Renewable Energy Market to Reach $2.5 Trillion, Globally, by 2033 at 8.5% CAGR: Allied Market Research

Wilmington, Delaware , Sept. 19, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Renewable Energy Market by Type (Hydroelectric Power, Wind Power, Bioenergy, Solar Energy and Geothermal Energy) and End Use (Residential, Commercial, Industrial and Utilities): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the renewable energy market was valued at $1.1 trillion in 2023, and is estimated to reach $2.5 trillion by 2033, growing at a CAGR of 8.5% from 2024 to 2033.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A00060

Prime determinants of growth

The global renewable energy market is experiencing growth due to favorable government policies & incentives and surge in investment and financing in renewable energy. However, high initial capital costs hinder the market growth. Moreover, integration of renewable energy in smart grids presents additional opportunities for the renewable energy market. The integration of renewable energy into smart grids opens up new business models and revenue streams for utilities, energy service providers, and technology vendors. These include offerings such as virtual power plants (VPPs), energy storage services, demand-side management solutions, and grid-interactive buildings. By leveraging data analytics, artificial intelligence, and predictive algorithms, stakeholders optimize energy operations, improve asset utilization, and unlock value from renewable energy investments.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $1.1 trillion |

| Market Size in 2033 | $2.5 trillion |

| CAGR | 8.5% |

| No. of Pages in Report | 340 |

| Segments Covered | Type, End Use, and Region |

| Drivers | Favorable government policies and incentives |

| Surge in investment and financing in renewable energy | |

| Opportunities | Integration of renewable energy in smart grids |

| Restraints | High initial capital costs |

Hydroelectric power segment to maintain its dominance by 2033

By type, the hydroelectric power segment held the highest market share in 2023. The reliability and predictability of hydroelectric power have long been significant driving factors. Hydroelectric power offers a consistent and controllable source of renewable energy compared to solar and wind energy, which are intermittent and dependent on weather conditions. By regulating water flow through dams and reservoirs, hydroelectric plants are adjusting electricity generation to match fluctuating demand, providing essential grid stability and energy security. This reliability has made hydroelectric power a cornerstone of many energy systems worldwide, particularly in regions with abundant water resources.

Procure Complete Report (306 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/renewable-energy-market

Residential segment is expected to lead the market by 2033

By end use, the residential segment held the highest market share in 2023 and is estimated to dominate during the forecast period. Technological advancements and innovations in renewable energy systems play a crucial role in driving residential adoption. Solar panels, wind turbines, and other renewable energy technologies have become more efficient, reliable, and affordable that makes them increasingly accessible to homeowners. In addition, advances in energy storage solutions, such as batteries, enable homeowners to store excess energy generated by renewable sources for use during periods of low generation or high demand, enhancing the reliability and functionality of residential renewable energy systems. In addition, smart home technologies and energy management systems allow homeowners to monitor and optimize their energy usage, maximizing the efficiency and performance of their renewable energy installations.

Asia-Pacific is expected to experience fastest growth during the forecast period

Based on region, Asia-Pacific was the fastest growing region in terms of revenue in 2023. Supportive policy frameworks and government incentives have played a crucial role in driving the adoption of renewable energy in the Asia-Pacific region. Countries in the region have implemented renewable energy targets, feed-in tariffs, tax incentives, and other supportive policies to encourage investment in renewable energy projects and stimulate market growth. These policies provide certainty and stability for investors, reduce financial risks, and create a conducive environment for the development of renewable energy infrastructure. Moreover, international commitments such as the Paris Agreement have prompted governments in the Asia-Pacific region to ramp up their efforts to reduce greenhouse gas emissions and transition to low-carbon energy systems that drive the demand for renewable energy.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A00060

Leading Market Players:

- Xcel Energy Inc.

- General Electric

- ACCIONA

- Tata Power

- National Grid Renewables

- Invenergy

- ABB

- Enel Green Power S.p.A.

- EDF Renewables

- Innergex

The report provides a detailed analysis of these key players in the global renewable energy market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Industry:

Renewable Energy Certificate Market Analysis and Industry Forecast, 2023-2033

Renewable Energy Integration Market Size, Share, Competitive Landscape, 2024-2033

Renewable Energy Policy Fit Analysis Market Analysis and Industry Forecast, 2023-2032

AI in Renewable Energy Market Size, Share and Trend Analysis, 2023-2032

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Blog: https://www.alliedmarketresearch.com/resource-center/trends-and-outlook/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Pipeline Has Oil-Storage Tanks at Key US Hub Running Dry

(Bloomberg) — Oil-storage tanks at a key US crude hub have drained to near their bottoms as a massive new pipeline in Canada diverts flows elsewhere, muddying market signals that traders have long relied on.

Most Read from Bloomberg

Inventories in Cushing, Oklahoma, have been dwindling for the past four months and now sit near the lowest in a decade for this time of year. Market participants say the drawdown — which typically takes place as fuel demand rises during the driving season — was exacerbated this year as the expanded Trans Mountain pipeline shifts Canadian oil supplies onto the country’s Pacific Coast and away from the US Gulf Coast.

The expanded pipeline has moved about 400,000 barrels of crude a day since starting operations in May, and Cushing’s tanks have lost almost 13 million barrels of oil during that span. Flows of Canadian crude to the US Gulf Coast have declined to the point where a competing pipeline system owned by Enbridge Inc. mostly operated without the congestion it typically experiences during the US summer driving season.

European demand for US crude is also pulling barrels out of storage at Cushing, traders said, particularly since buyers are on the hunt for similar grades after supply disruptions in Libya.

“With Libya risks, I tend to think storage will stay at tank bottoms in the near term, and the market will make WTI too expensive to export,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

The continued drawdowns at Cushing have helped prop up the price spread between the nearest two WTI futures contracts. The spread is hovering near $1 a barrel after climbing to the highest levels in nearly a month.

Movements in crude spreads are a closely watched gauge for supply-demand balances, and they are currently signaling a dearth of barrels for immediate delivery despite worries about a longer-term oversupply of oil.

Cushing’s current stockpiles of about 22.7 million barrels represent less than a third of the hub’s working capacity of 78 million barrels. The rapid decline is stoking concerns that the hub’s ability to operate normally may be threatened. Pipeline operators at the storage hub didn’t immediately respond to requests for comment.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Protein Chip Market Size to worth $3.55 billion by 2031, growing at a CAGR of 6.9%, says Coherent Market Insights

Burlingame, Sept. 19, 2024 (GLOBE NEWSWIRE) — The global Protein Chip Market Size to Grow from USD 2.23 Billion in 2024 to USD 3.55 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Growing focus on personalized medicine is boosting adoption of protein chips for proteomic analysis and disease diagnostics. Protein chips provide insights on molecular-level disease pathways, which help develop targeted therapies tailored to individual patients.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7218

Market Dynamics:

The growth of the protein chip market is driven by technological advancements in protein chip development and increasing applications of protein chips in proteomics research and disease diagnosis. Protein chips offer high-throughput analysis of thousands of proteins simultaneously, making it an attractive technology for disease biomarker discovery and diagnosis. Technology advances such as miniaturization and automation have increased protein binding capacities and detection sensitivity of protein chips. This has enhanced their utilization in biomedical research for studying protein-protein interactions, expression profiling, and screening of potential drug targets.

Protein Chip Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $2.23 billion |

| Estimated Value by 2031 | $3.55 billion |

| Growth Rate | Poised to grow at a CAGR of 6.9% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type, By Application, By Detection Technique, By End-user |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing healthcare needs and preventive care • Personalized medicine and companion diagnostics |

| Restraints & Challenges | • Availability of alternative technologies • High costs involved |

Market Trends:

Multiplexing technology allows testing of multiple protein samples and analytes on a single protein chip. This significantly enhances throughput and analysis of large sample sets. Incorporation of multiplexing has widened the applications of protein chips beyond proteomics tofields such as drug discovery, clinical diagnosis and biodefense. Many research labs and universities are increasingly adopting multiplexing protein chips for evaluating disease biomarkers.

Biochip manufacturers are actively collaborating with academic research institutes and pathology labs to develop customized protein chips tailored to their specific research applications. This helps address the need for protein chips designed for analyzing distinct protein subsets involved in diverse disease conditions. Ongoing collaborations also provide early adopter advantages to academic institutes and assist manufacturers in strengthening their product portfolios.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7218

The analytical microarrays segment is expected to hold the largest share of the global protein chip market during the forecast period. Analytical microarrays are used for high-throughput protein expression and interaction analysis. They are capable of capturing thousands of protein interactions on a single microarray slide. Rising demand for novel diagnostic and therapeutic targets is contributing to the growth of this segment.

The functional protein microarrays segment is anticipated to witness the highest CAGR over 2024-2031. These protein chips assist in assessing protein function by analyzing protein-protein, protein-DNA, and protein-ligand interactions. Growing applications of functional protein microarrays in proteomics research and drug discovery are fueling the segment growth.

The antibody characterization application segment accounted for the largest revenue share in 2024 owing to increasing research activities in disease proteomics and drug discovery. Protein chips help analyze antibodies and characterize protein interactions rapidly. This is positively impacting the growth of this segment.

The fluorescence detection technique dominated the global market in 2024 as it offers high sensitivity and allows multiplexing capabilities. Protein chips with fluorescence detection are widely used in key application areas such as proteomics and drug discovery. Integration of fluorescence into protein microarray platforms is augmenting the growth of this segment.

Key Market Takeaways:

The global protein chip market is projected to witness a CAGR of 6.9% during 2024-2031. Growing proteomics research and increasing demand for personalized therapeutics are driving the market.

By type, analytical microarrays held the highest share in 2024 due to their ability to capture thousands of protein interactions simultaneously.

Based on application, the antibody characterization segment dominated the market owing to rising research evaluating disease proteomics.

On the basis of detection techniques, fluorescence led the market as it provides high sensitivity for protein expression analysis.

Regionally, North America is expected to dominate the protein chip market through 2031 because of strong presence of key players and advancing biotechnology infrastructure.

Some of the prominent players operating in the protein chip market are Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, Thermo Fisher Scientific, Illumina, and Shimandzu Corporation among others. Strategic collaborations and new product launches are the commonly adopted strategies by companies to gain competitive edge.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7218

Recent Developments:

In July 2024, Herblife, launched its latest product, Protein Chips, in the U.S. and Puerto Rico. These new protein snacks offers a tasty. Savory, and convenient option for consumers looking to meet their daily nutritional needs while enjoying a healthy treat.

In January 2024, Agilent Technologies, introduced the ProteoAnalyzer system, a cutting-edge automated parallel capillary electrophoresis platform designed to streamline protein analysis.

Detailed Segmentation:

By Type:

- Analytical Microarrays

- Functional Protein Microarrays

- Reverse Phase Protein Microarrays

- Others

By Application:

- Antibody Characterization

- Clinical Diagnostics

- Proteomics

- Others

By Detection Technique:

- Fluorescence

- Chemiluminescence

- Mass Spectrometry

- Electrical

- Others

By End User:

- Hospitals & Clinics

- Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

By Region:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Medical Devices Domain:

Organ on a chip Market – Global Industry Insights, Trends, Outlook, and Opportunity Analysis, 2022-2028

Lab-on-a-chip and microarrays (biochip) market was valued at US$ 15,268.0 Mn in 2022 and is forecast to reach a value of US$ 41,690.9 Mn by 2030 at a CAGR of 13.43% between 2023 and 2030

Biochips Market is estimated to be valued at USD 11.50 Bn in 2024 and is expected to reach USD 32.15 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 15.8% from 2024 to 2031.

Human Microchipping Market size is estimated to be valued at US$ 1.71 Bn in 2023 and is expected to reach US$ 2.75 Bn by 2030, exhibit at a compound annual growth rate (CAGR) of 7% from 2023 to 2030.

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Intuitive Machines Stock Rocketed 24% Skyward on Thursday

The stock of space exploration company Intuitive Machines (NASDAQ: LUNR) strongly defied gravity on Thursday. It closed the day more than 24% higher, thanks in no small part to news of a major price-target increase from an analyst. That move came mere days after the company delivered some of the best news it’s ever reported.

Over the moon about NASA’s moon contract

The raise was enacted by B. Riley‘s Mike Crawford, who now feels a fair value estimation for Intuitive Machines should be considerably higher. He raised his by 50%, to $12 per share from the previous $8, and maintained the existing buy recommendation. The new price target anticipates upside of 29% on the stock’s most recent close.

It isn’t hard to be glowingly bullish on Intuitive Machines these days. On Tuesday, the company was selected by the National Aeronautics and Space Administration (NASA) as the sole business to establish a communications system between our planet and the moon.

In the grand tradition of major federal contracts, this one is potentially worth quite a bit of coin. All told the arrangement, which will be in force for five years with an option to extend to 10, could pay out as much as $4.8 billion for the stipulated services.

A surprise solo selection

Crawford did not expect Intuitive Machines would be the only winner of the contract; he anticipated one or two other providers would also be selected for the NASA project. This added to his impression that the ambitious company “is quickly establishing itself as a full-service space exploration company on the cusp of layering in hundreds of millions of dollars of high-margin services revenue, enabling a long tail of robust free cash flow generation.”

Should you invest $1,000 in Intuitive Machines right now?

Before you buy stock in Intuitive Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intuitive Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Intuitive Machines Stock Rocketed 24% Skyward on Thursday was originally published by The Motley Fool

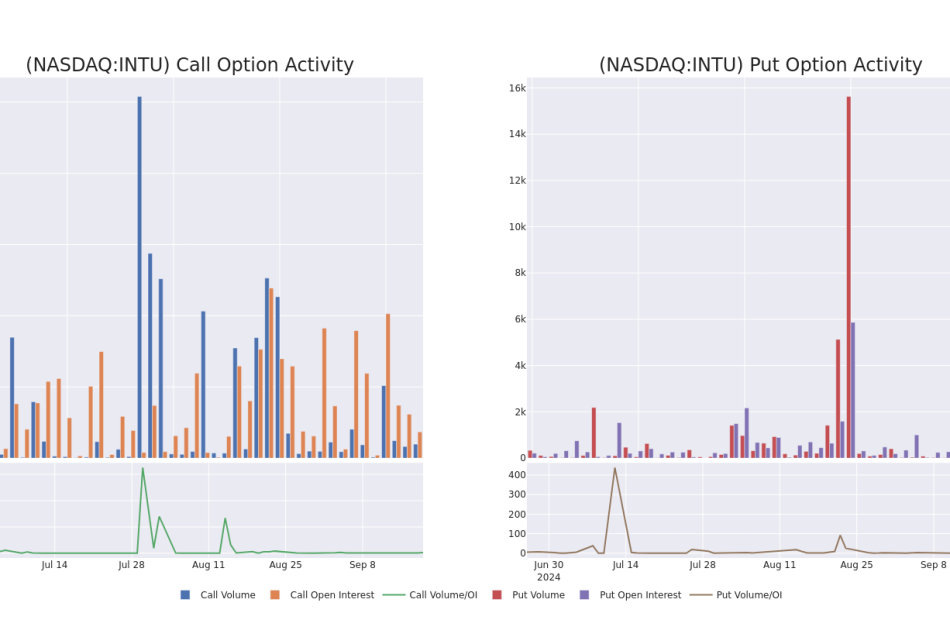

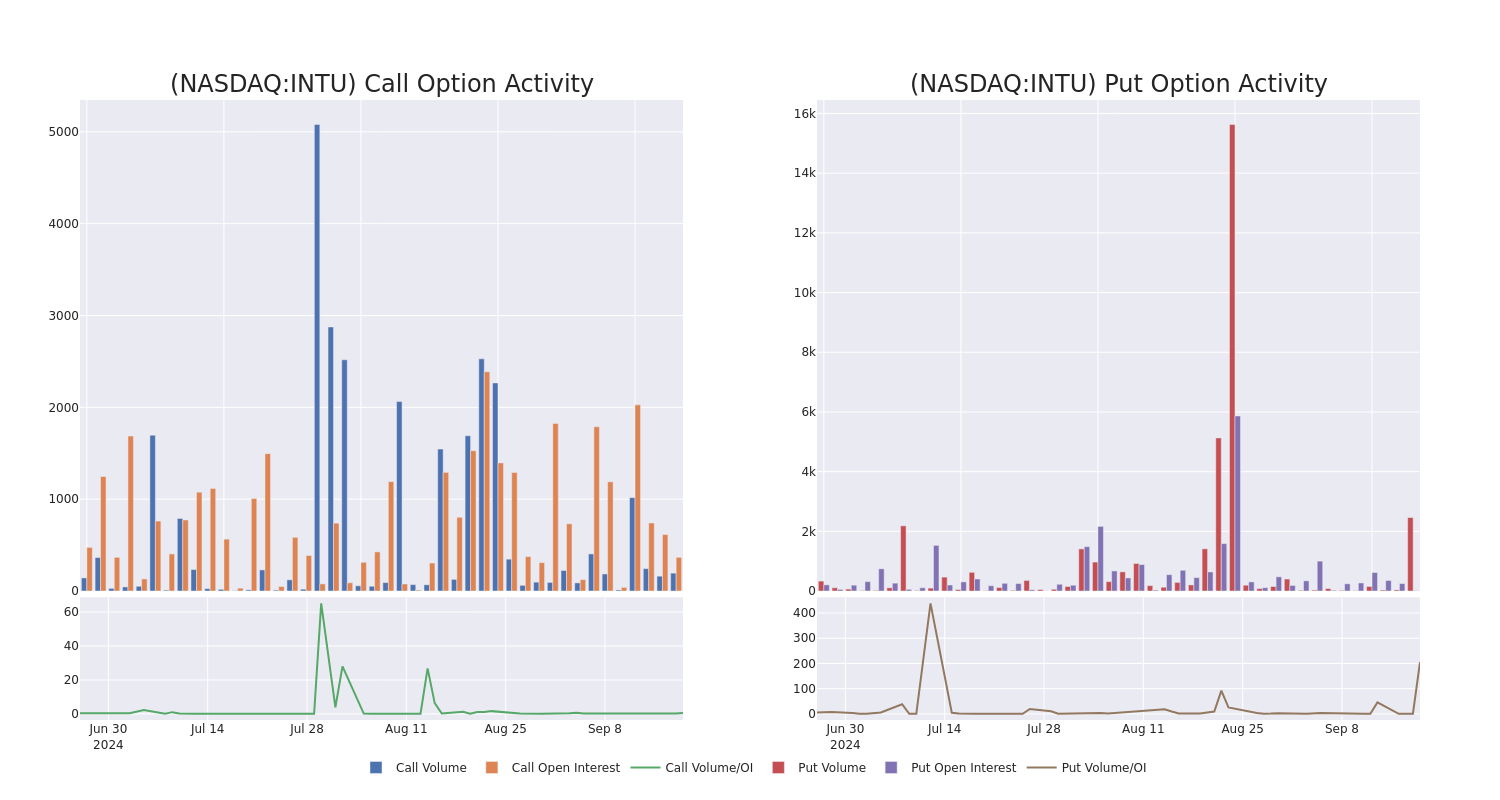

Check Out What Whales Are Doing With INTU

Investors with a lot of money to spend have taken a bullish stance on Intuit INTU.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with INTU, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 13 uncommon options trades for Intuit.

This isn’t normal.

The overall sentiment of these big-money traders is split between 69% bullish and 15%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $301,640, and 6 are calls, for a total amount of $226,850.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $500.0 to $690.0 for Intuit during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intuit’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intuit’s whale trades within a strike price range from $500.0 to $690.0 in the last 30 days.

Intuit 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | SWEEP | BULLISH | 10/18/24 | $18.0 | $17.8 | $18.0 | $660.00 | $59.4K | 255 | 59 |

| INTU | PUT | TRADE | NEUTRAL | 03/21/25 | $7.0 | $6.8 | $6.9 | $500.00 | $55.2K | 12 | 350 |

| INTU | PUT | SWEEP | BULLISH | 03/21/25 | $7.1 | $7.0 | $7.0 | $500.00 | $52.5K | 12 | 270 |

| INTU | PUT | TRADE | BEARISH | 03/21/25 | $6.6 | $6.2 | $6.5 | $500.00 | $49.4K | 12 | 539 |

| INTU | CALL | TRADE | BULLISH | 03/21/25 | $94.4 | $92.8 | $94.4 | $600.00 | $47.2K | 17 | 5 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Following our analysis of the options activities associated with Intuit, we pivot to a closer look at the company’s own performance.

Present Market Standing of Intuit

- Trading volume stands at 1,041,770, with INTU’s price up by 3.49%, positioned at $655.19.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 68 days.

Professional Analyst Ratings for Intuit

5 market experts have recently issued ratings for this stock, with a consensus target price of $739.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $768.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Intuit, targeting a price of $600.

* An analyst from BMO Capital has decided to maintain their Outperform rating on Intuit, which currently sits at a price target of $760.

* Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on Intuit with a target price of $790.

* An analyst from B of A Securities persists with their Buy rating on Intuit, maintaining a target price of $780.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuit, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jones Futures: Meta, Apple, Tesla Lead New Buys In Big Rally. Pay Attention To This Key Shift.

Dow Jones futures edged lower, along with S&P 500 futures and Nasdaq futures. Nike (NKE) and FedEx (FDX) were big movers overnight on news.

The stock market rally had strong gains Thursday in a day two reaction to Wednesday’s big Fed rate cuts. The Nasdaq led, clearing key levels. The Dow Jones and S&P 500 hit record highs.

↑

X

Stocks Jump, Dow Tops 42,000 Post-Fed; Ferrari, CRS, Taiwan Semi In Focus

Meta Platforms (META) gapped above buy points. Nvidia (NVDA) and Apple (AAPL) jumped above their 50-day lines while Tesla (TSLA) powered past a short-term high. All three offered aggressive entries, though NVDA stock might be too early.

Also breaking out or flashing buy signals: Carpenter Technology (CRS), Spotify (SPOT), Shift4 (FOUR), Alibaba (BABA), Uber Technologies (UBER), Netflix (NFLX), Nvidia chipmaker Taiwan Semiconductor (TSM), Broadcom (AVGO), Modine Manufacturing (MOD), Monday.com (MNDY), TransMedics Group (TMDX), Royal Caribbean (RCL), Caterpillar (CAT) and Ferrari (RACE).

While it was a broad advance, there was a clear shift toward growth and aggressive growth. Defensive groups such as utilities and REITs fell slightly once again.

Investors should take advantage of the buying opportunities, while adding more high-octane names to their portfolios.

Nvidia, Ferrari and Meta stock are on IBD Leaderboard. Nvidia stock, Monday.com, Ferrari and Spotify are on SwingTrader. TransMedics, Nvidia, Monday.com, Royal Caribbean, Meta Platforms and Netflix stock are on the IBD 50. Shift4 stock is on IBD Sector Leaders.

Dow Jones Futures Today

Dow Jones futures were just below fair value, even with a boost from Nike stock. S&P 500 futures fell 0.15% and Nasdaq 100 futures lost 0.2%.

The 10-year Treasury yield dipped to 3.71%.

China’s central bank kept interest rates unchanged overnight, a surprise given the Fed’s big rate cut and the weak Chinese economy.

The Bank of Japan left rates steady, as expected.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Nike CEO Shift

Nike announced Thursday night that Elliott Hill will take over as CEO on Oct. 14, with John Donahoe stepping down. Hill worked at Nike from 1998 until retiring in 2020 as consumer and marketplace chief. Nike stock leapt nearly 8% in late trade. NKE stock has been in a downtrend since late 2021 amid China woes and increased competition.

FedEx Earnings

After the close, FedEx (FDX) earnings fell short and the shipping giant slashed guidance. FedEx stock plunged 11% in extended trade. Shares had closed higher for a ninth straight session, clearing an aggressive entry within a base.

Lennar (LEN) reported better-than-expected earnings but fell margin guidance. Lennar stock fell modestly in extended action. Shares hit new highs in Thursday’s session.

Stock Market Rally

The stock market rally roared higher Thursday a day after Wednesday’s downside reversal. Investors slept on the big Fed rate cuts and decided they like the backdrop of lower rates and an apparent economic soft landing. The indexes did close modestly off the day’s best levels.

The Dow Jones Industrial Average popped 1.3% in Thursday’s stock market trading and the S&P 500 index 1.7%, both to all-time levels. The Nasdaq composite jumped 2.5%, now decisively above the 50-day line and clearing resistance at the 18,000 level. The small-cap Russell 2000 leapt 2.1%, closing in on multiyear highs.

The Invesco S&P 500 Equal Weight ETF (RSP) rose 1.1%, setting a record intraday.

The First Trust Nasdaq 100 Equal Weighted Index ETF (QQEW) bounced 2% to a two-month high, not far from the July 16 all-time best.

With the S&P 500, Dow and RSP at new highs as the Nasdaq and Russell 2000 look like cup-with-handle breakouts, it’s no surprise to see a large number of stocks breaking out.

There appears to be a clear shift from defensive sectors to growth and aggressive growth. Will that trend hold?

U.S. crude oil prices rose 1.5% to $71.95 a barrel.

The 10-year Treasury yield climbed 5 basis points to 3.74%, continuing to bounce from Tuesday’s 52-week low. The two-year yield was flat at 3.6%.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) gained 2.2%. The iShares Expanded Tech-Software Sector ETF (IGV) bounced 2.7%. The VanEck Vectors Semiconductor ETF (SMH) jumped 4.3%. Nvidia stock is the largest SMH holding by far, with Taiwan Semiconductor stock and Broadcom major components.

Reflecting more-speculative story stocks, ARK Innovation ETF (ARKK) rallied 2.7% and ARK Genomics ETF (ARKG) was up 2.1%. Tesla stock is a major holding across Ark Invest’s ETFs, but Meta is an even-bigger weight. Cathie Wood also has built up a big stake in NVDA stock.

SPDR S&P Metals & Mining ETF (XME) ran up 3.4%, with Carpenter Technology stock the No. 1 holding. The Global X U.S. Infrastructure Development ETF (PAVE) climbed 3%, with CRS stock also in this ETF. U.S. Global Jets ETF (JETS) ascended 0.7%. The SPDR S&P Homebuilders ETF (XHB) stepped up 2.75%, with Lennar stock in the ETF. The Energy Select SPDR ETF (XLE) advanced 1.2% and the Health Care Select Sector SPDR Fund (XLV) edged up 0.4%.

The Industrial Select Sector SPDR Fund (XLI) rose 1.7%, with Caterpillar, Uber stock and FedEx members. The Financial Select SPDR ETF (XLF) climbed 1.1%. The SPDR S&P Regional Banking ETF (KRE) leapt 2.85%.

Time The Market With IBD’s ETF Market Strategy

Meta Stock

Meta Platforms stock rallied 3.9% to 559.10 on Thursday. That pushed shares above a 542.81 buy point and a 544.23 alternate entry from a three-weeks-tight pattern.

Meta stock offered an early entry last week as it rebounded above the 50-day and 21-day lines, but now the Fed is out of the way.

Tesla Stock

Tesla stock jumped 7.4% to 243.92, clearing an aggressive entry of 235. TSLA stock has a 271 consolidation buy point, according to MarketSurge. Tesla China registrations were solid in the latest week, according to reports Thursday.

Tesla has a busy October, with third-quarter deliveries likely on Oct. 2, the robotaxi event on Oct. 10, and Q3 earnings on Oct. 16.

Meanwhile, China EV maker Nio (NIO) launched its Onvo L60 crossover on Thursday, a feature-loaded Model Y rival at a cheaper price.

As of Thursday night, Tesla dropped the price of Full Self-Driving to as low as $4,500 for select new inventory vehicles, another incentive to boost sales at the end of the quarter. The normal FSD price is $8,000, down from a peak of $15,000. FSD, despite its name is a Level 2 driver-assist system.

Nvidia Stock

Nvidia stock gained 4% to 117.87, back above its 50-day moving average after hitting resistance at the key level for several days. Investors could have used that as an aggressive entry. However, shares came off intraday highs of 119.66 and are still down for the week.

Taiwan Semiconductor and Broadcom stock are AI chip plays with better-looking charts.

NVDA stock has a 131.26 buy point from an unsightly handle. Investors also could use last week’s high of 120.79 as a much-smaller handle.

Apple Stock

Apple stock advanced 3.7% to 228.87, gapping above its 50-day moving average. The Dow Jones tech titan rallied on positive comments about the iPhone 16, following concerns of underwhelming demand. The latest handset, which begins official sales on Friday, will have AI features later this year.

Apple stock has a handle buy point of 232.92. Investors could have used Thursday’s move as an aggressive entry. There’s also a trendline, with Thursday’s intraday high of 229.82 as a specific trigger.

Other Stocks In Buy Zones

Carpenter stock, Spotify, Shift4, Alibaba, Netflix, Taiwan Semiconductor, Modine Manufacturing, Royal Caribbean and Caterpillar all cleared traditional buy points on Thursday. Monday.com stock cleared a short consolidation.

Uber stock cleared some key short-term levels in a long consolidation.

Broadcom stock broke a trendline entry, still in range of its 50-day line within a proper consolidation. TransMedics stock also broke a trendline, moving off the 50-day as it still works on a new base. Ferrari stock broke a short trendline and retook its 21-day line while rebounding from its 10-week line.

Funds Binge On Netflix Stock — But Don’t Ignore The Warning Label

What To Do Now

The stock market rally continues to gain momentum, with the major indexes at record highs or clearing key levels. Dozens of stocks have flashed buy signals in the past few days.

This is when investors should be looking to step on the gas, moving toward fully invested or even on margin if that’s your risk tolerance. Don’t accelerate like you’re in a Tesla, even if you own TSLA stock. Add exposure — which already should have been significant heading into Thursday — gradually.

Also consider rotating out of defensive and even defensive growth names to make room. There’s been a clear shift into growth and aggressive growth, especially into AI and other tech plays. You don’t want to have a portfolio of super-octane stocks, but you can look to be more aggressive with what you own as well as how much you own.

The past few days are when the hard work of analyzing charts and building up watchlists pays off. Keep working on those lists, both to identify potential new buys and to spot which sectors are rising up or down.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Here’s How Much Stocks Historically Rise On The First Fed Rate Cut.

LyondellBasell & Dacia Develop Recycled Solution for Duster Model

Lyondellbasell Industries N.V. LYB and Dacia recently partnered on the external design of the All-New Dacia Duster. The vehicle, known for its rugged elegance, now includes the durable “Starkle” material, owing to LYB’s CirculenRecover portfolio. These innovative CirculenRecover polypropylene (PP) compounds utilize recycled materials and add a distinctive look to the All-New Duster model.

The development of CirculenRecover polymers demonstrates LYB’s constant dedication to creating solutions for everyday sustainable living. The innovative material not only improves the appearance of vehicles but also aligns with LYB customers’ sustainability objectives.

The CirculenRecover polymer, a PP compound containing 20% recycled PP obtained through mechanical recycling, is created from post-industrial waste removed from the manufacturing process of items such as flexible packaging. Compared to virgin materials, this reduces CO2 emissions, demonstrating Dacia’s commitment to sustainability. It is included in Dacia’s “Starkle” material, which is utilized in exterior pieces like bumpers, trims and body side moldings on the All-New Duster model. The polymers not only function well on automobile exteriors but also provide a mold-in-color special effect with particles that showcase the usage of recycled content. This single-material solution removes additional steps, improves design efficiency and has the potential to increase part recyclability.

The All-New Dacia Duster showcases whether sustainability and modern design can coexist. LYB and Dacia are collaborating to set a new benchmark for automotive design and inspire the industry to embrace a more sustainable future.

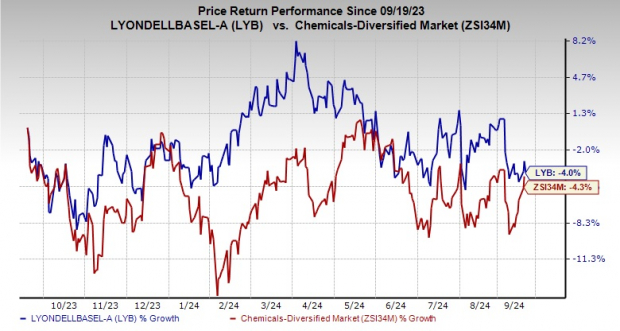

Shares of LyondellBasell have lost 4% over the past year compared with a 4.3% decline of its industry.

Image Source: Zacks Investment Research

For the third quarter, LyondellBasell expects margins to gain from the lower costs of natural gas and natural gas liquids used in its North American and Middle Eastern production against higher oil-based expenses in most other locations. With the ongoing summer driving season, oxyfuel margins are projected to stay higher than historical levels because of high octane premiums.

LYB intends to operate its assets in line with market demand in the third quarter, with average operating rates of 85% for North American olefins and polyolefins (O&P) assets, 80% for European O&P assets and 75% for Intermediates & Derivatives.

LYB’s Zacks Rank & Key Picks

LYB currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO and Hawkins, Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.9%. The company’s shares have soared 111.7% in the past year.

The Zacks Consensus Estimate for Eldorado’s current-year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO, a Zacks Rank #1 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company’s shares have rallied roughly 71.6% in the past year.

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14, indicating a rise of 15.3% from year-ago levels. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days. HWKN, a Zacks Rank #2 (Buy) stock, has rallied around 99.1% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Fed rate cut with the stock market at a record high? Here’s what history says.

The Federal Reserve on Wednesday cut interest rates with U.S. stocks trading near a record high, leaving investors searching for historical clues to the path ahead for markets.

The S&P 500 SPX briefly traded above its record close from July 16 after the Fed delivered a rate cut of 50 basis points before erasing its gain to end 0.3% lower. Stock-index futures pointed to sharp gains that could see the S&P 500 and Dow Jones Industrial Average DJIA take another run at record territory.

Most Read from MarketWatch

Do rate cuts with the stock market at or near all-time highs provide bulls additional fuel or do they portend trouble ahead? Dow Jones Market Data ran back the tape.

They found that since 1990, the Fed has cut rates seven times while the S&P 500 was at or near (within 1%) of an all-time high (see table below).

In those instances, stocks tended to rise on decision day (not including Wednesday) — up 71.4% of the time with a median gain of 0.51%. Six months later, the performance is mixed, rising 57.1% of the time with a tepid median gain of 0.62%.

Analysts at JPMorgan ran the data back 40 years, finding the Fed has cut rates 12 times with the S&P 500 within 1% of an all-time high. The market was higher a year later all 12 times with an average return of around 15%.

That’s interesting, but does it really tell investors much about the stock market’s direction over the course of the easing cycle? As countless market watchers have pointed out, it really tends to depend on the economic backdrop.

“Historically, only half of the bond rally has occurred by the time the first cut arrives. The direction of the equity market is less clear-cut — wholly

dependent on whether the Fed has staved off a recession or whether this rate relief came too late, as we have witnessed so many times in the past,” said David Rosenberg of Rosenberg Research, in a Wednesday note.

”The danger this time around,” he wrote, ”is the extreme level of complacency and the widespread consensus that the business cycle has been repealed.”

Related: History says Fed interest-rate cut sets up ‘crapshoot’ for stock-market investors

—Ken Jimenez and Steve Goldstein contributed.

Most Read from MarketWatch

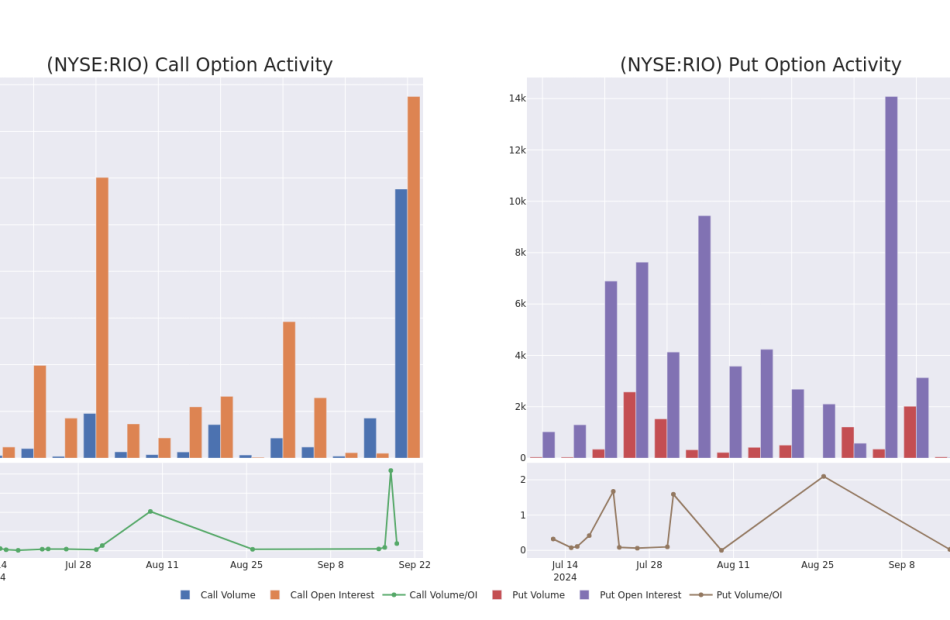

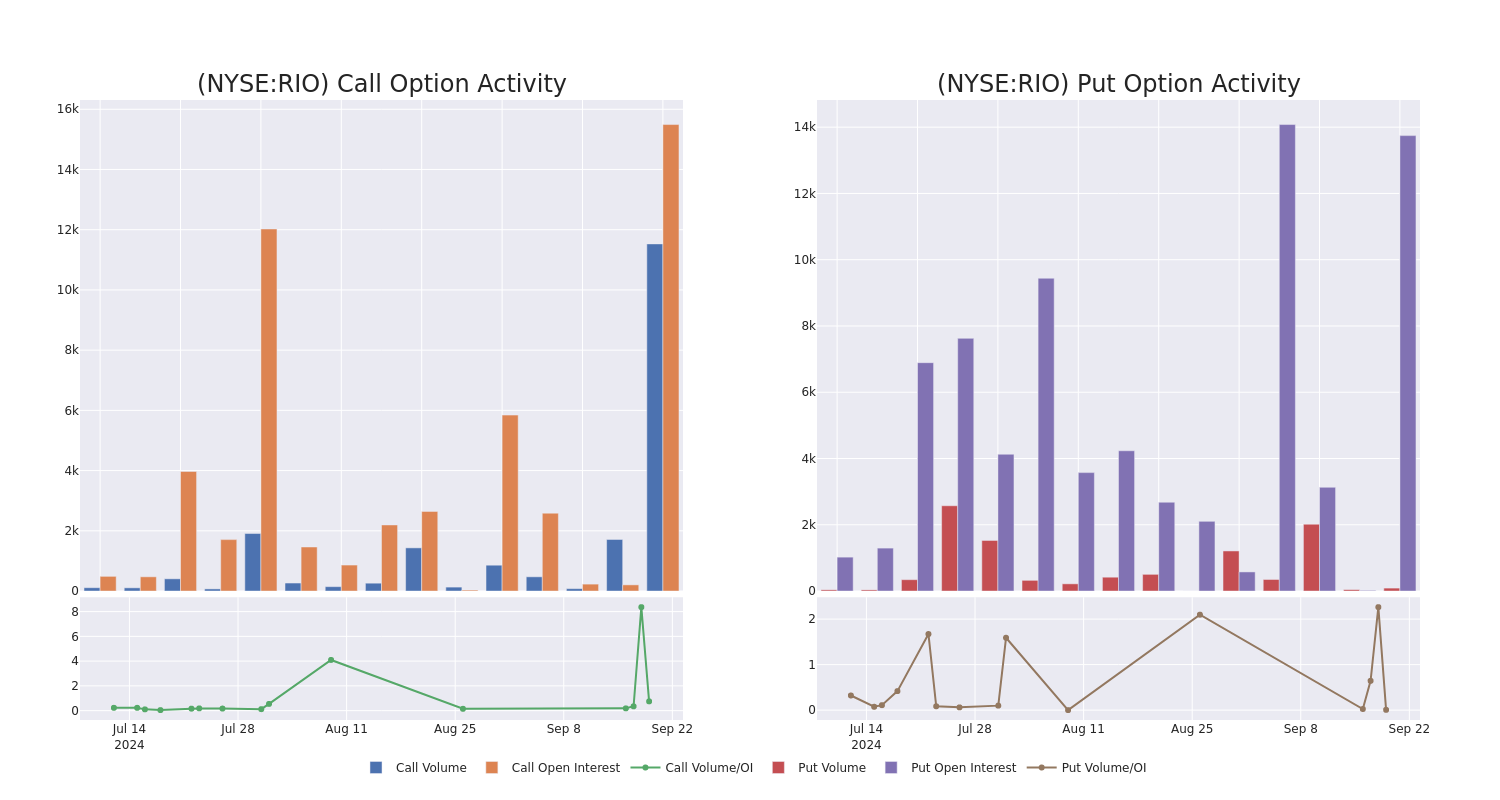

Market Whales and Their Recent Bets on RIO Options

Investors with a lot of money to spend have taken a bullish stance on Rio Tinto RIO.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RIO, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 14 options trades for Rio Tinto.

This isn’t normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,620, and 13, calls, for a total amount of $952,701.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $75.0 for Rio Tinto over the recent three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Rio Tinto’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Rio Tinto’s significant trades, within a strike price range of $60.0 to $75.0, over the past month.

Rio Tinto 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIO | CALL | SWEEP | BEARISH | 10/18/24 | $3.5 | $3.4 | $3.4 | $62.50 | $166.6K | 1.8K | 1.2K |

| RIO | CALL | SWEEP | BEARISH | 10/18/24 | $3.5 | $3.4 | $3.4 | $62.50 | $166.6K | 1.8K | 730 |

| RIO | CALL | SWEEP | BULLISH | 10/18/24 | $5.6 | $5.5 | $5.6 | $60.00 | $127.7K | 1.1K | 234 |

| RIO | CALL | SWEEP | BULLISH | 01/16/26 | $6.0 | $5.5 | $6.0 | $67.50 | $109.8K | 514 | 183 |

| RIO | CALL | TRADE | BULLISH | 11/15/24 | $4.5 | $3.2 | $4.5 | $62.50 | $90.0K | 339 | 202 |

About Rio Tinto

Rio Tinto is a global diversified miner. Iron ore is the dominant commodity, with significantly lesser contributions from copper, aluminum, diamonds, gold, and industrial minerals. The 1995 merger of RTZ and CRA, via a dual-listed structure, created the present-day company. The two operate as a single business entity, with shareholders in each company having equivalent economic and voting rights. Major assets included the Pilbara iron ore operations, a 30% stake in the Escondida copper mine, 66%-ownership of the Oyu Tolgoi copper mine in Mongolia, the Weipa and Gove bauxite mines in Australia, and six hydro-powered aluminum smelters in Canada.

After a thorough review of the options trading surrounding Rio Tinto, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Rio Tinto Standing Right Now?

- With a volume of 4,121,363, the price of RIO is up 3.45% at $65.08.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 153 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rio Tinto with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Donald Trump said he would not sell his Truth Social stock. But he technically can starting Thursday.

Donald Trump recently said he would not sell his stock in Trump Media & Technology Group (DJT). But, starting Thursday, he will have that option — something that’s not been available since the social media company went public in March.

“I have absolutely no intention of selling,” the former president told reporters at a press conference last week. “I love it. I use it as a method of getting out my word.”

DJT shares surged by double digits on Friday following his revelation, although the stock has recently given up those gains, falling more than 10% over the past six days to close below $14.50 on Thursday — near the low-end of its 52-week range and far off its record high of just over $79 a share.

Stakeholders, including the former president, are subject to a six-month lockup period before selling or transferring shares. That lockup period will expire on Thursday, although Trump was still able to pocket some cash in late April when the stock hit a milestone that secured him an additional $1.2 billion.

As Yahoo Finance’s Ben Werschkul detailed, the purpose of a lock-up period is to protect a newly public company’s interests and allow it to preserve stability before its founders can cash out.

“If I sell, it wouldn’t be the same, and I can understand that,” Trump said on Friday, adding that he knows his stake has been “whittled down” in recent months.

Trump maintains a roughly 60% interest in DJT. At current levels, Trump Media boasts a market cap of about $3.3 billion, giving the former president a stake worth around $2 billion. Right after the company’s public debut, Trump’s stake was worth just over $4.5 billion.

Trump Media went public on the Nasdaq in late March after merging with special purpose acquisition company Digital World Acquisition Corp. But the stock has been on a bumpy ride since, with shares oscillating between highs and lows as the moves have typically been tied to a volatile news cycle.

In June, the stock popped (then fell) after current commander in chief Joe Biden stumbled in his first presidential debate of 2024 with Trump. Biden dropped out of the presidential race one month later.

Since Biden’s announcement, shares have remained under pressure as Vice President Kamala Harris, the Democratic presidential nominee, tracks ahead of Trump in the latest polling. Most recently, the stock plummeted to new lows following last week’s debate as bets on a Harris presidency increased.

In May, Trump was found guilty on all 34 counts of falsifying business records intended to influence the 2016 presidential campaign — a verdict that sent shares down 5% the day after the conviction. His sentencing was recently delayed until Nov. 26.

Shares have fallen about 60% since the company’s public debut at the end of March.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, the platform now known as X, following the Jan. 6 Capitol riots in 2021. Trump has since been reinstated on those platforms. He officially returned to X in mid-August after about a year’s hiatus.

But as Truth Social attempts to take on the social media incumbents, the fundamentals of the company have long been in question.

Last month, DJT reported second quarter results that revealed a net loss of $16.4 million, about half of which was tied to expenses related to the company’s SPAC deal. The company also reported revenue of just under $837,000 for the quarter ending June 30, a 30% year over year drop.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.