Breaking Update: Octavio Espinoza Engages In Options Exercise At Ligand Pharmaceuticals

Octavio Espinoza, Chief Financial Officer at Ligand Pharmaceuticals LGND, reported a large exercise of company stock options on September 19, according to a new SEC filing.

What Happened: Espinoza, Chief Financial Officer at Ligand Pharmaceuticals, made a strategic move by exercising stock options for 1,486 shares of LGND as detailed in a Form 4 filing on Thursday with the U.S. Securities and Exchange Commission. The transaction value amounted to $36,527.

Currently, Ligand Pharmaceuticals shares are trading down 0.76%, priced at $104.21 during Friday’s morning. This values Espinoza’s 1,486 shares at $36,527.

Unveiling the Story Behind Ligand Pharmaceuticals

Ligand Pharmaceuticals Inc is a biopharmaceutical company focused on developing and acquiring technologies that aid in creating medicine. The company has partnerships and license agreements with various pharmaceutical and biotechnology companies. Ligand’s business model is based on drug discovery, early-stage drug development, product reformulation, and partnerships. The company’s revenue consists of three primary elements: royalties from commercialized products, license and milestone payments, and sale of its trademarked Captisol material.

Ligand Pharmaceuticals’s Financial Performance

Revenue Growth: Ligand Pharmaceuticals’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 57.52%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Insights into Profitability:

-

Gross Margin: The company sets a benchmark with a high gross margin of 93.0%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Ligand Pharmaceuticals’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -2.88.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 45.07 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 14.14 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Ligand Pharmaceuticals’s EV/EBITDA ratio stands at 19.13, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Cracking Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Ligand Pharmaceuticals’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

XPeng's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on XPeng. Our analysis of options history for XPeng XPEV revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $101,800, and 5 were calls, valued at $879,208.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $6.0 to $10.0 for XPeng during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for XPeng’s options for a given strike price.

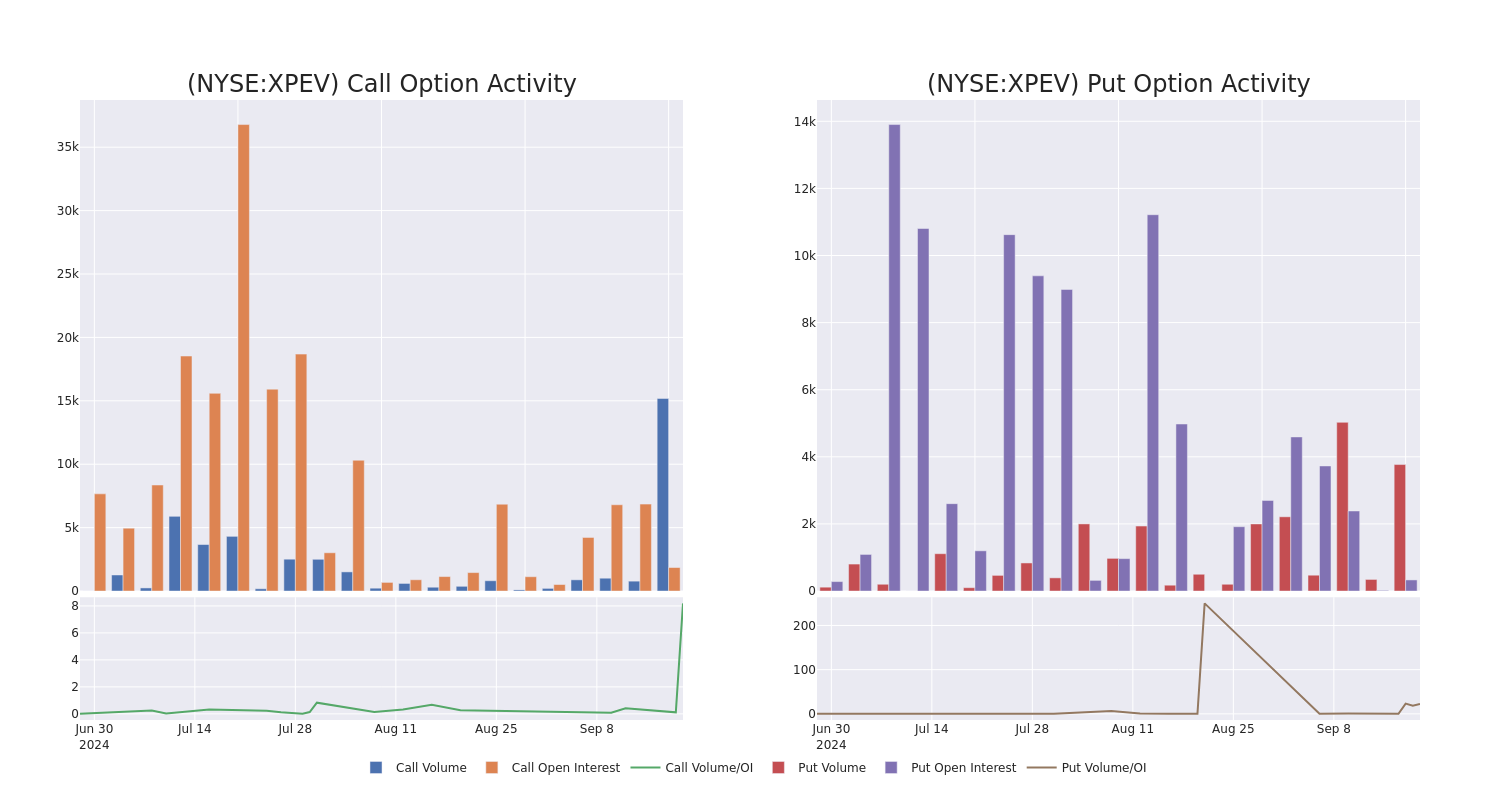

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of XPeng’s whale activity within a strike price range from $6.0 to $10.0 in the last 30 days.

XPeng Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XPEV | CALL | SWEEP | BULLISH | 04/17/25 | $1.82 | $1.75 | $1.82 | $10.00 | $387.1K | 465 | 2.1K |

| XPEV | CALL | SWEEP | BULLISH | 04/17/25 | $1.88 | $1.85 | $1.88 | $10.00 | $363.5K | 465 | 4.0K |

| XPEV | CALL | SWEEP | BEARISH | 01/17/25 | $3.85 | $3.8 | $3.8 | $6.00 | $53.1K | 1.3K | 143 |

| XPEV | PUT | SWEEP | BULLISH | 10/04/24 | $0.15 | $0.13 | $0.13 | $8.50 | $39.0K | 277 | 3.1K |

| XPEV | CALL | TRADE | BEARISH | 04/17/25 | $1.91 | $1.89 | $1.89 | $10.00 | $37.8K | 465 | 4.5K |

About XPeng

Founded in 2015, XPeng is a leading Chinese smart electric vehicle company that designs, develops, manufactures, and markets EVs in China. Its products primarily target the growing base of technology-savvy middle-class consumers in the midrange to high-end segment in China’s passenger vehicle market. The company sold over 141,000 EVs in 2023, accounting for about 2% of China’s passenger new energy vehicle market. It is also a leader in autonomous driving technology.

Following our analysis of the options activities associated with XPeng, we pivot to a closer look at the company’s own performance.

Where Is XPeng Standing Right Now?

- Currently trading with a volume of 12,013,899, the XPEV’s price is up by 2.13%, now at $9.59.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 54 days.

Expert Opinions on XPeng

1 market experts have recently issued ratings for this stock, with a consensus target price of $11.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Showing optimism, an analyst from JP Morgan upgrades its rating to Overweight with a revised price target of $11.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for XPeng with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How Much $1000 Invested In W.W. Grainger 5 Years Ago Would Be Worth Today

W.W. Grainger GWW has outperformed the market over the past 5 years by 15.22% on an annualized basis producing an average annual return of 29.13%. Currently, W.W. Grainger has a market capitalization of $50.23 billion.

Buying $1000 In GWW: If an investor had bought $1000 of GWW stock 5 years ago, it would be worth $3,534.58 today based on a price of $1028.81 for GWW at the time of writing.

W.W. Grainger’s Performance Over Last 5 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

K-BID.com Reached Significant Milestones in 2024, 50,000+ Auctions and 4+ Million Items Sold, Expanding Footprint Beyond the Midwest

MEDINA, Maine, Sept. 20, 2024 /PRNewswire/ — K-BID.com, one of the largest online auction platforms in the Midwest, has reached a significant milestone, surpassing 50,000+ completed auctions and over 4+ million items sold through a network of 170 independent auction companies. This accomplishment solidifies its position as a leader in online auctions, connecting buyers and sellers with diverse goods, ranging from vehicles and heavy equipment to estate items and collectibles.

“We want to take a minute to step back and recognize our affiliates, buyers, and sellers as we reach these important milestones as a company. This is not possible without them. We continue to evolve as a company and try to meet the needs of our customers and where they are at. We are excited for the future and embracing technology to keep improving the user experience on our platform,” said Chris Schwartz, President of K-BID.

With a dedicated community of over 475,000+ registered bidders, K-BID.com continues to innovate and enhance the auction experience, offering transparency, ease of use, and a wide range of independent affiliates. Having evolved from a traditional auction company into an online venue for independent auction companies, K-BID.com provides the perfect blend of technology and service, allowing bidders to access auctions from anywhere.

Looking ahead, K-BID.com is eyeing expansion in the Midwest and beyond. With its established model of supporting independent auction affiliates, the company plans to bring its dynamic auction platform to other states, offering even more opportunities for buyers and sellers nationwide.

“We are excited about the growth we’ve experienced and the partnerships we’ve built over the years,” said Direct of Marketing – Jeremy Delgado. “This milestone is a testament to the trust our users place in us, and we are committed to expanding our reach and improving our services to meet their needs.”

K-BID.com’s auctions attract buyers looking for unique items at competitive prices, while sellers benefit from a streamlined platform to liquidate assets. As the company prepares for expansion, it remains focused on maintaining the high standards of service and reliability that have made it a trusted name in online auctions.

For more information or to browse current auctions, visit www.k-bid.com.

About K-BID.com:

K-BID.com is an online auction platform serving the Midwest and beyond. Founded as a traditional auction company, K-BID has since transitioned to the digital space, empowering independent auction companies with a powerful platform and following of buyers and sellers. The company specializes in online auctions across various categories, including real estate, business assets, and personal property.

Media Contact:

Tyler Jaeger

Affiliate Network Manager

K-BID.com

383589@email4pr.com

763.367.6796

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/k-bidcom-reached-significant-milestones-in-2024–50-000-auctions-and-4-million-items-sold-expanding-footprint-beyond-the-midwest-302253756.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/k-bidcom-reached-significant-milestones-in-2024–50-000-auctions-and-4-million-items-sold-expanding-footprint-beyond-the-midwest-302253756.html

SOURCE K-BID Online Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Paul Seavey Sells $2.39M Worth Of Equity Lifestyle Props Shares

Paul Seavey, EVP & Chief Financial Officer at Equity Lifestyle Props ELS, disclosed an insider sell on September 19, according to a recent SEC filing.

What Happened: After conducting a thorough analysis, Seavey sold 31,988 shares of Equity Lifestyle Props. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $2,393,662.

During Friday’s morning session, Equity Lifestyle Props shares down by 0.0%, currently priced at $73.57.

Get to Know Equity Lifestyle Props Better

Equity Lifestyle Properties is a residential REIT that focuses on owning manufactured housing, residential vehicle communities, and marinas. The company currently has a portfolio of 451 properties across the U.S. with a higher concentration in the Sunbelt region with 38% of the company’s properties located in Florida, 12% in Arizona, and 8% in California. Equity Lifestyle targets owning properties in attractive retirement destinations with over 70% of the company’s properties either being age-restricted or having an average resident age over 55.

Breaking Down Equity Lifestyle Props’s Financial Performance

Positive Revenue Trend: Examining Equity Lifestyle Props’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 2.65% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 48.45%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Equity Lifestyle Props’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.42.

Debt Management: With a high debt-to-equity ratio of 2.41, Equity Lifestyle Props faces challenges in effectively managing its debt levels, indicating potential financial strain.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The P/E ratio of 38.32 is lower than the industry average, implying a discounted valuation for Equity Lifestyle Props’s stock.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 10.05 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 24.28, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Deep Dive into Insider Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Equity Lifestyle Props’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Engaging In Options Activity, James Owens Exercises Options Valued At $485K In Donaldson

A substantial insider activity was disclosed on September 19, as Owens, Director at Donaldson DCI, reported the exercise of a large sell of company stock options.

What Happened: Owens, Director at Donaldson, exercised stock options for 14,000 shares of DCI stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The exercise price of the options was $38.47 per share.

The latest update on Friday morning shows Donaldson shares down by 0.0%, trading at $73.17. At this price, Owens’s 14,000 shares are worth $485,800.

Get to Know Donaldson Better

Donaldson is a leading manufacturer of filtration systems and replacement parts (including air filtration systems, liquid filtration systems, and dust, fume, and mist collectors). The company serves a diverse range of end markets, including construction, mining, agriculture, truck, and industrial. Its business is organized into three segments: mobile solutions, industrial solutions, and life sciences. Donaldson generated approximately $3.6 billion in revenue and $544 million in operating income in its fiscal 2024.

Donaldson: Financial Performance Dissected

Positive Revenue Trend: Examining Donaldson’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.81% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Interpreting Earnings Metrics:

-

Gross Margin: With a low gross margin of 35.79%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Donaldson’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.91.

Debt Management: Donaldson’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.36.

Market Valuation:

-

Price to Earnings (P/E) Ratio: Donaldson’s P/E ratio of 21.65 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 2.5 is lower than the industry average, implying a discounted valuation for Donaldson’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 13.91, Donaldson could be considered undervalued.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Donaldson’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Macy's Up 1.1% Since Last Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Macy’s M. Shares have added about 1.1% in that time frame, underperforming the S&P 500.

Will the recent positive trend continue leading up to its next earnings release, or is Macy’s due for a pullback? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Macy’s Q2 Earnings Beat Estimates, Comps Decline Y/Y

Macy’s has reported second-quarter fiscal 2024 results, wherein the top line lagged the Zacks Consensus Estimate while the bottom line surpassed the same. Total revenues declined and earnings increased from the year-ago quarter’s reported figures. Comparable sales (comps) fell on an owned basis and an owned-plus-licensed basis.

Sales & Earnings Picture

Macy’s has reported adjusted earnings of 53 cents per share, surpassing the Zacks Consensus Estimate of 32 cents. Also, the bottom line increased from 23 cents in the year-ago period.

Net sales of $4,937 million missed the consensus estimate of $5,091 million. Also, the top line dipped 3.8% from the year-ago quarter. Comps fell 4% on an owned basis and 3.3% on an owned-plus-licensed-plus-marketplace basis from the prior-year quarter.

Macy’s ongoing business comps, including both go-forward locations and digital platforms across all nameplates, decreased 3.8% on an owned basis and 3% when including owned, licensed and marketplace channels.

Net credit card revenues were $125 million, up 4.2% from the year-ago period. The metric represented 2.5% of sales, up 20 basis points from the year-ago quarter.

Details by Brands

Comps across Macy’s declined 4.5% year over year on an owned basis and 3.6% on an owned-plus-licensed-plus-marketplace basis. At the Bloomingdale’s brand, comps decreased 1.1% on an owned basis and 1.4% on an owned-plus-licensed-plus-marketplace basis. Comps at the Bluemercury brand rose 2% on an owned basis.

Margins

The gross margin was 40.5%. The metric increased 240 basis points from 38.1% in the prior-year quarter. The merchandise margin increased 210 basis points primarily due to reduced year-over-year discounting, favorable inventory shortages resulting from the company’s asset protection efforts and M’s transition to cost accounting.

Delivery expenses as a percentage of net sales improved year over year by 30 basis points, driven by lower shipped sales volumes and enhanced delivery expense management, reflecting cost-saving measures and process re-engineering initiatives.

The company reported selling, general and administrative (SG&A) expenses of $1.97 billion, down 0.4% from $1.98 billion in the year-ago period. As a percentage of net sales, SG&A expenses increased 140 basis points year over year to 40% on lower net sales.

Macy’s reported an adjusted EBITDA of $438 million, up 26.2% from an adjusted EBITDA of $347 million in the year-ago quarter. We note that the adjusted EBITDA margin was 8.9%, up 210 basis points year over year.

Other Financial Aspects

M ended the fiscal second quarter with cash and cash equivalents of $646 million, long-term debt of $2.99 billion, and shareholders’ equity of $4.30 billion. Merchandise inventories rose 6% on a year-over-year basis. In the second quarter of fiscal 2024, Macy’s provided cash from operating activities of $137 million.

A Peek Into Guidance

The company has revised its annual outlook to account for more cautious consumers and a more intense promotional environment than previously anticipated. This updated outlook is intended to provide the flexibility needed to navigate the continued uncertainty in the discretionary consumer market. M has reaffirmed its annual adjusted earnings per share outlook.

However, Macy’s continues to see fiscal 2024 as a transitional and investment year, focusing on key strategic initiatives to improve customer experience. With the support of a strong balance sheet, the company will prioritize enhancing its gross margin and maintaining expense control to safeguard profitability amid ongoing macroeconomic challenges.

Net sales are projected to be $22.1-$22.4 billion, a slight reduction from the previously stated $22.3-$22.9 billion. Notably, the company reported net sales of $23.1 billion in fiscal 2023.

The outlook for comparable owned-plus-licensed-plus-marketplace sales on a 52-week basis has also been adjusted, with a projected year-over-year decline of 0.5-2%, down from the previously stated range between a drop of 1% and an increase of 1.5%.

Adjusted earnings per share are envisioned to be $2.55-$2.90 for fiscal 2024, implying a decline from the $3.50 earned in the prior year.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended downward during the past month.

The consensus estimate has shifted -100% due to these changes.

VGM Scores

Currently, Macy’s has a nice Growth Score of B, though it is lagging a lot on the Momentum Score front with a D. However, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions has been net zero. It’s no surprise Macy’s has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Performance of an Industry Player

Macy’s belongs to the Zacks Retail – Regional Department Stores industry. Another stock from the same industry, Dillard’s DDS, has gained 6.1% over the past month. More than a month has passed since the company reported results for the quarter ended July 2024.

Dillard’s reported revenues of $1.49 billion in the last reported quarter, representing a year-over-year change of -4.9%. EPS of $4.59 for the same period compares with $7.98 a year ago.

Dillard’s is expected to post earnings of $6.47 per share for the current quarter, representing a year-over-year change of -30.4%. Over the last 30 days, the Zacks Consensus Estimate has changed -4.2%.

Dillard’s has a Zacks Rank #4 (Sell) based on the overall direction and magnitude of estimate revisions. Additionally, the stock has a VGM Score of C.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Delivers Large Rate Cut In Bid To Sustain Labor Market; Stocks, Gold Set New Record Highs: This Week In The Markets

The Federal Reserve cut interest rates by 50 basis points at its September meeting, lowering the target range to 4.75%-5%. This bold move defied the predictions of most economists who had anticipated a more modest 25-basis-point reduction.

The Fed also hinted at the potential for additional cuts in the coming months, with the updated dot plot revealing a more aggressive rate-cutting trajectory than forecasted in June.

Fed Chair Jerome Powell highlighted the labor market as a key focus, stressing the importance of acting preemptively to sustain robust employment. “The time to support the labor market is when it’s strong, not when you begin to see layoffs,” Powell said.

Powell also called for caution, framing the rate cut as part of a “recalibration” rather than a signal of a broader policy shift. He reiterated that future decisions would remain data-dependent, underscoring the Fed’s flexibility in responding to economic conditions.

Wall Street analysts reacted by adjusting their rate cut forecasts more aggressively, reflecting expectations of a looser policy trajectory ahead.

Both gold prices and major U.S. stock indices, including the S&P 500 and Dow Jones, surged to record highs following the Fed’s decision.

Fed Fuels Growth

In an exclusive interview with Benzinga, a Lazard small-cap expert highlights the Federal Reserve’s shift to a pro-growth stance, which is expected to boost Russell 2000’s performance. This policy pivot could create favorable conditions for investors in smaller companies, which trade relatively cheaper compared to large-cap counterparts.

Mortgage Demand Rises

Mortgage rates fell to near 6%, spurring a surge in demand for both refinancing and home purchases. As homeowners and buyers capitalize on these lower rates, market activity in the real estate sector is picking up momentum, with increased interest in locking in favorable mortgage terms.

iPhone Demand Lags

Early pre-order data for Apple Inc. AAPL’s iPhone 16 suggests weaker-than-expected demand, raising concerns about the device’s market performance. Ssome analysts believe Apple could still exceed expectations with potential surprises in upcoming earnings reports.

GM Expands Charging

General Motors Co. GM has enhanced electric vehicle charging access, opening 17,800 Tesla chargers to all GM drivers via an adapter. This move broadens charging options for GM’s EV customers, potentially boosting EV adoption and aligning with the company’s electrification goals.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Movers For September 20, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Boeing Girds for Long Strike as Gig Economy Gives Workers Clout

(Bloomberg) — Around Boeing Co.’s vast aircraft manufacturing hub in Seattle, the great belt tightening has begun as the planemaker and its factory workers settle in for a labor dispute that will test the resolve of both sides.

Most Read from Bloomberg

Striking employees received their final Boeing paycheck on Thursday, and the company stops paying for their health insurance on Sept. 30. Both measures will pinch household finances, typically ratcheting up the pressure and stakes for union negotiators to reach an agreement on a new contract.

But as workers stare down the embattled manufacturer for better pay and benefits, the 33,000 members of IAM District 751 have the full benefit of a tight labor market and gig economy that provides a quick transition into jobs that help make ends meet. That gives the union bargaining leverage, potentially frustrating Boeing’s effort to swiftly end a conflict that’s costing it an estimated $100 million each day.

While the battle between one of the world’s largest exporters and its blue-collar workers may look like an uneven fight on its surface, Boeing finds itself in an increasingly untenable situation with its finances so dire that it can ill afford a drawn-out paralysis.

“I think everybody is ready for the long haul,” said Christopher Dahl, 38, who has worked at Boeing for 10 years, now testing flight-control systems. “I’ve gone through every strike because my parents were Boeing employees, so I know the game. And before, there wasn’t the options like we have to make money on the side.”

Companies like food-delivery provider DoorDash Inc. or Uber Technologies Inc. weren’t around 16 years ago, when Boeing’s largest union last walked off the job, shutting down its commercial airplane manufacturing for two months. Now, such companies, alongside a still-tight labor market, are providing possible options to sustain the strike.

Workers are once again digging in for a holdout after bucking their union leadership by voting overwhelmingly to reject a 25% pay raise. On picket lines outside the Renton factory where Boeing builds 737 Max jets, employees said they’ve been saving for years to strike for as long as it takes — without pay, aside from $250 weekly deposits from the IAM local.

Contract talks are at a stalemate, with no new sessions scheduled after two days of federal mediation. Updates from IAM District 751 earlier in the week showed union leaders drawing a hard line around 40% pay raises and reinstating pensions.

“With a 96% strike vote, we thought Boeing would finally understand that IAM 751 Machinists are demanding more,” the union said in a scathing update posted after the initial day of talks on Sept. 17.

With Washington state’s unemployment rate running at 4.9%, it’s easy to pick up temporary work in construction or driving for Amazon.com Inc. Across the street from the Boeing gate where union members were grilling hot dogs and waving at cars honking in support, Topgolf Callaway Brands Corp. prominently posted a sign saying “Now Hiring.”

“There’s so many jobs all over the place,” said Luis Arteaga, 54, who’s been at Boeing for 18 years. “Red Robin is hiring, LA Fitness, any restaurant is hiring, FedEx, UPS — I mean, every place is hiring. ”

Arteaga said he started planning his finances for this strike at least two years ago, and could easily last as long as three months without a regular Boeing paycheck, especially if he picks up a side job.

Others on the 24-hour picket lines estimated they could hold out until Christmas. Carmen Kim, who was striking with her husband — like her a Boeing employee — is prepared to get by for an entire year without regular work.

Boeing, meanwhile, is launching into a broad set of cost cuts to conserve cash. The austerity measures include unpaid leave for tens of thousands of US workers, and a cutback in travel that requires senior executives to fly in economy cabin seats. The planemaker is even contemplating selling equity to supplement its rapidly dwindling cash and maintain its investment-grade credit rating.

“While we are disappointed the discussions didn’t lead to more progress, we remain very committed to reaching an agreement as soon as possible that recognizes the hard work of our employees and ends the work stoppage in the Pacific Northwest,” Kelly Ortberg, Boeing’s new chief executive officer, said in a message to employees on Friday.

The labor strife at Boeing is remarkable for themes that resonate across other American companies: lost pensions and frustration over stagnating wages that haven’t kept pace with inflation, said Brian Bryant, international president of the International Association of Machinists and Aerospace Workers.

“The entire labor movement is watching this closely,” Bryant said in an interview. “This isn’t just a Boeing issue. Workers in this country have been left behind. There’s a movement here. Workers have said enough is enough.”

The Biden Administration has been monitoring the strike as well, said Bryant, whose union represents almost 700,000 members across North America.

“They’ve reached out to see what the status is, what support they can give, anything they can do to get the parties back together,” he added.

Many machinists interviewed by Bloomberg News cited a strong sense of injustice over what they perceived as union-busting tactics in the wake of the 2008 strike. Among them, Boeing started a second assembly line for the 787 Dreamliner in South Carolina, eroding its Seattle manufacturing base.

“While new CEO Kelly Ortberg has taken a more conciliatory approach, there is 16 years of history pitched against him,” said Rob Stallard, an analyst at Vertical Research Partners, adding that “the gap between what the IAM union members want and what Boeing is currently offering is large.”

A controversial 2014 contract extension looms particularly large. IAM members were pressured into a long-term deal that froze their pensions, increased health care premiums and locked in modest pay increases in order to keep manufacturing of the 777X jet in the Seattle area. It’s the deal that expired on Sept. 12.

“For 10 years, the union had no room to maneuver and lost all their leverage,” said Leon Grunberg, a sociology professor emeritus at the University of Puget Sound. “That may be contributing to the sense of payback or retribution.”

Boeing can’t resort to the same playbook in these talks. It doesn’t have a new jet development program in the pipeline after five years of heavy financial losses. It also can’t shift more manufacturing to the Southeastern US, since unemployment is still hovering near record-low rates in that region.

In fact, striking Boeing workers say they are getting many online help-wanted ads from Airbus SE, the company’s European rival, along with rocket maker Blue Origin LLC. Both have manufacturing plants in Alabama, where unemployment stood at 2.8% in July.

Bruce McFarland, an instrumentation technician at Boeing and IAM officer, pointed to another change that’s transformed the union from the past strikes: the spread of social media accounts that allow union members to stay connected and keep morale high over what could be months without work.

While it’s early days, many of his colleagues are driven by an idealistic goal as well as pocketbook concerns, he said. They want a fair contract, but they’d also to rebuild Boeing’s culture so workers are treated with dignity.

“I love my job, I love the work,” McFarland said. “Sometimes you have to wonder what the company’s doing.”

–With assistance from Eric Johnson and Anne Cronin.

(Updates with Boeing CEO’s comment in 15th paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.