2 Vanguard Index Funds Could Turn $400 Per Month Into $16,800 in Annual Dividend Income by Retirement

The S&P 500 (SNPINDEX: ^GSPC) outperformed virtually every other asset classes over the last decade, including bonds, international stocks, precious metals, and real estate. The index also outperformed over 85% of large-cap funds, meaning S&P 500 index funds often produce better returns than professional money managers.

Investors can use that information to build a portfolio that generates large amounts of passive income. For instance, $400 invested monthly in an S&P 500 index fund could grow into $789,500 over three decades. That sum could then be reinvested (less capital gains tax) in a high dividend yield index fund to generate $16,800 in passive income annually.

Here are the important details.

Step 1: Invest $400 per month in the Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is a low-cost S&P 500 index fund. It measures the performance of 500 U.S. companies that cover approximately 80% of domestic equities and more than 50% of global equities by market capitalization. In other words, it lets investors spread capital across many of the most influential businesses in the world.

The five largest holdings in the Vanguard S&P 500 ETF are listed by weight below:

-

Apple: 6.9%

-

Microsoft: 6.5%

-

Nvidia: 6.2%

-

Alphabet: 3.7%

-

Amazon: 3.4%

The S&P 500 returned 2,000% during the last three decades, which equates to 10.6% annually. I’ll round down to 10% to introduce a margin of safety. At that rate of return, $400 invested monthly in the Vanguard S&P 500 ETF would be worth $789,500 after three decades. Investors can then sell the index fund and reinvest the proceeds in another fund.

Depending on the account type, investors may have to pay capital gains tax when they sell the Vanguard S&P 500 ETF. The federal taxes on that amount would total about $100,000, but the state taxes would vary. So, I’ll round the total tax burden to $150,000, which leaves $639,500 to reinvest in another index fund with a high dividend yield.

Step 2: Invest $639,500 in the Vanguard High Dividend Yield ETF

The Vanguard High Dividend Yield ETF (NYSEMKT: VYM) measures the performance of 550 U.S. companies that are forecasted to pay above-average dividends. Whereas the Vanguard S&P 500 ETF includes value stocks and growth stocks, this index fund leans heavily toward value stocks. The five largest holdings are listed by weight below:

-

Broadcom: 4.2%

-

JPMorgan Chase: 3.6%

-

ExxonMobil: 3%

-

Procter & Gamble: 2.3%

-

Johnson & Johnson: 2.2%

The Vanguard High Dividend Yield ETF currently pays a dividend yield of 2.63%. At that rate, the $639,500 from the previous section would generate about $16,800 in annual dividend income. And the payout should increase over time.

The Vanguard High Dividend Yield ETF returned 88% over the last decade. At that pace, the total amount invested in the index fund would reach $1.2 million in 10 years, and that total would generate about $31,600 in annual dividend income.

Most people should save more than $400 per month

The median American worker earned $69,240 in after-tax income in 2023, according to the Census Bureau. Financial planners generally recommend saving 20% of after-tax income for retirement. That means the median worker should be saving $13,848 per year, or $1,154 per month.

In that context, $400 per month is a reasonable goal for most people. It would also leave the median worker with $754 per month in additional savings, which could be invested in stocks or other index funds. Either way, the end result should be a sizable nest egg that pays five digits of passive income annually by retirement.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Amazon, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, JPMorgan Chase, Microsoft, Nvidia, Vanguard S&P 500 ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Broadcom and Johnson & Johnson and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Vanguard Index Funds Could Turn $400 Per Month Into $16,800 in Annual Dividend Income by Retirement was originally published by The Motley Fool

Walmart To Offer Pay-By-Bank Feature For Online Transactions, With Launch In 2025

Walmart Inc. WMT is reportedly sweetening its pay-by-bank feature in Walmart Pay, allowing customers to pay directly from their checking accounts rather than debit cards, with transactions instantly reflected in their bank accounts.

With this update, Walmart will receive the funds instantly, reported Bloomberg.

Walmart’s new pay-by-bank offering will be launched in 2025.

The dealings will occur over Fiserv Inc FI’s NOW Network, which incorporates The Clearing House’s Real Time Payments network and the Federal Reserve’s FedNow.

According to Benzinga Pro, WMT stock has gained over 43.9% in the past year. Investors can gain exposure to the stock via SPDR Select Sector Fund – Consumer Staples XLP and Fidelity MSCI COnsumer Staples Index ETF FSTA.

Also Read: Walmart Steps Up Holiday Game, Inflation-Free Thanksgiving Meal Returns

The company is gearing up for the holiday season with new initiatives aimed at convenient shopping habits.

Leading the charge is the return of its inflation-free Thanksgiving meal, priced lower than last year, set to launch on Oct. 14.

This year, the retailer also introduced a “buy one, give one” donation feature, allowing customers to easily contribute meals to those in need.

Walmart said it is also expanding its delivery services, reaching an additional 12 million households, which will provide enhanced speed and convenience for customers looking to shop from the comfort of their homes.

Earlier this week, Sam’s Club, the $86-billion warehouse club division of Walmart, introduced a fresh workforce compensation plan, which boosted pay for close to 100,000 frontline associates and provided guidance for longer-term financial futures.

WMT Price Action: WMT shares are trading lower by 1.35% to $77.96 at last check Thursday.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mill Creek Announces Start of Preleasing at Modera Argyle

Hollywood-Based Mixed-Use Community Will Feature a Luxury Grocer

LOS ANGELES, Sept. 19, 2024 /PRNewswire/ — Mill Creek Residential, a leading developer and operator specializing in premier rental communities across the U.S., today announced that preleasing is underway at Modera Argyle, a contemporary mixed-use apartment community located in the heart of Hollywood.

The community, situated at the southeast corner of Argyle and Selma Avenue, features 276 homes and approximately 23,000 square feet of retail space, which includes Bristol Farms, a luxury grocer. Positioned one block south of Hollywood Boulevard, Modera Argyle also includes 7,500 square feet of luxury amenity space. First move-ins are anticipated for October.

“We look forward to joining the charismatic Hollywood area, which will always possess a unique niche as an emblem of the entertainment industry,” said Ryan Guthrie, senior managing director of development in Southern California for Mill Creek Residential. “Given the vibrant energy of the city’s residents, we believe Modera Argyle will quickly become a popular destination among renters and visitors alike. We’re excited to offer a top-of-market experience and further expand our presence in the greater LA area.”

Positioned at 6220 Selma Avenue, Modera Argyle is surrounded by many of the world-famous city’s most notable attractions. That includes the Walk of Fame, the Hollywood & Highland shopping mall, Hollywood Palladium, Pantages Theatre, Hollywood Bowl, Los Angeles Film School and several prominent theaters. Included are TCL Chinese Theatre and Dolby Theatre. The community is also within seven miles of Crypto.com Arena and six miles from Dodger Stadium.

Modera Argyle sits in a commuter-friendly location with near-direct access to the Red Line of the Metro Rail system. Several key thoroughfares also flank the community, including the U.S. 101 freeway, Sunset Boulevard and Hollywood Boulevard. The area’s A-list employers include Apple, Netflix, Disney, ABC and Universal Studios.

Modera Argyle features studio, one-, two- and three-bedroom homes with an average size of approximately 750 square feet and penthouse layouts available. Community amenities include a rooftop pool deck with views of the Hollywood sign, clubroom with shuffleboard, club-quality fitness center, coworking space, conference room, two private offices, demonstration kitchen, Ping-Pong table and pet spa. Residents will also have access to controlled-access subterranean parking, self-serve package locker system, dedicated bike storage and additional storage options.

Apartment interiors offer a variety of deluxe features and finishes, including nine-foot ceilings, wood-plank flooring, stainless steel appliances, quartz countertops, chef’s islands, custom cabinetry, tile backsplashes, upgraded fixtures and in-home washers and dryers. Spacious bedrooms include walk-in closets and built-in storage while bathrooms include frameless glass showers with tile surrounds and soaking tubs. Smart home technology includes keyless entry, USB outlets and smart thermostats.

About Mill Creek Residential

Mill Creek Residential Trust LLC is a national rental housing company focused on developing, acquiring, and operating rental communities in targeted markets nationwide. The national company, headquartered in Boca Raton, Florida, proactively develops, acquires, constructs, and operates communities through its seasoned team of real estate professionals in offices across the United States. Mill Creek is building its portfolio in many of the nation’s most desirable markets in Seattle, Portland, the San Francisco Bay area, Sacramento, Southern California, Phoenix, Denver, Dallas, Austin, Houston, South Florida, Tampa, Orlando, Atlanta, Nashville, Charlotte, Raleigh, Washington, D.C., New Jersey, New York, and Boston. As of June 30, 2024, the company’s portfolio comprises 145 communities representing over 41,350 rental homes operating and/or under construction. For more information, please visit www.MillCreekPlaces.com.

Media Contact

Stephen Ursery

LinnellTaylor Marketing

(303) 682-3945

stephen@linnelltaylor.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mill-creek-announces-start-of-preleasing-at-modera-argyle-302252780.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mill-creek-announces-start-of-preleasing-at-modera-argyle-302252780.html

SOURCE Mill Creek Residential

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Ultra-High-Yield Dividend Stocks With 12%-Plus Yields That Are Ideally Positioned for a Rate-Easing Cycle

One of the best aspects of putting your money to work on Wall Street is there’s no one-size-fits-all investment approach. With thousands of publicly traded companies and exchange-traded funds (ETFs) to choose from, there’s bound to be one or more securities that can help you reach your goal(s).

But among the countless ways to build wealth on Wall Street, few strategies have proved more consistently successful than buying and holding high-quality dividend stocks.

The lure of dividend stocks is simple: they’re almost always recurringly profitable and time-tested. A company that regularly shares a percentage of its profit is one that investors rarely have to worry about when going to sleep at night.

More importantly, dividend stocks have absolutely crushed non-payers in the return column over the last 50 years. A report released last year by the investment advisors at Hartford Funds (The Power of Dividends: Past, Present, and Future) compared the performance of income stocks to non-payers over the last half-century (1973-2023). What Hartford Funds found, in collaboration with Ned Davis Research, is that income stocks more than doubled up the average annual return of non-payers — 9.17% vs. 4.27% — over this span.

But this doesn’t mean investors can throw a dart at the newspaper and pick a winner. All dividend stocks are unique, and ultra-high-yielding companies (those with yields four or more times greater than the S&P 500) often come with added risk. Since yield is a function of share price, a company with a failing business model can “trap” income seekers with a lucrative but unsustainable yield.

But not all supercharged high-yield stocks are worth avoiding. With the Federal Reserve kicking off a rate-easing cycle this week, two income stocks with truly eye-popping yields of 12.5% and 13.9% are perfectly positioned to thrive.

The light at the end of the tunnel has arrived for Wall Street’s most-hated industry

While “most-hated” is a bit of a subjective term, there arguably hasn’t been an industry that analysts have disliked for a longer period than mortgage real estate investment trusts (REITs).

Mortgage REITs are companies that aim to borrow money at lower short-term lending rates and use this capital to purchase higher-yielding long-term assets, such as mortgage-backed securities (MBSs), which is how the industry got its name. The goal for mortgage REITs is to maximize their net interest margin, which is the average yield on the assets they own less their average short-term borrowing costs.

As you probably gathered, the mortgage REIT industry is highly sensitive to changes in interest rates. When the nation’s central bank began its steepest rate-hiking cycle in four decades in March 2022, it sent short-term borrowing costs soaring. The result for the mortgage REIT industry was shrinking net interest margin.

And it’s not just higher interest rates that the industry has to worry about. The velocity of monetary policy moves matters, too. If the Federal Reserve makes slow, calculated, and well-telegraphed moves, mortgage REITs have the opportunity to reposition their assets to maximize returns. But with the Fed chasing a four-decade peak in the prevailing rate of inflation, slow-stepping its rate-hiking cycle quickly went out the door.

Pretty much every publicly traded company in the mortgage REIT industry has seen its book value decline — most mortgage REITs trade very close to their respective book value — and net interest margin shrink since March 2022.

However, the light at the end of the tunnel has finally arrived for Wall Street’s most-hated industry. Annaly Capital Management (NYSE: NLY) and AGNC Investment (NASDAQ: AGNC), which sport respective yields of 12.5% and 13.9%, now have an excellent chance to outperform.

Annaly and AGNC are ideally positioned to thrive during a rate-easing cycle

With the prevailing rate of inflation cooling to 2.5% in August, the lowest reading observed since February 2021, the nation’s central bank was given every incentive in the world to undertake a rate-easing cycle.

When the Fed shifts to a dovish monetary policy and lowers the federal funds rate, it tends to reduce short-term borrowing costs and allows the net interest margin for Annaly and AGNC Investment to expand. At the same time, these two leading mortgage REITs have been able to scoop up MBSs with higher yields over the last two years, which can provide a further lift to their respective net interest margin.

Equally important, the Fed is currently walking on egg shells with regard to monetary policy. After leaving the federal funds rates at historic lows for too long and, in hindsight, overshooting to the upside in the wake of high inflation, the Federal Open Market Committee is liable to slow-step any further changes. Well-telegraphed moves will allow Annaly and AGNC to position to their portfolios for optimal success.

A rate-easing cycle would also be expected to lead to an eventual normalization of the yield curve.

Normally, the Treasury yield curve slopes up and to the right. This is to say that longer-dated bonds set to mature 30 years from now sport higher yields than Treasury bills that will mature in a year or less. We’ve recently witnessed the longest yield-curve inversion in history, with short-term yields handily outpacing long-term bonds. When the yield curve normalizes, mortgage REITs shine.

The final piece of the puzzle for Annaly Capital Management and AGNC Investment is that they predominantly invest in agency securities. An “agency” asset is one that’s backed by the federal government in the unlikely event of default.

Annaly closed out the June-ended quarter with $66 billion of its $74.8 billion portfolio tied up in highly liquid agency assets, while AGNC had all but $1 billion of its $66 billion portfolio allotted to agency MBSs and various agency securities. The added protection Annaly and AGNC enjoy from agency securities allows both companies to prudently lever their portfolios to maximize profits and sustain their outsized dividends.

Although both companies have vastly underperformed in the current bull market, Annaly and AGNC appear ready for their moment in the spotlight.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has positions in Annaly Capital Management. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks With 12%-Plus Yields That Are Ideally Positioned for a Rate-Easing Cycle was originally published by The Motley Fool

Alphabet, McDonald's And 2 Other Stocks Executives Are Selling

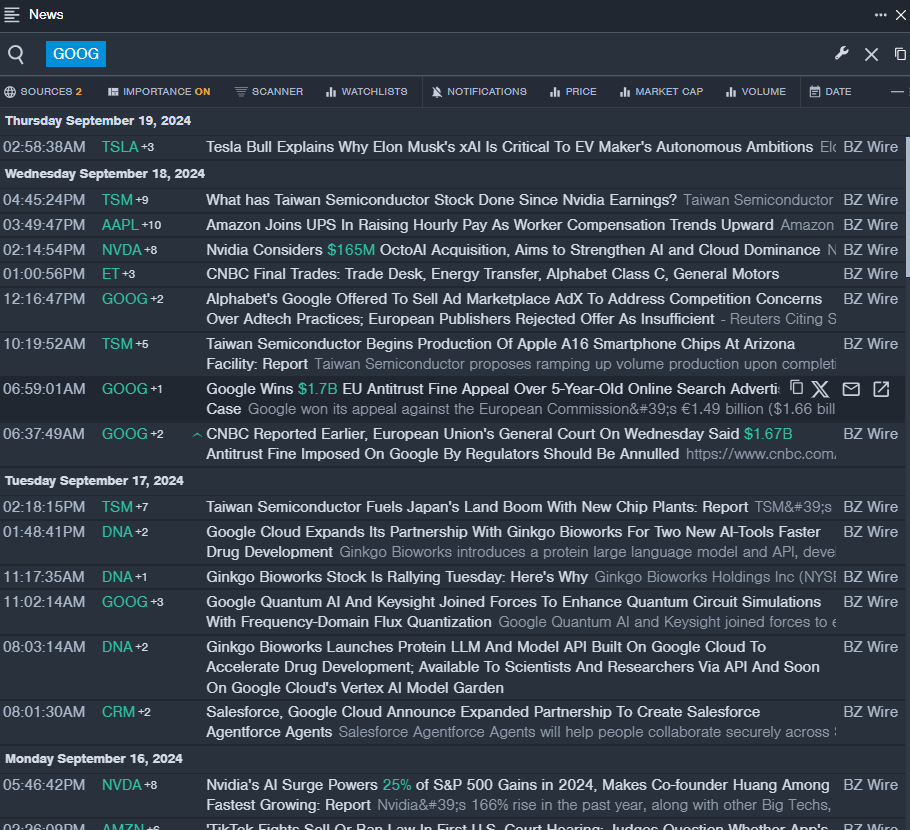

The Nasdaq 100 closed lower by around 0.5% during Wednesday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

Alphabet

- The Trade: Alphabet Inc. GOOGL GOOG CEO Sundar Pichai sold a total of 22,500 shares at an average price of $160.63. The insider received around $3.61 million from selling those shares.

- What’s Happening: Alphabet’s Google won its appeal against the European Commission’s €1.49 billion ($1.66 billion) antitrust fine for anticompetitive practices involving its online search advertising business.

- What Alphabet Does: Alphabet is a holding company that wholly owns internet giant Google.

- Benzinga Pro’s real-time newsfeed alerted to latest GOOG news.

Williams-Sonoma

- The Trade: Williams-Sonoma, Inc. WSM President and CEO Laura Alber sold a total of 40,000 shares at an average price of $145.27. The insider received around $5.8 million from selling those shares.

- What’s Happening: On Sept. 16, TD Cowen analyst Max Rakhlenko maintained Williams-Sonoma with a Buy and raised the price target from $150 to $160.

- What Williams-Sonoma Does: With a retail and direct-to-consumer presence, Williams-Sonoma is a player in the $300 billion domestic home category and $450 billion international home market, focused on expanding its exposure in the B2B ($80 billion total addressable market), marketplace, and franchise areas.

- Benzinga Pro’s charting tool helped identify the trend in WSM stock.

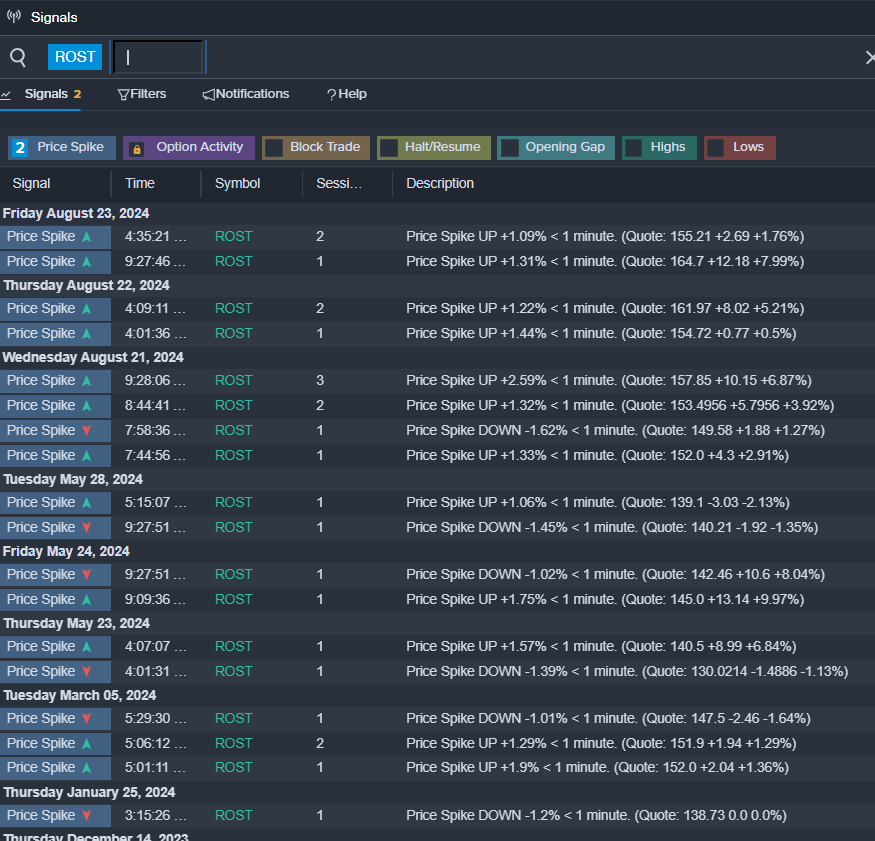

Ross Stores

- The Trade: Ross Stores, Inc. ROST Group President, COO Michael J. Hartshorn sold a total of 8,366 shares at an average price of $155.64. The insider received around $1.3 million from selling those shares.

- What’s Happening: On Aug. 22, Ross Stores reported better-than-expected second-quarter financial results and raised its FY24 EPS guidance with its midpoint above estimates.

- What Ross Stores Does: Ross Stores operates as an off-price apparel and accessories retailer with the majority of its sales derived from its Ross Dress for Less banner.

- Benzinga Pro’s signals feature notified of a potential breakout in ROST shares.

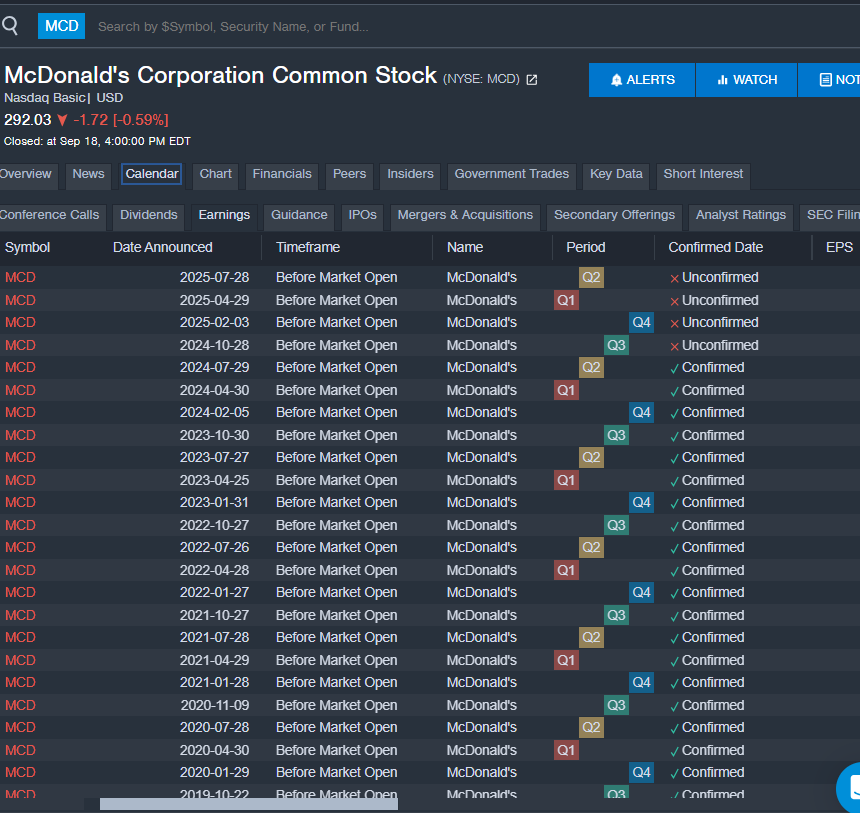

McDonald’s

- The Trade: McDonald’s Corporation MCD Chairman and CEO Christopher J Kempczinski sold a total of 3,934 shares at an average price of $300.00. The insider received around $1.2 million from selling those shares.

- What’s Happening: On Sept. 16, JP Morgan analyst John Ivankoe maintained McDonald’s with an Overweight and raised the price target from $270 to $290.

- What McDonald’s Does: McDonald’s is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets.

- Benzinga Pro’s earnings calendar was used to track upcoming MCD’s earnings reports.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

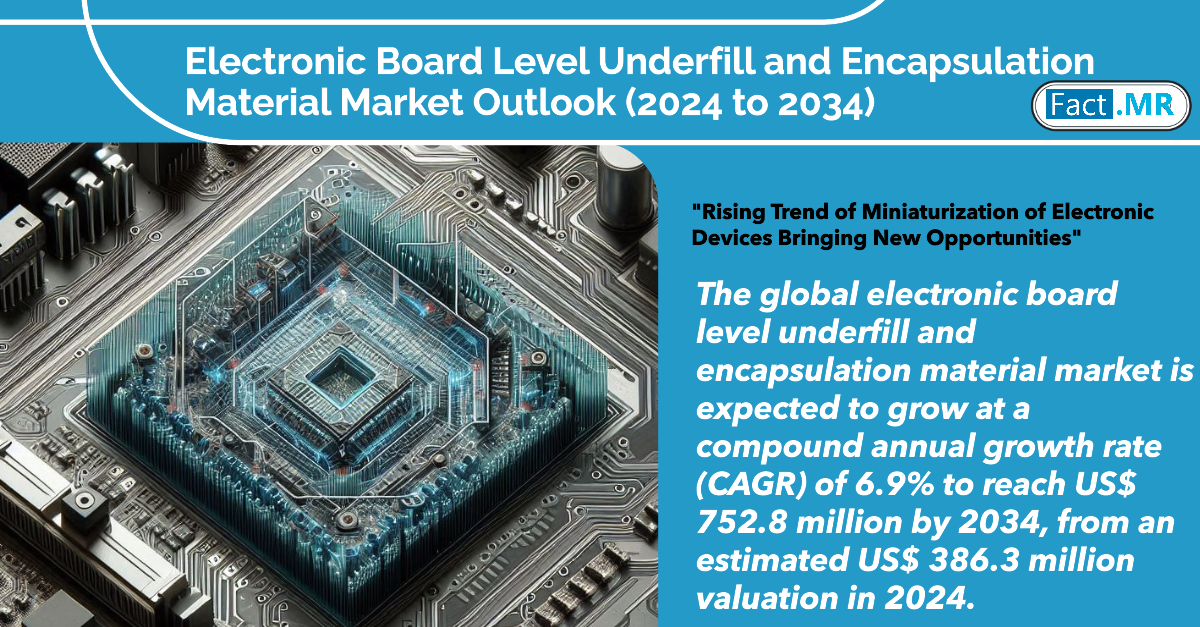

Electronic Board Level Underfill and Encapsulation Material Market is Projected to Reach US$ 752.8 Million by 2034 | Fact.MR Report

Rockville, MD , Sept. 19, 2024 (GLOBE NEWSWIRE) — As analyzed in the newly published report by Fact.MR, a market research and competitive intelligence provider, the global market for Electronic Board Level Underfill and Encapsulation Material Market is valued at US$ 386.3 million in 2024 and is forecasted to expand at a CAGR of 6.9% to reach US$ 752.8 million by 2034.

Electronic board-level underfill and encapsulation materials are becoming increasingly in demand with their widespread application. These materials are essential for the production of modern electronics because they safeguard and improve the functionality of printed circuit boards and other electronic components.

The demand for dependable protection against environmental elements, mechanical stress, and temperature problems has increased as technology develops and gadgets get smaller and more complicated. Effective solutions to these problems include underfill and encapsulation materials used in medical devices, automobile electronics, cellphones, aerospace systems, wearables, and other developing technology.

Manufacturers all around the world are using these materials more frequently because of their capacity to increase dependability, prolong the life of products, and facilitate creative designs. Further, market growth is also positively impacted by an increased emphasis on sustainability and the requirement for robust electronics in challenging settings. The need for these adaptable materials is also growing across several sectors, such as electronics.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10355

Key Takeaways from Market Study:

- The global electronic board level underfill and encapsulation material market is forecasted to make a revenue of US$ 752.8 million by 2034.

- The market in the United States is approximated to advance at a CAGR of 7.5% between 2024 and 2034, with a projected share of 74.6% of the North American market by the end of 2034.

- The East Asian market is estimated to reach a valuation of US$ 289.1 million by 2034.

- The market in South Korea in East Asia is evaluated to hold a share of 15.4% in 2024.

- Among all the products available in the market, underfill sales revenue is projected to expand at a CAGR of 6.7% between 2024 and 2034.

“Wearable technology coupled with the integration of IoT devices is contributing to the increased popularity of electronic board level underfill and encapsulation materials,” says a Fact.MR analyst.

Leading Players Driving Innovation in Electronic Board Level Underfill And Encapsulation Materials Market:

Dymax Corporation; Panasonic Corporation; Protavic International; YINCAE Advanced Materials, LLC; AI Technology, Inc.; Indium Corporation; H.B. Fuller Company; The Dow Chemical Company; ELANTAS GmbH; Zymet; Sanyu Rec Co., Ltd.; Epoxy Technology, Inc.; Namics Corporation; ASE Group; MacDermid Alpha Electronic Solutions; Parker LORD Corporation; Henkel AG and Co. KGaA.

Emerging Eco-Friendly Alternatives with Improved Technologies Escalating Market Growth:

Improved thermal conductivity is now possible with advanced formulations, enabling better heat management in high-performance devices. This discovery is especially important for the expanding 5G and AI businesses, where heat dissipation is a major problem. Another innovative breakthrough that offers improved mechanical strength and thermal performance in ultra-fine pitch applications is nano-filled underfills. These materials are making it possible to produce more potent and smaller devices in several industries.

Emerging green alternatives are tackling environmental issues and complementing international sustainability programs. The carbon footprint of electronic manufacturing processes is decreased by these environment-friendly substitutes without making any compromise on performance.

Fast-curing materials are also introduced, which is optimizing production lines and cutting costs and manufacturing times significantly. Large-scale manufacturers are particularly drawn to this efficiency improvement. The market’s potential is being increased by these advances, and thereby are also attracting new investors who understand how important these materials are to the advancement of electronic technology. As a result, the market for underfill and encapsulating materials is expanding quickly and has more funding.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10355

Regional Insights:

The United States market is poised for expansion, driven by the strong presence of several technological companies, particularly in sectors like smartphones and laptops. These devices heavily rely on electronic boards, which has attracted suppliers to actively grow their business in this field. The increasing smartphone user base further strengthens the foundation for electronic board manufacturers to capitalize on the demand.

Additionally, government reforms are easing export regulations, making international trade more accessible and profitable. These changes are opening new opportunities for manufacturers to boost their profit margins, contributing to the market’s projected growth from US$ 79.1 million in 2024 to US$ 163.5 million by 2034, with a 7.5% CAGR.

Segmentation of Electronic Board Level Underfill and Encapsulation Material Market Research:

By Type :

- Underfills

- Capillary

- Edge Bonds

- Gob Top Encapsulations

By Material :

- Quartz/Silicone

- Aluminia

- Epoxy

- Urethane

- Acrylic

- Others

By Board Type :

- CSP (Chip Scale Package)

- BGA (Ball Grid Array)

Checkout More Related Studies Published by Fact.MR Research:

The global electronic access control systems market stands at a value of US$ 14.64 billion in 2023 and is predicted to expand at a CAGR of 8.3% to reach US$ 32.5 billion by the end of 2033.

The global electronic chemicals & materials market size is estimated at a value of US$ 71.7 billion in 2024 and has been forecasted to expand at a CAGR of 5.9% to climb to US$ 127.1 billion by the end of 2034.

As of 2022, the electronic conformal coatings market stands at a net value of US$ 2.45 billion and is projected to rake in sales revenue of a total of US$ 4.3 billion by the end of 2032. From 2022 to 2032, the electronic conformal coatings market is anticipated to exhibit progression at a CAGR of 5.8%.

The global electronic design automation market is expected to reach a value of US$ 18.45 billion in 2024, as revealed in an updated Fact.MR research report. Worldwide demand for electronic design automation solutions is analyzed to increase at 7.4% CAGR and reach a market value of US$ 37.68 billion by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success.

With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automated Biochemical Analyzers Market to Reach $24.1 Billion, Globally, by 2033 at 12.2% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 19, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Automated Biochemical Analyzers Market by Analyzer (Biochemistry Analyzers, Immuno-Based Analyzers and Hematology Analyzers), by Application (Drug Discovery, Genomics, Proteomics, Bioanalyss, Analytical Chemistry and Others), and End User (Diagnostic Laboratories, Pharmaceutical and Biotechnology Companies and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the automated biochemical analyzers market was valued at $7.6 billion in 2023, and is estimated to reach $24.1 billion by 2033, growing at a CAGR of 12.2% from 2024 to 2033.

Request Sample of the Report on Automated Biochemical Analyzers Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A324373

Prime determinants of growth

Increase in prevalence of chronic conditions, surge in technological advancements, and rise in awareness about early diagnosis are the major factors that drive the growth of the automated biochemical analyzers market. However, the high initial cost of automated biochemical analyzers systems restricts the market growth. Moreover, growth opportunities in emerging markets and growing need for point-of-care testing offer remunerative opportunities for the expansion of the global automated biochemical analyzers market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $7.6 billion |

| Market Size in 2033 | $24.1 billion |

| CAGR | 12.2% |

| No. of Pages in Report | 228 |

| Segments Covered | Analyzer, Application, End User, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint | High cost of automated biochemical analyzers systems |

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324373

Segment Highlights

Immuno-based analyzer segment is expected to witness significant growth

By analyzer, the immuno-based analyzer segment is expected to drive significant growth in the automated analyzer market due to its high sensitivity and specificity in detecting a wide range of biomarkers. These analyzers are essential for diagnosing infectious diseases, cancer, and autoimmune disorders, providing rapid and accurate results. In addition, technological advancements, such as enhanced automation and integration with artificial intelligence, further boost their adoption. Further, the rising prevalence of chronic diseases and the increasing demand for personalized medicine also contribute to the growth of this segment.

Rise in demand for automated biochemical analyzers technology in drug discovery

By application, the drug discovery segment is poised for significant growth in the automated analyzer market owing to increasing demand for precise and high-throughput screening technologies. Automated analyzers streamline biochemical assays critical for drug development, enhancing efficiency and reducing time-to-market for new therapies. These analyzers enable rapid screening of compound libraries, biomarker identification, and toxicity testing, crucial for optimizing drug candidates. In addition, advances in automation, integration of AI and machine learning, and expanded capabilities in handling complex assays further bolster their appeal in pharmaceutical research.

Benefits of automated biochemical analyzers in pharmaceutical and biotechnology companies

By end user, the pharmaceutical and biotechnology companies segment is poised for significant growth in the automated analyzer market due to increasing demand for advanced analytical tools in drug development, quality control, and regulatory compliance. These companies require precise and reliable biochemical analysis for research on new therapies, batch testing of pharmaceutical products, and ensuring product safety and efficacy. In addition, rise in pharmaceutical research, driven by innovations in biotechnology and personalized medicine, the adoption of automated analyzers is expected to accelerate.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324373

Regional Outlook

North America to dominate by 2033

North America is poised to lead the growth in the automated analyzer market due to high healthcare infrastructure, high healthcare spending, and a strong emphasis on technological advancements. Rising prevalence of chronic diseases, such as diabetes and cardiovascular disorders, drives demand for automated analyzers for efficient diagnostic solutions. In addition, the presence of leading healthcare and pharmaceutical companies fosters innovation and adoption of advanced medical technologies which further supports the market growth.

Key Players

- Thermo Fisher Scientific

- Danaher Corporation

- Hudson Robotics Inc.

- Becton Dickinson and Company

- Synchron Lab Automation

- Agilent Technologies Inc.

- Siemens

- Tecan Group Ltd

- PerkinElmer Inc.

- Honeywell International Inc.

The report provides a detailed analysis of these key players in the global automated biochemical analyzers market. These players have adopted different strategies such as agreement, product approvals, product launch, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A324373

Recent Developments in Automated Biochemical Analyzers Industry

In November 2023, the Canon Medical held a ceremony at its Dalian plant in Liaoning province to mark the domestic production of its TBA-FX8 fully automated biochemistry analyzer, which was approved for sale in China in June.

Trending Reports in Healthcare Industry:

Drug Delivery Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Anti-Counterfeit Packaging Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Liquid Biopsy Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Companion Diagnostics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500, Dow Jones Hit Record Highs: Magnificent 7 Add $400 Billion After Fed's Historic Interest Rate Cut

Bulls are stampeding across Wall Street on Thursday in the wake of the Federal Reserve’s decision to cut interest rates for the first time in over four years.

The central bank’s bold move, a 50-basis-point cut, caught analysts off guard and sent the U.S. stock market to fresh record highs at the opening of Thursday’s session.

The S&P 500 soared to a new all-time high, reaching 5,700 points. Similarly, the Dow Jones Industrial Average climbed to an unprecedented 42,000 points.

In the first 30 minutes of trading, the S&P 500 and Dow Jones rose by 1.4% and 1%, respectively. The Nasdaq 100 climbed 1.5%, although the Russell 2000, representing small-cap stocks, outperformed with a surge of over 2%.

The market rally was primarily driven by the Magnificent Seven: Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Alphabet Inc. GOOG GOOGL, Amazon Inc. AMZN, Meta Platforms Inc. META and Tesla, Inc. TSLA. Each of the Magnificent Seven are recording daily gains ranging from 1.5% to 4.5%, solidly in positive territory.

Chart: S&P 500 Hits Record Highs

Strong Labor Market Eases Slowdown Fears, Analysts Boost Rate-Cut Wagers

Thursday’s economic data further boosted investor confidence. Weekly jobless claims came in well below expectations, suggesting a lower-than-expected trend of rising unemployment.

Continuing jobless claims also dropped more than expected, hinting at a potential absorption of long-term unemployed individuals into the job market.

This data alleviated concerns about rising unemployment and provided a more optimistic outlook for the economy.

Wall Street analysts quickly adjusted their expectations following the Federal Reserve’s rate cut. There is now growing anticipation of additional rate cuts, diverging from the cautious tone expressed in the Fed’s September “dot plot” and Chair Jerome Powell‘s remarks during the press conference.

Notably, Goldman Sachs economist Jan Hatzius revised his forecast from expecting a 25-basis-point cut at every other meeting to predicting a rate cut at every meeting. He even left the door open for a back-to-back 50-basis-point reduction in November.

Thursday’s 5 Top-Performing S&P 500 Stocks

Among the S&P 500, the top five performers as of 10 a.m. ET were:

| Name | 1-day Return |

| Darden Restaurants, Inc. DRI | 7.46 |

| Airbnb, Inc. ABNB | 5.27 |

| Cadence Design Systems, Inc. CDNS | 4.40 |

| Lam Research Corporation LCRX | 4.34 |

| NVIDIA Corporation NVDA | 4.33 |

Thursday’s 5 Top-Performing Dow Jones Industrial Average Stocks

Among the Dow Jone, the top five performers were:

| Name | 1-day Return |

| Apple Inc. AAPL | 3.02 |

| Salesforce, Inc. CRM | 3.01 |

| The Goldman Sachs Group, Inc. GS | 2.80 |

| Caterpillar Inc. CAT | 2.71 |

| American Express Company AXP | 2.67 |

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Beaten-Down Dividend Stocks to Load Up on Right Now

Expectations and narratives can drive stock movements. A company’s failure to deliver on expectations can lead to investor disappointment and a poorly performing stock. Honeywell (NASDAQ: HON), United Parcel Service (NYSE: UPS), and Chevron (NYSE: CVX) may be industry-leading companies, but they have all disappointed investors recently, and their share prices have suffered as a result.

Despite their challenges, all three of these dividend stocks are worth a closer look now. Here’s why.

Honeywell has failed to capitalize on megatrends

For several years now, Honeywell has discussed the growth potential of the Industrial Internet of Things (IIoT), which is basically the overlap of software and hardware. Instead of monitoring the performance of stand-alone machinery, IIoT can connect a fleet using sensors and electronic components. An integrated system can provide data-driven insights, allowing operators to be proactive rather than reactive to equipment performance and maintenance cycles.

In addition to its opportunities in the IIoT space, Honeywell has focused on the energy transition and a need for smarter buildings and warehouses that automate functions and consume less energy than older ones. It has a growing oil and gas, hydrogen, and liquefied natural gas business.

Honeywell’s largest segment is aerospace. It provides parts, components, controls, integrated solutions, and more for the commercial aerospace and defense industries. It even has a $5 billion quantum computing business.

Yet despite its exposure to all of these exciting themes, Honeywell’s results have fallen flat. Revenue has rebounded from its pandemic lows, but is still below where it was before the crisis. Operating margins and diluted earnings per share (EPS) are also ticking higher, albeit slowly.

Management has implemented an aggressive capital allocation program centered around mergers and acquisitions (M&A) and share buybacks to spur EPS growth. A core strength of Honeywell has been its balance sheet, but its leverage is likely to increase as it follows its plan to deploy billions more on M&A and stock repurchases.

Honeywell has increased its dividend every year since 2011 and its price-to-earnings (P/E) ratio today is below its three-, five-, and seven-year median levels. Given its growing dividend and reasonable valuation, Honeywell looks like a worthwhile turnaround play for investors who believe that its recent slew of acquisitions will help drive growth across its targeted themes.

The worst may be over for UPS

UPS stock soared during the pandemic as consumers shifted from in-person shopping to home delivery. The shipping and logistics giant expanded routes, thinking that the growth in package delivery volumes would remain elevated even after the pandemic, but that forecast proved painfully inaccurate.

Throw in expensive pension obligations and a messy contract negotiation process with the Teamsters Union, and it’s easy to see why UPS stock fell out of favor.

In March, UPS launched a three-year plan to turn the business around. But so far, it hasn’t made meaningful progress toward its goals. The company has done a lot wrong in a short period — leading to a 45% drawdown from its all-time high. But there’s reason to believe the worst could be over.

In the second quarter, UPS returned to U.S. volume growth for the first time since Q4 2021. This is a positive near-term sign. The outlook for its healthcare-related business is a medium-term positive. UPS expects healthcare to contribute half of its growth over the next three years as it focuses on temperature and time-sensitive deliveries.

Over the longer term, UPS has an entrenched position in domestic and international shipping and logistics. The stock has sold off so far that its forward P/E ratio is now just 17 and its dividend yields 5.1%. UPS may appeal to investors looking for a value stock that can turn things around as well as an investment that can boost their passive income.

Chevron is an ultra-reliable dividend payer

Unlike Honeywell and UPS, Chevron hasn’t disappointed investors by falling short of expectations. But it does have a major question mark that may be holding its share price back.

On Oct. 23, 2023, Chevron announced an agreement to acquire oil and natural gas exploration and production company Hess for $53 billion. However, ExxonMobil has held up that deal, citing nuances in contractual language regarding the rights to a shared asset offshore from Guyana.

Meanwhile, crude oil prices have tumbled to their lowest levels of 2024 due to lower demand expectations and elevated production levels. Chevron hasn’t made the operational errors of Honeywell or UPS. Nevertheless, the uncertainty over the fate of its Hess deal and lower oil prices have pushed the stock to a 52-week low.

With a P/E ratio of just 13.9, its valuation looks dirt cheap, but that ratio could rise to a more expensive level if lower oil prices lead to lower profits. Overall, Chevron is reasonably valued and sports a streak of 37 consecutive years of dividend raises and a 4.6% dividend yield — making it yet another passive income powerhouse to consider now.

“Loading up” responsibly

Investors may look at Honeywell, UPS, or Chevron and be tempted to back up the truck in hopes that they will rebound. And while it could be a good idea to load up on all three stocks, it’s important to maintain diversification in a balanced portfolio.

Going too heavy into just a few stocks or correlated themes can leave a portfolio at risk of outsized declines if the market slumps. A better approach is to only allocate larger shares of your portfolio to your highest conviction ideas, and to build those positions gradually over time.

Rushing too quickly into a stock can lead to stress, bad decision-making, and depleted buying power. No one knows when the next major stock market sell-off will happen, but when it does, it will be wise to be comfortable with your positions.

The best way to set yourself up for that is to be aware of your asset allocations and ensure that no single position becomes so large that a bad stretch for one industry can derail your portfolio’s performance and hold you back from achieving your financial goals.

Should you invest $1,000 in Honeywell International right now?

Before you buy stock in Honeywell International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Honeywell International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

3 Beaten-Down Dividend Stocks to Load Up on Right Now was originally published by The Motley Fool

HTX DAO and TRON Unite to Lead the Future of Web3 with Innovative Growth and a Vision for the Next Decade

SINGAPORE, Sept. 18, 2024 /PRNewswire/ — HTX DAO co-hosted an afterparty with TRON following TOKEN2049, one of the world’s most influential Web3 events, in collaboration with Alethea AI, TourBillion, BitWave, ChainGPT, Google Cloud, and The Block. TRON founder and Global Advisor to HTX, Justin Sun, along with several industry leaders, shared their vision for the next phase of Web3 and outlined key strategies to drive blockchain innovation and growth.

HTX’s 11-Year Legacy and Expansion

Celebrating 11 years in the crypto industry, HTX has evolved into a comprehensive blockchain ecosystem, serving 47.8 million users and supporting over 700 digital assets. Since its rebrand, HTX has introduced nearly 200 new tokens, 85% of which have seen significant value increases. With innovative products like restaking services and Trade to Earn, HTX continues to prioritize security, accessibility, and user growth.

To date, with the support of HTX, the liquidity pledges received by HTX DAO and the amount of $HTX repurchased and burned have reached a total of $51.5 million, while HTX Ventures has supported over 300 projects, driving blockchain innovation, reinforcing the platform’s commitment to decentralized communities.

Building the Web3 Ecosystem

HTX and TRON are focused on building an integrated Web3 ecosystem for billions of users. Key priorities include expanding TRC-20 USDT adoption as the backbone of the Web3 economy and growing partnerships to drive innovation in decentralized finance, digital assets, and social applications.

HTX aims to be the financial hub of the metaverse, offering secure and compliant services. TRON will continue to attract high-quality decentralized applications (DApps) to enhance user experience and ecosystem growth.

“We are excited to enter this new decade, driven by innovation and collaboration. The combined strength of TRON’s technical prowess and HTX’s market leadership will enable us to bring Web3 products and services to the global stage,” said Justin Sun, TRON founder and Global Advisor of HTX. “Our vision is to lead the next wave of blockchain and Web3 adoption, fostering a secure and user-centric ecosystem.”

Looking Ahead: Partnerships and Innovation

As a pioneer in the crypto space, HTX has consistently spearheaded industry innovation and set new trends since its inception 11 years ago. HTX will continue to pursue its vision of achieving financial freedom for 8 billion people on Earth.

As Justin Sun stated, “With the joint efforts of HTX and TRON, we are confident that we can create a truly practical, convenient, and thriving Web3 ecosystem for users worldwide within the next decade.” He also highlighted TRON’s success with SunPump and the launch of a $10 million meme ecosystem incentive program, signaling the platforms’ joint efforts to reshape the future of blockchain. With strategic partnerships and continuous innovation, HTX and TRON are set to unlock new opportunities for developers, investors, and users worldwide.

About HTX

Founded in 2013, HTX has evolved from a virtual asset exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, research, investments, incubation, and other businesses.

As a world-leading gateway to Web3, HTX harbors global capabilities that enable it to provide users with safe and reliable services. Adhering to the growth strategy of “Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance,” HTX is dedicated to providing quality services and values to virtual asset enthusiasts worldwide.

For more information on HTX, please visit HTX Square, or https://www.htx.com/, and follow X, Telegram, Discord. For further press enquiries, please contact htx@ruderfinn.com.

About HTX DAO

HTX DAO is a blockchain-based decentralized autonomous organization dedicated to revolutionizing decentralized governance and expanding the applications of blockchain technology. Our vision is centered around open finance and a decentralized, tokenized economy. At the core of HTX DAO, governance is democratically and transparently vested in the hands of HTX token holders. We warmly invite individuals and communities to join our journey, actively participate, and contribute, together shaping an open and innovative future for the blockchain world.

For more information on HTX Dao, please visit www.htxdao.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/htx-dao-and-tron-unite-to-lead-the-future-of-web3-with-innovative-growth-and-a-vision-for-the-next-decade-302252651.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/htx-dao-and-tron-unite-to-lead-the-future-of-web3-with-innovative-growth-and-a-vision-for-the-next-decade-302252651.html

SOURCE HTX; HTX DAO

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.