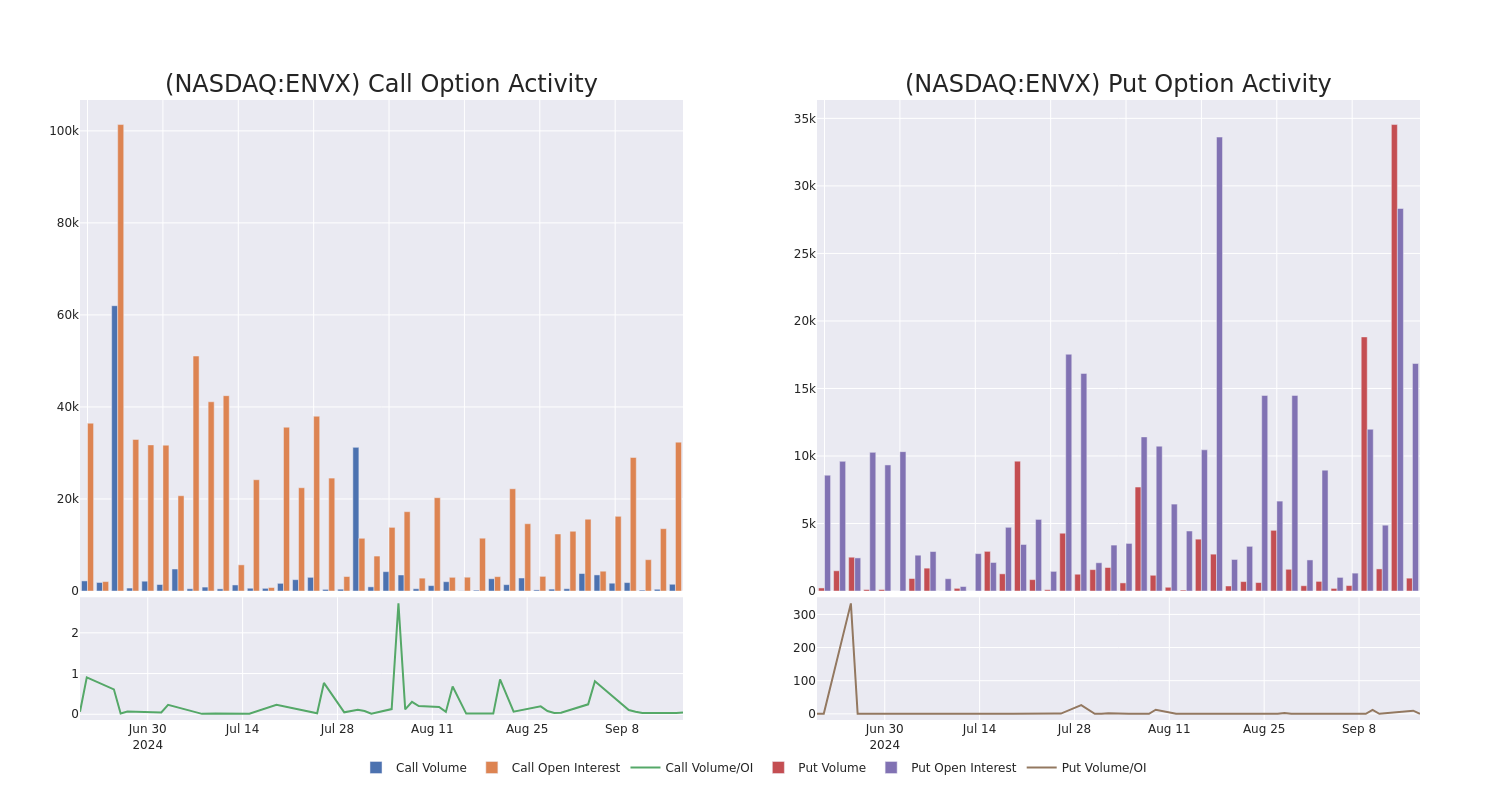

Smart Money Is Betting Big In ENVX Options

Deep-pocketed investors have adopted a bullish approach towards Enovix ENVX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ENVX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Enovix. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 37% bearish. Among these notable options, 2 are puts, totaling $59,914, and 6 are calls, amounting to $322,750.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $2.5 and $15.0 for Enovix, spanning the last three months.

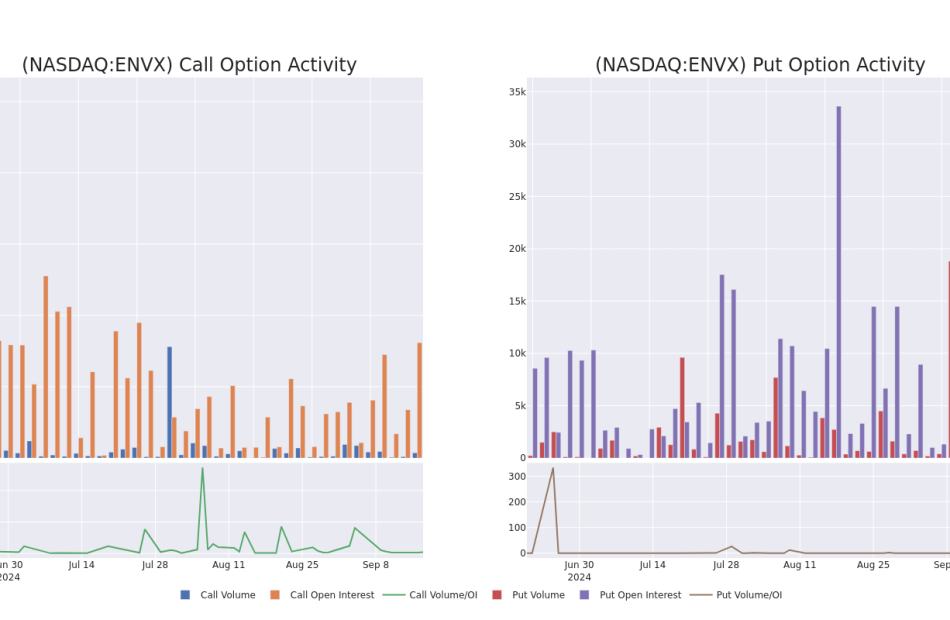

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Enovix’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Enovix’s substantial trades, within a strike price spectrum from $2.5 to $15.0 over the preceding 30 days.

Enovix Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $3.75 | $3.65 | $3.75 | $10.00 | $75.0K | 11.2K | 231 |

| ENVX | CALL | TRADE | BULLISH | 01/17/25 | $7.0 | $6.9 | $7.0 | $2.50 | $71.4K | 381 | 102 |

| ENVX | CALL | SWEEP | BEARISH | 01/16/26 | $3.5 | $3.25 | $3.25 | $12.00 | $65.0K | 5.6K | 200 |

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $2.7 | $2.63 | $2.7 | $15.00 | $54.0K | 13.1K | 500 |

| ENVX | PUT | TRADE | BEARISH | 10/18/24 | $1.39 | $1.36 | $1.38 | $10.00 | $34.9K | 16.8K | 230 |

About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Having examined the options trading patterns of Enovix, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Enovix Standing Right Now?

- With a volume of 3,709,975, the price of ENVX is down -3.02% at $9.47.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 49 days.

Professional Analyst Ratings for Enovix

1 market experts have recently issued ratings for this stock, with a consensus target price of $36.0.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Enovix, which currently sits at a price target of $36.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enovix, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biggest Even Microsoft Buyback, New Retail Sales Go Against Prevailing Wisdom, Trump Crypto Project

To gain an edge, this is what you need to know today.

Against Prevailing Wisdom

Please click here for an enlarged chart of Microsoft Corp MSFT.

Note the following:

- This article is about the big picture, not an individual stock. The chart of MSFT stock is being used to illustrate the point.

- The chart shows that after touching the low band of the support zone, MSFT stock has moved up in a straight line.

- The chart shows the move up in the early trade on three announcements:

- Microsoft is announcing a new $60B stock buyback program. This matches the largest buyback program ever from Microsoft.

- Microsoft is increasing the dividend by 10%.

- Microsoft is introducing more AI features in Office 365 and a new collaborative tool named Copilot Pages. This new tool allows users to collaborate and edit data taken from Copilot on a single page. The company is also introducing a new agent builder allowing users to build AI powered agents.

- As full disclosure, Microsoft is in The Arora Report’s ZYX Buy Core Model Portfolio. The Arora Report has just issued a new buy zone.

- Investors are seeing the news from Amazon.com, Inc. AMZN as return to normalcy after the pandemic – Amazon will require workers to be at the office five days a week.

- The stock market is running as Wall Street positions for a 50 bps rate cut. 50 bps rate cut has now become the prevailing wisdom.

- Prudent investors closely watch retail sales data as the U.S. economy is 70% consumer based. In The Arora Report analysis, the data just released is very important because it is the last piece of economic data that the FOMC is going to see before making its rate decision tomorrow. In The Arora Report analysis, the just released retail sales data does not support a 50 bps cut. Here is the latest retail sales data.

- Headline retail sales came at 0.1% vs. -0.2% consensus.

- Retail sales ex-auto came at 0.1% vs. 0.2% consensus.

- Prior retail sales were revised to 1.1% from 1.0%.

Magnificent Seven Money Flows

In the early trade, money flows are positive in AMZN, MSFT, Alphabet Inc Class C GOOG, Meta Platforms Inc META, NVIDIA Corp NVDA, and Tesla Inc TSLA.

In the early trade, money flows are negative in Apple Inc AAPL.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Trump has released details of his crypto project. The project is called World Liberty Financial. 63% of the coins will be bought by the public, 20% will be owned by the founding team, and 17% will be for user rewards.

The release of Trump’s crypto project details is bringing in buying in all cryptos, including Bitcoin BTC/USD.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BP Plans to Sell U.S. Onshore Wind Division Amid Strategic Shift

BP plc BP, a leading UK-based energy company, has announced plans to sell its onshore wind business in the United States. This marks a strategic shift as the energy giant refocuses on its solar partnership and other renewable energy sources. The move, which came amid challenges in the wind sector, signals BP’s shift from certain renewables despite previous efforts to diversify its energy portfolio.

BP to Exit Onshore Wind

The company revealed its intention to sell BP Wind Energy, which holds interests in 10 onshore wind projects across seven U.S. states, with a combined generating capacity of 1.3 gigawatts (GW). BP cited the misalignment of the business with its future growth strategies as the primary reason behind the sale. William Lin, BP’s executive vice president for gas and low-carbon energy, stated that the wind business “is likely to be of greater value for another owner.”

The onshore wind sector has encountered significant challenges of late, including high material costs, rising interest rates and supply-chain issues. Several companies in the sector have been compelled to cancel or renegotiate contracts, laying pressure on BP’s wind assets.

Focus Shifts to Lightsource BP Solar Partnership

In contrast to its wind energy divestment, BP is increasing its solar efforts. The company recently announced plans to take full ownership of Lightsource BP, Europe’s largest solar developer. This move aligns with BP’s broader strategy to concentrate on its solar partnership, which it considers to be on par with its current growth objectives.

The wind business sale marks a pivotal moment for BP as it realigns its energy transition strategy, pivoting away from wind energy to enhance its core oil and gas operations and focus on certain renewable sectors.

BP’s Zacks Rank & Key Picks

BP currently carries a Zack Rank #5 (Strong Sell).

Investors interested in the energy sector may look at some better-ranked stocks like TechnipFMC plc FTI, Core Laboratories Inc. CLB and VAALCO Energy, Inc. EGY, each carrying a Zacks Rank #2 (Buy) at present.

TechnipFMC is a leading manufacturer and supplier of products, services and fully integrated technology solutions for the energy industry, with a focus on the subsea segment in offshore basins worldwide. FTI’s growing backlog ensures strong revenue visibility and supports margin improvements.

The Zacks Consensus Estimate for FTI’s 2024 EPS is pegged at $1.34. The company has a Zacks Style Score of B for Value and A for Growth. It has witnessed upward earnings estimate revisions for 2025 in the past 30 days.

Core Laboratories, an oilfield services company, has a deep portfolio of sophisticated, proprietary products and services that positions it to take advantage of the growing maturity in the global hydrocarbon reserve base. CLB’s expanding international upstream projects indicate a positive trajectory for revenues and profitability, especially as oil demand continues to rise globally.

The Zacks Consensus Estimate for CLB’s 2024 EPS is pegged at $0.95. The company has a Value Score of B. It has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

VAALCO Energy is an independent energy company involved in upstream business operations, with a diversified presence in Africa and Canada. Having a large inventory of drilling locations in premium Canadian Acreage, the company’s production outlook seems bright.

The Zacks Consensus Estimate for EGY’s 2024 EPS is pegged at $0.65. The company has a Value Score of A. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lilly Gets FDA Approval for Eczema Drug Ebglyss

Eli Lilly and Company LLY announced that the FDA has granted approval to its IL-13 inhibitor Ebglyss (lebrikizumab) for treating moderate-to-severe atopic dermatitis, also called eczema. Ebglyss is approved for use in adults and children aged 12 and above who weigh at least 40 kgs and whose moderate-to-severe atopic dermatitis is not well controlled with topical prescription medicines.

Ebglyss was approved in the European Union in 2023 and in Japan in January this year. The drug generated sales of $7.5 million in the first half of 2024.

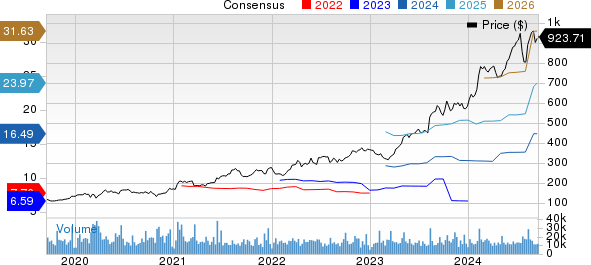

Year to date, Lilly’s stock has risen 58.5% compared with the industry’s 25.2% growth. The stock has also outperformed the sector as well as the S&P 500.

LLY Stock Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

More on LLY’s Ebglyss

Ebglyss’ approval in the United States was based on data from ADvocate 1, ADvocate 2 and ADhere studies. Data from these studies showed that patients treated with Ebglyss experienced significant skin clearance as early as four weeks and meaningful itch relief as early as two weeks. Many people living with eczema experience poor long-term disease control and severe itch despite treatment with topicals. Ebglyss offers such patients a new first-line biologic treatment option for treating their moderate-to-severe eczema. The injection will be launched in the United States in the coming weeks.

In the United States and some countries other than Europe, Lilly owns exclusive development and commercialization rights to Ebglyss. However, in Europe, it has out-licensed rights to develop and commercialize Ebglyss for the treatment of dermatology indications to its partner Almirall.

Lilly’s Several New Drug Approvals in Past Year

Lilly gained approvals for some other new drugs in the past year, with the most important being Mounjaro and Zepbound. Mounjaro and Zepbound include the same compound, tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). Mounjaro was approved in May 2022 for type II diabetes. Zepbound was launched in November 2023 to treat obesity.

Despite a short time on the market, Mounjaro and Zepbound have become key top-line drivers for Lilly in 2024, with demand rising rapidly. Mounjaro and Zepbound generated sales of almost $6.7 billion in the first half of 2024, accounting for around 44% of the company’s total revenues.

Other than Mounjaro and Zepbound, other new drug approvals include Omvoh for ulcerative colitis and BTK inhibitor Jaypirca for mantle cell lymphoma and chronic lymphocytic leukemia. Lilly expects its new drugs — Mounjaro, Omvoh, Zepbound, Ebglyss and Jaypirca — to drive its top line in the second half of 2024.

In July, Lilly won a long-awaited FDA approval for Kisunla (donanemab) for treating early symptomatic Alzheimer’s disease. Lilly believes Kisunla can generate blockbuster sales. Kisunla is only the second drug on the market to treat Alzheimer’s disease after Biogen BIIB and its Japan-based partner Eisai’s Leqembi.

Lilly’s Zacks Rank and Other Stocks to Consider

Lilly sports a Zacks Rank #1 (Strong Buy).

In the past 60 days, 2024 earnings estimates for Pfizer have improved from $2.38 per share to $2.62 per share. For 2025, earnings estimates have improved from $2.75 per share to $2.85 per share over the same timeframe. Pfizer shares have risen 1.6% year to date.

Pfizer’s earnings beat estimates in each of the last four quarters. PFE delivered a four-quarter average earnings surprise of 69.82%

Estimates for Novartis’ 2024 earnings have risen from $7.31 to $7.50 per share over the past 60 days. For 2025, earnings estimates have increased from $8.21 to $8.29 per share over the same timeframe. Year to date, Novartis stock has risen 14.5 %.

Novartis beat estimates in three of the last four quarters while missing in one, delivering a four-quarter average earnings surprise of 1.26%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.