Visa's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Visa.

Looking at options history for Visa V we detected 19 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 15 are puts, for a total amount of $875,964 and 4, calls, for a total amount of $279,465.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $230.0 to $300.0 for Visa over the recent three months.

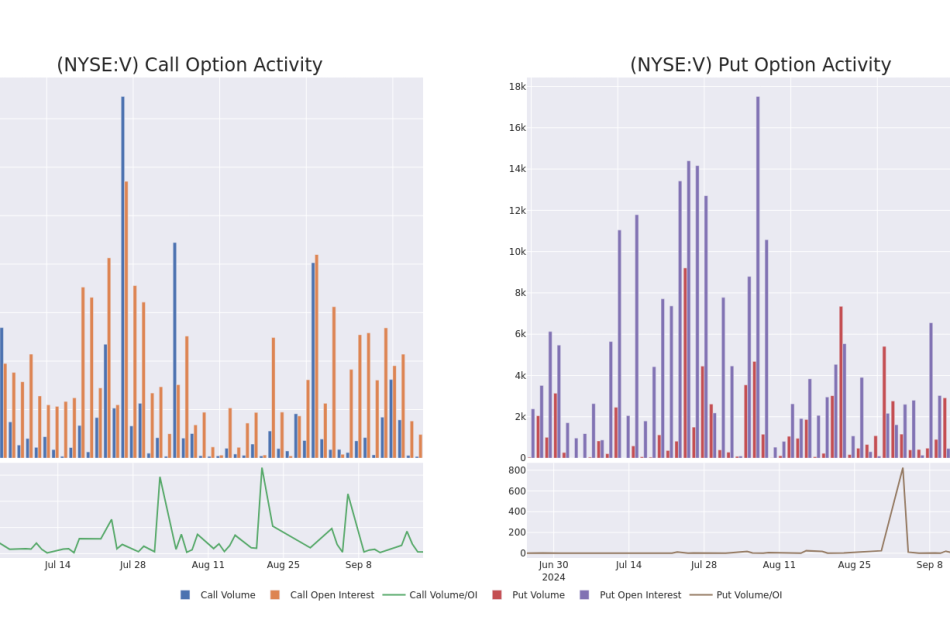

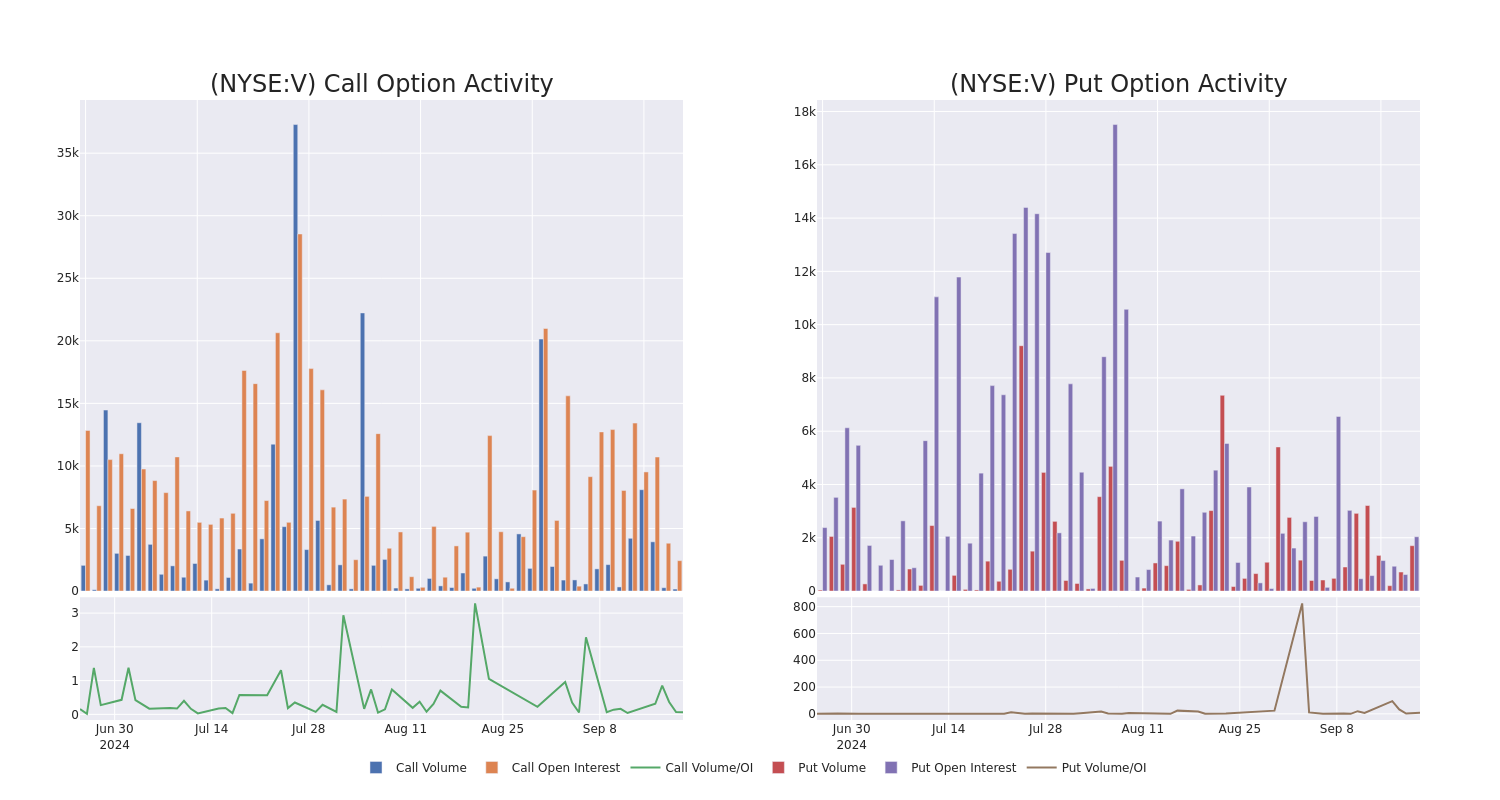

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Visa stands at 446.8, with a total volume reaching 1,862.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $300.0, throughout the last 30 days.

Visa Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | TRADE | BEARISH | 09/20/24 | $34.55 | $33.75 | $34.0 | $250.00 | $170.0K | 229 | 52 |

| V | PUT | SWEEP | BEARISH | 12/20/24 | $19.0 | $18.75 | $18.8 | $300.00 | $99.5K | 49 | 106 |

| V | PUT | SWEEP | BULLISH | 11/15/24 | $14.25 | $14.0 | $14.14 | $295.00 | $77.9K | 340 | 343 |

| V | PUT | SWEEP | BEARISH | 11/15/24 | $14.1 | $13.8 | $13.99 | $295.00 | $77.4K | 340 | 288 |

| V | PUT | SWEEP | BEARISH | 12/20/24 | $15.5 | $15.25 | $15.45 | $295.00 | $69.5K | 129 | 154 |

About Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Having examined the options trading patterns of Visa, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Visa

- With a volume of 27,553,349, the price of V is down -0.43% at $284.0.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 32 days.

What Analysts Are Saying About Visa

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $314.6666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Compass Point lowers its rating to Buy with a new price target of $319.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Visa, targeting a price of $308.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Visa with a target price of $317.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Visa with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VNDA Stock Down as FDA Rejects NDA for Tradipitant in Gastroparesis

Vanda Pharmaceuticals Inc. VNDA announced that the FDA issued a complete response letter to its new drug application (NDA) seeking approval for its pipeline candidate, tradipitant for the treatment of symptoms in gastroparesis.

Shares of the company were down 6.1% on Sept. 19 following the announcement of the news.

Marked by delayed gastric emptying, gastroparesis is a serious condition that slows down the stomach’s ability to empty its contents. The FDA has not approved any effective medicine for treating gastroparesis in more than 40 years.

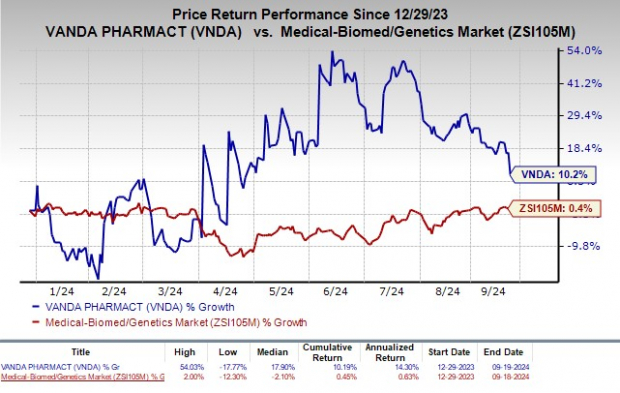

Year to date, shares of Vanda have increased 10.2% compared with the industry’s rise of 0.4%.

Image Source: Zacks Investment Research

More on FDA’s CRL for VNDA’s Tradipitant

Per the CRL, the FDA called for Vanda to conduct additional studies on tradipitant with a design that was inconsistent with the advice of key experts in the field and not appropriate based on the scientific understanding of the disease.

Also, per management, the FDA delayed its decision by more than 185 days and failed to meet the requirements specified by the Food Drug and Cosmetic Act (FDCA).

Notably, the FDCA requires that the FDA review an NDA and provide either an approval or a possible hearing within 180 days of the filing. The FDA failed to do either.

Per the company, it had time and again asked the FDA to hold an advisory committee meeting to discuss the NDA for tradipitant while the regulatory body declined.

Several patients treated with tradipitant have now filed a Citizen Petition pleading with the regulatory body to approve tradipitant for the treatment of gastroparesis.

VNDA’s Development Plans for Tradipitant

Despite the FDA declining to approve tradipitant for treating symptoms in gastroparesis, the company will continue to pursue the marketing approval for tradipitant in the given indication.

Apart from gastroparesis, VNDA is also developing tradipitant for preventing vomiting induced by motion sickness.

In May 2024, the company announced positive data from a second phase III study that investigated tradipitant for preventing vomiting induced by motion sickness.

Vanda plans to submit an NDA for tradipitant to the FDA for the treatment of motion sickness later in 2024.

Zacks Rank & Stocks to Consider

Vanda currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector are Illumina, Inc. ILMN, Krystal Biotech, Inc. KRYS and Fulcrum Therapeutics, Inc. FULC, each sporting a Zacks Rank #1 (Strong Buy) at present.

In the past 60 days, estimates for Illumina’s 2024 earnings per share have moved up from $1.84 to $3.63. Earnings per share estimates for 2025 have improved from $3.22 to $4.43. Year to date, shares of ILMN have lost 3.5%.

ILMN’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 463.46%.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $2.09 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 48.7%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, with the average surprise being 45.95%.

In the past 60 days, estimates for Fulcrum Therapeutics’ 2024 loss per share have narrowed from $1.33 to 28 cents. Loss per share estimates for 2025 have narrowed from $1.71 to $1.14. Year to date, shares of FULC have plunged 48.9%.

FULC’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 393.18%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Fed Cuts are Fantastic for Commercial Office- 3 Reasons Why Office Space Will Outperform: Gregory Kraut, CEO KPG Funds

NEW YORK, Sept. 20, 2024 /PRNewswire/ — There is immense opportunity for Office Space to Out-Perform as the Federal Reserve lowered interest rates. This will lead to increased values of office buildings, increased Office Space Leasing and Office Supply being taken off the market. Here’s why:

1. A Unique Market Reversal with the Lowering of Interest Rates

Unlike previous downturns, this CRE market correction is characterized by resilient cash flows despite falling property values. Capitalization rates (cap rates)—a key measure of CRE investment value—have adjusted, but the real question for investors is whether they have risen enough to justify the perceived risk. Gregory Kraut, CEO of KPG Funds explains “Interest rates going lower equals higher pricing for commercial buildings. Commercial buildings trade on capitalization rates which are directly tied to interest rates. Interest rates falls and capitalization rates will drop in sync.”

While some may argue that CRE appears overpriced when compared to Treasury yields, it is important to remember that investment decisions should not be made based on cap rates alone. Our analysis shows that cash flows, or net operating income (NOI), remain robust, aligning with peak levels from previous cycles. We believe this resilience in cash flows and lower interest rates, will eventually lead to a rebound in valuations.

2. Robust office market demand has returned

Office leasing demand has started to increase to pre-pandemic levels. Growth sectors of the economy are heavily reliant on low interests. We have already seen a surge in leasing volume in anticipation of the cuts and tenants now see a clear path to further job growth. We expect the IPO market to reopen which will usher in a wave of capital which will lead to employee hires. We have had several recent quarters of positive leasing activity that has been on par with pre-pandemic levels.

While vacancy rates are up in some cities, high end office buildings which KPG Funds specialize in New York City are fully leased and experiencing strong growth in NOI. This disparity presents a range of investment opportunities for those who know where to look.

KPG Funds‘ recent developments in Soho, the Lower East Side, and other key neighborhoods exemplify this trend. The company’s focus on providing state-of-the-art facilities with amenities like wellness centers, high-tech infrastructure, and aesthetic design has positioned them as a leader in meeting the evolving needs of modern businesses.

“Companies are looking for more than just office space—they want an environment that reflects their brand, values, and commitment to their employees,” says Kraut. “Our approach to developing premium office spaces is aligned with these expectations, and it is why we continue to see robust interest from tenants.

While some sectors of the commercial real estate market have faced hurdles, the story in New York City is more nuanced. Gregory Kraut, CEO of KPG Funds, believes that reports of the market’s decline have been greatly exaggerated. “New York City remains a global hub for business and culture, and that foundation is not easily shaken,” Kraut explains. “We’re seeing continued demand for quality office spaces, especially those offering top-tier amenities and a prime location.”

KPG Funds, known for transforming undervalued properties into premium office spaces, has observed a distinct “flight to quality” in the market. Businesses are prioritizing spaces that not only meet their operational needs but also offer an environment conducive to innovation, collaboration, and employee satisfaction. This trend has kept demand for luxury office spaces strong, even as other segments face challenges.

3. Office Supply: A rapidly shrinking CRE class due to recent residential conversions

Office to residential conversions is taking significant office space off the market. We are trending towards a supply constrained market in late 2025 through 2026 With interest rates falling we will see increasing supply coming off the market as companies look to expand. Kraut also notes that the conversion of commercial spaces to residential units has played a role in balancing the market. With fewer commercial properties available, those that offer high-quality, well-located office space are in greater demand. This dynamic has contributed to stabilizing prices in the premium segment, even as other areas experience volatility.

“As the market adapts, we’re seeing opportunities for growth, particularly in the premium office space sector,” Kraut adds. “Our strategy of focusing on quality and innovation ensures that we’re well-positioned to meet this demand and continue delivering value to our tenants and investors.”

Conclusion: Time to Reconsider CRE Exposure – Especially in NYC!

In our view, the recent sell-off in CRE may have run its course. As the Federal Reserve cuts interest rates, we anticipate a favorable shift in the market dynamic and an outperformance in the commercial real estate office sector. stabilized property values, continued resilience in cash flows, and improving credit conditions.

We remain optimistic about the future of commercial real estate and believe that, despite the headlines, now is a time of opportunity. Learn more at KPGFunds.com.

Media Contact:

Gregory Kraut

646-665-4508

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/why-fed-cuts-are-fantastic-for-commercial-office–3-reasons-why-office-space-will-outperform-gregory-kraut-ceo-kpg-funds-302253682.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/why-fed-cuts-are-fantastic-for-commercial-office–3-reasons-why-office-space-will-outperform-gregory-kraut-ceo-kpg-funds-302253682.html

SOURCE KPG Funds

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Is Nordson Up 1.6% Since Last Earnings Report?

It has been about a month since the last earnings report for Nordson NDSN. Shares have added about 1.6% in that time frame, underperforming the S&P 500.

Will the recent positive trend continue leading up to its next earnings release, or is Nordson due for a pullback? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Nordson Beats on Q3 Earnings, Sales Rise Y/Y

Nordson’s third-quarter fiscal 2024 (ended Jul 31, 2024) adjusted earnings of $2.41 per share surpassed the Zacks Consensus Estimate of $2.33. The bottom line decreased 6% year over year.

Quarterly Results of Nordson

Nordson’s revenues were $661.6 million, up 2% from the year-ago fiscal quarter’s number driven by solid momentum in the Industrial Precision Solutions segment. Revenues beat the Zacks Consensus Estimate of $655 million.

Organic sales declined 1% year over year due to softness in the electronics and medical product lines. Acquisitions had a positive impact of 4% while foreign currency translation had a negative impact of 1%.

On a regional basis, revenues from the Asia Pacific region increased 2.4% year over year to $195.2 million. Revenues generated from Europe increased 7.1% to $179.4 million while the metric in the Americas decreased 1.2% to $287 million.

Nordson reports revenues under three segments. The segments are Industrial Precision Solutions, Medical and Fluid Solutions and Advanced Technology Solutions. A brief snapshot of the segmental sales is provided below:

Revenues from Industrial Precision Solutions amounted to $370.6 million, up 9.6% from the year-ago fiscal quarter’s level. The segment contributed 56% to NORDSON’s top line in the quarter.

Organic sales increased 3.6% from the year-ago fiscal quarter’s level. Acquisitions had a positive impact of 7.4% while foreign currency translation had a negative impact of 1.4%.

Revenues from Medical and Fluid Solutions amounted to $166.7 million, down 2.4% from the year-ago fiscal quarter’s level. The segment contributed 25.2% to Nordson’s top line.

Organic sales decreased 2% from the year-ago fiscal quarter’s level. Foreign currency translation had a negative impact of 0.4%.

Advanced Technology Solutions’ sales were $124.3 million, down 10.9% from the year-ago fiscal quarter’s figure. The metric represented 18.8% of Nordson’s revenues in the period.

Organic sales decreased 10.2% from the year-ago fiscal quarter’s level. Foreign currency translation had a negative impact of 0.7%.

Margin Profile

Nordson’s cost of sales increased 1.5% from the year-ago fiscal quarter’s level to $292.6 million. Gross profit was $369 million, up 2.4% from the year-ago fiscal quarter’s level. The gross margin increased 30 basis points (bps) to 55.8%.

Selling and administrative expenses increased 6.7% year over year to $201.9 million. Adjusted EBITDA was $208.1 million, the margin being 31%. Operating income was $167.1 million, down 2.3% year on year. Operating margin of 25.3% decreased 110 bps from the year-ago period.

Net interest expenses totaled $17.8 million, reflecting a 54.8% increase from the year-ago fiscal quarter’s level.

Balance Sheet & Cash Flow

At the time of exiting the third quarter, Nordson’s cash and cash equivalents were $165.3 million compared with $115.7 million recorded at the end of the fourth quarter of fiscal 2023. Long-term debt was $1.4 billion compared with $1.6 billion recorded at the end of fourth-quarter fiscal 2023.

In the first nine months of fiscal 2024, Nordson generated net cash of $459.8 million from operating activities, down 3.8% from the last fiscal year period’s tally. Capital invested in purchasing property, plant and equipment totaled $43.8 million, up 81% from the year-ago fiscal period.

Dividends/Share Buyback

In the first nine months of fiscal 2024, Nordson paid out dividends of $116.8 million, up 4.8% from $111.5 million in the same period of the previous fiscal year.

Treasury purchase shares amounted to $34.1 million in the first nine months of the fiscal year, down from $78.2 million in the last fiscal year.

Outlook

For fiscal 2024 (ending October 2024), Nordson anticipates adjusted earnings to be in the range of $9.45-$9.65 per share compared with $9.35-$9.75 predicted earlier. Sales are expected to be in the range of $2.665-$2.705 billion compared with $2.630-$2.680 billion anticipated earlier.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates.

VGM Scores

Currently, Nordson has an average Growth Score of C, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Notably, Nordson has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Performance of an Industry Player

Nordson belongs to the Zacks Manufacturing – General Industrial industry. Another stock from the same industry, Applied Industrial Technologies AIT, has gained 10.5% over the past month. More than a month has passed since the company reported results for the quarter ended June 2024.

Applied Industrial Technologies reported revenues of $1.16 billion in the last reported quarter, representing a year-over-year change of +0.2%. EPS of $2.64 for the same period compares with $2.35 a year ago.

For the current quarter, Applied Industrial Technologies is expected to post earnings of $2.28 per share, indicating a change of -4.6% from the year-ago quarter. The Zacks Consensus Estimate has changed -0.5% over the last 30 days.

Applied Industrial Technologies has a Zacks Rank #3 (Hold) based on the overall direction and magnitude of estimate revisions. Additionally, the stock has a VGM Score of B.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Caterpillar

Deep-pocketed investors have adopted a bullish approach towards Caterpillar CAT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 22 extraordinary options activities for Caterpillar. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 36% bearish. Among these notable options, 14 are puts, totaling $1,288,875, and 8 are calls, amounting to $389,403.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $310.0 and $450.0 for Caterpillar, spanning the last three months.

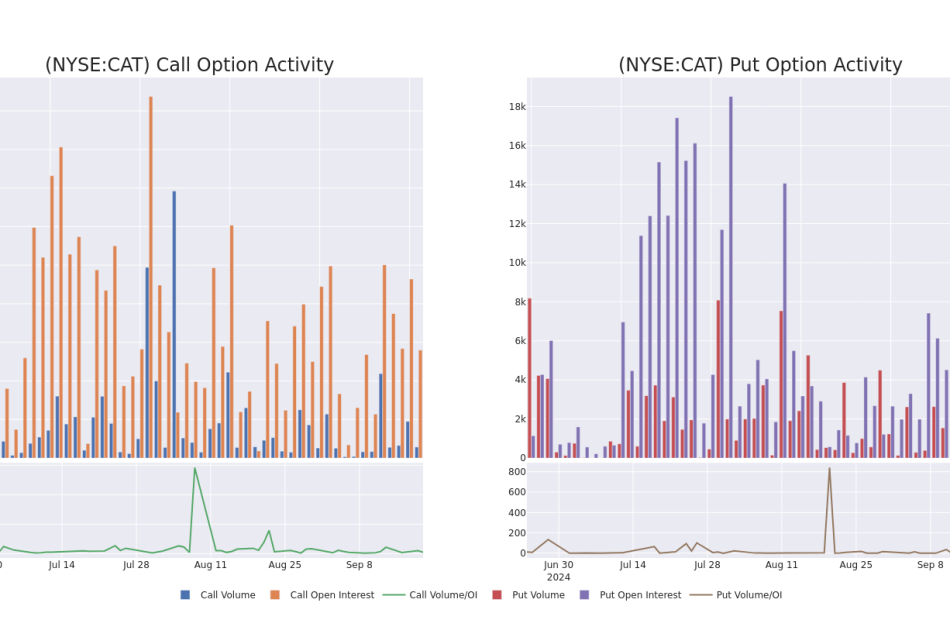

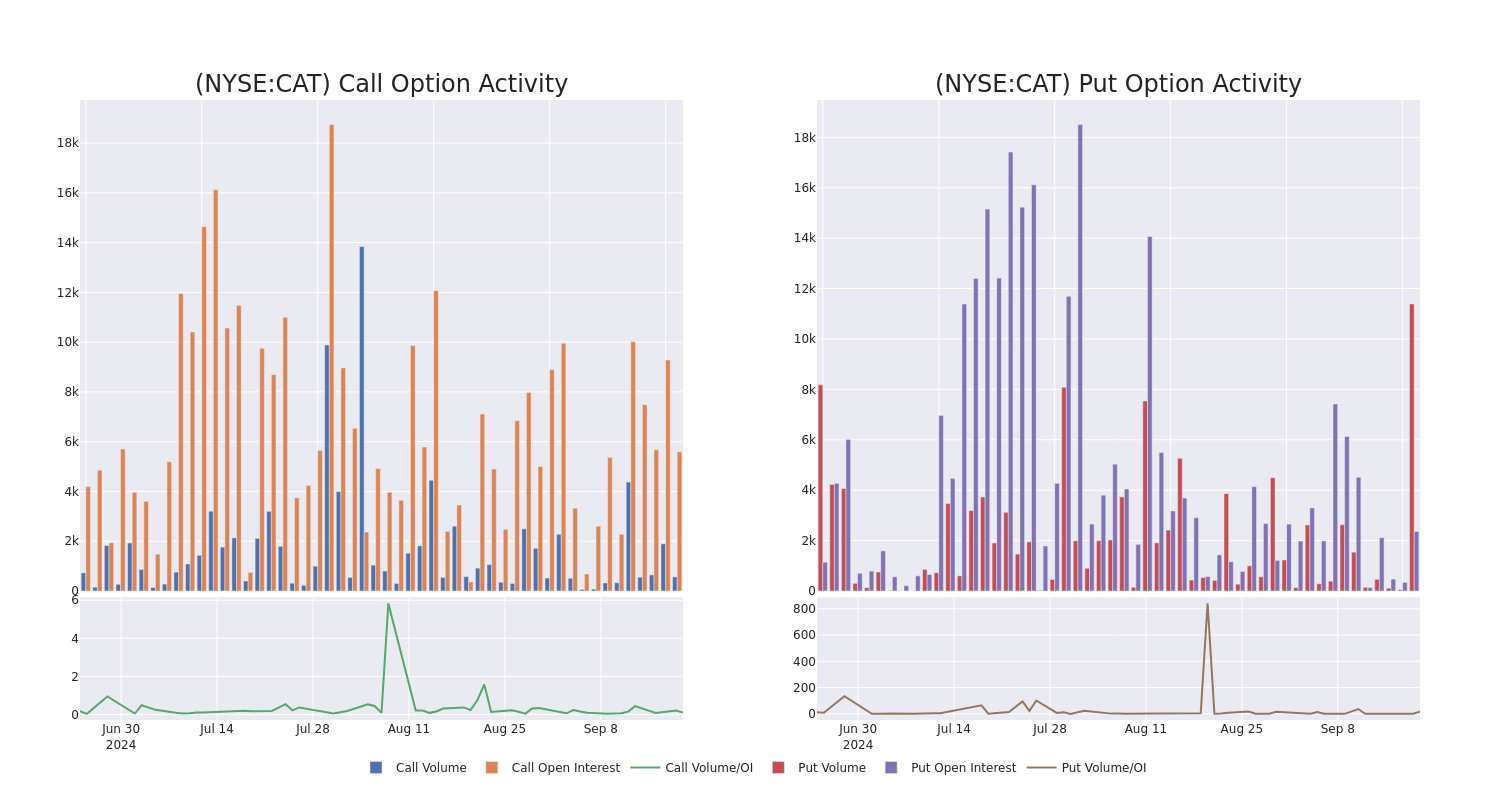

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 723.82 with a total volume of 11,962.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Caterpillar’s big money trades within a strike price range of $310.0 to $450.0 over the last 30 days.

Caterpillar Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $9.15 | $9.0 | $9.07 | $350.00 | $546.3K | 1.2K | 634 |

| CAT | CALL | TRADE | BULLISH | 03/21/25 | $5.65 | $5.3 | $5.65 | $450.00 | $141.2K | 136 | 250 |

| CAT | PUT | SWEEP | BULLISH | 11/01/24 | $7.55 | $6.85 | $6.85 | $350.00 | $123.3K | 27 | 200 |

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $9.05 | $8.95 | $9.02 | $350.00 | $95.5K | 1.2K | 1.3K |

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $8.8 | $8.75 | $8.79 | $350.00 | $89.7K | 1.2K | 1.5K |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world’s largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Following our analysis of the options activities associated with Caterpillar, we pivot to a closer look at the company’s own performance.

Current Position of Caterpillar

- With a volume of 5,177,212, the price of CAT is down -1.13% at $369.1.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 39 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Caterpillar options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed jumbo rate cut puts pressure on money market fund investors

By Suzanne McGee and Carolina Mandl

(Reuters) -Investment advisers are urging clients to dump hefty cash allocations now that the Federal Reserve has begun its much-anticipated interest-rate easing, a process they expect to limit the appeal of money-market funds in the coming months.

Retail investors’ assets in money market funds have grown by $951 billion since 2022, when the Fed started its rate-hiking cycle to tame inflation, according to the Investment Company Institute, which represents investment funds. Their assets stood at $2.6 trillion on Sept. 18, roughly 80% higher than at the beginning of 2022. Total money market assets stood at $6.3 trillion.

“As investors are now more convinced that the Fed will reduce rates in line with its guidance, investors will likely grasp for yields that will not dwindle overnight,” said Hannes Hofmann, head of family office group at Citi Private Bank, adding appetite for risk is likely to increase.

On Wednesday, the U.S. central bank cut the federal funds rate by a larger-than-usual 50 basis points to a range of 4.75% to 5%, which makes holding cash in deposit accounts and cash-like instruments less appealing.

“You’re going to have to shift everything … further up in the amount of risk you’re accepting,” said Jason Britton, Charleston-based founder of Reflection Asset Management, who manages or oversees around $5 billion in assets. “Money-market assets will have to become fixed-income holdings; fixed income will move into preferred stocks or dividend-paying stocks.”

Money-market funds – ultra low-risk mutual funds that invest in short-term Treasury securities and other cash proxies – are a way to gauge investor interest in the nearly risk-free returns they offer. When short-term interest rates climb, money-market returns rise with them, increasing their appeal to investors.

“Investors may need to look at something different, or longer-term, to lock in rates and not be as exposed to the Fed lowering interest rates,” said Ross Mayfield, investment strategist at Baird Wealth.

Some investors could end up transferring funds from money market funds to equities, advisers say. Daniel Morris, Chief Market Strategist, BNP Paribas Asset Management, said the appeal of money market funds will wane. Morris said he sees better opportunity in equities and is slightly overweight equities versus fixed income.

Carol Schleif, chief investment officer of BMO Family Office, expects investors to keep some cash on the sidelines to wait for opportunities to buy stocks.

It could take a while for initial reactions to the Fed’s decision on Wednesday to show up in money-market fund flows, as it has been tough to persuade retail investors to abandon their cash holdings, analysts note. Assets in money market funds tend to peak nine months after the first rate cut, BofA Securities said in a report.

“If people see a broader-based advance in stocks, they may move out of cash more quickly, as that would point to owning riskier assets as a good thing,” said Christian Salomone, chief investment officer of Ballast Rock Private Wealth.

Investors “are stuck between a rock and a hard place,” Britton said, faced with a choice between investing in riskier assets or earning a smaller return from cash-like products.

(Reporting by Suzanne McGee and Carolina Mandl; additional reporting by Davide Barbuscia; editing by Megan Davies, Rod Nickel and Nick Zieminski)

ICU Medical Recalls ParaPAC Plus Ventilators Due To Loose Outlet Connector That Can Cause Injury Or Death

ICU Medical Inc‘s ICUI subsidiary, Smiths Medical, initiated a recall Friday of its paraPAC plus P300 and P310 ventilators due to faulty parts.

According to the FDA, there’s a possibility that the patient outlet connector may loosen or detach, impacting active ventilation. If this happens, it could cause serious adverse health consequences, including not enough ventilation (hypoventilation), not enough oxygen (hypoxia), slowed heartbeat (bradycardia), low blood pressure (hypotension), a sudden stop of the lungs (respiratory arrest), and death.

There has been one reported injury. There has been one report of death.

Smiths Medical PneuPAC paraPAC Plus P300 and P310 Ventilators are gas-powered emergencies and transport portable ventilators, including in vehicles such as airplanes and helicopters.

They are suitable for emergencies at accident scenes and transports between hospitals or within a hospital or medical facility. These ventilators are intended to provide ventilatory support for adults, children, and infants.

The paraPAC Plus devices also provide free-flow oxygen therapy and continuous positive airway pressure (CPAP) therapy for spontaneously breathing patients. They can also be used in emergency situations to provide ventilatory support for CPR resuscitation.

Earlier this week, Smiths Medical initiated a recall of certain Bivona neonatal/pediatric and adult tracheostomy tubes due. A manufacturing defect caused the securement flange on the device to tear. There have been 35 reported injuries and two reported deaths.

Price Action: ICU Medical stock is down 1.56% at $178.44 at last check Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Seeking Agents: Empowering Home Buyers to Save Money through Agent Competition

PHOENIX, Sept. 20, 2024 /PRNewswire/ — Seeking Agents has launched a groundbreaking platform aimed at saving home buyers money by fostering competition among real estate agents. Built on over two decades of real estate brokerage expertise and cutting-edge technology, Seeking Agents provides home buyers with a unique opportunity to take control of the agent selection process, driving down commission rates and ensuring they receive the best value for their money.

In an industry known for high commissions and limited transparency, Seeking Agents is flipping the script. The platform allows home buyers to submit their criteria and have agents compete to represent them, offering clear, comparable bids that highlight services and commission rates. This competitive approach helps buyers make more informed decisions and ultimately save money.

Key Benefits for Home Buyers:

- Save Money: By allowing agents to compete for their business, buyers can secure lower commission rates, potentially saving thousands of dollars on real estate transactions.

- Avoid Dual Agency: Following the NAR settlement, many buyers have turned to the seller’s agent by default, which can create a conflict of interest. Seeking Agents empowers buyers to choose their own agent, ensuring they receive dedicated representation focused exclusively on their needs.

- Empowerment through Choice: Buyers have the freedom to compare competitive offers from multiple agents, selecting the one that best fits their needs and budget.

“Our goal with Seeking Agents is to give buyers the power to make the best financial decisions in the home-buying process,” said Hunter Gruler, Co-Founder of Seeking Agents. “By creating competition among agents, we’re helping buyers save money and find the best possible representation.”

How It Works:

Home buyers submit their home search criteria on the Seeking Agents platform, and real estate agents respond with personalized offers, detailing services and commission rates. Buyers can compare these offers side-by-side, choosing the agent that offers the best combination of service and value. The platform simplifies the home-buying process while driving down costs.

Why Choose Seeking Agents?

The traditional real estate model has long been criticized for its lack of transparency and high costs. Seeking Agents addresses these challenges by:

- Putting Buyers in Control: Buyers decide which agent they want to work with, based on clear, competitive offers tailored to their needs.

- Encouraging Competition: Agents are incentivized to provide better service and lower fees, allowing buyers to benefit from improved service at lower costs.

- Responding to Industry Changes: In the evolving real estate landscape, Seeking Agents is leading the charge in creating a more transparent, buyer-friendly process.

Seeking Agents is revolutionizing how home buyers connect with agents, offering a more efficient, cost-effective, and transparent solution. Buyers can now avoid traditional high-commission practices and choose agents based on competitive offers, ensuring they receive the best possible representation at the best price.

For more information or to request a demonstration of the platform, visit www.seekingagents.com or contact

Jim Gruler

383624@email4pr.com

1-833-733-5248

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/seeking-agents-empowering-home-buyers-to-save-money-through-agent-competition-302254178.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/seeking-agents-empowering-home-buyers-to-save-money-through-agent-competition-302254178.html

SOURCE Seeking Agents

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FDA-Approved Cannabis-Based Drug Shows Promising Results As A Treatment For War Veterans: Study Finds Improvement In Cognitive, Mood, Pain-Related Symptoms

The well-known cannabis-based pharmaceutical drug Epidiolex, primarily used to treat childhood epilepsy, may offer relief to veterans suffering from Gulf War Illness (GWI), according to new research.

A new study on rats shows the potential of Epidiolex, the FDA-approved cannabidiol (CBD) drug produced by Jazz Pharmaceuticals PLC JAZZ’s GW Pharmaceuticals, in addressing cognitive, mood and pain-related symptoms of GWI, a condition linked to chemical exposures during the 1990-1991 Gulf War.

The research, conducted by Chinese scientists, was first reported by Hemp Today.

Cognitive And Pain Improvements Observed

The research, published in Military Medical Research, reveals that long-term oral administration of CBD could alleviate cognitive impairments, mood disorders and chronic pain.

Rats treated with Epidiolex showed significant improvements in object recognition and memory retention, which are common areas of dysfunction in veterans with GWI. Additionally, CBD treatment helped ease anhedonia— the inability to experience pleasure— and reduced pain sensitivity.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

GWI, which affects 25% to 32% of the 700,000 veterans who served in Operation Desert Storm, stems from exposure to environmental hazards like pesticides, burning oil wells and chemical agents.

Veterans experience chronic fatigue, muscle and joint pain, gastrointestinal issues, respiratory problems, cognitive dysfunction and headaches. The study highlights CBD’s ability to target brain pathways linked to neuroinflammation and oxidative stress, both of which worsen GWI symptoms. In this manner, these findings add to the general notion of cannabis helping Veterans to overcome the consequences of war-related activity.

Read Also: THC Is Beneficial For PTSD Treatment, New Study Reveals

Veterans, Cannabis And War-Related Ailments

Unlike previous treatments such as curcumin or melatonin, Epidiolex proved effective at lower doses, reducing the risk of side effects. The 20 mg/kg dose used in rats equates to about 3.2 mg/kg for humans, offering a more efficient solution compared to other treatments.

The research also notes that Epidiolex didn’t impact motor function, confirming “an excellent safety profile even when taken long-term in low doses, with no observed harmful effects.”

Despite these promising results, the study emphasizes the need for further research, especially regarding potential drug interactions.

While CBD offers hope for veterans with GWI, comprehensive clinical studies are essential before it can become a widespread treatment.

This study, adds to the growing body of research on CBD showing medical uses for cannabis and war-related illnesses, such as PTSD and chronic pain.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Could Have Bought Any of 379 S&P 500 Companies With Nearly $78 Billion. Instead, He Piled It All Into His Favorite Stock.

Few investors receive as much attention on Wall Street as Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. This is because the Oracle of Omaha has lapped Wall Street’s benchmark index, the S&P 500, many times over.

Since taking the reins at Berkshire in the mid-1960s, Buffett has overseen an aggregate return in his company’s Class A shares of more than 5,400,000%. Comparatively, the S&P 500 has increased in value, including dividends, by around 37,000% over the same span.

Buffett’s well-publicized recipe for success has involved buying stakes in time-tested businesses that offer clear-cut competitive advantages and strong management teams. Most importantly, he looks to the horizon when investing and tends to hold on to positions in Berkshire Hathaway’s portfolio for years, if not decades, at a time.

But the Oracle of Omaha is also a big-time believer in portfolio concentration. This is to say that his best ideas are deserving of outsize investment capital.

While mirroring Buffett’s investment activity has, for decades, been a moneymaking strategy, investors will have to do some unconventional digging to locate his favorite stock to buy.

Warren Buffett has been a very selective buyer of stocks for nearly two years

No later than 45 calendar days following the end to a quarter, institutional investors with at least $100 million in assets under management are required to file Form 13F with the Securities and Exchange Commission. A 13F provides an easy-to-understand snapshot of which stocks, industries, sectors, and trends Wall Street’s best money managers bought into and sold out of in the latest quarter.

Warren Buffett’s 13Fs for the last seven quarters (Oct. 1, 2022 to June 30, 2024) show that he and his top investment aides, Ted Weschler and Todd Combs, have been unabashed sellers, with net stock sales totaling close to $132 billion. With Berkshire’s chief sending roughly $7.2 billion worth of Bank of America stock to the chopping block since July 17, it looks to be on pace for an eighth straight quarter of net equity sales.

However, Form 13Fs have highlighted small pockets of selective buying activity. For instance, Buffett can’t seem to get enough of integrated energy company Occidental Petroleum (NYSE: OXY). Since the start of 2022, more than 255.2 million shares of Occidental have been purchased.

Although a higher spot price for crude oil tends to be great news for all drillers, Occidental is especially levered to its drilling segment. While its downstream chemical plants can somewhat hedge downside in the spot price of oil, it relies heavily on elevated oil prices to drive operating cash flow from its upstream drilling operations.

Buffett has also been a willing buyer of property and casualty insurer Chubb (NYSE: CB). Chubb is the company that was revealed in mid-May as the “confidential” stock that Berkshire had been building a position in since the third quarter of 2023.

Though the insurance business tends to be boring, it’s also highly profitable. When catastrophe losses inevitably occur, insurers have a tangible reason to raise premiums on their customers. But even when payouts are on the low end, insurers like Chubb maintain exceptional premium pricing power given that loss claims and catastrophe events are normal occurrences over the long run.

Unfortunately, Berkshire Hathaway’s quarterly Form 13Fs fail to tell the full story about Buffett’s favorite stock to buy.

The Oracle of Omaha has put almost $78 billion to work in a stock near and dear to his heart

Despite holding $13 billion worth of Occidental stock, and nearing $8 billion in Chubb, neither of these holdings are Buffett’s most beloved stock.

This “favorite stock” is a company the Oracle of Omaha has purchased shares of for 24 consecutive quarters (a span of six years), as of June 30, 2024, and has sunk nearly $78 billion worth of his company’s cash into.

To demonstrate just how much conviction Buffett has in his favorite stock, compare this close to $78 billion investment to the 500 companies that comprise the broad-based S&P 500. As of the closing bell on Sept. 13, 379 S&P 500 companies had a lower market cap than the amount of money Buffett has put to work in the stock nearest and dearest to his heart over the last six years. In theory, Buffett could have outright purchased Chipotle Mexican Grill, FedEx, or Target, but chose to plow almost $78 billion into one stock.

The twist is that Buffett’s favorite stock to buy is… shares of his own company.

A 13F isn’t going to detail share repurchase activity. Rather, investors can usually find Berkshire Hathaway’s buyback activity highlighted just prior to the executive certifications page in every quarterly report.

Prior to July 2018, Buffett was only allowed to buy back stock if his company’s shares fell to or below 120% of their book value. Since shares never fell below this threshold, no buybacks were undertaken.

On July 17, 2018, Berkshire Hathaway’s board amended the rules governing buybacks to allow Buffett to work his magic. The new criteria states that buybacks can continue with no end date or ceiling as long as:

-

Berkshire has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Warren Buffett believes shares are intrinsically cheap.

This second point is wide open to interpretation, leaving Buffett with ample room to pull the trigger on buybacks whenever he sees fit. With Berkshire’s cash pile ballooning to an all-time record of $276.9 billion, as of the end of June, Buffett has more than enough firepower to continue repurchasing shares of his own company. The $345 million used for repurchases in the June-ended quarter increased total buybacks since this amendment in July 2018 to almost $78 billion.

One of the key reasons the Oracle of Omaha is such a big fan of buybacks is because they incentivize long-term investing by incrementally increasing the ownership stakes of patient investors. As the outstanding share count declines, each remaining share holds a fractionally larger stake in the company.

Furthermore, buybacks have a way of making most time-tested businesses more fundamentally attractive to investors. Businesses with steady or growing net income, such as Berkshire (sans unrealized investment gains/losses), should see their earnings per share (EPS) expand over time as the company’s share count decreases.

While Buffett might be bullish on Occidental Petroleum and Chubb, no other company can hold a candle to his most beloved stock, Berkshire Hathaway.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Chipotle Mexican Grill, FedEx, and Target. The Motley Fool recommends Occidental Petroleum and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Warren Buffett Could Have Bought Any of 379 S&P 500 Companies With Nearly $78 Billion. Instead, He Piled It All Into His Favorite Stock. was originally published by The Motley Fool