I loved my job at Microsoft, but I had to resign on principle. Here’s why

In Microsoft’s own words on climate change, “those of us who can afford to move faster and go further should do so.” So why is Microsoft going backwards?

No matter how we vote, what generation we belong to, or what part of the world we live in, many of us have sweltered this summer. During one week in June, the world broke 1,400 temperature records—with 1,300 people dying in the Hajj heatwave alone. That should remind us of our shared reality: Climate issues are among our most urgent challenges worldwide.

I am a Seattle-based, 32-year-old, plant-powered mountain athlete and climate activist who resigned earlier this year from Microsoft, a company hailed by one media outlet as the best ESG company of 2023. Now, I am co-leading a campaign to advocate for effective policy, inform standards, and build a cross-industry coalition to drive change. Before you dismiss me as an idealist tech worker disconnected from our oil-dependent economy, I want you to hear the backstory.

Leaving Microsoft—over principles

I painfully quit a job I loved leading multiple global sustainability programs primarily because, after years of organizing internally to make change, I could no longer reconcile Microsoft’s strong public environmental sustainability stance with its assistance to the oil and gas industry—a partnership that was dramatically increasing global emissions. I realized that internal pressure alone wasn’t going to shift the incentives; the public and shareholders needed to know what was happening.

Corporations play a role in many of the greatest challenges of our time, and many have made strong pledges around labor and human rights, conflict minerals, or privacy. Over almost a decade at Microsoft, the challenge I devoted my career to was environmental sustainability. I was in good company, with Microsoft’s laudable sustainability commitments backed by thousands of world-class employees and programs.

Microsoft is extremely outspoken on the ethics of technology and sustainability. President Brad Smith has ardently emphasized the need to control whether technology is used “for good or ill,” and has made strong statements on Microsoft’s role in climate change. Similarly, CEO Satya Nadella has stated to shareholders, “As we pursue our mission, we also recognize our enormous responsibility to ensure the technology we build benefits everyone on the planet, including the planet itself.”

I’m proud that the employee group I cofounded played a part in strengthening Microsoft’s environmental pledges. But even as the tech giant promulgates the urgency to act on climate for “a shared future,” its core business activities directly contribute to the climate crisis.

The leader in ‘responsible AI’ is acting irresponsibly

As outlined in an explosive new article in the Atlantic, in truth, Microsoft’s advanced technology is enabling a substantial increase in global emissions. The company dominates as the largest cloud provider of advanced technology (e.g. AI) to the fossil fuel industry, surpassing all other vendors combined. Its digital technology is contributing to staggering fossil fuel industry profits, with companies like Chevron last year producing “more oil and natural gas than any year in the company’s history.”

Between 2018-19, Microsoft publicized explicit goals—including “expand production” with Exxon, “generate new exploration opportunities” with Chevron, and accelerate “extracted and refined” hydrocarbons with BP. In one Microsoft customer case study, Staale Gjervik, president of ExxonMobil subsidiary XTO Energy, revealed, “Over the coming decade, we plan to drill thousands of new wells and build dozens of new facilities. It’s challenging to keep up with that pace, but with [Microsoft] Azure, we have the digital technology to help support our growth…”

In 2020, following Microsoft’s major carbon announcements and scrutiny from Greenpeace’s “Oil in the Cloud” report, the company shifted the tone of its public communications, largely omitting such references from its public-facing materials. However, inside the company, the focus on increasing extraction flourished. Over the past four years, fossil fuel companies became among the top consumers of Microsoft’s cloud and AI services—and now, generative AI has supercharged the problem.

Analyst reports suggest that advanced technologies—such as AI or machine learning (ML)—have the potential to increase fossil fuel yield by 15%, contributing to a resurgence of oil and potentially delaying the global transition to renewable energy. The real-world impacts are staggering: A single such deal between Microsoft and ExxonMobil could generate emissions that exceed Microsoft’s 2020 annual carbon removal commitments by over 600%. I saw dozens of such deals during the time I was employed at Microsoft.

Internally, discussions highlighted the most significant application of generative AI for the oil and gas industry: optimizing exploration activities. AI was celebrated as a “game changer” and the key for the fossil fuel industry to continue to be competitive.

Microsoft makes billions of dollars from helping fossil fuel companies accelerate all phases of oil and gas production. This makes their claims of facilitating the transition to a decarbonized economy and establishing AI guardrails toward a “nature-positive future” seem to me to be misleading for shareholders, employees, and customers who trust and invest in Microsoft due to its strong sustainability reputation. While Microsoft’s public statements and reports highlight the beneficial applications of AI for sustainability, they crucially omit the fact that a substantial part of Microsoft’s business is providing technology to fossil fuel companies to increase production.

Even if AI reduces emissions per barrel, its role in boosting overall production leads to a net increase in global emissions. Enhanced efficiency translates into more drilling, which undermines the transition to renewables, as the additional fossil fuels brought to market far outweigh any modest extraction-related emission cuts.

Microsoft’s dual approach—promoting sustainability publicly while aiding fossil fuel expansion privately—creates a misleading narrative that can obscure the true environmental impact of their business practices.

What needs to change

To be clear: While we were at Microsoft, my colleagues and I never advocated for the company to sever its ties with the fossil fuel industry; we understood we were still operating in a world dependent on oil. But we did argue that Microsoft needed to align its AI policies with broader global climate aims. The company needed to work to change the system, not capitulate to it.

Microsoft, and other AI companies, can do this by ensuring they are aligning their work in a way that supports climate policies. They can conduct audits of their impact, disclose the climate risks the application of their technologies pose, and actively shift revenue to renewable energy. Most importantly, doing these things and being transparent about the progress they are making—and the challenges they are facing—will encourage competitors to follow.

Relying on fossil-fuel companies to lead the clean-energy transition is risky, as their interests fundamentally remain tied to high-carbon activities. We can leverage their expertise without supporting their entire business, while public investment and green innovators drive the real shift to sustainable infrastructure.

Microsoft’s influence can reshape market dynamics and set an industry precedent, akin to its decisions on facial recognition and Google’s moratorium on custom AI for the oil and gas sector. As stated by Microsoft, “If the world is going to meet net zero goals by 2050, companies need to use their entire ecosystem and all of their positions of influence.” But this will only happen if they are transparent with the public about the progress they are making.

We presented these carefully considered recommendations to top Microsoft leadership, who enthusiastically agreed with us, but failed to follow through with implementation.

Microsoft has the capacity to do better than unfulfilled promises to employees and energy principles—their response to our internal pressure—that fail to address the core issues. Microsoft, and the tech industry at large, must take responsibility for the emissions enabled by their technology and lead the way toward a truly sustainable future for all.

(Microsoft had no comment when contacted by Fortune.)

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Ask an Advisor: I'm 68 With No Investments and $60k Cash – What Can I Do Now?

At 68, I do not have any investments of any kind. My $80,000 condo is paid off, and I have $60,000 saved. Am I too late?

-Bernhard

It’s never too late to start investing and managing your money. But I don’t want to sugarcoat it. If you’re planning to invest for retirement, getting the ball rolling in your late 60s certainly limits your options. So, let’s discuss some of your choices. (If you have additional questions about investing or retirement, this tool can help match you with potential advisors.)

Consider Alternate Forms of Income

With limited savings, you likely can’t afford to ignore Social Security benefits and other sources of income. If you haven’t tapped your Social Security benefit yet, keep in mind that waiting until 70 will maximize the benefit you receive.

It’s also worth exploring other ways to maintain income into your golden years. Can you continue working in your current position, find part-time employment or consult on the side?

Delaying full retirement will increase your cash flow in the near term, allow you to plan for a shorter retirement period and perhaps give you room to save and invest. (If you have additional questions about maximizing retirement income, this tool can help match you with potential advisors.)

Paying off Your Home Is Great, But Consider Other Expense Reductions

The fact that you outright own your $80,000 condo is commendable. And depending on your location, there may not be many other properties in a lower price tier. So, you may have limited options for downsizing or finding less expensive housing.

But consider other moves you can make to reduce expenses when it comes to transportation, travel, food and other costs. With minimal savings, you’ll need to keep a careful eye on spending.

Determine Appropriate Asset Allocation

If you plan to have your $60,000 last decades into retirement, it’s worth evaluating an appropriate investment balance that allows for both short-term liquidity, medium-term time horizons and long-term growth. Keeping 100% of your money in cash typically doesn’t allow it to keep up with inflation and it causes your nest egg to lose value over time.

Working with a financial advisor may help you build a portfolio and project out retirement spending and income needs into the future. A holistic advisor may also be able to help you work through the tax repercussions of your income and retirement projections.

Depending on your financial situation, consider whether you’re eligible for a financial advisor or even pro bono financial help from a source such as the Financial Planning Association. (If you have additional questions about investing or retirement, this tool can help match you with potential advisors.)

Next Steps

It’s never too late to start investing, but starting in your late 60s will impact the options you have. Consider Social Security strategies, income sources and appropriate asset allocation. A financial advisor may be able to help you project out your investment and income plan into the coming decades.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Consider a few advisors before settling on one. It’s important to make sure you find someone you trust to manage your money. As you consider your options, these are the questions you should ask an advisor to ensure you make the right choice.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Susannah Snider, CFP® is SmartAsset’s financial planning columnist and answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Susannah is not a participant in the SmartAsset AMP platform and was an employee of SmartAsset at the time of writing.

Photo credit: ©Jen Barker Worley, ©iStockPhoto/Moon Safari, ©iStockPhoto/Milan Markovic

The post Ask an Advisor: ‘Am I Too Late?’ I’m 68, Have No Investments and Only Have $60K Saved appeared first on SmartAsset Blog.

How PowerSchool's Latest AI Solutions Could Drive Stock Higher

PowerSchool Holdings, Inc. PWSC, a leader in cloud-based software for K-12 education, has announced two new AI-driven tools, PowerBuddy for College and Career and PowerBuddy for Custom AI. These tools aim to revolutionize the way students, families, and school districts access and manage information, potentially driving further growth for PWSC stock.

PWSC’s AI Tools to Transform College and Career Planning

PowerBuddy for College and Career helps students take control of their future planning by offering personalized guidance based on their unique needs. This AI assistant uses longitudinal student data to provide real-time responses about career paths, college options, scholarships, and more. With natural language interactions, students can easily access relevant information without wasting time sifting through resources.

The assistant is designed to reduce the burden on school counselors, who often manage far more students than recommended. By offering a self-service platform for students to explore postsecondary options, PowerBuddy allows counselors to focus on higher-impact areas of support.

PWSC’s AI Tools to Enhance School District Efficiency

PowerBuddy for Custom AI is designed to streamline how school districts interact with their communities. By providing real-time answers to district-specific queries — ranging from policy manuals to athletic schedules — this tool saves both time and effort for families and staff. The AI assistant ensures users receive approved, accurate information from the district’s knowledge base, reducing the need for manual searches.

Given that only 23% of educators feel partnerships with parents have strengthened since the pandemic, PowerBuddy’s ability to improve communication and accessibility could significantly impact school district adoption of PowerSchool’s software, boosting the company’s growth trajectory and stock appeal.

Both PowerBuddy tools are built on PowerSchool’s Responsible AI principles, with a strong focus on privacy and security. The company’s commitment to secure, efficient, and personalized technology could strengthen PowerSchool’s foothold in the education technology space.

As districts and schools seek more efficient ways to manage operations and student support, these AI-driven innovations could drive higher adoption rates of PowerSchool’s offerings, positively impacting PWSC stock.

PWSC Stock Performance

Shares of this cloud-based education software provider have gained 8.5% in the past six months against the Zacks Schools industry’s 9.1% decline. The company has been benefiting from the continuous strength in the market demand for its suite of mission-critical products, along with its focus on operating leverage. Furthermore, its advanced AI solutions enhancements and opportunities in its market bode well for PWSC’s prospects.

Image Source: Zacks Investment Research

Considering the estimate revision trend, the Zacks Consensus Estimate for 2024 and third-quarter earnings per share of PWSC have trended upward to 90 cents (from 63 cents) and 25 cents (from 18 cents) over the past 60 days, respectively. The estimated figures indicate 9.8% and 4.2% growth, respectively, from the year-ago period’s reported levels. Such an uptrend depicts analysts’ optimism about the stock’s potential.

In June 2024, PowerSchool entered into a definitive agreement to be acquired by one of the world’s leading private multi-asset alternative investment firms, Bain Capital. The transaction, valued at $5.6 billion, is expected to close in the second half of 2024, subject to customary closing conditions, including regulatory approvals. Although PWSC is set to be acquired, it will continue to remain a standalone company with no interruptions in its business operations and customer service.

PWSC Zacks Rank

PowerSchool currently carries a Zacks Rank #3 (Hold).

Key Picks

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector:

Stride, Inc. LRN presently carries a Zacks Rank of 2 (Buy). LRN has a trailing four-quarter earnings surprise of 40.3%, on average.

LRN shares have gained 31.8% in the past six months. The consensus estimate for LRN’s fiscal 2025 sales and EPS implies a rise of 6.3% and 7.7%, respectively, from the year-ago levels.

Grand Canyon Education, Inc. LOPE, currently carrying a Zacks Rank #2, has a trailing four-quarter earnings surprise of 10.2%, on average.

LOPE shares have gained 6.5% in the past six months. LOPE has seen an upward estimate revision for 2024 earnings to $7.98 per share from $7.80 over the past 60 days. This company’s earnings for 2024 are expected to register 13.4% growth from a year ago.

Lincoln Educational Services Corporation LINC, currently carrying a Zacks Rank #2, has a trailing four-quarter earnings surprise of 249.4%, on average.

LRN shares have gained 24.5% in the past six months. LINC has seen an upward estimate revision for 2024 earnings to 51 cents per share from 48 cents over the past 60 days. This company’s earnings for 2024 are expected to register 4.1% growth from a year ago.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Magnificent Dividend Stocks With Yields Above 5% to Buy Now and Hold Forever

The benchmark S&P 500 index is up by about 26% over the past three years, but that doesn’t mean every stock has had a great run. Over the same time frame, shares of W.P. Carey (NYSE: WPC), Verizon (NYSE: VZ), and Pfizer (NYSE: PFE) have tumbled by 15%, 18%, and 33%, respectively.

All three of these stocks offer yields above 5% at their beaten-down prices. You wouldn’t know it by looking at their stock charts, but all three of these businesses have what they need to meet their present dividend obligations and raise them much further in the years ahead.

Here’s how adding these stocks to a diversified portfolio could lead to heaps of passive income to fuel your retirement.

W.P. Carey

W.P. Carey is a diversified real estate investment trust (REIT) with a portfolio of 1,291 properties that it doesn’t manage. Instead, it employs net leases that transfer all the variable costs of building ownership to its tenants.

You may have noticed that W.P. Carey’s dividend payout decreased in 2023 after the REIT spun off a portfolio of 59 office buildings into a new company called Net Lease Office Properties. Now that it’s out of the office-leasing business, 63.9% of expected rent payments come from industrial properties and warehouses.

At recent prices, the stock offers a 5.5% yield and perhaps much more by the time you’re ready to retire. This year, management expects adjusted funds from operations, a proxy for earnings used to evaluate REITs, to reach a range between $4.63 and $4.73 per share. That’s more than enough to cover a dividend currently set at $3.48 per share.

In addition to predictable rental revenue from existing tenants, W.P. Carey investors can look forward to gains driven by new properties. This year management expects to expand its portfolio by investing between $1.25 billion and $1.75 billion.

Verizon

In September, Verizon increased its dividend payout for the 18th consecutive year. That’s the longest consecutive annual dividend-raising streak among America’s three large 5G network operators. At recent prices, the stock offers a huge 6.1% dividend yield.

Verizon’s equipment sales have declined due to longer smartphone-refresh cycles, but a recently launched iPhone 16 could lead to a sales bump in the fourth quarter.

Luckily, Verizon doesn’t need customers to have new phones to continue collecting their monthly service payments. Q2 wireless-service revenue rose 3.5% year over year to $19.8 billion.

Investors can look forward to another significant dividend raise next year. During the first half of 2024, Verizon reported $$8.5 billion in free cash flow but needed just $5.6 billion to meet its dividend obligations.

Verizon probably isn’t going to be the fastest-growing dividend stock in your portfolio. As one of just three nationwide 5G service providers, though, it might be the most reliable.

Pfizer

Pfizer’s stock price is down about 51% from the peak it reached in 2021. At a glance, the business looks like a disaster because sales of its COVID-19 vaccine and antiviral treatment both collapsed.

This stock is way down from its previous peak, but Pfizer’s overall business is booming. If we exclude COVID-19-related sales, Q2 revenue surged 14% year over year.

Last December, Pfizer raised its payout for the 15th year in a row. At recent prices, the stock offers a big 5.6% yield.

Even cautious investors can feel good about adding some Pfizer shares to their portfolios. Pfizer has a longer list of patent-protected medicines to sell than any of its Big Pharma peers.

In the first half of 2024, 11 of its products grew sales by a double-digit percentage, and new growth drivers are pouring out from an industry-leading development pipeline. Last year the Food and Drug Administration (FDA) approved nine new medicines from Pfizer. With plenty of new products for its global salesforce to market, Pfizer could keep raising its payout for another 15 years.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

3 Magnificent Dividend Stocks With Yields Above 5% to Buy Now and Hold Forever was originally published by The Motley Fool

4 Dividend Stocks to Double Up On Right Now

If you’re interested in adding more dividend-paying stocks to your portfolio, that’s a fine idea. For one thing, dividend payers tend to be more established and reliable growers, since they have reached a point where management is confident it can commit to a regular payout to shareholders. Better still, dividend-paying stocks tend to outperform non-payers!

For example, a study by Hartford Funds and Ned Davis Research found that from 1973 to 2022, companies that grew or initiated dividend payments delivered annualized returns of 10.3%, while those that didn’t have payouts delivered a 3.95% annualized return and an equal-weight S&P 500 fund returned 7.7% annually. Oh, and the dividend payers were less volatile than their counterparts, too.

Here are four well-known companies that recently had hefty dividend yields. You might want to consider some for your portfolio or your watch list.

1. Verizon Communications

Verizon Communications (NYSE: VZ), with a recent market value near $180 billion, recently had a fat dividend yield of 6.6%. That payout hasn’t been growing briskly lately, but it’s quite generous as is.

Verizon bulls like its strong wireless network and its chances of making it stronger still. Also promising is that Verizon recently announced it’s buying Frontier Communications Parent for $20 billion to expand fiber services in the U.S.

Bears worry about the safety of the dividend, though, given Verizon’s substantial debt load. That’s worth keeping an eye on, but for now the company’s significant cash flow is enough to cover dividend obligations. In a show of confidence, management just increased the payout by 1.9%.

2. Citigroup

Citigroup (NYSE: C) operates one of the largest banks in the country and had a recent market value near $109 billion — and that’s after a recent drop of 16% from its 52-week high. It’s worth understanding that when a stock’s price drops, its dividend yield will increase.

That’s part of the reason the stock’s dividend yield was recently a satisfying 3.6%. Better still, that payout has been rising over time, jumping by 6% in its last increase.

Citigroup has 19,000 corporate clients, including 85% of the Fortune 500, and more than 100 million customers using its credit card, wealth management, and banking services. Close to $5 trillion moves through the company each day.

So why the stock price decline? Well, the company has lagged peers in profitability, and it’s in the process of turning itself around. That involves, in part, selling off its consumer business in Mexico and investing more on wealth management and commercial banking.

3. CVS Health

CVS Health (NYSE: CVS) is another stock that has been facing challenges lately, with its price recently down 31% from its 52-week high, pushing its dividend yield up to 4.7%. That payout has been increased by an annual average rate of 6% over the past five years.

CVS recently had a payout ratio of 45%, meaning that 45% of its earnings are going to dividends. That suggests that the payout isn’t threatened and could have room to grow further.

Why has the stock dropped? While its pharmacy and health services divisions have been performing well, its health insurance business has lagged. Still, overall revenue grew by 2.6% year over year in the last quarter, and earnings per share exceeded expectations.

CVS Health’s stock looks attractively valued at recent levels, with a forward-looking price-to-earnings ratio (P/E) of 7.8, well below its five-year average of 9.5.

4. United Parcel Service

United Parcel Service (NYSE: UPS) is another familiar name, with a recent market value of $111 billion. The stock is down 21% from its 52-week high, pushing up its dividend yield to 5.1%. It’s an impressive delivery business, with more than a half-million employees and more than 22 million packages delivered daily.

The dividend has grown by a robust 11% average over the past five years. But that might not continue in the near future as the stock’s payout ratio is around 100%.

The company has been hurt by Amazon moving to do more of its deliveries itself instead of outsourcing. Still, as UPS cuts costs and welcomes a better economy, its earnings should improve. Our current habit of doing a lot of online shopping isn’t likely to abate anytime soon, so deliveries will continue to be vital.

The stock seems attractively valued, too, with a forward P/E of 14.1, well below the five-year average of 16.2.

Take a closer look at any of these stocks that interest you and know that there are plenty of other attractive dividend payers out there — and dividend-focused exchange-traded funds.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Selena Maranjian has positions in Amazon and Verizon Communications. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends CVS Health, United Parcel Service, and Verizon Communications. The Motley Fool has a disclosure policy.

4 Dividend Stocks to Double Up On Right Now was originally published by The Motley Fool

This Bank Could Be the Next to $1 Trillion in Assets. Should You Buy the Stock Today?

There are more than 4,500 bank subsidiaries in the U.S., according to the Federal Deposit Insurance Corporation. However, there is a wide discrepancy in size. Four banks — JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo — each have at least $1.6 trillion in assets, while the fifth largest bank has only $664 billion in assets. The next 10 banks after Citi total about $4.3 trillion in assets, compared to Chase’s main bank subsidiary, which has roughly $3.5 trillion in assets.

Scale matters in the world of banking today due to the complex regulatory landscape and the need to invest in tech. And make no mistake, the number of banks in the U.S. will consolidate over the next few decades, and the big banks will get bigger and likely be the winners. The bank I am going to talk about could be the next to reach $1 trillion in assets. Should you buy the stock today? Let’s take a look.

An aspiration to get bigger

Sitting behind the big four are three large consumer and commercial super-regional banks: U.S. Bancorp (NYSE: USB), PNC Financial Services Group (NYSE: PNC), and Truist (NYSE: TFC). U.S. Bancorp is the largest with nearly $665 billion in assets, and it’s certainly been an acquirer in the past and could be in the future. However, right now, it doesn’t seem to have a huge appetite, not that it wouldn’t look at opportunities if they came along. Meanwhile, Truist is the smallest of the three, with about $512 billion in assets, and it has been slow to make major acquisitions since the merger of BB&T and SunTrust that formed Truist back in 2019.

I think PNC, which currently has $557 billion in total assets, will make a big push in the coming years to reach $1 trillion in assets. PNC’s CEO Bill Demchak, who is viewed very favorably by investors, made a big splash in early 2021 when the bank used proceeds from the divestiture of its stake in the large asset manager BlackRock to purchase the U.S. operations of the Spanish bank BBVA for $11.6 billion. Over the past year, Demchak has been very transparent in his desire to grow, not just for growth’s sake, but as a necessity.

At the start of this year, Demchak said that size is a necessity during crises so PNC can garner the same “quasi support that the giant banks have.” At an industry conference in February, Demchak and CFO Rob Reilly pointed out that during the banking crisis last March, the biggest banks — including PNC — benefited as a result of being viewed as a flight to safety.

“From PNC’s perspective, it’s easy to conclude, and I think you would agree scale equals growth. So the scale providers are growing at a higher rate than the nonscale providers. So we think it’s plainly evident. The good news for PNC is we are a skilled acquirer. I think we’re viewed largely in terms of being good at it if and when the opportunity occurs,” Reilly said at the time.

PNC also has a pretty good currency, with its stock currently trading at roughly 200% of its tangible book value (TBV). This should put the bank in a pretty good position to find deals that are not only accretive to earnings, but also potentially accretive to tangible book value. These days, bank investors are very sensitive to dilutive deals; they want to see immediate TBV accretion or very short earnback periods.

PNC also has a common equity tier 1 capital ratio of 10.2%, which looks at a bank’s core capital compared to risk-weighted assets such as loans. The bank’s regulatory requirement for next year (starting Oct. 1) is 7%, so the bank is also operating with a healthy amount of excess capital.

It will take time

Despite the desire to grow, I expect Demchak to remain disciplined and not grow just for growth’s stake. Demchak recently said at a conference that he’s not seeing anything of value right now, although bank mergers and acquisitions (M&A) is starting to pick up.

Bank investors are also not super keen on large M&A right now. Many view the merger of equals between BB&T and SunTrust to create Truist as a disaster thus far. Since the deal closed on Dec. 6, 2019, the stock is down roughly 23%, and Truist has failed to hit financial targets. Additionally, the regulatory landscape is still quite difficult for large bank mergers. There are far bigger political issues these days, but the Biden Administration has made large bank M&A difficult. Regulatory approval times have been greatly extended, and some large banks have called off deals due to uncertainty over approval.

But I ultimately view Demchak, who is a well-known protégé of Jamie Dimon, as an ambitious CEO interested in legacy. He has the respect of investors, excess capital, and a good stock currency, and has been very clear about the bank’s intent to grow. It would likely take at least two large deals for PNC to hit the $1 trillion asset threshold.

There could be some near-term pressure when deals are announced, especially if they result in dilution to tangible book value. There will also be execution risk. Luckily, PNC has been a good acquirer in the past, so I do have confidence in the bank’s ability to successfully integrate deals.

Reaching $1 trillion in assets would designate PNC as a too-big-to-fail bank along with the big four, which does give it a special moat in a largely commoditized sector and the advantage of scale. That’s why I do ultimately view the stock as a good long-term buy.

Should you invest $1,000 in PNC Financial Services right now?

Before you buy stock in PNC Financial Services, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PNC Financial Services wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bram Berkowitz has positions in Bank of America and Citigroup. The Motley Fool has positions in and recommends Bank of America, JPMorgan Chase, PNC Financial Services, Truist Financial, and U.S. Bancorp. The Motley Fool has a disclosure policy.

This Bank Could Be the Next to $1 Trillion in Assets. Should You Buy the Stock Today? was originally published by The Motley Fool

Trump Media lockup deadline leaves Trump with a choice: trigger a fire sale or hold a meme stock

Presidents can move entire markets with a single sentence. Donald Trump, a former president, sent a single stock soaring with just three words: “I’m not selling,” he pronounced at a press conference on Sept. 13, when asked whether he would offload the millions of shares he owns in his social media company. Buoyed by this declaration of faith from its largest shareholder, the stock shot up 27% to $20.76, before closing the day at $17.97.

Later this month, for the first time since Trump Media & Technology Group (TMTG)—which owns Truth Social—went public, Trump will be allowed to sell his shares in the company. As the former chair of TMTG and a major insider, Trump is subject to a “lockup” provision that prevents insiders from selling stock in the newly public company before a certain date.

The lockup period for Trump, who owns about 57% of TMTG and is its largest stakeholder, will expire on Sept. 25 at the latest. If TMTG’s stock remains above $12, the lockup could end as early as Thursday, Sept. 19—a feat that looks increasingly likely. The price hasn’t dropped below $15 on any trading day since Aug. 22.

Trump currently owns 114.5 million shares of TMTG (ticker symbol: DJT), which are worth about $1.85 billion.

Trump’s stake in TMTG is likely a significant portion of his wealth. Forbes estimates Trump’s net worth to be about $3.7 billion, meaning the paper value of his TMTG shares would account for about 50% of his total wealth. Of course, as with anyone whose wealth is tied up in company stock, Trump’s net worth can fluctuate regularly with changes in the share price.

Trump cannot sell too much, too soon—in theory

As the lockup expiry date approaches, Fortune looked through dozens of SEC disclosures to examine the condition of TMTG. We found a company with a market cap of $3.1 billion—an almost inexplicable valuation given that the underlying enterprise is no larger than the size of a small family business. It has declining revenues, no profits, and is embroiled in multiple lawsuits. The company even confesses it made material misstatements in its financials reporting with no clear timeline of when it will be able to remedy them.

And—crucially for the company and anyone holding its shares—its future is largely tied up with the decisions of its largest individual shareholder: Donald Trump. The filings acknowledge Trump’s personal financial interests may hurt his investors because he has a right to vote his shares in ways that “may not always be in the interests of the Combined Entity’s stockholders generally.”

Insiders at newly public companies approaching the end of a lockup period will often communicate with the board to devise a plan to sell their stake incrementally over time and avoid a free-for-all in the market, according to Michael Ewens, a finance professor at Columbia Business School. “Everyone realizes selling it all is bad,” he says. “There’s a good reason for that; they don’t want the share price to tank.”

If insiders, especially Trump, rushed to offload as many shares as possible when the lockup period ended it would trigger a fire sale. Shareholders, many of whom are retail investors who bought the stock as a show of support for Trump, could see their investments greatly devalued or wiped out. But, as the largest shareholder of the company, no one would have more to lose from a cratering TMTG share price than Trump. The ensuing price drop could make whatever shares he wasn’t able to sell almost worthless, according to Jay Ritter, a professor at the University of Florida Warrington College of Business who studies public offerings.

But holding on to TMTG stock poses its own set of risks, namely that its share price appears entirely divorced from its underlying business results, trading mostly on the fervent devotion Trump inspires in his followers rather than any market fundamentals. That means Trump, as by far the largest shareholder, is caught between a rock and hard place. He can flood the market with shares knowing that whatever he doesn’t manage to sell will be worth a fraction of their original value. Or he can hold on to them and face the daunting prospect of turning TMTG and Truth Social into a genuine tech and media business.

TMTG’s shaky financial footing

Thus far, TMTG’s financial performance has been modest.

The company made revenues of just $1.6 million in the first half of 2024, a decline of 30% from the year before. It posted a net loss of $344 million for the period, as total costs rose 1,104% from $9.8 million to $118.5 million, according to TMTG’s latest quarterly earnings report.

To shore up its finances, TMTG struck a deal on July 3 to sell up to $2.5 billion worth of stock to Yorkville Advisors, a New Jersey investment firm that works with small- and micro-cap companies. The deal, a “standby equity purchase agreement,” is common among new companies. Essentially, it gives TMTG a guaranteed buyer if it issues new shares and a means to put cash on its balance sheet, while Yorkville gets the right to purchase discounted stock. In this case, Yorkville will pay 97.25% of the share price, which it can then turn around and sell at full price on the open market. Over the three-year term of the deal, TMTG will have sole discretion over when to issue shares that Yorkville can purchase, according to the agreement.

The deal limits Yorkville to 19.99% of TMTG’s outstanding shares, which as of July—when the deal was signed—was 37 million shares, worth $680 million. TMTG can also request advances. And the deal isn’t exclusive, meaning TMTG can still raise capital from other sources. In striking the deal, TMTG paid Yorkville a $25,000 structuring fee and issued 200,000 shares to Yorkville, currently worth $3.9 million, as a commitment fee.

“I see no reason why Yorkville would not want to immediately resell the shares, rather than expose itself to the risk of a stock price decline,” Ritter said. “Yorkville appears to be in a situation in which it can make some money as a middleman without exposing itself to much risk.”

While an equity purchase agreement isn’t unusual for a newly public company, its choice of investor does raise questions, according to Francine McKenna, a former public accountant at KPMG and PwC. Among them: “who those people are, who is part of that deal, who’s part of that insider group?,” McKenna said. “And in this case, you have Yorkville Advisors as part of the insider group. I would say they’re not Morgan Stanley or Goldman Sachs.”

In the past, Yorkville’s founder and president Mark Angelo had run-ins with regulators in Italy and Switzerland, according to disclosures made to the SEC. In 2015, Angelo and Yorkville Advisors were fined $135,000 by the Italian financial regulator the Commissione Nazionale per le Società e la Borsa for failing to make a public tender offer to buy the shares of certain shareholders involved in a deal. In 2022, Yorkville settled with the Swiss Federal Department of Finance for $82,515 over claims it didn’t properly disclose derivative holdings in three Swiss-listed companies.

A spokesperson for Yorkville Advisors declined to comment on the equity purchase agreement with TMTG, saying it “does not respond to inquiries from the press with respect to its business transactions.” The spokesperson described the fine from Italian regulators as a “technical violation in reliance on advice provided by Yorkville’s outside Italian counsel.” Yorkville did not respond to follow-up questions from Fortune about the settlement with Swiss regulators.

Fortune also sent TMTG a detailed set of questions regarding the statements made in its SEC filings, its financing deal with Yorkville Advisors, whether company insiders and the board had discussed plans regarding the end of the lockup period, and the company’s overall strategy. The company responded by questioning Fortune’s journalistic methods:

“By cherrypicking statements from our filings while omitting all countervailing information, and touting quotes from supposed experts who just happen to support all the reporter’s biases, Fortune offers a great lesson in how to manufacture fake news,” the spokesperson said.

A dispute among TMTG’s cofounders

TMTG was founded shortly after Trump left the White House in 2021. Two former contestants on The Apprentice, Wesley Moss and Andrew Litinsky, approached Trump with the idea to start their own social media site since he had recently been banned from mainstream platforms in the wake of Jan. 6.

Moss and Litinisky secured Trump’s approval to use his brand to bolster Truth Social, their nascent, conservative alternative to X (formerly Twitter). In return, a company they set up, United Atlantic Ventures (UAV), received an 8.6% equity stake in TMTG. In October 2021, TMTG agreed to go public via a “special purpose acquisition company” (SPAC) called Digital World Acquisition (DWAC), helmed by Florida investor Patrick Orlando.

TMTG wouldn’t end up going public until March 2024 after the deal got tied up in an SEC investigation. The SEC eventually alleged in an ongoing lawsuit that Orlando made material misrepresentations on disclosure forms when he said he didn’t have any intended acquisition targets, despite having already held “numerous lengthy discussions” with TMTG representatives. SPACs are generally not allowed to pre-coordinate with other companies.

“The lawsuits that were surrounding various parts of [the SPAC deal], and the SEC investigation slowing it down for so long, was unusual,” said Usha Rodrigues, a professor of corporate finance and securities law at the University of Georgia Law School, and an expert in SPACs. SPACs are “supposed to be blank-check companies where you really don’t have an intended target at the outset,” she said.

Earlier this month the judge in the case, Christopher R. Cooper of the U.S. District Court of D.C., granted Orlando’s lawyers’ request for a 30-day extension to respond to the SEC’s initial complaint.

Orlando did not respond to a request for comment sent via LinkedIn and multiple emails sent to his lawyers.

Those weren’t the only legal disputes plaguing TMTG. In February, Litinsky and Moss sued TMTG for allegedly withholding their 8.6% stake in the company by attempting to dilute their equity by issuing one billion new shares, including 900 million that would be designated as voting stock, according to the lawsuit. Doing so, Litinsky and Moss allege, was against the conditions of their original contract with Trump and TMTG (then called Trump Media Group Corp.), which granted them the right to approve both the issuance of new shares and the creation of any new classes of stock.

In response TMTG sued Litinsky and Moss’s company UAV a month later, claiming it was justified in doing so because the pair botched the company’s public offering, leading to a years-long delay. The two “failed spectacularly at every turn,” the suit alleges. In September the two won a separate case and the right to sell their shares on the open market. (Lawyers for Litinsky and Moss did not respond to multiple requests for comment).

TMTG’s risk factors include at least seven lawsuits against the company and Donald Trump

All companies are required by law to disclose possible risks to their business, even risks that seem remote. Most companies’ risks revolve around competitive or regulatory threats to their business models. But the risks at TMTG are unusual because they are tied to the popularity of one man.

The company’s management acknowledged in an SEC filing that Trump’s personal legal issues—one of which resulted in 34 felony convictions that Trump is currently appealing—leaves the company’s future hanging in the balance. The outcome of any one of the at least seven different criminal and civil court cases involving Trump could determine the success of a company with already precarious finances. While TMTG is not involved in any of these cases, the company says it “cannot predict” what effects “an adverse outcome” might have on Trump’s personal reputation and therefore its business, according to the same SEC filing.

In its discussion of the risks Trump’s legal troubles pose, TMTG cited a 2016 USA Today article that found the former president and his various businesses had been involved in roughly 3,500 lawsuits over 30 years. Trump had been a plaintiff in 1,900 of those cases, a defendant in 1,450, and in 150 he had either been a third party or involved in a bankruptcy proceeding.

In fact, throughout its official documents TMTG admits that much of its future hinges on Trump and Trump alone. TMTG cites Trump extensively as one of its risk factors, citing the possibility that the company’s fate is tied to his political fortunes, according to the SEC filings.

“Success depends in part on the popularity of our brand and the reputation and popularity of President Donald J. Trump,” one document reads. “The value of TMTG’s brand may diminish if the popularity of President Trump were to suffer.”

Should the focus of TMTG’s majority shareholder and pitchman waver, the company’s fortunes might falter. “If President Donald J. Trump were to cease to be able to devote substantial time to Truth Social, TMTG’s business would be adversely affected,” the SEC filings say.

TMTG also highlights Trump’s history of bankruptcies. TMTG is hardly the first venture to carry the Trump name, which can still be found on buildings across the world. Between 1991 and 1992 Trump’s Atlantic City casinos—the Trump Taj Mahal, the Trump Castle, and the Trump Plaza—all filed for bankruptcy.

Businesses that carried the Trump name via a licensing deal didn’t fare much better. Trump Steaks discontinued sales after just two months, Trump Mortgage, and Go.Trump.com—a Trump-branded travel site—were both founded in 2006 and shuttered by 2007.

Another of Trump’s online companies, Trump University, closed in 2011 amid a series of lawsuits that alleged students were deceived by false advertisements. In 2018, a federal court approved a $25 million settlement against Trump University.

Of each of those businesses, TMTG said “there can be no guarantee that TMTG’s performance will exceed the performance of those entities,” according to SEC filings.

Threats on the outside, and ‘material weaknesses’ on the inside

While dealing with the external threats posed by its numerous legal proceedings, TMTG is also grappling with an internal problem, one that officers of the company acknowledged they are struggling to rectify: properly accounting for TMTG’s finances. Any issues with a public company’s bookkeeping, referred to as “material weaknesses,” pose serious problems to investors, who rely on financial information being accurate.

When TMTG went public earlier this year executives realized the company did not have sufficient qualified personnel to meet the SEC’s reporting standards, according to an SEC filing made about two months after it went public. TMTG is currently trying to fix that. “These remediation measures will be time consuming, incur significant costs, and place significant demands on our financial and operational resources,” the same disclosure says.

Such issues are more common in startups and newly public companies because those types of firms have fewer resources and are not as experienced operating under SEC guidelines, according to Jason Schloetzer, an accounting professor at the McDonough School of Business at Georgetown University. “These weaknesses can lead to reduced investor confidence, increased regulatory scrutiny, and governance challenges, such as inadequate board oversight of the financial reporting process,” Schloetzer said.

What if DJT is just a meme stock worth only $1.50 a share?

It is not unusual for a company’s stock price to race ahead of reality. Lots of companies have over-inflated stock prices. This year, for instance, Big Tech stocks hit new highs based on the mostly unrealized promise that artificial intelligence will usher in a new age of productivity. But there is a difference between that type of hype—which is based on businesses that have underlying sales growth—and the situation at TMTG, where revenues are declining and losses are worsening.

The extensive risks outlined in TMTG’s own documents, combined with its sagging financial performance, raise questions about whether its current trading price is sustainable. The most common explanation is that TMTG is a meme stock, whose performance is based on the excitement of retail investors rather than sound fundamentals.

“A meme stock is almost by definition, not tied to economic realities,” said Rodrigues, the SPAC expert. “They trade on momentum, emotion, and rumor.”

In the case of TMTG the stock moves on news of its majority shareholder—Trump, according to Ritter, the UF professor and IPO researcher. “Meme stocks thrive on attention, so the stock might jump if there is news about the company or Donald Trump, even if the news is not necessarily good news,” he said.

As the stock moves with Trump’s news coverage, favorable or not, TMTG’s outlook remains a head-scratcher. TMTG’s current market price of $16.14 per share is grossly overinflated, roughly 90% higher than its fair market value of $1.50 it should be trading at if one were to look at the company’s cash per share, according to Ritter. By Ritter’s calculations, for TMTG to live up to the $4 billion valuation currently implied by its stock price it would have to generate sustainable earnings of $200 million a year. But TMTG’s current financial performance is far off that mark and there’s “no evidence” the company has a plan to start pulling in annual profits at those levels, according to Ritter.

“The only bull case for the stock that I can think of is the greater fool theory of investing: you can make money by buying an overvalued stock if you can find an even greater fool who is willing to buy it from you at an even more-inflated price,” Ritter said.

This story was originally featured on Fortune.com

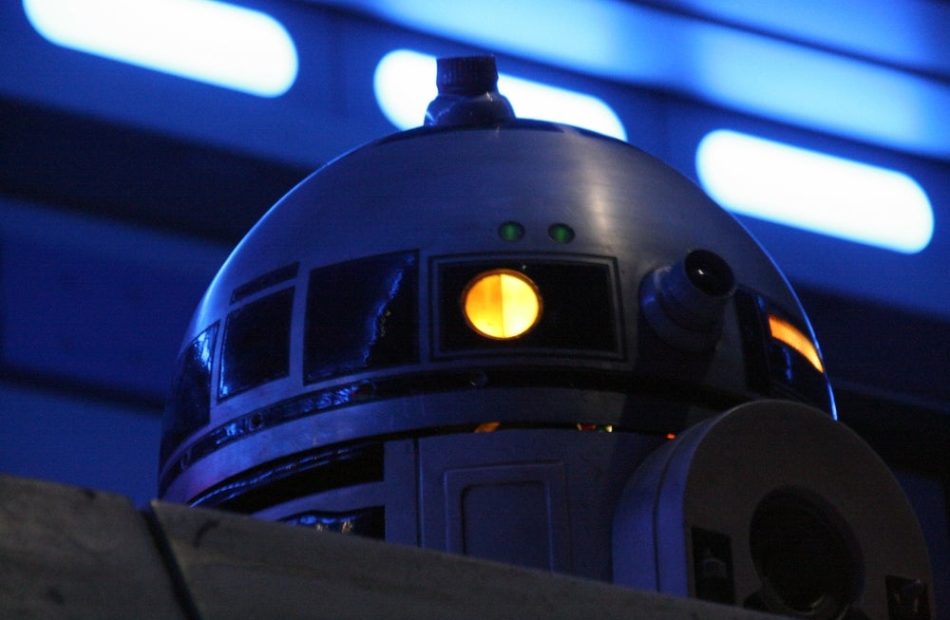

Elon Musk Agrees With Nvidia CEO Jensen Huang's Vision Of A Future Where We'll Have Our Own AI-Powered Personal Assistants Like Star Wars' R2-D2 Droid

Tesla and SpaceX CEO Elon Musk has agreed with Nvidia Corporation NVDA CEO Jensen Huang’s prediction of a future where individuals will have personal digital agents akin to Star Wars’ R2-D2 or C-3PO.

What Happened: On Wednesday, during T-Mobile’s Capital Markets Day 2024, Huang shared his vision of a future where digital agents will accompany and learn with individuals throughout their lives.

He expressed excitement about the idea of having a computer that grows smarter over time, helping its user accomplish tasks and essentially becoming a personal R2-D2 or C-3PO.

“I love the idea that I’ll have my own R2-D2, my own C3PO, and my R2 will be following me,” he stated, adding, “People who are just growing up now they’re going to have their own personal R2 with them.”

Huang then discussed the latest advancements introduced by Sam Altman-led OpenAI in the shape of their new reasoning model “o1,” highlighting how future AI systems will possess greater reasoning capabilities.

Unlike the single-pass approach currently used in tools like ChatGPT, future systems will perform hundreds of passes, using reinforcement learning to generate more thoughtful responses, he stated.

This increased computational demand is why Huang pointed out improvements in the Blackwell platform, which boosted inference performance by 50 times.

When a clip of Huang’s interview was shared on X, formerly Twitter, Musk responded with a simple “True,” indicating his agreement with Huang’s vision.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

R2-D2 and C-3PO are iconic droids from the Star Wars franchise. C-3PO is a protocol droid designed for etiquette and translation, fluent in over six million forms of communication. It is another gem from Star Wars, which often serves as a companion to R2-D2.

Why It Matters: Earlier this month, OpenAI launched a new model, ‘o1,’ which is a significant step towards achieving human-like artificial intelligence.

This model can answer complex questions faster than a human and outperforms previous models in writing code and solving multi-step problems.

Meanwhile, Nvidia is facing rising tensions due to the limited supply of its latest Blackwell chips. The company is experiencing such great demand for its chips that it is causing frustration among some of Nvidia’s customers.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Photo Courtesy: cfg1978 On Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Curbio CEO Awarded the 2024 HousingWire Vanguards Award in Recognition for His Contributions to Curbio's Growth and Dynamic Influence on the Real Estate Industry

POTOMAC, Md., Sept. 18, 2024 /PRNewswire/ — Curbio, the leading pre-listing home improvement company for real estate agents and their clients, is thrilled to share that CEO Rick Rudman has been named a 2024 HousingWire Vanguards Award recipient. HousingWire’s 2024 Vanguards have led their respective organizations to greatness while overcoming the challenges the housing economy has faced over recent years. Rudman is in a distinguished class of 100 honorees who were carefully selected by HousingWire’s selection committee for their vital contributions to their companies and their dynamic influence in transforming real estate and mortgage.

“The 2024 HousingWire Vanguards represent the pinnacle of leadership in our industry, driving transformative growth within their organizations and setting new standards for excellence,” said HW Media Editor-in-Chief Sarah Wheeler. “These extraordinary leaders embody the innovative spirit and resilience crucial for navigating today’s dynamic housing landscape. Their groundbreaking achievements highlight the profound impact of visionary leadership, making the Vanguards award a career-defining honor reserved for the very best in our field.”

Curbio’s mission is to make listing market prep hassle-free for agents so they can have more time to build client relationships, win listings, and sell more homes at better prices. Curbio is evolving the outdated, obstacle-ridden process of pre-sales improvements into a simplified, full-service experience powered by technology. Curbio streamlines how agents get listings ready for sale, offering quality pre-listing home repairs and updates with no money due from sellers until closing. It uses market and project data to generate same-day estimates, followed by personalized proposals reflecting the right scope for a listing. Curbio’s app offers agents and sellers instant communication and updates directly to their phones for complete visibility. Curbio has worked with thousands of agents from some of the most respected brokerages in real estate to bring a streamlined, supportive experience to sellers across the country.

“The HousingWire Vanguards award recognizes the most outstanding executive leaders in mortgage and real estate — executives who make a real impact by driving innovation, setting strategic direction, and steering their organizations toward monumental achievements,” said Clayton Collins, CEO of HW Media. “These leaders play a crucial role in shaping the industry’s future, with far-reaching impacts on market trends, operational efficiencies, and overall industry success. By leading with vision and decisiveness, HousingWire Vanguards propel their companies toward success and significantly influence the broader landscape of the housing economy.”

Additional information and full list of this year’s winners can be found at https://www.housingwire.com. For more information about Curbio, please visit, www.curbio.com.

About Curbio

Curbio is the leading provider of home repairs and improvements for real estate agents getting their listings ready for sale. With a turnkey approach and a simple pay-at-closing model, Curbio specializes in pre-listing home updates of any size. Curbio streamlines the fragmented and time-consuming home improvement process into an efficient, full-service experience for agents and their clients thanks to dedicated project managers, in-demand materials, quality work, and proprietary technology. Curbio is trusted by thousands of respected agents and brokers from companies including eXp Realty, RE/MAX, Berkshire Hathaway Home Services, Compass, National Association of REALTORS®, and Leading Real Estate Companies of the World.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/curbio-ceo-awarded-the-2024-housingwire-vanguards-award-in-recognition-for-his-contributions-to-curbios-growth-and-dynamic-influence-on-the-real-estate-industry-302252325.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/curbio-ceo-awarded-the-2024-housingwire-vanguards-award-in-recognition-for-his-contributions-to-curbios-growth-and-dynamic-influence-on-the-real-estate-industry-302252325.html

SOURCE Curbio

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.