Smart Money Is Betting Big In ENVX Options

Deep-pocketed investors have adopted a bullish approach towards Enovix ENVX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ENVX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Enovix. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 37% bearish. Among these notable options, 2 are puts, totaling $59,914, and 6 are calls, amounting to $322,750.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $2.5 and $15.0 for Enovix, spanning the last three months.

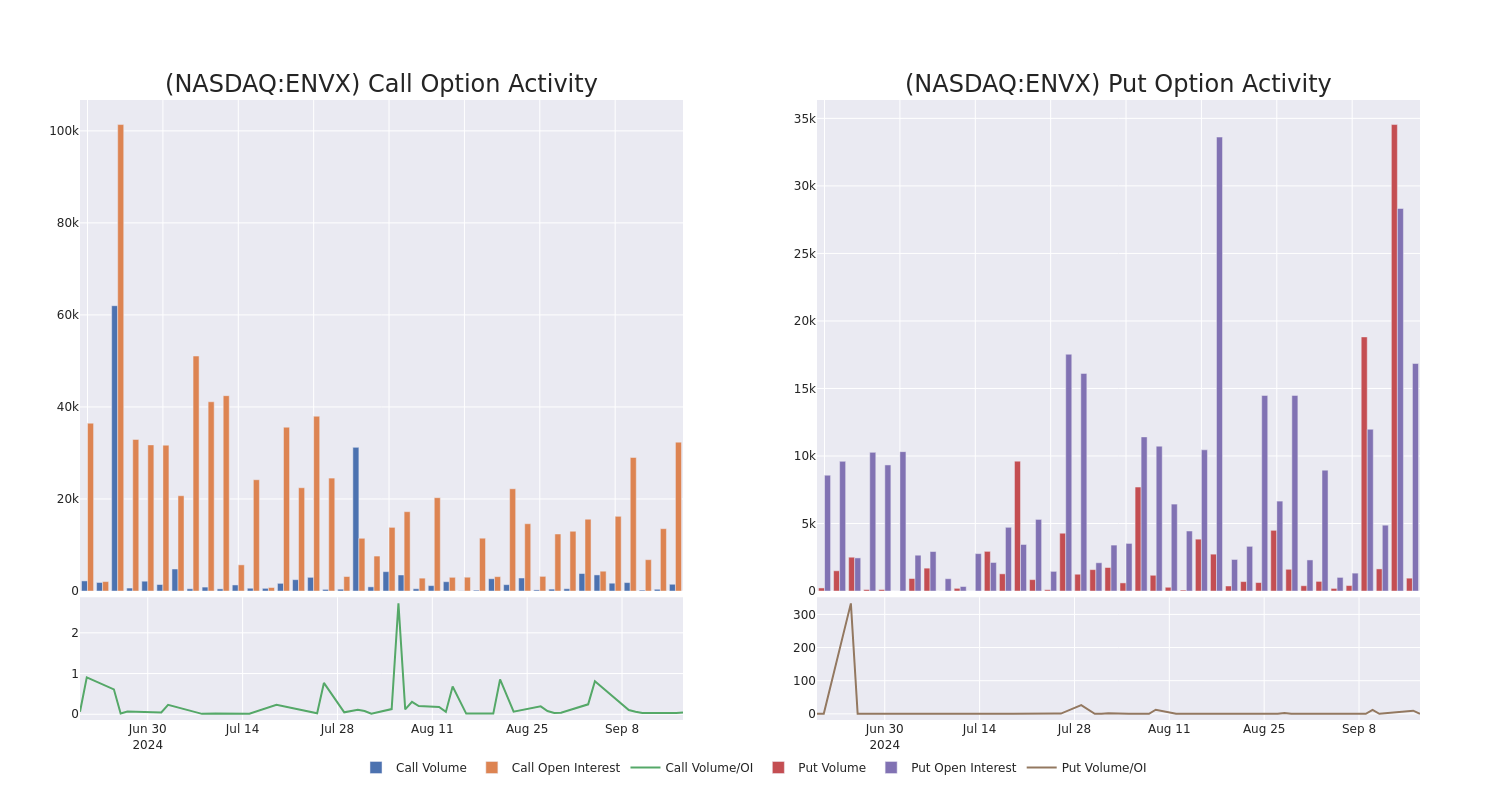

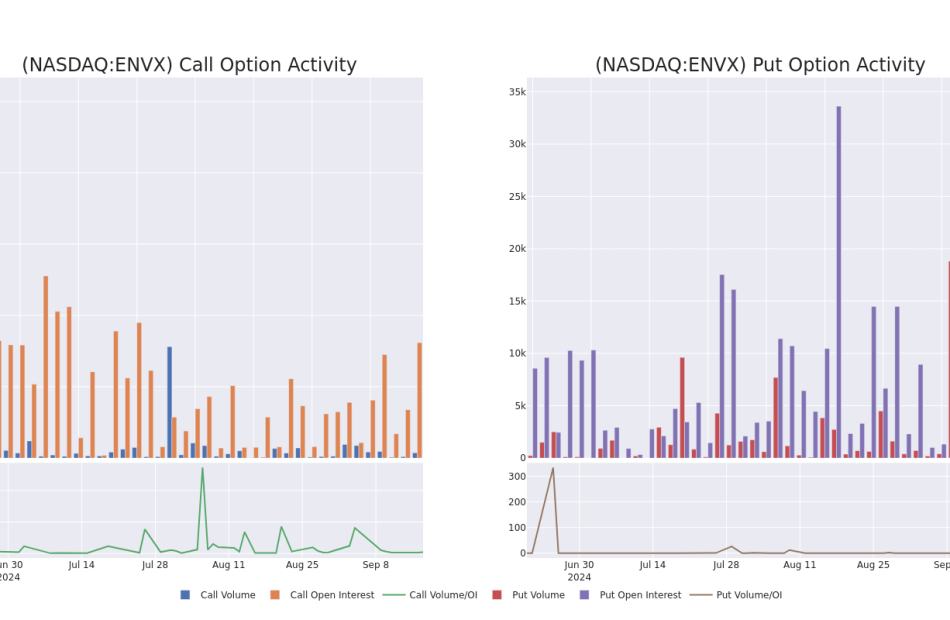

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Enovix’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Enovix’s substantial trades, within a strike price spectrum from $2.5 to $15.0 over the preceding 30 days.

Enovix Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $3.75 | $3.65 | $3.75 | $10.00 | $75.0K | 11.2K | 231 |

| ENVX | CALL | TRADE | BULLISH | 01/17/25 | $7.0 | $6.9 | $7.0 | $2.50 | $71.4K | 381 | 102 |

| ENVX | CALL | SWEEP | BEARISH | 01/16/26 | $3.5 | $3.25 | $3.25 | $12.00 | $65.0K | 5.6K | 200 |

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $2.7 | $2.63 | $2.7 | $15.00 | $54.0K | 13.1K | 500 |

| ENVX | PUT | TRADE | BEARISH | 10/18/24 | $1.39 | $1.36 | $1.38 | $10.00 | $34.9K | 16.8K | 230 |

About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Having examined the options trading patterns of Enovix, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Enovix Standing Right Now?

- With a volume of 3,709,975, the price of ENVX is down -3.02% at $9.47.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 49 days.

Professional Analyst Ratings for Enovix

1 market experts have recently issued ratings for this stock, with a consensus target price of $36.0.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Enovix, which currently sits at a price target of $36.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enovix, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply