Futures tread water as investors brace for Fed rate cut

By Johann M Cherian and Purvi Agarwal

(Reuters) – Wall Street’s main indexes were flat on Wednesday as investors stepped onto the sidelines ahead of the Federal Reserve’s highly anticipated first interest rate cut in more than four years, with bets favoring a 50-basis-point reduction.

Borrowing costs have stayed at their highest levels in over two decades since July 2023, when the central bank last hiked interest rates by 25 basis points to between 5.25% and 5.50% to combat inflation. But the focus recently has been more about a moderating labor market.

At 9:45 a.m., the Dow Jones Industrial Average fell 40.18 points, or 0.11%, to 41,560.69, the S&P 500 gained 3.11 points, or 0.06%, to 5,637.69 and the Nasdaq Composite edged up 22.76 points, or 0.13%, to 17,650.82.

Nine of the 11 S&P 500 sectors traded flat, although energy and industrials edged up 0.3% each.

The Russell 2000 index, tracking small caps which tend to fare better in a lower interest-rate environment, crept up 0.19%.

The benchmark S&P 500 and the blue-chip Dow both recovered from an early August rout and are trading just shy of their respective record highs ahead of the Fed decision, expected at 2:00 p.m. ET.

Economic indicators over the previous one month have been relatively mixed, making investors nervous ahead of the least predictable Fed decision in years.

Following dovish commentary from present and former Fed officials recently, traders are now pricing in 61% chances of a bigger 50-basis-point reduction, according to the CME Group’s FedWatch tool.

Some analysts, however, caution that an outsized move from the central bank could spook markets.

Bets for a smaller 25-bps cut have now slipped to 39% from 86% a week ago. Investors will also be watching for comments from Fed Chair Jerome Powell at 2:30 p.m. ET to gauge the central bank’s stance on the economy and prospects of further rate cuts this year.

“It’s been the first meeting in a while that you have no 100% consensus on whether it’s going to be one (quarter-percentage-point) cut or two,” said Mike Dickson, head of research in quantitative strategies at Horizon Investments.

“No matter what happens today, there’s going to be some people that get what they expected and some people that don’t.”

Stock options are pricing an about 1.1% swing, in either direction, for the S&P 500 after the Fed’s verdict, according to options analytics service ORATS.

Markets have rallied this year, with all three major indexes setting record highs on prospects of lower interest rates as inflation moderated and the jobs market showed gradual signs of cooling.

Heavyweight growth stocks such as Apple climbed 1% and Alphabet added 0.41%, while Microsoft slipped 0.57%.

Intuitive Machines jumped 52% after clinching a $4.8 billion navigation services contract from NASA.

U.S. Steel rose 1.7% after sources said the U.S. national security panel reviewing Nippon Steel’s bid for the U.S.-based steel maker let the companies refile their application for approval of the deal.

Advancing issues outnumbered decliners by a 1.75-to-1 ratio on the NYSE and by a 1.26-to-1 ratio on the Nasdaq.

The S&P 500 posted 16 new 52-week highs and no new lows, while the Nasdaq Composite recorded 23 new highs and 21 new lows.

(Reporting by Purvi Agarwal and Johann M Cherian in Bengaluru; Editing by Pooja Desai and Maju Samuel)

LYNN MOORE JR Implements A Sell Strategy: Offloads $2.88M In Tyler Technologies Stock

It was reported on September 16, that LYNN MOORE JR, President and CEO at Tyler Technologies TYL executed a significant insider sell, according to an SEC filing.

What Happened: JR’s recent move involves selling 5,000 shares of Tyler Technologies. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $2,883,088.

In the Tuesday’s morning session, Tyler Technologies‘s shares are currently trading at $585.73, experiencing a down of 0.0%.

Unveiling the Story Behind Tyler Technologies

Tyler Technologies provides a full suite of software solutions and services that address the needs of cities, counties, schools, courts and other local government entities. The company’s three core products are Munis, which is the core ERP system, Odyssey, which is the court management system, or CMS, and payments. The company also provides a variety of add-on modules and offers outsourced property tax assessment services.

Tyler Technologies: Delving into Financials

Revenue Growth: Tyler Technologies’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 7.28%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: With a low gross margin of 43.96%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Tyler Technologies’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.59.

Debt Management: Tyler Technologies’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.21.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 121.27 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 12.43 is above industry norms, reflecting an elevated valuation for Tyler Technologies’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 59.1, Tyler Technologies demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Tyler Technologies’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DXC TECHNOLOGY SHAREHOLDER ALERT BY FORMER LOUISIANA ATTORNEY GENERAL: KAHN SWICK & FOTI, LLC REMINDS INVESTORS WITH LOSSES IN EXCESS OF $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against DXC Technology Company – DXC

NEW ORLEANS, Sept. 17, 2024 (GLOBE NEWSWIRE) — Kahn Swick & Foti, LLC (“KSF”) and KSF partner, former Attorney General of Louisiana, Charles C. Foti, Jr., remind investors that they have until October 1, 2024 to file lead plaintiff applications in a securities class action lawsuit against DXC Technology Company DXC, if they purchased the Company’s shares between May 26, 2021, and May 16, 2024, inclusive (the “Class Period”). This action is pending in the United States District Court for the Eastern District of Virginia.

What You May Do

If you purchased shares of DXC and would like to discuss your legal rights and how this case might affect you and your right to recover for your economic loss, you may, without obligation or cost to you, contact KSF Managing Partner Lewis Kahn toll-free at 1-877-515-1850 or via email (lewis.kahn@ksfcounsel.com), or visit https://www.ksfcounsel.com/cases/nyse-dxc/ to learn more. If you wish to serve as a lead plaintiff in this class action, you must petition the Court by October 1, 2024.

About the Lawsuit

DXC and certain of its executives are charged with failing to disclose material information during the Class Period, violating federal securities laws.

On May 16, 2024, the Company announced its results for the fourth quarter and full year for 2024, disclosing that “the previous restructurings did not set a real, clean, solid, fully integrated baseline for profitable growth” and that the Company was undertaking a “real reset” from the “bottom up” requiring an additional $250 million on increased restructuring expenses.

On this news, the price of DXC shares fell $3.36 per share, or nearly 17%, from a closing price of $19.88 per share on May 16, 2024, to a closing price of $16.52 per share on May 17, 2024.

The case is Roofers’ Pension Fund v. DXC Technology Company, No. 24-cv-1351.

About Kahn Swick & Foti, LLC

KSF, whose partners include former Louisiana Attorney General Charles C. Foti, Jr., is one of the nation’s premier boutique securities litigation law firms. KSF serves a variety of clients – including public institutional investors, hedge funds, money managers and retail investors – in seeking recoveries for investment losses emanating from corporate fraud or malfeasance by publicly traded companies. KSF has offices in New York, Delaware, California, Louisiana and New Jersey.

To learn more about KSF, you may visit www.ksfcounsel.com.

Contact:

Kahn Swick & Foti, LLC

Lewis Kahn, Managing Partner

lewis.kahn@ksfcounsel.com

1-877-515-1850

1100 Poydras St., Suite 960

New Orleans, LA 70163

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lennar Continues Strategic Expansion Across New Jersey with Launch of Four New Communities This Fall

HAMILTON, N.J., Sept. 17, 2024 /PRNewswire/ — Lennar, one of the nation’s leading homebuilders, today underscored its commitment to the New Jersey market with the announcement of a strategic expansion that includes the opening of four new communities.

“Lennar is known for its innovative approach to home construction and community development, as such, we are excited to introduce a range of new homesites that cater to the diverse needs of New Jersey homeowners,” said Anthony Mignone, Lennar Regional Vice President for Lennar. “By leveraging our national experience and resources, we aim to create lasting value for homeowners alike across the state, while continuing to uphold Lennar’s legacy of building homes that stand the test of time.”

The four communities are all located in highly desirable towns, only short distances from Philadelphia, New York and the Jersey Shore. Designed with convenience in mind, these developments are positioned to offer homeowners easy access to main roads and highways, top-rated school districts, shopping and entertainment options. Additionally, each community will provide unique amenities focused on sustainability, health and wellbeing, helping to create vibrant neighborhoods where families can thrive. These offerings will range from on-site parks, expansive green spaces, state-of-the-art clubhouses featuring a resort-style pools and event spaces, pickleball and volleyball courts.

Lennar’s new developments promise to not only integrate seamlessly into the unique landscape of their surrounding New Jersey towns, but to provide exceptional craftsmanship and value. Every home will offer Lennar’s signature Everything’s Included® program, where Lennar’s most popular features and finishes are built into the base price of the home.

The master-planned communities debuting over the next few months include:

- The Grove, located in Whippany, just off of Route 10, will feature 60 well-appointed two and three-story townhomes. The community will be walking distance to shopping and entertainment and sits just minutes away from all major highways and NJ transit, giving residents an easy and short commute into NYC.

- The Signature Collection at Hopewell Parc, located in historic Hopewell, will add 111 luxury single-family homes to the larger Hopewell Parc community which is known for its access to top-rated schools and its central New Jersey location.

- The Ridings at Oakland, located in the prestigious Bergen County, adjacent to the award-winning Oakland high school, will offer 190 spacious townhomes.

- Emerson Square, located just 20 minutes outside of Philadelphia in Gloucester Township, will boast 63 value-positioned single-family homes and 95 townhomes.

This announcement of expansion follows closely on the heels of two recent community openings in New Jersey – The Collection at Hopewell and Monroe Park Terraces.

For more information on these new home opportunities, click here or call (609) 931-4509.

About Lennar Corporation

Lennar Corporation, founded in 1954, is one of the nation’s leading builders of quality homes for all generations. Lennar builds affordable, move-up and active adult homes primarily under the Lennar brand name. Lennar’s Financial Services segment provides mortgage financing, title and closing services primarily for buyers of Lennar’s homes and, through LMF Commercial, originates mortgage loans secured primarily by commercial real estate properties throughout the United States. Lennar’s Multifamily segment is a nationwide developer of high-quality multifamily rental properties. LENX drives Lennar’s technology, innovation and strategic investments. For more information about Lennar, please visit www.lennar.com.

Contact: Danielle Tocco

Vice President Communications

Lennar Corporation

Danielle.Tocco@Lennar.com

Direct Line: 949.789.1633

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-continues-strategic-expansion-across-new-jersey-with-launch-of-four-new-communities-this-fall-302250808.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-continues-strategic-expansion-across-new-jersey-with-launch-of-four-new-communities-this-fall-302250808.html

SOURCE Lennar

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amid Trump And Harris Opposition To Nippon Steel's $14B Bid For US Steel, National Security Panel To Reportedly Delay Decision Until After The Presidential Election

The U.S. national security panel has postponed its decision on Nippon Steel Corp NPSCY bid for United States Steel Corp X until after the presidential election.

What Happened: The Committee on Foreign Investment in the United States (CFIUS) will allow the companies to refile their application, delaying the decision. This move provides a glimmer of hope for the companies, whose deal faced potential blockage due to national security concerns, Reuters reported on Tuesday, citing people familiar with the matter.

CFIUS raised alarms on Aug. 31, citing risks to the steel supply chain critical to U.S. industries. The panel requires additional time to assess the national security implications and engage with the involved parties.

Refiling the application initiates a new 90-day review period. The deal’s anticipated collapse in late August led to significant support from business groups, including the U.S. Chamber of Commerce, who feared political interference.

Earlier this month, Vice President Kamala Harris expressed her desire for U.S. Steel to remain “American owned and operated” during a Pennsylvania rally. Meanwhile, former President Donald Trump has vowed to block the deal if he is re-elected.

CFIUS, Nippon Steel, and United States Steel did not immediately respond to Benzinga‘s request for comment.

Why It Matters: The decision to delay the ruling on Nippon Steel’s acquisition of U.S. Steel comes amid a backdrop of significant political and economic tension.

The deal, valued at $14.1 billion, has faced opposition from both President Joe Biden‘s administration and former President Trump, who have cited national security and supply chain concerns. U.S. Steel CEO David Burritt remains optimistic about the merger, arguing that it would benefit shareholders and employees while enhancing the U.S.’s ability to compete with China.

However, the United Steelworkers union has labeled the deal as “doomed,” expressing strong opposition to foreign ownership of the Pittsburgh-based company. The union’s resistance adds another layer of complexity to the already contentious acquisition.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon Told Its Staff They Must Come To Office Five Days A Week, But Its Primary Healthcare Subsidiary Workers Reportedly Have It Easier

Amazon.com Inc. AMZN has introduced a new return-to-office mandate for its corporate staff, requiring them to be in the office five days a week starting in January. However, its subsidiary One Medical has been given a different directive.

What Happened: One Medical informed its employees earlier in September that they must start coming into the office three times a week beginning in October. This timeline allows over a year for employees to adjust and relocate if necessary, reported Business Insider on Tuesday, citing people familiar with the matter.

Most One Medical employees will need to be based in one of four “hub” cities: Seattle, Austin, San Francisco, or Boston. Currently, nearly 40% of One Medical employees work outside these locations, one source noted.

While One Medical’s new policy is a significant shift, it is less stringent than Amazon’s RTO mandate. On Monday, CEO Andy Jassy announced that Amazon’s corporate employees must work in an office five days a week starting in January.

This announcement has faced criticism from many Amazon employees in internal communications, according to the report.

One Medical employees have been allowed to work remotely full-time since Amazon acquired the company for $3.9 billion last year. CEO Trent Green had even promoted remote work as a major benefit during layoffs and reorganization earlier this year.

Despite the more lenient approach at One Medical, the new 3-day rule is still causing uncertainty and frustration among its employees. Amazon has been closely integrating with One Medical, implementing its HR and benefits policies and scrutinizing financial performance to control losses.

People at Amazon have also expressed frustration with One Medical’s slower adaptation to Amazon’s fast-paced work environment and rigid culture. Conversely, One Medical staff feel that Amazon is disrupting a previously well-performing and fast-growing business, according to the report.

Amazon and One Medical did not immediately respond to Benzinga‘s request for comment.

See Also: Apple Shares Slide In Monday Premarket: What’s Souring Sentiment?

Why It Matters: The new RTO mandates at Amazon and One Medical come amid a broader trend of companies reevaluating remote work policies. In September, Amazon announced plans to cut management layers and end work-from-home arrangements, aiming to streamline operations and reduce bureaucracy.

CEO Jassy emphasized the need for employees to return to the office to address inefficiencies and improve productivity.

This shift is part of a larger debate about the future of work. Earlier this year, BlackRock‘s Rick Rieder acknowledged that remote work has boosted labor market participation and economic growth, particularly among prime-age female workers.

However, not everyone agrees. NYU Stern School of Business Professor Suzy Welch Professor Suzy Welch warned that a remote work lifestyle might hinder career advancement for younger generations, potentially limiting their chances of reaching executive positions.

Other companies are also taking a hard stance on RTO. In January, Bank of America warned employees of potential disciplinary action if they failed to comply with office attendance policies, highlighting the growing tension between corporate mandates and employee preferences.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Shocking Move by Elon Musk and Larry Ellison Signals Enormous Growth Ahead for Nvidia (and Should Eliminate Its Shareholders' Biggest Worry)

Nvidia (NASDAQ: NVDA) has grown by leaps and bounds over the past few years. Thanks to the company’s dominance in the artificial intelligence (AI) chip market, its quarterly revenues and profits have been climbing at triple-digit percentage rates year over year. The company also boasts a gross margin of over 70%. The market has responded to these amazing results by bidding the stock up by more than 2,400% over five years.

In fact, the stock climbed so high that the company engaged in a stock split this spring to bring its price down from more than $1,000 to about $120 — a move designed to make it easier for retail investors to buy in.

All of this sounds great, but current shareholders and potential investors remain worried about one thing — future growth. Competition in the AI chip market is on the rise, and some are concerned that Nvidia’s pace of growth will start to taper off as cheaper options become more widely available. But a recent shocking move by Tesla Chief Executive Officer Elon Musk and Oracle co-founder Larry Ellison actually signals that Nvidia still has enormous growth ahead, and should ease investors’ fears.

The GPU’s speed and efficiency

First, a quick summary of Nvidia’s path so far. The company makes graphics processing units (GPUs), a type of chip that processes multiple tasks simultaneously. Originally, GPUs were largely destined for use in the video gaming market, but it became clear that their speed and efficiency made them valuable for a host of other computing uses. As companies over the past few years have turned their attention to AI, which demands precisely the sort of high-speed parallel processing power that GPUs can bring to bear, Nvidia took center stage — and the rest is history.

Today, companies have some choices when they need high-powered chips to launch an AI program or set up a data center — other players, from Intel to Advanced Micro Devices, make rival AI chips to power such tasks as the training and inferencing of AI models. Some companies, such as Meta Platforms, are even making some of their own chips to power their AI workloads. This is why investors’ biggest worry about Nvidia right now is the growth of competition in the market.

Now, let’s consider the recent move made by Musk and Ellison. The two billionaires took Nvidia CEO Jensen Huang out for dinner and “begged” him for more GPUs, according to a report in Fortune. Ellison said he and Musk said to Huang, “Please take our money.”

Why would a pair of powerful CEOs have to beg for GPUs instead of just ordering more? Demand is still surpassing supply even as Nvidia works nonstop to keep up with it. But instead of turning to other suppliers, Ellison and Musk decided to talk with Huang and plead their case.

The early stages of an AI build-out

Now let’s consider what this means for Nvidia. First, it shows that the company’s revenue growth should continue at a high level — Ellison, Musk, and others are still in the early stages of their AI build-outs, and everyone hopes to reach the finish line first with a winning AI product or platform. So, demand for AI chips is going strong.

Next, and the most important point here, is that Nvidia doesn’t have to worry about the competition yet. Yes, some companies are building their own chips in addition to using Nvidia’s — but demand is so high that at this point, Nvidia can’t meet 100% of everyone’s needs, and its customers have recognized this and planned ahead. In other instances, less expensive chips may be just fine for certain tasks.

But, overall, what Ellison and Musk did illustrates exactly how important Nvidia’s GPUs are in the AI landscape — and the fact that major companies would rather beg Huang for more than turn to rival hardware.

This is excellent news for Nvidia’s shareholders today, and considering its strengths in innovation, it’s good news for those who plan to hold onto the stock for the long term, too.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Oracle and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Nvidia, Oracle, and Tesla. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

This Shocking Move by Elon Musk and Larry Ellison Signals Enormous Growth Ahead for Nvidia (and Should Eliminate Its Shareholders’ Biggest Worry) was originally published by The Motley Fool

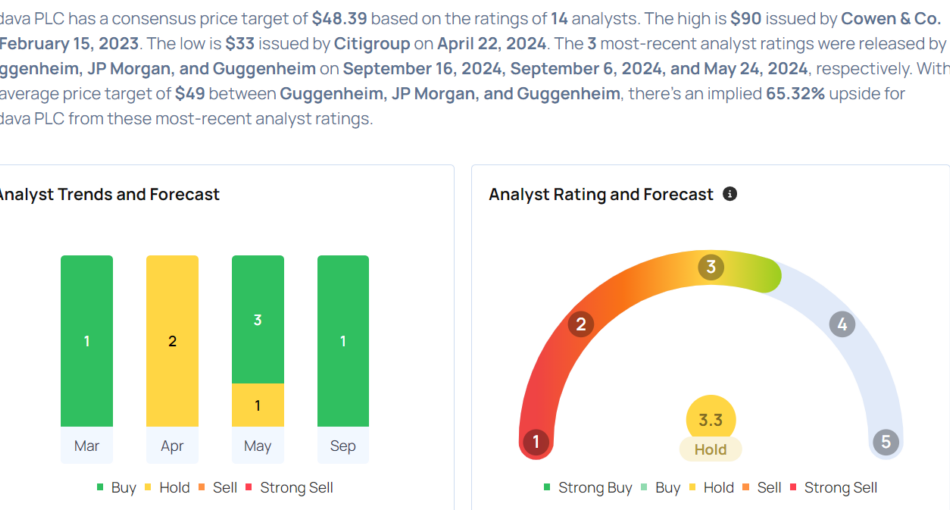

Top Wall Street Forecasters Revamp Endava Price Expectations Ahead Of Q4 Earnings

Endava plc DAVA will release earnings results for its fourth quarter, before the opening bell on Thursday, Sept. 19.

Analysts expect the UK-based company to report quarterly earnings at 30 cents per share, down from 71 cents per share in the year-ago period. Endava is projected to post revenue of $256.75 million, compared to $237.01 million a year earlier, according to data from Benzinga Pro.

On May 23, Endava posted third-quarter adjusted earnings of £0.22 per share on sales of £174.365 million.

Endava shares fell 8% to close at $29.40 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- TD Cowen analyst Bryan Bergin maintained a Buy rating and cut the price target from $46 to $42 on May 24. This analyst has an accuracy rate of 64%.

- Needham analyst Mayank Tandon maintained a Buy rating and slashed the price target from $50 to $42 on May 24. This analyst has an accuracy rate of 73%.

- Wedbush analyst Moshe Katri maintained an Outperform rating and cut the price target from $65 to $50 on May 23. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Tien-Tsin Huang maintained an Overweight rating and cut the price target from $49 to $43 on May 2. This analyst has an accuracy rate of 64%.

- Morgan Stanley analyst James Faucette maintained an Equal-Weight rating with a price target of $40 on April 22. This analyst has an accuracy rate of 65%.

Considering buying DAVA stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mohamed El-Erian Warns Markets Have Gone Too Far In Pricing Fed As 'Single Mandate' Central Bank, Highlights Potential Disappointment Awaiting Investors Looking Forward To Rate Cut

Ahead of the Federal Reserve’s upcoming rate decision, Mohamed El-Erian has highlighted concerns about the potential for disappointing interest rate cuts due to the Fed’s focus on employment.

What Happened: El-Erian, chief economic adviser at Allianz, highlighted concerns over the Federal Reserve’s focus on “maximum employment” potentially leading to underwhelming interest rate cuts.

El-Erian shared an article on X from The Economist titled “The Federal Reserve’s interest rate cuts may disappoint investors,” emphasizing that markets might have overestimated the Fed’s commitment to its employment mandate.

El-Erian noted, “The concern for markets is that they have gone too far in pricing the Fed as a single mandate central bank.”

The article suggested that Fed Chair Jerome Powell could still surprise investors with a hawkish stance. The Fed’s rate-setting committee is expected to announce a rate cut on Wednesday, with market pricing indicating a 40% chance of a 0.25 percentage point cut and a 60% chance of a 0.5 percentage point cut.

Investors have been eagerly awaiting a reversal in the Fed’s interest rate policy after a series of rapid rate hikes over the past two and a half years.

See Also: Nasdaq, S&P 500 Futures Firm Up Ahead Of Retail Sales Data

Why It Matters: The context around the Federal Reserve’s upcoming decision is crucial. Recent economic data has shown mixed signals, complicating the Fed’s decision-making process.

On Tuesday, U.S. retail sales for August rose by 0.1%, more than expected, suggesting resilient consumer spending.

Additionally, economist Quincy Krosby emphasized that the Fed must balance the impact of rate cuts on workers, noting that a smaller cut might offer more flexibility if inflation remains elevated.

Moreover, Nobel laureate Paul Krugman has argued that even a 50-basis-point cut would leave rates elevated. Meanwhile, economist Peter Schiff has warned that upcoming rate cuts might not lower borrowing costs, predicting rising mortgage rates and a potential dollar collapse.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Starbucks North America CEO Michael Conway Quits After Just 6 Months In The Position

In a surprising move, Michael Conway, Starbucks (NASDAQ:SBUX) North America CEO, has resigned after only six months in the role.

What Happened: Conway, who took on the position in April, informed the company of his decision last week, as per a Securities and Exchange Commission filing. He will remain with the company until November 30 to assist with the leadership transition, concluding his 11-year tenure at Starbucks, Business Insider reported on Tuesday.

Don’t Miss:

Before his North American CEO role, Conway served as group president of international and channel development and president of Starbucks Canada. His appointment was part of a reorganization effort by former CEO Laxman Narasimhan, Bloomberg noted in March.

Rather than appointing a new CEO for North America, Starbucks announced that Sara Trilling, the company’s North American president, will oversee retail operations across the region. Trilling has been with Starbucks for 22 years and previously managed 3,500 stores as senior vice president of its north division.

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

The company aims to enhance decision-making efficiency by streamlining its leadership structure, The Wall Street Journal reported. Conway’s departure follows other significant leadership changes, including the recent appointment of Brian Niccol, former CEO of Chipotle, as Starbucks’ new top executive.

Operational challenges have affected Starbucks’ North American stores, with complex drink orders, rising prices, and varying foot traffic impacting staff and profitability. Niccol plans to revamp operations and focus on customer experience, he stated last week.

Trending: The startup behind White Castle’s favorite Robot Fry Cook announces a next-generation fast food robot – Here’s how to get a share for under $5 today.

Why It Matters: This leadership change comes amid a series of strategic shifts at Starbucks. In March, the company announced a new geographic leadership structure to support global functions, appointing Conway as North America CEO to spearhead this initiative.

In August, the appointment of Brian Niccol as the new CEO boosted Starbucks’ valuation by over $15 billion in just one day. Niccol, known for his successful tenure at Chipotle, aims to steer Starbucks through its current challenges and enhance customer experience.

On his second day as CEO, Niccol outlined his vision to reconnect Starbucks with its community coffeehouse roots. He emphasized the need for comfortable seating and a clear distinction between “to-go” and “for-here” services to improve the in-store experience.

Read Next:

Image by Şahin Sezer Dinçer from Pixabay.

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Starbucks North America CEO Michael Conway Quits After Just 6 Months In The Position originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.