Redfin's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Redfin.

Looking at options history for Redfin RDFN we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 45% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $92,538 and 8, calls, for a total amount of $432,165.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $16.0 for Redfin during the past quarter.

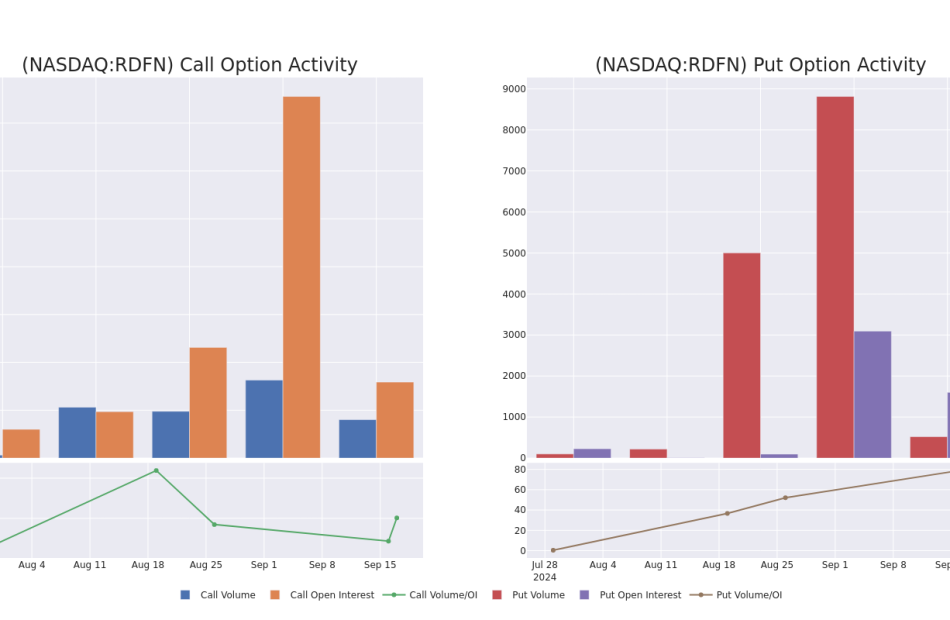

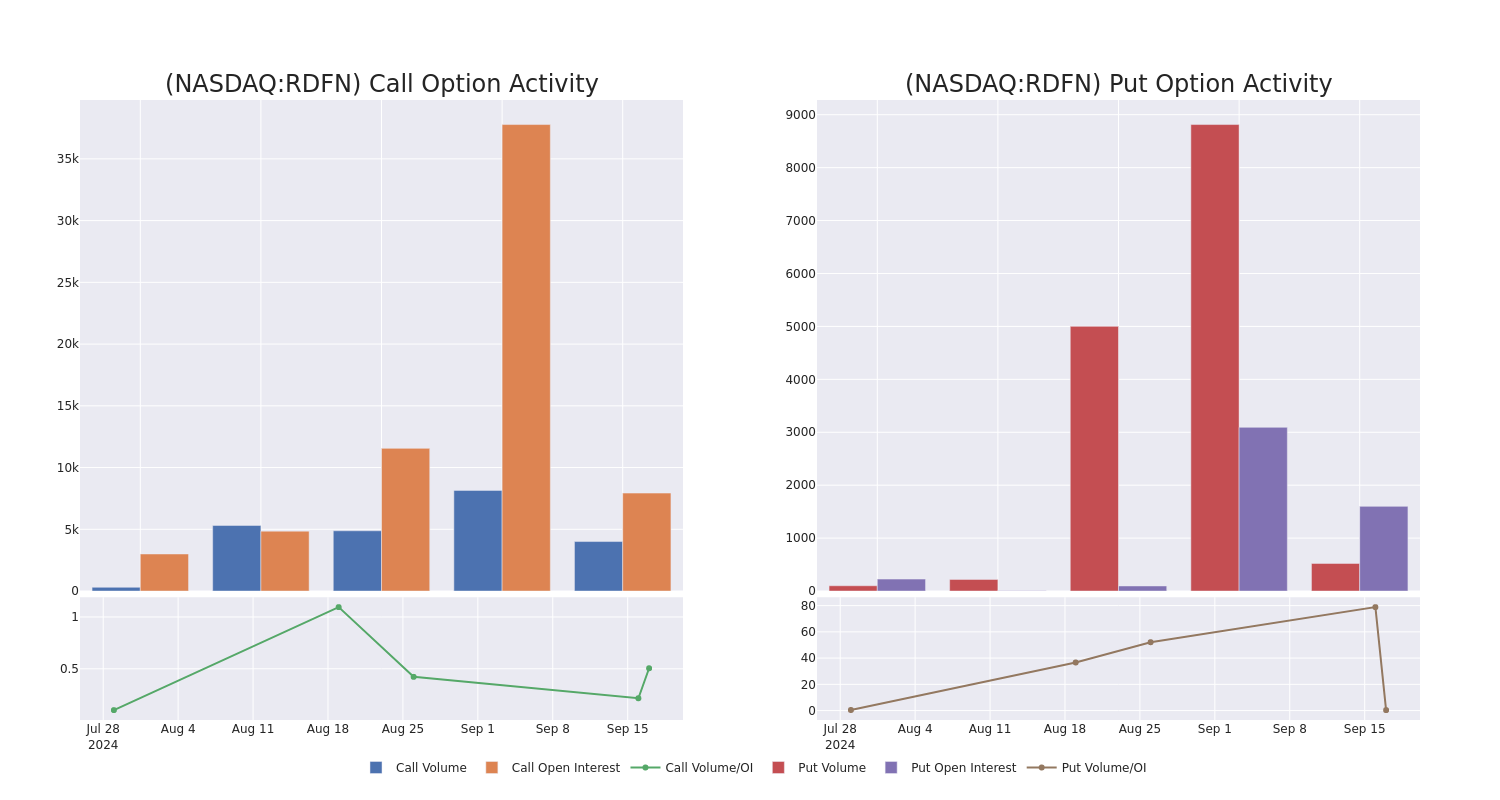

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Redfin’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Redfin’s whale activity within a strike price range from $10.0 to $16.0 in the last 30 days.

Redfin Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RDFN | CALL | TRADE | NEUTRAL | 11/15/24 | $2.5 | $2.4 | $2.45 | $14.00 | $122.2K | 1.8K | 507 |

| RDFN | CALL | TRADE | BULLISH | 10/18/24 | $4.3 | $4.2 | $4.3 | $10.00 | $64.5K | 2.8K | 200 |

| RDFN | CALL | SWEEP | BEARISH | 01/17/25 | $2.6 | $2.5 | $2.5 | $16.00 | $50.0K | 357 | 876 |

| RDFN | CALL | SWEEP | BULLISH | 11/15/24 | $1.6 | $1.5 | $1.6 | $16.00 | $48.0K | 521 | 300 |

| RDFN | CALL | SWEEP | BEARISH | 01/17/25 | $4.9 | $4.7 | $4.73 | $11.00 | $47.2K | 2.4K | 143 |

About Redfin

Redfin Corp is a residential real estate broker. It pairs its agents with the technology to create a service that is faster and costs less. The company meets customers through a listings-search website and mobile application. The company uses the same combination of technology and local service to originate mortgage loans and offer title and settlement services. It has five operating segments and three reportable segments, real estate services, rentals, and mortgage. The company generates the majority of its revenue from Real estate services.

After a thorough review of the options trading surrounding Redfin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Redfin

- With a trading volume of 9,416,053, the price of RDFN is up by 4.18%, reaching $14.21.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 44 days from now.

Professional Analyst Ratings for Redfin

In the last month, 1 experts released ratings on this stock with an average target price of $13.0.

- An analyst from B. Riley Securities upgraded its action to Buy with a price target of $13.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Redfin, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

STELLANTIS SHAREHOLDER ALERT BY FORMER LOUISIANA ATTORNEY GENERAL: KAHN SWICK & FOTI, LLC REMINDS INVESTORS WITH LOSSES IN EXCESS OF $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against Stellantis N.V. – STLA

NEW ORLEANS, Sept. 17, 2024 (GLOBE NEWSWIRE) — Kahn Swick & Foti, LLC (“KSF”) and KSF partner, former Attorney General of Louisiana, Charles C. Foti, Jr., remind investors that they have until October 15, 2024 to file lead plaintiff applications in a securities class action lawsuit against Stellantis N.V. STLA, if they purchased the Company’s securities between February 15, 2024 to July 24, 2024, inclusive (the “Class Period”). This action is pending in the United States District Court for the Southern District of New York.

What You May Do

If you purchased securities of Stellantis and would like to discuss your legal rights and how this case might affect you and your right to recover for your economic loss, you may, without obligation or cost to you, contact KSF Managing Partner Lewis Kahn toll-free at 1-877-515-1850 or via email (lewis.kahn@ksfcounsel.com), or visit https://www.ksfcounsel.com/cases/nyse-stla/ to learn more. If you wish to serve as a lead plaintiff in this class action, you must petition the Court by October 15, 2024.

About the Lawsuit

Stellantis and certain of its executives are charged with failing to disclose material information during the Class Period, violating federal securities laws.

On July 25, 2024, the Company announced its first half 2024 financial results, disclosing disappointing news, including “[n]et revenues of €85.0 billion, down 14% compared to H1 2023, primarily due to the decline in volume and mix; net profit of €5.6 billion, down 48% compared to H1 2023, primarily due to lower volume and mix, headwinds from foreign exchange and restructuring costs; adjusted operating income of €8.5 billion, down €5.7 billion compared to H1 2023, primarily due to decreases in North America.”

On this news, the price of Stellantis’ shares fell from a closing price of $19.60 per share on July 24, 2024 to $17.66 per share on July 26, 2024.

The case is Long v. Stellantis N.V., et al., No. 24-cv-06196.

About Kahn Swick & Foti, LLC

KSF, whose partners include former Louisiana Attorney General Charles C. Foti, Jr., is one of the nation’s premier boutique securities litigation law firms. KSF serves a variety of clients – including public institutional investors, hedge funds, money managers and retail investors – in seeking recoveries for investment losses emanating from corporate fraud or malfeasance by publicly traded companies. KSF has offices in New York, Delaware, California, Louisiana and New Jersey.

To learn more about KSF, you may visit www.ksfcounsel.com.

Contact:

Kahn Swick & Foti, LLC

Lewis Kahn, Managing Partner

lewis.kahn@ksfcounsel.com

1-877-515-1850

1100 Poydras St., Suite 960

New Orleans, LA 70163

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Compass Minerals Defies Expectations With Q3 Revenue Beat Amid Accounting Delays

Compass Minerals Intl Inc CMP shares are trading higher after the company announced preliminary third-quarter revenue above estimates.

The company reported preliminary revenue of $202.9 million, exceeding the estimated $197.775 million.

Compass Minerals reported preliminary adjusted EBITDA of $32.8 million, including a $0.9 million non-cash gain from a decrease in the Fortress contingent liability.

The Salt segment showed strong performance with adjusted EBITDA of $28.05 per ton. The average sales price for sulfate of potash rose to $691.27 per ton for the second consecutive quarter.

Additionally, Plant Nutrition segment witnessed an adjusted EBITDA per ton of $128.57 and an adjusted EBITDA margin of 18.6%.

Edward C. Dowling Jr., president and CEO, said, “Compass Minerals’ core businesses produced strong results in the third quarter. We had solid results in the Salt segment that reflect the robust earnings potential of that business, while we continued to see sequential improvements in realized price, adjusted EBITDA per ton, and adjusted EBITDA margin in the Plant Nutrition segment.”

“It’s disappointing that we have been delayed in sharing the positive performance of the core businesses with the market due to issues surrounding certain historical accounting matters. It is important for the market to know that the core Salt and Plant Nutrition business are performing well, and that we are also focused on positioning the company for better performance in the future.”

Compass Minerals stated that it continues to assess various options for the future of Fortress North America.

The company ended the quarter with $220.8 million in liquidity, including $12.8 million in cash and cash equivalents and $208.0 million available under its $375 million revolving credit facility.

Also, the company is actively engaged with its current and predecessor auditors as it corrects the errors and restates the affected financial statements.

As part of that process, additional audit procedures covering fiscal years 2021 through 2023 have been needed, thereby extending the process to complete the restatements.

Outlook: Compass Minerals has revised its FY24 revenue outlook, adjusting the Salt segment forecast from $900 million – $920 million to $900 million – $910 million, and the Plant Nutrition segment forecast from $170 million – $205 million to $175 million – $185 million.

Price Action: CMP shares are up 24.2% at $11.44 at the last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Fed May Cut Interest Rates This Week. History Says Stocks Will Do This Next.

The long-awaited moment has arrived. The Federal Reserve is meeting this week, and economists are predicting policymakers will launch the first interest rate cut in four years. The Fed began lifting rates back in 2022 to calm raging inflation and since has lifted the benchmark rate 11 times, leaving it at 5.5% today. That’s the highest level in more than 20 years.

These moves have done their job, with inflation dropping over this period. Right now, it’s at 2.5% and nearing the Fed’s goal of 2%. Why that level? Because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability,” according to the Federal Open Markets Committee.

So economists and traders have been speculating that on Wednesday the Fed will lower the benchmark rate by at least 25 basis points, and some even predict a 50 basis point cut. As an investor in the stock market, you may be wondering what the market will do following the Fed’s move. Let’s look to history for some clues.

Why is a rate cut such a big deal for stocks?

First, let’s consider why a rate cut is such a big deal for the stock market in general and for investors in particular. Higher rates can hurt corporate earnings and investor appetite for stocks due to a couple of factors. As the fed funds rate goes up, so do other borrowing costs for individuals and companies.

For example, high-growth companies relying on loans to build their businesses will see these expenses climb. As a result, potential investors may worry about their ability to fund growth and may stay away from these sorts of stocks. As for individuals, higher borrowing costs eat into their budgets, and that means they probably won’t have as much discretionary income to spend.

Investors, seeing this unfold, often lose confidence in stocks most vulnerable in this sort of environment. They might hesitate to buy shares of those young growth companies — often technology players — and they may stay away from companies, such as those in entertainment or travel, that rely on discretionary spending.

Investors might even rein in their investments in the stock market as a whole and opt for investments that tend to flourish in a higher-rate environment, such as bonds.

Of course, as interest rates fall, the situation shifts, with borrowing becoming easier and cheaper for companies and individuals, while consumers find themselves with more money to spend on non-essentials. All of this paints a brighter picture for corporate earnings, and that, in turn, makes investors more confident about putting their dollars into the stock market.

The S&P 500’s performance after past rate cuts

Now, as we await the Fed‘s next move, let’s consider how the stock market reacted in the past to rate cuts. In the past two cycles of cuts, from the initial rate decrease, the S&P 500 index (SNPINDEX: ^GSPC) rose in the double digits in the 12 months following that move. Those rate cuts were on March 3, 2020 and Aug. 1, 2019, and the S&P 500 rose 27% and 10%, respectively, over the year to follow.

Prior to that, rate cuts happened during the Great Recession and a crash in the housing market over the 2007 and 2008 period. The first rate cut then happened in September of 2007, and this time it took a lot longer for the S&P 500 to climb back to previous levels.

It’s important to note, though, that the Great Recession was a particularly difficult time worldwide, so it doesn’t represent a good point of comparison for the S&P 500 today.

What does all of this mean for the stock market moving forward? It’s impossible to predict what the index will do next, but recent history shows us a favorable trend. That said, if the Fed lowers rates as expected or makes an even more aggressive cut this week, this won’t ease the borrowing situation for companies and individuals overnight. It will take a series of cuts to produce concrete results.

But the good news is that a potential rate cut this week will get things moving in the right direction — and that could help the S&P 500 follow the recent historical trend and rise in the coming year.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Fed May Cut Interest Rates This Week. History Says Stocks Will Do This Next. was originally published by The Motley Fool

Tredway Founder & CEO Will Blodgett Honored by The American Institute for Stuttering

Evening Honors Will Blodgett, UFC Heavyweight Champ Curtis “Razor” Blaydes and NY Giants’ Joshua Ezeudu

NEW YORK, Sept. 17, 2024 /PRNewswire/ — Will Blodgett, Founder and CEO of Tredway, an affordable and mixed-income real estate developer that builds and preserves high-quality, high-opportunity housing, was honored by The American Institute for Stuttering (AIS) during the nonprofit’s 18th Annual Gala hosted by actress Emily Blunt last night in New York City. The evening raised over $1 million dollars to support AIS’s mission to provide free or low-cost therapy to underserved people who stutter.

As an AIS board member and advocate for the stuttering community, Will was recognized with the Freeing Voices Changing Lives Award, which recognizes individuals who’ve achieved professional success and not allowed stuttering to hold them back in their chosen careers. Past recipients of the award include President Joseph R. Biden; actors Colin Firth, Samuel L. Jackson and Bruce Willis; singer-songwriter Ed Sheeran and former New Jersey Governor and Chair of the Board of Carnegie Corporation of New York Thomas H. Kean.

“It is an incredible honor and privilege to join the ranks of those who’ve turned a speech impediment into a way to engage with other people on a deeper level and with greater empathy and understanding,” Will said. “I’m humbled to be in a position to give back to The American Institute for Stuttering and make life-changing therapy and support available to those who stutter while educating the wider public about this complex neurologic and genetic condition.”

Speaking at the event, Will shared how he was relentlessly bullied for having a stutter throughout his childhood, leading to problems both in and out of the classroom. Without access to the kind of specialized speech therapy that AIS provides, he grew frustrated and angry in his teenage years before finding a way to harness his feelings on the football field. Will ultimately went on to earn a scholarship to Yale University and subsequently MIT.

“In the past, I would wake up with this pit in my stomach that the world thinks I’m stupid, the world hates me, and I have to prove them wrong,” he said. “Now it’s, ‘I have to come through for my friends. I have to come through for my family, for my wife and kids.’ I have to show them how to take down bullies, how to fight and be courageous, how to get up in front of a room of 420 people and stutter and talk. That’s what inspires me now.”

For over twenty years, the American Institute for Stuttering has helped thousands of individuals from over a dozen countries worldwide speak freely and live fearlessly by offering stuttering speech therapy to adults and children. With scholarships available so that therapy is accessible to all, AIS works with its clients to accept and work with their stutters and to free them of the physical and emotional blocks that make speech difficult. For more information, visit stutteringtreatment.org

Media Contact: Kelly Magee / kelly@rivetpr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/tredway-founder–ceo-will-blodgett-honored-by-the-american-institute-for-stuttering-302250570.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/tredway-founder–ceo-will-blodgett-honored-by-the-american-institute-for-stuttering-302250570.html

SOURCE Tredway Management, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Taylor Family Investments LLC Sells $1.35M Worth Of Mission Produce Shares

Revealing a significant insider sell on September 16, Taylor Family Investments LLC, Director at Mission Produce AVO, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that LLC sold 101,944 shares of Mission Produce. The total transaction amounted to $1,345,469.

The latest update on Tuesday morning shows Mission Produce shares down by 0.0%, trading at $12.99.

Get to Know Mission Produce Better

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

Understanding the Numbers: Mission Produce’s Finances

Revenue Growth: Mission Produce’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 23.95%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Insights into Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 11.42%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Mission Produce exhibits below-average bottom-line performance with a current EPS of 0.17.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.45.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 39.36 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.81 is lower than the industry average, implying a discounted valuation for Mission Produce’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 12.67 positions the company as being more valued compared to industry benchmarks.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

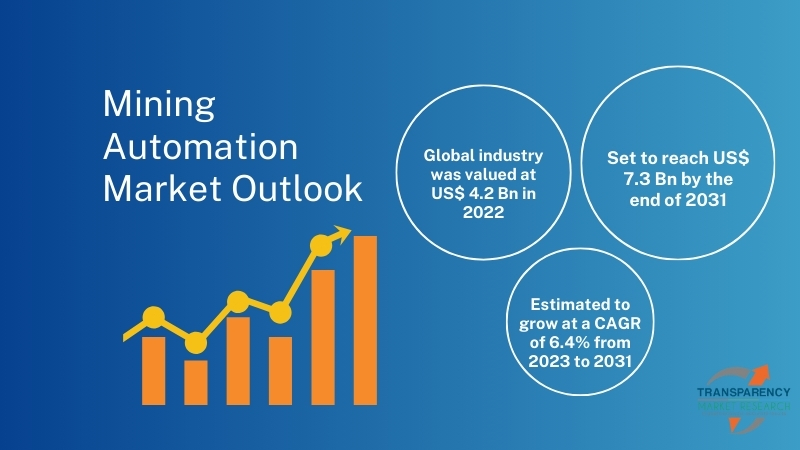

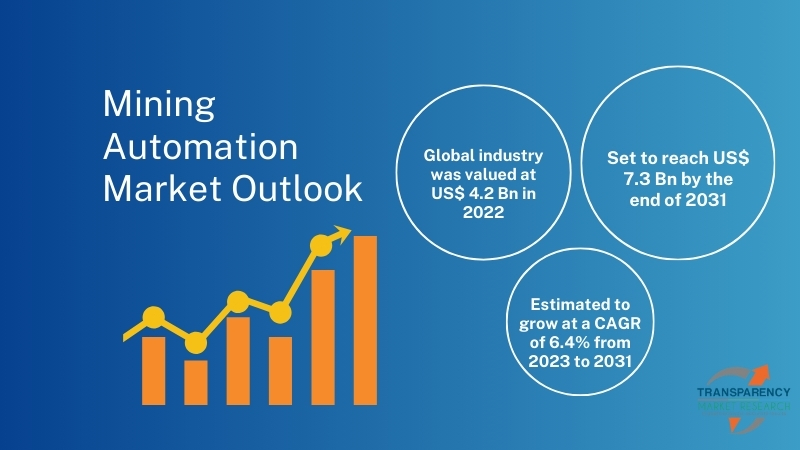

Mining Automation Market is set to boost at a CAGR of 6.4% by 2031 | Analysis by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 17, 2024 (GLOBE NEWSWIRE) — The value of the global mining automation industry (광산 자동화 산업) in 2022 was US$ 4.2 billion. The market is expected to expand at a CAGR of 6.4% from 2023 to 2031 and reach US$ 7.3 billion by then.

Although automation technology has revolutionized several industries for many years, robotics has only recently been introduced to the mining industry. Increasing pressure on mining companies to reduce costs, increase worker safety, and increase production has led to an increase in the use of mining robots. Remote-controlled drilling machines and self-driving trucks are some of the ways mining robots are transforming this vital sector.

With mines becoming deep and ore deposits becoming farther away and difficult to reach, automating underground mining has become more important. Automation in underground mining has historically been slow due to the dynamic nature of underground operations and the challenges associated with automating equipment.

Due to the Covid-19 pandemic and the necessity to conduct operations remotely, mine automation has become more prevalent. Increasing industrialization and population growth are largely responsible for driving the mining automation market. Due to this, mining operations have expanded, necessitating fleet management applications linked to mining operations.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/mining-automation-market.html

Key Findings of the Market Report

- A majority of the mining automation market is expected to be driven by equipment automation.

- The market is experiencing a growing demand for robotics, anticipating a surge in mining automation.

- By technology, underground mining will significantly drive demand for mining automation.

- Australia, China, and India are expected to have the world’s largest mining industries, making Asia Pacific the leading region globally.

- Mining automation is expected to experience growth in North America and Europe since these regions have a greater demand for metals and minerals.

Global Mining Automation Market: Growth Drivers

- The adoption of mining automation technology is propelled by the industry’s growing emphasis on enhancing worker safety. Automation technology can increase productivity and efficiency in the mining sector while reducing the risk of accidents and injuries.

- Improving mine productivity is another important factor driving the mining automation market’s growth. Based on real-time data, automation technologies maximize mining productivity and efficiency.

- With the aim of increasing production, while reducing costs, mining corporations are driving the market with linked mine evolution. In the digital era, cloud technologies, big data analytics, and the Internet of Things (IoT) are becoming more common.

- Automation technology is driving growth as the mining industry seeks to reduce operational expenses. The growing use of automated mining technologies is attributed to their benefits, such as improved accuracy and production.

- The rapid improvements in hardware automation technology are expected to make large-scale mining operations more efficient. Research and development investments in technological improvements will drive mining automation demand.

Global Mining Automation Market: Regional Landscape

- Asia Pacific is expected to grow rapidly in the mining automation market. Governments and mining firms in the Asia Pacific are increasingly focusing on safety and environmental laws. Using automation technologies leads to lower accident rates, worker safety, and lower environmental impact by reducing emissions and maximizing resource efficiency.

- Automation technology has made mining operations more economical and productive with self-driving haulage systems, remote-controlled machinery, artificial intelligence, and Internet of Things sensors. These technologies allow mining equipment to be remotely monitored and controlled, resulting in more efficient operations and less downtime.

- A lack of skilled labor and rising labor costs are driving the introduction of automation technologies in the mining industry. As a result of the reduced need for human labor, automated systems provide cost savings for mining businesses.

Global Mining Automation Market: Competitive Landscape

Top players in the mining industry have maintained their market share by introducing new technologies and constantly improving mining equipment’s functionality.

Over the past few years, demand for mining automation equipment has grown significantly, resulting in major competitors offering competitive prices to gain a larger market share. Companies that specialize in mining automation provide customers with customized equipment retrofitting solutions.

Market Players

- Atlas Copco Group

- Autonomous Solutions Inc.

- Caterpillar Inc.

- Hexagon AB

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Mine Site Technologies Pvt. Ltd.

- Rockwell Automation Inc.

- RPMGlobal Holdings Limited

- Sandvik AB

- Siemens

- Trimble Inc.

Key Developments

- In June 2023, on the eve of HxGN LIVE Global 2023 in Las Vegas, Hexagon’s Mining business unveiled a new autonomous portfolio to complement its planning, operations, and safety technology portfolios, demonstrating its commitment to addressing the major problems facing the mining sector.

- In March 2024, the largest copper producer in the world, Codelco, placed a significant order with Sandvik for an AutoMineload and haul automation system to be used in the new Andesita project at the El Teniente mine in Chile. The estimated value of the order is $39.9 million (SEK300 million). The new contract calls for Sandvik to install an advanced automation system and deploy a new automated Toro LH621i loader by 2024.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/mining-automation-market.html

Global Mining Automation Market: Segmentation

Type

- Software Automation

- Communications System

- Equipment Automation

- Remote Control

- Driver Assistance

- Teleoperation

Technology

- Robotics

- Artificial Intelligence

- Internet of Things

- Others (Drones, Advanced Sensors, etc.)

Technique

- Surface Mining

- Underground Mining

Automation

- Assistive Automation

- Partial Automation

- Conditional Automation

- Full Automation

Application

- Mine Development

- Mine Maintenance

- Mining Process

End User

- Mineral Mines

- Metal Mines

- Coal Mines

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Explore Transparency Market Research Inc. Extensive Coverage in Factory Automation Domain:

Precast Construction Market (プレキャスト建設市場) – As per TMR study, the global Precast Construction Market is anticipated to advance at CAGR of 4.6 % during the forecast period, starting in 2022 and ending in 2031.

Wire Harness Market (سوق تسخير الأسلاك) – The wire harness market on a global scale is poised to thrive, exhibiting a robust CAGR of 5.9% between 2023 and 2031. TMR’s latest report envisions a substantial market valuation of approximately US$ 165.2 billion by 2031. Presently, in 2023, the wire harness market is anticipated to conclude at a value of around US$ 88.2 billion.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's media stock falls before insider trading restrictions lift

By Noel Randewich

(Reuters) – Shares of Donald Trump’s media company fell for a second session on Tuesday ahead of the end of restrictions on share sales by the former U.S. president and other insiders.

Trump Media & Technology Group, which is 57% owned by the Republican presidential candidate, fell 3.6%, bringing its loss this week to 7%.

Trump Media’s stock jumped 12% on Friday after Trump told reporters he does not plan to sell his now $1.9 billion stake in the company, reversing weeks of steady losses partly due to worries about the end of insider trading restrictions related to its stock market debut in March.

Newly listed companies often see pressure on their stocks ahead of the end of so-called lock-up restrictions due to expectations that insiders may sell their shares and flood the market.

Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and Trump supporters who see it as a speculative bet on his chances of securing a second four-year term as president.

Other Trump Media insiders who will be allowed to begin selling shares when the lock-up ends include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media. They own a combined 11% of Trump Media, according to a company filing.

Trump Media’s market capitalization on Tuesday stood at $3.3 billion, with shares at $16.68, down about 75% from their March closing peak of over $66. The slide has accelerated in recent weeks after President Joe Biden gave up his reelection bid and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election.

The company’s revenue is equivalent to two Starbucks coffee shops and it is burning cash.

If Trump Media’s stock price remains at or above $12 through Thursday, then Trump and other insiders will be free to sell shares beginning on Friday. Otherwise, they are eligible to sell shares beginning on Sept. 26.

(Reporting by Noel Randewich; Editing by David Gregorio)

New Soil Survey Expands Copper and Gold Prospects in Chile

Source: Streetwise Reports 09/13/2024

Fitzroy Minerals Inc. FTZFF announced a major expansion of copper-in-soil anomalies at its Polimet Gold-Copper-Silver Project in Chile. The new soil geochemistry results highlight two continuous mineralized trends of 2.0 km and 1.9 km in length, alongside five additional anomalies ranging from 400 m to 1,000 m. These anomalies total 6.9 km and show significant expansion potential, particularly in a 450 m-wide zone at the southern end of one grid where no previous surface mineralization was indicated. This expansion follows the company’s earlier soil survey results reported on May 14, 2024.

Merlin Marr-Johnson, President and CEO of Fitzroy Minerals, spoke about these findings in the company news release, stating that they “highlight the mineral potential of Polimet” underscoring the project’s status as a high-priority drilling target.

Fitzroy’s soil sampling campaign included 800 samples, with 24% showing copper concentrations over 150 ppm, and 11% exceeding 200 ppm. The highest copper (Cu) concentration was measured at 993 ppm (0.1% Cu). The survey also correlated well with field and aerial observations, showing promising trends in both soil color and ASTER imagery data.

Digging Into Copper, Silver, and Gold Mining

Stockhead reported on September 13 that gold reached an all-time high of US$2,568/oz, driven by U.S. economic data and the anticipation of a potential interest rate cut by the Federal Reserve. ANZ commented that weak labor market data in the U.S., along with an uptick in initial jobless claims, raised the likelihood of an interest rate cut, further buoying the precious metals market. The rally in gold prices was also supported by investors buying back once-bearish bets, as money managers’ net short positions in Comex gold futures reached their highest level in four weeks by September 3.

This bullish trend in the gold sector is particularly relevant for companies such as Fitzroy Minerals, which continues to explore and develop projects like the Polimet Gold-Copper-Silver Project in Chile. Fitzroy Minerals’ CEO, Merlin Marr-Johnson, highlighted the recent soil geochemistry survey, noting that the Polimet project continues to deliver promising results. The discovery of multiple copper-in-soil anomalies, including two continuous trends measuring 2.0 km and 1.9 km, positions Polimet as a priority drilling target.

In terms of copper, Katusa Research pointed out on September 3 that its role in the global green energy transition is equally crucial. Copper is essential in electric vehicles, solar panels, and wind turbines, and the ongoing electrification of the world is set to increase its demand. Katusa emphasized that the mismatch between supply and demand is creating a “perfect storm” in the copper market, with inventories falling and prices expected to rise as industries scramble to secure this critical metal.

This growing deficit, combined with tightening market conditions, suggests a bullish future for copper prices, further supporting companies like Fitzroy Minerals, which are active in copper exploration.

Company Catalysts Section

The latest soil geochemistry results, as specified by the company, are expected to guide Fitzroy Minerals’ future exploration efforts at the Polimet project. The discovery of large-scale copper-in-soil anomalies across multiple kilometers enhances the company’s drilling strategy, with the anomalies acting as direct indicators for potential gold drilling targets within the gold-copper-silver system.

The Polimet project benefits from its proximity to the El Bronce Epithermal District, known for its significant gold and copper deposits. Fitzroy Minerals will build upon the current soil survey by conducting geophysical surveys and structural mapping to fine-tune their drilling targets.

Marr-Johnson noted, “Given these results and the significant infrastructure advantages of the area, Polimet is shaping up to be a priority drill target.” With further soil surveys and geophysical analysis planned, Fitzroy Minerals aims to capitalize on the promising indications of a robust mineral system, targeting high-grade pay shoots expected to be concentrated between 1,000 and 1,600 meters above sea level. The project’s strategic location and evolving data make it a key focus for the company’s upcoming exploration initiatives.

Expert Opinions Section

Michael Ballanger of GGM Advisory Inc., in his September 12 newsletter and covered on Streetwise Reports, provided a positive outlook on Fitzroy Minerals Inc., particularly regarding its Polimet Gold-Copper-Silver Project in Chile. He noted that Polimet is “a highly prospective copper-gold anomaly now believed to be far more extensive than originally thought.”

Ballanger expressed strong confidence in the company’s overall potential, stating that Fitzroy’s portfolio is “worth a great deal more than the current market cap of CA$21 million” implying significant undervaluation and investment potential.

In addition to his praise for the Polimet project, Ballanger highlighted that Fitzroy’s broader project portfolio, which includes two Chilean copper-gold projects and the Argentinian gold prospect Taquetren, positions the company well for future growth. He projected that with the upcoming drilling at Buen Retiro, Fitzroy’s market could move quickly into the CA$0.20 range. He also emphasized the substantial value of Buen Retiro, calling it “a company-maker” and one of the few projects in his 45-year career that has the potential to enrich shareholders in a meaningful way.

Ballanger’s analysis underscored his long-term belief in the gold and copper sectors, noting that while copper has faced headwinds due to concerns over China’s slowing economy, “gold has taken up the slack and risen to its rightful seat on the throne of all commodities.” His Buy recommendation on Fitzroy reflects his confidence in its dual focus on copper and gold, two metals he deems most promising for 2024 and beyond.

Ownership and Share Structure

According to Refinitiv, 6.67% of Fitzroy Minerals is owned by management and insiders. Of those, Executive Chairman Campbell Smyth owns the most, with 5.51%

5.18% of ownership is institutions, with CloudBreak Discovery Group holding the most at 5.18%. The rest is retail.

Fitzroy Mineral’s market capitalization is 10.08 million with 80.38 free float shares. The 52-week range for FTZ.V is US$0.02 – 0.18.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

84% of Retirees Are Getting This RMD Rule Wrong, Study Finds

Though retirees are only required to take a certain portion of their retirement savings out as distributions each year, a study from JPMorgan Chase shows that there is likely good reason to take out more. A withdrawal approach based solely on required minimum distributions (RMDs) not only fails to meet retirees’ annual income needs but can also leave money on the table at the end of their lives, the financial services firm found.

A financial advisor can help you right-size your retirement income. Find an advisor today.

Using internal data and an Employee Benefit Research Institute database, JPMorgan Chase studied 31,000 people as they approached and entered retirement between 2013 and 2018. The vast majority (84%) of the retirees who had already reached RMD age were only withdrawing the minimum. Meanwhile, 80% of retirees still had not reached RMD age were yet to take distributions from their accounts, the study found, suggesting a desire to preserve capital for later in retirement.

Retirees’ prudence surrounding withdrawals may be misguided, though.

“The RMD approach has some clear shortcomings,” JPMorgan Chase’s Katherine Roy and Kelly Hahn wrote. “It does not generate income that supports retirees’ declining spending in today’s dollars, a behavior that we see occurs with age. In fact, the RMD approach tends to generate more income later in retirement and can even leave a sizable account balance at age 100.”

What Are RMDs?

An RMD is the minimum amount the government requires most retirees withdraw from their tax-advantaged retirement accounts at a certain age. In 2020, the RMD age was raised from 70.5 to 72. The JPMorgan Chase study examined data that predated this change.

While most employer-sponsored retirement plans and individual retirement accounts (IRAs) are subject to RMDs, owners of Roth IRAs are exempt from taking minimum annual distributions.

The following retirement accounts all come with required minimum distributions:

An RMD is calculated by dividing a person’s account balance (as of Dec. 31 of the previous year) by his current life expectancy factor, a figure set by the IRS. For example, a 75-year-old has a life expectancy factor of 22.9. If a 75-year-old retiree has $250,000 in a retirement account, he would be required to withdraw at least $10,917 from his account that year.

A financial advisor can help you navigate the rules of RMDs.

RMD Approach vs. Declining Consumption Strategy

Using an RMD approach, a retiree simply sticks to the minimum required distributions each year. This strategy does have several notable advantages over a more static technique, like the 4% rule. For one, using actuarial statistics, the RMD approach factors in a person’s expectancy based on his current age; the 4% method does not. Also, by only withdrawing the minimum each year, the account owner will lessen his tax bill for the year and maintain maximum tax-deferred growth.

However, Roy and Hahn of JPMorgan Chase note that a more flexible withdrawal strategy tied to actual spending behaviors of retirees is more effective for meeting income needs and lowering the possibility of dying with a considerable account balance left over.

Assuming people spend more earlier in retirement than during their latter years, a withdrawal strategy should match this declining consumption, even if it means taking more than the required minimum distribution, Roy and Hahn wrote.

“On the consumption front, we believe the most effective way to withdraw wealth is to support actual spending behaviors, as spending tends to decline in today’s dollars with age,” they wrote. “Unlike the RMD approach, reflecting actual spending allows retirees to support higher spending early in retirement and achieve greater utility of their savings.”

In comparing the RMD approach to the declining consumption strategy, JPMorgan Chase found that a 72-year-old with $100,000 in retirement savings could spend more money each year using the declining consumption strategy approach until age 87 when the RMD strategy would support higher spending.

Meanwhile, the same retiree would still have more than $20,000 in his account by the time he turns 100 if he limited his distributions to the minimum amount. A 72-year-old using the declining consumption approach would only have a couple thousand left over by age 100.

Though RMD approach may increase a retiree’s odds of being able to leave money to loved ones, a retiree who’s more concerned with meeting his own needs would likely benefit from an option tied to his declining consumption later in life. Consider matching with a financial advisor if you need help with an RMD strategy.

Bottom Line

A whopping 84% of retirees who reached RMD age were limiting their retirement account withdrawals to the minimums that are required, a JPMorgan Chase study found. This method may leave a retiree with not enough annual income than what is needed. A withdrawal approach more closely aligned with a retiree’s spending needs will provide more retirement income and lessen the chances that retirement funds will outlast the retiree.

Tips for Retirement Saving

-

Do you have a financial plan for retirement? It’s never too late to begin planning and a financial advisor can help you do just that. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

If you’re still years or decades away from retiring, knowing where you stand on the path to retirement is still important. SmartAsset’s free 401(k) calculator can help you determine how much you can expect your savings to grow over time and how much you may have when the time comes to retire.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/katleho Seisa, ©iStock.com/Wand_Prapan, ©iStock.com/eggeeggjiew

The post 84% of Retirees Are Making This RMD Mistake appeared first on SmartAsset Blog.