Seattle-Based Contemporary Visual Artist Cristina Martinez Unveils New Public Art Installation at Pembroke Property, 400 Fairview

SEATTLE, Sept. 19, 2024 /PRNewswire/ — Renowned Seattle contemporary visual artist Cristina Martinez will unveil her latest public art installation, titled In Full Bloom, at Pembroke’s Fairview Market Hall, located at 400 Fairview Ave N., in the lively South Lake Union neighborhood. The installation, curated and produced by GCS Agency, will launch on September 26, 2024, with an event open to the public.

In Full Bloom is a powerful reflection on personal growth, depicted through stunning visual symbolism across four large-scale interconnected panels that span both the north and south entrances of 400 Fairview’s Fairview Market Hall. The installation features four artworks including two compelling portraits alongside a hand holding a book with the text “I’m so happy you’re here,” creating an invitation to reflect on one’s journey. A butterfly, symbolizing transformation, ties the panels together, emphasizing the continuous nature of growth.

“We wanted this artwork to reflect the growth we all experience in life and the beauty of embracing every step of that journey,” says Martinez, who draws inspiration from her own roots in Seattle and the people who have shaped her artistic vision.

“At Pembroke we create places for people. By collaborating with local artists, we not only support the community but also enhance the vibrancy of SLU’s bustling Fairview Market Hall. Our commitment is to amplify the experience both for the community who gather and connect here and our eclectic mix of shops and eateries by fostering an energetic and engaging environment” says Stacey Spurr of Pembroke.

The installation will be celebrated with a special launch event on September 26, 2024, at the North Entrance at 400 Fairview Ave N, where the public can meet the artist and view the artwork for the first time. This project is part of an ongoing initiative by Pembroke and GCS Agency to integrate art into everyday spaces and enrich the community experience.

Event Details:

- Event Date: September 26, 2024

- Location: North Entrance at 400 Fairview Ave N, South Lake Union, Seattle

- Time: 4 pm – 6 pm

For more information about In Full Bloom or GCS Agency’s ongoing projects, please visit www.gcsagency.com / @gcs_agency.

About Cristina Martinez:

Cristina Martinez is a Seattle-based contemporary visual artist known for her vibrant, emotive works that explore themes of identity, growth, and resilience. Her art has been featured in numerous exhibitions, and she continues to inspire through her unique blend of personal storytelling and visual beauty. For inquiries, contact anna@annamiyamanagement.com.

About GCS Agency:

GCS Agency is a full-service fine art creative agency that empowers artists and prioritizes accessibility and diversity in the art world. The agency curates art installations, produces cultural events, and partners with renowned brands to bring art into public and private spaces. For more information, visit www.gcsagency.com / @gcs_agency.

About Pembroke

We’re an international real estate advisor that acquires, develops and manages properties and places – specializing in mixed-use and office environments in the world’s leading cities. Facilitating the private capital of our investors, we take a long-term approach to real estate, investing in global cities with proven long-term growth potential. We have offices in Boston, Hamburg, London, Munich, San Francisco, Stockholm, Sydney, Tokyo, and Washington DC, and manage more than 830,000 sq m/8.9m sq ft in North America, Europe, and Asia Pacific. By combining a global point of view with local expertise, we’re able to create and manage world-class properties that deliver the best outcomes for our tenants, investors and the communities in which we work. For more information, visit www.pembroke.com.

About 400 Fairview’s Fairview Market Hall

Pembroke’s Fairview Market Hall is a welcoming community hub in the heart of South Lake Union (SLU), where locals experience a vibrant slice of Seattle. Inside you’ll discover an eclectic mix of specialty shops, buzzy eateries, and inviting gathering spaces to connect with neighbors. For more information, visit us on Instagram @fairviewmarkethall.

Contact:

Michael Aalto

Fidelity

michael.aalto@fmr.com

617-563-9462

![]() View original content:https://www.prnewswire.com/news-releases/seattle-based-contemporary-visual-artist-cristina-martinez-unveils-new-public-art-installation-at-pembroke-property-400-fairview-302252798.html

View original content:https://www.prnewswire.com/news-releases/seattle-based-contemporary-visual-artist-cristina-martinez-unveils-new-public-art-installation-at-pembroke-property-400-fairview-302252798.html

SOURCE Pembroke

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Research Solutions Reports Fourth Quarter and Fiscal Year 2024 Results

Reports 18% Revenue Increase, ARR of $17.4 Million and Record Cash Flow

HENDERSON, Nev., Sept. 19, 2024 /PRNewswire/ — Research Solutions, Inc. RSSS, a trusted partner providing cloud-based workflow solutions to accelerate research for R&D-driven organizations, reported record financial results for its fourth quarter and full fiscal year ended June 30, 2024.

Fiscal Fourth Quarter 2024 Summary (compared to prior-year quarter)

- Total revenue of $12.1 million, a 22% increase.

- Platform revenue up 86% to $4.3 million. Platform revenue accounted for 35% of the revenue as compared to 23% in the prior year.

- Annual Recurring Revenue (“ARR”) up 84% to $17.4 million, which includes approximately $12.1 million of B2B recurring revenue and $5.4M of B2C recurring revenue.

- Gross profit up 44%. Total gross margin improved 710 basis points to 46.5%.

- Net loss of $2.8 million, or ($0.09) per diluted share, compared to $376,000 or $0.01 per diluted share. The quarter’s result includes a charge of approximately $4.3 million related to increasing the projected earnout for Scite.

- Adjusted EBITDA of $1.4 million, a 70% improvement and a Company quarterly record, compared to $825,000.

- Cash flow from operations of $2.0 million, compared to $1.5 million, a 30% improvement.

Fiscal Year 2024 Summary (compared to Fiscal 2023)

- Total revenue of $44.6 million, an 18% increase.

- Platform revenue up 61% to $14.0 million. Transaction revenue increased 5.7% to $30.7 million.

- Gross profit up 34%. Total gross margin improved 500 basis points to 44.0%.

- Net loss of $3.8 million, or ($0.13) per diluted share, including the previously mentioned $4.3 million charge and $1.5 million in proxy and acquisition-related expenses, compared to net income of $572,000 or $0.02 per diluted share.

- Adjusted EBITDA of $2.2 million, which is inclusive of proxy and acquisition-related expenses of $1.4 million, a Company record, compared to $2.0 million.

- Cash flow from operations of $3.6 million, a Company record, compared to $3.4 million.

“Fiscal 2024 was a transformational year for the Company. We completed two acquisitions which helped position us as a vertical SaaS and AI company, helping researchers throughout their entire workflow. The integration of these acquisitions and our operational execution were meaningful contributors to our 85% year-over-year ARR growth and the double-digit increase in Adjusted EBITDA,” said Roy W. Olivier, President and CEO of Research Solutions. “There are many untapped market opportunities where our highly specialized product offerings can serve as a vital piece of the research process. Overall, we believe we are well-positioned to deliver meaningful ARR growth while expanding Adjusted EBITDA margins, creating long-term value for our shareholders.”

Fiscal Fourth Quarter 2024 Results

Total revenue was $12.1 million, a 22% increase from $10.0 million in the year-ago quarter primarily driven by increased platform revenue versus the prior-year period due to revenue from the Company’s acquisitions as well as organic platform revenue growth.

Platform subscription revenue for the quarter was $4.3 million, an 86% year-over-year increase. The increase was primarily due to the acquisition of Scite, as well as organic growth in the core Article Galaxy platform. The quarter ended with annual recurring revenue of $17.4 million, up 84% year-over-year (see the company’s definition of annual recurring revenue below).

Transaction revenue was $7.9 million, compared to $7.7 million in the fourth quarter of fiscal 2023. The transaction active customer count for the quarter was 1,398, compared to 1,404 customers in the prior-year quarter (see the company’s definition of active customer accounts and transactions below).

Total gross margin improved 710 basis points from the prior-year quarter to 46.5%. The increase was primarily driven by the continued revenue mix shift to the higher-margin Platforms business, as well as a 70 basis point increase in margins in the transactions business.

Total operating expenses were $5.0 million, compared to $3.7 million in the fourth quarter of 2023. The increase was primarily related to the additional cost base associated with the aforementioned acquisitions, as well as increased non-cash depreciation and amortization expense related to such acquisitions.

Other expense for the quarter was approximately $3.5 million, compared to other income of $120,000 in the prior-year quarter. The primary driver of this was $4.3M of expense related to increasing the earn-out assumption associated with the Scite acquisition.

Net loss in the fourth quarter was $2.8 million, or ($0.09) per diluted share, compared to net income of $376,000, or $0.01 per diluted share, in the prior-year quarter. Adjusted EBITDA was $1.4 million, compared to $825,000 in the year-ago quarter (see definition and further discussion about the presentation of Adjusted EBITDA, a non-GAAP term, below).

Full-Year Fiscal 2024 Results

Total revenue was $44.6 million, an 18% increase from fiscal 2023, driven by both increased platform revenue and transaction revenue.

Platform subscription revenue for fiscal 2024 was $14.0 million, a 61% year-over-year increase. The increase was primarily due to the acquisition of Scite, as well as organic growth in the core Article Galaxy platform.

Transaction revenue was $30.7 million, compared to $29.0 million in fiscal 2023. The increase was driven by organic growth and the impact of a full year of contribution from the acquisition of contracts from FIZ Karlsruhe, compared to six months in fiscal 2023.

Total gross margin improved 500 basis points from the prior-year to 44.0%. The increase was primarily driven by the continued revenue mix shift to the higher-margin Platforms business, as well as a 100 basis point increase in margins in the transactions business related to pricing initiatives.

Total operating expenses for the year were $20.4 million, compared to $14.5 million in fiscal 2023. The increase was primarily related to the additional cost base associated with the acquisitions, including increased non-cash depreciation and amortization expense related to such acquisitions, as well as the aforementioned proxy and acquisition-related expenses.

Net loss for fiscal 2024 was $3.8 million, or ($0.13) per diluted share, compared to net income of $572,000, or $0.02 per diluted share, in the prior-year. Adjusted EBITDA was $2.2 million, compared to $2.0 million in fiscal 2023 (see definition and further discussion about the presentation of Adjusted EBITDA, a non-GAAP term, below).

Conference Call

Research Solutions President and CEO Roy W. Olivier and CFO Bill Nurthen will host the conference call, followed by a question and answer period.

Date: Thursday, September 19, 2024

Time: 5:00 p.m. ET (2:00 p.m. PT)

Dial-in number: 1-412-317-5180

The conference call will be broadcast live and available for replay until October 19, 2024 by dialing 1-412-317-6671 and using the replay ID 10191850, and via the investor relations section of the company’s website at http://researchsolutions.investorroom.com/.

Fiscal Fourth Quarter Financial and Operational Summary Tables vs. Prior-Year Quarter

|

Quarter Ended June 30, |

Twelve Months Ended June 30, |

|||||||||

|

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

|||

|

Revenue: |

||||||||||

|

Platforms |

$ 4,277,338 |

$ 2,303,375 |

$ 1,973,963 |

85.7 % |

$ 13,956,517 |

$ 8,683,246 |

$ 5,273,271 |

60.7 % |

||

|

Transactions |

$ 7,856,176 |

$ 7,656,342 |

199,834 |

2.6 % |

$ 30,667,382 |

$ 29,020,206 |

1,647,176 |

5.7 % |

||

|

Total Revenue |

12,133,514 |

9,959,717 |

2,173,797 |

21.8 % |

44,623,899 |

37,703,452 |

6,920,447 |

18.4 % |

||

|

Gross Profit: |

||||||||||

|

Platforms |

3,650,286 |

2,028,265 |

1,622,021 |

80.0 % |

11,889,314 |

7,655,960 |

4,233,353 |

55.3 % |

||

|

Transactions |

1,992,580 |

1,892,278 |

100,302 |

5.3 % |

7,750,852 |

7,044,931 |

705,921 |

10.0 % |

||

|

Total Gross Profit |

5,642,866 |

3,920,543 |

1,722,323 |

43.9 % |

19,640,166 |

14,700,891 |

4,939,274 |

33.6 % |

||

|

Gross profit as a % of revenue: |

||||||||||

|

Platforms |

85.3 % |

88.1 % |

-2.7 % |

85.2 % |

88.2 % |

-3.0 % |

||||

|

Transactions |

25.4 % |

24.7 % |

0.6 % |

25.3 % |

24.3 % |

1.0 % |

||||

|

Total Gross Profit |

46.5 % |

39.4 % |

7.1 % |

44.0 % |

39.0 % |

5.0 % |

||||

|

Operating Expenses: |

||||||||||

|

Sales and marketing |

830,195 |

455,030 |

375,165 |

82.4 % |

3,442,503 |

2,285,478 |

1,157,025 |

50.6 % |

||

|

Technology and product development |

1,489,491 |

991,093 |

498,398 |

50.3 % |

5,442,382 |

3,742,192 |

1,700,190 |

45.4 % |

||

|

General and administrative |

1,917,907 |

1,649,333 |

268,574 |

16.3 % |

8,511,697 |

6,654,012 |

1,857,685 |

27.9 % |

||

|

Depreciation and amortization |

311,004 |

22,163 |

288,841 |

1303.3 % |

836,271 |

52,649 |

783,622 |

1488.4 % |

||

|

Stock-based compensation |

426,190 |

585,384 |

(159,194) |

-27.2 % |

2,155,461 |

1,849,906 |

305,555 |

16.5 % |

||

|

Foreign currency translation loss |

6,336 |

(37,743) |

44,079 |

116.8 % |

21,395 |

(121,953) |

143,348 |

117.5 % |

||

|

Total Operating Expenses |

4,981,123 |

3,665,260 |

1,315,863 |

35.9 % |

20,409,709 |

14,462,284 |

5,947,425 |

41.1 % |

||

|

Income (loss) from operations |

661,743 |

255,283 |

406,460 |

159.2 % |

(769,543) |

238,608 |

(1,008,151) |

-422.5 % |

||

|

Other Income (Expenses): |

||||||||||

|

Other income |

(3,451,948) |

120,522 |

(3,572,470) |

NM |

(2,903,983) |

338,617 |

(3,242,600) |

NM |

||

|

Provision for income taxes |

(31,022) |

(59) |

(30,963) |

NM |

(113,071) |

(5,602) |

(107,469) |

NM |

||

|

Total Other Income (Expenses): |

(3,482,970) |

120,463 |

(3,603,433) |

NM |

(3,017,054) |

333,015 |

(3,350,069) |

NM |

||

|

Net income (loss) |

$ (2,821,227) |

$ 375,746 |

(3,196,973) |

NM |

$ (3,786,597) |

$ 571,623 |

(4,358,220) |

NM |

||

|

NM |

||||||||||

|

Adjusted EBITDA |

$ 1,405,273 |

$ 825,087 |

$ 580,186 |

70.3 % |

$ 2,243,584 |

$ 2,019,210 |

$ 224,374 |

11.1 % |

||

|

Quarter Ended June 30, |

Twelve Months Ended June 30, |

|||||||||

|

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

|||

|

Platforms: |

||||||||||

|

B2B ARR (Annual recurring revenue*): |

||||||||||

|

Beginning of Period |

$ 11,653,063 |

$ 9,107,681 |

$ 2,545,382 |

27.9 % |

$ 9,444,130 |

$ 7,922,188 |

$ 1,521,942 |

19.2 % |

||

|

Incremental ARR |

407,139 |

336,448 |

70,691 |

21.0 % |

2,616,072 |

1,521,941 |

1,094,131 |

71.9 % |

||

|

End of Period |

$ 12,060,202 |

$ 9,444,129 |

$ 2,616,073 |

27.7 % |

$ 12,060,202 |

$ 9,444,129 |

$ 2,616,073 |

27.7 % |

||

|

Deployments: |

||||||||||

|

Beginning of Period |

983 |

815 |

168 |

20.6 % |

835 |

733 |

102 |

13.9 % |

||

|

Incremental Deployments |

38 |

20 |

18 |

90.0 % |

186 |

102 |

84 |

82.4 % |

||

|

End of Period |

1,021 |

835 |

186 |

22.3 % |

1,021 |

835 |

186 |

22.3 % |

||

|

ASP (Average sales price): |

||||||||||

|

Beginning of Period |

$ 11,855 |

$ 11,175 |

$ 680 |

6.1 % |

$ 11,310 |

$ 10,808 |

$ 502 |

4.6 % |

||

|

End of Period |

$ 11,812 |

$ 11,310 |

$ 502 |

4.4 % |

$ 11,812 |

$ 11,310 |

$ 502 |

4.4 % |

||

|

B2C ARR (Annual recurring revenue*): |

||||||||||

|

Beginning of Period |

$ 4,902,975 |

$ – |

$ 4,902,975 |

$ – |

$ – |

$ – |

||||

|

Incremental ARR |

460,154 |

– |

460,154 |

NM |

5,363,129 |

– |

5,363,129 |

NM |

||

|

End of Period |

$ 5,363,129 |

$ – |

$ 5,363,129 |

NM |

$ 5,363,129 |

$ – |

$ 5,363,129 |

NM |

||

|

Total ARR (Annualized recurring revenue): |

$ 17,423,331 |

$ 9,444,129 |

$ 7,979,202 |

84.5 % |

$ 17,423,331 |

$ 9,444,129 |

$ 7,979,202 |

84.5 % |

||

|

Transaction Customers: |

||||||||||

|

Corporate customers |

1,093 |

1,090 |

3 |

0.3 % |

1,088 |

1,012 |

76 |

7.5 % |

||

|

Academic customers |

305 |

314 |

(9) |

-2.9 % |

316 |

304 |

12 |

4.0 % |

||

|

Total customers |

1,398 |

1,404 |

(6) |

-0.4 % |

1,404 |

1,316 |

88 |

6.7 % |

||

Active Customer Accounts, Transactions and Annual Recurring Revenue

The company defines active customer accounts as the sum of the total quantity of customers per month for each month in the period divided by the respective number of months in the period. The quantity of customers per month is defined as customers with at least one transaction during the month.

A transaction is an order for a unit of copyrighted content fulfilled or managed in the Platform.

The company defines annual recurring revenue (“ARR”) as the value of contracted Platform subscription recurring revenue normalized to a one-year period. For B2C ARR, this includes the annualized value of monthly subscriptions, meaning their monthly value multiplied by twelve.

Use of Non-GAAP Measure – Adjusted EBITDA

Research Solutions’ management evaluates and makes operating decisions using various financial metrics. In addition to the company’s GAAP results, management also considers the non-GAAP measure of Adjusted EBITDA. Management believes that this non-GAAP measure provides useful information about the company’s operating results.

The tables below provide a reconciliation of this non-GAAP financial measure with the most directly comparable GAAP financial measure. Adjusted EBITDA is defined as net income (loss), plus interest expense, other income (expense) including any change in fair value of contingent earnout liability, foreign currency transaction loss, provision for income taxes, depreciation and amortization, stock-based compensation, gain on sale of discontinued operations, and other potential adjustments that may arise. Set forth below is a reconciliation of Adjusted EBITDA to net income (loss):

|

Quarter Ended June 30, |

Twelve Months Ended June 30, |

|||||||||

|

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

|||

|

Net Income (loss) |

$ (2,821,227) |

$ 375,746 |

$ (3,196,973) |

NM |

$ (3,786,597) |

$ 571,623 |

$(4,358,220) |

NM |

||

|

Add (deduct): |

– |

|||||||||

|

Other income (expense) |

3,451,948 |

(120,522) |

3,572,470 |

NM |

2,903,983 |

(338,617) |

3,242,600 |

NM |

||

|

Foreign currency translation loss |

6,336 |

(37,743) |

44,079 |

116.8 % |

21,395 |

(121,953) |

143,348 |

117.5 % |

||

|

Provision for income taxes |

31,022 |

59 |

30,963 |

NM |

113,071 |

5,602 |

107,469 |

NM |

||

|

Depreciation and amortization |

311,004 |

22,163 |

288,841 |

1303.3 % |

836,271 |

52,649 |

783,622 |

1488.4 % |

||

|

Stock-based compensation |

426,190 |

585,384 |

(159,194) |

-27.2 % |

2,155,461 |

1,849,906 |

305,555 |

16.5 % |

||

|

Gain on sale of disc. ops. |

– |

– |

– |

– |

– |

– |

||||

|

Adjusted EBITDA |

$ 1,405,273 |

$ 825,087 |

$ 580,186 |

70.3 % |

$ 2,243,584 |

$ 2,019,210 |

$ 224,374 |

11.1 % |

||

About Research Solutions

Research Solutions, Inc. RSSS provides cloud-based technologies to streamline the process of obtaining, managing, and creating intellectual property. Founded in 2006 as Reprints Desk, the company was a pioneer in developing solutions to serve researchers. Today, more than 70 percent of the top pharmaceutical companies, prestigious universities, and emerging businesses rely on Article Galaxy, the company’s SaaS research platform, to streamline access to the latest scientific research and data with 24/7 customer support. For more information and details, please visit www.researchsolutions.com

Important Cautions Regarding Forward-Looking Statements

Certain statements in this press release may contain “forward-looking statements” regarding future events and our future results. All statements other than statements of historical facts are statements that could be deemed to be forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the markets in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects”, “intends,” “plans,” “believes,” “seeks,” “estimates,” “endeavors,” “strives,” “may,” or variations of such words, and similar expressions are intended to identify such forward-looking statements. Readers are cautioned that these forward-looking statements are subject to a number of risks, uncertainties and assumptions that are difficult to predict, estimate or verify. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Such risks and uncertainties include those factors described in the Company’s most recent annual report on Form 10-K, as such may be amended or supplemented by subsequent quarterly reports on Form 10-Q, or other reports filed with the Securities and Exchange Commission. Examples of forward-looking statements in this release include statements regarding enhanced product offerings, additional customers, and the Company’s prospects for growth. Readers are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements. For more information, please refer to the Company’s filings with the Securities and Exchange Commission.

|

Research Solutions, Inc. and Subsidiaries |

||||||

|

June 30, |

June 30, |

|||||

|

2024 |

2023 |

|||||

|

Assets |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

$ |

6,100,031 |

$ |

13,545,333 |

||

|

Accounts receivable, net of allowance of $68,579 and $85,015, respectively |

6,879,800 |

6,153,063 |

||||

|

Prepaid expenses and other current assets |

643,553 |

400,340 |

||||

|

Prepaid royalties |

1,067,237 |

1,202,678 |

||||

|

Total current assets |

14,690,621 |

21,301,414 |

||||

|

Non-current assets: |

||||||

|

Property and equipment, net of accumulated depreciation of $922,558 and $881,908, |

88,011 |

70,193 |

||||

|

Intangible assets, net of accumulated amortization of $1,535,310 and $747,355, |

10,764,261 |

462,068 |

||||

|

Goodwill ($13,171,486 provisional) |

16,315,888 |

— |

||||

|

Deposits and other assets |

981 |

1,052 |

||||

|

Total assets |

$ |

41,859,762 |

$ |

21,834,727 |

||

|

Liabilities and Stockholders’ Equity |

||||||

|

Current liabilities: |

||||||

|

Accounts payable and accrued expenses |

$ |

8,843,612 |

$ |

8,079,516 |

||

|

Deferred revenue |

9,023,848 |

6,424,724 |

||||

|

Total current liabilities |

17,867,460 |

14,504,240 |

||||

|

Non-current liabilities: |

||||||

|

Contingent earnout liability |

12,298,114 |

— |

||||

|

Total liabilities |

30,165,574 |

14,504,240 |

||||

|

Commitments and contingencies |

||||||

|

Stockholders’ equity: |

||||||

|

Preferred stock; $0.001 par value; 20,000,000 shares authorized; no shares issued and |

— |

— |

||||

|

Common stock; $0.001 par value; 100,000,000 shares authorized; 32,295,373 and |

32,295 |

29,487 |

||||

|

Additional paid-in capital |

38,089,958 |

29,941,873 |

||||

|

Accumulated deficit |

(26,309,246) |

(22,522,649) |

||||

|

Accumulated other comprehensive loss |

(118,819) |

(118,224) |

||||

|

Total stockholders’ equity |

11,694,188 |

7,330,487 |

||||

|

Total liabilities and stockholders’ equity |

$ |

41,859,762 |

$ |

21,834,727 |

||

|

Research Solutions, Inc. and Subsidiaries |

||||||

|

Years Ended |

||||||

|

June 30, |

||||||

|

2024 |

2023 |

|||||

|

Revenue: |

||||||

|

Platforms |

$ |

13,956,517 |

$ |

8,683,246 |

||

|

Transactions |

30,667,382 |

29,020,206 |

||||

|

Total revenue |

44,623,899 |

37,703,452 |

||||

|

Cost of revenue: |

||||||

|

Platforms |

2,067,203 |

1,027,286 |

||||

|

Transactions |

22,916,530 |

21,975,275 |

||||

|

Total cost of revenue |

24,983,733 |

23,002,561 |

||||

|

Gross profit |

19,640,166 |

14,700,891 |

||||

|

Operating expenses: |

||||||

|

Selling, general and administrative |

19,573,438 |

14,409,634 |

||||

|

Depreciation and amortization |

836,271 |

52,649 |

||||

|

Total operating expenses |

20,409,709 |

14,462,283 |

||||

|

Income (loss) from operations |

(769,543) |

238,608 |

||||

|

Other income |

333,088 |

338,617 |

||||

|

Change in fair value of contingent earnout liability |

(3,237,071) |

— |

||||

|

Income (loss) from operations before provision for income taxes |

(3,673,526) |

577,225 |

||||

|

Provision for income taxes |

(113,071) |

(5,602) |

||||

|

Net income (loss) |

(3,786,597) |

571,623 |

||||

|

Other comprehensive income (loss): |

||||||

|

Foreign currency translation |

(595) |

3,717 |

||||

|

Comprehensive income (loss) |

$ |

(3,787,192) |

$ |

575,340 |

||

|

Basic income (loss) per common share: |

||||||

|

Net income (loss) per share |

$ |

(0.13) |

$ |

0.02 |

||

|

Weighted average common shares outstanding |

28,863,949 |

26,860,761 |

||||

|

Diluted income (loss) per common share: |

||||||

|

Net income (loss) per share |

$ |

(0.13) |

$ |

0.02 |

||

|

Weighted average common shares outstanding |

28,863,949 |

29,139,759 |

||||

|

Research Solutions, Inc. and Subsidiaries |

||||||

|

Years Ended |

||||||

|

June 30, |

||||||

|

2024 |

2023 |

|||||

|

Cash flow from operating activities: |

||||||

|

Net income (loss) |

$ |

(3,786,597) |

$ |

571,623 |

||

|

Adjustment to reconcile net income (loss) to net cash provided by operating activities: |

||||||

|

Depreciation and amortization |

836,271 |

52,649 |

||||

|

Fair value of vested stock options |

140,150 |

375,189 |

||||

|

Fair value of vested restricted common stock |

1,994,362 |

1,418,718 |

||||

|

Fair value of vested unrestricted common stock |

— |

68,272 |

||||

|

Modification cost of accelerated vesting of restricted common stock |

20,949 |

56,000 |

||||

|

Adjustment to contingent earnout liability |

3,237,071 |

— |

||||

|

Changes in operating assets and liabilities: |

||||||

|

Accounts receivable |

(344,020) |

(901,518) |

||||

|

Prepaid expenses and other current assets |

(164,579) |

(124,314) |

||||

|

Prepaid royalties |

135,441 |

(356,026) |

||||

|

Accounts payable and accrued expenses |

560,027 |

1,337,056 |

||||

|

Deferred revenue |

921,879 |

886,198 |

||||

|

Net cash provided by operating activities |

3,550,954 |

3,383,847 |

||||

|

Cash flow from investing activities: |

||||||

|

Purchase of property and equipment |

(71,510) |

(47,209) |

||||

|

Payment for acquisition of Resolute, net of cash acquired |

(2,718,253) |

— |

||||

|

Payment for acquisition of Scite, net of cash acquired |

(7,305,493) |

— |

||||

|

Payment for non-refundable deposit for asset acquisition |

— |

(297,450) |

||||

|

Net cash used in investing activities |

(10,095,256) |

(344,659) |

||||

|

Cash flow from financing activities: |

||||||

|

Proceeds from the exercise of stock options |

— |

57,500 |

||||

|

Common stock repurchase |

(554,202) |

(104,250) |

||||

|

Payment of contingent acquisition consideration |

(351,649) |

(50,509) |

||||

|

Net cash used in financing activities |

(905,851) |

(97,259) |

||||

|

Effect of exchange rate changes |

4,851 |

229 |

||||

|

Net increase (decrease) in cash and cash equivalents |

(7,445,302) |

2,942,158 |

||||

|

Cash and cash equivalents, beginning of period |

13,545,333 |

10,603,175 |

||||

|

Cash and cash equivalents, end of period |

$ |

6,100,031 |

$ |

13,545,333 |

||

|

Supplemental disclosures of cash flow information: |

||||||

|

Cash paid for income taxes |

$ |

113,071 |

$ |

5,602 |

||

|

Non-cash investing and financing activities: |

||||||

|

Contingent consideration accrual on asset acquisition |

$ |

32,022 |

$ |

138,428 |

||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/research-solutions-reports-fourth-quarter-and-fiscal-year-2024-results-302253566.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/research-solutions-reports-fourth-quarter-and-fiscal-year-2024-results-302253566.html

SOURCE Research Solutions, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With LOW

Investors with a lot of money to spend have taken a bullish stance on Lowe’s Companies LOW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LOW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

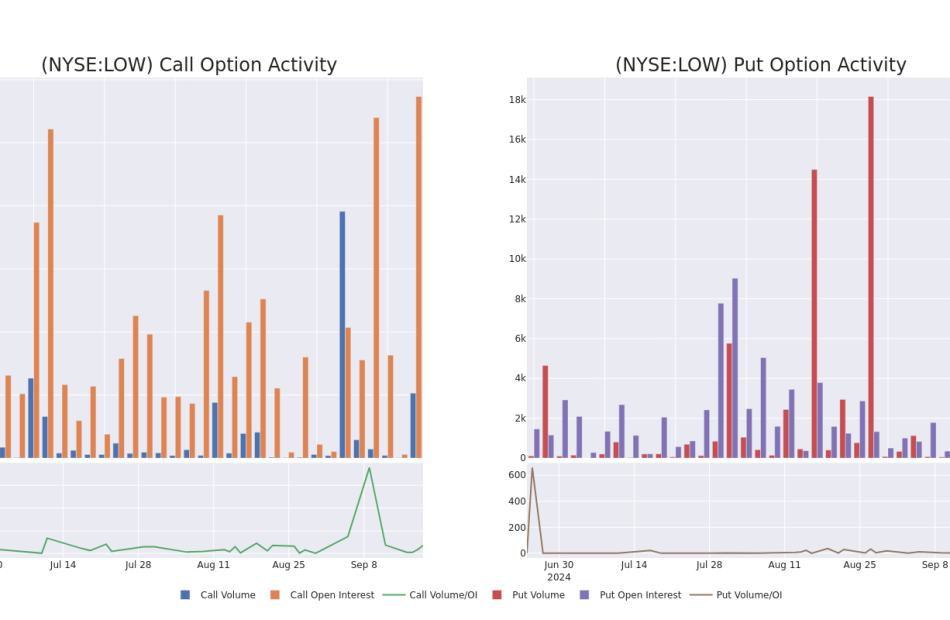

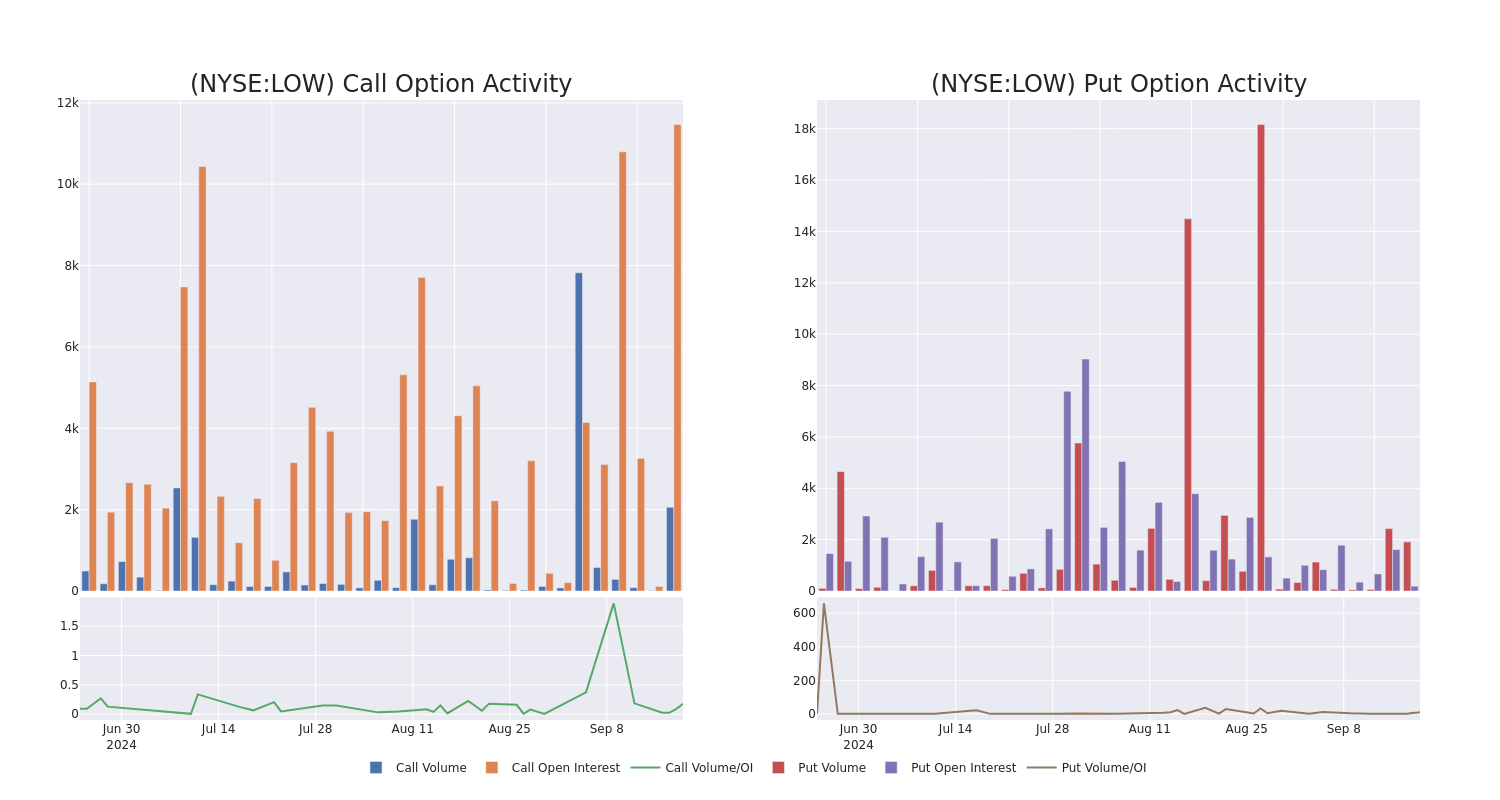

Today, Benzinga‘s options scanner spotted 21 uncommon options trades for Lowe’s Companies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 42% bullish and 42%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $233,364, and 15 are calls, for a total amount of $1,029,627.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $280.0 for Lowe’s Companies during the past quarter.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Lowe’s Companies options trades today is 1165.5 with a total volume of 3,971.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lowe’s Companies’s big money trades within a strike price range of $200.0 to $280.0 over the last 30 days.

Lowe’s Companies Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | CALL | SWEEP | BEARISH | 01/17/25 | $7.3 | $7.25 | $7.3 | $280.00 | $221.9K | 1.5K | 344 |

| LOW | CALL | SWEEP | BULLISH | 09/20/24 | $11.2 | $11.15 | $11.15 | $250.00 | $200.5K | 2.0K | 261 |

| LOW | PUT | SWEEP | BULLISH | 10/18/24 | $5.6 | $5.4 | $5.4 | $260.00 | $76.6K | 189 | 204 |

| LOW | CALL | SWEEP | BULLISH | 09/20/24 | $11.35 | $11.3 | $11.3 | $250.00 | $73.7K | 2.0K | 414 |

| LOW | CALL | SWEEP | BULLISH | 10/18/24 | $14.3 | $14.3 | $14.3 | $250.00 | $71.5K | 3.0K | 56 |

About Lowe’s Companies

Lowe’s is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe’s Canada, Réno-Dépôt, and Dick’s Lumber). The firm’s stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe’s targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers as well as commercial and professional business clients (around 25% of sales). We estimate Lowe’s captures a high-single-digit share of the domestic home improvement market, based on US Census data and management’s market size estimates.

After a thorough review of the options trading surrounding Lowe’s Companies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Lowe’s Companies Standing Right Now?

- With a volume of 2,187,069, the price of LOW is up 1.7% at $261.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 61 days.

Professional Analyst Ratings for Lowe’s Companies

5 market experts have recently issued ratings for this stock, with a consensus target price of $245.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group persists with their Market Perform rating on Lowe’s Companies, maintaining a target price of $230.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Lowe’s Companies with a target price of $265.

* Consistent in their evaluation, an analyst from Gordon Haskett keeps a Hold rating on Lowe’s Companies with a target price of $240.

* An analyst from Morgan Stanley persists with their Overweight rating on Lowe’s Companies, maintaining a target price of $255.

* An analyst from RBC Capital has decided to maintain their Sector Perform rating on Lowe’s Companies, which currently sits at a price target of $238.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lowe’s Companies, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jumps Over 500 Points; FactSet Research Posts Upbeat Earnings

U.S. stocks traded higher midway through trading, with the Dow Jones index jumping more than 500 points on Thursday.

The Dow traded up 1.25% to 42,023.61 while the NASDAQ rose 2.30% to 17,976.99. The S&P 500 also rose, gaining, 1.60% to 5,707.97.

Check This Out: Alphabet, McDonald’s And 2 Other Stocks Executives Are Selling

Leading and Lagging Sectors

Information technology shares jumped by 2.9% on Thursday.

In trading on Thursday, utilities shares fell by 0.6%.

Top Headline

FactSet Research Systems Inc FDS reported better-than-expected results for its fiscal fourth quarter.

The company posted quarterly sales growth of 4.9% year-on-year to $562.2 million, beating the analyst consensus estimate of $546.81 million. Adjusted EPS of $3.74 beat the analyst consensus estimate of $3.62.

FactSet said it sees fiscal 2025 revenue of $2.285 billion–$2.305 billion versus $2.301 billion estimate and adjusted EPS of $16.80–$17.40 versus consensus of $17.36.

Equities Trading UP

- Edgewise Therapeutics, Inc. EWTX shares shot up 37% to $26.23 after the company announced top-line data of EDG-7500 from the Phase 1 trial in healthy subjects and the single-dose arm of the Phase 2 CIRRUS-HCMtrial in patients with obstructive HCM.

- Shares of Signing Day Sports, Inc. SGN got a boost, surging 257% to $0.4545 after the company announced it will acquire sports gaming technology company Swifty Global.

- Mobileye Global Inc. MBLY shares were also up, gaining 16% to $13.51 after Intel reportedly said it does not have plans to divest a majority interest in the company.

Equities Trading DOWN

- Haoxi Health Technology Limited HAO shares dropped 79% to $0.64. Haoxi Health Technology announced the pricing of a $12 million underwritten follow-on public offering of 4 million units at a price of $3 per unit.

- Shares of Progyny, Inc. PGNY were down 30% to $17.21 after a client elected to exercise an option to terminate its services agreement with the company.

- Vivos Therapeutics, Inc. VVOS was down, falling 25% to $3.10 after the company announced a $4.3 million registered offering of 1.36 million shares of common stock at $3.15 per share.

Commodities

In commodity news, oil traded up 1% to $71.64 while gold traded up 0.1% at $2,600.00.

Silver traded up 1.4% to $31.115 on Thursday, while copper rose 1.1% to $4.3445.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 climbed 1.35%, Germany’s DAX climbed 1.66% and France’s CAC 40 jumped 2.11%. Spain’s IBEX 35 Index rose 0.50%, while London’s FTSE 100 rose 0.85%.

The Bank of England maintained the Bank Rate at 5% during its September meeting, after cutting rates by 25 bps in August. The current account surplus in the Eurozone increased to €48 billion in July from €25.5 billion in the year-ago period.

Asia Pacific Markets

Asian markets closed higher on Thursday, with Japan’s Nikkei 225 gaining 2.13%, Hong Kong’s Hang Seng Index surging 2%, China’s Shanghai Composite Index gaining 0.69% and India’s BSE Sensex gaining 0.29%.

Hong Kong’s unemployment rate came in unchanged at 3% in the three months ending August. The Hong Kong Monetary Authority cut its base rate by 50bps to 5.25% at its recent meeting.

Economics

- The U.S. reported a current account deficit of $266.8 billion in the second quarter versus a gap of $241 billion in the prior period and higher than market estimates of a $260 billion gap.

- U.S. initial jobless claims fell by 12,000 from the prior week to 219,000 in the week ending September 14, compared to market expectations of 230,000.

- The Philadelphia Fed Manufacturing Index climbed to 1.7 in September from -7 in the previous month and topping market estimates of -1.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

National Association of Realtors® Announces New "Consumer Guide" Series

CHICAGO, Sept. 19, 2024 (GLOBE NEWSWIRE) — The National Association of Realtors® today announced a new series of consumer resources designed to help agents who are Realtors® empower home buyers and sellers following recent practice changes. To date, NAR has published six installments in the series and will continue to release new resources in the weeks ahead.

“At the heart of what we do as Realtors® – who abide by a strict code of ethics – is protect and promote the interests of our clients,” said Kevin Sears, President of the National Association of Realtors®. “We are committed to making the process of buying or selling a home as transparent and seamless as possible for clients, and this new series of guides provides an exceptionally clear roadmap for the process of working with an agent who is a Realtor®.”

The following guides are currently available – in English and Spanish – on NAR’s website:

For more information and the latest consumer resources, please visit facts.realtor.

About the National Association of Realtors®

The National Association of Realtors® is America’s largest trade association, representing 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics.

# # #

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom.

Mantill Williams National Association of Realtors® 202/383-1128 mwilliams@nar.realtor

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Claritas Unveils Groundbreaking Insights in the 2024 Hispanic Market Report: Hispanic Population Eclipses 68 Million Mark and Average Household Lifetime Remaining Value Approaching $2.5 Million

Cincinnati, OH, Sept. 19, 2024 (GLOBE NEWSWIRE) — Claritas, a leader in data-driven marketing solutions, has released its highly anticipated 2024 Hispanic Market Report, offering an in-depth analysis of the burgeoning U.S. Hispanic market. The report underlines that Hispanics now represent over 20% of the U.S. population, with projections showing continuous growth over the next five years. This demographic’s influence is further accentuated by their exceptional spending power, which now approaches $2.5 million in remaining lifetime value for the average Hispanic household.

According to the report, the U.S. Hispanic population, standing at nearly 68.5 million, has been a significant contributor to the nation’s population growth, accounting for more than 62% since 2010. In stark contrast, the non-Hispanic White population has seen a decrease of almost 5% within the same timeframe. These trends are not just statistics but indicators of major shifts in consumer behavior and market dynamics, underlining the importance for marketers to tailor their strategies accordingly.

Ron Cohen, SVP Practice Leadership at Claritas, emphasized, “As the Hispanic population continues to grow while increasing in spending power and lifetime value, marketers across all categories need to develop the right strategies to engage these audiences or they will be left behind.”

Demographic Snapshot and Economic Impact

- Demographic Growth: The U.S. Hispanic population has almost doubled in size since the 2000 Census and is projected to increase by another 7.4 million by 2030.

- Consumer Influence: Hispanic households’ remaining lifetime spending is estimated to approach $2.5 million, significantly impacting various sectors such as retail, housing, education, and technology.

- Income Growth: Households with incomes above $200,000 are expected to spike by over 10% from 2023 to 2024, highlighting a growing affluent segment within the Hispanic community.

Geographical Distribution and Future Projections

The report highlights that major concentrations of the Hispanic population exist in states like California, Texas, Florida, New York, and Illinois. However, the forecast indicates broader dispersal into other regions, prompting businesses to recalibrate their geographic focus for targeted marketing efforts. With projections estimating more than one and a half additional Hispanics for every single decrease in the non-Hispanic White population between the 2020 and 2030 Census, the Hispanic demographic is set to become even more central to U.S. market strategies.

Marketing Insights and Cultural Nuances

Understanding cultural nuances is paramount for effective engagement with this versatile market. The Hispanic Market Report provides actionable data that helps marketers identify key cultural dimensions driving product preferences, brand loyalty, and purchasing behaviors among U.S. Hispanics.

Changing Racial Identity Landscape

One notable insight is the evolving racial identity among U.S. Hispanics. The report delves into how these changing identities impact consumer behavior and preferences, underscoring the need for brands to remain adaptive and culturally sensitive in their marketing approaches.

Conclusion

With the U.S. steadily moving towards a multicultural majority, businesses must acknowledge and adapt to the rapid growth and economic significance of the Hispanic population. Leveraging insights from the 2024 Hispanic Market Report will equip marketers with the knowledge needed to forge stronger connections with this dynamic demographic.

About Claritas

For almost five decades, Claritas has been a trailblazer in understanding the American consumer, resulting in the industry’s most embraced audience segmentation. Leveraging strategic acquisitions and a distinctive Identity Graph, the company has evolved into a marketing powerhouse. Claritas provides an integrated marketing optimization platform that enables marketers to enhance ROI by pinpointing ideal audiences, executing precise multichannel marketing engagements, and optimizing media spend across online and offline channels. With an accuracy-first foundation, the robust Claritas Identity Graph serves as the engine that drives these powerful solutions, encompassing a proprietary data set including 100% of U.S. adult consumers, over 1 billion devices and 10,000+ demographic and behavioral insights. The integration of patented and advanced AI technology as an underpin enhances the accuracy, speed, ease of use and scale of the Claritas solutions. Learn more at www.claritas.com.

Cort Irish Claritas 4024157764 cort.irish@claritas.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

iPower Reports Fiscal Fourth Quarter and Full Year 2024 Results

Optimization Initiatives Drive Material Gross Margin Expansion

and Second Consecutive Quarter of Profitability

iPower Management to Host Conference Call Today at 4:30 p.m. Eastern Time

RANCHO CUCAMONGA, Calif., Sept. 19, 2024 (GLOBE NEWSWIRE) — iPower Inc. IPW (“iPower” or the “Company”), a tech and data-driven online retailer and supplier of consumer home, pet and garden products, as well as a provider of value-added ecommerce services, today announced its financial results for the fiscal fourth quarter and full fiscal year ended June 30, 2024.

Fiscal Q4 2024 Results vs. Year-Ago Quarter

- Total revenue was $19.5 million compared to $23.4 million.

- Gross profit increased 2% to $9.2 million, with gross margin up 870 bps to 47.4% compared to 38.7%.

- Net income attributable to iPower increased to $0.7 million or $0.02 per share, compared to net loss attributable to iPower of $3.0 million or $(0.10) per share.

- Adjusted net income attributable to iPower (a non-GAAP financial measure defined below) improved to $0.9 million or $0.03 per share, compared to adjusted net loss attributable to iPower of $2.1 million or $(0.07) per share.

- As of June 30, 2024, total debt was reduced by 46% to $6.3 million compared to $11.8 million as of June 30, 2023.

Fiscal 2024 Results vs. Fiscal 2023

- Total revenue was $86.1 million compared to $88.9 million.

- Gross profit increased 13% to $39.3 million, with gross margin up 650 bps to 45.6% compared to 39.1%.

- Net loss attributable to iPower improved to $1.5 million or $(0.05) per share, compared to net loss attributable to iPower of $12.0 million or $(0.40) per share. The fiscal 2023 period includes approximately $3 million related to a goodwill impairment.

- Adjusted net loss attributable to iPower (a non-GAAP financial measure defined below) improved to $0.2 million or $(0.01) per share, compared to adjusted net loss attributable to iPower of $7.5 million or $(0.25) per share.

Management Commentary

“I’m proud of our team’s hard work in fiscal 2024 to drive record levels of gross margin, operating expense reductions and another year of positive cash flow from operations,” said Lawrence Tan, CEO of iPower. “Throughout the year, we delivered on multiple strategic initiatives to lay the foundation for future growth and profitability. We expanded channel distribution by launching sales on new platforms like TikTok Shop and Temu, both of which have seen promising early results. We’ve also strengthened the capabilities and resilience of our supply chain through partnerships with suppliers in South East Asia. We will remain focused on evaluating each aspect of our business to ensure we’re providing a best-in-class service to both our current and future customers.

“We also continued to elevate our SuperSuite supply chain business by integrating key components from value-added partners across logistics, technology and marketing to enhance our service offerings. We believe that this collaborative approach has positioned SuperSuite as a leader in supply chain management, merchandising and warehousing, attracting a diverse network of new customers and partners. We are working through a robust pipeline of prospective partners and look forward to capitalizing on the growing demand for SuperSuite as we continue to build out our partner ecosystem.”

iPower CFO, Kevin Vassily, added, “The optimization initiatives we implemented earlier this year are yielding results, enabling us to achieve material gross margin expansion and our second consecutive quarter of profitability in fiscal Q4. Additionally, we made significant improvements to our balance sheet as we reduced total debt by approximately $5.5 million compared to the close of fiscal 2023. We are pleased with the progress we made this year and look forward to delivering on our goals in fiscal 2025.”

Fiscal Fourth Quarter 2024 Financial Results

Total revenue in the fiscal fourth quarter of 2024 was $19.5 million compared to $23.4 million for the same period in fiscal 2023. The decrease was driven primarily by higher promotional activity in the year-ago period related to selling down inventory. This was partially offset by growth in iPower’s SuperSuite supply chain offerings.

Gross profit in the fiscal fourth quarter of 2024 increased 2% to $9.2 million compared to $9.1 million in the same quarter in fiscal 2023. As a percentage of revenue, gross margin increased 870 basis points to 47.4% compared to 38.7% in the year-ago period. The increase in gross margin was primarily driven by improved pricing through key supplier negotiations and favorable product mix.

Total operating expenses in the fiscal fourth quarter of 2024 improved 34% to $8.0 million compared to $12.0 million for the same period in fiscal 2023. As a percentage of revenue, operating expenses improved 1,050 basis points to 41.0% compared to 51.5% in the year-ago period. The decrease in operating expenses was driven primarily by lower selling and fulfillment expenses resulting from a combination of lower marketing and promotional activity, as well as credits from certain vendors.

Net income attributable to iPower in the fiscal fourth quarter of 2024 improved to $0.7 million or $0.02 per share, compared to net loss attributable to iPower of $3.0 million or $(0.10) per share for the same period in fiscal 2023.

Adjusted net income attributable to iPower (a non-GAAP financial measure defined below), which excludes legal fees for arbitration net of tax impact, improved to $0.9 million or $0.03 per share in the fiscal fourth quarter of 2024 compared to adjusted net loss attributable to iPower of $2.1 million or $(0.07) per share in the year-ago period.

Cash and cash equivalents were $7.4 million at June 30, 2024, compared to $3.7 million at June 30, 2023. As a result of the Company’s debt paydown, total debt was reduced by 46% to $6.3 million compared to $11.8 million as of June 30, 2023.

Conference Call

The Company will hold a conference call today, September 19, 2024, at 4:30 p.m. Eastern Time to discuss its results for the fiscal fourth quarter and full fiscal year ended June 30, 2024.

iPower’s management will host the conference call, which will be followed by a question-and-answer session.

The conference call details are as follows:

Date: Thursday, September 19, 2024

Time: 4:30 p.m. Eastern Time

Dial-in registration link: here

Live webcast registration link: here

Please dial into the conference call 5-10 minutes prior to the start time. If you have any difficulty connecting with the conference call, please contact the Company’s investor relations team at IPW@elevate-ir.com.

The conference call will also be broadcast live and available for replay in the Events & Presentations section of the Company’s website at www.meetipower.com.

About iPower Inc.

iPower Inc. is a tech and data-driven online retailer and supplier of consumer home, pet and garden products, as well as a provider of value-added ecommerce services for third-party products and brands. iPower’s capabilities include a full spectrum of online channels, robust fulfillment capacity, a network of warehouses serving the U.S., competitive last mile delivery partners and a differentiated business intelligence platform. iPower believes that these capabilities will enable it to efficiently move a diverse catalog of SKUs from its supply chain partners to end consumers every day, providing the best value to customers in the U.S. and other countries. For more information, please visit iPower’s website at www.meetipower.com.

Non-GAAP Financial Measures

iPower has disclosed non-GAAP net income/(loss) and non-GAAP earnings per share in this press release, which are non-GAAP financial measures as defined by SEC Regulation G. The Company defines non-GAAP net income/(loss) as net income excluding legal fees for arbitration net of tax impact. A table providing a reconciliation of non-GAAP net income/(loss) and non-GAAP EPS is included at the end of this press release.

The Company’s management believes that presenting non-GAAP net income/(loss) and non-GAAP EPS provides useful information to investors regarding the underlying business trends and performance of the Company’s ongoing operations, as well as providing for more consistent period-over-period comparisons. This non-GAAP measure assists management in its operational and financial decision-making, as well as monitoring the Company’s performance, non-GAAP net income/(loss) and non-GAAP EPS are used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial measures.

Our non-GAAP net income/(loss) and non-GAAP earnings per share are not measurements of financial performance under GAAP and should not be considered as an alternative to operating or net income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider these non-GAAP measures to be a substitute for, or superior to, the information provided by GAAP financial results. Non-GAAP financial measures are subject to limitations and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our GAAP results of operations. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

Management strongly encourages investors to review the Company’s consolidated financial statements in their entirety and to not rely on any single financial measure.

Forward-Looking Statements

All statements other than statements of historical fact in this press release are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that iPower believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. iPower undertakes no obligation to update forward-looking statements to reflect subsequent events or circumstances, or changes in its expectations, except as may be required by law. Although iPower believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and iPower cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results and performance in iPower’s Annual Report on Form 10-K, as filed with the SEC on September 19, 2024, its Quarterly Reports on Form 10-Q, as filed with the SEC on November 15, 2023, February 14, 2024 and May 14, 2024, and in its other SEC filings.

Investor Relations Contact

Sean Mansouri, CFA or Aaron D’Souza

Elevate IR

(720) 330-2829

IPW@elevate-ir.com

| iPower Inc. and Subsidiaries | ||||||||

| Consolidated Balance Sheets | ||||||||

| As of June 30, 2024 and 2023 | ||||||||

| June 30, | June 30, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalent | $ | 7,377,837 | $ | 3,735,642 | ||||

| Accounts receivable, net | 14,740,093 | 14,071,543 | ||||||

| Inventories, net | 10,546,273 | 20,593,889 | ||||||

| Prepayments and other current assets, net | 2,346,534 | 2,858,196 | ||||||

| Total current assets | 35,010,737 | 41,259,270 | ||||||

| Non-current assets | ||||||||

| Right of use – non-current | 6,124,163 | 7,837,345 | ||||||

| Property and equipment, net | 370,887 | 536,418 | ||||||

| Deferred tax assets, net | 2,445,605 | 2,155,250 | ||||||

| Goodwill | 3,034,110 | 3,034,110 | ||||||

| Intangible assets, net | 3,630,700 | 4,280,071 | ||||||

| Other non-current assets | 679,655 | 991,823 | ||||||

| Total non-current assets | 16,285,120 | 18,835,017 | ||||||

| Total assets | $ | 51,295,857 | $ | 60,094,287 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | 11,227,116 | 13,244,957 | ||||||

| Other payables and accrued liabilities | 3,885,487 | 5,548,443 | ||||||

| Advance from shareholders | – | 85,200 | ||||||

| Lease liability – current | 2,039,301 | 2,159,173 | ||||||

| Short-term loan payable | 491,214 | – | ||||||

| Short-term loan payable – related party | 350,000 | – | ||||||

| Long-term promissory note payable – current portion | – | 2,017,852 | ||||||

| Revolving loan payable | 5,500,739 | – | ||||||

| Income taxes payable | 276,158 | 276,683 | ||||||

| Total current liabilities | 23,770,015 | 23,332,308 | ||||||

| Non-current liabilities | ||||||||

| Long-term revolving loan payable, net | – | 9,791,191 | ||||||

| Lease liability – non-current | 4,509,809 | 6,106,047 | ||||||

| Total non-current liabilities | 4,509,809 | 15,897,238 | ||||||

| Total liabilities | 28,279,824 | 39,229,546 | ||||||

| Commitments and contingency | – | – | ||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, $0.001 par value; 20,000,000 shares authorized; 0 shares issued and | ||||||||

| outstanding at June 30, 2024 and 2023 | – | – | ||||||

| Common stock, $0.001 par value; 180,000,000 shares authorized; 31,359,899 and | ||||||||

| 29,710,939 shares issued and outstanding at June 30, 2024 and 2023 | 31,361 | 29,712 | ||||||

| Additional paid in capital | 33,463,883 | 29,624,520 | ||||||

| Accumulated deficits | (10,230,601 | ) | (8,702,442 | ) | ||||

| Non-controlling interest | (38,204 | ) | (24,915 | ) | ||||

| Accumulated other comprehensive loss | (210,406 | ) | (62,134 | ) | ||||

| Total stockholders’ equity | 23,016,033 | 20,864,741 | ||||||

| Total liabilities and stockholders’ equity | $ | 51,295,857 | $ | 60,094,287 | ||||

| iPower Inc. and Subsidiaries | ||||||||||||||||

| Consolidated Statements of Operations and Comprehensive Loss | ||||||||||||||||

| For the Three Months and Years Ended June 30, 2024 and 2023 | ||||||||||||||||

| For the Three Months Ended June 30, | For the Years Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| REVENUES | $ | 19,454,481 | $ | 23,399,166 | $ | 86,071,485 | $ | 88,902,048 | ||||||||

| TOTAL REVENUES | 19,454,481 | 23,399,166 | 86,071,485 | 88,902,048 | ||||||||||||

| COST OF REVENUES | 10,226,651 | 14,348,668 | 46,818,232 | 54,104,587 | ||||||||||||

| GROSS PROFIT | 9,227,830 | 9,050,498 | 39,253,253 | 34,797,461 | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Selling and fulfillment | 5,068,847 | 8,133,299 | 28,095,176 | 32,427,972 | ||||||||||||

| General and administrative | 2,902,127 | 3,913,672 | 12,120,969 | 12,792,998 | ||||||||||||

| Impairment loss – goodwill | – | – | – | 3,060,034 | ||||||||||||

| Total operating expenses | 7,970,974 | 12,046,971 | 40,216,145 | 48,281,004 | ||||||||||||

| INCOME (LOSS) FROM OPERATIONS | 1,256,856 | (2,996,473 | ) | (962,892 | ) | (13,483,543 | ) | |||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Interest expenses | (196,249 | ) | (265,497 | ) | (788,425 | ) | (1,066,280 | ) | ||||||||

| Loss on equity method investment | (2,890 | ) | (1,376 | ) | (5,508 | ) | (10,001 | ) | ||||||||

| Other non-operating income | (67,991 | ) | (306,874 | ) | (35,988 | ) | (107,749 | ) | ||||||||

| Total other expenses, net | (267,130 | ) | (573,747 | ) | (829,921 | ) | (1,184,030 | ) | ||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 989,726 | (3,570,220 | ) | (1,792,813 | ) | (14,667,573 | ) | |||||||||

| PROVISION FOR INCOME TAX (BENEFIT) EXPENSE | 336,309 | (605,374 | ) | (251,365 | ) | (2,690,500 | ) | |||||||||

| NET INCOME (LOSS) | 653,417 | (2,964,846 | ) | (1,541,448 | ) | (11,977,073 | ) | |||||||||

| Non-controlling interest | (3,685 | ) | (2,805 | ) | (13,289 | ) | (11,683 | ) | ||||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. | $ | 657,102 | $ | (2,962,041 | ) | $ | (1,528,159 | ) | $ | (11,965,390 | ) | |||||

| OTHER COMPREHENSIVE LOSS | ||||||||||||||||

| Foreign currency translation adjustments | (56,432 | ) | (21,090 | ) | (148,272 | ) | (67,812 | ) | ||||||||

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. | $ | 600,670 | $ | (2,983,131 | ) | $ | (1,676,431 | ) | $ | (12,033,202 | ) | |||||

| WEIGHTED AVERAGE NUMBER OF COMMON STOCK | ||||||||||||||||

| Basic | 29,943,439 | 29,747,497 | 29,878,196 | 29,713,354 | ||||||||||||

| EARNINGS (LOSSES) PER SHARE | ||||||||||||||||

| Basic | $ | 0.02 | $ | (0.10 | ) | $ | (0.05 | ) | $ | (0.40 | ) | |||||

| iPower Inc. and Subsidiaries | ||||||||||||||||

| Reconciliation of GAAP to Non-GAAP Financial Measures | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| For the Three Months Ended June 30, | For the Years Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| GAAP NET INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. | $ | 657,102 | $ | (2,962,041 | ) | $ | (1,528,159 | ) | $ | (11,965,390 | ) | |||||

| Legal fees for arbitration | 292,570 | 991,282 | 1,531,907 | 1,673,694 | ||||||||||||

| Impairment loss – goodwill | 0 | 0 | 0 | 3,060,034 | ||||||||||||

| Adjustments to tax provision | (99,366 | ) | (168,084 | ) | (214,784 | ) | (307,009 | ) | ||||||||

| NON-GAAP NET INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. | $ | 850,306 | $ | (2,138,843 | ) | $ | (211,036 | ) | $ | (7,538,671 | ) | |||||

| GAAP EARNINGS (LOSSES) PER SHARE * | ||||||||||||||||

| Basic | $ | 0.02 | $ | (0.10 | ) | $ | (0.05 | ) | $ | (0.40 | ) | |||||

| Impact of Non-GAAP adjustments | 0.01 | 0.03 | 0.04 | 0.15 | ||||||||||||

| NON-GAAP EARNINGS (LOSSES) PER SHARE * | $ | 0.03 | $ | (0.07 | ) | $ | (0.01 | ) | $ | (0.25 | ) | |||||

| WEIGHTED AVERAGE NUMBER OF COMMON STOCK* | ||||||||||||||||

| Basic – GAAP and NON-GAAP | 29,943,439 | 29,747,497 | 29,878,196 | 29,713,354 | ||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

D.C. Continues Crackdown On Cannabis Gifting Shops: One Arrested, Store Padlocked, Although Many More Remain Open

On Friday, September 13, Washington D.C. authorities shut down Green Cloud Shop, an unlicensed cannabis business, as part of a broader crackdown on illegal cannabis operations.

The Alcoholic Beverage and Cannabis Administration (ABCA), alongside the Metropolitan Police Department (MPD), padlocked the shop. The owner, a 49-year-old man, was arrested and charged with Possession with Intent to Distribute and Operating a Business After Certificate of Authority had been revoked.

This measure came in the context of an ongoing conflict with unregulated “gift economy” cannabis shops, which were tolerated in the past but are now being pushed to adapt to regulations, reported Axios.

Say Goodbye To D.C.’s Cannabis Gifting Economy

Cannabis gifting shops in D.C. have long used a loophole by “gifting” marijuana when customers purchase other products. This allowed them to bypass laws against recreational cannabis sales, in the context of the tricky legal situation affecting Washington D.C. cannabis.

However, city officials are now stepping up enforcement. The more than 100 unlicensed shops that are currently operating are seen as a major threat to the legal medical cannabis market.

The crackdown comes after the D.C. Council green-lit an emergency bill to give city officials the authority to impose penalties on unlicensed cannabis stores earlier this year. D.C. lawmakers, including progressive members, are backing this crackdown due to concerns about crime around all-cash businesses and the proximity of some shops to schools and daycare facilities.

The Latest Developments In D.C.

Green Cloud Shop’s closure is part of a new wave of enforcement following the Medical Cannabis Conditional License and Unlicensed Establishment Closure Clarification Emergency Amendment Act of 2024. This law, enacted in July, grants the ABCA enhanced authority to close illegal businesses.

Green Cloud is the second illicit cannabis business closed by ABCA since the new law went into effect.

Curiously, authorities reported padlocking the access to the store. This echoes New York’s special operation that cracked down on illicit cannabis during the first few months of the year.

In addition to the closures, the ABCA has issued 23 cease-and-desist orders and 79 warning letters to unlicensed cannabis businesses. Many shops, however, continue operating, with only a few being forced to shut down.

But still, property owners of illicit cannabis shops could face a $10,000 fine if they fail to comply with the ABCA’s closure orders.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

The Struggle Of Legal D.C. Cannabis Dispensaries

The crackdown comes at a crucial time for D.C.’s legal medical cannabis market, which has been struggling to compete with unlicensed operators.

Adding to the pressure, D.C. dispensaries face stiff competition from Maryland’s legal recreational market, where prices are often lower. Since January 2024, D.C.’s legal market has been in a steep decline, selling less than 400 pounds of flower per month.

Cover: Benzinga edit based on Washarapol D BinYo Jundang and Anna Lowe via Pixels

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Primed For Relief Rally As Traders Eye Jobless Claims, FedEx Earnings After Fed's 50 Basis-Point Cut: Strategist Says These Stocks Will Gain Edge In First 6 Months Of Rate Cut

U.S. stocks look set for a relief rally after the market failed to sustain the upward momentum set in motion by the 50 basis-point cut announced by the Federal Reserve on Wednesday. The index futures point to a sharply higher opening on Thursday. Given the central bank’s focus on labor market statistics, traders may closely monitor the weekly jobless claims data. The results of a regional manufacturing survey and the Conference Board’s leading economic index may also create some ripples in the market.

With the Fed decision on the back-burner, earnings could get back to the spotlight, with FedEx Corp. FDX due to report after the close. Tech and small-cap stocks remain poised to rally out of the gates even as most strategists warn of a tech rally cool-off. Volatility is on the wane amid the risk-on mood, with the CBOE Volatility Index, aka VIX, down about 9%.

| Futures | Performance (+/-) |

| Nasdaq 100 | +1.99% |

| S&P 500 | +1.53% |

| Dow | +1.15% |

| R2K | +2.88% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY jumped 1.55% to $570.08 and the Invesco QQQ ETF QQQ gained 2.00% to $480.96, according to Benzinga Pro data.

Cues From Last Session:

Wall Street closed Wednesday’s session modestly lower despite the Fed obliging with the magnitude of the cut the market was hoping for. The major indices resigned themselves to the pattern typical of a Fed decision day and moved sideways until the announcement was made. The central bank delivered and traders indulged in strong buying that took the S&P 500 Index to a new intraday high.

The dot plot suggested policymakers will likely cut rates a 25 basis points at each of the next two decisions and by at least another percentage point in 2025. While the growth outlook was left unchanged, the unemployment rate forecasts were revised. But Fed Chair Jerome Powell’s cautious comments at the press conference spooked the market, sending stocks lower in late-afternoon trading.

| Index | Performance (+/) | Value |

| Nasdaq Composite | -0.31% | 17,573.30 |

| S&P 500 Index | -0.29% | 5,618.26 |

| Dow Industrials | -0.25% | 41,503.10 |

| Russell 2000 | +0.04% | 2,206.34 |

Insights From Analysts:

It could be time for defensives and small-caps to shine, now that the rate-cutting cycle has begun and the door is open for more.

LPL Financial Chief Equity Strategist Jeff Buchbinder said in a note ahead of the rate cut that value stocks outperform their growth counterparts three and six months after the initial cut. The 1995 monetary policy is the most analogous to the current one, he said, adding that during the 12 months after the cut at that time, growth stocks were slightly better. But value stocks have an edge over the first six months, he said.

Defensive sectors typically outperform in the six months after the initial rate cuts, and this was particularly evident during the 1995 period that saw a soft landing and technology buildout, the strategist said. Specifically, the defense and the telecom services sector were top performers, while consumer staples and utilities also outperformed, he said. Financials did well in the 1995 cycle and performed in-line in the 2019 period, which is more comparable to the current situation than the 2001 cycle, he added.

Surprisingly, the technology sector underperformed the S&P 500 after the 1995 rate cut, even though the internet buildout was in its early phases, Buchbinder said, referring to Netscape’s initial public offering which came after the first rate cut. Netscape is credited with creating the first internet browser.

“The takeaway here is that the technology sector, which as we know, is in a major buildout phase now with artificial intelligence, may not get a performance bump from a more accommodating Fed,” the strategist said.

Carson Group Chief Market Strategist Ryan Detrick pointed out a positive data point that bodes well for the market. In a post on X, he said the Fed has cut rates with stocks near all-time highs 20 times in the past. In all the instances, the S&P 500 was higher a year later.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Labor Department is scheduled to release its weekly jobless claims data for the recent reporting week at 8:30 a.m. EDT. The number of individuals claiming unemployment benefits may have edged down from to 229,000 in the week ended Sept. 14, down from 230,000 in the previous week.