Prediction: These 3 Stocks Won't Be Magnificent Buys in 5 Years

The “Magnificent Seven” are a group of the world’s most popular and promising growth stocks. Investing in these big-name tech stocks has been a great way to earn some significant returns in recent years. But things can change quickly in the tech world, and just because some stocks have done well in recent years doesn’t mean that they will be solid stocks to hang on to in the long run.

Three Magnificent Seven stocks that I don’t think will look so magnificent in five years are Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA). Here’s why these particular stocks could struggle in the years ahead.

1. Alphabet

Alphabet used to be a stock I was bullish about. The business looked dominant with a top video streaming website (YouTube) and a top search engine (Google).

Nowadays, I’m not as optimistic. As the ads get longer and longer on YouTube, the risk is that it might give users an incentive to switch to a streaming service such as Netflix instead, where there’s a broad range of top content to choose from to help justify its price tag without annoying ads (depending on the subscription tier).

But the biggest risk for Alphabet undoubtedly comes in its search business. Regulators have already ruled that Google is a monopoly, and the consequences of that are still unknown, but they’ll likely hurt its growth prospects. And with more artificial intelligence (AI)-powered chatbots answering questions and reducing the need to go to Google, that’s another headwind for its sales growth.

The stock might look cheap, trading at just 23 times its trailing earnings, and its revenue is still strong, growing by 14% year over year in the latest reported quarter, but investors shouldn’t gloss over the long-term risks that Alphabet faces. There could be some daunting new challenges and competition that could stunt its growth and reduce its earnings power, which is why I would avoid the stock right now.

2. Meta Platforms

Another business that’s doing well right now but could struggle in the future is Meta Platforms. Business has been booming for the company: Revenue jumped 22% year over year in the June quarter, totaling $39.1 billion. Meta management says its AI assistant will be “the most used AI assistant in the world by the end of the year.”

The present looks solid, but the future might not be as promising. Like Alphabet, Meta faces challenges from regulators. Concerns relating to the company’s social media platforms and their alleged adverse mental health effects on users might lead to changes in Meta’s operations that could impact the bottom line. Last year, 42 state attorneys general sued Meta, claiming that Facebook and Instagram were too addictive for young kids. Elsewhere, greater restrictions are being called for on the data Meta collects and how it collects it. The social media platforms it operates could become less valuable for advertisers if the restrictions are added.

Then there is the continued massive spending by Meta on its Reality Labs segment and a metaverse that is showing little sign of ever providing the return on investment needed to justify it.

At 27 times earnings, Meta’s stock doesn’t look too expensive, but that could change if its growth slows down while the spending remains high. This is a tech stock I would avoid — it could have a long way to fall in the next few years.

3. Tesla

The most expensive stock on this list (based on valuation) is Tesla; investors are paying more than 60 times earnings to buy shares in it. But that isn’t uncommon for the electric vehicle (EV) maker. Investors are accustomed to paying high multiples for the stock. This year, however, hasn’t been a great one — the stock is down around 7%.

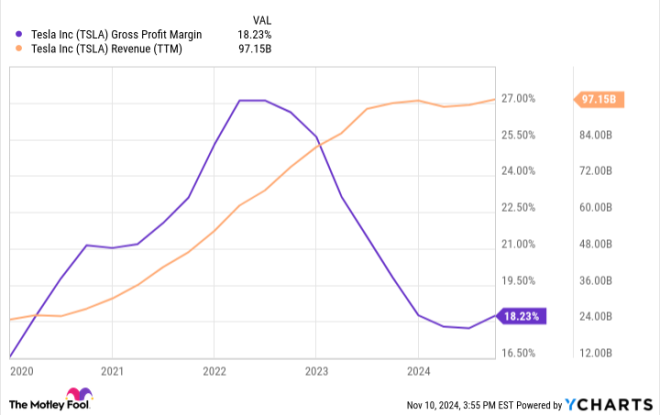

Investors are concerned about the company’s thinning margins due to a rise in competition and weak consumer demand. Neither one of those issues might improve anytime soon. A possible recession could hurt demand in the short term, and while that might be temporary, growing competition from Chinese EV makers could lead to Tesla needing to further reduce its prices, which would only exacerbate worries about its bottom line.

Tesla hopes that a successful launch of its robotaxi program could be a catalyst, but that could prove to be an underwhelming development for the company given the potential for regulatory issues and other obstacles.

As challenging as conditions are for Tesla right now, they could get worse for the stock over the next five years.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Netflix, and Tesla. The Motley Fool has a disclosure policy.

Prediction: These 3 Stocks Won’t Be Magnificent Buys in 5 Years was originally published by The Motley Fool

Leave a Reply