Wall Street’s New Era Off to Rocky Start Despite Big Fed Cut

(Bloomberg) — Jerome Powell delivered exactly what traders up and down Wall Street had long hoped for: A big interest-rate cut that would justify this year’s steep rally in stocks and bonds as the era of tight monetary policy finally began to reverse.

Most Read from Bloomberg

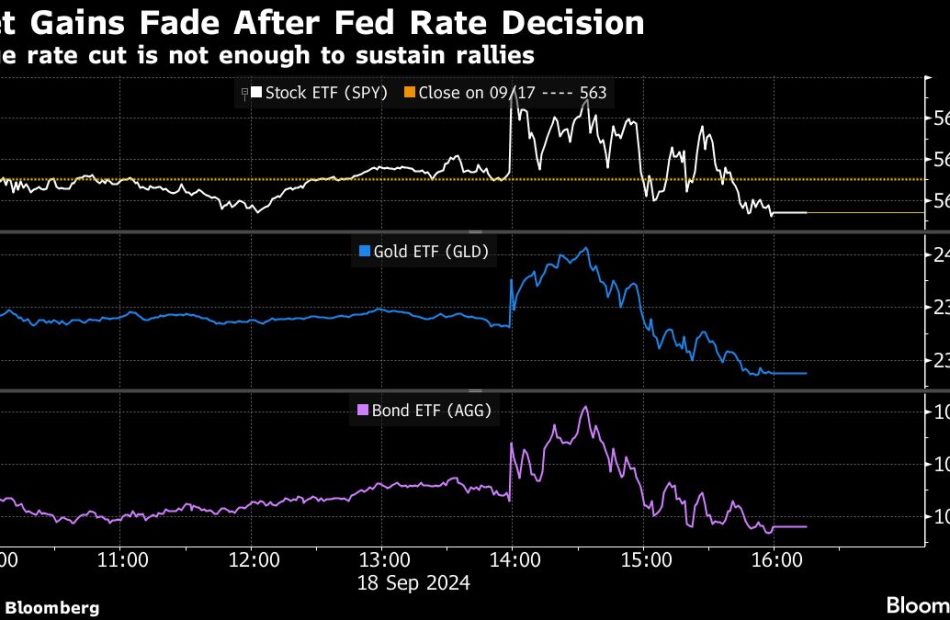

Equities, especially those of economically sensitive companies, briefly surged, driving the S&P 500 up as much as 1%. Ditto for bonds, while the prospect of easy money ahead initially pushed up speculative assets like crypto.

Yet by the time the trading day ended, the gains fizzled as a more sobering economic and market reality sunk in. Even with the half-point rate cut — the kind of aggressive move usually reserved for a recession or crisis — and more on the way, the investment backdrop was no more clear cut than it was before.

Stock prices are already near record highs. The economy is losing a little steam. And it’s no sure thing that the rock-bottom rates swept away by post-pandemic inflation will come back anytime soon.

While equities gained some momentum on Thursday, and Treasuries inched higher, every major asset was down Wednesday. While the scale of the declines were minor, a concerted pullback like that hadn’t followed a Fed policy decision since June 2021.

Of particular concern to traders were comments from Powell that coincided with the reversal in the stock and bond markets: that nobody should expect the Fed to make a habit of half-point reductions in the future, and that the neutral level of interest rates is likely higher than it was before the pandemic.

“The important point here is that there’s the action, in the 50 basis points, and the expectation in what was priced in,” said Jeffrey Rosenberg, a portfolio manager at BlackRock Inc., on Bloomberg Television. “This is a little bit disappointing relative to what’s been built up in bond expectations.”

In the aftermath, economists and traders moved to adjust their forecasts and wagers to account for the Fed’s new narrative. Goldman Sachs Group Inc. projected a longer string of consecutive cuts, while JPMorgan Chase & Co.’s economists reiterated their call for another half-point reduction in November even as they pointed to jobs data as key to their view.

Powell was upbeat about the economy and waved off recession fears, tempering the market’s expectations for where it’s heading. During his press conference, he said the central bank is confident “strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.” At the same time, he cautioned against assuming the half-point move set a pace that policymakers would continue — underscoring that everything would hinge on how the data come in.

Follow The Big Take on Apple Podcasts, Spotify or wherever you listen. Read the transcript.

The bond market had already been baking in a series of rate cuts and bets on Wednesday’s move had piled up so heavily that it was effectively already accounted for. The two-year Treasury yield, for example, had already tumbled from more than 5% in late April, enough to reflect several rate cuts.

“It was always going to be difficult for Powell to ‘out dove’ the bond market given how much it had moved in the last six weeks or so,” said Michael de Pass, global head of rates trading at Citadel Securities.

While the economy doesn’t seem in obvious need of stimulus, there are signs of a weakening trend. The three-month average gain in non-farm payrolls stands at the lowest since 2020 and gauges of factory output have slipped.

At the same time, the unemployment rate is just 4.2%, gross domestic product in 2024 is forecast to expand at the same rate as last year, and analysts currently peg 2025 earnings growth in the S&P 500 at an especially robust 14%. That sanguine backdrop had led investors to bid up stocks to nearly unprecedented valuations at the time of a first rate cut: more than 25 times earnings over the last four quarters.

That may reflect another anomaly of the current moment: the Fed has pushed rates so high — around 5.3% before Wednesday’s move — that it has made traders confident it has plenty of room to cut if the economy sputters.

“While we all can debate the warranted speed of rate cuts out of the gate, the reality is the direction of travel for policy rates is lower,” said Charlie Ripley, senior investment strategist for Allianz Investment Management. “The track record from this Fed has shown they haven’t historically been the fastest out of the gate, but they have exhibited the ability to dial up the pace when deemed necessary.”

Traders however have struggled to predict the Fed’s path since inflation surged in the wake of the pandemic, and Powell’s dependence on incoming data means that it will be no easier even now that it’s changed course.

Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast. Bond traders, however, are still counting on a more aggressive pace.

“A more prolonged and predictable easing cycle is at hand,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “It now will be a battle between market expectations and the Fed, with employment data — not inflation data —determining which side is right.”

–With assistance from Vildana Hajric, Liz Capo McCormick, Emily Graffeo, Aline Oyamada and Cecile Gutscher.

(Updates pricing in fifth paragraph and adds bank forecast changes in eighth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The Fed's outsized rate cut draws muted reaction in markets, but the calm may not last

NEW YORK (Reuters) — Investors who anticipated furious market swings following the Federal Reserve’s bumper rate cut saw more of a muted reaction. That may be fleeting.

Traders had been facing high uncertainty as they awaited the expected rate cut on Wednesday, with a split between those expecting 50 basis points and 25 basis points. The Fed cut rates by an unusually large half-percentage-point.

But while market reaction was muted, with stocks and the dollar reversing positions to mostly come full circle, there could be another wave of action. Some referred specifically to bond yields being at risk of spiking higher after rising on Wednesday.

“The calm, I think is not going to last,” said Brian Jacobsen, chief economist at Annex Wealth Management, which oversees $5.5 billion in assets. He pointed to a reversal in equities late in the day that could set the market up for weakness in stocks “unless and until we get some data giving us a clear sense of direction.”

Jacobsen said the market will be focused on upcoming data such as Thursday’s initial jobless claims.

“The Fed clearly is in catch-up mode and trying to make up for lost time with the cut it’s just made,” Jacobsen said.

There may also be a knock-on effect as the Fed decision ripples through other markets.

“The coming hours could prove dangerous … with traders exposed to sudden riptides as rate expectations are reinforced in other economies,” said Karl Schamotta, chief market strategist at payments company Corpay, about foreign-exchange markets.

“Aftershocks are likely to continue as positioning-related adjustments play out.”

Muted reaction

Stock options had priced in a roughly 1.1% swing, up or down, for the S&P 500 (^GSPC), according to options analytics service ORATS. But by the close of trading, the index had snapped a seven-day winning streak to finish down 0.29%, reversing earlier gains.

One reason for the muted market reaction on a close-to-close basis has to do with how asset prices moved in the days leading up to the Fed decision, said Sonu Varghese, global macro strategist at Carson Group. Through Tuesday, the Russell 2000 (^RUT) was up 5% over the previous five sessions and the dollar (^NYICDX) had slipped 0.7%, on expectations for the start of the Fed’s long-awaited rate-cutting cycle.

“It’s a very silly cliche, ‘buy the rumor, sell the news’, but that’s kind of what happened,” said Matt Diczok, head of fixed income strategy at Merrill and Bank of America Private Bank.

On Wednesday, the dollar index initially fell, but recovered to trade up 0.1% at 100.981.

“Since this policy move was mostly telegraphed, there is no outsized move in financial markets,” said Jack McIntyre, portfolio manager at Brandywine Global.

Bonds did register a significant move, however, with the 10-year yield spiking by seven basis points on the day, while the 2/10 U.S. Treasury yield curve reached its steepest level since July 2022, after the rate cut, signaling long-term expectations of higher inflation and growth.

Treasury yields, which move inversely to prices, had tumbled to their lowest levels since mid-2023 in the days ahead of the decision.

In a research note, Julian Emanuel, senior managing director at Evercore ISI, recommended positioning for a bounce in yields, and that progress by the Fed on inflation may slow or stall.

Small caps, which initially bounced, ended flat. Traders’ initial reaction was to lift the small-caps-focused Russell 2000 index by nearly 1% in the minute immediately after the Fed decision, making for the index’s largest one-minute percentage gain in at least three months, according to LSEG data.

Smaller companies typically rely more on borrowing, and lower interest rates cut their financing costs, bolstering their profitability and growth.

“To see the jump in small caps specifically, that’s the market buying what the Fed is saying, that they will continue to cut rates next year and that’s a potential tailwind to small caps,” said Ryan Detrick, chief market strategist at Carson Group.

But the Russell index finished up only 0.04% on the day.

Fed chair Jerome Powell said in the meeting that the rate cut marked a “strong start” to protecting strength in the economy.

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

Still, the outsized rate cut could be read more alarmingly.

“I do think that there will be a lot of profit-taking for investors that came into the day long equity to play this event and we may very well trade lower as the market continues to wonder what is scaring the Fed that we cannot see,” said Matthew Rowe, head of portfolio management and cross-asset strategies at Nomura Capital Management.

(Reporting by Saqib Iqbal Ahmed, Suzanne McGee and Carolina Mandl, additional reporting by Davide Barbuscia and Michelle Price, editing by Megan Davies and Rod Nickel)

NanoXplore Reports Results for Its Q4-2024 and Full Year 2024

MONTREAL, Sept. 18, 2024 (GLOBE NEWSWIRE) — NanoXplore Inc. (“NanoXplore” or “the Corporation”) GRA, a world-leading graphene company, reported today financial results for the year ended June 30, 2024.

All amounts in this press release are in Canadian dollars, unless otherwise stated.

Key Financial Highlights Q4-2024

- Record total revenues of $38,125,566 compared to $33,318,964 last year, representing a 14% increase;

- Adjusted gross margin* on revenues from customers of 23.6% compared to 20.8% last year;

- Loss of $2,421,110 compared to $2,003,549 last year;

- Adjusted EBITDA* of $2,488,304 compared to $526,140 last year;

- Adjusted EBITDA* of $3,329,793 compared to $1,130,962 last year for the Advanced Materials, Plastics and Composite Products segment;

- Adjusted EBITDA* loss of $841,489 compared to $604,822 last year for the Battery Cells segment (VoltaXplore initiative);

- Total liquidity of $36,504,880 as at June 30, 2024, including cash and cash equivalents of $26,504,880;

- Total long-term debt of $6,346,503 as at June 30, 2024, down by $1,529,385 compared to June 30, 2023.

Key Financial Highlights Fiscal Year 2024

- Record total revenues of $129,992,368 in 2024 compared to $123,857,171 in 2023, representing a 5% increase;

- Adjusted gross margin* on revenues from customers of 21.1% in 2024 compared to 17.4% in last year;

- Loss of $11,665,006 compared to $12,798,174 last year;

- Adjusted EBITDA* of $2,519,134 compared to a loss of $857,887 last year;

- Adjusted EBITDA* of $5,176,437 in 2024 compared to a loss of $234,795 last year for the Advanced Materials, Plastics and Composite Products segment;

- Adjusted EBITDA* loss of $2,657,303 in 2024 compared to $623,092 last year for the Battery Cells segment (VoltaXplore initiative).

Overview

Pedro Azevedo, Chief Financial Officer, said: “After a slow beginning to the year, I am very pleased with our 4th quarter and full year performance and financial results. We continued to execute on our expansion in graphene-enhanced SMC materials capacity and margin improvement plans. In addition, we also expanded, and continue to expand, our customer base for graphene powder and graphene-enhanced composites demonstrating the economic value of our graphene offering. These have resulted in our highest ever annual sales, highest ever gross margins and highest ever adjusted EBITDA. Growing our graphene and graphene-enhanced materials sales mix will continue to positively impact gross margins. We are in the 2nd stage of our growth plan but our financials do not yet fully reflect the full potential upside graphene sales will bring. We are once again well positioned for our next fiscal year and continue to execute on our 5-year strategic plan initiatives.”

Soroush Nazarpour, President & Chief Executive Officer, said: “We faced some headwinds and uncertainties at the beginning of this fiscal year namely high interest rate, inflation cost pressure and tight labour market but NanoXplore’s team performed well in this environment, and we delivered record revenues, while gross and EBITDA margins continued to expand. I expect this trend of organic growth and margin performance to continue in 2025 due to broader acceptance of our graphene base products. During the year, we received increased volumes on existing programs and won new customers, demonstrating the innovative nature of our graphene-based solutions and our ability to grow organically. We have a first mover advantage in an emerging advance material sector, and we intend on staying a market leader through developing innovative graphene-enhanced solutions for our customers while expanding our manufacturing capabilities as well as ensuring we maintain a strong balance sheet.”

* Non-IFRS Measures

The Corporation prepares its financial statements under IFRS. However, the Corporation considers certain non-IFRS financial measures as useful additional information in measuring the financial performance and condition of the Corporation. These measures, which the Corporation believes are widely used by investors, securities analysts and other interested parties in evaluating the Corporation’s performance, do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similarly titled measures presented by other publicly traded companies, nor should they be construed as an alternative to financial measures determined in accordance with IFRS. Non-IFRS measures include “Adjusted EBITDA” and “Adjusted gross margin”.

The following tables provide a reconciliation of IFRS “Loss” to Non-IFRS “Adjusted EBITDA” and of IFRS “Gross margin” to Non-IFRS “Adjusted Gross margin” for the three-month periods and for the years ended June 30, 2024 and 2023.

IFRS “Loss” to Non-IFRS “Adjusted EBITDA”

| Q4-2024 | Q4-2023 | FY 2024 | FY 2023 | |||||

| $ | $ | $ | $ | |||||

| Loss | (2,421,110 | ) | (2,003,549 | ) | (11,665,006 | ) | (12,798,174 | ) |

| Current and deferred income tax expenses (recovery) | 1,220,221 | (239,724 | ) | 966,577 | (38,650 | ) | ||

| Net interest revenues | 33,861 | 22,924 | (78,794 | ) | (63,342 | ) | ||

| Share of loss of a joint venture | — | — | — | 1,059,880 | ||||

| Loss (gain) on disposal of property, plant and equipment | (193 | ) | 131,974 | (18,453 | ) | 131,974 | ||

| Foreign exchange | 111,928 | (329,788 | ) | 287,302 | 725,221 | |||

| Share-based compensation expenses | 498,655 | 273,910 | 1,557,425 | 1,118,772 | ||||

| Non-operational items (1) | 189,783 | — | 459,783 | 116,000 | ||||

| Depreciation and amortization | 2,855,159 | 2,670,393 | 11,010,300 | 8,890,432 | ||||

| Adjusted EBITDA | 2,488,304 | 526,140 | 2,519,134 | (857,887 | ) | |||

| – From Advanced Materials, Plastics and Composite Products | 3,329,793 | 1,130,962 | 5,176,437 | (234,795 | ) | |||

| – From Battery Cells | (841,489 | ) | (604,822 | ) | (2,657,303 | ) | (623,092 | ) |

(1) Non-operational items consist of professional fees mainly due debt renegotiation and to prospectuses related fees.

IFRS “Gross margin” to Non-IFRS “Adjusted Gross margin”

| Q4-2024 | Q4-2023 | FY 2024 | FY 2023 | |

| $ | $ | $ | $ | |

| Revenues from customers | 37,717,688 | 33,010,658 | 128,600,936 | 122,700,485 |

| Cost of sales | 28,811,991 | 26,154,539 | 101,486,565 | 101,414,290 |

| Adjusted gross margin | 8,905,697 | 6,856,119 | 27,114,371 | 21,286,195 |

| Depreciation (production) | 1,657,615 | 1,535,165 | 6,362,339 | 5,873,873 |

| Gross margin | 7,248,082 | 5,320,954 | 20,752,032 | 15,412,322 |

Reporting Segments results

NanoXplore reports its financials in two distinct segments: Advanced Materials, Plastics and Composite Products and Battery cells.

| Q4-2024 | Q4-2023 | Variation |

YTD 2024 | YTD 2023 | Variation |

|||||||||||

| $ | $ | $ | % | $ | $ | $ | % | |||||||||

| From Advanced materials, plastics and composite products | ||||||||||||||||

| Revenues | 38,125,566 | 33,318,964 | 4,806,602 | 14 | % | 129,964,625 | 123,857,171 | 6,107,454 | 5 | % | ||||||

| Non-IFRS Measure * | ||||||||||||||||

| Adjusted EBITDA | 3,329,793 | 1,130,962 | 2,198,831 | 194 | % | 5,176,437 | (234,795 | ) | 5,411,232 | 2 305 | % | |||||

| From Battery cells | ||||||||||||||||

| Revenues | — | — | — | N/A | 27,743 | — | 27,743 | N/A | ||||||||

| Non-IFRS Measure * | ||||||||||||||||

| Adjusted EBITDA | (841,489 | ) | (604,822 | ) | (236,667 | ) | (39 | %) | (2,657,303 | ) | (623,092 | ) | (2,034,211 | ) | N/A | |

A. Results of operations variance analysis – Three-month periods

Revenues

| Q4-2024 | Q4-2023 | Variation | Q3-2024 | Variation | |||||

| $ | $ | $ | % | $ | $ | % | |||

| Revenues from customers | 37,717,688 | 33,010,658 | 4,707,030 | 14 | % | 33,617,106 | 4,100,582 | 12 | % |

| Other income | 407,878 | 308,306 | 99,572 | 32 | % | 250,641 | 157,237 | 63 | % |

| Total revenues | 38,125,566 | 33,318,964 | 4,806,602 | 14 | % | 33,867,747 | 4,257,819 | 13 | % |

All revenues are coming from the segment of Advanced Materials, Plastics and Composite Products.

Revenues from customers increased from $33,617,106 in Q3-2024 to $37,717,688 in Q4-2024. This increase is mainly due to a positive product mix and higher volume.

Revenues from customers increased from $33,010,658 in Q4-2023 to $37,717,688 in Q4-2024. This increase is mainly due to higher volume and higher tooling revenues.

Other income increased from $308,306 in Q4-2023 to $407,878 in Q4-2024. Other income amounted to $250,641 in Q3-2024. The variation is mainly in grants received for R&D programs.

Adjusted EBITDA

1) From Advanced Materials, Plastics and Composite Products

The adjusted EBITDA improved from $1,130,962 in Q4-2023 to $3,329,793 in Q4-2024. The variation is explained as follows:

- Gross margin on revenues from customers increased by $2,049,578 compared to last year due to higher volume, favourable product mix, improved productivity and cost control;

- Higher other income of $99,572 as explained above.

2) From Battery Cells

The adjusted EBITDA loss increased from $604,822 in Q4-2023 to $841,489 in Q4-2024. The variation is explained by the operational expenses increase (Selling, General & Administration “SG&A” and Research & Development “R&D”) of $236,667 due to higher than usual 3rd party pre-engineering expenses undertaken during the quarter.

B. Results of operations variance analysis – Year ended

Revenues

| FY 2024 | FY 2023 | Variation | |||

| $ | $ | $ | % | ||

| Revenues from customers | 128,600,936 | 122,700,485 | 5,900,451 | 5 | % |

| Other income | 1,391,432 | 1,156,686 | 234,746 | 20 | % |

| Total revenues | 129,992,368 | 123,857,171 | 6,135,197 | 5 | % |

All revenues are coming from the Advanced Materials, Plastics and Composite Products segment, except for $27,743 of other income [2023 – Nil] from the Battery Cells segment.

Revenues from customers increased from $122,700,485 last year to $128,600,936 this year. This increase is mainly due to higher volume and higher tooling revenues.

Other income increased from $1,156,686 last year to $1,391,432 this year. The variation is mainly in grants received for R&D programs.

Adjusted EBITDA

1) From Advanced Materials, Plastics and Composite Products

The adjusted EBITDA improved from a loss of $234,795 last year to a profit of $5,176,437 this year. The variation is explained as follows:

- Gross margin on revenues from customers increased by $5,828,176 compared to last year due to higher volume, favourable product mix, improved productivity and cost control;

- Higher other income of $234,746 as described above; and

- Partially offset by higher operating expenses (SG&A and R&D) of $967,730 mainly due to higher wages, including higher variable compensation.

2) From Battery Cells

The adjusted EBITDA loss increased from $623,092 last year to $2,657,303 this year. The variation is explained by the operating expenses (G&A and R&D) of $2,685,046 due in part to the acquisition during 2023 of the Martinrea share in VoltaXplore.

C. Other

Additional information about the Corporation, including the Corporation’s Management Discussion and Analysis for the years ended June 30, 2024 and 2023 (“MD&A”) and the Corporation’s consolidated financial statements for the for years ended June 30, 2024 and 2023 (the “financial statements”) can be found at www.nanoxplore.ca.

Webcast

NanoXplore will hold a webcast tomorrow, September 19, 2024, at 8:30 am EDT to review its year ended June 30, 2024. Soroush Nazarpour, CEO and President of NanoXplore, and Pedro Azevedo, Chief Financial Officer, will host the event. To access the webcast please click on the link https://edge.media-server.com/mmc/p/3gw4uj5b or you can access through our website in the Investors section under Events and Presentations. A replay of this event can be accessed via the above link or on our website.

About NanoXplore

NanoXplore is a graphene company, a manufacturer and supplier of high-volume graphene powder for use in transportation and industrial markets. Also, the Corporation provides standard and custom graphene-enhanced plastic and composite products to various customers in transportation, packaging, electronics, and other industrial sectors. The Corporation is also a silicon-graphene-enhanced Li-ion battery manufacturer for the Electric Vehicle and grid storage markets. NanoXplore is headquartered in Montreal, Quebec with manufacturing facilities in Canada, the United States and Europe.

Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements, and subject to risks and uncertainties. All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumption was made and on management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors deemed appropriate in the circumstances. No assurance can be given that these assumptions and expectations will prove to be correct. Forward-looking statements are not facts, but only predications and can generally be identified by the use of statements that include phrases such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “foresee”, “grow”, “expect”, “plan”, “intend”, “forecast”, “future”, “guidance”, “may”, “predict”, “project”, “should”, “strategy”, “target”, “will” or similar expressions suggesting future outcomes.

Forward-looking information is not a guarantee of future performance and involves a number of risks and uncertainties. Such forward-looking information necessarily involves known and unknown risks and uncertainties, including the relevant assumptions and risks factors set out in NanoXplore’s most recent annual management discussion and analysis filed on SEDAR+ at www.sedarplus.ca, which may cause NanoXplore’s actual results to differ materially from any projections of future results expressed or implied by such forward-looking information. These risks, uncertainties and other factors include, among others, the uncertain and unpredictable condition of global economy, notably as a consequence of the Covid-19 pandemic. Any forward-looking information is made as of the date hereof and, except as required by law, NanoXplore does not undertake any obligation to update or revise any forward–looking statement as a result of new information, subsequent events or otherwise.

Forward-looking statements reflect management’s current beliefs, expectations and assumptions and are based on information currently available to management. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. By their nature, forward-looking statements involve known and unknown risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated by such statements.

No securities regulatory authority has either approved or disapproved the contents of this press release.

For further information, please contact:

Pierre Yves Terrisse

Vice-President Corporate Development

py.terrisse@nanoxplore.ca

Tel: 1 438 476-1965

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

4 charts show why Wall Street's most bullish strategist expects the stock market to triple by 2030

-

Fundstrat’s Tom Lee expects the S&P 500 to top 15,000 by 2030.

-

Demographic trends, millennial spending habits, and technology advancements will be key drivers.

-

Here are the four charts that show why Lee is so bullish on the stock market.

Fundstrat’s Tom Lee raised eyebrows last month when he made an extremely bullish prediction: the S&P 500 will nearly triple by 2030.

In an interview with Bloomberg’s Odd Lots, Lee said he expects the S&P 500 to top 15,000 by the end of the decade. The index traded around 5,635 as of mid-September.

“If this is a normal S&P cycle following demographics…S&P should be potentially 15,000 by the end of the decade. To me, as you move into a longer timeframe that’s probably where I think we’re moving towards,” Lee said.

In the interview, Lee said he was looking at a handful of charts that back up his bullish long-term prediction.

Here are the four charts Lee shared with Business Insider that show why the already upbeat forecaster is so bullish on the stock market.

1. Thank you, millennials

Lee put the chart above together several years ago, but his thesis remains the same. The average age of millennials is now around 31 years old, and the global cohort of 2.5 billion people is starting to enter its prime age years of 30-50 years old.

“This would be the third time that stocks entered a cycle where annual returns compound at high teens. You had the roaring 20’s, and then you had the 50’s through the late 60’s, and this is a third cycle,” Lee told CNBC last month.

“They all coincided with a surge in the number of people aged 30-50, so in other words the number of prime age adults, and this time it’s powered by millennials and Gen Z.”

“It’s a demand story. When you get to your prime years, 30-50, Urban Institute shows you start to borrow more money, you’re making big life decisions, this is what powers the economy.”

2. Stock market peaks and demographics

The stock market has a history of peaking right around the same time a population hits its peak prime age of around 50 years old, as they are closer to retirement and often spend less money.

For example, when the greatest generation peaked in 1930, that coincided with a multi-year bear market in stocks.

Fast-forward to 1974, when the silent generation saw its prime age peak. This occurred around the same time as a painful stock market correction of about 35% that lasted years.

And the peak in the baby boomer population’s prime age was in 1999, just a year before a multi-year bear market hit stocks.

The average millennial is not set to hit their peak prime age until 2038, suggesting plenty of upside ahead for the stock market between now and then, according to Lee.

3. Tech will address a global labor shortage

According to Lee, spending on technology will boom in the coming years as the world grapples with a growing labor shortage.

“We have a really big opportunity for US technology companies because of AI, which is supplying the global digital labor, because there’s a global labor shortage. So these two forces are combining to I think power almost a decade of extraordinarily good stock returns,” Lee said.

“I think that there’s going to be a lot of dollars spent on US technology product because the world is short 80 million workers by the end of this decade, that’s roughly $3 trillion of labor salary that’s turning into silicon, so that means US suppliers of silicon and AI are going to have a $3 trillion revenue run rate.”

4. Money will flow into US tech stocks

As more companies spend trillions of dollars on technology to address a global labor shortage, that will catapult the technology sector to make up 50% of the S&P 500.

The information technology sector currently makes up about 30% of the index.

“If US companies are growing earnings at this speed, the P/E multiple of the US should go up. There’s going to be capital flows into the US. Where else in the world do you find the best and most important technology companies, they’re all basically in America,” Lee said.

This story was originally published in July 2024.

Read the original article on Business Insider

Boeing Enforces Temporary Furloughs Amid Strike, CEO Kelly Ortberg Announces 'Difficult Steps' Like Pay Cuts As $1B Weekly Loss Looms

Boeing Co. BA has started temporary furloughs for thousands of employees as it grapples with the financial impact of a machinists union strike.

What Happened: In a memo to employees, Boeing CEO Kelly Ortberg stated that the furloughs, affecting U.S.-based executives, managers, and employees, will occur one week out of every four until the strike concludes. Ortberg and his leadership team will also take pay cuts, The Washington Post reported on Wednesday.

“With production paused across many key programs in the Pacific Northwest, our business faces substantial challenges and it is important that we take difficult steps to preserve cash and ensure that Boeing is able to successfully recover,” Ortberg stated.

The strike, initiated by the 33,000-member International Association of Machinists and Aerospace Workers, began after rejecting Boeing’s offer. The union demands a 40% pay increase and the reinstatement of a pension program.

Despite the furloughs, work critical to quality, customer support, and key certification programs will continue. Production of the 787 jet in South Carolina remains unaffected.

Analysts estimate the strike could cost Boeing $1 billion weekly. The company could burn through $3.5 billion in cash if the strike extends through September, according to Bloomberg Intelligence.

Boeing’s financial measures include a hiring freeze, reduced capital and supplier spending, and an end to nonessential travel. The strike is the first by Boeing machinists in 16 years, according to the report.

Why It Matters: The strike’s origins trace back to Saturday, when over 30,000 workers walked off the job after rejecting Boeing’s offer of a 25% wage increase over four years. Union leader Jon Holden emphasized the workers’ resolve, stating, “They’re standing shoulder to shoulder and they’re ready. So it (the strike) could go on for a while.”

Subsequently, Boeing and the union returned to the negotiating table with federal mediators on Wednesday. The talks aim to resolve the wage and pension disputes that triggered the strike. The union’s demand for a 40% wage hike starkly contrasts with Boeing’s 25% offer.

Adding to the complexity, Elon Musk recently criticized the Federal Aviation Administration for allegedly favoring Boeing over SpaceX in regulatory matters.

Price Action: Boeing Co. closed at $155.11 on Wednesday, down 0.82% for the day. In after-hours trading, the stock gained 0.38%. Year to date, Boeing’s stock has dropped by 38.39%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Solid AI Stock That's Not Nvidia or Palantir to Focus On in the Next Few Years

Artificial intelligence (AI) is probably one of the biggest trends that will change our daily lives in the coming decades. While AI is still in its early development stage, companies like Nvidia and Palantir have already seen an impact on their business growth in recent quarters.

Still, some winners have yet to make money from selling AI-related services and products but are well-positioned to do so in the future. Tesla (NASDAQ: TSLA), one of the leading technology companies of our generation, is among those companies.

From EV to autonomous driving

Tesla, arguably, has contributed more to the automotive industry than any incumbent car maker since Ford Motor Company introduced its Model T in the early 1900s. The EV maker almost single-handedly drove the mass adoption of electric cars in the U.S. when most of the incumbents were skeptical of the potential of EV cars.

And while the EV transition will probably take decades to complete, the tech company is now riding on an even more significant trend of autonomous driving. According to McKinsey & Company, passenger car advanced driver-assistance and autonomous driving systems could generate $300 to $400 billion in revenue by 2035. And that’s just revenue from selling these systems. The rise of autonomous driving systems could also open up other business opportunities for Tesla, such as launching a robotaxi service.

There are good reasons to believe that Tesla is a front-runner well-positioned to grab a decent, if not substantial, market share in this emerging industry. For instance, Tesla has a huge fleet of vehicles (in the millions) that are constantly generating real-world driving data. This massive (and ever-growing) data set helps train Tesla’s models used to develop autonomous driving software, allowing the tech company to maintain its leadership in the autonomous driving race.

Besides, Tesla’s vertical integration from manufacturing cars to designing its software and chips gives it the speed and flexibility to optimize and improve its AI systems rather than rely on external parties for critical software or components. To this end, Tesla’s custom-built Dojo supercomputershelp train complex AI models with vast amounts of driving data, giving the company an edge in large-scale, low-cost computing.

While it’s too early to declare victory, Tesla’s early-mover advantage and its massive investment in AI positions the company well to maintain its leadership in the emerging autonomous driving industry. If it can sustain its current leadership, it’s likely just a matter of time before it starts making billions from this venture.

AI and robotics

Another area in which Tesla has huge ambitions is to build and sell humanoid robots. Known as Optimus, these Tesla bots could help solve problems in almost every sector, from manufacturing to healthcare, domestic care, education, etc.

According to Tesla CEO Elon Musk, the company could make trillions in profits from selling these robots to perform such tasks as teaching kids, babysitting, working in factories, and more. The idea is that, eventually, every human being will own one (or more) of these robots, and if Tesla grabs a substantial market share of, say, 10% and makes $10,000 profit from each robot, it would translate into trillions of dollars on the bottom line.

While these predictions are probably too rosy — Musk is never shy of giving huge targets — the opportunity is still massive even if the company could reach just 5% of that target.

As a leading AI and auto manufacturing player, Tesla can leverage its technology know-how and massive resources to develop and grow this business. In fact, the company expects to start using Optimus robots in its factory by next year and hopefully start selling them to external customers by 2026. While these dates may change (or be postponed), announcing them publicly indicates that Tesla is on its way to making Optimus a reality.

Suppose the company can continue to improve its AI software systems and integrate them with hardware via its advanced engineering capabilities. In that case, there is a decent chance that we could get our hands on these robots in the next few years. This venture could be worth more than Tesla’s automotive business at some point.

What it means for investors?

Tesla has been an early proponent and a heavy user of AI for many years even though it may not seem evident to many investors. This will change, especially as the autonomous driving starts to pick up and humanoid robots become a reality. While this will not happen overnight, the impact should be massive for Tesla and its shareholders.

Investors should start keeping an eye on the company.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Lawrence Nga has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.

1 Solid AI Stock That’s Not Nvidia or Palantir to Focus On in the Next Few Years was originally published by The Motley Fool

Dow Tumbles Over 100 Points Following Fed's Rate Decision: Fear & Greed Index In 'Greed' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, with the index in the “Greed” zone on Wednesday.

U.S. stocks settled lower on Wednesday, following the Federal Reserve’s interest rate decision. The U.S. central bank slashed interest rates by 50 basis points Wednesday at its September Federal Open Market Committee meeting, lowering the federal funds rate to a range of 4.75% to 5%. This marks the first rate cut in over four years and breaks a streak of 12 consecutive months with rates held steady.

On the economic data front, housing starts in the U.S. climbed by 9.6% from the prior month to an annualized rate of 1.356 million units for August. U.S. building permits gained by 4.9% to an adjusted annual rate of 1.475 million in August.

General Mills, Inc. GIS reported better-than-expected earnings for its first quarter on Wednesday.

Most sectors on the S&P 500 closed on a negative note, with consumer staples, utilities, and information technology stocks recording the biggest losses on Wednesday. However, energy and communication services stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 104 points to 41,503.10 on Wednesday. The S&P 500 fell 0.29% to 5,618.26, while the Nasdaq Composite fell 0.31% at 17,573.30 during Wednesday’s session.

Investors are awaiting earnings results from Darden Restaurants, Inc. DRI, FactSet Research Systems Inc. FDS, and FedEx Corporation FDX today.

What is CNN Business Fear & Greed Index?

At a current reading of 56.2, the index was in the “Greed” zone on Wednesday, versus a prior reading of 55.9.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Exicure Shares Are Trading Higher By Around 180%; Here Are 20 Stocks Moving Premarket

Shares of Exicure, Inc XCUR rose sharply in today’s pre-market trading after the company announced it received an extension from the Nasdaq Hearings Panel.

After the market close, Exicure announced that it was granted an extension for continued listing on the Nasdaq exchange. The early-stage biotechnology company must now show compliance with all applicable criteria for continued listing on the Nasdaq by Nov. 14.

Exicure shares jumped 179.9% to $6.41 in the pre-market trading.

Here are some other stocks moving in pre-market trading.

Gainers

- Zeo Energy Corp. ZEO gained 288.9% to $4.55 in pre-market trading after declining around 9% on Wednesday.

- Telesis Bio, Inc. TBIO gained 138.4% to $3.22 in the pre-market trading session. Telesis Bio recently announced that it has notified the Nasdaq Stock Market of its decision to delist.

- Venus Concept Inc. VERO gained 82.8% to $0.9188 in pre-market trading after the company announced Australian regulatory approval for Venus Bliss MAX.

- Freight Technologies, Inc. FRGT rose 60.6% to $0.1991 in pre-market trading after gaining 12% on Wednesday. Freight Technologies was recently selected by Bayer CropScience as a logistics provider for 2025 and was awarded six essential cross-border lanes to provide truckload services.

- Mynaric AG MYNA shares rose 25.6% to $1.37 in pre-market trading after gaining 18% on Wednesday.

- ProMIS Neurosciences, Inc. PMN gained 20.2% to $1.49 in pre-market trading after declining 5% on Wednesday.

- Maxeon Solar Technologies, Ltd. MAXN gained 17.4% to $0.1067 in pre-market trading after gaining more than 5% on Wednesday.

- Graphjet Technology GTI rose 17.4% to $3.00 in pre-market trading after gaining around 12% on Wednesday.

- XCHG Limited XCH shares gained 13.2% to $20.80 in pre-market trading after jumping over 65% on Wednesday.

Losers

- Progyny, Inc. PGNY fell 23.2% to $18.78 in pre-market trading.

- Webuy Global Ltd WBUY fell 17.4% to $0.1523 in pre-market trading after surging around 59% on Wednesday.

- Veea Inc. VEEA shares fell 15.8% to $10.31 in pre-market trading. Veea shares jumped 131% on Wednesday after the company announced a strategic partnership with Crowdkeep to integrate their respective technologies into a singular, tailored solution to track assets, people, and conditions across a variety of use cases.

- 1847 Holdings LLC EFSH shares dipped 15% to $1.70 in pre-market trading after declining 13% on Wednesday.

- BurgerFi International, Inc. BFI shares declined 12% to $0.15 in pre-market trading after dipping 27% on Wednesday.

- Allarity Therapeutics, Inc. ALLR shares declined 11.2% to $2.04 in pre-market trading following a 23% decline on Wednesday.

- Singularity Future Technology Ltd.. SGLY declined 11.2% to $1.86 in pre-market trading after gaining around 35% on Wednesday.

- Odyssey Marine Exploration, Inc. OMEX fell 9.3% to $1.27 in today’s pre-market trading after jumping 182% on Wednesday. The company recently announced an award in its arbitration with the United Mexican States under Chapter Eleven of the North American Free Trade Agreement (NAFTA).

- Smith Micro Software Inc SMSI shares fell 9.3% to $0.92 in pre-market trading after jumping around 6% on Wednesday.

- Steelcase Inc. SCS shares fell 8.9% to $12.85 in pre-market trading after the company reported worse-than-expected second-quarter revenue results.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Pinnacle West Capital Corp.

Summary

Pinnacle West Capital, based in Phoenix, generates and delivers electricity, and sells energy-related products and services to retail and wholesale customers in the western U.S. The company owns and operates 6,500 megawatts of generating capacity. Pinnacle West’s primary regulated utility, Arizona Public Service Co., supplies electricity to 1.4 million customers in 11 of 15 Arizona counties. Approximately 50% of current production is fr

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

STELLANTIS SHAREHOLDER ALERT: CLAIMSFILER REMINDS INVESTORS WITH LOSSES IN EXCESS OF $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against Stellantis N.V. – STLA

NEW ORLEANS, Sept. 18, 2024 (GLOBE NEWSWIRE) — ClaimsFiler, a FREE shareholder information service, reminds investors that they have until October 15, 2024 to file lead plaintiff applications in a securities class action lawsuit against Stellantis N.V. STLA, if they purchased the Company’s securities between February 15, 2024 to July 24, 2024, inclusive (the “Class Period”). This action is pending in the United States District Court for the Southern District of New York.

Get Help

Stellantis investors should visit us at https://claimsfiler.com/cases/nyse-stla/ or call toll-free (844) 367-9658. Lawyers at Kahn Swick & Foti, LLC are available to discuss your legal options.

About the Lawsuit

Stellantis and certain of its executives are charged with failing to disclose material information during the Class Period, violating federal securities laws.

On July 25, 2024, the Company announced its first half 2024 financial results, disclosing disappointing news, including “[n]et revenues of €85.0 billion, down 14% compared to H1 2023, primarily due to the decline in volume and mix; net profit of €5.6 billion, down 48% compared to H1 2023, primarily due to lower volume and mix, headwinds from foreign exchange and restructuring costs; adjusted operating income of €8.5 billion, down €5.7 billion compared to H1 2023, primarily due to decreases in North America.”

On this news, the price of Stellantis’ shares fell from a closing price of $19.60 per share on July 24, 2024 to $17.66 per share on July 26, 2024.

The case is Long v. Stellantis N.V., et al., No. 24-cv-06196.

About ClaimsFiler

ClaimsFiler has a single mission: to serve as the information source to help retail investors recover their share of billions of dollars from securities class action settlements. At ClaimsFiler.com, investors can: (1) register for free to gain access to information and settlement websites for various securities class action cases so they can timely submit their own claims; (2) upload their portfolio transactional data to be notified about relevant securities cases in which they may have a financial interest; and (3) submit inquiries to the Kahn Swick & Foti, LLC law firm for free case evaluations.

To learn more about ClaimsFiler, visit www.claimsfiler.com.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.