Unpacking the Latest Options Trading Trends in AutoZone

Investors with a lot of money to spend have taken a bearish stance on AutoZone AZO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AZO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for AutoZone.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 41%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $148,330, and 9 are calls, for a total amount of $868,830.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2400.0 to $3400.0 for AutoZone over the recent three months.

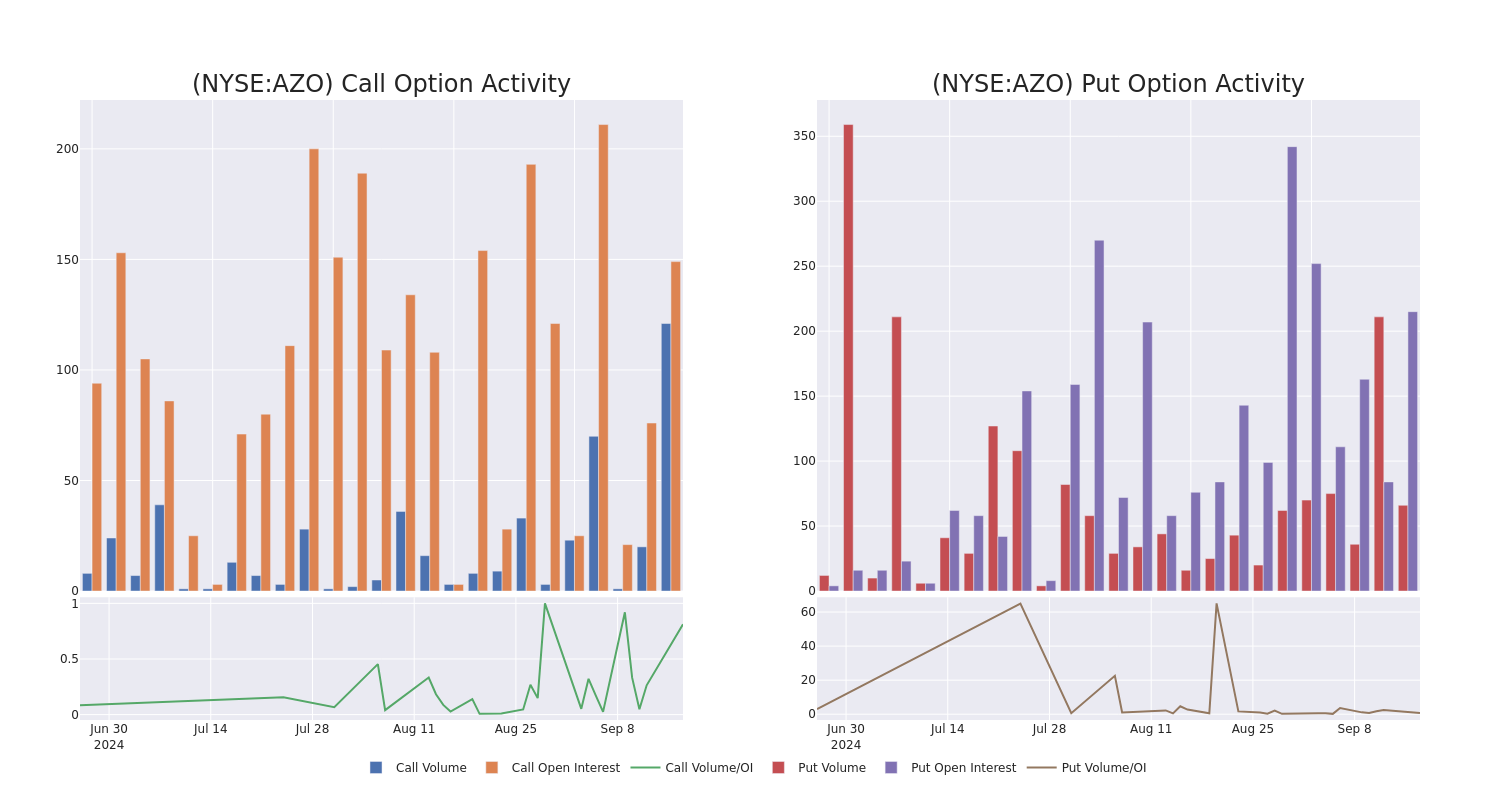

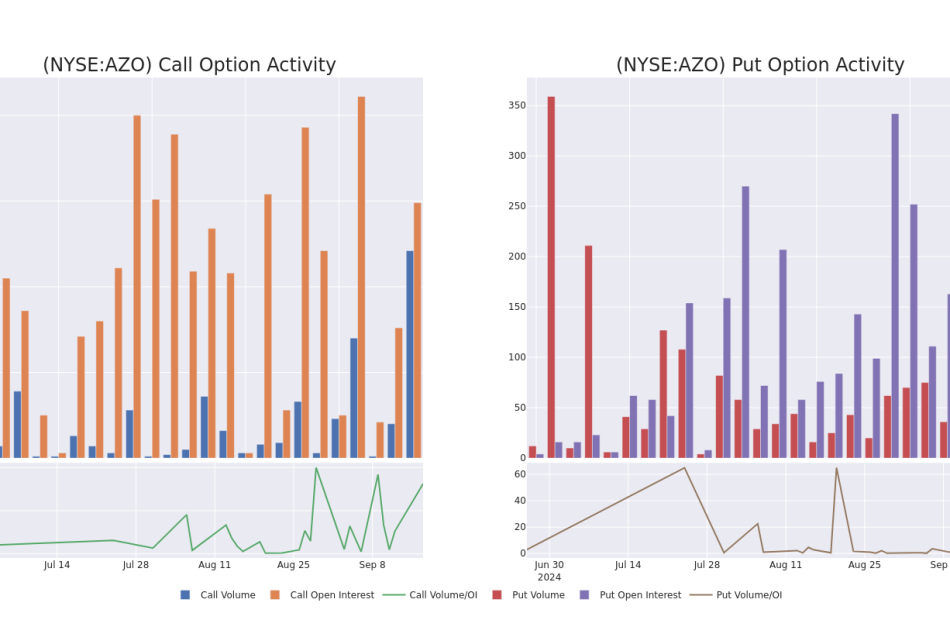

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AutoZone’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AutoZone’s whale trades within a strike price range from $2400.0 to $3400.0 in the last 30 days.

AutoZone 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $94.4 | $89.3 | $89.7 | $3400.00 | $179.4K | 90 | 38 |

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $95.2 | $89.3 | $91.1 | $3400.00 | $163.9K | 90 | 18 |

| AZO | CALL | SWEEP | BEARISH | 01/17/25 | $95.6 | $89.6 | $89.6 | $3400.00 | $161.2K | 90 | 56 |

| AZO | CALL | TRADE | BULLISH | 12/19/25 | $312.0 | $294.0 | $312.0 | $3350.00 | $93.6K | 4 | 3 |

| AZO | CALL | TRADE | BULLISH | 03/21/25 | $786.0 | $774.8 | $786.0 | $2400.00 | $78.6K | 0 | 1 |

About AutoZone

AutoZone operates as a leading retailer of aftermarket automotive parts in the United States. The firm operates over 6,300 stores domestically, serving both the do-it-yourself and commercial (do-it-for-me) end markets. Through its vast store footprint and distribution network, AutoZone manages a wide array of stock-keeping units applicable to numerous vehicle makes and models, providing its consumers with ample product availability. The firm drives traffic by providing superior and convenient customer service as AutoZone’s team of knowledgeable staff assists consumers with diagnosing a vehicle’s problem, selecting the necessary part for replacement, and in some instances, installation. The company also operates internationally, with over 750 stores in Mexico and more than 100 in Brazil.

After a thorough review of the options trading surrounding AutoZone, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is AutoZone Standing Right Now?

- Currently trading with a volume of 60,141, the AZO’s price is down by -0.58%, now at $3083.16.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 7 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AutoZone with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply