T-Mobile CEO talks Sprint merger, iPhone 16 demand, what's next

High-octane T-Mobile (TMUS) CEO Mike Sievert is back with more big promises to investors four years after his company’s last capital markets day with Wall Street.

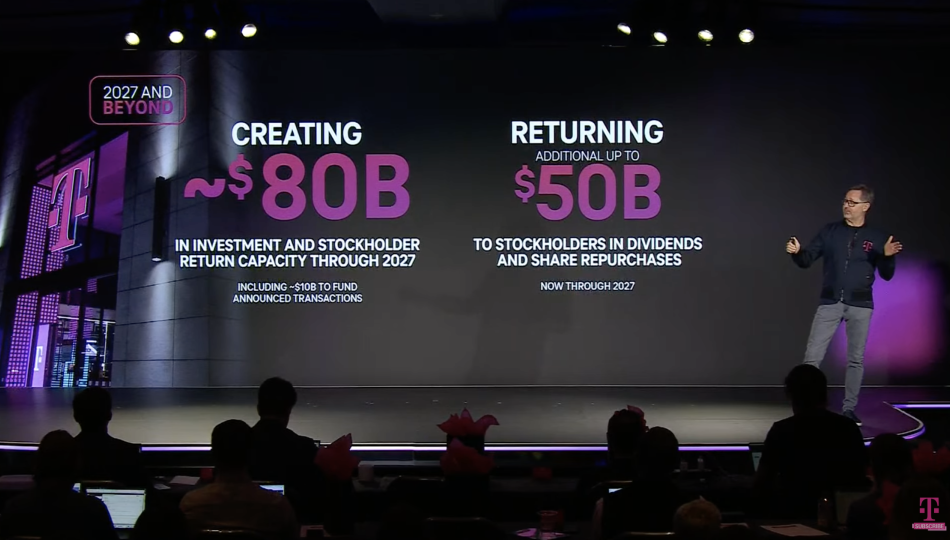

The company is targeting a compound annual services revenue growth rate (CAGR) of 5% through 2027, up from its current pace of about 4%, execs outlined at an analyst event on Wednesday afternoon.

T-Mobile is also aiming for $10 billion more in adjusted operating profits through 2027 compared to 2023, with a projected range of $38 billion to $39 billion.

Wall Street was modeling for $37.8 billion in 2027 adjusted operating profits ahead of the event.

The company promised $50 billion in dividends and stock buybacks through 2027, as well.

“We said we would combine these two companies [Sprint and T-Mobile] and complete the most successful merger of scaled telecoms in the history of the industry, and we did that, and we unlocked the value in excess of what we promised. And now it’s time for the next chapter,” Sievert said on Yahoo Finance moments after the event concluded.

Added Sievert, “We wanted to unveil these plans because investors want to know, after that historically successful run of the last few years, what’s next.”

T-Mobile stock is up 69% in the past four years, compared to a 27% drop for Verizon (VZ) and a 1% decline for AT&T (T).

Barring an economic collapse or recession, there’s good reason to believe T-Mobile could hit its new guidance.

For one, the company beat all its guidance for 2020 as adjusted operating profits rose 32% and free cash flow improved by 400%.

Consumers are continuing to upgrade to 5G cellphones and higher-speed home broadband, and the company has recently made a host of key deals.

Read more: Cell phones, furniture, used cars: Here’s where prices are easing up as inflation cooldown continues

T-Mobile’s $1.35 billion Mint Mobile deal closed in May, giving the company access to more value-conscious phone plan shoppers.

The company is also looking to close on deals for fiber-optic plays Metronet ($4.9 billion), US Cellular ($4.4 billion), and Lumos ($950 million).

“The company [US Cellular] has always been great at smaller markets in rural areas, and that’s a big growth strategy for us,” said Sievert.

If there is a wildcard on how T-Mobile’s analyst day will be digested, it will be the cost to build out the fiber-optic network. Sievert acknowledged the company is still assessing if they need to go after the opportunity even further.

“While there’s comfort in management’s long track record of beat-and-raises from an operational and financial lens, investors remain somewhat unsettled on the fiber strategy for now,” Evercore ISI analyst Vijay Jayant said in a client note.

Jayant rates T-Mobile shares at an Outperform rating.

T-Mobile’s second quarter showed a telecom business still in growth mode.

Total sales rose 4% from the prior year to $16.4 billion. The company notched 1.3 million net customer additions, pushing it past 100 million postpaid customers for the first time.

Adjusted operating profits increased 9%, while diluted earnings per share improved 34% year over year.

For the full year, T-Mobile expects net customer additions of 5.4 million to 5.7 million. Previously it projected 5.2 million to 5.6 million.

Hitting guidance in 2024 will be partially dependent on Apple’s (AAPL) iPhone 16 demand, which has reportedly come out of the gate slow in terms of preorders.

“It [the outlook] might mean that the demand cycle will be a little bit more stretched out as word of mouth builds after people actually get the AI features later. But already our sales are higher than last year. Last year was a good year. Good iPhone launch. This year, they’re higher. We’re seeing preference for the Pro versus the regular edition,” Sievert said.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Three times each week, I field insight-filled conversations with the biggest names in business and markets on Yahoo Finance’s Opening Bid podcast. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

In the Opening Bid episode below, former US Commerce Secretary Wilbur Ross explains what people may see during a second Trump presidency.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Jim Cramer: This Utilities Stock Is A Buy, Calls Wells Fargo A 'Winner'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Wells Fargo & Company (NYSE:WFC) is going to go higher, adding that it’s a “winner.”

On Sept. 17, the San Francisco-based bank launched specialized Application Programming Interfaces (APIs) for its Commercial Banking clients, expanding its API portfolio.

These APIs offer real-time data access aimed at boosting sales, improving liquidity, reducing credit risk, and cutting expenses for floorplan and channel finance clients across several industries.

Trending Now:

“It’s had too big a move up,” Cramer said when asked about Iron Mountain Incorporated (NYSE:IRM). “Let’s move on.”

On Aug. 1, Iron Mountain reported better-than-expected second-quarter financial results and issued FY24 AFFO guidance above estimates. Also, the company increased its quarterly dividend.

Palantir Technologies Inc. (NYSE:PLTR) is a “cold” stock, Cramer said.

On Sept. 17, the company inked a multi-year, multi-million-dollar contract with Nebraska Medicine. As per the deal, Palantir will utilize its Artificial Intelligence Platform (AIP) to enhance healthcare through transformative technologies.

The “Mad Money” host recommended buying PG&E Corporation (NYSE:PCG). “That stock is a good one, rate increase or no,” he added.

On Sept. 12, B of A Securities analyst Ross Fowler reinstated PG&E with a Buy and announced a $24 price target.

Keep Reading:

This article Jim Cramer: This Utilities Stock Is A Buy, Calls Wells Fargo A ‘Winner’ originally appeared on Benzinga.com

Texas new home sales market shows resilience despite a drop in August

DALLAS, Sept. 19, 2024 (GLOBE NEWSWIRE) — While Texas new home sales were lower last month in its four biggest markets, home sales are up 6% from a year ago, home prices are flattening, and inventory was up 2% from the prior month, according to the newest monthly Texas New Home Sales Report released today by HomesUSA.com and its founder and CEO, Ben Caballero, the nation’s top-ranked real estate agent.

The HomesUSA.com New Home Sales Report uses Multiple Listing Service data – the most comprehensive, current, and accurate information – from the Realtor Associations of North Texas, Houston, Austin, and San Antonio.

“Texas new home sales were a bit lower in August, but since the beginning of the year, sales are higher, showing how resilient our real estate market is,” said Caballero. “If the recent improvements in mortgage rates continue, we should see a bump in Texas new home sales that could counter the traditional seasonal slowdown experienced during the latter months of the year,” he added.

According to August MLS data from Dallas-Ft. Worth, Houston, Austin, and San Antonio, the new home sales’ pace flattened overall as the 3-month average of Days on Market (DOM) was 97.05 days versus 98.27 days in July. Houston and San Antonio DOM decreased, Austin DOM was flat, and Dallas-Ft. Worth DOM rose by more than two days.

The number of new home sales in Texas’ four largest markets posted a 3-month average of 5,803 in August versus 5,977 in July, with Dallas-Ft. Worth, Houston, Austin, and San Antonio each posting relatively flat sales in August. However, the 3-month average new home sales last year in August was significantly lower, totaling 5,450.

Good news for home buyers: the 3-month average new home price in the combined top four markets was flat in August and more than $27,000 lower than in August last year. Houston’s 3-month average home prices were lower month-over-month ($402,741 versus $404,253) and San Antonio was also lower ($340,755 versus $343,616). Austin’s average price was relatively flat ($494,920 versus $494,302) and Dallas-Ft. Worth once again posted a higher average sale price of $489,872 last month versus $487,347 in July.

The Texas new home Inventory continues to rise as the 3-month average of active listings reveal Texas’ four largest new home markets was up 2% last month – 31,983 versus 31,358 in July. Year-over-year active listings are up almost 17% from 27,305 in August 2023.

Pending sales, an indication of future sales, fell again last month. The 3-month average of pending sales in the four largest Texas new home markets in August was 6,575 versus 6,623 in July. It is the 4th straight month pending sales declined in these markets.

HomesUSA.com is sharing its New Home Sales Report and New Home Sales Index before the Commerce Department releases its nationwide New Residential Sales Report for August, set for Wednesday, September 25, 2024, at 10:00 a.m. Eastern time.

The HomesUSA.com monthly report covers closed sales recorded in MLSs by the 10th day of the following month. Sales reported by agents after the 10th of the month are not included. The report features 3-month and 12-month moving averages for six essential market data, including DOM, sales volume, sales prices, a sales-to-list price ratio, pending sales, and active listings. Caballero explained the 3-month moving average indices track market seasonality, while the 12-month moving average removes the seasonality and tracks the longer trend.

Days on Market Flatten – New Homes in Texas (Exclusive Data)

The HomesUSA.com New Home Sales Index showed the August 3-month moving average of DOM flattened in Texas’ four major new home markets. Dallas-Ft. Worth was the anomaly, as the DOM rose to 121.14 days versus 118.34 days in July. Houston’s DOM dropped to 88.12 days versus 91.21 days in July. In Austin, the DOM in August was 87.53 days versus 87.38 days in July. In San Antonio, the DOM decreased to 79.71 days versus 86.16 days in July. New homes have significantly higher DOM than existing homes because most new homes are listed while under construction. (See Chart 1: Texas New Homes Days on Market)

Texas New Home Sales Decrease

Based on all local MLS data, the most reliable and current source of all home sales activity, total new home sales decreased in Texas’ four largest new home markets last month. The August 3-month moving average of new home sales in Dallas-Ft. Worth was 1,862 versus 1,902 in July. In Houston, total new home sales dropped to 1,970 versus 2,053 in July. Austin’s new home sales last month were 871 versus 900 in July. In San Antonio, new home sales in August were lower at 1,100 versus 1,121 in July. (See Chart 2: Texas New Home Sales)

Texas New Home Prices Remain Flat

The average prices of new homes remained flat in the four major new home markets in Texas last month. In Dallas-Ft. Worth, the 3-month moving average price for new homes in August was higher at $489,762 versus $487,347 in July. In Houston, the average new home price in August was lower at $402,741 versus $404,253 in July. In Austin, the 3-month moving average price in August was $494,920 versus $494,302 in July. San Antonio’s average new home price was also lower in August at $340,775 versus $343,616 in July. (See Chart 3: Texas New Home Prices)

Texas Sales-to-List Price Ratio Remains Stable

Cumulative new home sales remain slightly lower than 100 percent of the asking price. The combined 3-month moving average of the sales-to-list price ratio in Texas’ four largest markets for August was 97.47 versus 97.98 percent a year ago and 97.60 percent in July this year. Dallas-Ft. Worth’s ratio in August was 97.78 versus 98.26 percent last August and 97.88 percent in July this year. In Houston, the ratio in August was 96.62 versus 98.35 percent last August and 96.92 percent in July this year. In Austin, the sales-to-price ratio in August was 97.60 versus 97.79 percent last August and 97.71 percent in July this year. San Antonio’s ratio in August was 98.33 versus 96.91 percent a year ago and 98.29 percent in July this year. (See Chart 4: Texas Sales-to-List Price Ratio)

Texas Pending New Homes Sales Decline

Based on local MLS data, the average 3-month pending new home sales continue to decline in two of the four largest Texas new home markets. The combined four-market average in August totaled 6,575 versus 6,623 in July. In Dallas-Ft. Worth, pending new home sales last month were 2,281 versus 2,335 in July. In Houston, pending new home sales in August were 1,957 versus 1,947 in July. In Austin, pending new home sales in August were 1,244 versus 1,272 in July. In San Antonio, pending new home sales were higher last month at 1,093 versus 1,069 in July. (See Chart 5: Texas Pending New Home Sales)

Texas Active Listings for New Homes Increase

Active new home listings continue to increase in all four of the largest Texas new home markets in August. The August 3-month average active listings inventory in Texas’ four major new home markets was 31,983 new homes versus 31,358 in July. Dallas-Ft. Worth’s active listings in August increased to 7,686 versus 7,348 in July. Active listings in Houston last month also increased to 12,812 versus 12,603 in July. In Austin, active listings in August were higher at 5,973 versus 5,950 in July. In San Antonio, active listings last month were 5,512 versus 5,456 in July. (See Chart 6: Texas Active Listings)

About the HomesUSA.com New Home Sales Index

The HomesUSA.com Index is reported as both a 3-month and 12-month moving average of the Days on Market for new homes listed in the local Multiple Listing Services (MLSs) for Dallas-Ft. Worth, Houston, Austin, and San Antonio. Created by Ben Caballero, it is the first Days on Market index to track the Texas new home market and includes homes listed while under construction. (See Chart A: 12-Month Moving Averages)

*Note: Texas data denotes a combination of its four largest new home markets – Houston, Dallas-Ft. Worth, Austin, and San Antonio – which comprise the vast majority of new home sales and MLS data statewide.

About Ben Caballero and HomesUSA.com®

Ben Caballero, founder and CEO of HomesUSA.com, is a three-time Guinness World Records title holder for ‘Most annual home sale transactions through MLS by an individual sell-side real estate agent – current.’ Ranked by REAL Trends as America’s top real estate agent for home sales since 2013, Ben is the most productive real estate agent in U.S. history. He is the only individual real estate agent to exceed $3 billion in residential sales transactions in a single year (2022), the first agent to exceed $2 billion (2018, 2019, 2020), and the first agent to exceed $1 billion (2015, 2016, 2017). Ben, an award-winning innovator and technology pioneer, works with more than 60 home builders in Dallas-Fort Worth, Houston, Austin, and San Antonio. His podcast series is available widely, including iTunes, Spotify and YouTube. Learn more at HomesUSA.com |Twitter: @bcaballero – @HomesUSA | Facebook: /HomesUSAdotcom.

Note for journalists: You may contact Ben Caballero directly by email at ben@homesusa.com.

REALTOR® is a federally registered collective membership mark which identifies a real estate professional who is a member of the NATIONAL ASSOCIATION OF REALTORS® and subscribes to its strict Code of Ethics.

Media Contact:

Kevin Hawkins

(206) 866-1220

kevin@wavgroup.com

Image: Ben Caballero (2023)

https://homesusa.com/wp-content/uploads/2023/04/Ben_Caballero_1-scaled.jpg

Individual Chart images:

Chart 1: Texas New Homes Tracking – Days on Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-1-Texas-New-Homes-Tracking-Days-on-Market.jpg

Chart 2: Texas New Home Sales Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-2-Texas-New-Home-Sales-Market.jpg

Chart 3: Texas New Home Sales Prices Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-3-Texas-New-Home-Sales-Prices-Market.jpg

Chart 4: Texas Sales-to-List-Price Ratio Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-4-Texas-Sales-to-List-Price-Ratio-Market.jpg

Chart 5: Texas Pending New Home Sales Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-5-Texas-Pending-New-Home-Sales-Market.jpg

Chart 6: Texas Active Listings for New Home Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-6-Texas-Active-Listings-for-New-Homes-Market.jpg

Chart A: Texas 12-Month Moving Averages Market – August 2024: https://homesusa.com/wp-content/uploads/2024/09/Chart-A-12MonthChart-DataOnly.jpg

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: MICHAEL HARTNETT Unloads $3.63M Of RBC Bearings Stock

It was reported on September 18, that MICHAEL HARTNETT, President and CEO at RBC Bearings RBC executed a significant insider sell, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that HARTNETT sold 12,503 shares of RBC Bearings. The total transaction amounted to $3,630,287.

During Thursday’s morning session, RBC Bearings shares down by 0.0%, currently priced at $292.16.

Discovering RBC Bearings: A Closer Look

RBC Bearings Inc is an international manufacturer and marketer of highly engineered precision bearings, components and essential systems for the industrial, defense and aerospace industries. The offering includes plain bearings, roller bearings, ball bearings, and engineered products. The end market is the United States of America. The company has two reportable segments: Aerospace Defense segment represents the end markets for the company’s highly engineered bearings and precision components used in commercial aerospace, defense aerospace, and sea and ground defense applications; and Industrial segment represents the end markets for the company’s engineered bearings and precision components used in various industrial applications. It derives maximum revenue from Industrial Segment.

Financial Milestones: RBC Bearings’s Journey

Revenue Growth: RBC Bearings displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 4.96%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 45.29%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): RBC Bearings’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.92.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.42.

Market Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 43.03, RBC Bearings’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 5.41, RBC Bearings’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 20.42 reflects market recognition of RBC Bearings’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of RBC Bearings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Samuel Kapourales Cashes Out $505K In Energy Servs of America Stock

On September 19, a recent SEC filing unveiled that Samuel Kapourales, Director at Energy Servs of America ESOA made an insider sell.

What Happened: Kapourales’s recent move involves selling 50,000 shares of Energy Servs of America. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $505,000.

Energy Servs of America‘s shares are actively trading at $10.71, experiencing a up of 7.1% during Thursday’s morning session.

Get to Know Energy Servs of America Better

Energy Services of America Corporation is engaged in providing contracting services for energy-related companies. The company is predominantly engaged in the construction, replacement, and repair of natural gas pipelines and storage facilities for utility companies and private natural gas companies. It services the gas, petroleum, power, chemical, and automotive industries and does incidental work such as water and sewer projects. Energy Service’s other services include liquid pipeline construction, pump station construction, production facility construction, water and sewer pipeline installations, various maintenance and repair services, and other services related to pipeline construction.

A Deep Dive into Energy Servs of America’s Financials

Revenue Growth: Over the 3 months period, Energy Servs of America showcased positive performance, achieving a revenue growth rate of 0.46% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Energy sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 17.82%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Energy Servs of America’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.06.

Debt Management: Energy Servs of America’s debt-to-equity ratio surpasses industry norms, standing at 0.66. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Energy Servs of America’s P/E ratio of 6.9 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.47 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Energy Servs of America’s EV/EBITDA ratio, lower than industry averages at 4.2, indicates attractively priced shares.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Transaction Codes Worth Your Attention

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Energy Servs of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Descartes Expands Product Portfolio With $24M MyCarrierPortal Buyout

Descartes Systems DSGX recently expanded its portfolio with the acquisition of Assure Assist, Inc., operating as MyCarrierPortal (“MCP”). MCP is renowned for its carrier onboarding and risk monitoring solutions for the trucking industry, enabling freight brokers and shippers to manage their carrier networks efficiently. The initiative is aimed at bolstering DSGX’s capabilities in fraud prevention and compliance within the trucking industry.

Descartes’ acquisition of MCP involves an up-front consideration of $24 million in cash, with the potential for an additional $6 million in performance-based consideration. This earn-out depends on the joined forces achieving specific revenue-growth targets over the next two years, with payouts expected in fiscal 2026 and fiscal 2027.

Over the past years, the trucking industry has witnessed a surge in carrier fraud and cargo theft. Due to this, there has been a heightened demand for robust solutions that help brokers and shippers navigate these logistics challenges. MCP’s platform streamlines the complex task of onboarding carriers, gathering and screening their information to ensure compliance with industry regulations. By scrutinizing truck carriers for legitimacy, insurance coverage and safety records, MCP helps freight brokers mitigate risks in transporting goods.

Merging DSGX MacroPoint FraudGuard Tool With MCP Solution

The cutting-edge solution, when paired with MCP’s onboarding and risk-monitoring solution, creates a swift process where carriers are examined, monitored and tracked in real-time. In addition, any fraudulent activities observed during the onboarding or monitoring phases are immediately addressed, allowing brokers and shippers to take quick action and minimize potential risks.

Descartes MacroPoint, a solution that provides real-time visibility and tracking of shipments, has been a powerful tool for brokers and shippers. With the addition of the FraudGuard feature in April 2024, it enables customers to detect and prevent fraudulent carrier activities more effectively. Carriers can seamlessly integrate with the solution via GPS-based electronic logging devices, transportation management systems, or mobile app-based tracking methods.

The transportation industry is currently dealing with two of the most pressing issues – carrier fraud and cargo theft. DSGX’s latest deal not only addresses critical challenges in the logistics industry but also improves overall supply chain performance by empowering freight brokers and shippers seeking robust Know-Your-Carrier capabilities. MCP’s platform complements Descartes’ existing investments in logistics technology, enabling customers to manage the entire lifecycle of shipments in a secure, efficient manner.

DSGX’s Strategic Buyouts Buoying Revenues

Acquisition and innovation remain at the forefront of Descartes to foster top-line growth. In the last reported quarter, DSGX revenues soared 14% year over year to $163.4 million, beating the Zacks Consensus Estimate by 2.8%. Synergies stemming from the acquisition of BoxTop Technologies during the quarter, along with OCR and Thyme ASD buyouts settled in the fiscal first quarter with GroundCloud and Localz acquisition in 2024, drove the top-line performance.

In June 2024, it acquired England-based BoxTop Technologies Limited for $13 million (or £10.25 million) in an all-cash transaction. The acquisition will integrate BoxTop solutions with its Global Logistics Network platform. The initiative is likely to broaden the network’s reach and capabilities, providing customers with even greater efficiency and visibility across their supply chains.

However, uncertainty prevailing over global macroeconomic conditions, geopolitical instability and volatile supply-chain issues remain headwinds.

Based in Canada, Descartes provides software-as-a-service logistics solutions to businesses, including transportation and logistics, manufacturing, retail and healthcare.

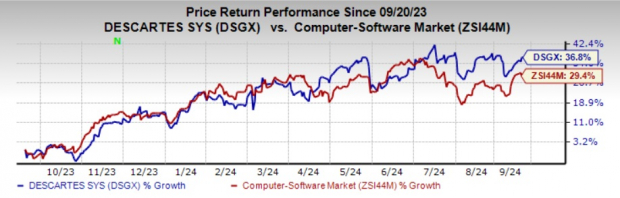

DSGX’S Zacks Rank & Stock Price Performance

At present, DSGX has a Zacks Rank #4 (Sell). Its shares have gained 36.8% compared with the sub-industry’s growth of 29.4% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Harmonic Inc. HLIT, Arista Networks, Inc. and Ubiquiti Inc. HLIT and UI sport a Zacks Rank #1 (Strong Buy), whereas ANET carries a Zacks Rank #2 (Buy) each at present.

Harmonic enables media companies and service providers to deliver ultra-high-quality broadcast and OTT video services to consumers globally. HLIT delivered a trailing four-quarter average earnings surprise of 32.5%.

Ubiquiti company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques.

Arista Networks supplies products to a prestigious set of customers, including Fortune 500 global companies in markets like cloud titans, enterprises, financials and specialty cloud service providers. It delivered a trailing four-quarter average earnings surprise of 15.02%. In the last reported quarter, ANET delivered an earnings surprise of 8.25%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Executive Officer Of DaVita Sold $9.86M In Stock

Javier Rodriguez, Chief Executive Officer at DaVita DVA, reported an insider sell on September 17, according to a new SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Rodriguez sold 59,881 shares of DaVita. The total transaction value is $9,861,636.

Tracking the Wednesday’s morning session, DaVita shares are trading at $161.38, showing a down of 1.73%.

All You Need to Know About DaVita

DaVita is the largest provider of dialysis services in the United States, boasting market share that eclipses 35% when measured by both patients and clinics. The firm operates over 3,000 facilities worldwide, mostly in the us, and treats about 250,000 patients globally each year. Government payers dominate us dialysis reimbursement. DaVita receives about two thirds of us sales at government (primarily Medicare) reimbursement rates, with the remainder coming from commercial insurers. While commercial insurers represent only about 10% of the us patients treated, they represent nearly all of the profits generated by DaVita in the us dialysis business.

Breaking Down DaVita’s Financial Performance

Revenue Growth: DaVita’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 6.21%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Exploring Profitability:

-

Gross Margin: Achieving a high gross margin of 32.77%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): DaVita’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 2.56.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 18.45, caution is advised due to increased financial risk.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 17.47 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.2 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): DaVita’s EV/EBITDA ratio, lower than industry averages at 9.82, indicates attractively priced shares.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of DaVita’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Endava PLC Misses Q4 Earnings and Revenue Estimates

Endava PLC DAVA came out with quarterly earnings of $0.28 per share, missing the Zacks Consensus Estimate of $0.29 per share. This compares to earnings of $0.71 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of -3.45%. A quarter ago, it was expected that this company would post earnings of $0.23 per share when it actually produced earnings of $0.28, delivering a surprise of 21.74%.

Over the last four quarters, the company has surpassed consensus EPS estimates two times.

Endava, which belongs to the Zacks Computers – IT Services industry, posted revenues of $245.3 million for the quarter ended June 2024, missing the Zacks Consensus Estimate by 1.35%. This compares to year-ago revenues of $237.56 million. The company has topped consensus revenue estimates two times over the last four quarters.

The sustainability of the stock’s immediate price movement based on the recently-released numbers and future earnings expectations will mostly depend on management’s commentary on the earnings call.

Endava shares have lost about 62.9% since the beginning of the year versus the S&P 500’s gain of 17.8%.

What’s Next for Endava?

While Endava has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?

There are no easy answers to this key question, but one reliable measure that can help investors address this is the company’s earnings outlook. Not only does this include current consensus earnings expectations for the coming quarter(s), but also how these expectations have changed lately.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. Investors can track such revisions by themselves or rely on a tried-and-tested rating tool like the Zacks Rank, which has an impressive track record of harnessing the power of earnings estimate revisions.

Ahead of this earnings release, the estimate revisions trend for Endava: mixed. While the magnitude and direction of estimate revisions could change following the company’s just-released earnings report, the current status translates into a Zacks Rank #3 (Hold) for the stock. So, the shares are expected to perform in line with the market in the near future.

It will be interesting to see how estimates for the coming quarters and current fiscal year change in the days ahead. The current consensus EPS estimate is $0.38 on $257.42 million in revenues for the coming quarter and $1.60 on $1.06 billion in revenues for the current fiscal year.

Investors should be mindful of the fact that the outlook for the industry can have a material impact on the performance of the stock as well. In terms of the Zacks Industry Rank, Computers – IT Services is currently in the top 20% of the 250 plus Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Accenture ACN, another stock in the same industry, has yet to report results for the quarter ended August 2024. The results are expected to be released on September 26.

This consulting company is expected to post quarterly earnings of $2.77 per share in its upcoming report, which represents a year-over-year change of +2.2%. The consensus EPS estimate for the quarter has been revised 0% higher over the last 30 days to the current level.

Accenture’s revenues are expected to be $16.33 billion, up 2.2% from the year-ago quarter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

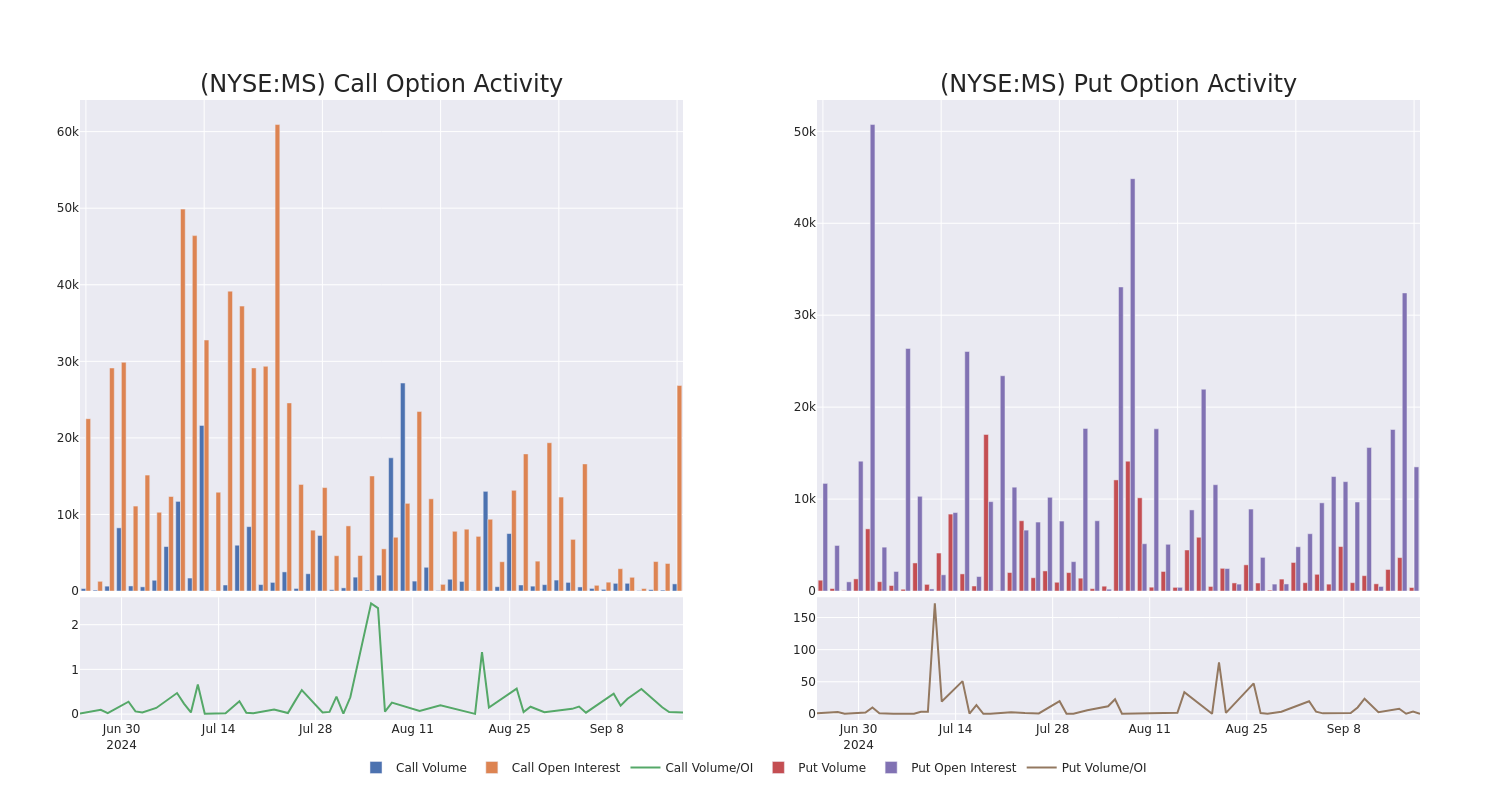

Looking At Morgan Stanley's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Morgan Stanley MS.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MS, it often means somebody knows something is about to happen.

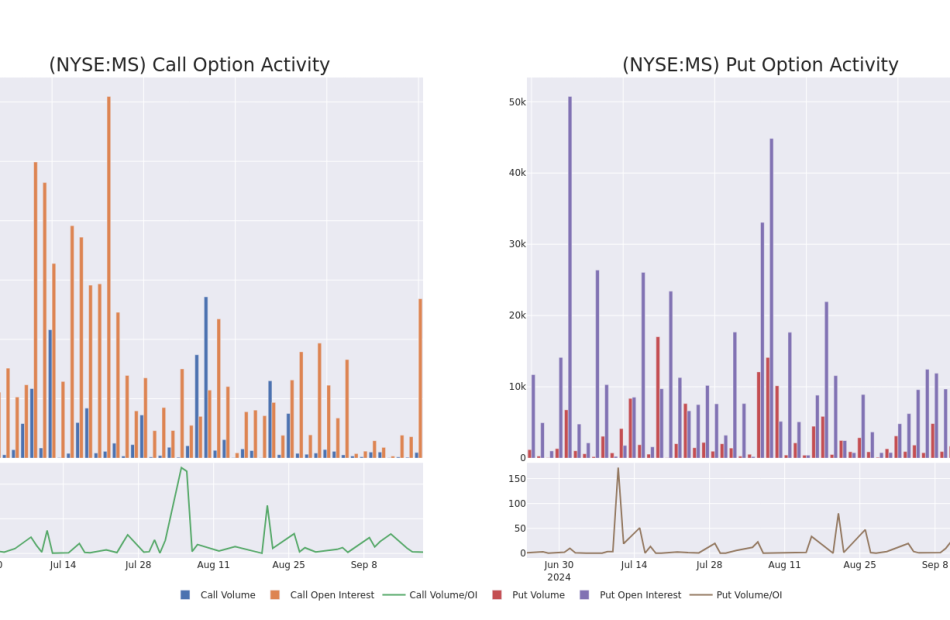

Today, Benzinga’s options scanner spotted 8 options trades for Morgan Stanley.

This isn’t normal.

The overall sentiment of these big-money traders is split between 25% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $48,850, and 7, calls, for a total amount of $497,736.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $105.0 for Morgan Stanley during the past quarter.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Morgan Stanley stands at 5764.14, with a total volume reaching 1,318.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $80.0 to $105.0, throughout the last 30 days.

Morgan Stanley Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | SWEEP | BEARISH | 01/17/25 | $6.85 | $6.75 | $6.8 | $100.00 | $125.8K | 14.8K | 206 |

| MS | CALL | SWEEP | BEARISH | 03/21/25 | $23.0 | $22.9 | $22.9 | $80.00 | $103.0K | 56 | 50 |

| MS | CALL | SWEEP | BEARISH | 01/17/25 | $4.3 | $4.2 | $4.2 | $105.00 | $84.0K | 7.8K | 211 |

| MS | CALL | TRADE | NEUTRAL | 10/18/24 | $3.9 | $3.8 | $3.85 | $100.00 | $57.3K | 3.5K | 379 |

| MS | CALL | SWEEP | BULLISH | 02/21/25 | $8.45 | $8.35 | $8.45 | $97.50 | $50.7K | 220 | 63 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

Having examined the options trading patterns of Morgan Stanley, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Morgan Stanley’s Current Market Status

- Currently trading with a volume of 9,054,366, the MS’s price is up by 1.44%, now at $100.73.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 27 days.

Expert Opinions on Morgan Stanley

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $105.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Goldman Sachs lowers its rating to Neutral with a new price target of $105.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Morgan Stanley, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LeaseCrunch Announces Webinar on GASB 87 and GASB 96

MILWAUKEE, Sept. 19, 2024 (GLOBE NEWSWIRE) — LeaseCrunch LLC, a leading lease accounting software company, today announces a webinar on GASB 87 and GASB 96: “From Basic Principles to Advanced Practices.” The webinar will take place on September 26 at 1:00 p.m. CDT.

The webinar will feature Jess Vento, senior director of solution engineering, education and support at LeaseCrunch, as she explores lease recognition, measurement and disclosure under GASB 87, subscription-based IT Arrangements (SBITAs) in GASB 96 and how to handle lease modifications for real-world compliance.

Attendees will:

- Understand the principles of GASB 87 and GASB 96, including lease/SBITA recognition, measurement and disclosure requirements for government entities.

- Analyze the accounting treatment of SBITAs under GASB 96 and how this differs from leases under GASB 87.

- Apply practical strategies to manage lease modifications and ensure compliance with the latest GASB standards in real-world government accounting scenarios.

“We are committed to offering education that simplifies lease and SBITA accounting,” states Megan Krajnik, CMO, LeaseCrunch. “Our webinars provide targeted insights on effectively managing the latest GASB standards, walking through various scenarios specific to governmental organizations to ensure compliance.”

Registration is currently open for this webinar.

About LeaseCrunch

LeaseCrunch offers easy-to-use, automated lease accounting software that significantly reduces the time needed to transition, account for and maintain leases in compliance with ASC 842, GASB 87, GASB 94, GASB 96 and IFRS 16. The platform is trusted by over 650 CPA firms and more than 26,000 companies across the United States, offering white-glove support to ensure a seamless transition and superior ongoing management of lease accounting needs.

Media Contact:

Vicki LaBrosse

Edge Marketing for LeaseCrunch

Vlabrosse@edgemarketinginc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.