David Krantz Joins RockFarmer Properties as Principal, Head of Capital Markets

NEW YORK, Sept. 18, 2024 (GLOBE NEWSWIRE) — RockFarmer Properties, a fully integrated real estate development and investment firm, proudly announces the appointment of David Krantz as the company’s new Head of Capital Markets. With over 22 years of extensive experience in the real estate industry, Krantz brings a wealth of knowledge and a proven track record in capital markets, private equity, investment strategy and team leadership to his new role as the company looks to aggressively expand its national investment platform.

“We are thrilled to welcome David to the RockFarmer team,” said John Petras, Managing Principal of RockFarmer Properties. “David’s extensive experience in managing and optimizing diversified investment platforms will be invaluable in driving our growth as we continue to expand our portfolio and explore new opportunities in key markets nationwide.”

As Head of Capital Markets at RockFarmer Properties, Krantz will focus on curating new investment opportunities, growing their institutional investor clientele, building out the company’s investor vehicles, structuring and negotiating portfolio debt and fostering key relationships both internally and externally. His expertise will play a pivotal role as the company continues to expand its investment footprint across targeted U.S. growth locations, expanding the company’s offerings and targeting distressed assets with a particular focus on multifamily, office, retail, and mixed-use properties created by dislocation in the market.

“RockFarmer sees this as a unique moment in time to seize new opportunities and invest in the future, especially given the current market dislocation,” added Krantz. “Drawing on lessons learned from previous downturns, John and George have built an institutional-quality family office that is strategically positioned to capitalize on emerging opportunities in New York and across the Sun Belt states. The team also shares excitement and optimism regarding future things to come with a strategic plan to stay ahead of the upswing.”

David Krantz joins RockFarmer Properties after serving as Managing Director and Head of Real Estate at Mirae Asset Securities (USA). At Mirae, a global asset manager with $550 billion in assets under management, Krantz was responsible for reconstituting the U.S. real estate platform. He successfully developed and implemented investment strategies, built a team of dedicated professionals, and managed a $7 billion pipeline of equity opportunities. His role involved overseeing investment activities across multifamily, student housing, manufactured housing and development projects.

Prior to Mirae, Krantz held senior roles at prominent firms such as Savills USA, CBRE, and The Praedium Group, LLC, where he led capital market groups, managed investment sales, and structured complex real estate transactions. Throughout his career, Krantz has been involved in transactions exceeding $18.5 billion across various asset classes and has a deep understanding of market cycles, distressed investments and monetization strategies.

RockFarmer Properties, founded by George Michelis and John Petras, has a strong reputation for successfully executing the development, acquisition, renovation, and repositioning of residential and commercial properties across New York’s most diverse neighborhoods. The company’s expansion into key markets, including Texas, is a testament to its commitment to growth and innovation in the real estate sector.

RockFarmer Properties is a privately owned fully integrated vertical development and investment firm based in New York City. Founded by George Michelis and John Petras, the company has successfully executed the development, acquisition, renovation and repositioning of more than 70 transformative residential and commercial properties across New York and Texas’s most diverse neighborhoods. For more information, please visit www.rockfarmerproperties.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ca61b84b-52bb-4e46-bb31-6e015238237f

Contact: Greg McGunagle 2129671449 gmcgunagle@transmitterpr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Thailand's New Cannabis Bill: Stricter Rules, But Marijuana Remains Legal

Thailand has introduced a new cannabis bill to regulate the country’s booming marijuana industry, marking the latest step in its ongoing efforts to steer cannabis use toward medical and health-related purposes.

This move comes after a series of policy shifts and follows the 2022 decriminalization of the plant, which made Thailand the first country in Asia to take such action.

See Also: Thailand’s Cannabis Prices Drop Amid Oversupply And Legal Uncertainties

The new draft bill, published earlier this week by the Ministry of Public Health, is seen as a more measured approach than previous proposals, Bloomberg reported.

It arrives just days after Prime Minister Paetongtarn Shinawatra‘s administration took office. The legislation allows cannabis and its extracts to be used for medical treatment and research by state agencies, while also approving its use in herbal remedies, food products, and cosmetics.

Softer Stance On Recreational Use

One key aspect of the bill is its omission of a clause that explicitly outlaws recreational cannabis use, which was part of an earlier draft under former Prime Minister Srettha Thavisin.

The new version also abandons previous efforts to reclassify cannabis as a “narcotic,” a significant shift from the original stance taken by the ruling Pheu Thai Party during last year’s national elections.

While Pheu Thai initially vowed to restrict cannabis use to medical purposes over addiction concerns, opposition from the Bhumjaithai Party, a key coalition partner, has resulted in the plant remaining legal.

Despite this more lenient approach, penalties for those who use cannabis outside the bill’s defined uses remain steep.

Under the current draft, individuals caught using cannabis for purposes not specified in the legislation will face fines of up to 60,000 baht (approximately $1,803). Sellers of cannabis products not adhering to the law face even harsher penalties, including a possible one-year jail term, fines of up to 100,000 baht, or both.

Impacts On Thailand’s Cannabis Boom

Thailand’s decriminalization of cannabis in 2022 led to the rapid rise of more than 9,400 cannabis dispensaries across the country, especially in popular tourist destinations and business hubs such as Bangkok.

With this new bill, the government seeks to bring tighter control over this growing industry, requiring all cannabis growers, sellers and related businesses to apply for licenses or permits. Failure to comply could result in hefty fines or jail terms.

The draft legislation also calls for stricter regulations on the planting, sale, export and import of cannabis. Businesses that produce cannabis-infused goods, such as candies and baked goods, will be required to adhere to the current law, which mandates that these products contain no more than 0.2% THC, the psychoactive compound responsible for cannabis’ “high” effect.

The public and industry stakeholders have until September 30 to submit their feedback on the draft legislation. The Ministry of Public Health will review the input and may make changes before presenting the bill to the cabinet. From there, it will head to parliament for approval, where it could still face further debate and revisions.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Basilea enters into agreement with BARDA to develop novel antifungals and antibacterials and receives initial funding

- Initial funding of USD 29 million to support development of Basilea’s clinical stage first-in-class antifungals, fosmanogepix and BAL2062

- Multi-year Other Transaction Agreement (OTA) allows for potential funding of up to approximately USD 268 million to develop antifungal and antibacterial assets

- Increasing FY 2024 financial guidance on total revenue, operating result and net profit

Ad hoc announcement pursuant to Art. 53 LR

Allschwil, Switzerland, September 19, 2024

Basilea Pharmaceutica Ltd, Allschwil BSLN, a commercial-stage biopharmaceutical company committed to meeting the needs of patients with severe bacterial and fungal infections, announced today that the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) within the US Department of Health and Human Services, has awarded Basilea an Other Transaction Agreement (OTA), under OTA number 75A50124C00033. As a result, Basilea increases its financial guidance for the full year 2024.

David Veitch, Chief Executive Officer of Basilea, said: “Basilea has been working with BARDA since 2013. In continuing this partnership through an OTA, we will be leveraging our strong portfolio and the capabilities of our organization to develop urgently needed novel antifungals and antibacterials. We believe this long-term partnership will also lead to the successful implementation of our strategy to become a leading anti-infectives company.”

Under the terms of the OTA, BARDA will support the development of designated novel, first-in-class antifungals and antibacterials in Basilea’s portfolio with a total potential non-dilutive funding of up to approximately USD 268 million over up to twelve years, if all additional options to extend the contract are exercised by BARDA upon successful completion of pre-defined milestones, including clinical and regulatory activities.

With the signing of the OTA, initial BARDA funds of USD 29 million have been committed to support the development of the antifungals fosmanogepix and BAL2062. BARDA’s financial contribution is assumed to be about 60% of the total costs over the term of the OTA.

Under the OTA, BARDA and Basilea can jointly decide to move candidates into and out of the portfolio based on product performance, technical risk, and programmatic need. This flexibility results in significant time, effort, and cost savings to both partners.

Increasing full-year (FY) 2024 financial guidance

Reflecting the near-term impact of the OTA, Basilea updates its financial guidance for the full year 2024. Development costs under the OTA will continue to be reported under research and development expenses. The BARDA reimbursements will be reported under other revenue, resulting in increased total revenue and unchanged operating expenses. Also, additional deferred taxes are recognized due to the expected positive effect of the OTA on the company’s medium-term financial outlook. This results in a higher operating result and net profit for FY 2024.

| (In CHF million) | FY 2024e (new) |

FY 2024e (previous) |

FY 2023 |

| Cresemba and Zevtera-related revenue | ~190 | ~190 | 150.3 |

| of which royalty income | ~92 | ~92 | 78.9 |

| Total revenue | ~203 | ~196 | 157.6 |

| Cost of products sold | ~40 | ~40 | 26.8 |

| Operating expenses | ~120 | ~120 | 111.7 |

| Operating result | ~43 | ~36 | 19.2 |

| Net profit | ~60 | ~42 | 10.5 |

About fosmanogepix

Fosmanogepix is a clinical-stage broad-spectrum antifungal. It has a novel mechanism of action and its active moiety has shown activity against common species of Candida and Aspergillus, including multi-drug-resistant strains, such as Candida auris and Candida glabrata, as well as rare difficult-to-treat molds including Fusarium spp., Scedosporium spp., and some fungi from the Mucorales order.1 Fosmanogepix is available in intravenous and oral formulations and has been evaluated for efficacy and safety in a phase 1 / phase 2 program, including three open-label phase 2 studies for the treatment of Candidemia, including Candida auris, and invasive mold infections.1, 2, 3, 4 Basilea will initiate shortly a double-blind non-inferiority phase 3 study in invasive yeast infections.5 Fosmanogepix has received Fast Track and Orphan Drug designations from the US Food and Drug Administration for seven separate indications, and is designated as a Qualified Infectious Disease Product (QIDP) for the treatment of four indications.

About BAL2062

BAL2062 is a first-in-class antifungal, derived from a natural product, and has demonstrated fungicidal activity against clinically important molds such as Aspergillus spp., including azole-resistant strains.6 Safety and tolerability have been demonstrated in a previously completed phase 1 study with single and multiple ascending intravenous (i.v.) doses.7 The drug candidate has Qualified Infectious Disease Product (QIDP), Orphan Drug and Fast Track designation from the US Food & Drug Administration (FDA) for invasive aspergillosis.

About invasive mold infections

Invasive aspergillosis and invasive infections with rare molds (e.g., Fusarium spp., Scedosporium spp., and Mucorales fungi) are life-threatening infections that predominantly affect immunocompromised patients, including patients with hematologic malignancies (blood cancer), transplant patients, or patients with other immunodeficiency disorders. These infections are associated with high morbidity and mortality.8, 9

About invasive candidiasis

Invasive candidiasis, including deep-seated tissue candidiasis and candidemia, is an increasingly important nosocomial infection, especially in patients hospitalized in intensive care units. Candida species are ranked as the fourth main cause of bloodstream infections in hospitals in the US.10 The prognosis of invasive candidiasis remains difficult, with a reported mortality rate for invasive candidiasis as high as 40%, even when patients receive antifungal therapy.11

About Basilea

Basilea is a commercial-stage biopharmaceutical company founded in 2000 and headquartered in Switzerland. We are committed to discovering, developing and commercializing innovative drugs to meet the needs of patients with severe bacterial and fungal infections. We have successfully launched two hospital brands, Cresemba for the treatment of invasive fungal infections and Zevtera for the treatment of bacterial infections. In addition, we have preclinical and clinical anti-infective assets in our portfolio. Basilea is listed on the SIX Swiss Exchange BSLN. Please visit basilea.com.

Disclaimer

This communication expressly or implicitly contains certain forward-looking statements, such as “believe”, “assume”, “expect”, “forecast”, “project”, “may”, “could”, “might”, “will” or similar expressions concerning Basilea Pharmaceutica Ltd, Allschwil and its business, including with respect to the progress, timing and completion of research, development and clinical studies for product candidates. Such statements involve certain known and unknown risks, uncertainties and other factors, which could cause the actual results, financial condition, performance or achievements of Basilea Pharmaceutica Ltd, Allschwil to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Basilea Pharmaceutica Ltd, Allschwil is providing this communication as of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events or otherwise.

For further information, please contact:

This ad hoc announcement can be downloaded from www.basilea.com.

References

- K. J. Shaw, A. S. Ibrahim. Fosmanogepix:A Review of the First-in-Class Broad Spectrum Agent for the Treatment of Invasive Fungal Infections. Journal of Fungi (Basel) 2020 (6), 239

- M. R. Hodges, E. Ople, P. Wedel et al. Safety and Pharmacokinetics of Intravenous and Oral Fosmanogepix, a First-in-Class Antifungal Agent, in Healthy Volunteers. Antimicrobial Agents and Chemotherapy 2023 (67), e01623-22

- J. A. Vazquez, P. G. Pappas, K. Boffard et al. Clinical Efficacy and Safety of a Novel Antifungal, Fosmanogepix, in Patients with Candidemia Caused by Candida auris: Results from a Phase 2 Trial. Antimicrobial Agents and Chemotherapy2023 (67), e01419-22

- P. G. Pappas, J. A. Vazquez, I. Oren et al. Clinical safety and efficacy of novel antifungal, fosmanogepix, for the treatment of candidaemia: results from a Phase 2 trial. Journal of Antimicrobial Chemotherapy 2023 (78), 2471-2480

- ClinicalTrials.gov identifier NCT05421858

- K. J. Shaw. GR-2397: Review of the Novel Siderophore-like Antifungal Agent for the Treatment of Invasive Aspergillosis. Journal of Fungi (Basel) 2022 (8), 909

- ClinicalTrials.gov identifier NCT02956499: M. P. Mammen, D. Armas, F. H. Hughes et al. First-in-Human Phase 1 Study To Assess Safety, Tolerability, and Pharmacokinetics of a Novel Antifungal Drug, VL-2397, in Healthy Adults. Antimicrobial Agents and Chemotherapy 2019 (63), e00969-19

- J. Cadena, G. R. Thompson 3rd, T. F..Patterson. Aspergillosis: Epidemiology, Diagnosis, and Treatment. Infectious Disease Clinics of North America 2021 (35), 415-434

- M. Slavin, S. van Hal, T. C. Sorrell et al. Invasive infections due to filamentous fungi other than Aspergillus: epidemiology and determinants of mortality. Clinical Microbiology and Infection 2015 (21), 490.e1-490.e10

- Candidemia (Blood Infection) and Other Candida Infections. 2019 Factsheet by the American Thoracic Society: https://www.thoracic.org/patients/patient-resources/resources/candidemia.pdf (Accessed: September 18, 2024)

- B. J. Kullberg, M. C. Arendrup. Invasive Candidiasis. The New England Journal of Medicine 2015 (373), 1445-1456

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Homeowners in Auburn Can Now Fund Roofing, HVAC, Renewable Energy, Water Saving Projects, and Earthquake Resiliency through Property Assessed Clean Energy (PACE) Financing with Home Run Financing

Innovative Form of Financing Now Available in Auburn After City Council Vote

AUBURN, Calif., Sept. 18, 2024 /PRNewswire/ — Homeowners in Auburn, the county seat of Placer County, can now access Property Assessed Clean Energy (PACE) home improvement financing through industry leader Home Run Financing (HRF), in accordance with a recent vote by the Auburn City Council. The Placer County Board of Supervisors voted in December to extend the program, originally approved in 2020, for another five years in unincorporated areas of the county, showing confidence in the program and an appreciation for its benefits for Placer County homeowners. The county’s largest city, Roseville, has also approved PACE financing for its residents.

PACE financing can be used to fund renewable energy, and energy and water efficiency upgrades, as well as earthquake resiliency. Auburn joins more than 340 other cities and towns in California in making PACE Funding available to homeowners.

“With the recent high temperatures in Auburn and Excessive Heat Warning through the region, Auburn homeowners need funding options to upgrade their homes to be more resilient and energy-efficient,” said Home Run Financing CEO, Robert Giles. “PACE can help build the community’s resiliency to such extreme weather events. It can also allow more homeowners to add solar panels, energy efficient HVAC, and other efficient and renewable energy systems to lower their utility bills and reduce the region’s carbon emissions.”

PACE Financing is available only through registered and trained contractors. State legislation and regulation by the state Department of Financing Protection and Innovation (DFPI) provides robust consumer protections for homeowners.

Drought remains a perennial problem in California and more and more homeowners are looking for additional ways to fund home upgrades to save water. California homeowners are also looking for ways to reduce utility bills in the face of rising energy costs, both by installing renewable energy systems like solar panels, and by installing more efficient (less leaky) windows and doors and roofs. PACE Financing is specifically designed to be used for such water and energy saving projects.

The PACE financing model provides the strongest consumer protections of any home improvement financing product, with homeowner identity verification measures; recorded confirmation of terms calls conducted in English or Spanish to ensure the homeowner understands the financing; a further recorded call in English or Spanish to verify the project is complete before the contractor gets paid; third-party inspection of completed projects; rigorous contractor oversight and training; and additional protections for the elderly and low-income homeowners, among several other stringent consumer protection measures.

In the eight years Home Run Financing (previously PACE Funding Group) has been operating in California, the company has provided more than $555 million in PACE financing for more than 18,000 home improvement projects across the state. These projects have set in place greenhouse gas reductions, over the lifetime of the upgrades, of 177,800 metric tons, equivalent to taking more than 42,000 cars off the road for a year or powering more than 23,000 homes for a year. The water efficiency upgrades have set in place the conservation of 191 million gallons of water, equivalent to filling 9,000 backyard pools or taking 9 million five-minute showers. HRF-financed projects have created 5,000 good-paying jobs across the state.

Learn more at www.homerunfinancing.com.

CONTACT

Severn Williams

510-336-9566

swilliams@tanagercommunications.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/homeowners-in-auburn-can-now-fund-roofing-hvac-renewable-energy-water-saving-projects-and-earthquake-resiliency-through-property-assessed-clean-energy-pace-financing-with-home-run-financing-302252174.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/homeowners-in-auburn-can-now-fund-roofing-hvac-renewable-energy-water-saving-projects-and-earthquake-resiliency-through-property-assessed-clean-energy-pace-financing-with-home-run-financing-302252174.html

SOURCE Home Run Financing

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Predicts No 'Huge Run' For Tech Stocks After Federal Reserve Cuts Rate: 'It Got Out Of The Wish Game A Very Long Time Ago'

Amid the Federal Reserve’s recent decision to cut interest rates, CNBC’s Jim Cramer has weighed in on how these changes might affect the technology sector.

What Happened: Cramer discussed the Federal Reserve’s recent interest rate cuts and their implications for the technology sector on Wednesday. He believes these cuts do not significantly benefit tech stocks.

According to CNBC on Thursday, Cramer stated, “With a double-sized rate cut that everybody already expected, you aren’t going to see a huge run in tech.”

He emphasized that the Fed’s actions are more beneficial to companies reliant on a healthy consumer base.

The Federal Reserve initiated its rate-cutting cycle by reducing rates by half a point and signaled an additional 50 basis points cut by year-end. This marks the first rate cut since the pandemic, aimed at addressing inflation and balancing economic risks.

Cramer highlighted his observations from Salesforce Inc. CRM’s annual conference in San Francisco, noting that tech companies, particularly those focused on AI, are less impacted by rate cuts. These companies cater to enterprises rather than consumers, distancing them from the labor market.

See Also: Ethereum Co-Founder Says Donald Trump Is ‘Certainly The Favorite’ Over Kamala Harris For Crypto

He suggested that consumer-oriented companies might benefit more during this rate-cutting cycle. Despite potential gains for tech stocks, Cramer noted that Wall Street often shifts focus to companies that thrive with lower rates.

Cramer concluded, “On days like today, we want the companies that desperately needed a rate cut, because they just got what they wished for. But tech? It got out of the wish game a very long time ago.”

Why It Matters: The Federal Reserve’s decision to cut interest rates by 50 basis points marks a significant shift in monetary policy, breaking a streak of 12 consecutive months with rates held steady. This move aims to address inflation and balance economic risks. The rate cut has already impacted market sentiment, with the CNN Money Fear and Greed index showing improvement, moving into the “Greed” zone.

Price Action: Invesco QQQ Trust, Series 1 QQQ, which tracks tech players like Apple Inc. AAPL, Microsoft Corp. MSFT, Nvidia Corp. NVDA, Broadcom Inc. AVGO and others, was trading 1.67% higher during the pre-market at $479.33 while it closed at $471.44, as per Benzinga Pro.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

53% of Warren Buffett's $309 Billion Portfolio Is Invested in These 3 Unstoppable Stocks

For more than a half-century, mirroring Warren Buffett’s investment activity has made investors richer. Since ascending to the CEO chair at Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), the aptly named “Oracle of Omaha” has overseen a cumulative return in his company’s Class A shares (BRK.A) of more than 5,400,000%, as of the closing bell on Sept. 13!

What’s particularly great about Warren Buffett’s investing philosophy is that he’s more than willing to share the traits he looks for in so-called “wonderful companies.” The characteristics Buffett craves are sustainable moats/competitive advantages, strong management teams, and time-tested businesses that often have exceptional capital-return programs.

But the one factor that doesn’t get nearly enough credit for Berkshire Hathaway’s long-term outperformance is the Oracle of Omaha’s penchant for portfolio concentration. Even though Buffett is currently overseeing a 43-stock, $309 billion investment portfolio (not including exchange-traded funds), the lion’s share of his company’s invested capital has been put to work in his best ideas.

Out of Berkshire’s $309 billion of invested assets, roughly 53% can be traced to just three unstoppable stocks.

Apple: $89 billion (28.8% of invested assets)

Despite Buffett being a net-seller of more than 500 million shares of tech goliath Apple (NASDAQ: AAPL) over the last three quarters, the 400 million shares of Wall Street’s largest publicly traded company still owned by Berkshire Hathaway equates to almost 29% of invested assets.

During Berkshire Hathaway’s annual shareholder meeting in May, Buffett suggested that corporate tax rates were liable to increase in the future, and hinted at this thesis as his reasoning for selling a significant stake in Apple. In other words, he believes investors will, over time, appreciate locking in outsized unrealized gains in Apple at a favorably low tax rate.

But make no mistake about it, the Oracle of Omaha still believes Apple is a fantastic business and has plenty of faith in its CEO Tim Cook.

Apple is easily one of the most-recognized and strongest brands in the world. Minimal marketing is needed when consumers line up in front of its stores, or rush to their laptops or smartphones to place pre-orders, for the company’s latest devices.

The thing investors should know about Apple is that it’s much more than just a company that develops physical products. Although the iPhone is still its top revenue driver, Tim Cook has been overseeing a multiyear shift toward subscription services. A subscription-focused platform should produce higher margins, improve customer loyalty even more, and smooth out the revenue hills and valleys often observed during major iPhone upgrade cycles.

I’d be remiss if I didn’t also mention Apple’s market-leading share repurchase program. Since the start of 2013, Apple has bought back approximately $700 billion worth of its common stock and reduced its outstanding share count by 42.2%. This has incrementally increased Berkshire Hathaway’s ownership stake in Apple, as well as provided a hearty lift to Apple’s earnings per share.

American Express: $39.3 billion (12.7% of invested assets)

The second-largest holding in the $309 billion portfolio the Oracle of Omaha oversees at Berkshire Hathaway is credit-services goliath American Express (NYSE: AXP). AmEx is Berkshire’s second longest-tenured holding (since 1991).

The reason Warren Buffett tends to gravitate to financials (his favorite sector) is because they’re cyclical. Even though Buffett is well aware that recessions are a normal part of the economic cycle, he wisely understands that downturns resolve quickly. Three-quarters of the 12 U.S. recessions since the end of World War II failed to endure for 12 months. Comparatively, two periods of growth surpassed the decade mark, with most expansions sticking around for multiple years.

American Express is a company that’s built to thrive during disproportionately long periods of growth.

Furthermore, AmEx benefits from both sides of the transaction aisle. It’s the No. 3 payment processor by credit card network purchase volume in the U.S., which means it’s generating predictable fees from merchants when facilitating payments. But it’s also a lender. The personal and business credit cards AmEx issues allow it to collect annual fees and generate interest income. Being able to double-dip on both sides of a transaction has helped AmEx grow into the behemoth it is today.

Another key factor for American Express has been its ability to court high-earning clientele. Compared to the average-earning consumer, high earners are less likely to demonstrably alter their spending habits or fail to pay their bills during economic disruptions. On paper at least, AmEx appears better suited than most lenders to navigate a U.S. recession.

With Berkshire’s cost-basis in AmEx an ultra-low $8.49 per share, it should be noted that American Express’s base annual payout of $2.80 per share equates to an annual yield on cost of 33% for Buffett’s company. In short, Buffett is seeing his initial investment in AmEx double about every three years on dividend income alone.

Bank of America: $33.2 billion (10.7% of invested assets)

The third-largest holding that, in addition to Apple and American Express, collectively accounts for about 53% of Berkshire Hathaway’s invested assets is Bank of America (NYSE: BAC), which is better-known as “BofA.”

This longtime top holding for Berkshire Hathaway has been in the spotlight of late. Thanks to required Form 4 filings with the Securities and Exchange Commission, we know that Buffett has sold a grand total of almost 174 million shares of BofA in 27 of the last 39 trading sessions, dating back to July 17.

This selling activity could be completely benign or potentially worrisome. For instance, tax-related selling (similar to the reasoning given for ringing the register on shares of Apple) wouldn’t be much of a concern. However, Buffett may also be building a mammoth cash position at his company because he believes the stock market is historically pricey.

The primary lure to bank stocks, as discussed earlier, is that they’re cyclical. Non-linear economic cycles allow banks to grow their loan portfolios over time and generate progressively higher fees and interest income.

Bank of America just happens to be the most interest-sensitive of America’s largest banks by assets. The 525-basis-point increase in the federal funds rate from March 2022 through the present has lifted its net interest income by billions of dollars every quarter. But with the Fed expected to kick off a rate-easing cycle this week, there remains a distinct possibility that BofA’s bottom line could be harmed more than any other bank stock for the foreseeable future.

Something else to keep in mind is that Berkshire’s stake in Bank of America has fallen to 11.1% of BofA’s outstanding shares. If this stake should dip below 10%, the Oracle of Omaha will no longer be required to lift the hood on every transaction. Instead, investors will have to wait until quarterly 13Fs are filed to get the full details of what he and his investment team have been up to.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America and American Express are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

53% of Warren Buffett’s $309 Billion Portfolio Is Invested in These 3 Unstoppable Stocks was originally published by The Motley Fool

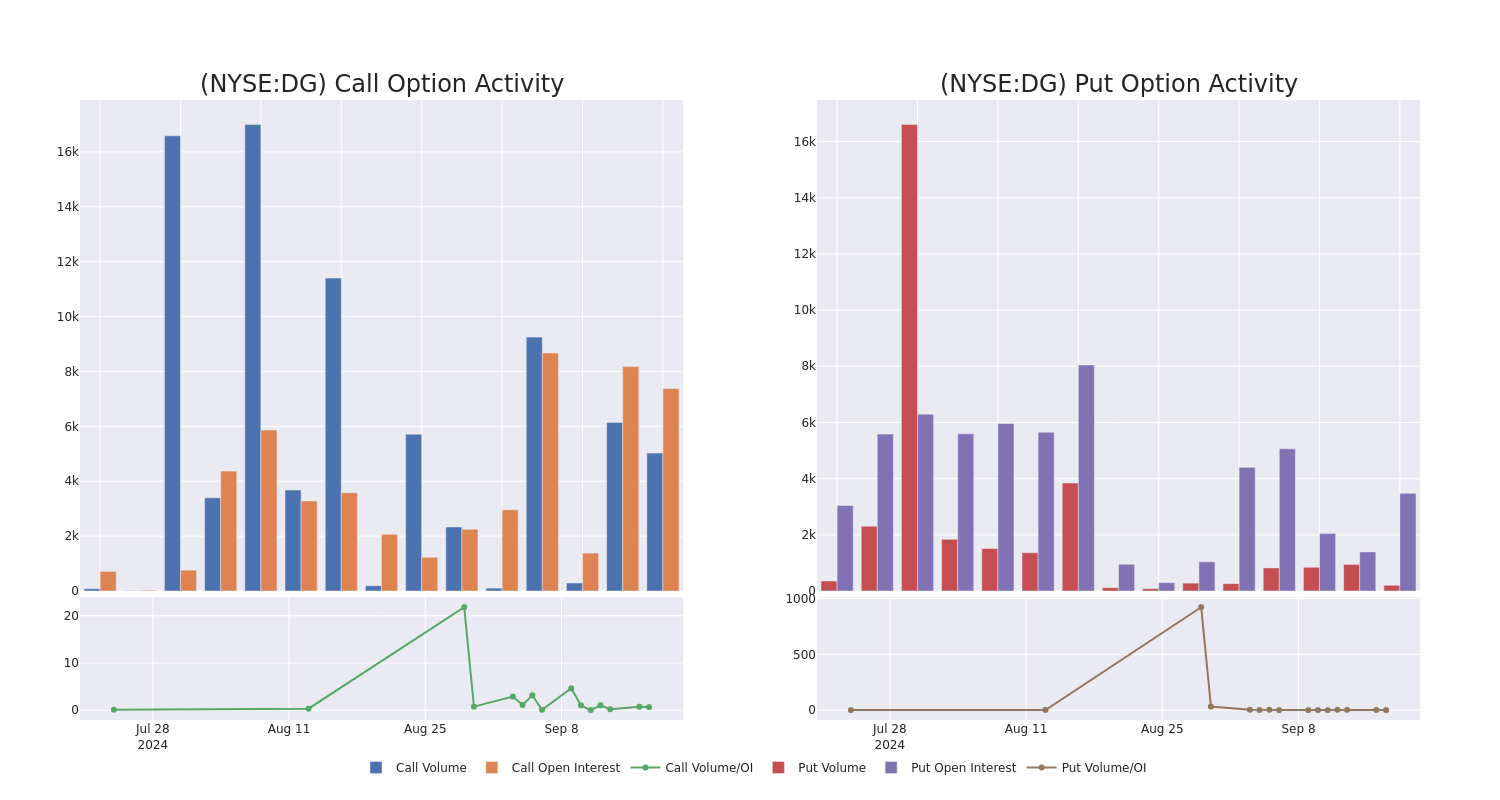

Unpacking the Latest Options Trading Trends in Dollar Gen

Financial giants have made a conspicuous bullish move on Dollar Gen. Our analysis of options history for Dollar Gen DG revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $588,385, and 4 were calls, valued at $391,647.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $105.0 for Dollar Gen over the recent three months.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Dollar Gen’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Dollar Gen’s whale activity within a strike price range from $70.0 to $105.0 in the last 30 days.

Dollar Gen Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DG | PUT | SWEEP | BULLISH | 01/16/26 | $11.75 | $11.7 | $11.75 | $80.00 | $345.4K | 588 | 385 |

| DG | CALL | SWEEP | BEARISH | 01/16/26 | $14.45 | $13.05 | $13.05 | $95.00 | $261.0K | 1.4K | 200 |

| DG | PUT | SWEEP | BULLISH | 01/16/26 | $12.35 | $11.75 | $11.75 | $80.00 | $105.7K | 588 | 1 |

| DG | CALL | SWEEP | BEARISH | 09/19/25 | $8.15 | $8.0 | $8.0 | $105.00 | $78.4K | 6 | 1 |

| DG | PUT | TRADE | BULLISH | 03/21/25 | $8.8 | $8.75 | $8.75 | $85.00 | $68.2K | 1.6K | 78 |

About Dollar Gen

With more than 20,000 locations, Dollar General’s banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

After a thorough review of the options trading surrounding Dollar Gen, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Dollar Gen’s Current Market Status

- With a volume of 3,489,659, the price of DG is up 0.99% at $86.86.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 78 days.

What The Experts Say On Dollar Gen

In the last month, 5 experts released ratings on this stock with an average target price of $112.4.

- An analyst from Evercore ISI Group persists with their In-Line rating on Dollar Gen, maintaining a target price of $100.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Dollar Gen with a target price of $130.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Dollar Gen with a target price of $122.

- Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Dollar Gen with a target price of $120.

- An analyst from BMO Capital has decided to maintain their Market Perform rating on Dollar Gen, which currently sits at a price target of $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dollar Gen, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are remote workers really working all day? No. Here's what they're doing instead.

What do remote and hybrid workers do all day?

They often brag about how productive they are with no gossipy colleagues to distract them or time wasted on long commutes.

But a new survey is offering fresh insights into how remote workers really spend their time. Spoiler alert: It’s not all white papers and PowerPoint presentations.

While employees in the office might kill time messaging friends or flipping through TikTok, remote workers take advantage of being far from the watchful gaze of bosses to chip away at personal to-do lists or to goof off.

Nearly half of remote workers multitask on work calls or complete household chores like unloading the dishwasher or doing a load of laundry, according to the SurveyMonkey poll of 3,117 full-time workers in the US.

A third take advantage of the flexibility of remote work to run errands, whether popping out to the grocery store or picking up dry cleaning.

Sleeping on the job? It happens more than you might think. One in 5 remote workers confessed to taking a nap.

Some 17% of remote workers said they worked from another location without telling anyone or watched TV or played video games. A small percentage – 4% – admitted to working another job.

Multitasking during Zoom calls is another common pastime.

Nearly a third of remote and hybrid workers said they used the bathroom during calls while 21% said they browsed social media, 14% went on online shopping sprees, 12% did laundry and 9% cleaned the kitchen.

In a finding that may shock some, 4% admit they fall asleep and 3% take a shower.

“Employees are making their own rules to accommodate the demands of high-pressure work environments,” said Wendy Smith, senior manager of research science at SurveyMonkey. “One thing we uncovered was that what you might consider ‘off-the-booksbehavior’ is widespread.”

And it’s not just the rank-and-file. More than half of managers and 49% of executives multitask on work calls, too, Smith said.

When asked “have you ever browsed social media while on a video or conference call at work,” managers, executives, and individual contributors were about even (22%, 20%, and 21%), she said.

But managers and executives shopped online more frequently than individual contributors (16% and 14% compared to 12% of individual contributors), according to Smith.

Different generations also have different work habits:

-

26% of millennials admit to taking a nap during the workday compared to 16% of GenX;

-

18% of GenZ have worked another job compared to 2% of GenX and 1% of boomers;

-

and 31% of GenZ have worked from another location without telling anyone compared to 16% of GenX.

This article originally appeared on USA TODAY: Do remote workers actually work? Yes but they also shop and shower

Nvidia, T-Mobile US, Vivos Therapeutics, SoFi Technologies, Tesla: Why These 5 Stocks Are On Investors' Radars Today

Wednesday’s trading session saw the stock market slip into the red following the Federal Reserve’s decision to cut interest rates by 0.5%. This marks the beginning of the central bank’s highly anticipated cutting cycle, the first since March 2020. T

The Dow Jones Industrial Average dropped 0.25% to 41,503.10, while the S&P 500 slipped 0.3% to 5,618.26. The Nasdaq also fell 0.3%, closing at 17,573.30.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Nvidia Corporation NVDA

Nvidia shares closed down 1.92% at $113.37, after hitting an intraday high of $117.7 and a low of $113.22. The stock’s 52-week high is $140.76, and its 52-week low is $39.23. The tech giant is considering a $165 million acquisition of the OctoAI startup to bolster its software and cloud computing services.

T-Mobile US, Inc. TMUS

T-Mobile shares ended the day down 2.97% at $196.68, with an intraday high of $206.1 and a low of $195.47. The stock’s 52-week high is $206.31, and its 52-week low is $135.82. The company announced a partnership with Nvidia, Ericsson, and Nokia to pioneer AI-driven mobile networks. The company has also signed an agreement with OpenAI to transform customer experience and redefine customer success standards globally

Vivos Therapeutics, Inc. VVOS

Vivos Therapeutics shares surged 47.50% to close at $4.13, after hitting an intraday high of $5.95 and a low of $3.02. The stock’s 52-week high is $48.79, and its 52-week low is $1.91. The FDA granted 510(k) clearance to the company’s flagship oral medical device, poised to disrupt the pediatric sleep apnea market.

SoFi Technologies Inc. SOFI

SoFi shares closed down 0.12% at $8.11, after hitting an intraday high of $8.53 and a low of $8.04. The stock’s 52-week high is $10.49, and its 52-week low is $6.01. The shares moved on heavy trading volume as investors anticipated a rate cut from the Federal Reserve.

Tesla Inc. TSLA

Tesla shares ended the day up 0.48% at $227.87, with an intraday high of $234.57 and a low of $226.55. The stock’s 52-week high is $273.93, and its 52-week low is $138.8. The shares traded higher likely due to the broader market reaction to the Federal Reserve’s recent policy decision to cut interest rates.

Photo by Phongphan on Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shopoff Realty Investments Receives Unanimous City Council Approval for 29-Acre Magnolia Tank Farm Project in Huntington Beach

HUNTINGTON BEACH, Calif., Sept. 18, 2024 /PRNewswire/ — Shopoff Realty Investments (“Shopoff”), a national manager of opportunistic and value-add real estate investments, has secured City Council approval for its mixed-use master plan project, Magnolia Tank Farm, located on 29 acres near Magnolia Avenue and Pacific Coast Highway in Huntington Beach, California. The council voted 7-0 in favor of the project. It was our ability to build a coalition of diverse groups that led to our ability to garner unanimous support.

Shopoff secured California Coastal Commission approval in July 2024. With City Council approval now in place, plans for this vibrant future community in Huntington Beach can now move into the next stage of development. The project anticipates approximately 200+ for-sale single-family detached and attached homes, a 50-unit affordable multifamily community, and a 215-key boutique hotel with 19,000 square feet of retail.

“We are grateful to the city of Huntington Beach for their support of this project, which we believe will be a fantastic addition to the city, brightening this historically blighted stretch of the coast,” explained Shopoff President and CEO William Shopoff. “This approval marks a major milestone for the project, and we’d like to thank all our many supporters who saw the immense value in this new community, including affordable housing advocates, labor unions, construction and hotel workers, Huntington Beach residents and businesses, as well as the California Coastal Commission. Being able to build such as diverse coalition of groups to support this project ultimately led to our ability to garner unanimous support.”

This new community in southeastern Huntington Beach will provide quality housing for Huntington Beach residents, with a much-needed affordable housing component. This includes a first-of-its-kind program which will dedicate 50% of the affordable housing to hotel workers on-site and within the coastal region of Huntington Beach. Shopoff believes this innovative program is vitally important to the success of this project, as it will allow workers to live in the city where they are employed, avoiding lengthy daily commutes.

Shopoff intends to break ground on the project in summer/fall 2025.

About Shopoff Realty Investments

Shopoff Realty Investments is an Irvine, California-based real estate firm with a 32-year history of value-add and opportunistic investing across the United States. The company primarily focuses on proactively generating appreciation through the repositioning of commercial income-producing properties, the entitlement of land assets, and development projects. The 32-year history includes operating as Asset Recovery Fund, Eastbridge Partners, and Shopoff Realty Investments (formerly known as The Shopoff Group). Performance has varied in this time frame, with certain offerings generating losses. For additional information, please visit www.shopoff.com or call (844) 4-SHOPOFF.

Disclosures

This is not an offering to buy or sell any securities. Such an offer may only be made through the offering memorandum to qualified purchasers. Any investment in Shopoff Realty Investments programs involves substantial risks and is suitable only for investors who have no need for liquidity and who can bear the loss of their entire investment. There is no assurance that any strategy will succeed to meet its investment objectives. The performance of this asset is not indicative of future results of other assets. Securities are offered through Shopoff Securities, Inc. member FINRA/SIPC, 18565 Jamboree Road, Suite 200, Irvine, CA 92612.

Contact:

Jill Swartz

Spotlight Marketing Communications

949.427.1389

jill@spotlightmarcom.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/shopoff-realty-investments-receives-unanimous-city-council-approval-for-29-acre-magnolia-tank-farm-project-in-huntington-beach-302252183.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/shopoff-realty-investments-receives-unanimous-city-council-approval-for-29-acre-magnolia-tank-farm-project-in-huntington-beach-302252183.html

SOURCE Shopoff Realty Investments

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.