V.F. Corp Stock Gains 30% in 3 Months: What's Next for Investors?

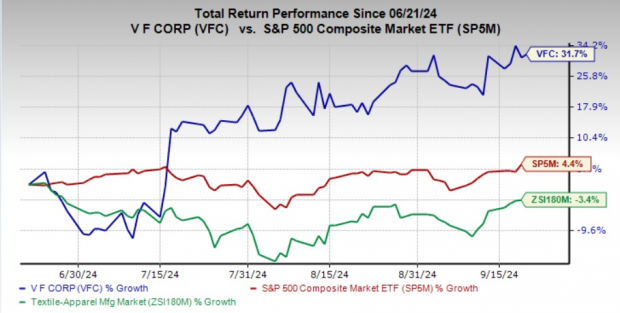

V.F. Corporation VFC has provided investors with solid gains, appreciating 31.7% over the past three months. This performance outpaces the industry’s decline of 3.5% and the S&P 500’s 4.4% growth. This gain is attributed to several factors, including its Reinvent transformation program, cost-reduction initiatives and strengthening balance sheet.

One of the most crucial aspects of V.F. Corp’s recent progress is its focus on stabilizing gross margins. While the company continues to face near-term uncertainties, it is encouraged by sequential improvements in sales at Vans, one of VFC’s key brands. Although overall sales have not yet returned to positive territory, the improvement is a promising sign.

Closing at $18.65, the stock trades close to its 52-week high mark of $20.69 touched in December 2023. Moreover, the stock’s current level reflects a premium of 70% from its 52-week low.

The technical indicators show that the stock is trading above both its 50 and 200-day moving averages, indicating strong upward momentum and suggesting sustained investor confidence in the company’s performance.

Image Source: Zacks Investment Research

What’s Fueling V.F. Corp’s Stock Rally?

V.F. Corp remains on track with its Reinvent transformation program, which focuses on brand-building and improving operational performance. The plan targets four key objectives: improving North American performance, turning around the Vans brand, reducing costs and strengthening the balance sheet.

As part of this plan, the company continues to streamline processes and invest in initiatives to drive brand demand and boost growth. In the first quarter of fiscal 2025, V.F. Corp generated $50 million in cost savings through the Reinvent program. This large-scale cost-reduction program is expected to deliver $300 million in fixed cost savings by reducing expenditure in non-strategic areas, and simplifying and right-sizing its structure in the first half of fiscal 2025.

The company’s strategic approach to selling the Supreme brand marks a significant shift, aims to refocus on its core business and improve operational efficiency. The company acknowledges that Supreme lacked synergy with its broader portfolio, leading to its divestiture. This move will help V.F. streamline its operations and enhance financial flexibility by reducing leverage.

VFC Stock’ Promising Outlook

V.F. Corp is set to benefit from its growth plan for fiscal 2023-2027. It expects revenues to witness a mid-to-high single-digit CAGR and earnings to record a high single to low double-digit CAGR. The company projects an operating margin of 15% by fiscal 2027, supported by gross margin expansion and lower SG&A expenses.

A key component of V.F. Corp’s recovery strategy is the revitalization of the Vans brand, which has encountered challenges in recent years. Analysts are optimistic, forecasting that the company will start to see gradual improvements in its fundamentals in the next four to six quarters.

While it is too early to declare a complete turnaround, we believe 2025 could mark a turning point for the brand, which is critical to the company’s broader recovery efforts.

Near-Term Concerns for VFC Stock

V.F. Corp’s first-quarter fiscal 2025 results were affected by a tough operating environment, and dismal performance across regions, channels and brands. This led to a decline in sales 9% year over year and 8% in constant currency. The decline was the result of soft performance across regions and channels, despite sequential improvement.

V.F. Corp is facing challenges with its well-known brands, The North Face and Vans. Both brands, once reliable revenue drivers, are experiencing declining sales and struggling to connect with their core customer bases. For The North Face, the issues arise from shifting consumer preferences and heightened competition in the outdoor apparel market. The brand has found it difficult to maintain its premium positioning while trying to appeal to a broader audience.

Vans, meanwhile, is dealing with a saturated sneaker market and a decline in its appeal among younger customers. However, a recovery strategy is in place, and there are expectations for improvement in the near term.

Three Picks You Can’t Miss

VFC currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Discretionary space are Wolverine World Wide, GIII Apparel Group and Steven Madden, Ltd.

Wolverine World Wide designs, manufactures and distributes a wide variety of casual and active apparel and footwear. The company sports a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for WWW’s current financial-year sales indicates a decline of almost 23% from the year-ago reported figures. The consensus mark for EPS reflects significant growth to 85 cents from 5 cents reported in the prior year. WWW has a trailing four-quarter earnings surprise of 7.5%, on average.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. It carries a Zacks Rank #1 at present.

GIII Apparel has a trailing four-quarter earnings surprise of 118.2%, on average. The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales indicates growth of 3.3% from the year-ago figure.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 6.9% and 12.6%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Rate Cut May Drive Investors Away From Money Markets, Says Portfolio Manager

The Federal Reserve’s decision cut interest rates by 0.5% on Wednesday may pull investors away from money market funds and into longer duration bonds, according to a portfolio manager.

Total money market fund assets decreased by $20.02 billion to $6.30 trillion for a week ending on Wednesday, Sept. 18, the Investment Company Institute said. Among taxable money market funds, government funds decreased by $18.82 billion and prime funds decreased by $2.42 billion.

“Historically, we’ve seen more assets move into longer duration bonds when yields have fallen, and I think we’ve already seen some of that happen this year,” said Timothy Ng, a fixed-income portfolio manager with Capital Group.

“I expect this trend to continue as the Fed continues to cut rates,” he said.

Read Also: Mortgage Rates Near 6%, Demand Increases For Refinancing, Purchases

“I think some of that flow will go into both equities and bonds, but in terms of relative scale, it will likely depend on the outlook for the economy, valuations and market sentiment between the two asset classes.”

A lot of assets moved into the money markets in recent years because money market yields were very attractive, but that may no longer be the case as the Fed plans to make further rate cuts this year, he said.

“Now you’re not getting as much yield waiting around, and you run the risk of missing out on capital appreciation that comes with having more duration in your portfolio as yields fall,” he said.

Price Action: Exchange-traded funds that hold money market funds gained slightly into Friday’s late-afternoon trading.

- iShares Short Treasury Bond ETF SHV gained 0.05%

- BlackRock Short Maturity Bond ETF NEAR rose 0.06%

- SPDR Bloomberg Barclays 1-3 Month T-Bill ETF BIL went up 0.044%

- Invesco Ultra Short Duration ETF GSY picked up 0.07%

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Firstenergy Corp.

Summary

FirstEnergy is a diversified energy company based in Akron, Ohio. It is one of the nation’s largest investor-owned electric systems, with 10 regulated subsidiaries. The company has small regulated generating capacity, under 4,000 MW. FE’s focus is on transmission and distribution; however, the company has been selling portions of its transmission business and expects about 20% of 2024 earnings to be from transmission operations. The company serves 6 million customers, including 2.3 million in Ohio, 1.8 million in Pennsylvania, and 2 million more in other mid-Atlantic states. FE does not have natural gas operations, and regulated electricity distribution accounted for about 85% of total 2023 revenues.

FE’s generation mix is carbon-neutral nuclear (53%), scrubbed baseload coal (35%), natural gas and oil (4%), and pumped-storage hydro and other renewables (8%). We believe that the company is at a disadvantage versus its peers given its heavy reliance on coal generation. FE has pledged to reduce GHG emissions by 30%

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Why Is Urban Outfitters Up 0% Since Last Earnings Report?

It has been about a month since the last earnings report for Urban Outfitters URBN. Shares have added about 0% in that time frame, underperforming the S&P 500.

Will the recent positive trend continue leading up to its next earnings release, or is Urban Outfitters due for a pullback? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Urban Outfitters Q2 Earnings Top Estimates, Retail Sales Up Y/Y

Urban Outfitters reported impressive results for second-quarter fiscal 2025, wherein the bottom and top lines surpassed the Zacks Consensus Estimate. Also, both metrics improved from the prior-year quarter.

URBN’s Q2 Performance

This lifestyle specialty retailer delivered earnings per share of $1.24, surpassing the Zacks Consensus Estimate of 98 cents. Also, the bottom line increased 12.7% from the comparable quarter of the prior fiscal year.

Total net sales increased 6.3% year over year to $1,351.9 million, surpassing the consensus estimate of $1,338 million.

Total net sales in the Retail segment rose 3.1%, with comparable net sales in this segment increasing 2%. This growth was primarily fueled by low single-digit positive gains in both digital channel sales and sales from retail stores. Specifically, comparable Retail net sales rose 7.1% at Free People and 6.7% at Anthropologie but fell 9.3% at Urban Outfitters.

In the Wholesale segment, net sales grew 15.1% year over year, primarily due to a 17.5% rise in Free People’s wholesale sales, which was attributed to increased sales to department stores and specialty customers. This was, however, somewhat offset by a decline in Urban Outfitters’ wholesale sales.

The Nuuly segment saw a significant 62.6% increase in net sales mainly due to a 55% rise in average active subscribers from the prior-year quarter.

Margin Insights of URBN

Gross profit rose 8.3% from the prior-year quarter to $493.3 million. Also, the gross margin expanded 68 basis points (bps) to 36.5%, mainly owing to higher initial merchandise markups across all brands primarily due to the company’s cross-functional initiatives. This increase was somewhat mitigated by higher Retail segment merchandise markdowns, particularly at the Urban Outfitters brand.

Selling, general and administrative (SG&A) expenses were up 7.6% year over year to $348.2 million. The increase was mainly due to higher marketing expenses aimed at boosting customer traffic and sales in the Retail and Nuuly segments, as well as increased payroll costs to support the growth in comparable sales at Retail segment stores. As a percentage of net sales, SG&A deleveraged 32 bps to 25.6%, mainly due to the Urban Outfitters brand’s inability to reduce expenses at the same pace as its net sales.

URBN recorded an operating income of $145.1 million, up 9.9% from $132.1 million in second-quarter fiscal 2025. As a rate of sales, the operating margin increased 36 bps year over year to 10.7%.

URBN Store Details

In the fiscal second quarter, the company opened 11 retail locations, which included one Urban Outfitters store, three Anthropologie stores and seven Free People stores (including six FP Movement stores). Additionally, it closed five retail locations, which included two Urban Outfitters stores, two Anthropologie stores and one Free People store.

As of Jul 31, 2024, URBN operated 263 Urban Outfitters stores in the United States, Canada and Europe and websites; 239 Anthropologie Group stores in the United States, Canada and Europe, catalogs and websites; 205 Free People stores (including 45 FP Movement stores) in the United States, Canada and Europe, catalogs and websites; nine Menus & Venues restaurants; seven Urban Outfitters franchisee-owned stores; and two Anthropologie Group franchisee-owned stores.

Financial Details of URBN

Urban Outfitters ended the quarter with cash and cash equivalents of $209.1 million and a total shareholders’ equity of $2.24 billion. As of July 31, 2024, the total inventory was up 3.1% year over year. Total Retail segment inventory increased 3.1%, with the Retail segment’s comparable inventory declining 1.3%. The Wholesale segment’s inventory increased 3.5%.

URBN provided net cash of $163.8 million from operating activities as of July 31, 2024. During the six months ended July 31, 2024, the company repurchased and subsequently retired 1.2 million shares at a total cost of approximately $52 million. As of the same date, 18 million common shares remained available for repurchase under the program.

URBN’s Outlook

URBN expects total company sales growth in the mid-single digits for the third quarter, driven by a combination of low-single-digit growth in its Retail segment, low-teen growth in the Wholesale segment and strong mid-double-digit growth in its Nuuly segment.

However, the company anticipates a 100 basis point decline in the gross margin for the third quarter, primarily due to higher markdowns to clear inventory, a result of recent sales trends. Despite this, URBN is optimistic about gross margin improvement in the fourth quarter, aiming for a full-year improvement in the range of 50-100 basis points from the previous year. This expected improvement is largely attributed to better inventory alignment and reduced markdowns, particularly within the Urban Outfitters brand.

In terms of physical stores, URBN is set to open approximately 57 new stores and close around 25 stores in fiscal 2025, with a focus on expanding the FP Movement, Free People and Anthropologie brands. The company also plans to optimize its retail footprint, especially for Urban Outfitters, by resizing stores and considering relocations or closures of underperforming locations.

Capital expenditures for fiscal 2025 are planned at approximately $210 million.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates.

The consensus estimate has shifted -18.16% due to these changes.

VGM Scores

At this time, Urban Outfitters has a strong Growth Score of A, though it is lagging a lot on the Momentum Score front with a D. However, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Notably, Urban Outfitters has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Performance of an Industry Player

Urban Outfitters is part of the Zacks Retail – Apparel and Shoes industry. Over the past month, Tapestry TPR, a stock from the same industry, has gained 6.6%. The company reported its results for the quarter ended June 2024 more than a month ago.

Tapestry reported revenues of $1.59 billion in the last reported quarter, representing a year-over-year change of -1.8%. EPS of $0.92 for the same period compares with $0.95 a year ago.

For the current quarter, Tapestry is expected to post earnings of $0.95 per share, indicating a change of +2.2% from the year-ago quarter. The Zacks Consensus Estimate remained unchanged over the last 30 days.

The overall direction and magnitude of estimate revisions translate into a Zacks Rank #3 (Hold) for Tapestry. Also, the stock has a VGM Score of A.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Federal Trade Commission Sues CVS Health, Cigna, UnitedHealth's Pharmacy Benefit Managers For Inflating Insulin Prices

On Friday, the Federal Trade Commission (FTC) filed a formal complaint against three major pharmacy benefit managers (PBMs)—CVS Health Inc’s CVS Caremark, Cigna Corp’s CI Express Scripts, and UnitedHealth Group Inc’s UNH Optum—for allegedly engaging in unfair and anti-competitive practices that have inflated the list price of insulin medications.

The complaint accuses the PBMs of creating a system that benefits them financially by prioritizing drug rebates, forcing patients to pay higher costs for life-saving insulin. These PBMs, referred to as the Big Three, administer around 80% of prescriptions in the U.S.

The FTC claims that the PBMs abused their market power to inflate insulin prices by promoting a rebate system with drug manufacturers.

This system led to the exclusion of lower-priced insulin from formularies, further driving up the cost for vulnerable patients.

The result is higher out-of-pocket expenses for those needing essential diabetes medication.

For example, the list price of Eli Lilly And Co’s LLY Humalog rose dramatically from $21 in 1999 to over $274 in 2017.

Despite the availability of lower-priced alternatives, PBMs favored higher-priced drugs due to the lucrative rebates they provided.

The FTC is also examining the role of drug manufacturers, including Eli Lilly, Novo Nordisk A/S NVO, and Sanofi SA SNY, in driving up insulin prices, signaling potential further action against these companies.

The rebate-driven system excluded lower-priced insulins and allowed the Big Three PBMs to keep significant revenue in the form of rebates and fees, a strategy that hurt patients while benefiting the PBMs financially.

Vulnerable patients, such as those with high deductibles or coinsurance, bore the brunt of these inflated costs, paying more for their insulin than the overall net cost to insurers.

Price Action: At last check Friday, CVS stock was down 1.61% at $57.49, UNH stock was down 0.29% at $575.39, and CI stock was up 0.07% at $357.52.

Read Next:

Photo by towfiqu barbhuiya via unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

/R E P E A T — MEDIA ADVISORY – FEDERAL GOVERNMENT TO MAKE HOUSING ANNOUNCEMENT IN BURNABY/

BURNABY, BC, Sept. 19, 2024 /CNW/ – Media are invited to join Parm Bains, Member of Parliament for Steveston-Richmond East, alongside the Honourable Raj Chouhan, Member of the Legislature for Burnaby-Edmonds, Mike Hurley, Mayor of Burnaby, and FeiFei Peng, L’Arche Greater Vancouver’s Executive Director.

|

Date: |

September 20, 2024 |

|

Time:

|

9:30 AM PT

|

|

Location:

|

7415 Sussex Avenue Burnaby, BC, V5J 3V6 |

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c0140.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c0140.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FITB Stock Hits 52-Week High on Fed Rate Cut: Is It Worth Retaining?

Fifth Third Bancorp FITB shares touched a 52-week high of $43.85 on Thursday following the Federal Reserve’s announcement of a 50-basis points interest rate cut.

The FITB stock closed slightly lower at $43.64, gaining nearly 18% over the past six months. It has outperformed its industry, the S&P 500 Index and its close peers like Comerica Incorporated CMA and Bank of America Corporation BAC in the same time frame.

Six-Month Price Performance

Image Source: Zacks Investment Research

Key Drivers Behind FITB Stock’s New 52-Week High

A major factor for this upward movement of FITB stock can be attributed to the Federal Reserve’s aggressive start to monetary policy easing.

On Wednesday, the central bank signaled two additional rate cuts this year to support the economy. Fed officials further indicated plans for four more cuts in 2025 and two in 2026.

The interest rate cut is a positive development for banks, including Fifth Third, CMA and BAC, which have been struggling with rising funding cost pressures. While higher rates have led to a significant jump in banks’ net interest income (NII) the same led to increased funding costs, which squeezed margins.

FITB’s NII has witnessed a three-year (2020-2023) compound annual growth rate of 6.8%. However, the company’s NII declined in the first half of 2024 due to higher funding costs.

So now that the Fed has cut the rates, funding costs will gradually stabilize and eventually start declining, thus supporting FITB’s NII.

Other Factors Supporting FITB’s Performance

Raised Guidance: At the Barclays Global Financial Services Conference, FITB raised its third-quarter 2024 outlook. The bank stated that total revenues are now expected to rise 2-3% sequentially in the third quarter from its baseline of $2.2 billion compared with the previous guidance of a 1-2% increase. Also, management updated its non-interest income, now expecting a 3-4% increase from its baseline of $717 million, up from the earlier projection of a 1-2% rise.

Strategic Collaborations: The company has been expanding its embedded payments platform on the back of strategic partnerships, positioning itself for substantial growth in the commercial payments space. Fifth Third’s embedded payments platform, Newline, entered into a collaborative agreement with Trustly in September. This collaboration aims to develop its pay-by-bank arrangements and payments made through the Automated Clearing House and Real Time Payments networks.

In July, the bank announced a collaborative agreement between its embedded payments arm, Newline, and Stripe, a financial infrastructure platform, to expand embedded financial services offerings.

In May 2024, in collaboration with Bottomline, Fifth Third launched Enhanced Payables — a new payment platform powered by the latter’s business payments network, Paymode-X. This partnership offers customers access to a wide range of payment options, including invoice automation, virtual card payments, premium ACH payments, standard ACH payments, check payments and business-to-consumer payments.

Through such strategic collaborations, the bank anticipates commercial payments to be a $1 billion business in the next five years. This will eventually boost the company’s non-interest income growth over time.

Balance Sheet: The bank has a strong liquidity position. As of June 30, 2024, the company had a total debt (long-term debt and other short-term borrowings) of $19.7 billion and total liquidity (cash and due from banks and other short-term investments) of $23.9 billion. The company’s senior debt enjoyed investment-grade credit ratings of BBB+, A- and Baa1 from Standard & Poor’s, Fitch and Moody’s, respectively. This will likely enable the company to access the debt market at favorable rates.

Impressive Capital Distribution: The company is expected to keep enhancing shareholder value through efficient capital distribution. This month, the company announced a 5.7% rise in quarterly dividend to 37 cents per share. It has increased its dividend five times in the last five years. At present, the company has a dividend payout ratio of 40% with an annualized dividend growth rate of 8.55%.

Similarly, BAC hiked quarterly dividends by 8.3% in July to 26 cents, while CMA has kept its dividend payouts steady at 71 cents per share since February 2023.

In addition to dividends, the company has an impressive share repurchase plan. FITB repurchased 3.5 million of its outstanding common shares in the first half of 2024 as part of the 100-million-share repurchase plan announced on June 18, 2019. As of June 30, 2024, 28.6 million shares remain available under the authorization. Going forward, the company expects to repurchase $200 million worth of shares for each remaining quarter of 2024. Such efforts will enhance shareholder value in the long term.

Few Concerns Prevail for FITB

Mounting Expenses: Fifth Third’s non-interest expense saw a five-year CAGR of 2.8%, ending 2023. In the first half of 2024, the non-interest expenses remained flat compared with the same period of last year. Higher compensation and benefits expenses, as well as initiatives, such as branch expansion and digitization, will keep the company’s expense base under pressure in the short term.

Limited Loan Portfolio Diversification: The company’s loan portfolio comprises majorly of commercial loans (61.6% of total portfolio loans and leases as of June 30, 2024). The current rapidly changing macroeconomic backdrop may put some strain on commercial lending. Moreover, in case of any economic downturn, the asset quality of these credit categories might deteriorate. Thus, the lack of loan portfolio diversification is likely to hurt the company’s financials if the economic situation worsens.

Final Words on FITB

FITB’s inorganic expansion efforts and a robust balance sheet position, along with the Fed’s recent rate cut, are set to support FITB’s financials in the upcoming period.

Sales Estimate

Image Source: Zacks Investment Research

EPS Estimate

Image Source: Zacks Investment Research

Unlocking Valuation

FITB stock appears expensive relative to the industry. The company is currently trading at the 12-month trailing price-to-earnings (P/E) F12M ratio of 12.49%, above the industry’s 11.59%.

P/E F12M

Image Source: Zacks Investment Research

Though the rising expense and lack of diversification in its loan portfolio remain near-term concerns, FITB’s long-term prospects remain bright.

Considering its expensive valuation, prospective investors can keep this Zacks Rank #3 (Hold) stock on their radar and can wait for a better entry point.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Revenue Contraction Affect Jabil's Q4 Earnings Results?

Jabil Inc. JBL is set to release fourth-quarter fiscal 2024 results on Sept. 26, before the opening bell. In the last reported quarter, the company delivered an earnings surprise of 2.16%. It pulled off a trailing four-quarter earnings surprise of 3.10%, on average.

The leading global supplier of electronic manufacturing services is likely to witness a revenue contraction year over year in the fourth quarter of fiscal 2024. Soft demand trends in some end markets and macroeconomic challenges are likely to impede the top-line growth. Initiatives to improve profitability and free cash flow are positives.

Factors at Play

Jabil is placing a strong emphasis on integrating sophisticated AI and ML capabilities to enhance portfolio offerings and improve the efficiency of its internal process. Growing demand for AI infrastructure in data center space, along with AI proliferation in cloud, networking and industrial automation end markets are major tailwinds. Jabil’s focus on end market and product diversification, coupled with its large-scale global operations, offers a high degree of resilience during times of macroeconomic and geopolitical disruption. Management’s focus on operational efficiency and effective working capital management is boosting profitability and free cash flow.

However, demand softness in several key end markets, including 5G, renewable energy, digital print and healthcare is weighing on net sales. The company’s automotive vertical is also experiencing headwinds as the Chinese automotive market grapples with overcapacity and high inventory levels. Moreover, the launch of new electric vehicle platforms has been postponed by several quarters. These factors are likely to have impeded revenues in the fourth quarter of fiscal 2024. The company’s strategy to move away from less prospective markets by restructuring and reshaping its portfolio will impact top-line growth in the near term.

The Zacks Consensus Estimate for the DMS vertical is pegged at $3.384 billion, indicating a decline from $4.436 billion reported in the year-ago quarter. Revenues from the EMS vertical are pegged at $3.169 billion, implying a downtrend from $4.022 billion in the year-ago quarter.

For the August quarter, the Zacks Consensus Estimate for revenues is pegged at $6.573 billion, which indicates a decline from the year-ago quarter’s tally of $8.458 billion. The consensus estimate for earnings is pegged at $2.23, suggesting a decrease from $2.45 reported in the prior-year quarter.

Earnings Whispers

Our proven model doesn’t conclusively predict an earnings beat for Jabil this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -0.22%.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

Accenture ACN is set to release its quarterly numbers on Sept. 26. It has an Earnings ESP of +0.37% and a Zacks Rank #2.

The Earnings ESP for Carnival CCL stands at +2.99%. The company carries a Zacks Rank of 3. It is scheduled to report quarterly numbers on Sept. 30.

The Earnings ESP for Costco Wholesale COST stands at +0.62%, and it carries a Zacks Rank of 3. The company is scheduled to report quarterly numbers on Sept. 26.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With CRWD

Financial giants have made a conspicuous bearish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings CRWD revealed 44 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $485,505, and 32 were calls, valued at $1,672,938.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $160.0 and $350.0 for CrowdStrike Holdings, spanning the last three months.

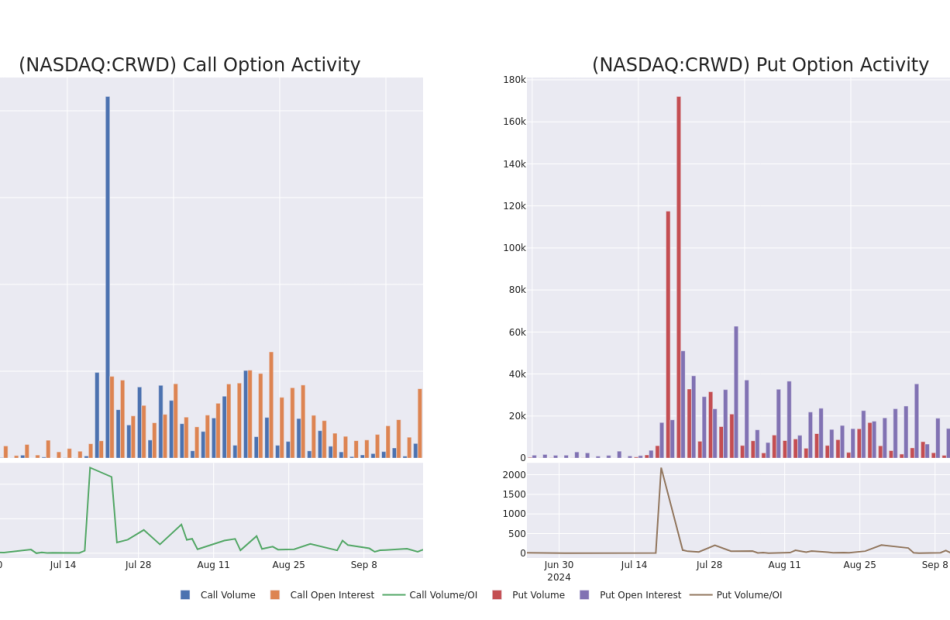

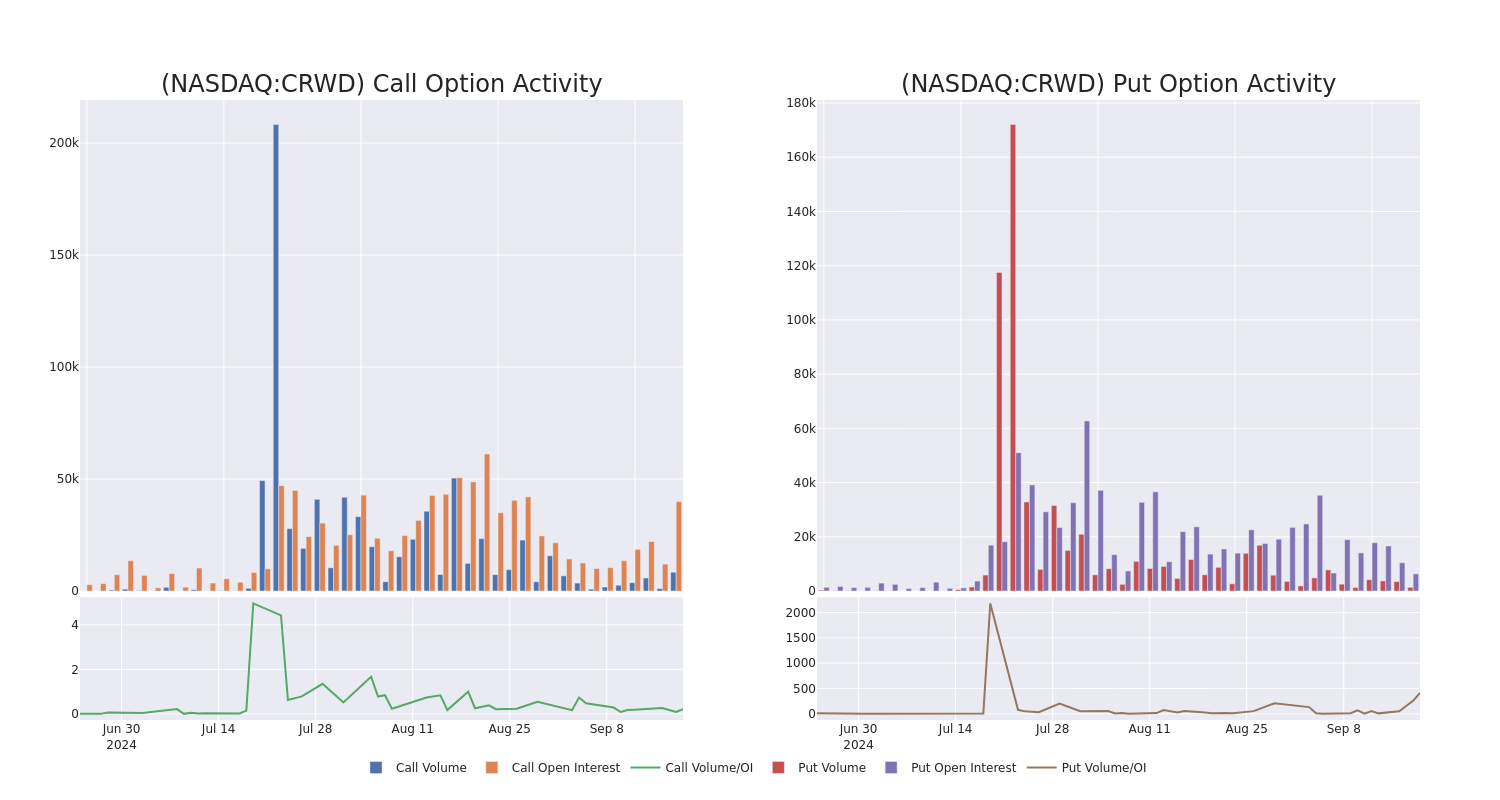

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of CrowdStrike Holdings stands at 1009.16, with a total volume reaching 14,198.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $160.0 to $350.0, throughout the last 30 days.

CrowdStrike Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | SWEEP | BULLISH | 10/18/24 | $5.65 | $5.6 | $5.6 | $310.00 | $138.3K | 2.9K | 775 |

| CRWD | CALL | SWEEP | BULLISH | 09/27/24 | $29.65 | $29.25 | $29.45 | $265.00 | $115.0K | 512 | 447 |

| CRWD | CALL | SWEEP | BEARISH | 09/27/24 | $29.65 | $29.25 | $29.46 | $265.00 | $94.5K | 512 | 447 |

| CRWD | CALL | SWEEP | BULLISH | 09/20/24 | $19.1 | $18.85 | $18.85 | $270.00 | $94.2K | 2.5K | 301 |

| CRWD | CALL | SWEEP | BULLISH | 09/27/24 | $29.65 | $28.95 | $29.37 | $265.00 | $85.2K | 512 | 447 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike’s primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Following our analysis of the options activities associated with CrowdStrike Holdings, we pivot to a closer look at the company’s own performance.

CrowdStrike Holdings’s Current Market Status

- Trading volume stands at 9,545,342, with CRWD’s price up by 8.03%, positioned at $299.64.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 67 days.

Expert Opinions on CrowdStrike Holdings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $322.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Raymond James has decided to maintain their Outperform rating on CrowdStrike Holdings, which currently sits at a price target of $275.

* An analyst from Rosenblatt persists with their Buy rating on CrowdStrike Holdings, maintaining a target price of $330.

* An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on CrowdStrike Holdings, which currently sits at a price target of $350.

* An analyst from Bernstein has decided to maintain their Outperform rating on CrowdStrike Holdings, which currently sits at a price target of $327.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for CrowdStrike Holdings, targeting a price of $330.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Is Wolfspeed Down 31.3% Since Last Earnings Report?

It has been about a month since the last earnings report for Wolfspeed WOLF. Shares have lost about 31.3% in that time frame, underperforming the S&P 500.

Will the recent negative trend continue leading up to its next earnings release, or is Wolfspeed due for a breakout? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Wolfspeed Reports Loss in Q4 Earnings, Revenues Down Y/Y

Wolfspeed reported a fourth-quarter fiscal 2024 non-GAAP loss of 89 cents per share, wider than the Zacks Consensus Estimate of a loss of 84 cents per share but narrower than the year-ago quarter’s loss of 36 cents per share.

Revenues of $200.7 million decreased 1% year over year but lagged the consensus mark by 0.2%. Mohawk Valley Fab contributed $41 million in revenues in the reported quarter.

Power Products accounted for 52.1%, while Materials Products contributed 47.9%. Power Products revenues decreased 2.3% year over year to $104.6 million. Materials Products revenues increased 0.5% year over year to $96.1 million.

Power device design-ins were $2 billion in the reported quarter. Quarterly design wins were $0.5 billion.

Wolfspeed’s Operating Details

For the fiscal fourth quarter, Wolfspeed reported a non-GAAP gross margin of 5.4%, down from 30.7% reported in the year-ago quarter. Underutilization costs of $24 million negatively impacted gross margin in the reported quarter.

In the reported quarter, sales, general and administrative expenses were $60 million (29.9% of total revenues), up 37.6% year over year.

Research & development expenses (30.7% of total revenues) increased 4.8% year over year to $61.6 million.

Wolfspeed incurred $20.5 million in factory start-up costs in the fourth quarter of fiscal 2024.

The company incurred a non-GAAP operating loss of $118.9 million, wider than the operating loss of $66.8 million in the year-ago quarter.

WOLF’s Balance Sheet & Cash Flow

As of Jun 30, 2024, WOLF had cash, cash equivalents and short-term investments of $2.17 billion compared with $2.55 billion as of Mar 31, 2024.

Long-term debt was $3.13 billion as of Jun 30, 2024.

Free cash outflow was $885.3 million, comprising $239.5 million of operating cash outflow and $644.2 million of capital expenditures.

Guidance

For first-quarter fiscal 2025, Wolfspeed expects revenues in the range of $185-$215 million. Non-GAAP loss is expected between 90 cents and $1.09 per share.

The company expects Mohawk Valley Fab to contribute nearly $20-$30 million in revenues in the first quarter of fiscal 2025.

It expects non-GAAP gross margin in the range of 13-20%. Non-GAAP operating expenses are expected to be $109 million, including $13 million of start-up costs.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates.

The consensus estimate has shifted -11.14% due to these changes.

VGM Scores

At this time, Wolfspeed has a poor Growth Score of F, a grade with the same score on the momentum front. Following the exact same course, the stock was allocated a grade of F on the value side, putting it in the bottom 20% quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Estimates have been trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Notably, Wolfspeed has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.