Exclusive-US to seek 6 million barrels of oil for reserve, amid low oil price

By Timothy Gardner

WASHINGTON (Reuters) – The Biden administration will seek up to 6 million barrels of oil for the Strategic Petroleum Reserve, a source familiar with issue said on Tuesday, a purchase that if completed will match its largest yet in the replenishment of the stash after a historic sale in 2022.

The administration will announce the solicitation as soon as Wednesday to buy oil for delivery to the Bayou Choctaw site in Louisiana, the source said, one of four heavily guarded SPR locations along the coasts of that state and Texas.

The U.S. will buy the oil from energy companies for delivery in the first few months of 2025, the source said.

The Department of Energy has taken advantage of relatively low crude prices that are below the target price of $79.99 per barrel at which it wants to buy back oil after the 2022 SPR sale of 180 million barrels over six months.

West Texas Intermediate oil was $71.70 a barrel on Tuesday, up after Hurricane Francine shut crude output in the Gulf of Mexico last week, but worries about demand have kept prices relatively low in recent weeks.

President Joe Biden announced the 2022 sale, the largest ever from the reserve, after Russia, one of the world’s top three oil producers, invaded Ukraine. The invasion had helped push gasoline prices to a record of over $5 a gallon.

The administration has so far bought back more than 50 million barrels, after selling the 180 million barrels at an average of about $95 a barrel, the Energy Department says.

While oil is now below the target buyback price, conflict in the Middle East and other factors can quickly boost oil prices. In April, the U.S. canceled an SPR purchase of oil due to rising prices.

The reserve currently holds 380 million barrels, most of which is sour crude, or oil that many U.S. refineries are engineered to process. The most it has held was nearly 727 million barrels in 2009.

(Reporting by Timothy Gardner; Editing by Chizu Nomiyama)

Upcoming Stock Splits This Week (September 16 to September 20) – Stay Invested

These are the upcoming stock splits for the week of September 16 to September 20, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split. In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

iSpecimen Inc. (ISPC) – iSpecimen is a technology-enabled marketplace that connects researchers to a global network of sample providers, thus streamlining specimen procurement. It enables sample procurement of biofluids, tissues, stem, and immune cells. On September 11, ISPC announced a one-for-20 reverse stock split of its common stock to improve the per share trading price and attract institutional investors. Shares will start trading on a stock-adjusted basis on September 16, in compliance with the minimum bid price requirement for continued listing on Nasdaq.

Zepp Health Corp. (ZEPP) – Zepp Health operates a proprietary technology platform that includes AI chips, biometric sensors, and data algorithms, which support smart health devices for consumers and data analytics services for population health. On September 6, ZEPP announced a one-for-four reverse stock split of its ADS (American Depositary Shares). The reverse stock split will change the ratio of ordinary shares to ADS from one-to-four to one-to-16. Effective September 16, the ADS will start trading on a split-adjusted basis.

Knightscope Inc. Class A (KSCP) – Knightscope is an American advanced security camera and robotics company. It develops and sells automated devices that deter, detect, and report threats. On September 11, KSCP announced a one-for-50 reverse stock split of its Class A and Class B common stock. Shares will start trading on a split-adjusted basis on September 16.

Deckers Outdoor (DECK) – Deckers Outdoor designs, markets, and distributes innovative footwear, apparel, and accessories for everyday casual lifestyle use and high-performance activities. On September 13, Decker’s shareholders approved a six-for-one forward stock split as well as a proportionate increase in the company’s authorized common stock. This move will make DECK shares more affordable and attractive to a broader group of investors.

Purple Biotech (PPBT) – Purple Biotech is a clinical-stage biotechnology company. Its technology harnesses the power of the tumor microenvironment (TME) to overcome drug resistance and improve treatment outcomes for cancer patients. On September 12, PPBT announced a one-for-20 reverse stock split of its ADS (American Depositary Shares) to increase the per share trading price of its ADS. The reverse stock split will change the ratio of ordinary shares to ADS to one-to-200. Effective September 17, the ADS will start trading on a split-adjusted basis.

Atlantic Sapphire (AASZF) – Atlantic Sapphire undertakes innovative, land-based aquaculture of salmons. The company announced a rights issue of its shares in the ratio 1:1, with an ex-date of September 18 to increase capital.

Cybin (CYBN) – Cybin is a clinical-stage biopharmaceutical company engaged in developing safe and effective psychedelic-based therapies to treat mental health conditions. On September 4, Cybin’s board approved a one-for-38 reverse stock split, to take effect on September 19.

Markforged Holding (MKFG) – Markforged offers 3D printing to enable resilient and flexible industrial manufacturing. On September 9, MKFG’s board announced a one-for-ten reverse stock split of its common shares effective September 19. The step is being taken to regain compliance with the minimum bid price requirement for continued listing on the New York Stock Exchange.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.

Association of Corporate Counsel and Empsight Compensation Reports Provide Industry-Leading, Comprehensive Data for In-house Professionals

Washington, Sept. 17, 2024 (GLOBE NEWSWIRE) — The Association of Corporate Counsel (ACC) and Empsight International, LLC, today released the “2024 Law Department Compensation Survey,” one of the largest and most comprehensive Safe Harbor Compliant compensation data sets available for in-house legal professionals.

The Law Department Compensation Survey – Self Reported Report is based on responses from 1,887 in-house legal professionals throughout the United States. This self-reported data is used to create the Executive Summary (available to everyone). The Full Self-Reported Survey Report (available for purchase) includes all jobs and covers companies of all revenue sizes enabling individual law department professionals to benchmark their own compensation and career planning.

Some key findings in the Executive Summary using the self-reported data include:

- General counsel in companies with $5 billion or more in revenue make 66 percent more (a 15.8 percent increase from last year’s data) in base salary and 144 percent more in total compensation (a 10 percent decrease compared to last year) compared to GC in companies under $1 billion in revenue. This is driven by higher base salaries and higher short-term and long-term incentives. Larger organizations often offer higher compensation to general counsel due to the increased complexity and scope of the legal issues they face.

- Twenty-five percent of respondents reported changing jobs in the last two years, down from 37 percent in 2023. However, job mobility is expected to increase, with 20 percent of respondents anticipating a job change withing the next year, up from 16 percent in 2023.

- Eighty-five percent of participants say their work arrangement supports their work-life balance either “very well” or “somewhat well”. Those working full-time in the office are least satisfied, while those working fully remote are the most satisfied.

- Certain legal specialties tend to have higher compensation across the board. This year, those practice areas were

- Antitrust

- Securities

- Government relations

- IP and patent litigation

- Licensing.

- In-house counsel with law firm experience earn 19 percent more than their counterparts without prior law firm work experience.

- The average merit increase this year was 3.8 percent (this includes zero percent increases).

“Fair and competitive compensation is critical to individuals and companies alike, and it’s important to get it right,” said Blake Garcia, Ph.D., ACC’s senior director of business intelligence. “In order to do so, accurate, comprehensive data is key and that is exactly what ACC and Empsight’s suite of reports provide. With specific job titles for numerous in-house legal professionals in similarly sized companies, industries, and geographic locations, individuals and law department leaders have everything they need to make informed compensation-related decisions.”

“Accurate and comprehensive compensation data is essential for making informed decisions in today’s competitive in-house law department landscape,” said Jeremy Feinstein, Empsight’s founder and managing director. “Our collaboration with the ACC on the Law Department Compensation Survey ensures that law department executives and in-house counsel in organizations of all sizes have access to the most reliable benchmarking data available. Whether managing a small team or overseeing a large, complex department, the survey reveals how the size of an organization impacts compensation levels, with larger organizations often offering base and total compensation. This data enables law departments to attract, retain, and reward key talent, no matter the scale of their operations.”

The Executive Summary can be viewed here. For further information or to answer any questions, please contact Dan Weber at d.weber@acc.com and visit acc.com/compensation.

###

About ACC: The Association of Corporate Counsel (ACC) is the premier global legal association that promotes the common professional and business interests of in-house counsel who work for corporations, associations and other organizations through information, education, networking, and advocacy. For more than 40 years, ACC has set the standard for in-house counsel and raised awareness regarding the value of the chief legal officer in the C-suite and boardroom. With more than 45,000 members employed by over 10,000 organizations and spanning 100+ nations, ACC connects its members to the people and resources necessary for both personal and professional growth. By in-house counsel, for in-house counsel® remains the foundation for ACC’s market leadership. For more information, visit www.acc.com and follow ACC on LinkedIn, Twitter, and Facebook.

Empsight International, LLC is a human resource consulting firm which helps employers make better decisions about their investment in people. Empsight’s compensation surveys organizations to benchmark their critical functional areas against other relevant peers. Our surveys are seen as definitive data reference sources in markets where such information is critical to maintaining competitiveness. The surveys cover key corporate functional areas, with an emphasis on new and emerging roles. Our survey participation tools are streamlined and designed for ease of use. We rely on input and feedback from our Survey Advisory Group comprised of industry leaders to keep our surveys competitive and on-point. Our Principals and staff have significant experience in consulting on compensation, organizational and human resource issues across multiple industry sectors.

Dan Weber Association of Corporate Counsel 2026961557 d.weber@acc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bankrupt Trucker Yellow Loses Ruling Over $6.5 Billion in Pension Debts

(Bloomberg) — Bankrupt trucker Yellow Corp. and its hedge fund owners lost a key court ruling over $6.5 billion in debt that pension funds claim the defunct company owes them, likely wiping out most recovery for shareholders.

Most Read from Bloomberg

US Bankruptcy Judge Craig T. Goldblatt sided with pension funds over how to calculate the penalty Yellow must pay for canceling workers’ retirement plans when the company shut down last year. The ruling, issued last week, means there is little chance the company will have any cash left for shareholders like hedge fund MFN Partners after Yellow finishes selling its real estate portfolio and paying the pension penalty.

Goldblatt didn’t set a payment amount, but the ruling means the 11 pension funds involved have the upper hand in how that debt is calculated. Yellow last year sold its trucking terminals for $1.9 billion, enough to cover all of Yellow’s secured debt but not pension claims.

Shares, which had been trading above $5 most of this year, plunged a record 88% on Sept. 13, when the ruling was released. Shares were trading at 70 cents Tuesday.

The pension funds alleged Yellow is required to pay a “withdrawal liability” for canceling the retirement benefit. The funds asked Goldblatt to rule that billions of dollars in federal grant money they received from the US last year should be ignored when that liability is calculated. Yellow asked the judge to do the opposite.

The Pension Benefit Guaranty Corp., which regulates retirements funds like those set up for Yellow’s union workers, argued that other companies with traditional pension plans would have an incentive to cancel their retirement benefits if Yellow won since shareholders wouldnt be forced to pay a hefty penalty.

Yellow claimed it was unfair to make it pay the penalty since federal grants made the pensions solvent for decades.

The case is In re Yellow Corp., 23-11069, US Bankruptcy Court, District of Delaware (Wilmington)

–With assistance from Jonathan Randles.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Fed rate cut decision risks investor 'angst' — here's what strategists are saying

With the Federal Reserve poised to start cutting interest rates Wednesday, investors cautioned against policy “angst,” calling for a gradual easing cycle to build confidence in the economy.

Speaking at the Future Proof festival in California, David Kelly, chief global strategist for JPMorgan Asset Management, said the central bank risked “freaking people out” by being too hawkish.

“If they cut rates aggressively here, they’re going to undermine confidence,” Kelly said in an interview with Yahoo Finance. “It’s kind of like lowering a piano down from the fourth floor of the building. You’ve got to do it slowly and carefully.”

The FOMC meeting is set to officially bring an end to a years-long tightening campaign to cool inflation, marking a significant shift in policy. The most recent Consumer Price Index (CPI) showed prices increased 2.5% year on year in August, the slowest rate of increase since 2021, putting inflation within reach of the Fed’s 2% target.

But Wall Street has remained divided on how aggressively the Fed should move to protect the labor market and avoid a recession — and on whether to cut interest rates by 25 or 50 basis points. Kelly struck an optimistic tone, saying that while growth is likely slow, the risks of a significant economic downturn remain low.

“In the end, you’ve got to give me a reason why consumers stop spending, and I think it takes a lot to make American consumers stop spending,” Kelly said.

Retail sales data released Monday pointed to the relative resilience among consumers. Sales increased unexpectedly in August by 0.1%, while the July data was revised up to 1.1%. That comes as the labor market starts to show signs of slowing, as the US economy added fewer jobs than expected in August.

Saira Malik, president of Nuveen equities and fixed income, said the cycle of high inflation and interest rate increases will eventually hit the consumer. She forecasts an economic recession “sometime” in 2025.

“We are definitely cautious,” Malik said at Future Proof. “Look at history. Employment markets tend to crack right when a recession starts, so you cannot depend on employment telling you when a recession is coming.”

Bryan Whalen, chief investment officer at TCW’s fixed income group, echoed those sentiments. The Fed’s policy shift may defer a downturn in the economy, but it’s unlikely to prevent it, he said.

“Whether it’s going to be a mild recession or a moderate recession, I think a lot of that’s going to be determined by the Fed reaction function, how bad things get,” Whalen said. “Does something break in the capital markets? And then how do they react from a rate and a [quantitative easing] perspective? That will determine how deep this goes.”

Investors reassess portfolios for a new interest rate environment

The climb in interest rates over the past couple of years has driven big demand for cash and short-term assets, including things like CDs and short-term bills. The strategists at Future Proof said now is a good time to take a second look at that positioning as the Fed prepares to cut rates.

“Reinvestment risk is now an investor’s biggest problem and biggest threat,” said Lauren Goodwin, chief market strategist at New York Life Investments.

Read more: What a Fed rate cut would mean for bank accounts, CDs, loans, and credit cards

Callie Cox, chief market strategist at Ritholtz Wealth Management, told Yahoo Finance in an interview that investors need to keep an eye on falling rates: “We’ve obviously seen the 10-year yield move from 4.7% to 3.7%. We’re saying lock in rates now and understand why you’re holding cash where you are.”

Cox is counseling clients to shift their portfolios.

“Now is the time to invest in risk assets, especially if you’re a long-term investor and you can handle some swings that we see,” she said. “At the same time, prepare for a recession. Have a game plan ready.”

The traditional portfolio allocation of 60% invested in stocks and 40% invested in fixed income has long been debated by investors and the registered investment advisers who made up most of the Future Proof conference attendees.

Malik and Goodwin said the template can — and should — be tinkered with.

“We’re looking at balancing, for example, large-cap equity, where we’ve seen a lot of the gains manifest over the past couple of years, with lower- or middle-market private equity as an opportunity to balance a portfolio,” Goodwin said. “Be creative within that 60-40 benchmark.”

Malik went further, saying, ”The 60-40 evolves to a 50-30-20,” meaning 50% equities, 30% fixed income, and 20% alternatives.

Kelly also noted that after periods of outperformance — like in the last decade — the returns from the 60-40 wane.

“You have to have the discipline to add international to a portfolio because we do think that in the long run that will give you better returns,” Kelly said. “Also look at alternatives — things like infrastructure, transportation, some areas of real estate, if you can find the right manager.”

Whalen, as chief investment officer of TCW, a fixed-income giant, made a case for bonds no matter the economic backdrop from here.

If the Fed succeeds in averting a recession, he said, “your investment-grade corporate bond fund is probably going to return you plus or minus 5%. That’s not bad.”

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

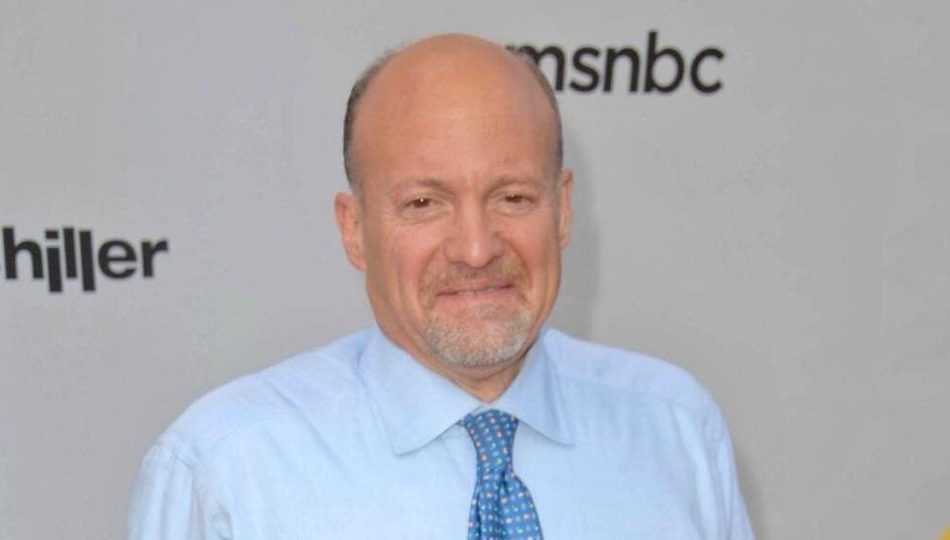

Jim Cramer Says He Likes This Nancy Pelosi Portfolio Stock 'Very Much:' And This AI Play Is Reasonably Valued Than High-Flier Nvidia

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Chipmaker Broadcom Corp.’s (NASDAQ:AVGO) shares, which began to rally at the start of 2023, have been going through a consolidation phase since topping out in late June. The stock has found itself a fan in CNBC Mad Money host Jim Cramer.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

What Happened: Stephanie Link, chief investment strategist and portfolio manager at Hightower Advisors, has bought Broadcom shares, said Cramer in a post on X on Monday. More than the disclosure about Link’s Broadcom buy, what caught the attention of social media users was Cramer’s comment about his disposition toward the stock. Broadcom, he said, is “a stock I like very much….”

Some social media users poked fun at Cramer by reminding him about the negative psychology he has on stocks. “It’s up $30 (21%) or so in 5 days after a dip and it’s near all-time highs, then Jim endorses it…,” one of his followers said.

Broadcom Living Up To Hype? Broadcom, which was largely flying under the radar once, has now risen to prominence with its artificial intelligence foray. The company is now the 11th most-valued global corporation, boasting a market capitalization of a little over $766 billion. Incidentally, it has the highest market cap among techs outside of the Magnificent Seven, minus Tesla, and TSMC.

This semiconductor and infrastructure software products manufacturer recently reported third-quarter results that thumped Street estimates, thanks to strong AI revenue and solid performance of its VMware business. The San Jose, California-based company also raised its AI revenue guidance for the fourth quarter and the full year. Despite the results ticking most boxes, the slightly light fourth-quarter guidance sent the stock tanking a little over 10% immediately after the results.

Since then the stock has come back up, thanks to its nearly 20% rise from its post-earnings low.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

“Rocket City” is about to blast off — you can invest in this real estate market for just $100.

Yet, the stock trades at a reasonable forward price/earnings multiple of 26.81 compared to Nvidia Corp.’s (NASDAQ:NVDA).

Incidentally, Rep. Nancy Pelosi (D-Calif), who is known for her investments, bought 20 Broadcom call options on June 24, with a strike price of $800 and an expiration date of June 20, 2025. The purchase was made after the company reported its second-quarter results on June 12 and announced a 10-for-1 stock split. The stock began trading on a split-adjusted basis on July 15. The congresswoman’s call options now have a strike price of $80, giving effect to the split.

The average analysts’ price target for Broadcom is $198.66, according to TipRanks, with the 12-month price target pointing to over 21% upside from current levels.

Looking For Higher-Yield Opportunities?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For instance, the Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000. Benzinga Readers: Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Jim Cramer Says He Likes This Nancy Pelosi Portfolio Stock ‘Very Much:’ And This AI Play Is Reasonably Valued Than High-Flier Nvidia originally appeared on Benzinga.com

Unifor extends CAMI Assembly Plant negotiations with GM

INGERSOLL, ON, Sept. 17, 2024 /CNW/ – Unifor is extending the negotiation deadline with General Motors (GM) on behalf of members of Unifor Local 88 at the CAMI Assembly plant and Battery Assembly facility in Ingersoll, Ontario beyond the current contract expiration at 10:59 p.m. today.

“Our members deserve a contract that identifies and supports the many challenges they have faced, and the bargaining committee is dedicated to getting that done. Our bargaining committee continues to make progress at the bargaining table and talks will continue so long as that remains the case,” said Unifor National President Lana Payne.

While negotiations are ongoing the members will continue to report to regularly scheduled shifts until otherwise directed by the union. Last month, Unifor Local 88 members at CAMI delivered an overwhelming strike mandate, with 97% voting to support strike action if an agreement is not reached.

Unifor’s top priorities are improvements to wages, pensions, and job security as well as aligning future contract bargaining dates for Unifor Local 88 members at CAMI with the union’s main Detroit Three (Ford, General Motors and Stellantis) negotiations.

Unifor’s pattern agreement was set between the union’s 20,000 auto sector members and Detroit Three automakers in 2023. Unifor Local 88 members are outside of the master agreement and since their last negotiations have experienced extensive layoff time following the plant’s transition to production of the Chevrolet BrightDrop EV 600 and EV 400.

“Our bargaining team is fully committed to reach a deal with GM that addresses our members’ needs given the plant’s significant downtime and gets all of our members the job and retirement security they have earned,” said Unifor CAMI Plant Chairperson Mike Van Boekel.

Unifor is Canada’s largest union in the private sector, representing 320,000 workers in every major area of the economy. The union advocates for all working people and their rights, fights for equality and social justice in Canada and abroad, and strives to create progressive change for a better future.

SOURCE Unifor

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/17/c4118.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/17/c4118.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ACRES Commercial Realty Corp. Declares Quarterly Cash Dividends for its Preferred Stock

UNIONDALE, N.Y., Sept. 17, 2024 /PRNewswire/ — ACRES Commercial Realty Corp. ACR (the “Company”) announced today that its Board of Directors declared cash dividends on its Preferred Stock.

The Company will pay a cash dividend on its 8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock (“Series C Preferred Stock”) in the amount of $0.6988981 per share, which reflects a rate of 11.18237%, equal to three-month Term SOFR on the dividend determination date plus a spread of 5.927% per annum. The floating rate period for dividends on the Series C Preferred Stock began on July 30, 2024. The dividend will be payable on October 30, 2024, to holders of record on October 1, 2024.

The Company will also pay a cash dividend on its 7.875% Series D Cumulative Redeemable Preferred Stock in the amount of $0.4921875 per share. The dividend will be payable on October 30, 2024, to holders of record on October 1, 2024.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate (“CRE”) mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market CRE lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “trend,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-declares-quarterly-cash-dividends-for-its-preferred-stock-302250766.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-declares-quarterly-cash-dividends-for-its-preferred-stock-302250766.html

SOURCE ACRES Commercial Realty Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Eugene A Hall Offloads $17.21M Worth Of Gartner Stock

Eugene A Hall, Chairman and CEO at Gartner IT, executed a substantial insider sell on September 16, according to an SEC filing.

What Happened: Hall’s recent move involves selling 34,060 shares of Gartner. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $17,213,808.

Tracking the Tuesday’s morning session, Gartner shares are trading at $511.7, showing a up of 0.32%.

All You Need to Know About Gartner

Based in Stamford, Conn., Gartner provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Unraveling the Financial Story of Gartner

Revenue Growth: Gartner’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 6.11%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 67.82%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Gartner’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 2.95.

Debt Management: Gartner’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 4.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Gartner’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 48.53.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 6.65 is above industry norms, reflecting an elevated valuation for Gartner’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 29.75 reflects market recognition of Gartner’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Core Molding Technologies Recent Insider Activity

DAVID DUVALL, Chief Executive Officer at Core Molding Technologies CMT, reported an insider sell on September 16, according to a new SEC filing.

What Happened: DUVALL’s decision to sell 50,846 shares of Core Molding Technologies was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $911,591.

At Tuesday morning, Core Molding Technologies shares are up by 0.16%, trading at $18.4.

Get to Know Core Molding Technologies Better

Core Molding Technologies Inc operates in the engineered materials market as one operating segment as a molder of thermoplastic and thermoset structural products. It produces and sells molded products for varied markets, including medium and heavy-duty trucks, automobiles, power sports, construction and agriculture, building products, and other industrial markets. The processes include compression molding of sheet molding compound (SMC), resin transfer molding (RTM), liquid molding of dicyclopentadiene (DCPD), spray-up and hand-lay-up, direct long-fiber thermoplastics (D-LFT) and structural foam, and structural web injection molding (SIM). It operates operates in Columbus, Ohio; Gaffney, South Carolina; Winona, Minnesota; Matamoros and Escobedo, Mexico; and Cobourg, Ontario, Canada.

Core Molding Technologies’s Financial Performance

Revenue Challenges: Core Molding Technologies’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -9.19%. This indicates a decrease in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 19.97%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Core Molding Technologies’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.74.

Debt Management: Core Molding Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.15, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 9.82 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.5, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 4.24, Core Molding Technologies presents an attractive value opportunity.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Core Molding Technologies’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.