US bank stocks rise as jumbo rate cut eases default risk, cost concerns

By Niket Nishant and Manya Saini

(Reuters) -U.S. bank stocks rose on Thursday, a day after the Federal Reserve cut interest rates by 50 basis points, which is expected to reduce deposit costs and alleviate pressure on borrowers.

Elevated interest rates have weighed on loan growth and consumer spending this year, while also increasing fears of borrowers defaulting on their loans.

Commercial real estate loan portfolios have been under immense pressure due to high rates and lack of demand for office spaces, prompting banks to set aside billions as a cushion against delinquencies.

“For banks, particularly those that hold mortgages and auto loans, there may be a benefit to spreads in the near term,” said Charlie Wise, senior vice president and head of global research and consulting at TransUnion.

Investment bank Goldman Sachs led gains in large-cap bank stocks with a 2% rise, followed by Citigroup and Bank of America, which climbed 1.4% and 1.3% respectively.

Wells Fargo climbed 0.8% while JPMorgan, the largest U.S. bank by assets and the sector’s bellwether, was last trading 0.4% higher. Wall Street powerhouse Morgan Stanley was also up 0.5%.

REFINANCING WINDOW

Most auto loans and mortgages carry a fixed rate of interest, which means banks will continue to fetch higher yields even after the cut.

Borrowers looking for immediate relief could also refinance their loans and negotiate better repayment terms, lowering the risk of defaults. Top banks echoed the Fed’s move and reduced their prime lending rates on Wednesday, giving consumers an immediate reprieve on borrowing costs.

Regional banks are expected to benefit more from rate cuts, compared with their larger rivals, as elevated deposit costs normalize and the demand for loans recovers.

“We expect a lower funds rate to ignite commercial borrower demand for loans,” said J.P. Morgan analyst Steven Alexopoulos. “The Fed cut reduces uncertainty over the borrowing costs and the economy.”

Valley National led gains in regional banks with a 2.9% rise. Banc of California, KeyCorp, Western Alliance and Regions Financial rose between 1.2% and 1.6%.

“The initial positive reaction by the bank stock indices makes sense, as a 50 bp cut takes the edge off the high-end credit concerns,” analysts at Jefferies said.

“But leave open the question about the underlying economy today.”

The S&P 500 Banks Index, which tracks large-cap banks, has gained 17.5% this year through previous close, compared with an 18% gain in the benchmark S&P 500. The KBW Regional Banking Index is up 4.4% over the same period.

Investor sentiment toward the sector had taken a hit after three major players collapsed in early 2023, in part due to higher rates racking up unrealized losses on their loan books.

“(The cuts) will be credit positive for banks’ asset quality because lower rates make debt payments more affordable for borrowers with floating-rate loans,” said Allen Tischler, senior vice president of Financial Institutions Group at Moody’s Ratings.

Still, lenders are maneuvering a delicate economic environment. While investors expect the Fed to continue easing in the coming months, some have questioned if the central bank is behind the curve.

Fed Chair Jerome Powell said, however, that he doesn’t believe the central bank waited too long.

(Reporting by Manya Saini and Niket Nishant in Bengaluru; Editing by Shailesh Kuber)

At A-Mark Precious Metals, GREGORY ROBERTS Chooses To Exercise Options, Resulting In $965K

In a new SEC filing on September 17, it was revealed that ROBERTS, Chief Executive Officer at A-Mark Precious Metals AMRK, executed a significant exercise of company stock options.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday revealed that ROBERTS, Chief Executive Officer at A-Mark Precious Metals in the Consumer Discretionary sector, exercised stock options for 27,000 shares of AMRK stock. The exercise price of the options was $8.4 per share.

A-Mark Precious Metals shares are currently trading down by 0.61%, with a current price of $44.16 as of Wednesday morning. This brings the total value of ROBERTS’s 27,000 shares to $965,520.

Get to Know A-Mark Precious Metals Better

A-Mark Precious Metals Inc is a precious metal trading company. It is principally engaged in the wholesale of gold, silver, platinum, copper, and palladium bullion and related products in the form of bars, wafers, coins, and grains. The company’s operating segment includes Wholesale Sales and Ancillary Services; Secured Lending and Direct-to-Consumer. It generates maximum revenue from the Wholesale Trading and Ancillary Services segment. The Wholesale Trading and Ancillary Services segment comprises business units such as Industrial, Coin and Bar, Trading and Finance, Storage, Logistics, and Mint. Geographically, it derives a majority of its revenue from the United States and the rest from Europe, Asia Pacific, Australia, Africa, and other regions.

Breaking Down A-Mark Precious Metals’s Financial Performance

Decline in Revenue: Over the 3 months period, A-Mark Precious Metals faced challenges, resulting in a decline of approximately -19.06% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 1.7%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): A-Mark Precious Metals’s EPS reflects a decline, falling below the industry average with a current EPS of 1.34.

Debt Management: A-Mark Precious Metals’s debt-to-equity ratio surpasses industry norms, standing at 1.28. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: A-Mark Precious Metals’s P/E ratio of 15.64 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.11 is lower than the industry average, implying a discounted valuation for A-Mark Precious Metals’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 13.06 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Important Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of A-Mark Precious Metals’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Stock Is Skyrocketing. 1 Analyst Thinks It Has Another 38% Gain Ahead.

The artificial intelligence revolution has been a mixed bag for software companies. While software stocks that harness the power of large language models (LLMs) have the potential to accelerate revenues, AI also gives software customers the potential to “do-it-yourself.”

For instance, private buy-now-pay-later company Klarna recently announced it would attempt to get rid of its Salesforce and Workday software in lieu of building its own CRM and employee management software internally, through the use of AI.

Yet AI software platform Palantir (NYSE: PLTR) is showing an acceleration in its commercial business due to the advent of AI. And one Wall Street analyst thinks it has much farther to run.

Palantir is no meme stock

Some investors have equated Palantir with the meme stock revolution, leading to doubts about its recent run. This could be due to a few things. First, the stock has a high percentage of retail investors relative to institutional investors. Second, Palantir went public in a direct listing in late 2020, when interest rates were low and many dubious software and technology companies sold shares to the public. Finally, CEO Alex Karp is regarded as some as a quirky and outspoken leader, for better or worse.

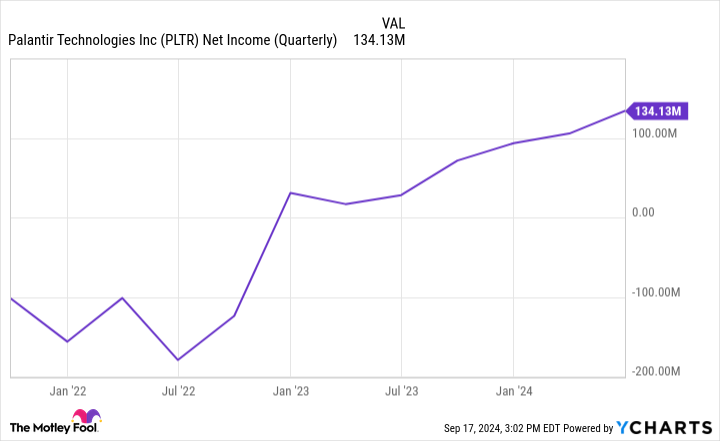

But Palantir is no meme stock. As a proof point, the company was recently admitted to the prestigious S&P 500 index, which has stringent criteria for admission. In the past couple years, Palantir has qualified for the index by posting consistent GAAP profitability — somewhat rare for a software stock.

PLTR Net Income (Quarterly) data by YCharts

AI is leading to a reacceleration in growth

In addition, Palantir has seen its revenue growth accelerate. That acceleration coincided with the introduction of the Palantir Artificial Intelligence Platform, or “AIP,” about a year ago. AIP allows companies to incorporate third-party LLMs or other specialized models directly into Palantir’s existing Gotham or Foundry software platforms.

AIP has invigorated interest in Palantir’s software, especially from commercial customers, resulting in a reacceleration of revenue growth since AIP was introduced.

Normally, it’s harder for companies to increase their growth rate as they get bigger because of the law of large numbers. However, one can see that Palantir has defied this trend. The introduction of AIP and Palantir fine-tuning its marketing strategy to include periodic, “boot camps,” are likely reasons for the inflection. These boot camps allow prospective customers to bring their actual data and experience the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

Currently, most of Wall Street is actually bearish on Palantir’s stock. As of August, only six out of 18 analysts rate shares a Buy or Strong Buy, with another six rating shares Neutral and the remaining six rating shares a Sell. The average price target on shares is $27, below the $36 current price as of this writing. This is probably due to Palantir’s stock having more than doubled this year, while currently trading at an expensive valuation of roughly 35 times sales.

But one analyst, Mariana Perez Mora of Bank of America rates shares a Buy, with a street-high $50 price target on the stock. The analyst believes Wall Street misunderstands Palantir, and sees big things in the company’s future, justifying a higher stock price.

Mora thinks others miss how differentiated Palantir is relative to other enterprise software stocks, both product-wise and how Palantir goes to market. Of note, Palantir typically has members of its R&D team embed themselves with a customer first, in order to understand a customer’s business problems and pain points. Then, Palantir tailors its modular software to that business’ specific infrastructure, making its data analytics capabilities more relevant to each individual customer. In its annual report, Palantir notes seeks out “risky and resource-intensive” engagements where other competitors may shy away.

Mora believes this method, which is more difficult upfront and where Palantir doesn’t see immediate revenues, ultimately pays off. This is because the upfront work allows Palantir more pricing power later on. She then sees Palantir’s products spreading to more industries as Palantir rolls out industry-specific platforms, such as the upcoming Warp Speed for manufacturing businesses.

An industry-standard OS like Windows?

Whereas Palantir was formerly known as a specialized software platform for the Defense industry in the War on Terror, Mora sees Palantir becoming an industry-standard platform in the future, calling it, “the common data operational system for the U.S. government and large U.S. businesses.”

If Palantir’s recent acceleration across commercial enterprises continues, she may very well end up being correct. With the majority of revenues still coming from the Defense industry, Palantir’s recent penetration of the much larger enterprise market gives it the chance to keep growth rates high for a while, potentially justifying today’s lofty stock price.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Billy Duberstein and/or his clients have positions in Bank of America. The Motley Fool has positions in and recommends Bank of America, Palantir Technologies, Salesforce, and Workday. The Motley Fool has a disclosure policy.

Palantir Stock Is Skyrocketing. 1 Analyst Thinks It Has Another 38% Gain Ahead. was originally published by The Motley Fool

Fanhua Reports First Half 2024 Unaudited Financial Results

GUANGZHOU, China, Sept. 18, 2024 (GLOBE NEWSWIRE) — Fanhua Inc. FANH (the “Company” or “Fanhua”), a leading independent financial services provider in China, today announced its unaudited financial results for the first half ended June 30, 20241.

Financial Highlights for the First Half of 2024:

| (In thousands, except per ADS data and percentages) | 2023H1 (RMB) |

2024H1 (RMB) |

2024H1 (US$) |

Change % | ||||||||

| Total net revenues | 1,960,377 | 1,123,178 | 154,555 | (42.7 | ) | |||||||

| Operating income | 146,387 | 54,910 | 7,557 | (62.5 | ) | |||||||

| Loss from fair value change | — | (73,761 | ) | (10,150 | ) | — | ||||||

| Net income attributable to shareholders | 136,967 | 4,738 | 653 | (96.5 | ) | |||||||

| Adjusted EBITDA2 | 178,221 | 77,665 | 10,687 | (56.4 | ) | |||||||

| Diluted net income per ADS | 2.54 | 0.09 | 0.01 | (96.5 | ) | |||||||

| Diluted adjusted EBITDA per ADS3 | 3.31 | 1.45 | 0.20 | (55.2 | ) | |||||||

| Cash, cash equivalent, short-term investments at end of the period | 1,611,554 | 770,133 | 105,974 | (52.2 | ) | |||||||

Key operating metrics for the First Half of 2024:

| (In thousands, except percentages and number of agents) | 2023H1 (RMB) |

2024H1 (RMB) |

2024H1 (US$) |

Change % | ||||||||

| Total life gross written premiums (“GWP”) | 8,703,510 | 8,642,319 | 1,189,223 | (0.7 | ) | |||||||

| – First year premium (“FYP”) | 2,329,504 | 1,205,417 | 165,871 | (48.3 | ) | |||||||

| – Renewal premium | 6,374,006 | 7,436,902 | 1,023,352 | 16.7 | ||||||||

| Number of life insurance performing agents | 11,855 | 7,723 | — | (34.9 | ) | |||||||

| FYP per life insurance performing agent | 196 | 156 | — | (20.6 | ) | |||||||

________________________

| 1 | This announcement contains currency conversions of certain Renminbi (“RMB”) amounts into U.S. dollars (US$) at specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.2672 to US$1.00, the effective noon buying rate as of June 28, 2024 in The City of New York for cable transfers of RMB as set forth in the H.10 weekly statistical release of the Federal Reserve Board | |

| 2 | Adjusted EBITDA is defined as net income before income tax expense, share of loss of affiliates, investment income, interest income, financial cost, depreciation, amortization of intangible assets, share-based compensation expenses and change in fair value of equity investments and contingent consideration. | |

| 3 | Diluted adjusted EBITDA per ADS is defined as adjusted EBITDA divided by total weighted average number of diluted ADSs of the Company outstanding during the period. | |

Mr. Yinan Hu, Founder and Chief Executive Officer, commented: “In the first half of 2024, the implementation of the ‘Unified Commissions and Fees in Reporting and Underwriting’ policy in the agency and broker channel has caused unprecedented disruption in the sector. Against this backdrop, we took a series of proactive measures and steadily advanced our strategy of ‘professionalization, service ecosystem development, intelligence, open platform, and internationalization’ to ensure stable business operations. In the first half of 2024, we achieved gross written premiums of RMB8.8 billion, with first year premiums of RMB1.4 billion, fully demonstrating our resilience.

“We are pleased that the first AI model in the insurance industry, ‘Du Xiaobao’ L2, co-developed by Fanhua and Baidu Smart Cloud, was launched for trial operation and has been well received among sales agents. We firmly believe that artificial intelligence will play an increasingly important role in insurance distribution. It will not only enhance the overall customer experience but also reshape the traditional insurance sales model, bringing new growth momentum to the industry. ‘Du XiaoBao’ is central to our intelligence strategy and will play a crucial role in driving our future competitiveness, propelling the Company toward greater growth and new breakthroughs.

Open Platform and M&A Contributions over the First Half of 2024

- The number of platform professional users who used our Open Platform reached 963 as of June 30, 2024, generating RMB322.7 million in first year premiums, which accounted for 26.8% of our life insurance FYP.

Share Repurchase Program

On July 4, 2024, the Board authorized the expansion of the Company’s share repurchase program by an additional US$20 million, bringing the total authorized amount of share repurchase to US$40 million. Under the Company’s previously authorized share repurchase program, as of June 30, 2024, the Company had repurchased an aggregate of 726,616 ADSs, at an average price of approximately US$7.5 per ADS for a total amount of approximately US$5.4 million.

Analysis of our Financial Results for the First Half of 2024

Revenues

Total net revenues were RMB1.1 billion (US$154.0 million) for the first half of 2024, representing a decrease of 42.7% from RMB2.0 billion for the corresponding period in 2023.

- Net revenues for agency business were RMB901.0 million (US$124.0 million) for the first half of 2024, representing a decrease of 48.6% from RMB1.8 billion for the corresponding period in 2023. Total GWP was RMB8.8 billion for the first half of 2024, remaining stable compared to the same period of 2023, of which FYP decreased by 43.7% year-over-year to RMB1.4 billion while renewal premiums grew by 16.7% year-over-year to RMB7.4 billion.

- Net revenues for the life insurance business were RMB828.6 million (US$114.0 million) for the first half of 2024, representing a decrease of 50.2% from RMB1.7 billion for the corresponding period in 2023. The decrease was mainly due to i) the decrease in commission rates paid by insurance companies and decline in sales volume as the result of the implementation of the “Unified Commissions and Fees in Reporting and Underwriting” policy which imposed a commission cap in the broker and agency channel and ii) a relatively high base from the sales spike before the downward pricing rate adjustment of life insurance products from 3.5% to 3%. Total life insurance GWP decreased by 0.7% year-over-year to RMB8.6 billion, of which life insurance FYP decreased by 48.3% year-over-year to RMB1.2 billion while renewal premiums grew by 16.7% year-over-year to RMB7.4 billion.

Net revenues generated from our life insurance business accounted for 73.8% of our total net revenues in the first half of 2024, as compared to 84.8% in the same period of 2023. - Net revenues for the non-life insurance business (formerly categorized as “property and casualty insurance business”) were RMB72.4 million (US$10.0 million) for the first half of 2024, representing a decrease of 18.9% from RMB89.3 million for the corresponding period in 2023. Net revenues generated from the non-life insurance business accounted for 6.4% of our total net revenues in the first half of 2024, as compared to 4.6% in the same period of 2023.

- Net revenues for the life insurance business were RMB828.6 million (US$114.0 million) for the first half of 2024, representing a decrease of 50.2% from RMB1.7 billion for the corresponding period in 2023. The decrease was mainly due to i) the decrease in commission rates paid by insurance companies and decline in sales volume as the result of the implementation of the “Unified Commissions and Fees in Reporting and Underwriting” policy which imposed a commission cap in the broker and agency channel and ii) a relatively high base from the sales spike before the downward pricing rate adjustment of life insurance products from 3.5% to 3%. Total life insurance GWP decreased by 0.7% year-over-year to RMB8.6 billion, of which life insurance FYP decreased by 48.3% year-over-year to RMB1.2 billion while renewal premiums grew by 16.7% year-over-year to RMB7.4 billion.

- Net revenues for the claims adjusting business were RMB222.1 million (US$30.6 million) for the first half of 2024, representing an increase of 7.0% from RMB207.6 million for the corresponding period in 2023. The increase was mainly due to the growth in auto insurance claims adjusting business. Net revenues generated from the claims adjusting business accounted for 19.8% of our total net revenues in the first half of 2024, as compared to 10.6% in the same period of 2023.

Gross profit

Total gross profit was RMB424.6 million (US$58.4 million) for the first half of 2024, representing a decrease of 29.0% from RMB597.7 million for the corresponding period in 2023. By product line, the results were:

- Life insurance business recorded a gross profit of RMB323.8 million (US$44.6 million), representing a decrease of 35.2% from RMB500.0 million for the first half of 2023. The decrease was largely in line with the decrease in net revenues. Gross margin for the period was 39.1%, as compared with 30.1% in the same period of 2023.

- Non-life insurance business recorded a gross profit of RMB26.1 million (US$3.6 million), representing an increase of 10.6% from RMB23.6 million for the first half of 2023, primarily due to the increased contribution from higher margin insurance brokerage business. Gross margin for the period was 36.0%, as compared with 26.4% in the same period of 2023.

- Claims adjusting business recorded a gross profit of RMB74.8 million (US$10.3 million), representing an increase of 0.8% from RMB74.2 million for the first half of 2023. Gross margin for the period was 33.8%, as compared with 35.7% in the same period of 2023.

Operating expenses

Selling expenses were RMB110.1 million (US$15.2 million) for the first half of 2024, representing a decrease of 15.8% from RMB130.8 million for the corresponding period in 2023. The decrease was primarily due to cost savings from personnel optimization and decreased number of our sales outlets.

General and administrative expenses were RMB259.6 million (US$35.7 million) for the first half of 2024, representing a decrease of 19.0% from RMB320.5 million for the corresponding period in 2023. The decrease was mainly due to personnel optimization and decreased rental costs of branch offices at provincial level.

As a result of the foregoing factors, we recorded operating income of RMB54.9 million (US$7.6 million) for the first half of 2024, representing a decrease of 62.5% from RMB146.4 million for the corresponding period in 2023.

Operating margin was 4.9% for the first half of 2024, compared to 7.5% for the corresponding period in 2023.

Loss from fair value change was RMB73.7 million (US$10.2 million) for the first half of 2024, which primarily represented an unrealized holding loss of RMB82.5 million (US$11.4 million) in the first half of 2024, to reflect the change in the fair value of the Company’s 2.8% equity interests in Cheche Group Inc. (“Cheche”), which was partially offset by an unrealized income of RMB8.8 million (US$1.2 million) representing the fair value change of the contingent consideration in regards to business combinations in the first quarter of 2023.

Investment income was RMB24.5 million (US$3.4 million) for the first half of 2024, representing a decrease of 2.0% from RMB25.0 million for the corresponding period in 2023. The decrease reflects the periodic fluctuation in yields from short-term investments in financial products as it is recognized when the investment matures or is disposed of.

Income tax expense was RMB6.7 million (US$0.9 million) for the first half of 2024, representing a decrease of 82.5% from RMB38.3 million for the corresponding period in 2023.

As a result of the foregoing factors, net income attributable to the Company’s shareholders was RMB4.7 million (US$0.7 million) for the first half of 2024, representing a decrease of 96.6% from RMB137.0 million for the corresponding period in 2023.

Net margin was 0.4% for the first half of 2024, as compared to 7.0% for the corresponding period in 2023.

Adjusted EBITDA2 was RMB77.7 million (US$10.7 million) for the first half of 2024, representing a decrease of 56.4% from RMB178.2 million for the corresponding period in 2023.

Adjusted EBITDA margin4 was 6.9% for the first half of 2024, as compared to 9.1% for the corresponding period in 2023.

Basic and diluted net income per ADS were RMB0.09 (US$0.01) and RMB0.09 (US$0.01) for the first half of 2024, respectively, representing a decrease of 96.5% and 96.5% from RMB2.54 and RMB2.54 for the corresponding period in 2023, respectively.

Basic5 and diluted adjusted EBITDA per ADS were RMB1.45 (US$0.20) and RMB1.45 (US$0.20) for the first half of 2024, representing a decrease of 56.2% and 56.2% from RMB3.31 and RMB3.31 for the corresponding period in 2023, respectively.

As of June 30, 2024, the Company had RMB770.1 million (US$106.0 million) in cash, cash equivalents and short-term investments, as compared with RMB1.6 billion as of June 30, 2023. The decrease was due to loans provided to third parties amounting to RMB705 million in the aggregate, among which loans of RMB610 million have been pledged with equity interests as collaterals and fully guaranteed by the controlling shareholder of the debtor as of the date of this announcement. The loans to third parties all have one-year term with an average annual interest rate of 5%.

Fanhua’s Insurance Sales and Service Distribution Network:

- As of June 30, 2024, excluding newly acquired entities, Fanhua’s distribution network consisted of 539 sales outlets in 24 provinces and 69 services outlets in 31 provinces as of June 30, 2024, compared with 606 sales outlets in 24 provinces and 89 services outlets in 31 provinces as of June 30, 2023. The decrease in the number of sales outlets reflected our focus on growing profitable branches, coupled with the challenging decisions to close those which were not yielding profits. The number of the Company’s in-house claims adjustors was 2,457 as of June 30, 2024, compared with 2,120 as of June 30, 2023.

________________________

| 4 | Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of net revenues. | |

| 5 | Basic adjusted EBITDA per ADS is defined as adjusted EBITDA divided by total weighted average number of ADSs of the Company outstanding during the period. | |

About Fanhua Inc.

Driven by its digital technologies and professional expertise in the insurance industry, Fanhua Inc. is the leading independent financial service provider in China, focusing on providing insurance-oriented family asset allocation services that covers customers’ full lifecycle and a one-stop service platform for individual sales agents and independent insurance intermediaries.

With strategic focus on long-term life insurance products, we offer a broad range of insurance products, claims adjusting services and various value-added services to meet customers’ diverse needs, through an extensive network of digitally empowered sales agents and professional claims adjustors. We also operate Baowang (www.baoxian.com), an online insurance platform that provides customers with a one-stop insurance shopping experience.

For more information about Fanhua Inc., please visit https://ir.fanhgroup.com

Forward-looking Statements

This press release contains statements of a forward-looking nature. These statements, including the statements relating to the Company’s future financial and operating results, are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “will,” “expects,” “believes,” “anticipates,” “intends,” “estimates” and similar statements. Among other things, management’s quotations and the Business Outlook section contain forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions, estimates and projections about Fanhua and the industry. Potential risks and uncertainties include, but are not limited to, those relating to its ability to attract and retain productive agents, especially entrepreneurial agents, its ability to maintain existing and develop new business relationships with insurance companies, its ability to execute its growth strategy, its ability to adapt to the evolving regulatory environment in the Chinese insurance industry, its ability to compete effectively against its competitors, quarterly variations in its operating results caused by factors beyond its control including macroeconomic conditions in China. Except as otherwise indicated, all information provided in this press release speaks as of the date hereof, and Fanhua undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although Fanhua believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by Fanhua is included in Fanhua’s filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

About Non-GAAP Financial Measures

In addition to the Company’s consolidated financial results under generally accepted accounting principles in the United States (“GAAP”), the Company also provides adjusted EBITDA, adjusted EBITDA margin and basic and diluted adjusted EBITDA per ADS, all of which are non-GAAP financial measures, as supplemental measures to review and assess operating performance. Adjusted EBITDA is defined as net income before income tax expense, share of loss of affiliates, investment income, interest income, financial cost, depreciation, amortization of intangible assets, share-based compensation expenses and change in fair value of equity investments and contingent consideration. Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of net revenues. Basic adjusted EBITDA per ADS is defined as adjusted EBITDA divided by total weighted average number of ADSs of the Company outstanding during the period. Diluted adjusted EBITDA per ADS is defined as adjusted EBITDA divided by total weighted average number of diluted ADSs of the Company outstanding during the period. The Company believes that both management and investors benefit from referring to these non-GAAP financial measures in assessing the Company’s performance and when planning and forecasting future periods. The Company’s non-GAAP financial measures do not reflect all items of income and expenses that affect the Company’s operations. Specifically, the Company’s non-GAAP measures exclude interest income, investment income, financial cost, income tax expense, depreciation, amortization of intangible assets, share of loss of affiliates, share-based compensation expenses and change in fair value of equity investments and contingent consideration. Further, these non-GAAP financial measures may not be comparable to similarly titled measures presented by other companies, including peer companies. The presentation of these non-GAAP financial measures has limitations as analytical tools, and investors should not consider them in isolation from, or as a substitute for analysis of, the financial information prepared and presented in accordance with GAAP. We encourage investors and other interested persons to review our financial information in its entirety and not rely on a single financial measure.

For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Net Income to Adjusted EBITDA and Adjusted EBITDA Margin” set forth at the end of this press release.

| FANHUA INC. Unaudited Condensed Consolidated Balance Sheets (In thousands) |

|||||||||||

| As of December 31, | As of June 30, | As of June 30, | |||||||||

| 2023 | 2024 | 2024 | |||||||||

| RMB | RMB | US$ | |||||||||

| ASSETS: | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | 521,538 | 189,527 | 26,080 | ||||||||

| Restricted cash | 53,238 | 47,920 | 6,594 | ||||||||

| Short term investments | 928,270 | 580,606 | 79,894 | ||||||||

| Accounts receivable, net | 639,418 | 582,516 | 80,157 | ||||||||

| Other receivables | 111,770 | 714,383 | 98,302 | ||||||||

| Other current assets | 121,331 | 44,344 | 6,102 | ||||||||

| Total current assets | 2,375,565 | 2,159,296 | 297,129 | ||||||||

| Non-current assets: | |||||||||||

| Restricted bank deposit – non-current | 27,228 | 26,783 | 3,685 | ||||||||

| Contract assets, net – non-current | 711,424 | 726,879 | 100,022 | ||||||||

| Property, plant, and equipment, net | 91,659 | 86,223 | 11,865 | ||||||||

| Goodwill and intangible assets, net | 432,465 | 421,851 | 58,050 | ||||||||

| Deferred tax assets | 40,735 | 35,250 | 4,851 | ||||||||

| Investment in affiliates | - | 8,614 | 1,185 | ||||||||

| Other non-current assets | 235,752 | 244,166 | 33,598 | ||||||||

| Right of use assets | 136,056 | 112,011 | 15,413 | ||||||||

| Total non-current assets | 1,675,319 | 1,661,777 | 228,669 | ||||||||

| Total assets | 4,050,884 | 3,821,073 | 525,798 | ||||||||

| Current liabilities: | |||||||||||

| Short-term loan | 164,300 | 98,375 | 13,537 | ||||||||

| Accounts payable | 406,807 | 337,807 | 46,484 | ||||||||

| Insurance premium payables | 14,943 | 10,418 | 1,434 | ||||||||

| Other payables and accrued expenses | 185,999 | 177,787 | 24,464 | ||||||||

| Accrued payroll | 94,305 | 62,566 | 8,609 | ||||||||

| Income tax payable | 100,260 | 96,780 | 13,317 | ||||||||

| Current operating lease liability | 57,164 | 49,521 | 6,814 | ||||||||

| Total current liabilities | 1,023,778 | 833,254 | 114,659 | ||||||||

| Non-current liabilities: | |||||||||||

| Accounts payable – non-current | 401,385 | 408,416 | 56,200 | ||||||||

| Other tax liabilities | 34,368 | 29,722 | 4,090 | ||||||||

| Deferred tax liabilities | 149,151 | 144,808 | 19,926 | ||||||||

| Non-current operating lease liability | 71,311 | 57,707 | 7,941 | ||||||||

| Other non-current liabilities | 33,373 | 33,375 | 4,593 | ||||||||

| Total non-current liabilities | 689,588 | 674,028 | 92,750 | ||||||||

| Total liabilities | 1,713,366 | 1,507,282 | 207,409 | ||||||||

| Ordinary shares | 8,675 | 8,675 | 1,194 | ||||||||

| Treasury stock | (178 | ) | (197 | ) | (27 | ) | |||||

| Additional Paid-in capital | 162,721 | 177,993 | 24,493 | ||||||||

| Statutory reserves | 608,376 | 608,376 | 83,715 | ||||||||

| Retained earnings | 1,319,605 | 1,324,343 | 182,236 | ||||||||

| Accumulated other comprehensive loss | (27,936 | ) | (33,208 | ) | (4,570 | ) | |||||

| Total shareholders’ equity | 2,071,263 | 2,085,982 | 287,041 | ||||||||

| Non-controlling interests | 266,255 | 227,809 | 31,348 | ||||||||

| Total equity | 2,337,518 | 2,313,791 | 318,389 | ||||||||

| Total liabilities and equity | 4,050,884 | 3,821,073 | 525,798 | ||||||||

| FANHUA INC. Unaudited Condensed Consolidated Statements of Income and Comprehensive Income (In thousands, except for shares and per share data) |

|||||||||||

| For the Six Months Ended | |||||||||||

| December 31, | |||||||||||

| 2023 | 2024 | 2024 | |||||||||

| RMB | RMB | US$ | |||||||||

| Net revenues: | |||||||||||

| Agency | 1,752,742 | 901,064 | 123,990 | ||||||||

| Life insurance business | 1,663,463 | 828,621 | 114,022 | ||||||||

| Non-life insurance business | 89,279 | 72,443 | 9,968 | ||||||||

| Claims adjusting | 207,635 | 222,114 | 30,565 | ||||||||

| Total net revenues | 1,960,377 | 1,123,178 | 154,555 | ||||||||

| Operating costs and expenses: | |||||||||||

| Agency | (1,229,172 | ) | (551,247 | ) | (75,854 | ) | |||||

| Life insurance business | (1,163,502 | ) | (504,866 | ) | (69,472 | ) | |||||

| Non-life insurance business | (65,670 | ) | (46,381 | ) | (6,382 | ) | |||||

| Claims adjusting | (133,479 | ) | (147,333 | ) | (20,274 | ) | |||||

| Total operating costs | (1,362,651 | ) | (698,580 | ) | (96,128 | ) | |||||

| Selling expenses | (130,802 | ) | (110,122 | ) | (15,153 | ) | |||||

| General and administrative expenses | (320,537 | ) | (259,566 | ) | (35,717 | ) | |||||

| Total operating costs and expenses | (1,813,990 | ) | (1,068,268 | ) | (146,998 | ) | |||||

| Income from operations | 146,387 | 54,910 | 7,557 | ||||||||

| Other income (loss), net: | |||||||||||

| Loss from fair value change | — | (73,761 | ) | (10,150 | ) | ||||||

| Investment income | 24,957 | 24,451 | 3,365 | ||||||||

| Interest income | 9,097 | 8,586 | 1,180 | ||||||||

| Financial cost | (4,682 | ) | (960 | ) | (132 | ) | |||||

| Others, net | 6,482 | (3,216 | ) | (443 | ) | ||||||

| Income from operations before income taxes and share income of affiliates | 182,241 | 10,010 | 1,377 | ||||||||

| Income tax expense | (38,289 | ) | (6,659 | ) | (916 | ) | |||||

| Share of loss of affiliates | (540 | ) | (1,121 | ) | (154 | ) | |||||

| Net income | 143,412 | 2,230 | 307 | ||||||||

| Less: net (loss) income attributable to non-controlling interests | 6,445 | (2,508 | ) | (345 | ) | ||||||

| Net income attributable to the Company’s shareholders | 136,967 | 4,738 | 652 | ||||||||

| FANHUA INC. Unaudited Condensed Consolidated Statements of Income and Comprehensive Income-(Continued) (In thousands, except for shares and per share data) |

|||||||||||

| For The Six Months Ended | |||||||||||

| June 30, | |||||||||||

| 2023 | 2024 | 2024 | |||||||||

| RMB | RMB | US$ | |||||||||

| Net incomeper share: | |||||||||||

| Basic | 0.13 | 0.01 | — | ||||||||

| Diluted | 0.13 | 0.01 | — | ||||||||

| Net incomeper ADS: | |||||||||||

| Bsic | 2.54 | 0.09 | 0.01 | ||||||||

| Diluted | 2.54 | 0.09 | 0.01 | ||||||||

| Shares used in calculating net income per share: | |||||||||||

| Basic | 1,077,103,934 | 1,066,793,835 | 1,066,793,835 | ||||||||

| Diluted | 1,077,451,347 | 1,069,840,827 | 1,069,840,827 | ||||||||

| Net income | 143,412 | 2,230 | 307 | ||||||||

| Other comprehensive income, net of tax: Foreign currency translation adjustments | 8,880 | 783 | 108 | ||||||||

| Unrealized net (losses) gains on available-for-sale investments | 2,695 | (6,054 | ) | (833 | ) | ||||||

| Comprehensive income (loss) | 154,987 | (3,041 | ) | (418 | ) | ||||||

| Less: | |||||||||||

| Comprehensive (loss) income attributable to the non-controlling interests | 6,445 | (2,508 | ) | (345 | ) | ||||||

| Comprehensive income (loss) attributable to the Company’s shareholders | 148,542 | (533 | ) | (73 | ) | ||||||

| FANHUA INC. Unaudited Condensed Consolidated Statements of Cash Flow (In thousands, except for shares and per share data) |

|||||||||||

| For the Six Months Ended | |||||||||||

| June 30, | |||||||||||

| 2023 | 2024 | 2024 | |||||||||

| RMB | RMB | US$ | |||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net income | 143,412 | 2,230 | 307 | ||||||||

| Adjustments to reconcile net income to net cash generated from operating activities: | |||||||||||

| Investment income | (6,989 | ) | (5,256 | ) | (723 | ) | |||||

| Share of loss of affiliates | 540 | 1,121 | 154 | ||||||||

| Other non-cash adjustments | 74,859 | 145,765 | 20,058 | ||||||||

| Changes in operating assets and liabilities | (178,173 | ) | (110,934 | ) | (15,265 | ) | |||||

| Net cash generated from operating activities | 33,649 | 32,926 | 4,531 | ||||||||

| Cash flows from investing activities: | |||||||||||

| Purchase of short-term investments | (2,103,010 | ) | (1,617,780 | ) | (222,614 | ) | |||||

| Proceeds from disposal of short-term investments | 1,823,149 | 1,962,588 | 270,061 | ||||||||

| Cash rendered for loan receivables from third parties | (80,000 | ) | (728,800 | ) | (100,286 | ) | |||||

| Cash received for loan receivables from third parties | 180,000 | 130,500 | 17,957 | ||||||||

| Cash acquired from business acquisitions | 21,208 | — | — | ||||||||

| Disposal of subsidiaries, net of cash disposed | — | (12,761 | ) | (1,756 | ) | ||||||

| Others | (6,185 | ) | (3,982 | ) | (548 | ) | |||||

| Net cash used in investing activities | (164,838 | ) | (270,235 | ) | (37,186 | ) | |||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from bank and other borrowings | 182,268 | 98,375 | 13,537 | ||||||||

| Repayment of bank and other borrowings | (18,026 | ) | (164,300 | ) | (22,608 | ) | |||||

| Repurchase of ordinary shares from open market | (22,107 | ) | (5,734 | ) | (789 | ) | |||||

| Dividend distributed to non-controlling interest | — | (29,500 | ) | (4,059 | ) | ||||||

| Others | (4,238 | ) | — | — | |||||||

| Net cash generated from (used in) financing activities | 137,897 | (101,159 | ) | (13,919 | ) | ||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 6,708 | (338,468 | ) | (46,574 | ) | ||||||

| Cash, cash equivalents and restricted cash at beginning of period | 648,211 | 602,004 | 82,839 | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | 6,668 | 694 | 94 | ||||||||

| Cash, cash equivalents and restricted cash at end of period | 661,587 | 264,230 | 36,359 | ||||||||

| FANHUA INC. Reconciliations of Net Income to Adjusted EBITDA and Adjusted EBITDA Margin (In thousands, except for shares and per share data) |

|||||||||||

| For The Six Months Ended | |||||||||||

| June 30 | |||||||||||

| 2023 | 2024 | 2024 | |||||||||

| RMB | RMB | USD | |||||||||

| Net income | 143,412 | 4,738 | 652 | ||||||||

| Income tax expense……………………………………… | 38,289 | 6,659 | 916 | ||||||||

| Share of loss of affiliates………………………………. | 540 | 1,121 | 154 | ||||||||

| Investment income……………………………………….. | (24,957 | ) | (24,451 | ) | (3,365 | ) | |||||

| Interest income…………………………………………….. | (9,097 | ) | (8,586 | ) | (1,180 | ) | |||||

| Financial cost………………………………………………. | 4,682 | 960 | 132 | ||||||||

| Depreciation……………………………………………….. | 8,371 | 7,339 | 1,010 | ||||||||

| Amortization of intangible assets…………………… | 8,797 | 8,395 | 1,155 | ||||||||

| Share-based compensation expenses………………. | 8,184 | 7,729 | 1,064 | ||||||||

| Change in fair value of equity investments and contingent consideration……………………………… | — | 73,761 | 10,150 | ||||||||

| Adjusted EBITDA | 178,221 | 77,665 | 10,687 | ||||||||

| Total net revenues………………………………………… | 1,960,377 | 1,123,177 | 154,554 | ||||||||

| Adjusted EBITDA Margin……………………………. | 9.1 | % | 6.9 | % | 6.9 | % | |||||

| Adjusted EBITDA per ADS: | |||||||||||

| Basic | 3.31 | 1.46 | 0.20 | ||||||||

| Diluted | 3.31 | 1.45 | 0.20 | ||||||||

| Shares used in calculating adjusted EBITDA per share: | |||||||||||

| Basic | 1,077,103,934 | 1,066,793,835 | 1,066,793,835 | ||||||||

| Diluted | 1,077,451,347 | 1,069,840,827 | 1,069,840,827 | ||||||||

Source: Fanhua Inc.

For more information, please contact: Investor Relations Tel: +86 (20) 8388-3191 Email: ir@fanhgroup.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Germany suffers ‘spectacular’ 70pc drop in electric car sales

Germany has suffered a “spectacular” drop in electric car sales as the European Union faces growing calls to delay ambitious carbon reduction targets.

The European Automobile Manufacturers’ Association (ACEA) said that sales for new battery-powered electric vehicles (EV) in the bloc’s largest economy plunged by nearly 70pc in August, which drove a wider 18pc decline for new car sales across the EU.

In France, the EU’s second-largest market for battery electric vehicles behind Germany, sales fell by 33pc.

The ACEA said “the spectacular drop” in Germany and France meant that only 92,627 battery electric vehicles were registered across Europe last month, a fall of 43.9pc from 165,204 a year earlier.

The EV sales crisis has prompted the ACEA to call for “urgent action” against the new EU rules.

It warned that the “continual downward trajectory” of the European electric car market leaves manufacturers at risk of multibillion-euro fines.

The European Commission, which creates and enforces EU law, is preparing to introduce new targets for cars and vans designed to slash carbon emissions and encourage the adoption of electric vehicles instead.

However, the ACEA said that the EV market share remains far below the level needed to be compliant with the EU’s vehicle emissions rules.

The Brussels-based industry body said that 902,011 new battery-electric cars were registered from January to August, representing 12.6pc of the market.

“We are missing crucial conditions to reach the necessary boost in production and adoption of zero-emission vehicles: charging and hydrogen refilling infrastructure, as well as a competitive manufacturing environment, affordable green energy, purchase and tax incentives, and a secure supply of raw materials, hydrogen and batteries,” the ACEA said.

It urged the European Union to delay new carbon emissions targets and instead take “urgent and meaningful action” to reverse the decline.

Top carmakers including Volkswagen, BMW and Renault have already suggested pushing back the targets, which would see companies fined for failing to comply.

Meanwhile, Italy urged the EU to pause its “absurd” plans to ban petrol cars by 2035 amid concerns the policy risks triggering the automotive industry’s collapse.

Drivers are increasingly reluctant to purchase electric vehicles on mounting concerns about range, resale and the availability of charging points.

The European market share of EVs also fell during August from 21pc to 14.4pc. Petrol car sales also decreased by 17.1pc, although they still represent 32.6pc of the market. Diesel car sales also dropped 26.4pc.

Registrations of plug-in hybrid cars in Europe dropped 22.3pc last month, with declines recorded in all major markets.

American Healthcare REIT Announces Pricing of Upsized Primary Public Offering of Common Stock

IRVINE, Calif., Sept. 18, 2024 /PRNewswire/ — American Healthcare REIT, Inc., AHR the “, Company”, ))), announced today the pricing of an underwritten public offering of 17,400,000 shares of its common stock at a public offering price of $23.55 per share. The Company has granted the underwriters a 30-day option to purchase up to an additional 2,610,000 shares of common stock.

The Company expects to use the net proceeds from the offering to exercise its option to purchase its joint venture partner’s 24% minority membership interest in Trilogy Holdings, LLC and to repay certain amounts of debt outstanding under its lines of credit. All of the shares are being offered by the Company, and the offering is expected to close on September 20, 2024, subject to customary closing conditions.

BofA Securities, Morgan Stanley and KeyBanc Capital Markets are acting as the joint book-running managers of the offering. Citigroup, RBC Capital Markets, Truist Securities and Barclays are acting as the book-running managers of the offering. Citizens JMP, Fifth Third Securities, Regions Securities LLC and Credit Agricole CIB are acting as co-managers of the offering.

The offering of the common stock is being made pursuant to the Company’s effective shelf registration statement filed with the Securities and Exchange Commission (the “SEC”). A prospectus supplement and accompanying prospectus relating to the offering will be filed with the SEC. When available, a copy of the prospectus supplement and accompanying prospectus relating to the offering may be obtained from BofA Securities, Inc., NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus Department, Email: dg.prospectus_requests@bofa.com; Morgan Stanley & Co. LLC, Attn.: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014; or KeyBanc Capital Markets Inc., 127 Public Square, 7th Floor, Cleveland, OH 44114, Attention: Equity Syndicate, or by visiting the EDGAR database on the SEC’s web site at www.sec.gov.

This press release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of these securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About American Healthcare REIT, Inc.

American Healthcare REIT, Inc. is a self-managed REIT that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on outpatient medical buildings, senior housing, skilled nursing facilities and other healthcare-related facilities. Its properties are located in the United States, the United Kingdom and the Isle of Man.

Forward-Looking Statements

Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,” “will,” “can,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Any such forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which the Company operates, and beliefs of, and assumptions made by, the Company’s management and involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied therein, including, without limitation, risks disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and other periodic reports filed with the Securities and Exchange Commission. Except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statements contained in this release.

|

Contact: |

Alan Peterson |

|

VP, Investor Relations & Finance |

|

|

(949) 270-9200 |

|

|

investorrelations@ahcreit.com |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/american-healthcare-reit-announces-pricing-of-upsized-primary-public-offering-of-common-stock-302252543.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/american-healthcare-reit-announces-pricing-of-upsized-primary-public-offering-of-common-stock-302252543.html

SOURCE American Healthcare REIT, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

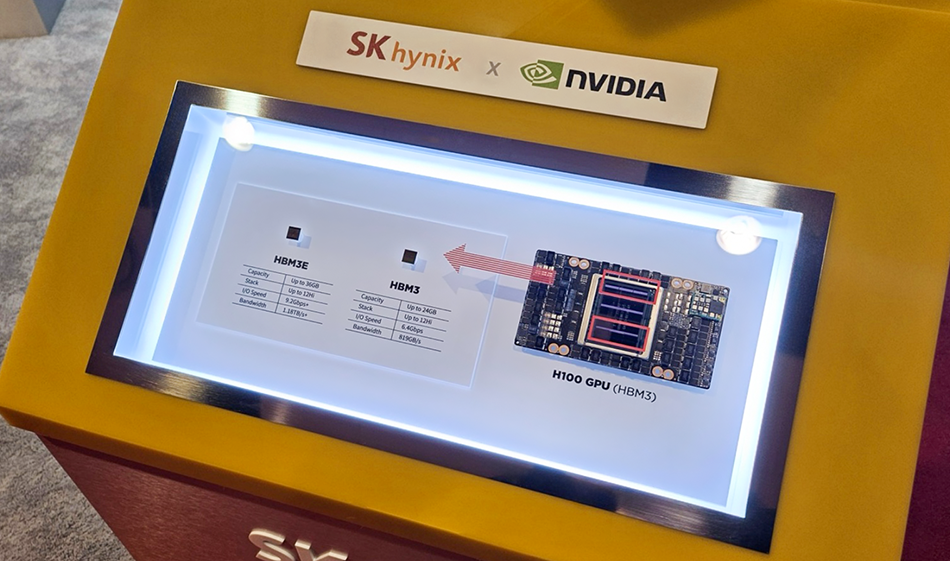

Nividia Supplier SK Hynix Shares Drop To Lowest Level Since February In Seoul After Morgan Stanley Downgrade: 'Memory Conditions Are Beginning To Deteriorate'

NVIDIA Corp‘s NVDA key supplier for high-bandwidth memory chips SK Hynix HXSCF declined over 6% on the South Korean exchange after Morgan Stanley downgraded the Korean memory chipmaker to underweight from overweight.

What Happened: Morgan Stanley in a brokerage note slashed SK Hynix’s target price to 120,000 won from 260,000 won, citing the least preference for the stock among global memory makers, reported Bloomberg on Thursday.

“We prefer moving up to quality in Samsung and value-oriented end markets,” wrote analysts Shawn Kim and Duan Liu. “Memory conditions are beginning to deteriorate. It will get tougher for revenue growth and margins from here as we move past late-cycle conditions.”

The stock hit its lowest level since Feb. 19 after falling as much as 10%. Meanwhile, Samsung Electronics Co SSNLF saw a 3.1% decline among other semiconductor shares traded in Seoul.

See Also: Donald Trump To Visit Springfield, Ohio ‘Soon’? Not So Fast, Polymarket Traders Say

Why It Matters: In July, Goldman Sachs Group Inc. increased SK Hynix’s stock-price target to 290,000 won ($210), indicating a potential gain of 25%. Meanwhile, Citigroup Inc. raised its prediction to 350,000 won during the same period.

SK Hynix’s parent company, SK Group, pledged to invest 80 trillion won ($56 billion) by 2026 in artificial intelligence and semiconductors, primarily in high-bandwidth memory chips, data centers, and personalized AI assistant services. This move is expected to strengthen its supply chains for emerging technology and bolster its position as a leading supplier to Nvidia.

The ongoing AI boom has put two South Korean chipmakers, Samsung and SK Hynix, in the spotlight. Industry experts are now discussing which company is the better investment in this AI-driven market.

Price Action: SK Hynix is currently trading at 151,800 won, with a decline of 6.76% on Thursday. The stock has gained 6.60% year-to-date, according to data from Benzinga Pro.

Read Next:

Image via SK Hynix

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump-supporting hedge fund billionaire says he'll pull his money out of the market if Harris wins the election

-

John Paulson will sell his stocks and buy gold if Kamala Harris wins the presidency.

-

The Trump-supporting hedge fund billionaire criticized Harris’ tax plans on a Fox Business segment.

-

Paulson said a proposed tax on unrealized gains would “cause mass selling of almost everything.”

Billionaire hedge fund manager and Trump donor John Paulson told Fox Business that he will sell his stocks if Kamala Harris wins the presidency in November.

“I’d go into cash and I’d go into gold because I think the uncertainty regarding the plans they outlined would create a lot of uncertainty in the markets and likely lower markets,” Paulson said on “The Claman Countdown.”

Paulson was particularly focused on Harris’ proposal to levy a 25% tax on unrealized gains for individuals worth more than $100 million. He says such a measure could trigger major asset-dumping across the economy, and broader catastrophe for markets.

“If they do implement a 25% tax on unrealized gains, that would cause mass selling of almost everything: stocks, bonds, homes, art,” Paulson said. “I think it would result in a crash in the markets and an immediate, pretty quick recession.”

Despite Paulson’s gloomy view of the policy, the specifics of Harris’ proposal have not yet been confirmed. Kent Smetters, the faculty director of the Penn Wharton Budget Model, told Business Insider recently that he’s only been able to confirm two firm policies.

The first is a bump up in corporate tax from 21% to 28%, and the second is an increase to the top rate for long-term capital gains to 28% for those making above $1 million. Much of the rest is hearsay based on media discussions with sources or a belief that she will take on Biden policies, he noted.

Meanwhile, former president Donald Trump has indicated that he would extend the Tax Cut and Jobs Act, which is set to expire in 2025. The legislation lowered the corporate tax to 21%, and Paulson characterized it as “very successful.”

Not every wealthy taxpayer is siding with Trump.

Billionaire Mark Cuban took to X, formerly Twitter, to compare how businesses would do between Harris’ tax policy and Trump’s plans for broad-sweeping tariffs, concluding that Harris would offer more in after-tax profit.

Further, many on Wall Street have scrutinized Trump’s tariff idea, fearing it could spark higher inflation and trigger trade wars. The Republican candidate has pledged to apply 10% tariffs on all US trade, and even suggested replacing the income tax with duties.

Paulson sees tariffs as an effective strategy, telling Fox Business that it would be a powerful way to boost revenue.

Read the original article on Business Insider

Forget Nvidia: 1 Stock-Split AI Stock to Buy Before It Soars 195%, According to Certain Wall Street Analysts

Nvidia has led the S&P 500 (SNPINDEX: ^GSPC) higher this year amid frenetic interest in artificial intelligence (AI). The stock has surged 136% since January, and Wall Street analysts forecast median upside of 30% from the current share price of $115. But betting on a single AI stock is a bad strategy.

Consultancy PwC estimates AI will add more than $15 trillion to the global economy by 2030, and numerous companies will benefit as the technology diffuses through different industries. So, rather than focusing solely on Nvidia, investors should forget the chipmaker (temporarily) and consider server maker Super Micro Computer (NASDAQ: SMCI).

Super Micro has a 10-for-1 stock split scheduled for late September, such that shares will begin trading on a split-adjusted basis on Oct. 1. Two analysts, Nehal Chokshi at Northland Securities and Hans Mosesmann at Rosenblatt Securities, value Super Micro at $1,300 per share, implying 195% upside from its current share price of $440.

Here’s what investors should know.

Super Micro Computer is the market leader in AI servers

Super Micro develops accelerated computing platforms, including storage systems and servers, for enterprise and cloud data centers. Its portfolio includes individual devices, and full server racks optimized for workloads like data analytics and artificial intelligence (AI). What sets Super Micro apart are its internal manufacturing capabilities and its modular approach to product development.

Specifically, the company uses electronic “building blocks” that can quickly be assembled into a broad range of servers. It also handles most assembly and testing at internal facilities to enable rapid prototyping and product releases. That usually allows Super Micro to bring new technologies to market two to six months before its competitors, according to CEO Charles Liang.

Hans Mosesmann highlighted that advantage in a note earlier this year. “Super Micro has developed a model that is very, very quick to market. They usually have the widest portfolio of products when a new product comes out from Nvidia or AMD or Intel.” That advantage has helped Super Micro secure a leadership position in the AI server market.

That puts the company in an enviable position. Statista estimates AI server sales will grow at 30% annually through 2033 as businesses build out their AI infrastructure. If Super Micro can maintain its time-to-market advantage, its revenue and earnings could increase at a similar pace over the next decade.

Super Micro shares have fallen sharply on subpar financial results and a scathing short report

Super Micro reported mixed financial results in the fourth quarter of fiscal 2024 (ended June 2024). Revenue increased 144% to $5.3 billion, but gross margin contracted almost six percentage points to 11.2% and non-GAAP earnings increased 78% to $6.25 per diluted share. Investors interpreted weak margins has proof of increased competition in the AI server market.

However, management attributed the issue to costs associated with direct liquid cooling (DLC) components. Importantly, the company expects gross margin to normalize between 14% and 17% before the end of fiscal 2025 as DLC solutions ship in higher volume. Moreover, investments in DLC solutions could strengthen Super Micro’s position in the AI server market. Liquid cooling is more efficient than traditional air cooling, and it will become increasingly important as AI servers become more powerful.

Even so, the stock tumbled 20% following the fourth-quarter report due to concerns about contracting margins. And shares moved even lower in late August when short-seller Hindenburg Research targeted Super Micro with allegations of “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures and customer issues.” Shortly thereafter, Super Micro delayed filing its Form 10-K and several analysts downgraded the stock due to uncertainty arising from the situation.

However, CEO Charles Liang dismissed the Hindenburg report as containing “false or inaccurate statements about our company including misleading presentations of information that we have previous shared publicly.” He also wrote, “We don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results. This is good news. I continue to have strong confidence in our finance and internal teams.”

Investors should stay informed on the situation. In the past, Hindenburg has uncovered serious wrongdoing at certain companies, but other times its reports have ultimately been inconsequential. Either way, the allegations make the stock risky right now, despite being down 63% from its high.

Super Micro stock is trading at a bargain price, but only for risk-tolerant investors

Wall Street expects Super Micro’s adjusted earnings to grow at 41% annually through fiscal 2026 (ends June 2026). That makes the current valuation of 20 times earnings look cheap. Those figures give a PEG ratio of 0.5, a material discount to the three-year average of 0.9. But Super Micro stock also looks cheap compared to rival server maker Dell Technologies, which has a PEG ratio 1.7.

Personally, I think risk tolerant investors should consider buying a small position in Super Micro today. The stock could rebound in a big way if the short report amounts to nothing and the company’s gross margin expands in the coming quarters. That said, shares could decline much further if either of those situations go the wrong way.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia: 1 Stock-Split AI Stock to Buy Before It Soars 195%, According to Certain Wall Street Analysts was originally published by The Motley Fool

David Grzebinski Exercises Options, Realizes $1.25M

A large exercise of company stock options by David Grzebinski, CEO at Kirby KEX was disclosed in a new SEC filing on September 17, as part of an insider exercise.

What Happened: Grzebinski, CEO at Kirby, exercised stock options for 26,358 shares of KEX stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The exercise price of the options was $75.5 per share.

Currently, Kirby shares are trading down 0.0%, priced at $122.88 during Wednesday’s morning. This values Grzebinski’s 26,358 shares at $1,248,842.

Unveiling the Story Behind Kirby

Kirby Corp is a domestic tank barge operator, transporting bulk liquid products throughout three United States coasts. The Company transports petrochemicals, black oil, refined petroleum products, and agricultural chemicals by tank barge. The Company conducts operations in two reportable business segments: The Marine transportation segment which provides marine transportation services, operating tank barges and towing vessels transporting bulk liquid products, and the Distribution and services segment, which provides after-market service, and genuine replacement parts for engines, transmissions, reduction gears, and power generation equipment used in oil and gas and commercial and industrial applications. The company’s revenue is generated from the Marine Transportation segment.

A Deep Dive into Kirby’s Financials

Revenue Growth: Over the 3 months period, Kirby showcased positive performance, achieving a revenue growth rate of 6.07% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Exploring Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 25.56%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Kirby’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.44.

Debt Management: Kirby’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.38.

Market Valuation:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 26.09 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 2.27 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 12.88 positions the company as being more valued compared to industry benchmarks.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Navigating the World of Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Kirby’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.