General Mills, Steelcase And 3 Stocks To Watch Heading Into Wednesday

With U.S. stock futures trading higher this morning on Wednesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects General Mills, Inc. GIS to report quarterly earnings at $1.06 per share on revenue of $4.80 billion before the opening bell, according to data from Benzinga Pro. General Mills shares rose 0.4% to $74.83 in after-hours trading.

- 23andMe Holding Co. ME disclosed that the independent directors resigned from the Board. 23andMe shares dipped 15% to $0.29 in the after-hours trading session.

- Analysts are expecting Steelcase Inc SCS to post quarterly earnings at 37 cents per share on revenue of $864.10 million for the recent quarter. Steelcase shares gained 0.8% to $14.12 in the after-hours trading session.

Check out our premarket coverage here

- Intuitive Machines, Inc. LUNR said it was awarded a NASA Near Space Network contract for communication and navigation services, with a maximum potential value of $4.82 billion. Intuitive Machines shares jumped 55.6% to $8.40 in the after-hours trading session.

- Analysts expect Sangoma Technologies Corporation SANG to post a quarterly loss at 3 cents per share on revenue of $61.03 million after the closing bell. Sangoma Technologies shares 6% to $6.37 in after-hours trading.

Check This Out:

Image generated using AI tools

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Stock Reaction After iPhone Launch Sparks Portfolio Manager's Reflection: 'I May Be Wrong In The Short Term But…Will Be Back In The Long Run'

Apple, Inc. AAPL shares have barely budged to the Glowtime hardware launch event held on Sept. 9, and a portfolio manager on Tuesday offered “Mea Culpa” for his short-term stance on the stock.

What Happened: Very early indications point to a nearly 10% year-over-year decline in the sales of the iPhone 16, the newest iteration of Apple’s flagship product, said portfolio manager and founder of Niles Investment Management Dan Niles. This is in contrast to expectations that the addition of the artificial intelligence features will drive 10% sales growth, he said.

Quoting famous American researcher, scientist and futurist Roy Amara’s law, Nile said, “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

The portfolio manager noted that Apple’s price/earnings multiple calculated on calendar year 2024 earnings expanded from 24 times to 31 times, primarily on AI expectations. “It is hard to argue for valuation support at current levels,” he said.

While noting that “a crucial trait for successful investing is admitting when you are wrong and moving on,” Nile said. “I think I am wrong in the short run but have a feeling that I will be back in the long run.”

Ahead of the Apple event, Niles had said this time around Apple stock could go against the grain on the launch day. He based his expectation on Apple supplier Hon Hai Precision Industry Co., Ltd. HNHPF reporting 33% year-over-year revenue growth for August, which was the highest quarterly growth for the company of the year.

“While historically $AAPL product launches are sell the news events, this AI-focused event on 9/9 has a chance to buck the trend,” he had said then.

AI Undeniable Prop: Nile said Apple Intelligence will be a pulling point for consumers. “I believe consumers will want AI functionality available to them 24/7 and the smartphone is the one piece of technology that we have with us all the time.”

Weighing in on the early softness, the strategist said with the staggered rollout of AI across geographies, AI features will be available to consumers in China, a key market, only in 2025.

He also noted that the promotion of the new phones by the U.S. wireless carriers is not much different than last year.

Niles’ views echo that of tech venture capitalist Gene Munster. In a recent note, he said he expects iPhone revenue to rise 15% in fiscal year 2025, more than double the 7% growth the Street currently models. Munster sees growth accelerating slightly to 17% in the next fiscal compared to the Street forecast of 8% growth.

“The most significant factor in my estimate is my belief that 8% of the iPhone installed base will upgrade early in FY25, and 14% in FY26,” he had said. The tech specialist, however, sees a slowdown to 5% each in fiscal years 2027 and 2028.

In premarket trading on Wednesday, Apple shares fell 0.44% to $215.83, according to Benzinga Pro data. The stock has added 13% for the year-to-date period, underperforming the 19% gain for the SPDR S&P 500 ETF Trust SPY, an exchange-traded fund that tracks the S&P 500 Index.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From FedEx Stock Ahead Of Q1 Earnings

FedEx Corporation FDX is scheduled to release earnings results for its first quarter, after the closing bell on Thursday.

Analysts expect the company to report quarterly earnings at $4.83 per share, up from $4.55 per share in the year-ago period. The company projects to report revenue of $21.99 billion for the quarter, according to data from Benzinga Pro.

On Sept. 6, the Equal Employment Opportunity Commission (EEOC) sued FedEx, saying the global shipping and logistics company violated federal law by discriminating against its employees with disabilities.

With the recent buzz around FedEx, some investors may be eyeing potential gains from the company’s dividends too. As of now, FedEx offers an annual dividend yield of 1.89%, which is a quarterly dividend amount of $1.38 per share ($5.52 a year).

So, how can investors exploit its dividend yield to pocket a regular $500 monthly?

To earn $500 per month or $6,000 annually from dividends alone, you would need an investment of approximately $318,089 or around 1,087 shares. For a more modest $100 per month or $1,200 per year, you would need $63,501 or around 217 shares.

To calculate: Divide the desired annual income ($6,000 or $1,200) by the dividend ($5.52 in this case). So, $6,000 / $5.52 = 1,087 ($500 per month), and $1,200 / $5.52 = 217 shares ($100 per month).

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

How that works: The dividend yield is computed by dividing the annual dividend payment by the stock’s current price.

For example, if a stock pays an annual dividend of $2 and is currently priced at $50, the dividend yield would be 4% ($2/$50). However, if the stock price increases to $60, the dividend yield drops to 3.33% ($2/$60). Conversely, if the stock price falls to $40, the dividend yield rises to 5% ($2/$40).

Similarly, changes in the dividend payment can impact the yield. If a company increases its dividend, the yield will also increase, provided the stock price stays the same. Conversely, if the dividend payment decreases, so will the yield.

FDX Price Action: Shares of FedEx gained 2.2% to close at $292.63 on Monday.

Read More:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Balk at Record as Fed Bets ‘Up in the Air’: Markets Wrap

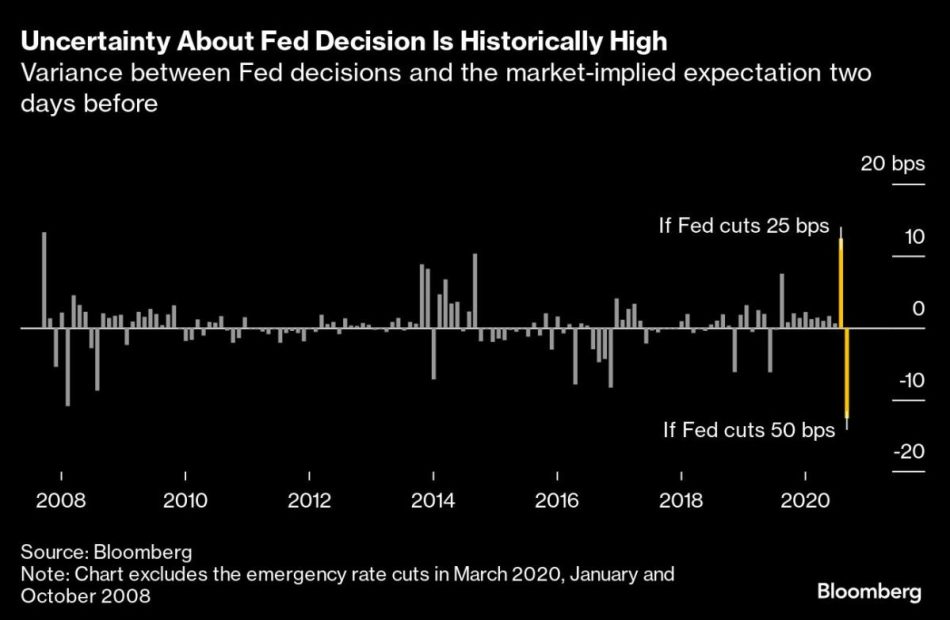

(Bloomberg) — Stocks drifted near all-time highs ahead of the Federal Reserve decision, with traders split on the size of an interest-rate cut.

Most Read from Bloomberg

The S&P 500 closed little changed after briefly crossing the threshold of a record amid an increase in US retail sales. Economically sensitive industries once again outperformed tech. Treasury yields edged up, with shorter maturities leading the move. The market-implied odds the Fed announces a 50-basis-point reduction on Wednesday were around 55%.

For several market observers, perhaps the most-important aspect of what happens may be the investor reaction. Could a 25 basis-point reduction leave traders worried the Fed is behind the curve? Could a 50 basis-point move spook markets that the Fed must know the economy is in dire shape? Or will investors be reassured that, whatever the Fed does, Chair Jerome Powell is on top of the situation?

“It’s rare under the Powell Fed for markets to be this ‘up in the air’ on what exactly the Fed will do with just one day to go before the decision,” according to Bespoke Investment Group strategists. “Although maybe the Fed is happy with the market being 100% sure that we’ll at least get a cut.”

A survey conducted by 22V Research showed investors who expect a 25 basis-point reduction are split on whether that cut would deliver a “risk-on” or “risk-off” reaction. Meantime, those betting on 50 basis points think a smaller Fed move would be “risk-off.”

The S&P 500 closed near 5,635. The Nasdaq 100 and Dow Jones Industrial Average were little changed. The Russell 2000 of small firms added 0.7%. Treasury 10-year yields rose two basis points to 3.64%. The dollar gained.

While the market has typically done well on Fed Days when rates have been cut, performance in the week after the first rate cut of a new easing cycle has been pretty weak, according to Bespoke.

The S&P 500 has averaged a drop of 0.56% from the close on the day before the first rate cut through one week later, while eight of 10 sectors have averaged declines as well. Financials and health care have seen the most weakness in the week after the first rate cut, while tech and communication services have bucked the trend and averaged gains.

The Fed will either cut 50 basis points or opt for a 25 basis-point reduction, but signal that they will be more aggressive going forward, according to Matt Maley at Miller Tabak.

Still, he says, that does not guarantee that the stock market and/or bond market will rally in a meaningful way. Maley says the Fed will likely try to convey that a more dovish stance is not seen as something that means they’re suddenly worried about an imminent recession.

“Therefore, given that the stock market is approaching overbought territory, we could still get a ‘sell the news’ reaction to the Fed this week,” he added.

“If the Fed doesn’t initiate its easing cycle with 50 basis points, surely a 25 basis-point move will be enveloped by a dovish tone,” according to Quincy Krosby at LPL Financial. Ryan Detrick at Carson Group said “a larger cut out of the gate makes a lot of sense” given that now the big concern is the potential for a quickly slowing labor market.

Steve Sosnick at Interactive Brokers still believes the Fed should lean to 25 basis points, but notes that years of trading experience have taught him to respect the message of the market.

“And that message has been saying 50,” he said.

Sosnick noted there will likely be widespread disappointment if the Fed opts for 25 basis points. He says equity markets always crave more liquidity, and at the same time, bond markets have all but priced in an aggressive rate cutting path for future meetings. So the smaller cut would bias against both.

Kristina Hooper at Invesco expects the Fed to cut by 25 basis points as a bigger reduction would raise alarm bells about the state of the US economy.

“Recall that the Fed started a brief easing cycle with a 50 basis point cut in March 2020 with the global pandemic upon us; it would be very hard to argue that the situation is so dire now,” she noted.

What Powell says in his press conference about the state of the US economy could help build confidence for those worried about a recession in the near term, Hooper added.

“In addition, it will be valuable to hear Powell’s thoughts on the expected path of rate cuts — in particular, what conditions could trigger a change of course, either a moderation or acceleration in easing,” she noted. “These are just things you can’t glean from the dot plot, so the press conference is ‘must see TV’ in my view.”

Corporate Highlights:

-

Microsoft Corp. raised its quarterly dividend 10% and unveiled a new $60 billion stock-buyback program, matching the size of a repurchase plan three years ago.

-

Intel Corp. made a raft of announcements, spurring optimism that the chipmaker’s turnaround plan is starting to bear fruit.

-

Salesforce Inc. is unveiling a pivot in its artificial intelligence strategy this week at its annual Dreamforce conference, now saying that its AI tools can handle tasks without human supervision and changing the way it charges for software.

-

Newmont Corp., the world’s biggest gold miner, said it’s on track to raise $2 billion — if not more — from selling smaller mines and development projects.

-

JPMorgan Chase & Co. is in discussions with Apple Inc. about taking over a credit card portfolio that rival Goldman Sachs Group Inc. has been trying to ditch.

-

Snap Inc. Chief Executive Officer Evan Spiegel unveiled a new version of the company’s Spectacles smart glasses, revitalizing an effort to build an advanced augmented reality product that may one day replace or rival the smartphone.

-

Ozempic, the blockbuster diabetes shot made by Novo Nordisk A/S, is “very likely” to be one of the next drugs targeted for a price cut in bargaining with the US government’s Medicare program, a company executive said.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 4 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average was little changed

-

The MSCI World Index was little changed

-

S&P 500 Equal Weighted Index rose 0.2%

-

Bloomberg Magnificent 7 Total Return Index rose 0.4%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.1% to $1.1117

-

The British pound fell 0.4% to $1.3163

-

The Japanese yen fell 1.1% to 142.22 per dollar

Cryptocurrencies

-

Bitcoin rose 4% to $59,953.71

-

Ether rose 3.4% to $2,352.4

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.64%

-

Germany’s 10-year yield advanced two basis points to 2.14%

-

Britain’s 10-year yield advanced one basis point to 3.77%

Commodities

-

West Texas Intermediate crude rose 1.8% to $71.34 a barrel

-

Spot gold fell 0.5% to $2,568.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Landmark Homes Announces New Product Type and Floor Plans Coming to Northfield at Old Town in Fort Collins

FORT COLLINS, Colo., Sept. 17, 2024 /PRNewswire/ — Landmark Homes, an esteemed local homebuilder, is proud to announce an expansion of lifestyle opportunities by introducing a new product type and meticulously crafted floor plans at Northfield at Old Town — the most attainable new construction homes in Fort Collins. Those with aspirations to live in the area can get the first glimpse of these innovative home designs.

Eager homebuyers are invited to join the Northfield at Old Town interest list and be among the first to experience a new living space era that reflects thoughtful design and optimization.

Future Owners Will Enjoy:

- Space-conscious and intuitive layouts

- The newest generation of condo living

- A greater availability of widely-loved floor plans

- Living within walking distance to the heart of downtown

- Easy access to the bike trail and Poudre River

Northfield at Old Town Is LEED Gold Certified

Northfield at Old Town is at the forefront of sustainable living in Fort Collins. The community is built with an eye towards the future, featuring homes that meet LEED Gold Standards, promoting healthier living environments and reducing carbon footprints.

LEED Gold Certification is a Commitment to Sustainable Living. Homeowners will get the benefits of:

- Water-efficient fixtures

- Solar panels

- HRV ventilation systems for improved indoor air quality

- Low VOC paintings and coatings

- Electric car charging stations

- 30A circuit in garage

- And more!

About Landmark Homes:

Landmark Homes is recognized for its commitment to building well-crafted homes in the best communities. With a focus on attached homes, Landmark Homes allows for more affordable living options without compromising on location or quality. Each community is meticulously planned to create environments that enhance the lives of its residents, proving that a home is more than just a house – it’s where life unfolds and memories are made.

Jason Sherrill, CEO and design visionary at Landmark Homes, comments on the community: “Northfield is a great example of collaboration between private and public sectors coming together to make this unique project happen. We’ve created an affordable homeownership opportunity that really doesn’t exist this close to downtown. The average sales price in a 3-mile radius is $675,00, our average is $450,000.”

Secure an invite to the exclusive preview event! Contact Kendra at 970-632-7173 or join our interest list: (https://landingpages.mylandmarkhomes.net/the-new-northfield).

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/landmark-homes-announces-new-product-type-and-floor-plans-coming-to-northfield-at-old-town-in-fort-collins-302250717.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/landmark-homes-announces-new-product-type-and-floor-plans-coming-to-northfield-at-old-town-in-fort-collins-302250717.html

SOURCE Landmark Homes

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

L3Harris Wins $587M Contract for Next Generation Jammer-Low Band

L3Harris Technologies LHX announced that it has received a five-year contract, worth $587.4 million, to deliver custom tactical jamming pods designed to modernize the U.S. Navy’s Aerial Electronic Attack capability.

Details of LHX’s New Contract

The Next Generation Jammer-Low Band (NGJ-LB) is an advanced airborne electronic warfare system. The L3Harris solution will be simpler to maintain than the Navy’s present system because of its modular, open-system architecture, which allows for seamless updates.

It also combines enhanced processing with greater jamming capability. The L3Harris system will work with combined and allied forces to offer expansion potential for future technological integration.

Over the course of the next five years, the company will provide more test assets for airworthiness and design verification, in addition to eight operational prototype pods for the U.S. Naval Air Systems Command to evaluate the fleet. The Navy intends to replace the outdated AN/ALQ-99 Tactical Jamming System, and the NGJ-LB pods will aid the initiative by flying on the EA-18G Growler.

Benefits of NGJ-LB

With high-power RF jamming, LHX’s NGJ-LB pod transforms the Growler’s capacity to carry out its main mission, Suppression of Enemy Air Defense, from standoff ranges. This results in improved lethality and scalability for upcoming technological advancements.

The NGJ-LB helps cover a broad spectrum of frequencies to serve diverse Department of Defense-wide electronic warfare demands.

The NGJ-LB reduces aircrew workload and cockpit distractions while increasing the number of simultaneous targets that aircrews can attack through high Equivalent, Isotropically Radiated Power and tailored waveforms. The cutting-edge technology of the NGJ-LB significantly improves availability and sustainment while eradicating existing system capability gaps.

Peer Prospects

Along with LHX, other defense companies like RTX Corp. RTX, Northrop Grumman NOC and Lockheed Martin LMT are also set to take advantage of the expanding EW market.

In August 2024, RTX won a contract involving its Next Generation Jammer Mid-Band (NGJ-MB) System. Valued at $27.7 million, the contract is expected to be completed by August 2026. Per the terms of the deal, RTX will be involved in the repair of several components used in the NGJ-MB System employed on the F/A-18 aircraft.

RTX’s long-term (three to five-year) earnings growth rate is 10.42%. The Zacks Consensus Estimate for 2024 EPS indicates a year-over-year increase of 7.7%.

Northrop Grumman has been providing Naval Airborne EW solutions for more than 55 years and is the Airborne Electronic Attack System Integrator for the U.S. Navy warfighter. Some of its EW systems are the ALQ-251 radio frequency countermeasures system and the AN/APR-39 Radar Warning Receiver/Electronic Warfare Management System.

NOC’s long-term earnings growth rate is 8.68%. The Zacks Consensus Estimate for 2024 EPS indicates a year-over-year increase of 7.9%.

LMT provides global ground EW solutions to U.S. forces, as well as partner nations, through a unique next-generation open architecture product platform and open business model. Its Advanced Off-Board EW program delivers persistent electronic surveillance and attack capability against naval threats like anti-ship missiles.

LMT’s long-term earnings growth rate is 4.67%. The Zacks Consensus Estimate for 2024 sales indicates a year-over-year increase of 5.3%.

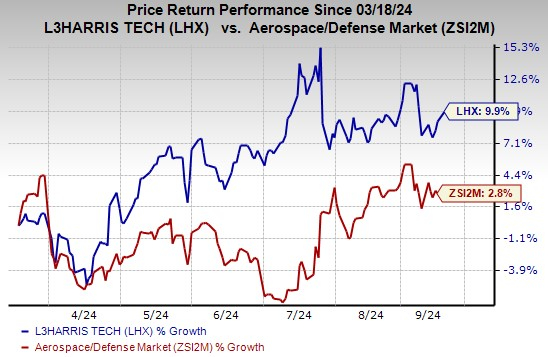

LHX’s Stock Price Performance

In the past six months, shares of LHX have risen 9.9% compared with the industry’s 2.8% growth.

Image Source: Zacks Investment Research

LHX’s Zacks Rank

LHX currently carries a Zacks Rank #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marijuana Stock Movers For September 17, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Meet the 16 members of the $100 billion club — who are jointly worth more than Amazon or Google

-

The elite group worth more than $100 billion includes Elon Musk, Jeff Bezos, and Bill Gates.

-

The 16 members have grown about $414 billion richer this year and are jointly worth $2.4 trillion.

-

Walmart heirs Jim and Rob Walton joined the club this month and their sister could soon follow.

Elon Musk, Jeff Bezos, and Mark Zuckerberg are among the handful of people on the planet with a net worth above $100 billion.

Members of this elite group have amassed 12-digit fortunes by owning huge amounts of stock in some of the world’s most valuable companies. Most are founders and either current or former CEOs, and some, such as Warren Buffett, would be much richer if they didn’t give billions to charity.

There may be only 16 centibillionaires, but their combined wealth is around $2.4 trillion, according to the Bloomberg Billionaires Index. They’re worth more than Amazon or Google-parent Alphabet, which command market values of around $2 trillion each.

All but one of them have grown richer this year, adding a net $414 billion to their collective fortunes. Procter & Gamble ($409 billion), Costco ($406 billion), and Johnson & Johnson ($398 billion) are all worth less than that.

Walmart heirs Jim and Rob Walton joined the exclusive group this month thanks to their net worths surging by over $29 billion this year. Their sister, Alice, could soon follow given her net worth stands at $99.5 billion.

Here’s the list of individuals worth at least $100 billion, showing Bloomberg’s estimate of their net worth at the time of publication, how much it’s changed this calendar year, and the source of their wealth.

All figures are correct as of September 16, 2024.

1. Elon Musk

Net worth: $251 billion

YTD change in wealth: +$21.7 billion

Source of wealth: Tesla and SpaceX stock

Elon Musk is the CEO of the electric-vehicle maker Tesla and the spacecraft manufacturer SpaceX. He’s also the owner of X, the social network formerly known as Twitter.

His other businesses include The Boring Company, Neuralink, and xAI.

2. Jeff Bezos

Net worth: $209 billion

YTD change in wealth: +$32.1 billion

Source of wealth: Amazon stock

Jeff Bezos is the founder, executive chairman, and former CEO of Amazon, the e-commerce and cloud-computing giant.

He also founded the space company Blue Origin and owns The Washington Post.

3. Mark Zuckerberg

Net worth: $186 billion

YTD change in wealth: +$58.3 billion

Source of wealth: Meta stock

Mark Zuckerberg is the cofounder, chairman, and CEO of Meta Platforms, the social-media titan behind Facebook, Instagram, WhatsApp, and Threads.

Meta’s Reality Labs division makes virtual-reality and augmented-reality headsets and experiences.

4. Bernard Arnault

Net worth: $180 billion

YTD change in wealth: -$27.8 billion

Source of wealth: LVMH stock

Bernard Arnault is the founder, chairman, and CEO of LVMH Moët Hennessy Louis Vuitton. His conglomerate owns a bevy of luxury brands, including Dior, Fendi, Dom Pérignon, Sephora, and Tiffany & Co.

5. Larry Ellison

Net worth: $174 billion

YTD change in wealth: +$50.8 billion

Source of wealth: Oracle and Tesla stock

Larry Ellison is the cofounder, chief technology officer, and former CEO of Oracle, an enterprise software company specializing in cloud computing and database platforms.

He invested in Tesla prior to joining the automaker’s board in 2018 and made more than 10 times his money on paper by the time his term as a director ended in August 2022.

6. Bill Gates

Net worth: $161 billion

YTD change in wealth: +$20.1 billion

Source of wealth: Microsoft stock

Bill Gates is the cofounder and former CEO of Microsoft, which makes the Office application suite, the cloud-computing platform Microsoft Azure, and Xbox consoles.

He’s renowned for his philanthropic work at the helm of the Bill & Melinda Gates Foundation, one of the world’s largest charitable entities.

7. Steve Ballmer

Net worth: $149 billion

YTD change in wealth: +$18.3 billion

Source of wealth: Microsoft stock

Steve Ballmer served as Microsoft’s CEO between 2000 and 2014. He joined the company in 1980 as Bill Gates’ assistant, initially negotiating a profit share which he later swapped for an equity stake when it became excessively large.

Ballmer retired as CEO in 2014 with a 4% stake — a position now worth more than $120 billion. He promptly bought the Los Angeles Clippers for $2 billion and remains the basketball team’s owner.

8. Larry Page

Net worth: $143 billion

YTD change in wealth: +$16.2 billion

Source of wealth: Alphabet stock

Larry Page cofounded Google with his Stanford University classmate Sergey Brin in a friend’s garage in 1998 and served as CEO until 2001.

He took the reins again between 2011 and 2015 after Google was restructured as a subsidiary of Alphabet alongside other businesses such as YouTube and Waymo.

9. Warren Buffett

Net worth: $141 billion

YTD change in wealth: +$21.4 billion

Source of wealth: Berkshire Hathaway stock

Warren Buffett acquired Berkshire Hathaway when it was a failing textile mill in 1965 and has since grown it into one of the world’s largest companies. His nearly 15% stake is worth around $145 billion.

The famed investor’s conglomerate owns scores of businesses, including GEICO, See’s Candies, and BNSF Railway, and holds multibillion-dollar stakes in public companies such as Apple and Coca-Cola.

Buffett has gifted around half of his Berkshire shares to the Gates Foundation and four family foundations since 2006. All else being equal, if he’d retained all his stock he would be the world’s wealthiest person with a net worth over $300 billion.

10. Sergey Brin

Net worth: $134 billion

YTD change in wealth: +$14.4 billion

Source of wealth: Alphabet stock

Sergey Brin cofounded Google with Page in 1998 and served as the search-and-advertising titan’s first president.

He and Page stepped down from their respective roles as Alphabet’s president and CEO in 2019.

11. Mukesh Ambani

Net worth: $112 billion

YTD change in wealth: +$15.3 billion

Source of wealth: Reliance Industries stock

Mukesh Ambani is the chairman and managing director of Reliance Industries and Asia’s richest person.

His father, Dhirubhai Ambani, founded Reliance and trusted Mukesh to grow the conglomerate’s petrochemicals business and expand into new areas such as telecommunications.

Mukesh threw a star-studded, multi-event wedding ceremony for his son Anant Ambani this summer.

12. Amancio Ortega

Net worth: $111 billion

YTD change in wealth: +$23.6 billion

Source of wealth: Inditex stock

Amancio Ortega is the founder and former chairman of Inditex, a fashion retail group home to brands such as Zara, Bershka, and Massimo Dutti.

The billionaire philanthropist and real-estate investor stopped running Inditex in 2011. His daughter Marta Ortega Pérez was appointed chair at the end of 2021.

13. Michael Dell

Net worth: $108 billion

YTD change in wealth: +$29.5 billion

Source of wealth: Dell stock

Michael Dell is the founder, chairman, and CEO of the eponymous computer maker. Dell stock has ballooned from below $40 in March last year to upwards of $110, valuing the company at over $80 billion, as investors wager it will be a key beneficiary from the AI boom.

Dell owns about 46% of his company, and pocketed well over $10 billion from the sale of Dell-backed VMware to Broadcom last year.

14. Jensen Huang

Net worth: $104 billion

YTD change in wealth: +$60.4 billion

Source of wealth: Nvidia stock

Jensen Huang cofounded Nvidia in 1993, but the microchip maker has become a market darling within the past two years as its semiconductors have proven pivotal to developing artificial intelligence.

Nvidia’s stock price has skyrocketed from under $15 at the end of 2022 to $130, valuing the business at about $2.9 trillion and making Huang one of the richest people in the world.

15. Jim Walton

Net worth: $102 billion

YTD change in wealth: +$29.9 billion

Source of wealth: Walmart stock

Jim Walton is the youngest son of Walmart founder Sam Walton, who gave each of his four children a 20% stake in the budding retail business over 70 years ago. Jim and his two surviving siblings, Rob and Alice, each still own over 11% of the company.

Jim’s net worth crossed $100 billion this month thanks to the retailer’s stock soaring 53% this year.

16. Rob Walton

Net worth: $101 billion

YTD change in wealth: +$29.3 billion

Source of wealth: Walmart stock

Rob Walton, Sam Walton’s eldest, sat on Walmart’s board for more than 40 years before retiring this June.

His net worth passed $100 billion for the first time last week, making him the second Walton to join the club after his younger brother, Jim. Their sister, Alice, is poised to follow them given her $99.5 billion net worth.

Read the original article on Business Insider

S&P 500 Briefly Hits Record High Just Ahead Of Fed Rate Cut, Extends 7-Day Winning Streak: Tuesday's Top 5 Gainers

The S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, hit fresh record highs during Tuesday morning trading and closed up 0.04%, marking its seventh consecutive day of gains, just ahead of the Federal Reserve’s highly anticipated interest rate decision.

The performance of the index tracking the largest 500 U.S. companies by market capitalization was in line with other major indices. The Invesco QQQ Trust, Series 1 QQQ, which tracks the tech-heavy Nasdaq, and the SPDR Dow Jones Industrial Average ETF DIA both closed broadly flat for the day.

However, small-cap stocks outperformed their larger counterparts, as the iShares Russell 2000 ETF IWM finished 0.8% higher.

Policymakers gathered on Tuesday for the two-day Federal Open Market Committee (FOMC) meeting, with the interest rate decision expected on Wednesday at 2:00 p.m. ET.

Market expectations are mixed, with CME FedWatch data indicating a 65% chance of a 50-basis-point rate cut and a 35% chance of a smaller 25-basis-point cut. This level of uncertainty is unusual on the eve of a Fed decision.

Expectations for a larger rate cut fell slightly after August retail sales came in stronger than anticipated. Retail sales increased by 0.1% month-over-month, decelerating from July’s robust 1.1% growth but beating forecasts of a 0.2% decline.

The unexpected strength in consumer spending has cast some doubt on the need for a significant rate cut to support the economy.

An overwhelming consensus among Wall Street analysts anticipates a 25-basis-point cut, yet JPMorgan Chase stands among the outliers predicting a 50-basis-point reduction.

Tuesday’s Top 5 S&P 500 Stocks

| Name | Sector | 1-day Return (%) |

| Enphase Energy, Inc. ENPH | Information Technology | 6.32 |

| Hewlett Packard Enterprise Company HPE | Information Technology | 5.66 |

| Moderna, Inc. MRNA | Health Care | 4.05 |

| Synchrony Financial SYF | Financials | 4.00 |

| United Rentals, Inc. URI | Industrials | 3.95 |

| Airbnb, Inc. ABNB | Consumer Discretionary | 3.86 |

Read Next:

Image created using artificial intelligence via Dall-E.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cousins Props EVP Trades $205K In Company Stock

On September 16, a recent SEC filing unveiled that Roper Pamela F, EVP at Cousins Props CUZ made an insider sell.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, F sold 7,047 shares of Cousins Props. The total transaction value is $205,279.

The latest update on Tuesday morning shows Cousins Props shares down by 0.0%, trading at $29.5.

About Cousins Props

Cousins Properties Inc is a real estate investment trust principally involved in the ownership, management, and development of properties in the Southern United States. Cousins Properties’ real estate portfolio mainly comprises offices and mixed-use developments that encompass both apartment and retail space. Offices make up the vast majority of the portfolio in terms of total square footage. Cousins’ assets are mainly located in Texas and Georgia, with North Carolina also playing host to a smaller amount of rental space. The company derives nearly all of its revenue in the form of rental income from its properties, the majority of which comes from its office locations. A diverse set of tenants in the cities of Houston and Atlanta represent the company’s key markets.

Financial Milestones: Cousins Props’s Journey

Revenue Growth: Cousins Props’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 4.24%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Exploring Profitability:

-

Gross Margin: The company shows a low gross margin of 66.84%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Cousins Props’s EPS is below the industry average. The company faced challenges with a current EPS of 0.05. This suggests a potential decline in earnings.

Debt Management: With a below-average debt-to-equity ratio of 0.59, Cousins Props adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Cousins Props’s current Price to Earnings (P/E) ratio of 75.64 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 5.49, Cousins Props’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Cousins Props’s EV/EBITDA ratio of 13.87 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Closer Look at Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cousins Props’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.