Quarterra Multifamily and QuadReal Announce Start of Leasing at The Piper Apartments

Redmond, Wash. community features 284 luxury homes in Marymoor Village

REDMOND, Wash., Sept. 18, 2024 /PRNewswire/ — Quarterra Multifamily, a subsidiary of Lennar Corporation and a multifamily apartment developer, property manager, and asset manager, today announced the start of leasing at The Piper. Developed in partnership with QuadReal Property Group (“QuadReal”), a global real estate investment, operating and development company, The Piper is a luxury rental community located along Marymoor Park in Redmond, Washington.

The Piper’s 284 thoughtfully designed homes offer a distinguished living experience for established professionals seeking an active lifestyle in the heart of the rapidly developing Marymoor Village. Residents can choose from three unique design styles, and the apartment mix includes one-, two- and three-bedroom homes, ranging from 475 square foot studios to family sized three-bedroom homes with 1,400 square feet of living space.

A market-leading suite of amenities including a pool and spa, kids play areas and co-working spaces cascade into the 640-acre Marymoor Park, a regional outdoor epicenter home to a summer concert series, a robust trail system, various sports facilities, a premier 40-acre dog park and climbing wall.

“The Piper is designed to appeal to residents seeking the space to spread out and explore while still living within a vibrant neighborhood,” said Brad Reisinger, Quarterra Regional President. “With immediate access to transit, retail and recreation, and open-air amenities to meet a variety of interests, The Piper presents a dynamic living experience for our future residents.”

The Piper is one of three joint ventures between Quarterra and QuadReal in the region including Spectra, also in Marymoor Village, and Ovation in Seattle’s First Hill neighborhood.

“Working alongside strong partners is an important part of QuadReal’s global strategy and with Quarterra we will deliver an exceptionally amenitized and well-located apartment community,” said Jameson Weber, Managing Director, Head of Americas, at QuadReal. “The Piper is a high-quality addition to QuadReal’s robust global residential portfolio and elevates the rental housing options in the community for individuals and area families.”

The Piper’s two five-story mid-rise buildings are separated by a linear pedestrian art walk pathway designed through its participation in the City of Redmond’s art program. Lined with murals and sculptures, the pathway features work from more than 10 different artists. The community also features an artist in residence program offering studio space to local artists.

Situated at 17305 NE 67th Ct. in Redmond, the community is just blocks from the future Southeast Redmond Light Rail Station and within a short drive of key thoroughfares, including Redmond Way, State Route 520 and East Lake Sammamish Parkway, allowing direct access to Bellevue, Seattle, Sammamish, Issaquah and Kirkland. The transit access links The Piper to the region’s primary tech sector employers such as Microsoft, Facebook/Oculus, Amazon, Google, Space X, Nintendo and SmartSheet. The Piper is just a few minutes from downtown Redmond, the Microsoft campus and Downtown Bellevue. Residents also enjoy walkability to Whole Foods Market and easy access, via the Lake Sammamish trail, to Redmond Town Center – a mixed-use shopping and entertainment development with more than 110 shops, restaurants and breweries.

As a MFTE/AARCH program participant, The Piper offers 10% of its homes at 50% area median income (AMI).

The Piper is Quarterra’s eleventh development in the Seattle Metro Area. It joins nine completed communities in Atlas, Axle, The Bower, Ovation, Spectra, Twenty20 Mad, Valdok I & II, and The Whittaker, as well as Tavin in Seattle’s Crown Hill, which is currently under construction.

To learn more about The Piper please visit: https://thepiperapts.com/

About Quarterra Multifamily

Quarterra Group, Inc., a wholly-owned subsidiary of Lennar Corporation LEN, is a multi-strategy, real estate focused, alternative asset management company comprising three rapidly growing verticals: Multifamily, Single-Family Rental, and Land. Launched in 2011, Quarterra Multifamily, previously known as LMC, is among the nation’s most active developers, builders, and managers and has been on the National Multi-Housing Council’s (NMHC) annual Top 50 list for nine consecutive years.

Quarterra creates extraordinary communities where people can live remarkably.

www.Quarterra.com

About QuadReal Property Group

QuadReal Property Group is a global real estate investment, operating and development company headquartered in Vancouver, British Columbia. Its assets under management are $77.6 billion. From its foundation in Canada as a full-service real estate operating company, QuadReal has expanded its capabilities to invest in equity and debt in both the public and private markets. QuadReal invests directly, via programmatic partnerships and through operating platforms in which it holds an ownership interest.

QuadReal seeks to deliver strong investment returns while creating sustainable environments that bring value to the people and communities it serves. Now and for generations to come.

QuadReal: Excellence lives here.

Media Contact

Marlena DeFalco

LinnellTaylor Marketing

303-682-3943

marlena@linnelltaylor.com

Hannah Wanlin

QuadReal Property Group

416-881-5129

Hannah.wanlin@quadreal.com

![]() View original content:https://www.prnewswire.com/news-releases/quarterra-multifamily-and-quadreal-announce-start-of-leasing-at-the-piper-apartments-302251490.html

View original content:https://www.prnewswire.com/news-releases/quarterra-multifamily-and-quadreal-announce-start-of-leasing-at-the-piper-apartments-302251490.html

SOURCE Quarterra

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why You Should Retain Xylem Stock in Your Portfolio for Now

Xylem Inc. XYL is well-poised for growth in the coming quarters, courtesy of its businesses and accretive acquisitions. The company’s efforts to reward its shareholders add to its appeal.

Headquartered in Rye Brook, NY, Xylem is one of the leading providers of water solutions worldwide. It is involved in the full water-process cycle, including the collection, distribution and return of water to the environment. XYL has a significant presence in the United States, the Asia Pacific, Europe and various other nations. Over the past year, this Zacks Rank #3 (Hold) company has gained 40.4% compared with the industry’s 26.8% growth.

Image Source: Zacks Investment Research

Let’s discuss the factors that might influence investors to retain this stock in their portfolio for the time being.

Business Strength: Xylem is seeing growth across most of its businesses. The Measurement & Control Solutions (“M&CS”) segment is benefiting from robust demand for advanced technology solutions like smart metering and other applications, primarily in the United States. The segment’s organic sales were up 26% year over year, driven by smart metering demand and execution.

Growth in the transport application business, driven by a strong pipeline of capital projects in Western Europe and increased infrastructure projects in the United States, is boosting the Water Infrastructure segment’s performance. Strong momentum in the treatment applications business, supported by increasing capital projects in emerging markets, also bodes well. The segment’s organic sales increased 7% year over year in the second quarter, buoyed by price realization and growth across all regions and applications.

Strength in dewatering business across major markets (particularly in the United States and emerging regions), driven by increased sales volume and favorable pricing, is a key catalyst to the Water Solutions and Services segment’s growth. The segment’s organic sales grew 12% year over year in the second quarter, supported by higher capital project revenues and gains in integrated solutions and services in the United States.

Expansion Efforts: The company solidifies its product portfolio and leverages business opportunities through asset additions. Acquisitions contributed $265 million to Xylem’s total revenues in the second quarter. The company acquired mission-critical water treatment solutions and services provider Evoqua in May 2023.

Evoqua’s advanced water and wastewater treatment capabilities and position in key industrial markets complement Xylem’s portfolio of solutions across the water cycle. The acquisition boosted its position in water technologies, solutions and services. The transaction is expected to deliver run-rate cost synergies of $140 million within three years upon closing. It is also expected to strengthen the company’s balance sheet.

Rewards to Shareholders: Xylem’s commitment to rewarding shareholders through dividends and share buybacks is encouraging. In the first six months of 2024, it paid dividends of $175 million, up 25.9% year over year. The company also bought back shares worth $18 million in the same period. In February 2024, it hiked its dividend by 9%. Also, in 2023, Xylem paid out dividends worth $299 million and bought back shares worth $25 million.

Downsides of Xylem

Segmental Weakness: Xylem has been experiencing weakness in the Applied Water segment owing to the slowdown in the broader economy. In July 2024, the Institute for Supply Management’s manufacturing index registered 48.5%, indicating a contraction in U.S. manufacturing activity for the third consecutive month. The impact of this slowdown is reflected in the decrease in demand for industrial and building solutions applications, including pumps, valves, heat exchangers, controls and dispensing equipment.

Amid these challenges, the segment’s second-quarter revenues declined 5% on a year-over-year basis in the second quarter. A reduced number of project wins is likely to impact its performance in the near term.

Rising Costs: Xylem has been grappling with the adverse impacts of cost inflation. In the second quarter, its cost of revenues increased 26.1% year over year due to high raw material, labor, freight and overhead costs. Selling, general and administrative expenses rose 8.7% due to additional operational expenditure from the acquisition of Evoqua. Escalating costs pose a threat to the bottom line.

Stocks to Consider

Some better-ranked companies from the same space are discussed below.

Flowserve Corporation currently carries a Zacks Rank #2 (Buy).

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 2.6%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.3%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Irish Cannabis Patients Will Now Gain Access To New Products Through This International Agreement

SOMAÍ Pharmaceuticals has partnered with Georgelle Pharmaceutical Ltd. to bring an extensive range of cannabis-based medicines to Irish patients.

This marks SOMAÍ’s fifth international expansion, having already established operations in the UK, Australia, Germany, and Poland earlier this year.

Under a three-year agreement, SOMAÍ will supply Irish cannabis-prescribing clinics with a diverse cannabinoid-containing product line, including THC, CBD, and balanced oral solutions.

Read Also: Eli Lilly Pumps $800M Into Irish Operations To Meet Skyrocketing Demand For Mounjaro, Zepbound

The range will later expand to terpene-infused oral solutions and inhalation extracts, designed to address specific patient needs.

SOMAÍ’s founder and interim CEO, Michael Sassano, said, “Bringing Irish patients a full range of products and choices will further increase the range of demographics that need medicinal cannabis and have suffered with few options to treat themselves.”

The partnership aims to improve accessibility to cannabis-based medicines in Ireland, where patients have had limited options for treatment. Daniel O’Brien, CSO of Georgelle, expressed enthusiasm about the collaboration, saying,

“We admire [SOMAÍ’s] commitment to innovation and making a positive impact… to significantly improve the portfolio of available medicines for Irish patients.”

This move positions SOMAÍ as a leader in the Irish medical cannabis market, continuing its mission to offer patients enhanced treatment options tailored to their needs.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Green Cosmetic Products Market Size to Reach USD 70.6 Billion by 2034, Growing at a CAGR of 7% Amid Rising Demand for Sustainable Ingredients- Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 18, 2024 (GLOBE NEWSWIRE) — The global green cosmetic products market (mercado de productos cosméticos verdes ) was worth US$ 33.7 billion in 2023. A CAGR of 7.0% is anticipated between 2024 and 2034, and the industry will reach US$ 70.6 billion by 2034. Oleochemicals, which are naturally occurring compounds produced from plant and animal fats, are another option being investigated by green cosmetic makers. Eco-friendly cosmetics can be made more sustainable by using oleochemicals as alternatives to petroleum-based products.

Enhancing consumer relationships and offering customized experiences are among the trends observed in the cosmetics sector, along with personalized care and immersive beauty experiences. This reduces waste and enables customers to customize their beauty regimens to meet their unique demands. Supply chain transparency is being made possible through blockchain technology in the cosmetics industry. By using sustainable ingredients in green cosmetics, consumers are able to make informed choices about their purchases.

Several cosmetic businesses have already adopted vegan products and cruelty-free ingredients to reduce the presence of synthetic surfactants, parabens, essential oils, silicones, synthetic sunscreens, drying alcohols, fragrances, and colors in their products. The future of green cosmetics appears bright, provided that innovation and the development of more environmentally friendly and sustainable formulations continue.

Unlock Growth Potential in Your Industry! Download PDF Brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85990

Key Findings of the Market Report

- Female-targeted green cosmetic products are highly sought after on the market.

- The green cosmetics market is expected to grow as e-commerce sales rise and discount offers continue.

- The skin care segment held most of the market share in 2023.

- North America accounted for a majority of the market share in 2023.

Global Green Cosmetic Products Market: Growth Drivers

- The environmental consciousness of customers leads them to look for products with less environmental impact. As more people adopt healthier lifestyles, they turn to natural and safe goods to maintain their health. Using synthetic chemicals in traditional cosmetics may pose health risks to consumers, so green cosmetics have become increasingly popular.

- Regulating organizations worldwide are imposing stricter rules on the cosmetics industry, especially regarding hazardous chemicals and compounds.

- Cosmetic companies have been reformulating their goods to comply with these rules, resulting in the need for green substitutes. Companies are increasingly focusing on sustainability as part of their business strategies.

- Social media sites and beauty influencers greatly influence consumer preferences. Influencers help fuel the growing demand for eco-friendly beauty products among their followers by promoting these goods and sharing their experiences with eco-friendly firms. Technological developments have made it simpler for cosmetic companies to create creative, environmentally-friendly formulas and packaging.

- Customers are increasingly choosing goods that reflect their values and worldviews. Customers today emphasize transparency, ethical sourcing, and sustainability. As a result, eco-friendly cosmetics featuring these features have gained popularity.

Global Green Cosmetic Products Market: Regional Landscape

- North America has implemented more regulations to ensure the safety of cosmetic products, particularly in the United States and Canada. Health Canada and the Food and Drug Administration (FDA) in the United States have scrutinized the use of specific components in cosmetics, forcing companies to restructure their products. As a result, green cosmetic products require safer, more natural ingredients.

- The dangers of artificial chemicals included in cosmetics are becoming more apparent to North American consumers. Customers are highly concerned with their health and wellness, so they tend to seek out products without potentially harmful ingredients such as parabens, phthalates, and sulfates. The market for green cosmetics with clearer, cleaner formulas has grown due to this greater awareness.

- Clean beauty promotes sustainable, safe, and transparent cosmetic products in North America. Clean beauty standards drive consumers’ preference for eco-friendly cosmetics that follow these principles.

- A high value is placed on environmental responsibility and sustainability by North American millennials and Gen Z. Several sectors, including the cosmetics industry, are seeing consumer demand for environmentally friendly products increase. These demographic groups’ increasing purchasing power and preference for eco-friendly cosmetics have brought a shift in the market.

Email Directly Here with Detail Information: sales@transparencymarketresearch.com

Global Green Cosmetic Products Market: Competitive Landscape

Across the global market for green cosmetic products, most companies are investing a significant amount of money and time into establishing their presence in prominent regions. Players operating in the market rely heavily on product launches.

Key Market Players

- Chanel

- Ere Perez

- Giorgio Armani

- Herbivore Botanicals, LLC

- Lady Green

- L’Occitane en Provence

- Moringaia

- Origins Natural Resources Inc.

- Sky Organics

- Weleda

Key Developments

- In January 2022, Chanel launched N°1, a new line of sustainable and neutral beauty products. Through its latest collection, Chanel made a foray into clean cosmetics. A laboratory open to the sky in the French town of Gaujacq produces the company’s organic camellia-based products.

- In April 2023. Ere Perez Natural Cosmetics introduced an eco-refillable compact made of 100% aluminum. This sustainable and natural beauty firm offers a variety of skincare and makeup items for customers seeking minimal, ethical, and healthy beauty. An entirely aluminium refillable compact has been introduced by the company to reduce its environmental impact.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85990<ype=S

Global Green Cosmetic Products Market: Segmentation

By Product Type

- Cleanser

- Moisturizer

- Serum

- Face Oil

- Sunscreen

- Others

- Shampoo

- Conditioner

- Hair Color

- Hair Mask

- Hair Oil

- Hair Serum

- Others

- Soaps

- Shower Gel

- Body Cream

- Oils

- Others

- Facial Make up

- Eye Make up

- Lip Products

- Others

By Consumer Orientation

By Distribution Channel

- E-commerce Website

- Company-owned Website

- Hypermarket/Supermarket

- Specialty Stores

- Other Retail Stores

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

More Trending Reports by Transparency Market Research –

- Nicotine Pouches Market– The global nicotine pouches market (mercado de bolsas de nicotina) is projected to advance at a CAGR of 29.7% from 2022 to 2031.

- Disposable Face Mask Market – The global disposable face mask market (mercado de mascarillas desechables) is projected to expand at a CAGR of 13.4% during the forecast period from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Edge Lower As Fed Rate Decision Looms, Treasury Yields Rise As Odds Improve For Smaller Cut: What's Driving Markets Wednesday?

Wall Street is jittery hours before the highly anticipated Federal Open Market Committee (FOMC) meeting, with all major indices posting modest losses by midday in New York. While a Federal Reserve rate cut is considered a done deal, the market remains divided on the magnitude of the cut.

Current implied probabilities show a 60% chance of a 50-basis-point reduction, while a smaller 25-basis-point cut has lately gained traction, rising to 40% odds, as per CME FedWatch.

The growing expectation of a smaller cut has pushed Treasury yields higher across the curve, reflecting a shift in market sentiment.

Amid this uncertainty, the CBOE Volatility Index (VIX), often seen as the market’s fear gauge, spiked 8%, signaling heightened investor anxiety.

The U.S. dollar steadied, recovering from overnight losses. Commodities retreated, with oil prices down 0.9%, despite a fresh escalation of tensions in the Middle East, and silver slipping 1%. Gold remained flat.

In the cryptocurrency market, Bitcoin BTC/USD declined 1.5%, dipping below the $60,000 mark after a 3.6% rally on Tuesday.

Wednesday’s Performance In Major U.S. Indices, ETFs

| Major Indices | Price | 1-day chg % |

| S&P 500 | 5,622.28 | -0.2% |

| Dow Jones | 41,482.17 | -0.3% |

| Nasdaq 100 | 19,369.89 | -0.3% |

| Russell 2000 | 2,201.42 | -0.5% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY was 0.3% lower to $561.44.

- The SPDR Dow Jones Industrial Average DIA fell 0.3% to $416.11.

- The tech-heavy Invesco QQQ Trust Series QQQ fell 0.4% to $471.53.

- The iShares Russell 2000 ETF IWM eased 0.5% to $218.40.

- The Energy Select Sector SPDR Fund XLE outperformed, up 0.2%. The Technology Select Sector SPDR Fund XLK lagged, down 0.8%.

Wednesday’s Stock Movers

- ResMed Inc. RMD fell over 5% after Wolfe Research cut the stock rating from ‘Peer Perform’ to ‘Underperform.’

- General Motors Co.GM shares surged over 2% on Wednesday following the announcement that its electric vehicle customers will soon be able to access Tesla Inc. TSLA’s Supercharger network using a GM-approved adapter.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investors in CrowdStrike Holdings, Inc. Should Contact The Gross Law Firm Before September 30, 2024 to Discuss Your Rights – CRWD

NEW YORK, Sept. 18, 2024 (GLOBE NEWSWIRE) — The Gross Law Firm issues the following notice to shareholders of CrowdStrike Holdings, Inc. CRWD.

Shareholders who purchased shares of CRWD during the class period listed are encouraged to contact the firm regarding possible lead plaintiff appointment. Appointment as lead plaintiff is not required to partake in any recovery.

CONTACT US HERE:

https://securitiesclasslaw.com/securities/crowdstrike-loss-submission-form/?id=103182&from=3

CLASS PERIOD: November 29, 2023 to July 29, 2024

ALLEGATIONS: The complaint alleges that during the class period, Defendants issued materially false and/or misleading statements and/or failed to disclose that: (1) CrowdStrike had instituted deficient controls in its procedure for updating the Company’s main product software, Falcon and was not properly testing updates to Falcon before rolling them out to customers; (2) this inadequate software testing created a substantial risk that an update to Falcon could cause major outages for a significant number of the Company’s customers; and (3) such outages could pose, and in fact ultimately created, substantial reputational harm and legal risk to CrowdStrike. As a result of these materially false and misleading statements and omissions, CrowdStrike stock traded at artificially high prices during the Class Period.

DEADLINE: September 30, 2024 Shareholders should not delay in registering for this class action. Register your information here: https://securitiesclasslaw.com/securities/crowdstrike-loss-submission-form/?id=103182&from=3

NEXT STEPS FOR SHAREHOLDERS: Once you register as a shareholder who purchased shares of CRWD during the timeframe listed above, you will be enrolled in a portfolio monitoring software to provide you with status updates throughout the lifecycle of the case. The deadline to seek to be a lead plaintiff is September 30, 2024. There is no cost or obligation to you to participate in this case.

WHY GROSS LAW FIRM? The Gross Law Firm is a nationally recognized class action law firm, and our mission is to protect the rights of all investors who have suffered as a result of deceit, fraud, and illegal business practices. The Gross Law Firm is committed to ensuring that companies adhere to responsible business practices and engage in good corporate citizenship. The firm seeks recovery on behalf of investors who incurred losses when false and/or misleading statements or the omission of material information by a company lead to artificial inflation of the company’s stock. Attorney advertising. Prior results do not guarantee similar outcomes.

CONTACT:

The Gross Law Firm

15 West 38th Street, 12th floor

New York, NY, 10018

Email: dg@securitiesclasslaw.com

Phone: (646) 453-8903

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Decision Is Here: 5 Things Investors Need To Know Ahead Of Wednesday's Pivotal Interest Rate Call

“The time has come for policy to adjust.” With these simple words, Federal Reserve Chair Jerome Powell signaled at the Jackson Hole conference last month that interest rates are likely to be cut at the Fed’s September meeting.

As the Federal Open Market Committee decision at 2 p.m. ET Wednesday approaches, here’s what investors need to know:

1. Interest Rates Are Set To Be Cut

It’s almost certain the Federal Reserve will cut the fed funds rate from the current 5.25%-5.5% level.

This would mark the first rate cut since March 2020, when the central bank slashed rates in response to the pandemic-induced recession.

Also Read: From ‘Too Hot’ To ‘Time Has Come’: 10 Moments Powell Shed Light On Inflation

2. The Size Of The Cut Remains Uncertain

Unusually, there is still no consensus on the size of the upcoming rate cut. According to the latest market-implied odds, investors are pricing in a 50-basis-point rate cut with a 59% probability.

The remaining odds suggest a smaller 25-basis-point move.

Historically, the Fed has started a rate-cutting cycle with a 50-basis-point reduction.

| Potential Rate Cut Size | Probability |

|---|---|

| 50 basis points | 59% |

| 25 basis points | 41% |

3. Wall Street Analysts Predict 0.25% Cut

An overwhelming majority of Wall Street analysts expect the Federal Reserve to cut rates by 0.25 percentage points.

Their rationale is that the economy remains resilient and does not require a significant rate cut, especially with inflation still above target.

Additionally, a larger 50-basis-point cut could be seen as politically charged, as this meeting is the last before the November presidential election.

4. All Eyes On Dot Plot

Alongside the rate decision, the Fed will release its updated Summary of Economic Projections, covering growth, inflation and the expected path of the Fed funds rate.

The “‘dot plot,” which maps out FOMC members’ expectations for future rate moves, will be closely watched. In June, the average dot indicated only one rate cut by the end of this year, followed by 100 basis points of cuts in both 2025 and 2026.

Market participants now anticipate a more aggressive forecast for rate reductions.

5. Let Powell Speak

The rate decision and the economic projections will be unveiled at 2 p.m. ET, but traders will be glued to Chair Jerome Powell‘s press conference starting at 2:30 p.m. ET.

Powell will likely face tough questions regarding the rationale behind the day’s decision and the Fed’s approach to the upcoming rate-cutting cycle.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Prepares For First Rate Cut, But Is It Too Late? Ed Yardeni Calms Recession Fears Amid Recent Strong Data

Even as the Federal Reserve prepares to announce its first rate cut in the current monetary policy cycle, some have expressed fears that the move could be a little too late to keep the economy from slipping into a recession. Market strategist and President of Yardeni Research Ed Yardeni, however, allayed the concern.

What Happened: The Atlanta Federal Reserve’s GDPNow model revised the estimate for third-quarter real GDP growth from a seasonally adjusted annual rate of 2.5% to 3%. The growth pertains to the national economy. Yardeni noted that the upward revision was made following the release of solid August retail sales and industrial production reports.

The Commerce Department said Tuesday that retail sales rose 0.1% month-over-month in August compared to consensus expectations for a 0.2% drop. Auto sales edged down 0.1% but core retail sales excluding motor vehicle and parts dealers and gas stations rose a moderate 0.2%.

Separately, the Federal Reserve said industrial production rose 0.8% month-over-month in August, better than the 0.2% consensus forecast.

Yardeni noted that an upward revision in real consumer spending growth from 3.5% to a whopping 3.7% was primarily responsible for the upward adjustment to the GDPNow model. The increase in real spending on capital equipment was raised from 10.8% to 11.6%, he added.

See Also: Best Growth Stocks

Why It’s Important: The two strong reports from Tuesday along with the August non-farm payroll gains confirm that the index of coincident economic indicators may have risen to yet another record in August, Yardeni said. The coincident economic index, calculated by the Conference Board, takes into account payroll employment, personal income less transfer payment, manufacturing and trade sales, and industrial production

The year-over-year growth rates of the coincident economic index and real GDP are highly correlated, he said, adding that “both are rising at a solid pace.”

This could be good news for the market as most strategists opine that the Fed rate cuts could prove more beneficial for the market if the economy holds up without slipping into a recession.

The SPDR S&P 500 ETF Trust SPY, an exchange-traded fund that tracks the performance of the S&P 500 Index, rose 0.14% to $563.84, according to Benzinga Pro data.

Read Next:

Image via Pexels

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Kingpin Market to Reach US$7.27 Billion by 2034, Growing at a CAGR of 4.4% | Fact.MR Report

Rockville, MD, Sept. 18, 2024 (GLOBE NEWSWIRE) — The global automotive kingpin market is estimated at US$ 4.73 Billion in 2024, according to a new research analysis published by Fact.MR, is a market research and competitive intelligence provider. Worldwide demand for automotive kingpins is projected to reach a market valuation of US$ 7.27 billion by the end of 2034.

Expansion of construction and mining sectors worldwide is forecasted to augment demand for heavy commercial vehicles. Kingpins are replaced at a comparatively higher rate in heavy-duty commercial vehicles, projected to contribute to market expansion in the coming decade. In addition, the growing vehicle production is also projected to drive demand for automotive kingpins. Rising demand for transportation and logistics is forecasted to generate the need for kingpin replacement in the aftermarket to increase the lifespan of heavy-load vehicles.

A majority of retailers are participating in several promotional activities to increase the visibility of their respective brands, especially to tap into some beneficial markets. Many vehicles use technologically advanced couplings and steering systems, which is estimated to drive sales of automotive kingpins.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9788

Key Takeaways from the Market Study:

- The global automotive kingpin market is estimated at US$ 4.73 billion in 2024.

- Sales of automotive kingpins are forecasted to reach US$ 7.27 billion by the end of 2034.

- The market is projected to expand at 4.4% CAGR from 2024 to 2034.

- Worldwide demand for automotive kingpin kits is forecasted to increase at a 4.5% CAGR and reach a market valuation of US$ 4.38 billion by 2034-end.

- East Asia is forecasted to account for 36.2% share of the global market by the end of 2034.

- Sales of automotive kingpins in the United States are projected to increase at 3.3% CAGR and reach US$ 1.37 billion by 2034-end.

“Rising automotive production, globalization of automotive industry supply chains, and government initiatives promoting vehicle safety are forecasted to positively influence demand for automotive kingpins,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Automotive Kingpin Market:

Diesel Technic SE, Meritor, Inc., Schaeffler Technologies Ag & Co. Kg, Dana Limited, Elgin Industries, Mulberry Fabrications Ltd., JG Automotive, LE.MA S.r.l., Ferdinand Bilstein GmbH + Co. KG, Stemco Products Inc., Belton Group, PE Automotive

Growing Demand for Automotive Kingpins for Use in Heavy Commercial Vehicles:

More contractors generally opt for heavy-duty commercial vehicles for the transportation of heavy materials. The growing demand for these powerful vehicles, attributed to their strong suspension systems and higher load-carrying capacity, is projected to contribute to the demand for efficient and durable automotive kingpins.

Automotive Kingpin Industry News:

- Meritor, Inc. declared the launch of its ReadySet kingpin kits in 2021. This new launch is an ideal option for vocational, linehaul, bus, and city delivery applications.

Get Customization on this Report for Specific Research Solutions-https://www.factmr.com/connectus/sample?flag=S&rep_id=9788

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the automotive kingpin market, presenting historical demand data for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (kits, individual parts), vehicle type (light commercial vehicles, heavy commercial vehicles, off-road vehicles), and sales channel (OEMs, aftermarket), across six major regions of the world (North America, Europe, East Asia, Latin America, South Asia & Oceania, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

The global automotive 48V system market size is set to accelerate to a value of US$ 24.98 billion by-end 2034, up from US$ 3.08 billion in 2024, expanding at a CAGR of 23.3% from 2024 to 2034.

The global automotive active grille shutter market is pegged at US$ 5,180.2 million in 2024. The global market is forecast to increase at a 7.7% CAGR and reach a market value of US$ 10,876.9 million by the end of 2034.

The global automotive active health monitoring systems market is expected to surge ahead at CAGR of 30.2%, rising from its current market value of US$ 500 million to US$ 7 billion by the end of 2033.

The global automotive actuator market is estimated to reach US$ 22.45 billion in 2024. The market has been analyzed to climb to a value of US$ 42.53 billion by the end of 2034, expanding at a CAGR of 6.6% over the next ten years.

The global automotive additives market is estimated at USD 8.2 Billion in 2022 and is forecast to reach USD 13.2 Billion by 2032, growing at a CAGR of 4.9% during 2022-2032.

The global automotive adhesives and sealants market size is evaluated at US$ 8.11 billion in 2024. According to projections by Fact.MR in its latest market study, worldwide sales of automotive adhesives and sealants are forecasted to increase at a CAGR of 5.7% to reach US$ 14.12 billion by 2034

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Credibility At Stake – Wall Street Positioned For 50 BPS Cut And Highly Dovish Comments

To gain an edge, this is what you need to know today.

Fed Credibility At Stake

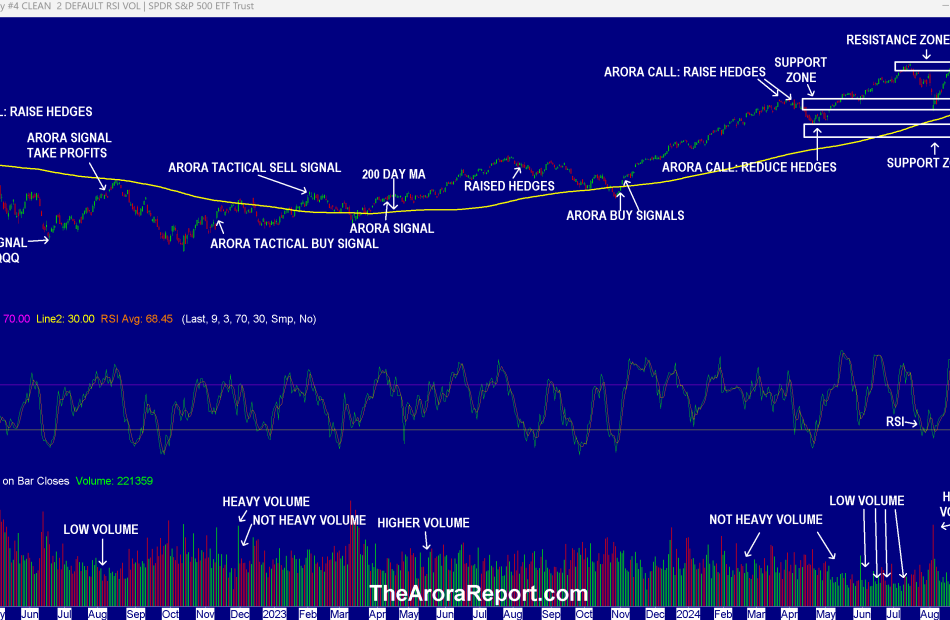

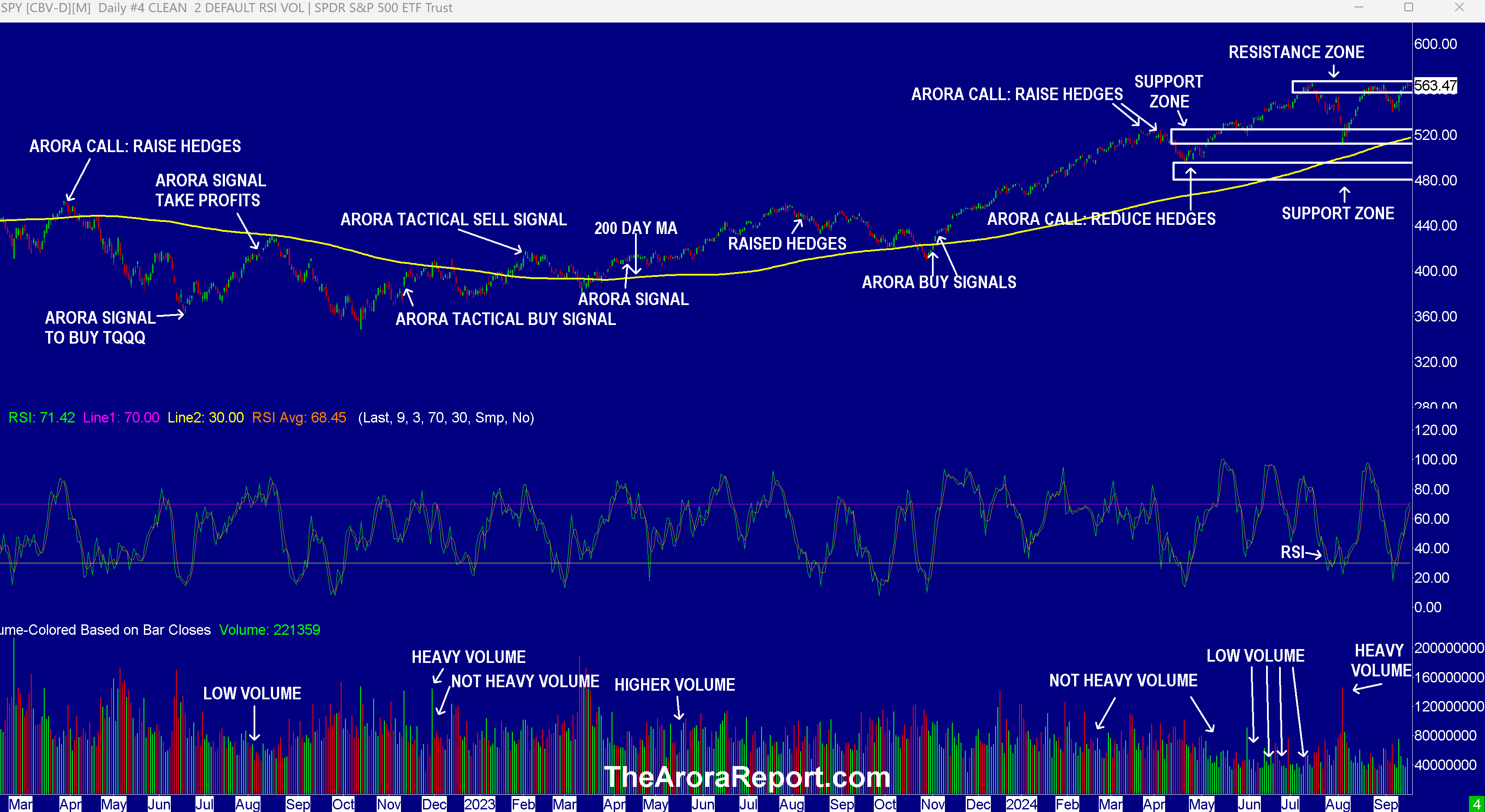

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust SPY which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows that the stock market is near the resistance zone.

- The chart shows that the rally has been on low volume. This indicates a lack of conviction.

- The chart shows that RSI has just entered the overbought zone. This indicates that the stock market can go either way.

- The chart shows that if the stock market does not break out and turns down from here, it will be tracing a triple top. A triple top is a negative pattern.

- FOMC will announce its rate decision at 2pm ET today and will be followed by Powell’s press conference at 2:30pm ET.

- Understanding Wall Street positioning can give investors a big edge. Wall Street is positioned for a 50 bps cut and highly dovish comments.

- In The Arora Report analysis, the totality of data does not justify a 50 bps cut. Further in The Arora Report analysis, the totality of data does not justify very dovish commentary.

- In The Arora Report analysis, if the Fed complies with the momo crowd’s demands, the Fed’s credibility will be hurt in the long run. There may be unintended consequences. One unintended consequence may be a rise in long term yields in due course. The other potential unintended consequence may be an unhealthy drop in the dollar.

- If the momo crowd gets what they want, S&P 500 at 6000 is a magnet for traders.

- If the momo crowd gets what they want, the momo crowd will aggressively buy. However, it is not clear how smart money will react. There is a fair probability of smart money taking advantage of the strength to sell.

- If the Fed cuts by 25 basis points, then the market reaction will depend on commentary and the dot plot.

- In The Arora Report analysis, if the Fed cuts by 25 bps and the commentary is not dovish, there is a downside risk to the stock market.

- Prudent investors need to be very mindful that the Fed is about to cut interest rates at a time when the stock market is near its all time high, house prices are near all time highs, and the economy is strong. Historically, the Fed cuts interest rates when the economy is weak or in recession, house prices are falling, and the stock market is weak. By aggressively cutting interest rates now accompanied by highly dovish commentary, the Fed risks its long term credibility. Highly dovish action now also has the potential to start rampant speculation in stocks, housing, and cryptos.

- A 50 bps cut and highly dovish commentary will be helpful for a Harris election. The Fed will never admit it, but there is a school of thought that the Fed wants to help Harris win the election. The reason is that Trump has already said he will not reappoint Powell. Further, Trump has said that he will interfere with the Fed.

Housing Starts

Housing starts came at 1356K vs. 1320K consensus.

Building permits came at 1475K vs. 1415K consensus.

In The Arora Report analysis, activity among builders is increasing as they anticipate falling interest rates will let loose pent up demand. This will increase economic activity, which in turn is good for the stock market.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Apple Inc AAPL, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and Tesla Inc TSLA.

In the early trade, money flows are neutral in Amazon.com, Inc. AMZN and NVIDIA Corp NVDA.

In the early trade, money flows are positive in SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is seeing buying in anticipation of a 50 bps rate cut. Bullish crypto gurus are hopeful that a 50 bps cut will take bitcoin to a new high.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.