Alphabet, McDonald's And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed lower by around 0.5% during Wednesday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

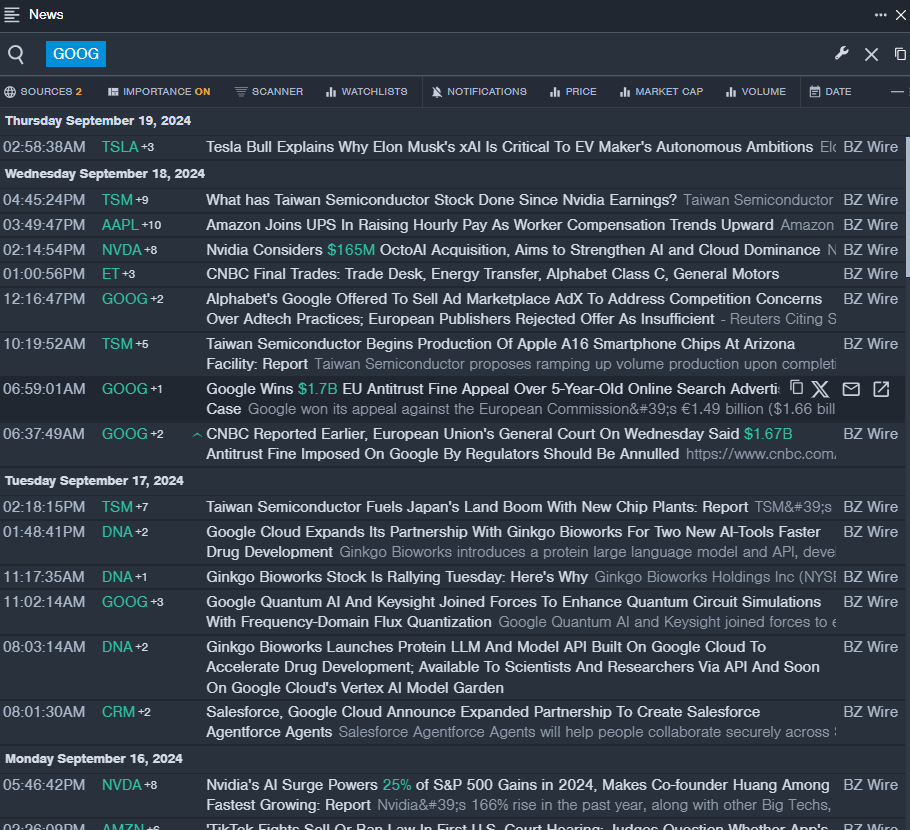

Alphabet

- The Trade: Alphabet Inc. GOOGL GOOG CEO Sundar Pichai sold a total of 22,500 shares at an average price of $160.63. The insider received around $3.61 million from selling those shares.

- What’s Happening: Alphabet’s Google won its appeal against the European Commission’s €1.49 billion ($1.66 billion) antitrust fine for anticompetitive practices involving its online search advertising business.

- What Alphabet Does: Alphabet is a holding company that wholly owns internet giant Google.

- Benzinga Pro’s real-time newsfeed alerted to latest GOOG news.

Williams-Sonoma

- The Trade: Williams-Sonoma, Inc. WSM President and CEO Laura Alber sold a total of 40,000 shares at an average price of $145.27. The insider received around $5.8 million from selling those shares.

- What’s Happening: On Sept. 16, TD Cowen analyst Max Rakhlenko maintained Williams-Sonoma with a Buy and raised the price target from $150 to $160.

- What Williams-Sonoma Does: With a retail and direct-to-consumer presence, Williams-Sonoma is a player in the $300 billion domestic home category and $450 billion international home market, focused on expanding its exposure in the B2B ($80 billion total addressable market), marketplace, and franchise areas.

- Benzinga Pro’s charting tool helped identify the trend in WSM stock.

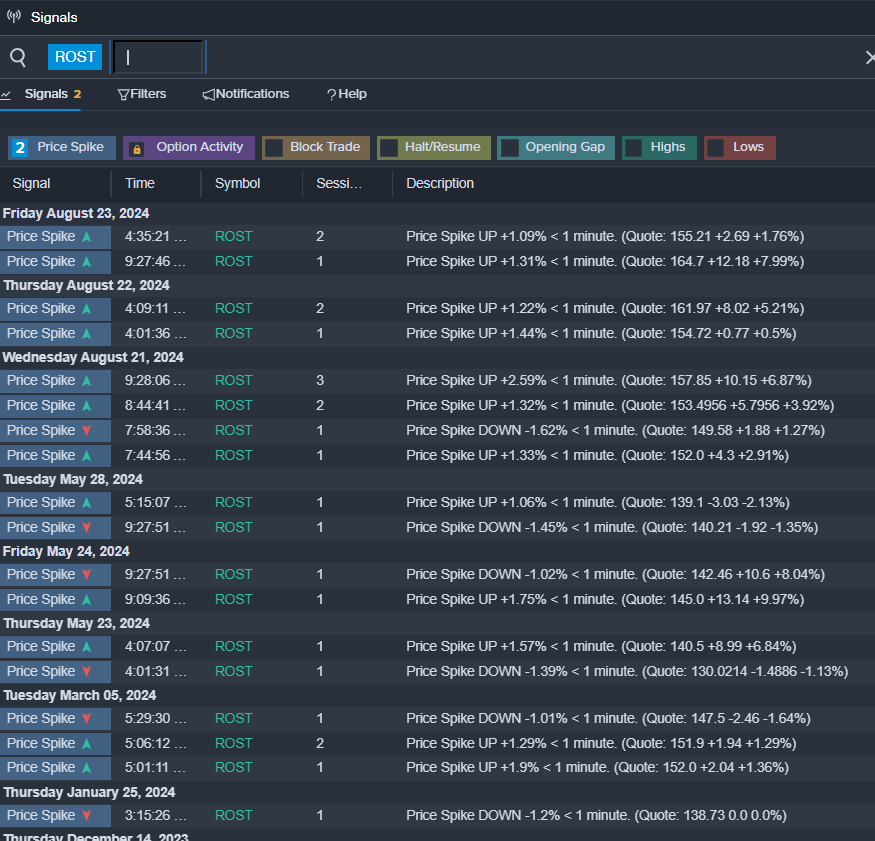

Ross Stores

- The Trade: Ross Stores, Inc. ROST Group President, COO Michael J. Hartshorn sold a total of 8,366 shares at an average price of $155.64. The insider received around $1.3 million from selling those shares.

- What’s Happening: On Aug. 22, Ross Stores reported better-than-expected second-quarter financial results and raised its FY24 EPS guidance with its midpoint above estimates.

- What Ross Stores Does: Ross Stores operates as an off-price apparel and accessories retailer with the majority of its sales derived from its Ross Dress for Less banner.

- Benzinga Pro’s signals feature notified of a potential breakout in ROST shares.

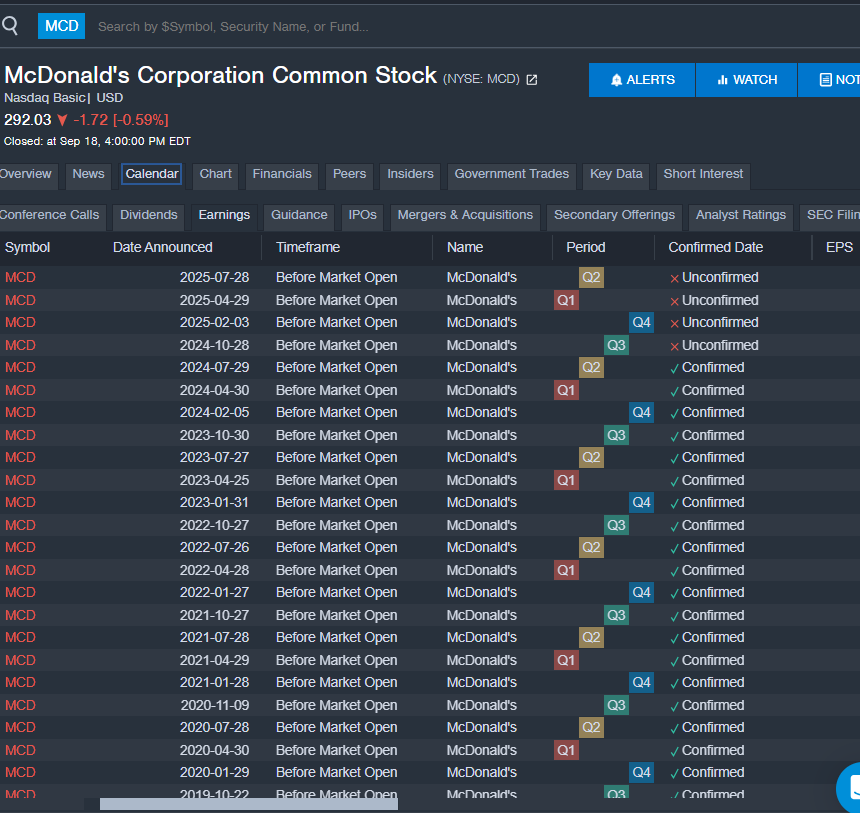

McDonald’s

- The Trade: McDonald’s Corporation MCD Chairman and CEO Christopher J Kempczinski sold a total of 3,934 shares at an average price of $300.00. The insider received around $1.2 million from selling those shares.

- What’s Happening: On Sept. 16, JP Morgan analyst John Ivankoe maintained McDonald’s with an Overweight and raised the price target from $270 to $290.

- What McDonald’s Does: McDonald’s is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets.

- Benzinga Pro’s earnings calendar was used to track upcoming MCD’s earnings reports.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Electronic Board Level Underfill and Encapsulation Material Market is Projected to Reach US$ 752.8 Million by 2034 | Fact.MR Report

Next Post

Leave a Reply