Check Out What Whales Are Doing With LOW

Investors with a lot of money to spend have taken a bullish stance on Lowe’s Companies LOW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LOW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 21 uncommon options trades for Lowe’s Companies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 42% bullish and 42%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $233,364, and 15 are calls, for a total amount of $1,029,627.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $280.0 for Lowe’s Companies during the past quarter.

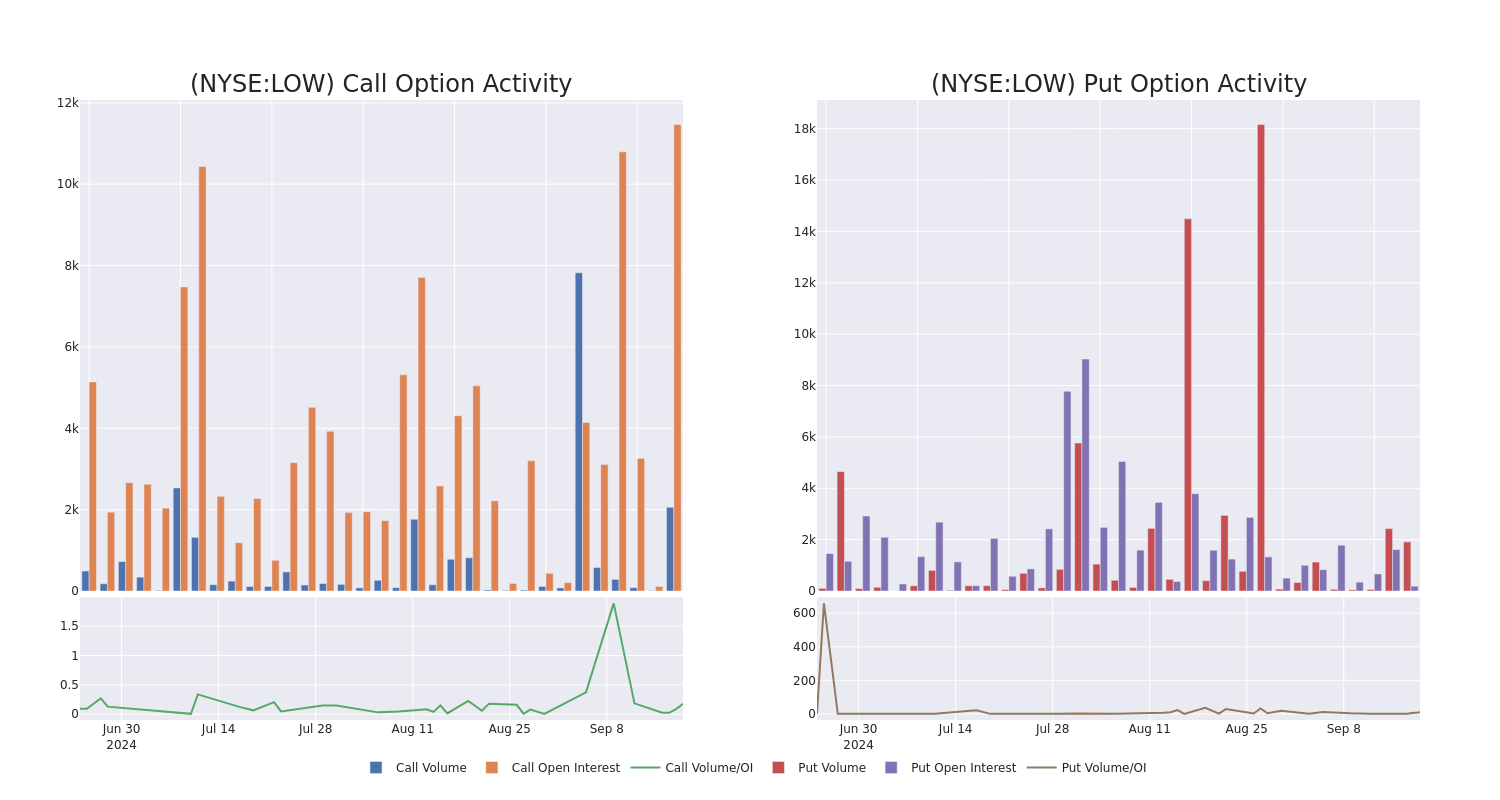

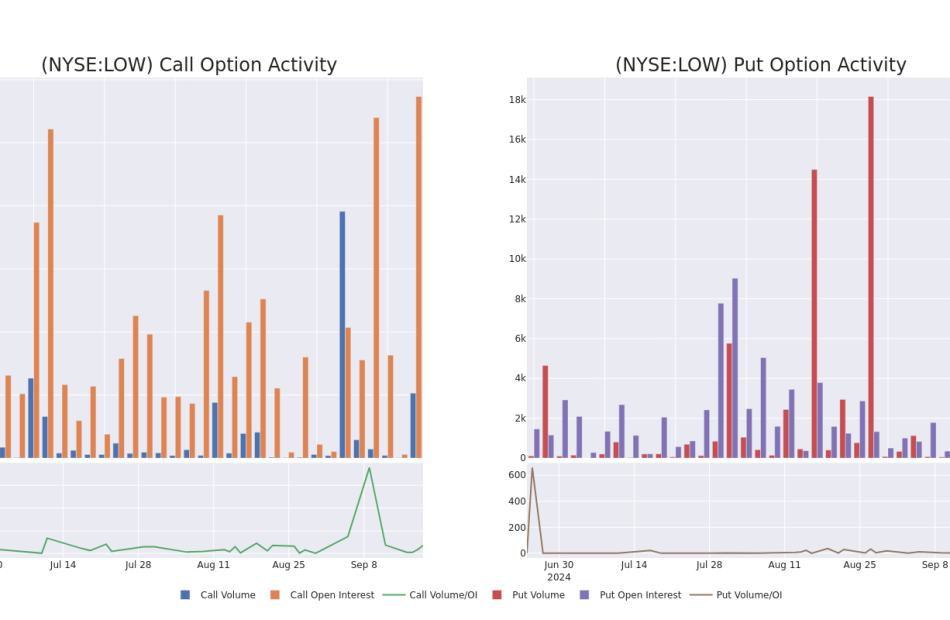

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Lowe’s Companies options trades today is 1165.5 with a total volume of 3,971.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lowe’s Companies’s big money trades within a strike price range of $200.0 to $280.0 over the last 30 days.

Lowe’s Companies Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | CALL | SWEEP | BEARISH | 01/17/25 | $7.3 | $7.25 | $7.3 | $280.00 | $221.9K | 1.5K | 344 |

| LOW | CALL | SWEEP | BULLISH | 09/20/24 | $11.2 | $11.15 | $11.15 | $250.00 | $200.5K | 2.0K | 261 |

| LOW | PUT | SWEEP | BULLISH | 10/18/24 | $5.6 | $5.4 | $5.4 | $260.00 | $76.6K | 189 | 204 |

| LOW | CALL | SWEEP | BULLISH | 09/20/24 | $11.35 | $11.3 | $11.3 | $250.00 | $73.7K | 2.0K | 414 |

| LOW | CALL | SWEEP | BULLISH | 10/18/24 | $14.3 | $14.3 | $14.3 | $250.00 | $71.5K | 3.0K | 56 |

About Lowe’s Companies

Lowe’s is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe’s Canada, Réno-Dépôt, and Dick’s Lumber). The firm’s stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe’s targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers as well as commercial and professional business clients (around 25% of sales). We estimate Lowe’s captures a high-single-digit share of the domestic home improvement market, based on US Census data and management’s market size estimates.

After a thorough review of the options trading surrounding Lowe’s Companies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Lowe’s Companies Standing Right Now?

- With a volume of 2,187,069, the price of LOW is up 1.7% at $261.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 61 days.

Professional Analyst Ratings for Lowe’s Companies

5 market experts have recently issued ratings for this stock, with a consensus target price of $245.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group persists with their Market Perform rating on Lowe’s Companies, maintaining a target price of $230.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Lowe’s Companies with a target price of $265.

* Consistent in their evaluation, an analyst from Gordon Haskett keeps a Hold rating on Lowe’s Companies with a target price of $240.

* An analyst from Morgan Stanley persists with their Overweight rating on Lowe’s Companies, maintaining a target price of $255.

* An analyst from RBC Capital has decided to maintain their Sector Perform rating on Lowe’s Companies, which currently sits at a price target of $238.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lowe’s Companies, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply