Coinbase Global, Electronic Arts And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed slightly higher during Tuesday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

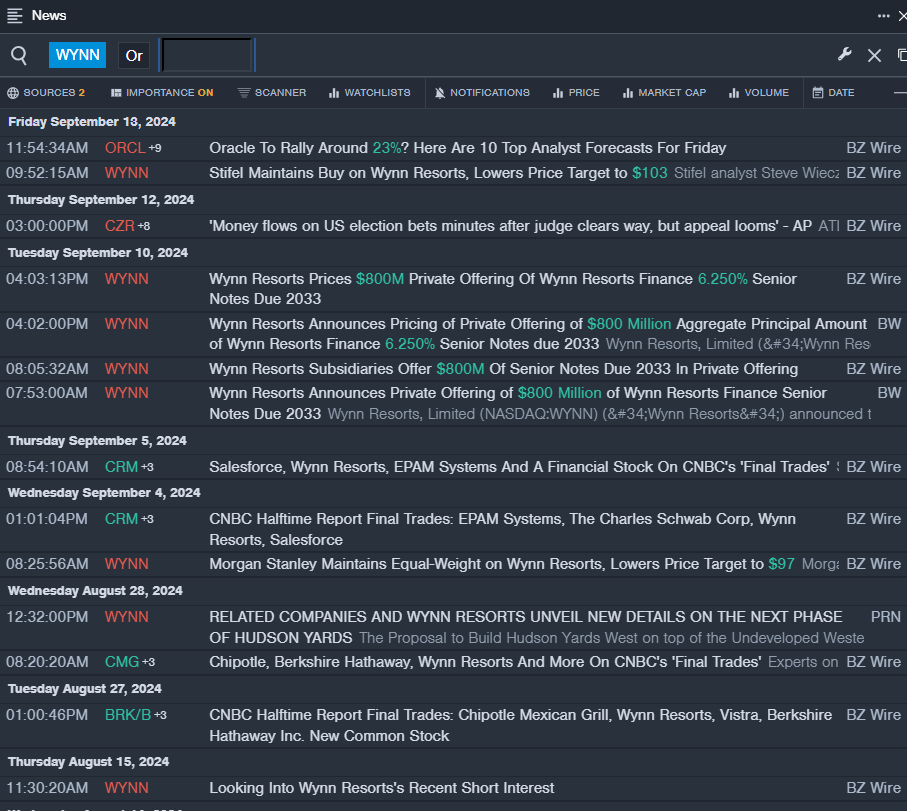

Wynn Resorts

- The Trade: Wynn Resorts, Limited WYNN Director Patricia Mulroy sold a total of 2,650 shares at an average price of $78.73. The insider received around $208,635 from selling those shares.

- What’s Happening: On Sept. 10, Wynn Resorts priced its $800 million private offering of Wynn Resorts Finance 6.250% Senior Notes due 2033.

- What Wynn Resorts Does: Wynn Resorts operates luxury casinos and resorts. The company was founded in 2002 by Steve Wynn, the former CEO.

- Benzinga Pro’s real-time newsfeed alerted to latest WYNN news.

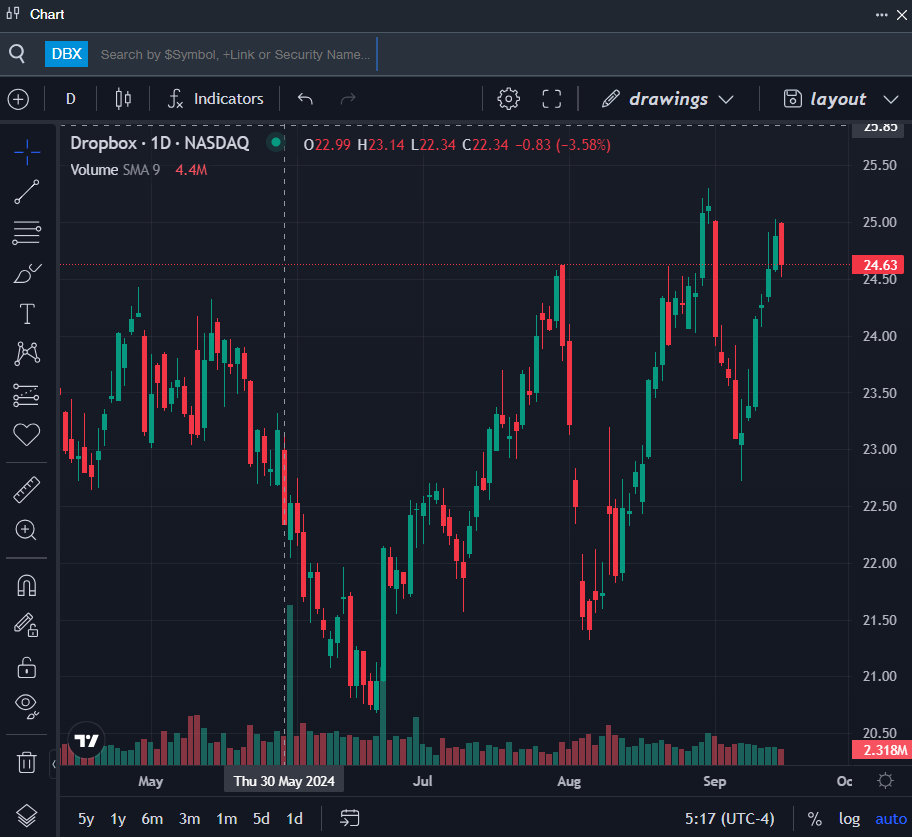

Dropbox

- The Trade: Dropbox, Inc. DBX CFO Timothy Regan sold a total of 3,300 shares at an average price of $24.51. The insider received around $80,875 from selling those shares.

- What’s Happening: On Aug. 8, Dropbox reported better-than-expected second-quarter financial results.

- What Dropbox Does: Dropbox is a leading provider of cloud-storage and content collaboration tools with an emphasis on individuals and SMB.

- Benzinga Pro’s charting tool helped identify the trend in DBX stock.

Coinbase Global

- The Trade: Coinbase Global, Inc. COIN President and COO Emilie Choi sold a total of 1,500 shares at an average price of $162.24. The insider received around $243,360 from selling those shares.

- What’s Happening: On Sept. 12, Coinbase announced the launch of Coinbase Wrapped BTC (cbBTC), a new ERC20 token backed 1:1 by Bitcoin held in Coinbase’s custody to bridge Bitcoin to Ethereum and base networks.

- What Coinbase Global Does: Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States.

- Benzinga Pro’s signals feature notified of a potential breakout in COIN shares.

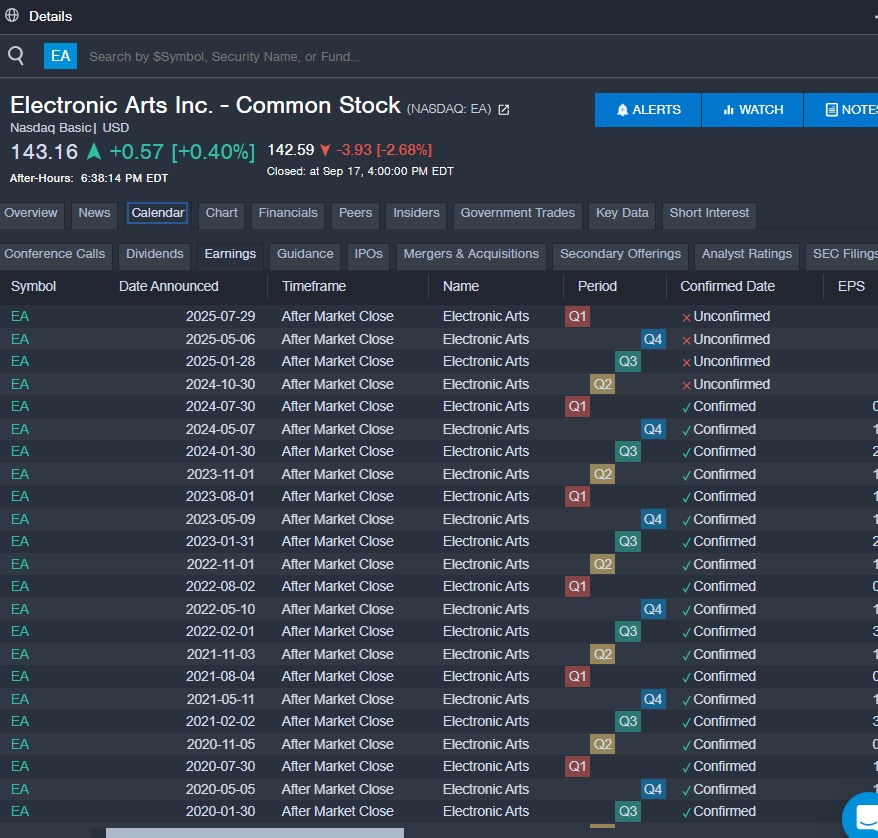

Electronic Arts

- The Trade: Electronic Arts Inc. EA EVP, Global Affairs and CLO Jacob J. Schatz sold a total of 1,500 shares at an average price of $146.58. The insider received around $219,870 from selling those shares.

- What’s Happening: On Sept. 17, Electronic Arts outlined its long-term growth strategy at its Investor Day event.

- What Electronic Arts Does: EA is one of the world’s largest third-party video game publishers and has transitioned from a console-based video game publisher to the one of the largest publishers on consoles, PC, and mobile.

- Benzinga Pro’s earnings calendar was used to track upcoming EA’s earnings reports.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ray Dalio Warns Fed Faces Tough Road Ahead Balancing Interest Rate Cuts And 'Enormous' US Debt Amid $1 Trillion In Interest Payments This Year

Billionaire investor Ray Dalio has highlighted the difficulties faced by the U.S. Federal Reserve as it navigates interest rate cuts amid a heavily indebted economy.

What Happened: On Thursday, Dalio the founder of Bridgewater Associates said that the Fed must balance keeping interest rates high enough to benefit creditors while not excessively burdening debtors, Dalio said in an interview with CNBC.

The central bank reduced the federal funds rate by 50 basis points on Wednesday to 4.75% to 5%, impacting banks’ short-term borrowing costs.

Dalio expressed concerns about the “enormous amount of debt” in the U.S. The government has spent over $1 trillion on interest payments for its $35.3 trillion national debt this year.

Despite these challenges, Dalio does not foresee a looming credit event but anticipates a significant depreciation in the value of debt through artificially low real rates. He warned that the path forward might involve monetizing the debt, similar to Japan’s approach, which could lead to depreciated currency values and lower bond yields.

“I see a big depreciation in the value of that debt through a combination of artificial low real rates, so you won’t be compensated,” Dalio said.

Dalio concluded by stating that he does not favor debt assets for his portfolio, preferring to underweight them, particularly bonds.

Why It Matters: The Federal Reserve’s recent rate cut marks the first reduction in more than four years. Federal Reserve Chair Jerome Powell defended the decision, emphasizing the need to support a strong labor market and prevent economic harm. Powell stated, “The time to support the labor market is when it’s strong, not when you begin to see layoffs.”

Furthermore, the rate cut’s implications extend to consumer financial products. The reduction could affect mortgage rates, credit card interest rates, and auto loan rates, potentially easing the financial burden on consumers.

However, the economic landscape remains complex. Jim Cramer noted that the rate cuts might not significantly benefit tech stocks, suggesting that the market had already anticipated this move.

Read Next:

Image via Wikimedia Commons/ Web Summit

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

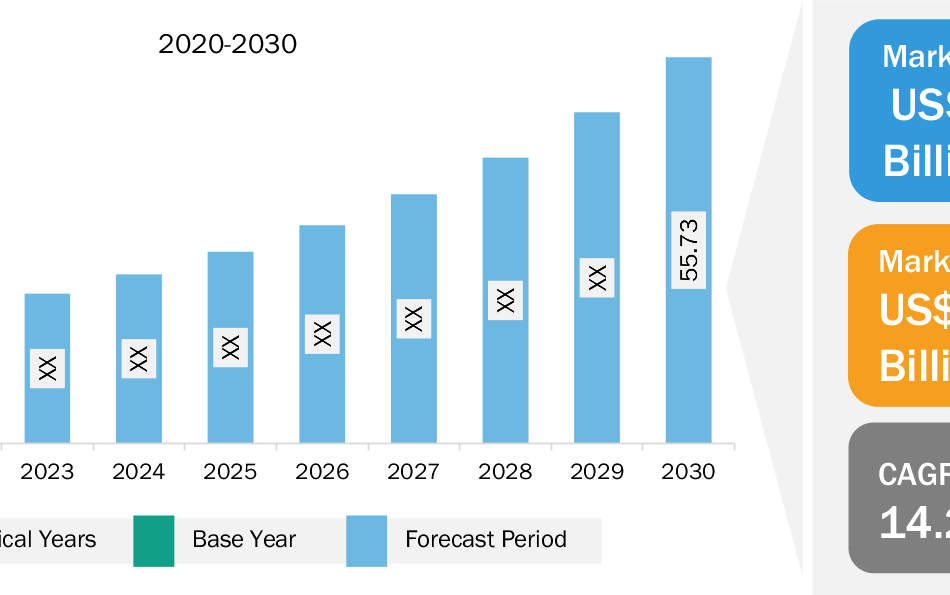

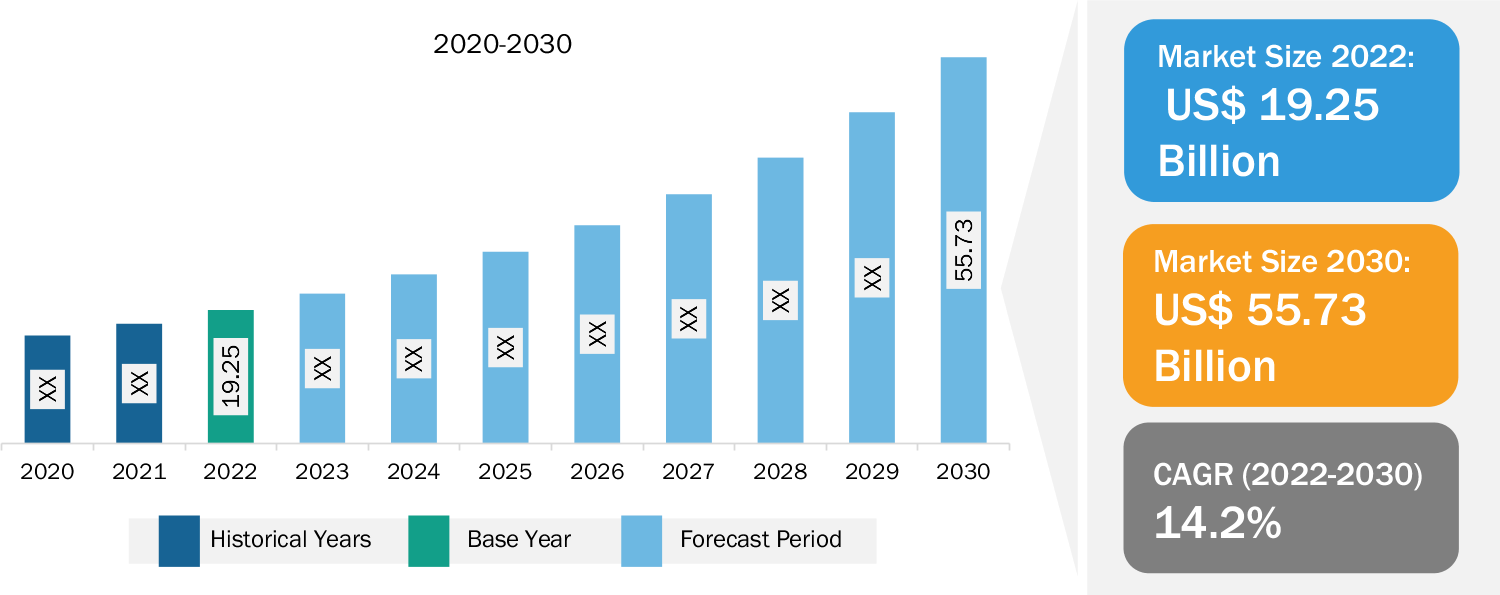

Cloud OSS BSS Market Worth $55.73 Billion, Globally, by 2030 – Exclusive Report by The Insight Partners

US & Canada, Sept. 19, 2024 (GLOBE NEWSWIRE) — According to a new comprehensive report from The Insight Partners, the continuous product innovations by vendors and growing demand for cloud OSS by Tier 1 communication service providers drives the market.

The report carries out an in-depth analysis of market trends, key players, and future opportunities. In general, the cloud OSS BSS market comprises a vast array of solution, deployment model, enterprise size, and industry which are expected to register strength during the coming years.

Download Sample PDF Brochure: https://www.theinsightpartners.com/sample/TIPRE00011165/

Source: The Insight Partners’ Analysis

Overview of Report Findings:

1. Market Growth: The cloud OSS BSS market is expected to reach US$ 55.73 billion by 2030 from US$ 19.25 billion in 2022, at a CAGR of 14.2% during the forecast period.

Identify The Key Trends Affecting This Market – Download PDF

2. By geography, the cloud OSS BSS market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. North America is one of the most technologically advanced regions, owing to the early adoption of technologies, investment of the governments in advancements of technologies, and strong economic growth. Moreover, North America has the most developed telecom markets globally, with a high mobile internet penetration. According to the GSMA Intelligence report, in 2022, the adoption of 5G in the region had skyrocketed and is set to dominate the wireless services sector by 2025. Further, the 5G connections will reach 280 million and account for 64% of all mobile connections in North America by 2025. Thus, the increasing demand for 5G connectivity is expected to boost the market growth in this region.

3. APAC is growing with the highest CAGR over the forecast period. Growth in the telecom industry in Asia Pacific, coupled with the increase in mobile internet penetration, is propelling the cloud OSS BSS market. Additionally, APAC is the fastest-growing market for communication service providers (CSPs). Moreover, the high internet consumption rate in APAC due to the high volume of mobile and broadband subscribers and users is propelling the market. Furthermore, the region’s demand for 5G is increasing due to the economic recovery post-pandemic, the rise in 5G handset sales, and overall marketing efforts. 5G connections in Asia Pacific are expected to be more than 400 million by 2025.

Purchase Premium Copy of Cloud OSS BSS Market Growth Report (2022-2030) at: https://www.theinsightpartners.com/buy/TIPRE00011165/

Market Segmentation:

- Based on solution, the cloud OSS BSS market is segmented into OSS and BSS. The OSS segment held the largest share in the cloud OSS BSS market in 2022.

- Based on deployment model, the cloud OSS BSS market is public cloud, private cloud, and hybrid cloud. The public cloud segment held the largest share in the cloud OSS BSS market in 2022.

- Based on enterprise size, the cloud OSS BSS market is small and medium enterprises and large enterprises. The public cloud segment held the largest share in the cloud OSS BSS market in 2022.

- In terms of industry, the market is segmented into IT and telecom, BFSI, media and entertainment, healthcare, and others. The IT and telecom segment held the largest share in the cloud OSS BSS market in 2022.

Obtain Analysis of Key Geographic Markets – Download PDF

Competitive Strategy and Development:

- Key Players: A few major companies operating in the cloud OSS BSS market include Amdocs; Oracle Corp; Telefonaktiebolaget LM Ericsson; Hewlett Packard Enterprise Development LP; Huawei Technologies Co Ltd; Axino Solutions GmbH; CSG Systems International Inc; Nokia Corp; Infosys Ltd; and Softelnet SA

- Trending Topics: Artificial Intelligence, Cloud Computing, 5G Networks, Security and Fraud Management and Others.

Global Headlines on Cloud OSS BSS:

- In April 2024, Optiva Inc., a leader in powering the telecom industry with cloud-native billing, charging, and revenue management software on private and public clouds, announced a strategic go-to-market partnership with GDi, a digital technology company with a complete portfolio for network planning, design, and rollout. The partnership is expected to provide communication service providers (CSPs) with pre-integrated and tested BSS and OSS software.

Want More Information about Competitors and Market Players? Get PDF

- In April 2024, Netcracker Technology announced the continued delivery of mission-critical IT functions, applications, and services to Altafiber—the leading supplier of fiber-based services in Greater Cincinnati. Altafiber’s long-standing relationship with Netcracker includes managed and professional services for components of Netcracker Digital BSS and Digital OSS solutions, which support its B2C and B2B customers across Ohio, Kentucky, and Indiana, as well as its subsidiary operations at Hawaiian Telcom.

Conclusion:

The growing demand for cloud OSS by tier 1 communication service providers is a key factor fueling the growth of the cloud OSS BSS market. Cloud OSS are used for multiple applications due to their heterogeneous technology and vendor landscape. These solutions offer an efficient and easy way for resource sharing, automation, and monitoring. Using cloud OSS solutions, CSPs simplify software upgrade procedures, thus reducing the cost considerably by ensuring near-zero downtime during the upgrade. Cloud OSS benefits Tier 1 CSPs by providing elasticity to handle burst traffic scenarios without any upfront investment. In addition, it enables them to automate server configurations, along with assisting them in monitoring server usage to improve efficiency. Cloud OSS also helps improve operational agility. New software versions can be easily deployed on virtual machines (VM), keeping the native hardware in place. After testing the software, the network load can be redirected to the new VMs. The cloud OSS solution also provides a faster time-to-market for new services as new capabilities can be easily scaled up or down on demand. Furthermore, cloud OSS solutions provide Tier 1 CSPs with big data solutions and analytics.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement

The report from The Insight Partners, therefore, provides several stakeholders—including component providers, system integrator, and others—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.

Related Report Titles:

- OSS BSS Software Market Size and Forecasts (2021 – 2031)

- Cloud POS Market Size, Forecast, Share, and Growth 2031

- Cloud Computing Market Share, Size and Trends| 2028

- Cloud PBX Market Size, Share, Statistics Report 2022, 2027

- Distributed Cloud Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Cloud Security Market Size & Share, Analysis & Forecast 2028

- Cloud Orchestration Market Outlook, Segments, Geography, Dynamics, Recent Developments, and Strategic Insights by 2031

- Multi-Cloud Management Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast by 2031

- Cloud Communication Platform Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Cloud ERP Market Strategies, Top Players, Growth Opportunities, Analysis, and Forecast by 2030

- Cloud Applications Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- Cloud Field Service Management Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Telecom Cloud Market Size and Growth 2031

- Marketing Cloud Platform Market Dynamics, Recent Developments, and Strategic Insights by 2031

- Cloud Billing Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- Cloud Based ITSM Market Analysis, Size, Share, Growth, Trends, and Forecast by 2031

- Cloud Storage Market Analysis, Size, Share, Growth, Trends, and Forecast by 2031

- Cloud Discovery Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- Cloud Workflow Market Report 2031 by Segments, Geography, Dynamics, Recent Developments, and Strategic Insights

- Cloud Enterprise Application Software Market Analysis, Size, Share, Growth, Trends, and Forecast by 2031

- Cloud Engineering Market Outlook, Segments, Geography, Dynamics, Recent Developments, and Strategic Insights by 2031

- Cloud Collaboration Market Analysis and Forecast by Size, Share, Growth, Trends 2031

- Cloud High-Performance Computing (HPC) Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Cloud Storage Gateway Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Cloud Testing Market Analysis, Size, Share, Growth, Trends, and Forecast by 2031

- Cloud-Based Training Software Market Analysis, Size, Share, Growth, Trends, and Forecast by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/cloud-oss-bss-market

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Is Yesterday's News: These 2 Artificial Intelligence (AI) Stocks Are Poised to Skyrocket Up to 1,050%, According to Select Wall Street Pundits

For much of the last two years, no trend has captivated the attention of investors quite like artificial intelligence (AI).

The potential for AI-backed software and systems to learn over time without human intervention gives this technology the ability to improve productivity and alter consumer/enterprise consumption habits in most sectors and industries. It’s why the researchers at PwC expect the global addressable market for AI to reach $15.7 trillion by the turn of the decade.

Thus far, semiconductor behemoth Nvidia (NASDAQ: NVDA) has been the undisputed beneficiary of the rise of AI. But according to select Wall Street pundits, two other artificial intelligence stocks offer truly eye-popping upside — up to 1,050%!

Sorry, Nvidia, but you’re yesterday’s news

Between the start of 2023 and shortly after Nvidia completed its historic 10-for-1 stock split in June 2024, its valuation soared from $360 billion to a peak of $3.46 trillion. Although it wasn’t the first $3 trillion company, we’ve never witnessed a market-leading business tack on $3 trillion in value in less than 18 months.

Nvidia’s expansion has truly been textbook. The company’s AI-graphics processing units (GPUs) rapidly became the preferred choice in enterprise data centers focused on running generative AI solutions and training large language models (LLMs). Based on estimates from the analysts at TechInsights, Nvidia has accounted for 98% of the GPUs shipped to data centers in back-to-back years. Plus, with its prized H100 backlogged, it’ll likely maintain a near-monopoly like market share in 2024.

Exceptional demand and otherworldly pricing power for Nvidia’s AI-GPUs has been assisted by the all-important CUDA software platform. CUDA is the toolkit used by developers to build LLMs and get the most out of their Nvidia hardware. Think of CUDA as the hook that usually keeps clients loyal to Nvidia’s ecosystem of products and services.

But all periods of euphoria eventually come to an end on Wall Street, and Nvidia may very well be yesterday’s news.

One of the biggest advantages Nvidia possesses is its pricing power. With demand for AI-GPUs overwhelming supply, Nvidia’s chips have often commanded a 100% to 300% price premium to rival hardware. But this could soon change.

A number of rival companies, including Advanced Micro Devices, are ramping up production of their considerably cheaper AI-GPUs which are, for the moment, in supply. Businesses wanting to gain first-mover advantages may be strongly incented to use these rival chips.

Furthermore, Nvidia’s four-largest customers by net sales are internally developing AI-GPUs as either complements or eventual replacements to the AI-GPU hardware they’ve ordered from Nvidia. The writing certainly appears to be on the wall that access to AI-accelerated data center “real estate” will be harder to come by in 2025 and onward.

As new chips become available and Nvidia’s larger customers supplement their needs with internally developed AI-GPUs, Nvidia is very likely to see its pricing power and gross margin fade. In short, Nvidia’s best days are likely in the rearview mirror.

But based on the forecast of select Wall Street pundits, this isn’t the case for two other potentially high-growth AI stocks.

Tesla: Implied upside of 1,050%

The first artificial intelligence stock that could blow investor’s socks off, in terms of upside, is electric-vehicle (EV) manufacturer Tesla (NASDAQ: TSLA). The CEO and Chief Investment Officer of Ark Invest, Cathie Wood, has pegged Tesla’s stock as heading to $2,600 per share by 2029. Based on its share price at the time of this writing, this would translate into eventual upside of a cool 1,050%!

The primary thesis behind Ark’s Monte Carlo analysis is that autonomous ride-hailing (i.e., robotaxis) will drive much of Tesla’s growth. Ark’s expected case is for Tesla to generate $1.2 trillion in sales by 2029, 63% of which would originate from its robotaxi operations. What’s more, 86% of the $440 billion in forecast earnings before interest, taxes, depreciation, and amortization (EBITDA), would come from autonomous ride-hailing services.

Although Tesla is North America’s leading EV manufacturer, and the company has done something no other automaker had achieved for over a half-century — build a new car company from scratch to mass-production — there are a multitude of reasons to believe Wood’s price target on the company won’t come anywhere close to reality.

The glaring flaw in Wood’s Monte Carlo analysis is that it assumes rapid adoption of Tesla’s robotaxi. However, Tesla has precisely zero autonomous robotaxis on public roads today, and hasn’t surpassed Level 2 full self-driving autonomy for years.

By comparison, Mercedes-Benz began selling vehicles with Level 3 autonomous self-driving technology in California and Nevada late last year, and has been developing hands-free Level 4 autonomous driving systems. Tesla has rapidly lost its lead when it comes to autonomous driving capabilities and is highly unlikely to achieve the sales and EBITDA targets Cathie Wood has laid out.

To make matters worse, Tesla is losing its grip in the EV space with competition coming out of the woodwork. After kicking off a price war last year that saw Tesla slash the price of its EV models on more than a half-dozen occasions, its operating margin has, predictability, plummeted. The kick in the pants is that these price cuts haven’t halted a rise in global EV inventory for the company.

Last but not least, a progressively larger percentage of the company’s pre-tax income can be traced to regulatory tax credits sold to other automakers and interest income on its cash position. These are unsustainable sources of income and not what you’d expect from a market leader.

Suffice it to say, I don’t believe Tesla is the “next Nvidia.”

Mobileye Global: Implied upside of 216%

The other AI stock with tantalizing upside that could make Nvidia yesterday’s news is advanced driver assistance systems (ADAS) and autonomous driving technologies company Mobileye Global (NASDAQ: MBLY). Noticing the next-gen vehicle/EV trend yet?

Evercore ISI global automotive and mobility analyst Chris McNally believes Mobileye stock can jump to $35 per share. Though this is below its record-closing high, it would represent a jaw-dropping 216% increase from where shares are trading at the time of this writing.

The optimism surrounding Mobileye has to do with the ongoing addition of technology and driver safety features with each new generation of vehicles — especially electric vehicles. The company’s lineup of EyeQ chips is being leaned on to power SuperVision, an end-to-end ADAS system enabled by 11 cameras and autonomous vehicle maps that learn over time.

While there’s plenty of excitement surrounding this technology, the EV industry is running into challenges that typically plague early stage innovations. The lack of available EV infrastructure, among other factors, has weakened global EV sales in recent quarters and led to reduced demand for Mobileye’s solutions.

Mobileye Global also pointed to a key customer outside of China delaying the launch of its ADAS system, as well as new tariffs in Europe and the U.S., as added reasons it’s had to temper its sales guidance of late. The company’s full-year sales guide of $1.64 billion at the midpoint is well below the peak of $1.96 billion that had once been expected in 2024.

If there’s a silver lining for Mobileye Global, it’s that the company closed out the second quarter with $1.2 billion in cash and cash equivalents and had no debt on its balance sheet. Even with lumpy near-term orders, Mobileye possesses exceptional financial flexibility.

Though it could take some time for ADAS technology demand to mature, Mobileye’s solutions look well-positioned for eventual success.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Tesla. The Motley Fool recommends Mobileye Global. The Motley Fool has a disclosure policy.

Nvidia Is Yesterday’s News: These 2 Artificial Intelligence (AI) Stocks Are Poised to Skyrocket Up to 1,050%, According to Select Wall Street Pundits was originally published by The Motley Fool

Automatic Immunoassay Analyzer Market to Reach $51.4 Billion, Globally, by 2033 at 15.3% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 19, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Automatic Immunoassay Analyzer Market by Product (Immunofluorescence, Chemiluminescence, Enzyme Linked Fluorescent System and Others), by Application (Infectious Diseases, Endocrinology, Drug Monitoring, Chronic Diseases, Allergy Testing and Others), and End User (Hospitals, Diagnostic Laboratories, Pharmaceutical and Biotechnology Companies and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the automatic immunoassay analyzer market was valued at $12.3 billion in 2023, and is estimated to reach $51.4 billion by 2033, growing at a CAGR of 15.3% from 2024 to 2033.

Request Sample of the Report on Automatic Immunoassay Analyzer Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A323969

Prime determinants of growth

Increase in prevalence of chronic diseases, rise in technological advancements, and rise in geriatric population are the major factors that drive the growth of the automatic immunoassay analyzer market growth. However, limited availability of skilled personnel poses a significant restraint on the growth of the automatic immunoassay analyzer market. Moreover, growth opportunities in emerging markets offer remunerative opportunities for the expansion of the global automatic immunoassay analyzer market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $12.3 billion |

| Market Size in 2033 | $51.4 billion |

| CAGR | 15.3% |

| No. of Pages in Report | 228 |

| Segments Covered | Product, Application, End User, and Region. |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323969

Segment Highlights

Rise in adoption of chemiluminescence segment

By product, the chemiluminescence segment is driven by its ability to offer highly sensitive and specific detection of analytes. This technology utilizes light emission from chemical reactions to quantify biomolecules, making it ideal for applications requiring precise measurement of low-concentration substances in complex biological samples. Chemiluminescence-based analyzers provide advantages such as wide dynamic range, rapid assay turnaround times, and automation capabilities, which streamline laboratory workflows. These attributes are particularly valuable in clinical diagnostics, pharmaceutical research, and biotechnology, where accurate and efficient analysis of biomarkers is essential. As a result, the chemiluminescence segment is witnessing increasing adoption and is poised to contribute significantly to the growth of the segment.

Increase in demand for automatic immunoassay analyzer technology in infectious diseases

By application, the infectious diseases segment had a significant market share in 2023. This is attributed to the rise in prevalence of infectious diseases. In addition, growing awareness of infectious diseases and the importance of early diagnosis have led to an increased demand for advanced diagnostic technologies which further support the segment growth.

Rise in adoption of automatic immunoassay analyzer in pharmaceutical and biotechnology companies

By end user, the pharmaceutical and biotechnology companies segment is poised for significant growth in the automatic immunoassay analyzer market due to its increasing demand for advanced diagnostic tools and technologies. These companies require accurate and efficient diagnostic solutions to support their research and development efforts, drug discovery processes, and clinical trials. Automatic immunoassay analyzers provide reliable and rapid results, which are crucial for pharmaceutical and biotechnology companies in ensuring the safety and efficacy of their products. In addition, the automation capabilities of these analyzers help streamline workflow and reduce human error, contributing to improved operational efficiency and cost-effectiveness in laboratory settings. Thus, the pharmaceutical and biotechnology companies segment is expected to drive substantial growth in the automatic immunoassay analyzer market.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323969

Regional Outlook

North America to dominate by 2033

North America is poised to lead the growth in the automated analyzer market due to high healthcare infrastructure, high healthcare spending, and a strong emphasis on technological advancements. Rising prevalence of chronic diseases, such as diabetes and cardiovascular disorders, drives demand for automated analyzers for efficient diagnostic solutions. In addition, the presence of leading healthcare and pharmaceutical companies fosters innovation and adoption of advanced medical technologies which further supports the market growth.

Key Players

- Meril Life Sciences Pvt. Ltd.

- F. Hoffmann-La Roche Ltd

- Carolina Liquid Chemistries

- Becton Dickinson and Company,

- Bio-Rad Laboratories, Inc

The report provides a detailed analysis of these key players in the global automatic immunoassay analyzer market. These players have adopted different strategies such as product approval, product approvals, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A323969

Recent Developments in Automatic Immunoassay Analyzer Industry

- In July 2023, Beckman Coulter Diagnostics received FDA clearance for the DxC 500 AU Chemistry Analyzer, expanding its clinical chemistry offerings. It is designed for small-to-medium-sized labs. This automated analyzer optimizes workflows and supports critical clinical decisions, showcasing the company’s commitment to innovation in in vitro diagnostics.

Trending Reports in Healthcare Industry:

Neurostimulation Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Alopecia Treatment Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Thyroid Function Test Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Protein Expression Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nio Is About to Shift Into a Higher Gear

If you’ve been along for the Nio (NYSE: NIO) investment ride since the beginning, it hasn’t been for the faint of heart. There have been wild ups and downs, bankruptcy rumors, and capital raises. Despite all the twists and turns, it was easy to buy into the early hype, especially considering China’s electric vehicle (EV) market is years ahead of the United States’ and Nio’s luxury vehicles are well-received by consumers.

Now, the company might be kicking things into a higher gear — let’s dig in.

What have you done for me lately?

Speaking of ups and downs, despite plunging 54% during the first half of 2024, Nio just turned in an excellent second-quarter earnings result. Here are some of the highlights before we look at how the company could shift into a higher gear.

Second-quarter vehicle deliveries checked in at 57,373 units, which was split between 32,562 premium electric SUVs and 24,811 premium electric sedans. Its vehicle deliveries result represented a staggering 143.9% increase year over year and a 90.9% increase from the first quarter of 2024.

The company’s vehicle margins checked in at 12.2% during the second quarter, comparing favorably to the prior year’s 6.2% mark and the first quarter’s 9.2% figure. Revenue totaled $2.4 billion, which marked a 98.9% year-over-year increase and a 76.1% jump from the first quarter. And perhaps best of all, its net loss narrowed 16.7% year over year to $694.4 million.

Nio’s CEO, William Bin Li, doesn’t expect the momentum to slow from its record second quarter delivery figure, saying, “The total delivery volume for the third quarter is expected to set another record, further solidifying and expanding market share.”

What’s next?

After Nio unveiled its second brand’s first model — the L60 — in May, the vehicles just started rolling off the assembly line, and deliveries will begin shortly. Even thought it’s just one model, it’s expected to be a huge step for the company as it hopes the L60 can attack Tesla‘s Model Y market share in China.

The Onvo L60’s price will undercut the Model Y by about $4,000 in China. The company is also opening over 100 Onvo stores soon, a move that should help drive the vehicle into consumer hands. The company hopes the Onvo brand will help drive its current sales momentum higher; NIO has delivered 128,100 vehicles through August, a 35.8% year-over-year increase.

Higher gear?

Not only is Onvo expected to help fuel Nio’s momentum, it could be only the first step in that push. Consider that an even more affordable Nio brand is on the way, named Firefly, which could challenge the industry with price tags between $14,000 and $28,000.

Nio already has momentum, posted a strong second quarter, and has two brands poised to shift the company into a higher gear — investors today have good reason to be optimistic about the EV maker’s prospects in the months and years ahead.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Nio Is About to Shift Into a Higher Gear was originally published by The Motley Fool

Fuel Cards Market to Reach $1,329.92 Billion, Globally, by 2032 at 5.8% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 19, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, ”Fuel Cards Market by Type (Branded, Universal and Merchant Fuel Cards), and Application (Fuel Refill, Parking, Vehicle Service, Toll Charge and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032″. According to the report, the “fuel cards market” was valued at $735 billion in 2022, and is projected to reach $2.8 trillion by 2032, growing at a CAGR of 14.4% from 2023 to 2032.

Get Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/2969

The necessity for improved fuel management and the penetration of digital transaction solutions drives the growth of the market. In addition, the rise in the adoption of banking & financial sectors across the globe fuels the growth of the market. Moreover, the increase in demand from developing countries is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, the lack of security measures limits the growth of the fuel cards market.

The universal segment held the highest market share in 2022.

By type, the universal segment dominated the market in 2022. This segment’s prominence is due to the broad acceptance and versatility of universal fuel cards, which can be used at a wide range of fuel stations and service providers. Universal fuel cards offer significant convenience for businesses and individual users by allowing them to access various networks without being restricted to specific brands or locations. However, the merchant segment is expected to witness the largest CAGR of 15.7%, this anticipated growth is driven by several key factors. First, merchants, including gas stations and convenience stores, are increasingly adopting fuel card solutions to streamline payment processes, enhance transaction efficiency, and offer value-added services to customers.

The fuel refill segment held the highest market share in 2022.

By application, the fuel refill segment accounted for the largest share in 2022. This dominance is attributed to the fundamental role that fuel refills play in the daily operations of both individual vehicle owners and fleet managers. Fuel cards simplify the process of purchasing fuel by providing a streamlined, cashless transaction method that is both efficient and convenient. However, the others segment is expected to witness the largest CAGR of 16.2%. This growth is driven by the increasing integration of fuel card solutions with comprehensive fleet management systems, which include the procurement of spare parts. Companies are seeking to streamline operations by using fuel cards not only for managing fuel expenses but also for efficiently handling spare parts procurement and maintenance costs.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/2969

Regional Insights: The Europe region held the highest market share in 2022.

By region, the fuel cards market was dominated by Europe in 2022. Europe has a well-established infrastructure for fuel card usage, driven by high adoption rates across various industries, including transportation and logistics. The region’s mature market benefits from extensive networks of fuel stations that accept fuel cards, along with robust regulatory frameworks that support the use of such financial tools.

Key Industry Developments

•In September 2024, RBL Bank launched the ‘Xtra Credit Card’ in partnership with Indian Oil Corporation, offering customers up to 8.5% savings on fuel purchases. The bank expects a moderate growth of 12-15% in its credit card portfolio this fiscal year. The card will be issued via the Mastercard network and offers significant fuel points for every rupee spent.

In June 2024, WEX partnered with EG America, the WEX EDGE savings network includes pre-negotiated fuel discounts at participating locations nationwide and savings on other essential products and services to keep businesses moving more efficiently.

•In November 2021, Shell Oil Company (Shell) acquired MSTS Payments, LLC and its Multi Service Fuel Card business from Multi Service Technology Solutions, Inc. (dba TreviPay). The Multi Service Fuel Card acceptance network and transaction processing platform provide Shell with a closed-loop payment network used by Commercial Road Transport (CRT) companies at thousands of trucks stops in North America.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fuel cards market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of fuel cards market outlook.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fuel cards market segmentation assists in determining the prevailing fuel cards market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global fuel cards market trends, key players, market segments, application areas, and market growth strategies.

Get Your Personalized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/2969

Fuel Cards Market Report Highlights:

By Type

By Application

By Region

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Key Market Players

Puma Energy, FleetCor Technologies, Inc., U.S. Bancorp, Exxon Mobil Corporation, FirstRand Limited, BP p.l.c., Royal Dutch Shell PLC, WEX Inc., Engen Petroleum Ltd., Libya Oil Holdings Ltd.

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Forex Prepaid Cards Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by End User : Global Opportunity Analysis and Industry Forecast, 2023-2032

Contactless Smart Cards Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Functionality, by Industry Vertical : Global Opportunity Analysis and Industry Forecast, 2023-2032

Digital Gift Card Market Size, Share, Competitive Landscape and Trend Analysis Report, by Channel, by Transaction Type, by Card Type, by Application Area, by End Users : Global Opportunity Analysis and Industry Forecast, 2023-2032

Gift Cards Market Size, Share, Competitive Landscape and Trend Analysis Report, by Card Type, by End User : Global Opportunity Analysis and Industry Forecast, 2023-2032

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Collegium Pharmaceutical Insider Trades Send A Signal

On September 17, a recent SEC filing unveiled that Thomas B Smith, EVP and Chief Medical Officer at Collegium Pharmaceutical COLL made an insider sell.

What Happened: Smith’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday unveiled the sale of 9,593 shares of Collegium Pharmaceutical. The total transaction value is $351,319.

During Wednesday’s morning session, Collegium Pharmaceutical shares up by 2.51%, currently priced at $38.32.

Delving into Collegium Pharmaceutical’s Background

Collegium Pharmaceutical Inc is a specialty pharmaceutical company. The company is engaged in developing and planning to commercialize abuse-deterrent products that incorporate its patented DETERx platform technology for the treatment of chronic pain and other diseases. The DETERx platform technology is designed to maintain the extended-release and safety profiles of highly abused drugs in the face of various methods including chewing, crushing, and dissolving. Its product portfolio includes Xtampza ER, which is an abuse-deterrent, extended-release, oral formulation of oxycodone; and Nucynta Products, which are extended-release and immediate-release formulations of tapentadol; Belbuca, and Symproic.

Key Indicators: Collegium Pharmaceutical’s Financial Health

Revenue Growth: Collegium Pharmaceutical’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 7.18%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 62.51%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Collegium Pharmaceutical’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.6.

Debt Management: Collegium Pharmaceutical’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.58, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 14.05 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.9, Collegium Pharmaceutical’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 4.17 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Collegium Pharmaceutical’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

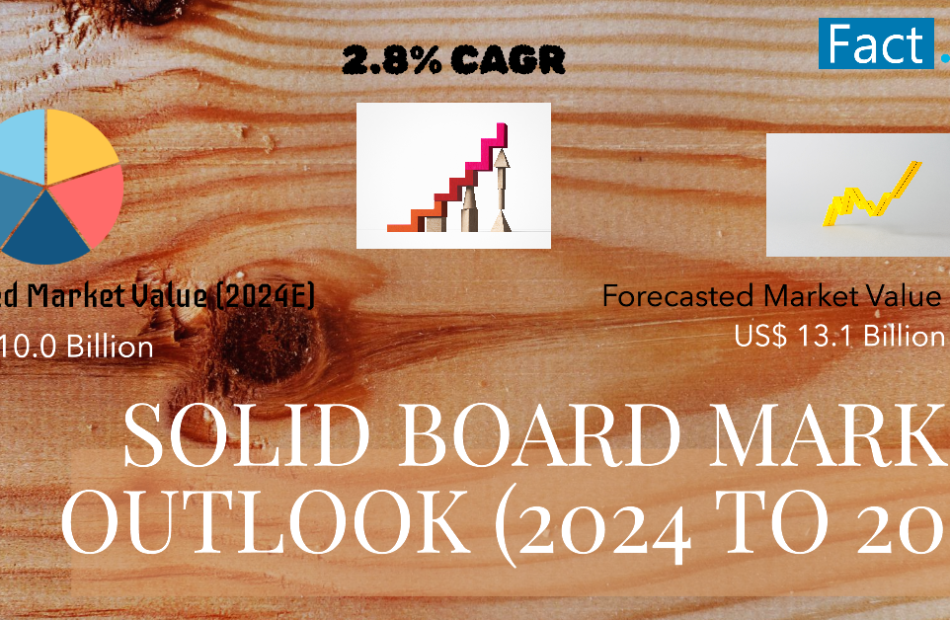

Solid Board Market is Set to Surge at 2.8% CAGR, to Reach US$ 13.1 Billion by 2034 | Fact.MR Report

Rockville, MD , Sept. 19, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Solid Board Market is estimated to reach a valuation of US$ 10.0 billion in 2024 and is expected to grow at a CAGR of 2.8% during the forecast period of (2024 to 2034).

Solid board has been used since its inception as the best packing material for production. Solid board packaging is used in many industries, such as electronics, construction, and food & beverage. Utilizing solid boards gives products and packaging a major competitive edge over alternative kinds. Products that need to be kept safe, such food, medical supplies, electronics, and other delicate objects, are usually packaged using solid board.

It is anticipated that the market for solid board would grow in response to consumers’ growing need for flexible and lightweight packaging. The rise in promotional packaging, which includes boxes, layer pads, and pop displays, suggests that solid boards will continue to rise in the years to come.

Demand for the solid board industry is driven by growing e-commerce and disposable money. Additionally, the solid board industry may benefit from the movement toward eco-friendly products and a distaste for things made of plastic.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10359

Key Takeaways from Market Study:

- The global Solid board market is projected to grow at 2.8% CAGR and reach US$ 13.1 billion by 2034

- The market created an opportunity of US$ 3.2 billion between 2024 to 2024

- East Asia is a prominent region that is estimated to hold a market share of 33.1% in 2024

- The sale for Food and beverages under end use industry is estimated at a CAGR of 2.7% creating an absolute $ opportunity of US$ 1.0 billion between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 2.0 billion collectively

“The demand for solid board is also expected to rise as more eco-friendly packaging solutions are used and the online shopping sector grows. The solid board market is likely to become one of the most popular options among producers refocusing their efforts on greener products”, says a Fact.MR analyst.

Leading Players Driving Innovation in the Solid Board Market:

Key players in the solid board market are International Paper Company, Mayr-Melnhof Karton AG, Smurfit Kappa Group Plc, Mondi Group, DS Smith Packaging Limited, Georgia Pacific LLC, WestRock Company, Rengo Co.Ltd, Stora Enso, Billerudkorsnas AB, Other Prominent Players.

Market Development

Recent innovations include, In April 2024, International Paper and DS Smith Plc announced that they had achieved an agreement on the parameters of a recommended all-share merger, resulting in a genuinely global leader in sustainable packaging solutions.

- In Oct 2022, The Mayr-Melnhof group has successfully acquired the Essentra Packaging Company and all entities connected to it. This perfectly complements the current position of MM Packaging in pharmaceutical packaging in the Nordics and France.

- In March 2022, The acquisition of Verso by BillerudKorsnäs was completed for about US$ 825 million in cash. It is among the largest manufacturers of North America in the coated paper segment.

Solid Board Industry News:

A significant portion of many businesses’ revenue is allocated to research and development (R&D) in the hopes of developing novel solutions or finding new clients who would support their continued existence. In order to counter others, businesses are creating specialized solutions to challenges that meet industry demands.

- International Paper and DS Smith Plc declared in April 2024 that they had reached a consensus over the terms of an all-share merger that would create a truly worldwide leader in environmentally friendly packaging.

- International Paper purchased two of Spain’s top corrugated box manufacturers in March 2021. These are the kinds of solutions that will enable the house to grow beyond the nation’s industrial centers, specifically Madrid and Catalonia.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10359

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global solid board market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of Material Type (Recycled Paper, Virgin Paper), Weight (Up to 200 GSM, 201 to 300 GSM, 301 to 500 GSM, Above 500 GSM), Application (Boxes, POP Display, Edge Protectors, Trays, Layer Pads), End Use Industry (Electrical and Electronics, Health care and Pharmaceuticals, Cosmetics and Personal care, Food and Beverages, Other Industrial Packaging, Building and Construction, Tobacco Packaging) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Solid Board Industry Research:

By Material Type :

- Recycled Paper

- Virgin Paper

By Weight :

- Up to 200 GSM

- 201 to 300 GSM

- 301 to 500 GSM

- Above 500 GSM

By Application :

- Boxes

- POP Display

- Edge Protectors

- Trays

- Layer Pads

By End Use Industry :

- Electrical and Electronics

- Health care and Pharmaceuticals

- Cosmetics and Personal care

- Food and Beverages

- Confectionery

- Fresh Produce

- Milk and Dairy

- Frozen Food

- Meat and Poultry

- Building and Construction

- Tobacco Packaging

- Other Industrial Packaging

Check out More Related Studies Published by Fact.MR:

Combine Harvester Market: Size is evaluated to reach US$ 8.85 billion in 2024. The global market is forecasted to advance at a CAGR of 3.9% and reach a value of US$ 12.97 billion by the end of 2034.

Centrifugal Industrial Dryer Market: Size is projected to reach US$ 426.8 million by the end of 2034 from US$ 267.1 million in 2024, further advancing at a CAGR of 4.8% from 2024 to 2034, as opined in newly published Fact.MR report.

Vibratory Hammer Market: Size is projected to reach US$ 649.4 million in 2024. The market is analyzed to increase to a size of US$ 1.12 billion by the end of 2034, expanding at a CAGR of 5.6% over the next ten years (2024 to 2034).

Battery Operated Smoke Detector Market: Size is projected to generate revenue of US$ 2.41 billion in 2024 and reach a value of US$ 5.4 billion by 2034-end. The market has been forecasted to increase at a CAGR of 8.4% between 2024 and 2034.

Li-Ion Pouch Battery Market: Size is projected to reach US$ 69.13 billion in 2024. The market has been forecasted to reach a value of US$ 174.48 billion by the end of 2034, expanding at a CAGR of 9.7% over the next ten years.

Fiberboard Market: Size is anticipated to grow at a compound annual growth rate (CAGR) of 8.1%, from a valuation of US$ 31.04 billion in 2024 to US$ 67.63 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

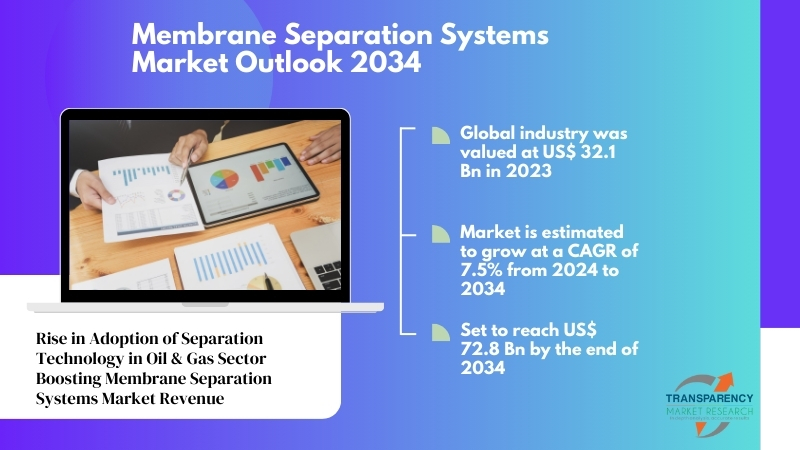

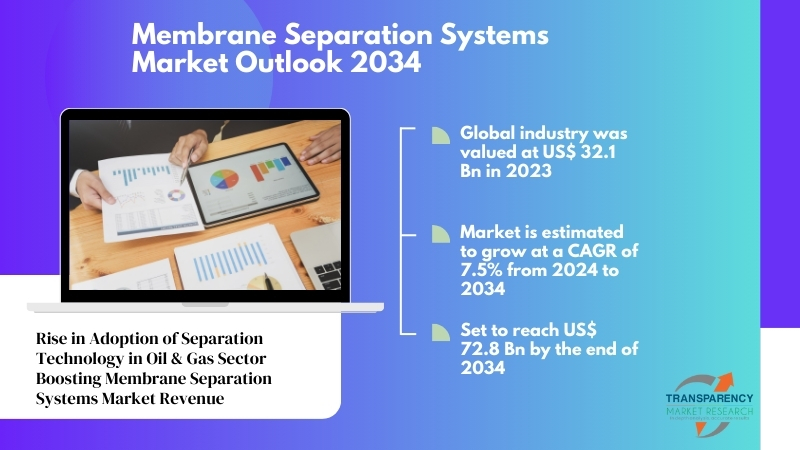

Membrane Separation Systems Market Size is Expected to Reach USD 72.8 billion, Advancing at a CAGR of 7.5% by 2034: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 19, 2024 (GLOBE NEWSWIRE) — The global membrane separation systems market (막 분리 시스템 시장) is estimated to flourish at a CAGR of 7.5% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for membrane separation systems is estimated to reach US$ 72.8 billion by the end of 2034.

The rise of decentralized water treatment systems is gaining traction, particularly in remote or underdeveloped regions. These systems offer cost-effective solutions for small communities and industries. The emergence of forward osmosis as a promising technology is creating new opportunities. It offers advantages such as lower energy consumption and reduced membrane fouling compared to traditional methods.

The increasing demand for membrane bioreactors (MBRs) in wastewater treatment is a notable trend. MBRs combine biological treatment with membrane filtration, offering higher efficiency and smaller footprint compared to conventional wastewater treatment plants. The integration of artificial intelligence and data analytics in membrane systems is enhancing operational efficiency and predictive maintenance capabilities, reducing downtime and operational costs.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/membrane-separation-market.html

The growing application of membrane separation systems in emerging sectors such as renewable energy production, biotechnology, and gas separation is expanding the market’s horizons, driving innovation and diversification within the industry.

Membrane Separation Systems Market: Competitive Landscape

In the competitive landscape of the global membrane separation systems market, key players vie for market share through strategic initiatives such as mergers and acquisitions, product innovations, and partnerships. Companies like DuPont de Nemours, Inc., Suez SA, and Koch Membrane Systems, Inc. dominate the market with their extensive product portfolios and global presence.

Emerging players focus on niche segments and technological advancements to gain a competitive edge. Market dynamics such as increasing demand for water and wastewater treatment solutions, stringent environmental regulations, and the need for sustainable processes drive competition, compelling companies to innovate and differentiate their offerings to meet evolving customer needs. Some prominent players are as follows:

- 3M

- Advantec MFS Inc.

- Amazon Filters Ltd

- Koch Membrane Systems Inc.

- GE Healthcare

- Merck Millipore (Merck KGaA)

- Sartorius AG

- Pall Corporation

- Novasep

- TriSep Corporation (Microdun-Nadir US Inc.)

Product Portfolio

- 3M offers innovative solutions in consumer, industrial, and healthcare sectors. From adhesive products to advanced filtration technologies, 3M’s diverse portfolio caters to various needs. With a commitment to sustainability and quality, 3M continues to redefine industries worldwide.

- Advantec MFS Inc. specializes in manufacturing high-quality filtration products. Their range includes membranes, syringe filters, and filter papers, ensuring precise filtration across diverse applications. With a focus on reliability and efficiency, Advantec MFS, Inc. delivers trusted solutions for laboratory and industrial filtration needs.

- Amazon Filters Ltd excels in providing cutting-edge filtration solutions for industrial processes. From pharmaceuticals to food and beverage industries, their products ensure purity and efficiency. With a dedication to innovation and customer satisfaction, Amazon Filters Ltd remains a trusted partner for critical filtration challenges worldwide.

Key Findings of the Market Report

- Reverse osmosis leads the membrane separation systems market due to its widespread applications in water treatment, desalination, and industrial processes.

- The healthcare segment leads the membrane separation systems market due to demand for purification, sterilization, and separation processes in medical applications.

- Polyethersulfone (PES) emerges as a leading material segment in the membrane separation systems market due to its high chemical and thermal resistance.

Membrane Separation Systems Market (Marché des systèmes de séparation par membrane) Growth Drivers & Trends

- Rising environmental concerns and stringent regulations regarding water quality and industrial waste drive the demand for membrane separation systems.

- Technological advancements enhance efficiency and broaden applications across industries.

- Increasing focus on sustainability and resource conservation fuels market growth.

- Growing population and urbanization amplify the need for clean water and efficient filtration solutions.

- Expansion of key industries such as pharmaceuticals, food and beverage, and healthcare further propel market demand.

Global Membrane Separation Systems Market: Regional Profile

- In North America, stringent environmental regulations and a focus on sustainability drive the demand for membrane separation systems. The region boasts a mature market, characterized by extensive adoption of advanced technologies in water and wastewater treatment, pharmaceuticals, and food and beverage industries.

- Europe, similarly, showcases a robust market for membrane separation systems, fueled by a strong emphasis on resource conservation and environmental protection. Stringent regulations pertaining to water quality and industrial effluent discharge further stimulate market growth.

- Increasing investments in research and development activities contribute to technological advancements, enhancing the efficiency and versatility of membrane separation systems across various applications.

- The Asia Pacific region, with its rapid industrialization and population growth, presents significant opportunities for market expansion. Increasing urbanization, coupled with growing concerns regarding water scarcity and pollution, propels the adoption of membrane separation systems across industries such as water treatment, healthcare, and food processing.

- Government initiatives aimed at improving water quality and promoting sustainable practices further drive market growth in the region.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/membrane-separation-market.html

Membrane Separation Systems Market: Key Segments

By Technology

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Chromatography

- Ion Exchange

By Application

- Environmental

- Food & Beverages

- Healthcare

- Others (Energy, Electrical & Electronics, Mining, Dairy, Chemical, etc.)

By Material

- Polyethersulfone (PES)

- Polysulfone (PS)

- Cellulose-based

- Nylon

- Polypropylene (PP)

- Polyvinylidene Fluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Polyacrylonitrile (PAN)

- Polyvinyl Chloride (PVC)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

Electric Actuator Market (電動アクチュエータ市場) is projected to reach US$ 20.9 billion, Expanding at a CAGR of 6.1% between 2023 and 2031.

Programmable Logic Controller (PLC) Market (Markt für speicherprogrammierbare Steuerungen (SPS).) is expected to accumulate a Value of US$ 17.2 Bn by Registering a CAGR of 4.7% in the Forecast Period 2023 to 2031: TMR Study

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.