Mission Produce Insider Trades Send A Signal

On September 18, a recent SEC filing unveiled that Taylor Family Investments LLC, Director at Mission Produce AVO made an insider sell.

What Happened: LLC opted to sell 297,072 shares of Mission Produce, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $3,884,632.

The latest market snapshot at Thursday morning reveals Mission Produce shares up by 0.07%, trading at $13.37.

All You Need to Know About Mission Produce

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

A Deep Dive into Mission Produce’s Financials

Positive Revenue Trend: Examining Mission Produce’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 23.95% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Exploring Profitability:

-

Gross Margin: With a low gross margin of 11.42%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Mission Produce’s EPS is below the industry average. The company faced challenges with a current EPS of 0.17. This suggests a potential decline in earnings.

Debt Management: Mission Produce’s debt-to-equity ratio is below the industry average at 0.45, reflecting a lower dependency on debt financing and a more conservative financial approach.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 40.52 is lower than the industry average, implying a discounted valuation for Mission Produce’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.83, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Mission Produce’s EV/EBITDA ratio of 12.97 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Says Warren Buffett Is Positioning For Kamala Harris Win With His $277B Cash Pile As Pro-Trumper John Paulson Warns Of Equity Market Exit

While Vice President Kamala Harris surges ahead in polls against her Republican rival Donald Trump, she hasn’t found much traction in the business and investing world. Hedge fund manager John Paulson, the founder of New York-based investment firm Paulson & Co. said on Tuesday in a media appearance that he would pull his money off the market in the eventuality of a Harris win, while Tesla CEO Elon Musk flagged something even more ominous.

Don’t Miss:

Chalk & Cheese: The market timing and investor timing will depend on who the president is, said Paulson in an interview with conservative media outlet Fox News. Paulson is a pro-Trumper and a Republican donor, and the ex-president reciprocates the sentiment. In March, a Bloomberg report said Trump was considering the hedge fund manager for the role of Treasury Secretary.

Trending: The startup behind White Castle’s favorite Robot Fry Cook announces a next-generation fast food robot – Here’s how to get a share for under $5 today.

“If Harris was elected [I] would pull my money from the market. I’d go into cash, and I’d go into gold because I think the uncertainty regarding the plans they outlined would create a lot of uncertainty in the markets and likely lower markets,” he told Fox News.

Paulson is known for his profitable bet against the subprime mortgage in 2007.

While Trump wants to extend the 2017 tax cuts implemented during his term in office, Harris was planning to allow them to expire, he said, adding that the latter seeks to raise the corporate tax rate from 21% to 28% and the capital gains tax from 20% to 28%.

Trending: Miami is expected to take New York’s place as the U.S. Financial Capital. Here’s how you can invest in the city before that happens.

The vice president has also proposed a 25% tax on unrealized gains for people having a net worth of $100 million or more, Paulson said. If implemented it would cause “mass selling of almost everything – stocks, bonds, homes, art – I think it would result in a crash in the markets and an immediate, pretty quick recession,” he added.

Musk Chimes In: When Mario Nawfal, who hosts shows and Twitter Spaces, shared the Fox News clipping of Paulson’s interview, Musk said, “[Warren] Buffett is already preparing for this outcome.”

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Musk, who has publicly pledged allegiance to Trump after the first assassination attempt against the former president in a Pennsylvania campaign rally, apparently referred to Berkshire Hathaway, the firm led by Buffett, divesting large positions in some of its key holdings.

Berkshire sold 115 million Apple shares in the first quarter and followed up the sales of another 390 million shares in the second quarter. At the end of June, the firm still owned 400 million Apple shares despite the disposals. At Berkshire’s annual shareholder meeting held in May, the investment guru said the decision to sell the firm’s biggest holding Apple was to raise cash to foot the federal tax bill and also in line with his intention to hold more cash during times of uncertainty.

The company’s cash position at the end of the June quarter was a massive $277 billion.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

The Buffet-run investment holding company has also been trimming its stake in Bank of America Corp. (NYSE:BAC), another of its core portfolio stocks.

The Berkshire chairman and CEO vouches for value investing – an investment strategy of betting on quality stocks that trade well below their intrinsic value. He rarely invests in techs, which qualify as growth stocks. Musk, for his part, has been sending feelers to Berkshire and Buffett via his social media posts regarding investing in his flagship electric-vehicle company.

Since Buffett is regarded as a model investor known for his risk-averse strategies, any decision to reduce his equity holdings could negatively impact sentiment toward stocks.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Elon Musk Says Warren Buffett Is Positioning For Kamala Harris Win With His $277B Cash Pile As Pro-Trumper John Paulson Warns Of Equity Market Exit originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Stanley Druckenmiller Just Added This Hot Dividend Growth Stock to His Portfolio

It can pay to track the investing legends. Billionaire Stanley Druckenmiller put up 30% returns for 30 years when running his hedge fund, and he never had a down year for his investors. Clearly, he is one of the best investors out there, making it worthwhile to track what he is buying and selling.

While you shouldn’t blindly follow the investing legends, it can be a great source of inspiration for potential new stocks to buy.

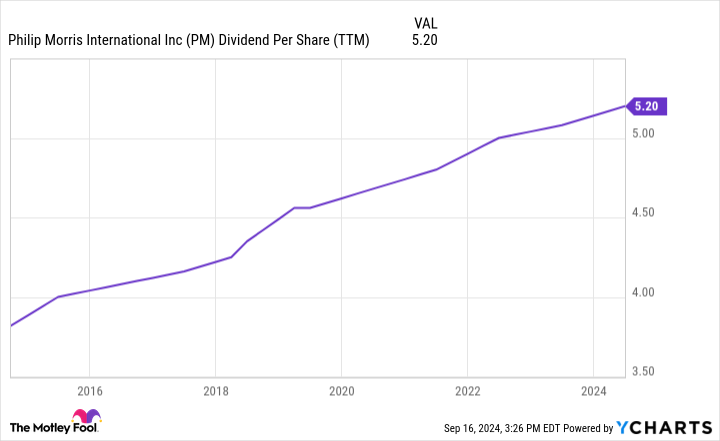

Luckily for individuals, large investment funds are required to disclose their buys and sells and overall portfolio each quarter. Recently, Druckenmiller’s family office disclosed a new position in growing dividend payer Philip Morris International (NYSE: PM). Even though the stock has posted a total return of 36% year to date, Druckenmiller is indicating that he is still bullish on the stock.

Should you hop on the dividend growth train and buy Philip Morris International stock for your portfolio?

Growing volumes through new-age products

Philip Morris International is categorized as one of the tobacco companies in terminal decline. At the start of this year, the company sported a dividend yield of 5.5%, which is much higher than the average large-cap company. There is a narrative that tobacco is uninvestable due to the heavy usage declines for cigarette smokers.

This narrative began to change in 2024 for Philip Morris International. Why? Because of the undeniable growth of Philip Morris’ new-age nicotine products. These products are led by Iqos heat-not-burn tobacco and Zyn nicotine pouches. There are more than 36 million active users of these smoke-free nicotine products, which has helped Philip Morris stabilize and begin to grow shipment volumes in the last few quarters. Last quarter, smoke-free gross profit grew 22.2% year over year, which led consolidated operating earnings to grow by 12.5%.

No wonder investors like Druckenmiller are excited about Philip Morris. The stock was trading at a sky-high dividend yield even though it had returned to top- and bottom-line growth. This is why the stock is up big this year and the dividend yield is down to 4.1%, one of its lowest levels in years.

Earnings growth equates to dividend growth

In 2024, Philip Morris is expecting to generate at or just under $6 in earnings per share (EPS). This is significant growth from the $5.02 it generated in 2023 and will be an all-time high if it is hit or surpassed. The company is seeing rapid earnings growth as its new-age products get more operating leverage and start contributing more and more to the bottom line.

EPS is important to track as it is the lifeblood of Philip Morris’ dividend payout each quarter. Recently, Philip Morris declared an increase in its dividend per share to $1.35 a quarter, which is equivalent to an annual payout of $5.40. This is still well below the company’s guidance of $6 in EPS for the full year. If Philip Morris can keep growing its EPS over the next five to 10 years, it will have plenty of room to keep pushing the dividend per share higher and higher.

The stock is (still) cheap

Philip Morris International’s dividend yield has come down as the stock has gone up. But the stock still looks cheap at these levels. The company’s dividend yield of 4.1% is well above the 10-year U.S. Treasury yield of 3.6% and has plenty of room to grow. Over the next five years, there is room for the company’s EPS to hit $10. Assuming the dividend per share climbs to $9, that is a sky-high forward dividend yield of 7.1% based on the current stock price of $126.

There is a lot of income coming the way of Philip Morris international shareholders. Its dividend should keep growing year after year as more people switch from cigarettes to heat-not-burn and nicotine pouch brands. This makes Philip Morris International stock an easy buy for dividend growth investors today.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

Billionaire Stanley Druckenmiller Just Added This Hot Dividend Growth Stock to His Portfolio was originally published by The Motley Fool

A Once-in-a-Decade Investment Opportunity: 1 Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist Right Now (Hint: It's Not Nvidia)

One of the biggest opportunities among artificial intelligence (AI) investments is semiconductor stocks. Of course, some obvious opportunities include such powerhouses as Nvidia and Advanced Micro Devices. Both companies make chipsets called graphics processing units (GPUs), which play a critical role in developing generative AI applications.

Below, I’ll explain why the semiconductor realm presents such lucrative investment prospects over the next several years. Moreover, I’ll break down which companies are the major players in the chip space and share my top pick.

What is the market potential for AI-powered chips?

Chips play an integral role throughout the AI ecosystem. Some prominent use cases for AI chips include natural language processing (NLP), machine learning, and cloud computing.

According to data compiled by Precedence Research, the global total addressable market for AI-powered chips is expected to grow at a compound annual rate of 30% between 2023 and 2032 — ultimately reaching a size of $227 billion by early next decade.

Who are the major players in semiconductors now?

As I referenced above, Nvidia and AMD are perhaps the two biggest names in AI chips right now. In addition, more niche players include Arm Holdings and Broadcom — the latter of which looks poised to disrupt both the software and hardware side of AI chips.

However, smart investors understand that other opportunities exist beyond core market players. In fact, many of Nvidia’s customers are investing heavily in the development of their own AI chips.

Right now, Amazon and Meta Platforms are two tangential opportunities for investors interested in exposure to the chip market. Amazon is developing its own line of chips, dubbed Trainium and Inferentia. Meanwhile, Meta’s Training and Inference Accelerator could be seen as a more strategic move to migrate away from Nvidia’s H100 GPUs — which comprises a portion of Meta’s current capital expenditure budget.

Furthermore, Tesla CEO Elon Musk has even teased the idea of competing with Nvidia in the future. Considering the number of high-caliber companies using Nvidia chips, how could I see another opportunity as superior?

Well, there’s a subtle theme from all the examples above. Namely, Nvidia is facing a rising wave of competition. Over time, I think the company will lose its ability to command such high pricing power, and this will subsequently eat into its market-dominating position. For these reasons, I would not be surprised to see Nvidia’s growth decelerate and the stock premium begin to normalize.

But fear not; there’s one company I see positioned to benefit from the growth of the AI chip market no matter which company is witnessing the most demand.

Why one company sticks out among the pack

Taiwan Semiconductor Manufacturing (NYSE: TSM) is one of the most important players in the chip space. It is a specialist in the manufacturing side of the chip equation thanks to its fabrication facilities. You see, Nvidia and many of its cohorts do very little in the way of manufacturing. Instead, once new chip designs are tested and finalized, many semiconductor companies outsource their manufacturing needs to TSMC (as it’s often known).

In fact, some of Taiwan Semiconductor’s customers include Nvidia, AMD, Broadcom, Amazon Web Services, Intel, Qualcomm, and Sony. Given this level of diversification, I think TSMC stands to benefit from the more macro secular tailwinds fueling the AI chip market and need not worry about which companies specific chips businesses are buying.

Perhaps even more enticing about Taiwan Semiconductor is its valuation. The stock’s forward price-to-earnings multiple of 25.4 is notably on the low side when benchmarked against other popular chip stocks. I find this disparity peculiar since TSMC is less vulnerable to competition than some of its cohorts.

The AI revolution is still in its early stages, and chips are poised to continue being a critical component of the technology’s development. Given how many different companies are investing in their own chip endeavors, combined with evolving AI use cases, I see the chip market as one that should continue flourishing over the next several years.

Furthermore, there’s an argument to be made that Taiwan Semiconductor is the most important chip company of all because so many companies rely on its outsourcing and manufacturing capabilities.

Considering the long-run growth prospects of the AI chip market and Taiwan Semiconductors’ influential role in bringing chips to life, plus the stock’s attractive valuation, I think now is a great opportunity to scoop up shares hand over fist.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

A Once-in-a-Decade Investment Opportunity: 1 Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist Right Now (Hint: It’s Not Nvidia) was originally published by The Motley Fool

Kids Facing 'Sudden Wealth Syndrome' As Harris' Rise Has Parents Worried, Racing To Transfer Billions To Kids Before A 2025 Benefit Expires

A significant tax incentive is scheduled to expire in 2025, with many wealthy parents rushing to transfer their assets to their children as Kamala Harris gains ground in the polls ahead of the 2024 presidential election. This rush, however, has sparked new concerns over the emotional toll of sudden wealth on children – a phenomenon known as “sudden wealth syndrome.”

Don’t Miss:

What’s Happening?

Currently, individuals can transfer up to $13.61 million tax-free to family members, while couples can transfer up to $27.22 million. But this generous tax benefit is set to expire at the end of 2025 and the amount will likely drop by about half. This change prompts ultrawealthy families to act quickly, moving large sums of money to their children before the window closes.

Wealthy parents are under pressure to provide money to their children as soon as possible because Harris is advocating for more taxes on the wealthy. They are concerned that a Democratic president may implement tax laws that would be less advantageous for them.

But while they’re focused on protecting their kids’ financial futures, they’re also concerned about how suddenly receiving so much money could impact their children’s well-being.

The Risks of Sudden Wealth

Sudden wealth syndrome is a real challenge for people who suddenly get a lot of money. Children who inherit enormous sums or receive unexpected wealth may experience overwhelming anxiety and uncertainty about what to do with all of their newfound income.

Wealth advisors are encouraging families to consider carefully before making these transfers – not just about the tax savings but also about the impact on their children’s mental health and future.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

What’s At Stake?

According to a report, “Much is often made in the media of millennial and Generation Z heirs, but Generation X will be first in line to inherit from their wealthy parent(s).”

It also says that over the next 10 years, about 1.2 million people worth $5 million or more will pass down over $31 trillion. Almost two-thirds will come from the ultrarich, those worth $30 million or more. Ultimately, around $20 trillion will be passed down from just 155,000 of the richest individuals.

Educating kids about financial responsibility before they inherit a fortune can help them feel more comfortable managing their wealth. Some families are setting up gradual inheritance plans to ensure their kids won’t get all the money at once, while others are seeking professional help to guide their kids through this major life change.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Kids Facing ‘Sudden Wealth Syndrome’ As Harris’ Rise Has Parents Worried, Racing To Transfer Billions To Kids Before A 2025 Benefit Expires originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Internet Initiative is on the Move, Here's Why the Trend Could be Sustainable

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

Often, the direction of a stock’s price movement reverses quickly after taking a position in it, making investors incur a short-term capital loss. So, it’s important to ensure that there are enough factors — such as sound fundamentals, positive earnings estimate revisions, etc. — that could keep the momentum in the stock going.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

Internet Initiative Japan

IIJIY is one of the several suitable candidates that passed through the screen. Here are the key reasons why it could be a profitable bet for “trend” investors.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. IIJIY is quite a good fit in this regard, gaining 49.6% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 15.3% over the past four weeks ensures that the trend is still in place for the stock of this internet service provider.

Moreover, IIJIY is currently trading at 93.5% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in IIJIY may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fresh Food Packaging Market to Surpass $124.15 Billion by 2031, Says Coherent Market Insights (CMI)

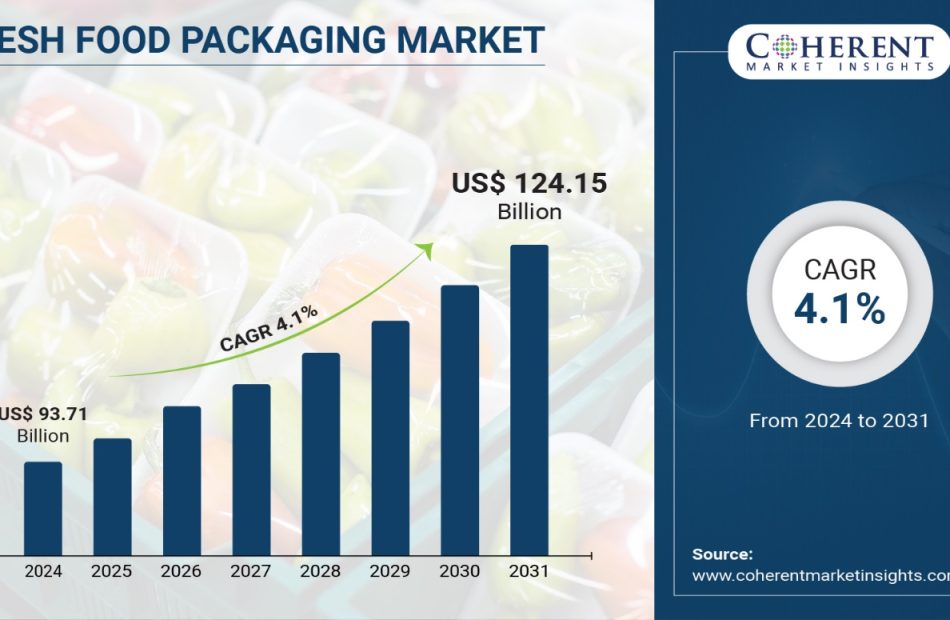

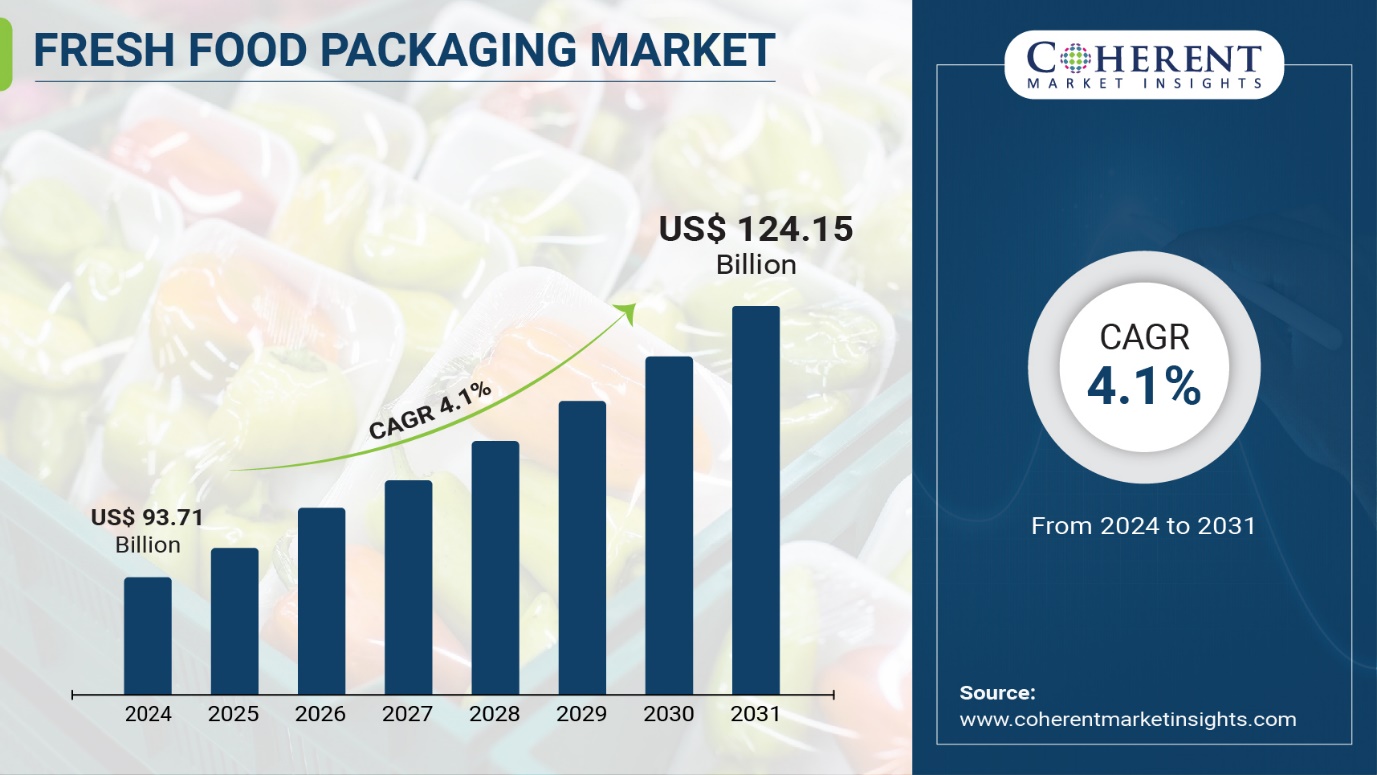

Burlingame, Sept. 19, 2024 (GLOBE NEWSWIRE) — The global Fresh Food Packaging Market Size to Grow from USD 93.71 Billion in 2024 to USD 124.15 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 4.1% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Growing chilled and frozen food retail industry also requires effective packaging solutions to maintain quality during storage and delivery. Further, innovation in active and intelligent packaging materials integrated with sensors is gaining traction to continuously monitor food quality.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7304

Market Dynamics:

The growth of the fresh food packaging market is driven by increasing demand for convenient packaging from both manufacturers as well as consumers. Fresh food packaging helps extend the shelf life of foods by preventing contamination and moisture loss. Modified atmosphere packaging and active packaging technologies maintain a favorable atmospheric condition inside the package preventing microbial growth. Additionally, innovations in material science have led to the development of materials like ethylene-vinyl alcohol copolymer film and antimicrobial coatings that further enhance the shelf life of fresh foods.

Fresh Food Packaging Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $93.71 billion |

| Estimated Value by 2031 | $124.15 billion |

| Growth Rate | Poised to grow at a CAGR of 4.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Material Type, By Packaging Type, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing demand for fresh and healthy foods • Increasing demand for longer shelf life of perishable products |

| Restraints & Challenges | • Volatility in raw material prices • High cost of innovation and manufacturing |

Market Trends:

There is a growing shift towards sustainable packaging materials to reduce environmental footprint. Materials like paper & paperboard, bio-based and biodegradable plastics are gaining widespread acceptance in the fresh food packaging industry. Manufacturers are focusing on ‘greening’ their portfolios and replacing non-recyclable materials with eco-friendly alternatives highlighting their sustainability credentials to environment-conscious consumers.

The fast-paced lifestyle has boosted the demand for packaged, ready-to-eat fresh foods that offer convenience without compromising on quality. Innovative packaging solutions like re-closable, easy-open and stand-up pouches are well-aligned with the evolving consumption patterns. Customizable pack sizes are also increasingly popular for on-the-go consumption.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7304

Market Opportunities:

The demand for convenient and easy-to-use food packaging is growing tremendously. With rising health awareness and busy lifestyles, consumers are increasingly looking for packaging that allows them to easily store, transport and consume food items safely and hygienically without much effort. Food brands and retailers recognize this trend and are developing innovative packaging solutions that offer added convenience like re-closable, leak-proof and microwavable features. They are also focusing on portable and lightweight designs for on-the-go consumption. This fast evolving demand for convenience is opening up new opportunities for packaging manufacturers to develop advanced materials and designs.

With sustainability and eco-friendliness becoming a priority, packaging manufacturers are exploring alternatives to plastics and using more recycled content in their products. They are investing in renewable and plant-based materials like paper, bioplastics and biodegradable films that have lower environmental footprint. Brands and retailers also prefer sustainable options for their green image and to comply with stringent regulations. This shift towards eco-packaging presents opportunities to develop innovative and viable sustainable solutions across various segments like meat, fruits, vegetables etc. Companies developing sustainable packages with improved performance, reduced costs and compelling marketing proposition will gain an edge.

Key Market Takeaways

The global fresh food packaging market size was valued at USD 93.71 billion in 2024 and is anticipated to witness a CAGR of 4.1% during the forecast period. Rapid urbanization, increasing disposable incomes and growing demand for packaged and convenience foods are driving the market.

On the basis of material, the flexible & rigid plastic segment holds the dominant position owing to its low cost, durability and versatility. However, paper & paperboard is expected to register higher growth due to growing preference for sustainable options.

On the basis of end use, the meat products segment dominates the market driven by growing meat consumption worldwide. However, the fruits segment is projected to witness highest growth on account of increased health consciousness and demand for seasonal fruits.

Regionally, North America holds the dominant position in the fresh food packaging market driven by well-established food processing sector and demand for packaging innovations. Asia Pacific is slated to emerge as the fastest growing regional market supported by rapid economic expansion, urbanization and rising disposable incomes.

Key players operating in the fresh food packaging market include International Paper Company, Mondi Group, Sonoco Products Company, Ball Corporation, Smurfit Kappa, Amcor, DS Smith, and Sealed Air Corporation. These companies are focused on expanding their product portfolio and presence across major markets through acquisitions and partnerships.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7304

Recent Developments:

In 2020, Amcor PLC partnered with Moda; this is a New Zealand based company in order to provide innovative packaging solutions in North and Latin American regions.

Amcor PLC successfully merged with Bemis Company Inc.in2019. The acquisition of Bemis was expected to enhance the scale of operations as well as capabilities so that Amcor could

boost its market position.

Detailed Segmentation:

By Material:

- Plastic

- Paper & Paperboard

- Glass

- Metal

- Others

By Packaging:

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

- Others

By Application:

- Eggs, Meat and Seafood

- Fruits and Vegetables

- Dairy Products

By Regional:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Packaging Domain:

Personalized Packaging Market is estimated to be valued at USD 36.23 Bn in 2024 and is expected to reach USD 51.32 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.1% from 2024 to 2031.

Disappearing Packaging Market is estimated to be valued at USD 4.26 Bn in 2024 and is expected to reach USD 8.96 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 11.2% from 2024 to 2031.

Retort Packaging Market size is expected to reach US$ 64.76 Bn by 2030, from US$ 35.43 Bn in 2023, at a CAGR of 9% during the forecast period.

Foam Cooler Box Market size was valued at US$ 2.9 Bn in 2023 and is expected to reach US$ 5.2 Bn by 2030, growing at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$1.8M Bet On Singular Genomics? Check Out These 3 Stocks Executives Are Buying

Although U.S. stocks closed lower on Wednesday, there were a few notable insider trades.

When insiders purchase shares, it indicates their confidence in the company’s prospects or that they view the stock as a bargain. Either way, this signals an opportunity to go long on the stock. Insider purchases should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a buying decision.

Below is a look at a few recent notable insider purchases. For more, check out Benzinga’s insider transactions platform.

Singular Genomics Systems

- The Trade: Singular Genomics Systems, Inc. OMIC 10% owner TANG CAPITAL PARTNERS LP acquired a total of 122,416 shares at an average price of $14.75. To acquire these shares, it cost around $1.81 million.

- What’s Happening: On Sept. 12, Singular Genomics announced it received a non-binding acquisition proposal from Deerfield.

- What Singular Genomics Systems Does: Singular Genomics Systems Inc is a life science technology company that is leveraging novel next generation sequencing and multiomics technologies to build products that empower researchers and clinicians.

NewtekOne

- The Trade: NewtekOne, Inc. NEWT Director Gregory L Zink acquired a total of 1,000 shares at an average price of $11.38. To acquire these shares, it cost around $11,380.

- What’s Happening: On Sept. 16, NewtekOne declared a quarterly dividend of 19 cents per share.

- What NewtekOne Does: NewtekOne Inc is a financial holding company engaged in providing financial solutions, It has developed a financial and technology-based business model that enables itself to acquire and process its clients in a very cost-effective manner.

SR Bancorp

- The Trade: SR Bancorp, Inc. SRBK Director Thomas Lupo bought a total of 5,000 shares at an average price of $10.58. To acquire these shares, it cost around $52,885. The company’s Executive Chair also bought 1,000 shares.

- What’s Happening: On July 30, SR Bancorp posted a second-quarter loss of 34 cents per share.

- What SR Bancorp Does: SR Bancorp Inc principal business is to acquire deposits from individuals and businesses in the communities surrounding offices and to use these deposits to fund loans.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LightPath Technologies Reports Fiscal 2024 Fourth Quarter and Full Year Financial Results

ORLANDO, Fla., Sept. 19, 2024 /PRNewswire/ — LightPath Technologies, Inc. LPTH (“LightPath,” the “Company,” or “we”), a leading global, vertically integrated provider of thermal imaging cores, custom optical assemblies, photonics and infrared solutions for the industrial, commercial, defense, telecommunications, and medical industries, today announced financial results for its fiscal 2024 fourth quarter and full year ended June 30, 2024.

Fiscal 2024 Full Year & Fourth Quarter Highlights:

- Revenue of $8.6 million for the fourth quarter of fiscal 2024; revenue of $31.7 million for the full fiscal year 2024

- 28% and 20% of revenue, respectively, for customized lens assemblies and solutions and related engineering services, or LightPath 2.0 as we refer to these product groups

- Total backlog at June 30, 2024, of $19.3 million

- Net loss for the fourth quarter of fiscal 2024 was $2.4 million; net loss of $8.0 million for the full fiscal year 2024

- EBITDA* loss for the fourth quarter of fiscal 2024 was $1.3 million; EBITDA* loss of $3.7 million for the full fiscal year 2024

- Achieved Key Qualification Milestone with Lockheed Martin for US Army Missile Program

- Successfully Transitioned Key Customer from Germanium to BlackDiamond Glass Optics

- Released First AI-Ready EdgeIR Cameras

Management Commentary

LightPath’s President and Chief Executive Officer Sam Rubin stated, “Looking back at fiscal 2024, LightPath took significant steps in our strategic plan to position the Company for growth. We continued transitioning from a component provider to a custom thermal imaging solutions provider while pursuing our three pillars of growth: automotive, defense, and camera solutions.”

“Throughout the year, we demonstrated the potential of our thermal imaging cameras through each introduction of application-specific variations. We introduced new versions of the Mantis camera, including a high-temperature furnace monitoring camera and a long-range detection camera, as well as AI-enabled thermal cameras. Each one of these cameras introduces capabilities previously unavailable within a single camera. The development of these specially tuned cameras was enabled by our acquisition of Visimid in July 2023.”

“Our strategic decision to focus on defense began to pay dividends as we announced our work with Lockheed Martin on a next-generation missile project. The work on this project will influence LightPath over the long term, and should Lockheed secure the project, it would be a transformative opportunity for the Company. Since being chosen for this project, we have continually hit our milestones and have now qualified to ship air worthy units.”

Mr. Rubin concluded, “As a result of China’s decision last year to limit exports of certain critical minerals, we made the strategic decision to transition away from a germanium-dependent business. Despite this headwind, I am proud to say we were able to hold revenue near level for the year compared to the prior year. Moving away from Germanium has allowed us to more fully turn toward our own proprietary Black Diamond glass materials and, in some instances, further induce customers to partner with us on their designs to incorporate our materials. In July, we announced that a major defense customer did exactly this, qualifying a new optics design incorporating our BlackDiamond glass. An order is expected once the customer completes current demand using its inventory of Germanium.”

2024 Fiscal Fourth Quarter Financial Results

Revenue for the fourth quarter of fiscal 2024 was approximately $8.6 million, a decrease of approximately $1.1 million, or 11%, as compared to approximately $9.7 million in the same quarter of the prior fiscal year. Revenue among our product groups for the fourth quarter of fiscal 2024 was as follows:

|

Product Group Revenue |

Fourth Quarter |

Fourth Quarter |

% Change |

|

Infrared (“IR”) components |

$3.0 |

$4.8 |

-36 % |

|

Visible components |

$3.2 |

$3.2 |

0 % |

|

Assemblies & modules |

$1.4 |

$1.6 |

-14 % |

|

Engineering services |

$1.0 |

$0.1 |

698 % |

|

** Numbers may not foot due to rounding |

- Revenue generated by IR components was approximately $3.0 million in the fourth quarter of fiscal 2024, a decrease of approximately $1.7 million, or 36%, as compared to the same quarter of the prior fiscal year. The decrease in revenue is primarily due to a decrease in sales against a large annual contract for Germanium-based products, which was not renewed in the second quarter of fiscal year 2024, as we decided to reduce the amount of optics we produce from Germanium, both to reduce our risk of supply chain disruption, and more importantly, to work with customers to convert their systems to use optics made of our own BlackDiamond materials.

- Revenue generated by visible components was approximately $3.2 million, which was about the same in comparison to the same quarter of the prior fiscal year, with a decrease in sales to defense customers due to timing of orders offset by an increase in sales through U.S. catalog and distribution channels.

- Revenue from assemblies and modules decreased by $0.2 million for the fourth quarter of fiscal 2024, as compared to the same quarter of the prior fiscal year, primarily due to lower sales of a custom visible lens assembly to a medical customer for which we have an end-of-life order in backlog going into fiscal 2025. In the fourth quarter of fiscal year 2023, this customer requested a greater number of units shipped, whereas in fiscal year 2024 we have shipped a lower but more consistent amount each quarter. This decrease was partially offset by the addition of Visimid revenue.

- Revenue from engineering services was $1.0 million for the fourth quarter of fiscal 2024, an increase of $0.9 million as compared to the same quarter of the prior fiscal year. This increase was primarily driven by Visimid’s contract with Lockheed Martin, where revenue is generally recognized based on the achievement of milestones.

Gross margin in the fourth quarter of fiscal 2024 was approximately $2.5 million, a decrease of $0.6 million, or 18%, as compared to the same quarter of the prior fiscal year. Total cost of sales was approximately $6.1 million for the fourth quarter of fiscal 2024, compared to approximately $6.6 million for the same quarter of the prior fiscal year. Gross margin as a percentage of revenue was 29% for the fourth quarter of fiscal 2024, compared to 32% for the same quarter of the prior fiscal year. The decrease in gross margin as a percentage of revenue is primarily due to the overall decrease in revenue, resulting in a lower contribution to our fixed manufacturing costs. Sequentially, gross margin improved from 21% in the third quarter of fiscal 2024 as we moved past the inventory revaluation which negatively impacted that quarter.

Selling, general and administrative (“SG&A”) costs were approximately $3.6 million for the fourth quarter of fiscal 2024, an increase of approximately $0.6 million, or 20%, as compared to the same quarter of the prior fiscal year. The increase in SG&A for the fourth quarter of fiscal 2024 is primarily due to an increase in wages, including non-recurring executive severance costs of $0.1 million, and an increase in legal and consulting fees related to business development initiatives. We also incurred additional legal and professional fees associated with the previously disclosed Delaware chancery court proceedings related to various corporate matters.

Net loss for the fourth quarter of fiscal 2024 was approximately $2.4 million, or $0.06 basic and diluted loss per share, compared to $0.8 million, or $0.02 basic and diluted loss per share, for the same quarter of the prior fiscal year. The increase in net loss of approximately $1.5 million for the fourth quarter of fiscal 2024, as compared to the same quarter of the prior fiscal year, was primarily attributable to the decrease in gross margin, coupled with increased operating expenses, including amortization of intangibles.

EBITDA* for the quarter ended June 30, 2024 was a loss of approximately $1.3 million, compared to income of $0.1 million for the same period of the prior fiscal year. The decrease in EBITDA in the fourth quarter of fiscal year 2024 was primarily attributable to the decrease in revenue and gross margin, coupled with increases in SG&A and Other expenses, net, which expense increases primarily related to non-recurring items.

2024 Fiscal Year Financial Results

Revenue for fiscal 2024 was approximately $31.7 million, a decrease of approximately $1.2 million, or 4%, as compared to approximately $32.9 million in the same period of the prior fiscal year. The decrease was primarily driven by a decrease in sales of visible components, partially offset by increases in sales of IR components and engineering services. Revenue among our product groups for fiscal 2024 was as follows:

|

Product Group Revenue ($ in |

Fiscal 2024 |

Fiscal 2023 |

% Change |

|

Infrared (“IR”) components |

$14.1 |

$14.4 |

-2 % |

|

Visible components |

$11.2 |

$13.4 |

-16 % |

|

Assemblies & modules |

$4.5 |

$4.7 |

-5 % |

|

Engineering services |

$2.0 |

$0.4 |

363 % |

|

** Numbers may not foot due to rounding |

- Revenue generated by IR components was approximately $14.1 million in fiscal 2024, a decrease of approximately $0.3 million, or 2%, as compared to the prior fiscal year. The decrease in revenue related to the Germanium-based annual contract that was not renewed was mostly offset by an increase in shipments against an annual contract for an international military program. This contract was renewed during the first quarter of fiscal 2024 for a higher dollar value than the previous contract.

- Revenue generated by visible components was approximately $11.2 million in fiscal 2024, a decrease of approximately $2.2 million, or 16%, as compared to the prior fiscal year. The decrease in revenue is primarily due to a decrease in sales to customers in the defense industry, as well as a decrease in sales through catalog and distribution channels in the U.S. and in Europe. Sales to customers in the telecommunications industry in China also decreased.

- Revenue from assemblies and modules was approximately $4.5 million in fiscal 2024, a decrease of approximately $0.2 million, or 5%, as compared to the prior fiscal year, primarily due to a decrease in shipments against a multi-year contract with a defense customer due to timing, as well as decreases in sales of infrared assemblies to industrial customers in China and the U.S.. Customers in both regions have been steadily decreasing orders since the peak of COVID-19. These decreases were partially offset by the addition of revenue from sales of infrared camera cores.

- Revenue from engineering services was approximately $2.0 million for fiscal 2024, an increase of $1.5 million as compared to the prior fiscal year. This increase was primarily driven by our contract with Lockheed Martin, where revenue is generally recognized based on the achievement of milestones. The remaining increase is driven by revenue from one of our space-related funded research contracts.

Gross margin for fiscal 2024 was approximately $8.6 million, a decrease of 22%, as compared to approximately $11.1 million in fiscal year 2023. Gross margin as a percentage of revenue was 27% for fiscal year 2024 as compared to 34% for fiscal year 2023. The decrease in gross margin as a percentage of revenue is primarily due to the decrease in visible components sales, which typically have higher margins than our infrared components product group. Our infrared components product group comprised a greater portion of our sales for fiscal year 2024. In addition, gross margin as a percentage of revenue for fiscal year 2024 was unfavorably impacted by the revaluation of inventory during the third quarter of fiscal 2024. The revaluation resulted in a net write-down of inventory.

SG&A costs were approximately $12.3 million for fiscal 2024, an increase of approximately $0.9 million, or 8%, as compared to the prior fiscal year. The increase in SG&A for fiscal 2024 is primarily due to an increase in wages, including non-recurring executive severance costs of $0.1 million, and an increase in legal and consulting fees related to business development initiatives. These increases are partially offset by a decrease in stock-based compensation, whereas fiscal 2023 included increased stock compensation costs associated with two director retirements. We also incurred additional legal and professional fees in fiscal 2024 associated with our rescheduled annual stockholder meeting and previously disclosed Delaware chancery court proceedings. We expect SG&A costs to remain elevated for the next few quarters as we continue with certain business development initiatives.

Net loss for fiscal 2024 was approximately $8.0 million, or $0.21 basic and diluted loss per share, compared to approximately $4.0 million, or $0.13 basic and diluted loss per share, for fiscal 2023. The increase in net loss for fiscal 2024, as compared to fiscal 2023, is attributable to the approximately $4.3 million increase in operating loss resulting from lower revenue and gross margin and increased operating expenses. This decrease was partially offset by a decrease in other expense, net, of approximately $0.1 million, primarily due to the decrease in interest expense. In addition, there was a favorable difference of approximately $0.2 million in the provision for income taxes for fiscal 2024 as compared to fiscal 2023.

EBITDA* for fiscal 2024 was a loss of approximately $3.7 million, compared to $0.4 million for fiscal 2023. The decrease in EBITDA for fiscal 2024 is primarily attributable to lower revenue and gross margin, coupled with increased operating expenses, including SG&A and new product development. SG&A for fiscal 2024 includes a number of non-recurring cost items, particularly as related to the recently announced acquisition.

Liquidity and Capital Resources

Cash provided by operations was approximately $0.5 million for fiscal 2024, compared to cash used in operations of approximately $2.8 million for the prior fiscal year. The increase in cash flows from operations during fiscal year 2024 is primarily due decreases in accounts receivable and inventory, due to lower sales in fiscal year 2024, as compared to fiscal year 2023. Cash used in operations for fiscal year 2023 was primarily due to an increase in accounts receivable, due to higher sales in the fourth quarter of fiscal year 2023, and an increase in inventory during the second half of fiscal year 2023. The cash outflow for accounts payable and accrued liabilities for fiscal year 2023 was largely due to the previously described events that occurred at our Chinese subsidiaries, for which certain expenses were accrued as of June 30, 2021 and paid during fiscal years 2022 and 2023.

Capital expenditures were approximately $2.2 million for fiscal 2024, compared to approximately $3.1 million in the prior fiscal year. The Company also expended approximately $0.8 million, net of cash acquired, to acquire Visimid during fiscal 2024. Fiscal year 2024 also reflects proceeds of approximately $0.4 million from sale-leasebacks of equipment. During fiscal years 2024 and 2023, our capital expenditures were primarily related to the expansion of our Orlando facility. In August 2023, we completed the construction of certain tenant improvements subject to our continuing lease for our Orlando facility, of which the landlord provided $2.4 million in tenant improvement allowances. We funded the balance of the tenant improvement costs of approximately $3.7 million in fiscal years 2023 and 2024.

Sales Backlog

Our total backlog as of June 30, 2024, was approximately $19.3 million, a decrease of 11%, as compared to $21.7 million as of June 30, 2023. The decrease in backlog during fiscal 2024 as compared fiscal 2023 is primarily due to fiscal 2024 shipments against the prior period backlog under several annual and multi-year contract renewals. The timing of multi-year contract renewals are not always consistent and, thus, backlog levels may increase substantially when annual and multi-year orders are received and decrease as shipments are made against these orders. We anticipate that our existing annual and multi-year contracts will be renewed in foreseeable future quarters. The reduction in backlog as a result of these shipments during fiscal 2024 were partially offset by the following: (i) a significant contract renewal (represented a 40% increase in dollar value as compared to the previous order) for advanced infrared optics for a critical international military program; and (ii) a significant contract awarded to Visimid by Lockheed Martin in December 2023. In previous years we have typically received a significant contract renewal during our second fiscal quarter from our largest customer for infrared products made of Germanium. However, as previously disclosed we have decided to reduce the amount of optics we produce from Germanium, both to reduce our risk of supply chain disruption and, more importantly, to work with customers to convert their systems to use optics made of our own BlackDiamond materials. As such, in the second quarter of fiscal 2024 we did not book our typical annual renewal order for Germanium optics with this customer. Instead, we continue to work with this customer, as well as other customers, to convert their systems to use BlackDiamond optics, which we believe will result in future orders to replace the orders for Germanium-based optics.

Investor Conference Call and Webcast Details

LightPath will host an audio conference call and webcast on Thursday, September 19, 2024, at 5:00 p.m. ET to discuss its financial and operational performance for its fiscal 2024 fourth quarter and full year.

Date: Thursday, September 19, 2024

Time: 5:00 p.m. (ET)

Dial-in Number: 1-877-317-2514

International Dial-in Number: 1-412-317-2514

Webcast: 4Q24 Webcast Link

Participants are recommended to dial-in or log-on approximately 10 minutes prior to the start of the event. A replay of the call will be available approximately one hour after completion through October 3, 2024. To listen to the replay, dial 1-877-344-7529 (domestic) or 1-412-317-0088 (international), and enter conference ID #7324919.

*Use of Non-GAAP Financial Measures

To provide investors with additional information regarding financial results, this press release includes references to EBITDA, which is a non-GAAP financial measure. For a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with GAAP, see the table provided in this press release.

A “non-GAAP financial measure” is generally defined as a numerical measure of a company’s historical or future performance that excludes or includes amounts, or is subject to adjustments, so as to be different from the most directly comparable measure calculated and presented in accordance with GAAP. The Company’s management believes that this non-GAAP financial measure, when considered together with the GAAP financial measure, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. Management also believes that this non-GAAP financial measure enhances the ability of investors to analyze underlying business operations and understand performance. In addition, management may utilize these non-GAAP financial measures as guides in forecasting, budgeting, and planning. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP.

The Company calculates EBITDA by adjusting net income to exclude net interest expense, income tax expense or benefit, depreciation, and amortization.

About LightPath Technologies

LightPath Technologies, Inc. LPTH is a leading global, vertically integrated provider of optics, photonics and infrared solutions for the industrial, commercial, defense, telecommunications, and medical industries. LightPath designs and manufactures proprietary optical and infrared components including molded glass aspheric lenses and assemblies, custom molded glass freeform lenses, infrared lenses and thermal imaging assemblies, fused fiber collimators, and proprietary BlackDiamond™ (“BD6”) chalcogenide-based glass lenses. LightPath also offers custom optical assemblies, including full engineering design support. The Company is headquartered in Orlando, Florida, with manufacturing and sales offices in Dallas, Texas, Latvia and China.

LightPath’s wholly-owned subsidiary, Visimid Technologies, was acquired in July 2023, and specializes in the design and development of customized infrared cameras, for the industrial and defense industries. Such customized cameras are often sold together with customized optical assemblies from LightPath.

LightPath’s wholly-owned subsidiary, ISP Optics Corporation, manufactures a full range of infrared products from high performance MWIR and LWIR lenses and lens assemblies. ISP’s infrared lens assembly product line includes athermal lens systems used in cooled and un-cooled thermal imaging cameras. Manufacturing is performed in-house to provide precision optical components including spherical, aspherical and diffractive coated infrared lenses.

For more information on LightPath and its businesses, please visit www.lightpath.com.

Forward-Looking Statements

This press release includes statements that constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “guidance,” “plan,” “estimate,” “will,” “would,” “project,” “maintain,” “intend,” “expect,” “anticipate,” “prospect,” “strategy,” “future,” “likely,” “may,” “should,” “believe,” “continue,” “opportunity,” “potential,” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements are based on information available at the time the statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the impact of varying demand for the Company products; the ability of the Company to obtain needed raw materials and components from its suppliers; general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; geopolitical tensions, the Russian-Ukraine conflict, and the Hamas/Israel war; the effects of steps that the Company could take to reduce operating costs; rising inflation and increased interest rates, which diminish capital market cash flow and borrowing power; the inability of the Company to sustain profitable sales growth, convert inventory to cash, or reduce its costs to maintain competitive prices for its products; circumstances or developments that may make the Company unable to implement or realize the anticipated benefits, or that may increase the costs, of its current and planned business initiatives; and those factors detailed by LightPath Technologies, Inc. in its public filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on 10-Q. Should one or more of these risks, uncertainties, or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

(tables follow)

|

LIGHTPATH TECHNOLOGIES, INC. |

|||||||

|

Condensed Consolidated Balance Sheets |

|||||||

|

(unaudited) |

|||||||

|

June 30, |

June 30, |

||||||

|

Assets |

2024 |

2023 |

|||||

|

Current assets: |

|||||||

|

Cash and cash equivalents |

$ 3,480,268 |

$ 4,687,004 |

|||||

|

Restricted cash |

— |

2,457,486 |

|||||

|

Trade accounts receivable, net of allowance of $25,676 and $18,502 |

4,928,931 |

6,634,574 |

|||||

|

Inventories, net |

6,551,059 |

7,410,734 |

|||||

|

Prepaid expenses and deposits |

445,900 |

570,293 |

|||||

|

Other current assets |

131,177 |

— |

|||||

|

Total current assets |

15,537,335 |

21,760,091 |

|||||

|

Property and equipment, net |

15,210,612 |

12,810,930 |

|||||

|

Operating lease right-of-use assets |

6,741,549 |

9,571,604 |

|||||

|

Intangible assets, net |

3,650,739 |

3,332,715 |

|||||

|

Goodwill |

6,764,127 |

5,854,905 |

|||||

|

Deferred tax assets, net |

123,000 |

140,000 |

|||||

|

Other assets |

59,602 |

65,939 |

|||||

|

Total assets |

$ 48,086,964 |

$ 53,536,184 |

|||||

|

Liabilities and Stockholders’ Equity |

|||||||

|

Current liabilities: |

|||||||

|

Accounts payable |

$ 3,231,713 |

$ 2,574,135 |

|||||

|

Accrued liabilities |

1,911,867 |

662,242 |

|||||

|

Accrued payroll and benefits |

1,446,452 |

1,499,896 |

|||||

|

Operating lease liabilities, current |

1,059,998 |

969,890 |

|||||

|

Loans payable, current portion |

209,170 |

1,023,814 |

|||||

|

Finance lease obligation, current portion |

177,148 |

103,646 |

|||||

|

Total current liabilities |

8,036,348 |

6,833,623 |

|||||

|

Deferred tax liabilities, net |

326,197 |

465,000 |

|||||

|

Accrued liabilities, noncurrent |

611,619 |

— |

|||||

|

Finance lease obligation, less current portion |

528,753 |

341,201 |

|||||

|

Operating lease liabilities, noncurrent |

8,058,502 |

8,393,248 |

|||||

|

Loans payable, less current portion |

325,880 |

1,550,587 |

|||||

|

Total liabilities |

17,887,299 |

17,583,659 |

|||||

|

Commitments and Contingencies |

|||||||

|

Stockholders’ equity: |

|||||||

|

Preferred stock: Series D, $.01 par value, voting; |

|||||||

|

500,000 shares authorized; none issued and outstanding |

— |

— |

|||||

|

Common stock: Class A, $.01 par value, voting; |

|||||||

|

94,500,000 and 44,500,000 shares authorized; |

|||||||

|

39,254,643 and 34,344,739 shares issued and outstanding |

392,546 |

373,447 |

|||||

|

Additional paid-in capital |

245,140,758 |

242,808,771 |

|||||

|

Accumulated other comprehensive income |

509,936 |

606,536 |

|||||

|

Accumulated deficit |

(215,843,575) |

(207,836,229) |

|||||

|

Total stockholders’ equity |

30,199,665 |

35,952,525 |

|||||

|

Total liabilities and stockholders’ equity |

$ 48,086,964 |

$ 53,536,184 |

|||||

|

LIGHTPATH TECHNOLOGIES, INC. |

|||||||||||

|

Condensed Consolidated Statements of Comprehensive Income (Loss) |

|||||||||||

|

(unaudited) |

|||||||||||

|

Three Months Ended |

Year Ended |

||||||||||

|

June 30, |

June 30, |

||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||

|

Revenue, net |

$ 8,634,132 |

$ 9,684,721 |

$ 31,726,192 |

$32,933,949 |

|||||||

|

Cost of sales |

6,109,100 |

6,603,559 |

23,094,946 |

21,859,126 |

|||||||

|

Gross margin |

2,525,032 |

3,081,162 |

8,631,246 |

11,074,823 |

|||||||

|

Operating expenses: |

|||||||||||

|

Selling, general and administrative |

3,605,988 |

3,009,109 |

12,297,383 |

11,437,241 |

|||||||

|

New product development |

582,822 |

615,675 |

2,400,420 |

2,145,413 |

|||||||

|

Amortization of intangible assets |

434,403 |

281,271 |

1,635,523 |

1,125,083 |

|||||||

|

Loss (gain) on disposal of property and equipment |

111,336 |

(22,463) |

124,584 |

(78,373) |

|||||||

|

Total operating expenses |

4,734,549 |

3,883,592 |

16,457,910 |

14,629,364 |

|||||||

|

Operating loss |

(2,209,517) |

(802,430) |

(7,826,664) |

(3,554,541) |

|||||||

|

Other income (expense): |

|||||||||||

|

Interest expense, net |

(42,814) |

(54,561) |

(191,862) |

(283,266) |

|||||||

|

Other income (expense), net |

(155,354) |

59,769 |

78,670 |

24,970 |

|||||||

|

Total other income (expense), net |

(198,168) |

5,208 |

(113,192) |

(258,296) |

|||||||

|

Loss before income taxes |

(2,407,685) |

(797,222) |

(7,939,856) |

(3,812,837) |

|||||||

|

Income tax provision |

(53,912) |

11,618 |

67,490 |

234,034 |

|||||||

|

Net loss |

$ (2,353,773) |

$ (808,840) |

$ (8,007,346) |

$ (4,046,871) |

|||||||

|

Foreign currency translation adjustment |

(119,009) |

(370,492) |

(96,600) |

(328,589) |

|||||||

|

Comprehensive loss |

$ (2,472,782) |

$ (1,179,332) |

$ (8,103,946) |

$ (4,375,460) |

|||||||

|

Loss per common share (basic) |

$ (0.06) |

$ (0.02) |

$ (0.21) |

$ (0.13) |

|||||||

|

Number of shares used in per share calculation (basic) |

38,850,526 |

37,320,084 |

37,944,935 |

31,637,445 |

|||||||

|

Loss per common share (diluted) |

$ (0.06) |

$ (0.02) |

$ (0.21) |

$ (0.13) |

|||||||

|

Number of shares used in per share calculation (diluted) |

38,850,526 |

37,320,084 |

37,944,935 |

31,637,445 |

|||||||

|

LIGHTPATH TECHNOLOGIES, INC. |

||||||||

|

Condensed Consolidated Statements of Changes in Stockholders’ Equity |

||||||||

|

(unaudited) |

||||||||

|

Accumulated |

||||||||

|

Class A |

Additional |

Other |

Total |

|||||

|

Common Stock |

Paid-in |

Comphrehensive |

Accumulated |

Stockholders’ |

||||

|

Shares |

Amount |

Capital |

Income |

Deficit |

Equity |

|||

|

Balances at June 30, 2022 |

27,046,790 |

$ 270,468 |

$ 232,315,003 |

$ 935,125 |

$ (203,789,358) |

$ 29,731,238 |

||

|

Issuance of common stock for: |

||||||||

|

Employee Stock Purchase Plan |

33,523 |

335 |

40,045 |

— |

— |

40,380 |

||

|

Exercise of Stock Options, RSUs & RSAs, net |

1,173,516 |

11,735 |

34,165 |

— |

— |

45,900 |

||

|

Issuance of common stock under public equity placement |

9,090,910 |

90,909 |

9,108,601 |

— |

— |

9,199,510 |

||

|

Stock-based compensation on stock options, RSAs & RSUs |

— |

— |

1,310,957 |

— |

— |

1,310,957 |

||

|

Foreign currency translation adjustment |

— |

— |

— |

(328,589) |

— |

(328,589) |

||

|

Net loss |

— |

— |

— |

— |

(4,046,871) |

(4,046,871) |

||

|

Balances at June 30, 2023 |

37,344,739 |

373,447 |

242,808,771 |

606,536 |

(207,836,229) |

35,952,525 |

||

|

Issuance of common stock for: |

||||||||

|

Employee Stock Purchase Plan |

30,447 |

304 |

39,373 |

— |

— |

39,677 |

||

|

Exercise of Stock Options, RSUs & RSAs, net |

945,188 |

9,452 |

(9,452) |

— |

— |

— |

||

|

Issuance of common stock under public equity placement |

585,483 |

5,855 |

800,477 |

— |

— |

806,332 |

||

|

Issuance of common stock for acquisition of Visimid |

348,786 |

3,488 |

482,566 |

— |

— |

486,054 |

||

|

Stock-based compensation on stock options, RSUs & RSAs |

— |

— |

1,019,023 |

— |

— |

1,019,023 |

||

|

Foreign currency translation adjustment |

— |

— |

— |

(96,600) |

— |

(96,600) |

||

|

Net loss |

— |

— |

— |

— |

(8,007,346) |

(8,007,346) |

||

|

Balances at June 30, 2024 |

39,254,643 |

$ 392,546 |

$ 245,140,758 |

$ 509,936 |

$ (215,843,575) |

$ 30,199,665 |

||

|

LIGHTPATH TECHNOLOGIES, INC. |

|||

|

Condensed Consolidated Statements of Cash Flows |

|||

|

(unaudited) |

|||

|

Year Ended June 30, |

|||

|

2024 |

2023 |

||

|

Cash flows from operating activities: |

|||

|

Net loss |

$ (8,007,346) |

$ (4,046,871) |

|

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|||

|

Depreciation and amortization |

4,048,409 |

3,174,569 |

|

|

Interest from amortization of debt costs |

— |

58,774 |

|

|

Loss (gain) on disposal of property and equipment |

124,584 |

(78,373) |

|

|

Stock-based compensation on stock options, RSUs & RSAs, net |

1,019,023 |

1,310,957 |

|

|

Provision for credit losses |

(4,426) |

8,158 |

|

|

Change in operating lease assets and liabilities |

183,393 |

(231,561) |

|

|

Inventory write-offs to allowance |

136,676 |

316,297 |

|

|

Deferred taxes |

(121,803) |

(73,015) |

|

|

Changes in operating assets and liabilities: |

|||

|

Trade accounts receivable |

1,498,698 |

(1,431,440) |

|

|

Other current assets |

(131,177) |

– |

|

|

Inventories |

960,739 |

(741,604) |

|

|

Prepaid expenses and deposits |

133,810 |

(97,792) |

|

|

Accounts payable and accrued liabilities |

680,457 |

(977,622) |

|

|

Net cash provided by (used in) operating activities |

521,037 |

(2,809,523) |

|

|

Cash flows from investing activities: |

|||

|

Purchase of property and equipment |

(2,182,805) |

(3,077,154) |

|

|

Proceeds from sales of equipment |

— |

209,169 |

|

|

Proceeds from sale-leaseback of equipment |

364,710 |

— |

|

|

Acquisition of Visimid Technologies, net of cash acquired |

(847,141) |

— |

|

|

Net cash used in investing activities |

(2,665,236) |

(2,867,985) |

|

|

Cash flows from financing activities: |

|||

|

Proceeds from sale of common stock from Employee Stock Purchase Plan |

39,677 |

40,380 |

|

|

Proceeds from issuance of common stock under public equity placement |

806,332 |

9,199,510 |

|

|

Borrowings on loans payable |

278,926 |

141,245 |

|

|

Payments on loans payable |

(2,459,474) |

(1,852,256) |

|

|

Repayment of finance lease obligations |

(131,901) |

(73,003) |

|

|