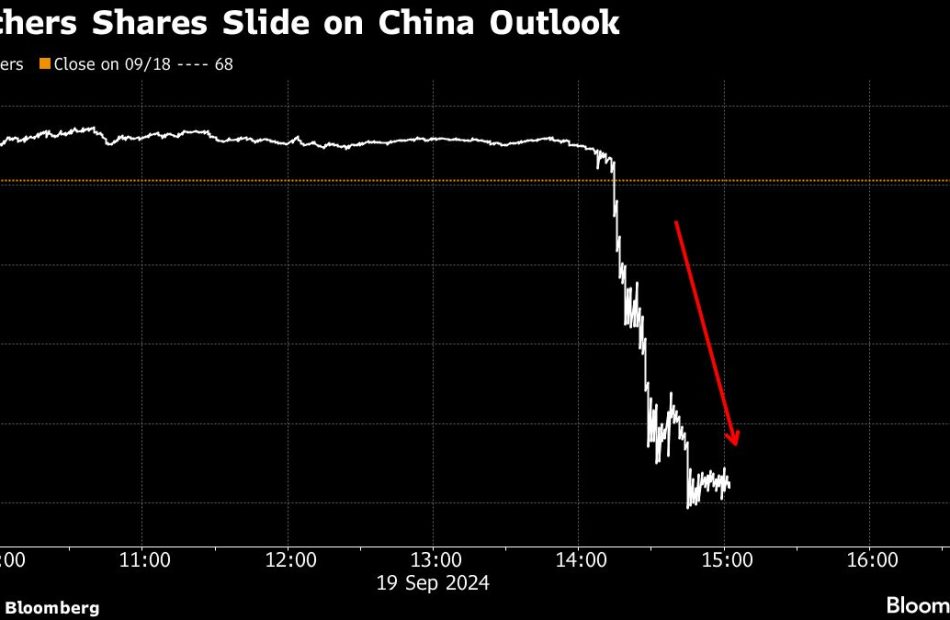

Skechers Stock Tumbles as CFO Gives Warning on China Outlook

(Bloomberg) — Skechers U.S.A. Inc. shares delivered their worst daily performance since February after the footwear company’s chief financial officer told an industry conference that China sales will be under pressure the rest of the year.

Most Read from Bloomberg

Shares slipped 9.6% Thursday to close at $61.56, the lowest level since early August. Footwear peers including Nike Inc. and Under Armour Inc. saw their shares briefly dip on the comments, then rebound. The stock of competitor On Holding AG shed 2.4%.

“We’ve definitely seen worse conditions unfold in China than we expected for the back half of the year, so I would expect the back of the year’s going to be more disappointing than what we had originally thought,” said Skechers CFO John Vandemore at the Wells Fargo Consumer Conference. “I think that’s a market that’s still re-forming itself post Covid.”

China is a major market for global retailers, and concerns about the strength of Chinese consumer buying have long been a focus. The Asia Pacific region accounted for more than a quarter of Skechers’ sales in 2023, according to a filing.

Thursday’s slump put Skechers shares in negative territory for the year. Still, Wall Street is bullish on the company.

Wall Street analysts give Skechers 17 buy ratings and one hold, according to data compiled by Bloomberg. The average price target of about $81 is more than 30% higher than where shares currently trade.

–With assistance from Janet Freund.

(Updates stock move at market close)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Bitcoin, Ethereum, Dogecoin Move Higher As Aggressive Rate Cut By Fed Fuels Crypto Demand: Top Trader's Bullish Forecast For King Crypto Hinges On This Condition

Leading cryptocurrencies edged higher Thursday as risk-taking investors continued to cheer the Federal Reserve’s bold half-point interest rate cut.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:45 p.m. EDT) |

| Bitcoin BTC/USD | +1.73% | $62,980.73 |

| Ethereum ETH/USD |

+2.45% | $2,452.33 |

| Dogecoin DOGE/USD | +0.16% | $0.1042 |

What Happened: Bitcoin surged above $63,800 in the afternoon, clocking its highest value in nearly four weeks. The leading cryptocurrency descended below $63,000 overnight as some investors locked in gains.

The Fed announced a 50 basis point cut in interest rates earlier this week, bringing the federal funds rate down to a range of 4.75% to 5%. Since this move, Bitcoin has leaped nearly 6%.

The second-largest cryptocurrency, Ethereum almost touched $2,500, before retreating to the mid- $2,400 region.

The total cryptocurrency liquidations soared past $124 million in the past 24 hours, with $77 million in downside bets getting wiped out.

Bitcoin’s funding rate was positive on most major cryptocurrency exchanges like Binance and Bybit, indicating the dominance of long-position traders.

The market sentiment was “neutral,” according to the popular Cryptocurrency Fear and Greed Index.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:45 p.m. EDT) |

| Bittensor (TAO) | +11.87% | $378.80 |

| Core (CORE) | +11.51% | $1.07 |

| Immutable (IMX) | +9.06% | $1.50 |

The global cryptocurrency market stood at $2.17 trillion, following an increase of 1.80% in the last 24 hours.

Stocks closed at new highs Thursday. The Dow Jones Industrial Average rose 522.09 points, or 1.26%, to finish at 42,025.19, marking the 30-stock index’s first close above 42,000. The S&P 500 lifted 1.70% to end at 5,713.64, while the tech-focused Nasdaq Composite surged 2.51% to close at 18,013.98.

Inventors weighed in the weekly jobless claims numbers that fell by 12,000 from the prior week to 219,000 in the week ending Sept. 14, well below the estimates.

See More: Best Cryptocurrency Scanners

Analyst Notes: Widely-followed cryptocurrency analyst and trader Ali Martinez observed Bitcoin’s RSI breaking out of a key resistance trendline, prompting him to issue a bullish forecast.

“However, BTC still needs to reclaim the 200-day moving average as support to confirm the continuation of the bull run,” the analyst added the caveat.

Prominent analyst Michaël van de Poppe raised Ethereum’s upside potential after the rate cut, predicting higher inflows into ETFs and more interest in yield.

“The likelihood of more rate cuts will be substantial, through which $ETH and DeFi become way more attractive,” he remarked.

Photo by SvetlanaParnikova on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed rate cuts are arriving too late and layoffs show the US economy is already in a recession, bond king Jeff Gundlach says

-

The Fed should have cut interest rates a lot sooner, according to Jeff Gundlach.

-

The “Bond King” thinks the economy is already in recession, as evidenced by rising layoffs.

-

Job cut announcements climbed 193% over the last month, per a report from Challenger.

The Fed is cutting interest rates too late, as mounting job losses show that the US economy is already in a recession, according to Jeff Gundlach.

The billionaire “bond king” and DoubleLine CEO pointed to the Fed’s anticipated rate move on Wednesday, with markets expecting central bankers to lower the federal funds rate by 50 basis points at the conclusion of their policy meeting. That will mark the first rate cut the Fed has issued in over four years — a shift to prevent high rates from weighing too heavily on the job market and economic growth.

But the economy has already slowed to recessionary levels, Gundlach said in a conference panel on Tuesday, pointing to concerns surrounding the weakening job market.

“We are in a recession already,” Gundlach said at the event, per Bloomberg’s report. “I see an awful lot of layoffs announcement.”

Hiring has slowed steadily over the past year, even as GDP has continued to grow in recent quarters. Layoff announcements climbed 193% over the last month, according to a report from the consultancy Challenger, Gray, & Christmas. Hiring plans for the year have also fallen to their lowest level on record, down 41% in August compared to last year, the report added.

Still, most experts note that the US economy remains on solid footing. GDP grew 3% last quarter. Unemployment, meanwhile, remains near historic lows, with the jobless rate clocking in at 4.2% in August.

Gundlach, though, said he would give the Fed an “F” grade for its performance over the past several years. Central bankers hiked interest rates 525 basis-points in 2022 and 2023 to lower inflation, but they should have responded to inflationary pressures much sooner, he said, which could have prevented interest rates from being kept too high for too long.

“I think they’re going to cut 50 — they seem so out of line,” Gundlach said. ‘The Fed is way behind the curve and they should get their act together.”

Markets will be watching for the Fed’s next rate move and Powell’s prepared remarks Wednesday afternoon. The Fed chief is expected to deliver guidance on the path of further rate cuts, as well as the outlook for the job market and the economy.

Read the original article on Business Insider

FedEx Q1 Earnings: Revenue Miss, EPS Miss, Lowered Guidance — 'Challenging Quarter'

FedEx Corp FDX reported financial results for the first quarter of fiscal 2025 after the market close on Thursday. Here’s a look at the key metrics from the quarter.

Q1 Earnings: FedEx reported first-quarter revenue of $21.6 billion, missing analyst estimates of $21.955 billion, according to Benzinga Pro. The company reported first-quarter adjusted earnings of $3.60 per share, missing analyst estimates of $4.80 per share.

FedEx said its first-quarter results were negatively affected by a mix shift, which reduced demand for priority services, increased demand for deferred services and constrained yield growth. The quarter was also impacted by higher operating expenses and one fewer operating day in the quarter.

Federal Express operating results fell during the quarter due to lower U.S. domestic priority package volume. Increased wage and purchased transportation rates also negatively impacted operating results. FedEx Freight operating results decreased during the quarter due to a decline in weight per shipment and reduced priority shipments.

FedEx noted it completed a $1 billion accelerated buyback during the quarter. The company expects to repurchase an additional $1.5 billion of its common stock during fiscal 2025. As of Aug. 31, $4.1 billion remained on the buyback program. FedEx said it ended the quarter with $5.9 billion in cash on hand.

“Despite a challenging quarter, we remain focused on transforming our network, improving our efficiency, lowering our cost-to-serve, and enhancing our ability to adapt with speed to evolving market dynamics,” said Raj Subramaniam, president and CEO of FedEx.

“Overall, I remain confident in the value-creation opportunities ahead as we focus on reducing our structural cost, growing revenue profitably, and leveraging the insights from our vast collection of data as we continue to build the world’s most flexible, efficient and intelligent network.”

See Also: Darden Restaurants, FedEx And 3 Stocks To Watch Thursday

Outlook: FedEx revised its full-year outlook lower. The company now sees full-year 2025 revenue growing in the low single-digit range, versus its prior outlook of revenue growth in the low-to-mid single-digits.

The company also lowered its full-year earnings forecast from a range of $18.25 to $20.25 per share to a new range of $17.90 to $18.90 per share.

Management will hold a conference call to discuss these quarterly results at 5:30 p.m. ET.

FDX Price Action: FedEx shares were down 8.94% in after hours, trading at $273.55 at the time of publication Thursday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk, Mark Zuckerberg And Jay-Z Take Out Mortgages Despite Their Billion-Dollar Fortunes – Here's Why The Ultra-Wealthy Borrow

It’s easy to think that once someone hits billionaire status, they’d just buy whatever they want with cash – especially something as basic as a home. But even the world’s wealthiest, like Elon Musk, Mark Zuckerberg and Jay-Z, have taken out mortgages for their homes. It’s not because they must, but because it makes good financial sense.

Trending:

According to Federal Reserve data, the typical U.S. home price has shot up over the years – from around $288,000 in 2014 to over $412,000 in 2024. With median annual wages just below $60,000 this year, it’s no wonder people struggle to scrape together enough for a down payment, let alone the full cost of a house.

But here’s where things get interesting. When you’re sitting on billions, like Musk or Zuckerberg, you could buy a house outright without blinking. However, these moguls choose to take out loans instead of dropping cash on the table. Why? It’s all about smart money management.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

First, taking out a mortgage helps keep cash on hand. Cash flow isn’t an issue for people like Musk, but it’s still a handy tool. Think about it – homes are what’s called “illiquid.” Unlike stocks, which can be sold in seconds, homes take time to sell.

Instead of locking away millions in a house, the ultrawealthy prefer to keep their cash accessible, ready for new investments or business opportunities. They can make easy mortgage payments while their liquid assets stay free for more profitable uses.

As financial planner Matt Wilson said, “Mortgages allow wealthy individuals to be more flexible with their money. They can take advantage of better investment opportunities by not tying up a large chunk of it in one place.”

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

According to financial experts, there’s another sweet perk – tax deductions. In the U.S., mortgage interest is tax-deductible on loans up to $750,000. This means billionaires can still claim a deduction on their tax returns. While it may seem like small change to them, it’s still cash saved.

Another reason is investment returns. Currently, the average mortgage rate hovers around 6.2%. Historically, though, rates were even lower. Conversely, the stock market has an average return of 10% annually. Even if the actual return is closer to 7%, that’s still better than what a mortgage costs.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

Think about it this way: why spend $500,000 outright on a house when you could take out a mortgage, invest that same $500,000 in stocks and potentially make an 8% return? You’d end up with more money in the long run. It’s like killing two birds with one stone.

As financial expert Sarah Newman explains, “Why pay off a mortgage when you can invest that money and earn a higher return? It’s about making your money work harder.”

Jay-Z, for instance, took out a mortgage on his $88 million Bel-Air estate. He could have written a check, but took out a loan. Why? Likely because that freed-up cash could be used to invest in more ventures like art, tech or startups, all of which can yield much higher returns over time.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Elon Musk, Mark Zuckerberg And Jay-Z Take Out Mortgages Despite Their Billion-Dollar Fortunes – Here’s Why The Ultra-Wealthy Borrow originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dividend Investor Making $110,000 Shares His Portfolio: Top 12 Stocks and ETFs You Might Be Missing

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing took a back seat ever since the AI-led craze caused everyone to pile into technology growth stocks. However, long-term investors seeking a stable and reliable income stream always look for strong dividend payers that can survive market volatility. A few days ago, a Redditor posted a detailed income report on r/Dividends, a community of over 580,000 members, saying he earns $110,000 a year in dividends with an investment of about $1.2 million.

Check It Out:

The Redditor said part of his portfolio is allocated to money market funds and fixed income.

“About half of it is in money market/fixed income making 5%. All of it together is making $110k a year. Just sharing for feedback and comments. The plan is to move the fixed income into dividend equities as the rates go down so the income keeps up or increases,” he said.

When asked how he accumulated $1.2 million to invest, the Redditor said he worked for 20 years while his wife worked for 15 years.

“We both have 401ks apart from this after-tax account, which we plan to leave alone for a while,” he added.

The investor generously shared his detailed portfolio. Let’s examine some of the important stocks and funds in it.

Schwab Value Advantage Money Fund (SWVXX)

The biggest investment in the portfolio of the Redditor making about $110,000 a year is the money market fund Schwab Value Advantage Money Fund (SWVXX). The fund is suitable for those looking for a stable, secure place to park their cash. It has total assets of about $204 billion and yields approximately 5.13%.

Blackrock Multi-Sector Income Trust

Blackrock Multi-Sector Income Trust (NYSE:BIT) yields about 9.8% and invests in loan and debt instruments. The fund’s goal is to generate income and capital appreciation. Some of its top holdings include FEDERAL NATIONAL MORTGAGE ASSOCIATION, UNIFORM MBS, TRANSDIGM INC., CLOUD SOFTWARE GROUP INC. and HUB INTERNATIONAL LTD.

AGNC Investment Corp

AGNC Investment Corp (NASDAQ:AGNC) is a mortgage REIT with a dividend yield of about 13%. The company pays monthly dividends. AGNC invests in secure agency mortgage-backed securities since Fannie Mae or Freddie Mac guarantees the MBS principal in case of defaults.

Icahn Enterprises LP

Billionaire Carl Icahn’s conglomerate, Icahn Enterprises LP (NASDAQ:IEP), is one of the stocks in the Redditor’s portfolio. IEP has a 30% yield, but its sustainability and safety have been raising questions for quite a while now.

In August, Icahn settled with the SEC over charges related to personal margin loans. Last year, IEP cut its dividend by 50% and now pays about $1 per share.

Horizon Technology Finance Horizon Technology Finance Corp (NASDAQ:HRZN) is a business development company that lends to technology, life science, health care and information services companies. HRZN pays monthly dividends and yields about 12%.

Stellus Capital Investment Corp

Stellus Capital Investment Corp (NYSE:SCM) is another business development company on the list. It pays monthly dividends and yields around 12%. Stellus generates income through its portfolio of debt investments in middle-market companies. The stock is up about 6.5% this year.

Realty Income

Realty Income Corp (NYSE:O) has become a no-brainer dividend stock in Redditors’ portfolios, generating decent monthly income. The company pays monthly dividends and has increased its payouts for 29 years. The latest monthly dividend increase came earlier this month when Realty Income raised its dividend by 0.2%.

Cornerstone Strategic Value Fund

Cornerstone Strategic Value Fund Inc. (NYSEAMERICAN: CLM) is a closed-end fund that generates income by investing in public companies. The fund yields about 17% and pays monthly dividends.

Read More:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Investing in private credit could potentially unlock APY up to 20%, with benefits like shorter term durations and diversified returns – Find out more if you’re an accredited investor.

Global X Nasdaq 100 Covered Call ETF

Global X Nasdaq 100 Covered Call ETF (NASDAQ:QYLD) generates income by selling covered call options on the Nasdaq-100 Index. The fund was started in 2013 and has since paid monthly income to investors. The fund yields about 11.5%. Some of the top holdings of the ETF are Apple, Nvidia, Microsoft, Amazon and Broadcom.

Energy Transfer

With a dividend yield of about 8%, Energy Transfer LP (NYSE:ET) is a popular dividend stock on Reddit. The company is relatively insulated from the volatile commodities market since most of its revenue comes from fee-based contracts. Last month, Energy Transfer LP (NYSE:ET) increased its full-year profit outlook after posting strong volumes for the second quarter.

MPLX

Midstream energy infrastructure company MPLX LP (NYSE:MPLX) is one of the high-yield dividend stocks in the Redditor’s portfolio. The company has a dividend yield of about 8% and is owned by Marathon Petroleum. During the second quarter, MPLX revenue rose about 13% yearly, beating Wall Street’s estimates.

Ares Capital

Ares Capital Corporation (NASDAQ:ARCC) is one of the notable business development companies in the Redditor’s portfolio, earning $110,000 in dividends. The stock has a dividend yield of about 9.4%. During its second-quarter earnings call, Ares Capital’s management said the company swapped its $850 million issued debt to a floating interest rate. Analysts believe this move would help the company position well for the upcoming rate cut cycle, as its interest burden will decrease with the expected ease in monetary policy.

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to give up those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Dividend Investor Making $110,000 Shares His Portfolio: Top 12 Stocks and ETFs You Might Be Missing originally appeared on Benzinga.com

Nvidia, Tesla Rally As Dow, S&P 500 Surge To Fresh Highs After Fed Cuts Rates: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, while the index remained in the “Greed” zone on Thursday.

U.S. stocks settled higher on Thursday, with the Dow Jones index and S&P 500 hitting fresh record highs during the session. The US Federal Reserve, on Wednesday, slashed interest rates by 50 basis points Wednesday at its September Federal Open Market Committee meeting, lowering the federal funds rate to a range of 4.75% to 5%.

On the economic data front, the U.S. reported a current account deficit of $266.8 billion in the second quarter versus a gap of $241 billion in the prior period and higher than market estimates of a $260 billion gap. U.S. initial jobless claims fell by 12,000 from the prior week to 219,000 in the week ending September 14, compared to market expectations of 230,000.

Tech stocks rallied, with shares of NVIDIA Corporation NVDA and Advanced Micro Devices, Inc. AMD gaining around 4% and 6%, respectively. Micron Technology, Inc. MU shares added 2.2% during the session. Tesla Inc. TSLA also surged, closing the day with gains of 7.4%.

Most sectors on the S&P 500 closed on a positive note, with consumer discretionary, communication services, and information technology stocks recording the biggest gains on Thursday. However, consumer staples and utilities stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 522 points to 42,025.19 on Thursday. The S&P 500 surged 1.70% to 5,713.64, while the Nasdaq Composite climbed 2.51% at 18,013.98 during Thursday’s session.

Investors are awaiting earnings results from VinFast Auto Ltd. VFS today.

What is CNN Business Fear & Greed Index?

At a current reading of 65.7, the index remained in the “Greed” zone on Thursday, versus a prior reading of 60.8.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

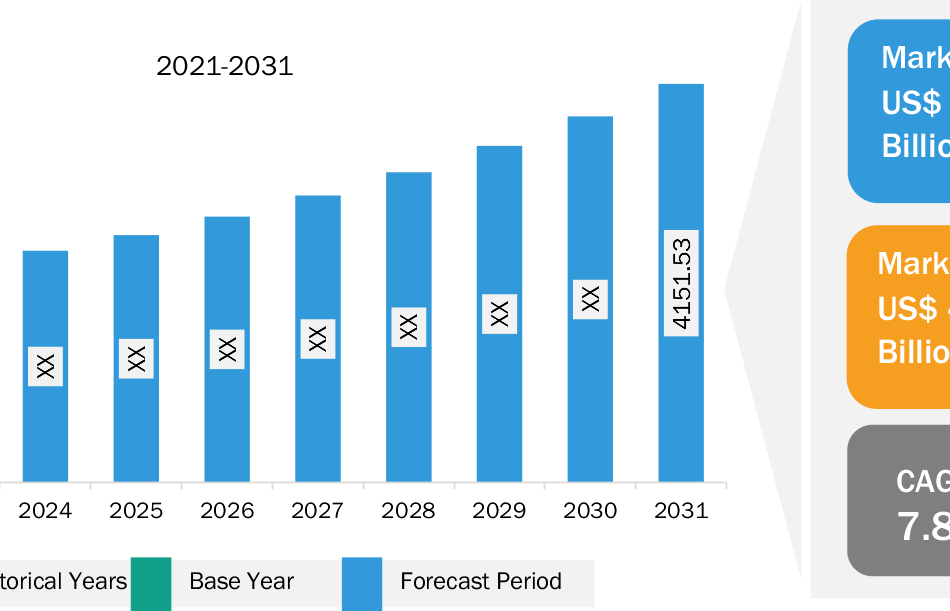

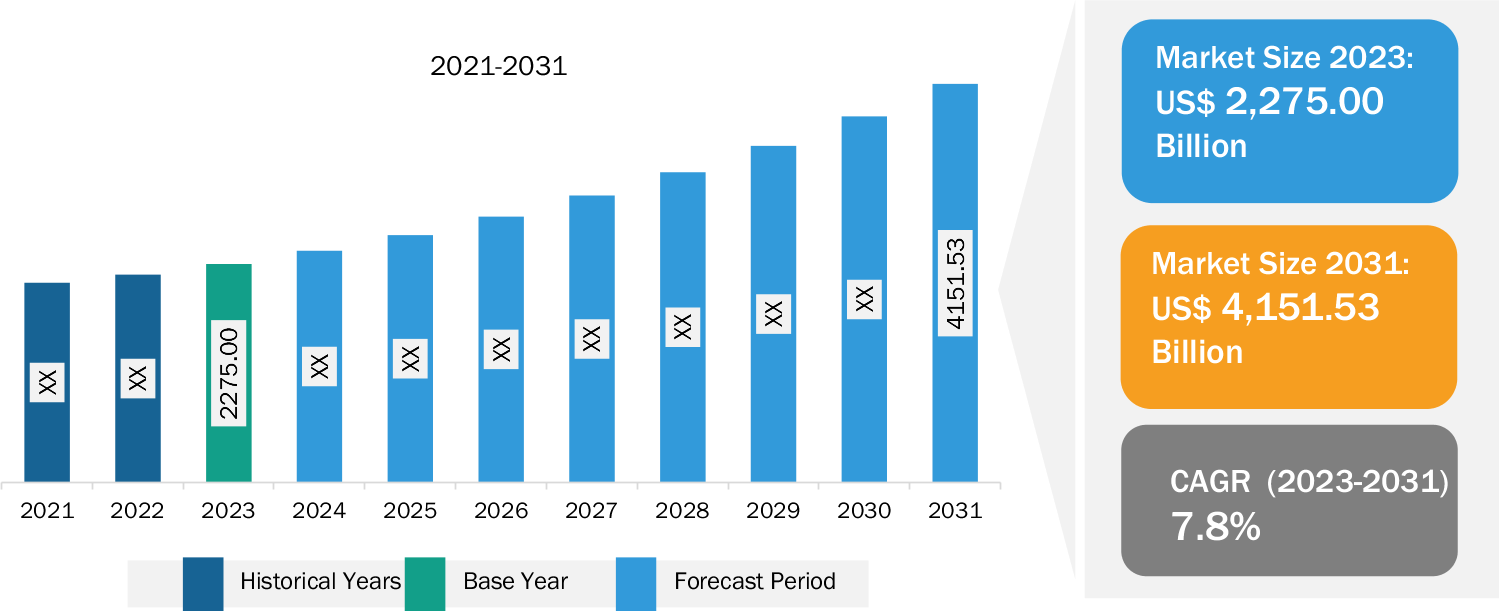

Engineering Professional Services Market Worth $4,151.53 Billion, Globally, by 2031 – Exclusive Report by The Insight Partners

US & Canada, Sept. 19, 2024 (GLOBE NEWSWIRE) — According to a new comprehensive report from The Insight Partners, the global engineering professional services market is observing significant growth owing to surge in demand for civil engineering services owing to rapid urbanization and rapid advancement of industrial IoT.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the engineering professional services market comprises a vast array of type, service type, sector, vertical and geography which are expected to register strength during the coming years.

Download Sample PDF Brochure: https://www.theinsightpartners.com/sample/TIPRE00039033/

Overview of Report Findings:

1. Market Growth: The engineering professional services market was valued at US$ 2275.00 billion in 2023 and is projected to reach US$ 4151.53 billion by 2031; it is expected to register a CAGR of 7.8% during 2023–2031.

Identify The Key Trends Affecting This Market – Download PDF

2. By geography, the engineering professional services market is segmented into the Americas, Europe, and Asia Pacific and Middle East & Africa (APMEA). The Americas dominated the engineering professional services market in 2023. The engineering professional services market in the Americas (particularly in the US) is substantial and dynamic, with significant market size and growth potential. The presence of multinational engineering firms in the local market has supported the local engineering services in the Americas, contributing to the growth and demand for more engineers at a global level and boosting the demand for engineering professional services.

3. Europe is the second-largest contributor to the global engineering professional services market, followed by APMEA. The engineering professional services market in APMEA encompasses various verticals, including advanced manufacturing, energy and utilities, infrastructure, and environmental. APMEA is witnessing significant advancements in advanced manufacturing, driven by technological innovations and the adoption of Industry 4.0 principles. This has led to a growing demand for engineering professional services to support the development and implementation of advanced manufacturing processes and technologies.

Purchase Premium Copy of Engineering Professional Services Market Growth Report (2023-2031) at: https://www.theinsightpartners.com/buy/TIPRE00039033/

Market Segmentation:

- Based on type, the market is bifurcated into consulting and non-consulting. The consulting segment held a larger share of the engineering professional services market in 2023.

- Based on service type, the market is segmented into designing and construction, ESG, program management, and others. The designing and construction segment held a larger share of the engineering professional services market in 2023.

- Based on sector, the market is bifurcated into private and public. The private segment held a larger share of the engineering professional services market in 2023.

- Based on vertical, the market is segmented into advanced manufacturing, infrastructure, energy and utilities, environmental, transportation, and others. The transportation segment held a larger share of the engineering professional services market in 2023.

- The engineering professional services market is segmented into five major regions: North America, Europe, APAC, Middle East and Africa, and South and Central America.

Obtain Analysis of Key Geographic Markets – Download PDF

Competitive Strategy and Development:

- Key Players: A few major companies operating in the engineering professional services market include Accenture PLC, Capgemini SE, Larsen & Toubro Technology Services, Tata Consultancy Services, and Wipro Ltd.

- Trending Topics: Engineering Software, Engineering Design Development Software, Engineering Information Management [EIM] Solution, and 3D Engineering Animation.

Want More Information about Competitors and Market Players? Get PDF

Global Headlines on Engineering Professional Services Market:

- “Tata Consultancy Services Ltd’s subsidiary, Tata Consulting Engineers Limited, revealed its cooperation in the Shri Ram Janmbhoomi Teerth Kshetra Project. The company provides design review, engineering, and project management consultants for the entire project.”

- “Sweco AB led a consortium to develop a new large-scale hospital complex in south Luxembourg. This hospital is expected to be fully operational by 2033, and the company will be responsible for managing the entire spectrum of design phases in the project.”

Conclusion:

Rapid technological advancements, increasing infrastructure development, and the growing demand for sustainable and innovative solutions across various industries present significant opportunities for engineering professional services. Additionally, the global emphasis on smart cities, digital transformation, and renewable energy initiatives expands the market potential. Moreover, the rising complexity of engineering projects, coupled with the need for specialized expertise, creates a demand for tailored engineering solutions, thereby opening avenues for market growth.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement

The report from The Insight Partners, therefore, provides several stakeholders—including service providers and end users —with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.

Related Report Titles:

- Engineering Software Market Forecast and Growth 2031

- Architectural Engineering and Construction Software Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Cloud Engineering Market Outlook, Segments, Geography, Dynamics, Recent Developments, and Strategic Insights by 2031

- IoT Engineering Services Market Size and Forecasts (2021 – 2031)

- Automotive Acoustic Engineering Services Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Civil Engineering Design Software Market Size and Forecasts (2021 – 2031)

- Computer Aided Engineering Market Size and Forecasts (2021 – 2031)

- Industrial IoT Gateway Market Size and Forecasts (2021 – 2031)

- 5G Industrial IoT Market Size and Forecasts (2021 – 2031)

- Online Program Management Market to Grow at a CAGR of 15.4% to reach US$ 26,253.37 million from 2019 to 2027

- Spend Analytics for Electronics and Semiconductor Market – 16.1% CAGR (2030)

- EV Battery Reuse Market Size and Forecasts (2021 – 2031)

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/engineering-professional-services-market

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LVMH's Bernard Arnault has gone from the world's richest person to flirting with 5th place after a $54 billion wipeout

-

Bernard Arnault has gone from the world’s wealthiest person to being on the brink of dropping to fifth.

-

The LVMH CEO’s net worth has tanked by $54 billion from its March peak, and $30 billion so far this year.

-

LVMH stock has slumped 16% this year as softer demand has hit the company’s sales and profits.

Bernard Arnault was the richest person on the planet six months ago; now he’s flirting with fifth place.

Arnault is the founder and CEO of LVMH Moët Hennessy Louis Vuitton, the French luxury-goods behemoth. In late March, he was worth an estimated $231 billion, ranking him ahead of Tesla CEO Elon Musk and Amazon founder Jeff Bezos at the top of the Bloomberg Billionaires Index.

The fashion tycoon’s fortune has shrunk by $54 billion since then to $177 billion at Wednesday’s close. That places him fourth and only $1 billion ahead of the Oracle cofounder Larry Ellison.

Arnault’s net worth has tanked by $30 billion this year, making him the biggest wealth loser among the 500 individuals on Bloomberg’s list. He’s also the only person among the 18 richest people who’s in the red for 2024; the others have all gained at least $14 billion and as much as $63 billion.

Forbes’ wealth rankings tell a similar story: Arnault has dropped from first place, with a $233 billion net worth on March 8, to fifth, with a $175 billion fortune, behind Musk, Bezos, Ellison, and Meta CEO Mark Zuckerberg.

The wealth hit for the “Wolf in Cashmere” reflects a 16% slump in LVMH’s stock price to its lowest level in two years. Arnault owns about 48% of the luxury conglomerate, which houses around 75 brands, including Tiffany & Co., Louis Vuitton, Dom Perignon, and Sephora.

LVMH shares have been hit by the company’s troubles. It struggled in the first half of this year with underlying revenues inching up only 2% and income from recurring operations sliding 8%. Underlying profits tanked 26% in the wines and spirits business, 19% in watches and jewelry, and 6% in the key fashion and leather goods segment.

Arnault also warned of a “climate of economic and geopolitical uncertainty” in the earnings release. Meanwhile, Bloomberg reported last month that Sephora was slashing its 4,000-person workforce in China by 10% to weather a challenging local market.

The luxury industry boomed after the pandemic as travel resumed and pent-up shopping demand was released. But it has struggled more recently as historic inflation, steeper interest rates, and recession fears have tempered demand even among wealthy consumers.

Read the original article on Business Insider

ORBIT GARANT DRILLING REPORTS FISCAL 2024 FOURTH QUARTER AND YEAR-END FINANCIAL RESULTS

– Margins increased in fourth quarter, following exit from West Africa and continued demand for drilling services from senior and intermediate mining customers –

VAL-D’OR, QC, Sept. 19, 2024 /CNW/ – Orbit Garant Drilling Inc. OGD (“Orbit Garant” or the “Company”) today announced its financial results for the three-month period (“Q4 2024”) and fiscal year ended June 30, 2024. All dollar amounts are in Canadian dollars unless otherwise stated.

Financial Highlights

|

($ amounts in millions, except per share amounts) |

Three months ended |

Three months ended |

Fiscal year ended |

Fiscal year ended |

|

Revenue |

45.3 |

46.8 |

181.2 |

201.0 |

|

Gross Profit |

7.3 |

0.7 |

20.4 |

18.3 |

|

Gross Margin (%) |

16.1 |

1.4 |

11.2 |

9.1 |

|

Adjusted Gross Margin (%)¹ |

21.7 |

15.9 |

16.7 |

16.2 |

|

Adjusted EBITDA¹ |

6.4 |

1.8 |

14.4 |

19.1 |

|

Net earnings (loss) |

(1.2) |

(4.1) |

(1.3) |

(0.7) |

|

Net earnings (loss) per share |

||||

|

– Basic and diluted ($) |

(0.04) |

(0.11) |

(0.04) |

(0.02) |

|

(1) This is a non-IFRS measure and is not a standardized financial measure. The Company’s method of calculating such financial measures may differ from the methods used by other issuers and, accordingly, the definition of these non-IFRS financial measures may not be comparable to similar measures presented by other issuers. Refer to “Reconciliation of Non-IFRS financial measures” on page 4 of this news release for more information about each non-IFRS measure and for the reconciliations to the most directly comparable IFRS financial measures. |

“We generated solid margins in our fiscal fourth quarter, reflecting continued steady demand from our senior and intermediate mining customers in Canada and Chile, and our cessation of operations in West Africa earlier this year. Our year-over-year decline in revenue for the quarter reflects our exit from West Africa and the current low levels of junior exploration activity in Canada, which is attributable to their continued restrained access to capital,” said Pierre Alexandre, President and CEO of Orbit Garant. “During fiscal year 2024, we entered into an agreement to sell our remaining assets in West Africa and recorded a long-term account receivable totalling $7.5 million as compensation. During the quarter, we recorded a non-cash substantial modification of a receivable and expected credit loss totalling $5.2 million. Excluding this modification, our net income would have been $4.0 million, or $0.11 per share for the quarter.”

“While financing conditions remain challenging for junior exploration and certain intermediates companies in Canada, we expect to maintain our improved margins based on our expertise in drilling contracts with senior and well-financed intermediate mining companies, which represented 87% of our revenue for fiscal 2024. Record-high gold prices and strong copper pricing are providing incentive for producing mining companies to continue investing in mine development activities.”

Fourth Quarter Results

Revenue for Q4 2024 totalled $45.3 million, a decrease of 3.0% compared to $46.8 million for the three-month period ended June 30, 2023 (“Q4 2023”). Canada revenue totalled $32.8 million in Q4 2024, an increase of 0.9% compared to $32.6 million in Q4 2023. Canada revenue was negatively affected by financing difficulties for junior and intermediate mining companies during Q4 2024, resulting in lower drilling activity than previous years, whereas revenue in Q4 2023 was negatively impacted by project suspensions due to forest fires. International revenue totalled $12.5 million in Q4 2024 compared to $14.2 million in Q4 2023. The year-over-year decline in international drilling revenue reflects the Company’s cessation of drilling activity in Burkina Faso and Guinea during its Fiscal 2024 second quarter (“Q2 2024”), partially offset by increased drilling activity in Chile.

The Company recorded a one-time, non-cash $4.2 million restructuring charge in Q4 2023 relating to its decision to exit Burkina Faso and complete its drilling program in the country during Q2 2024. The restructuring charge reflects a write-down of inventory to its net realizable value. Orbit Garant subsequently made the decision to not renew its drilling contract in Guinea, which was completed at the end of Q2 2024, as the Company determined that it was no longer financially viable to maintain drilling activities in West Africa considering its exit from Burkina Faso.

The Company had entered into an agreement to sell its inventories, for an amount of $1.2 million, and property, plant and equipment, for an amount of $6.3 million, located in West Africa and recorded a short-term receivable as compensation, for an amount of $7.5 million. As at June 30, 2024, the Company recorded the derecognition of the short-term receivable and the recognition of a new long-term receivable of $3.9 million following a significant change in contractual payment terms of the receivable. The effect of this substantial modification of the receivable is a loss of $3.5 million included in the expenses of the Consolidated Statements of Loss. The Company also recognized an expected credit loss on this receivable for an amount of $1.7 million in the Consolidated Statements of Loss.

Gross profit for Q4 2024 was $7.3 million, or 16.1% of revenue, compared to $0.7 million, or 1.4% of revenue, in Q4 2023. The increase in gross profit and gross margin reflects the write-down of inventories from restructuring in Q4 2023, as discussed above, and improved profitability of the Company’s international operations, resulting from the Company’s increased drilling activity in Chile and the cessation of drilling activity in West Africa, which was unprofitable. Depreciation expenses totalling $2.5 million are included in the cost of contract revenue for Q4 2024, compared to depreciation expenses of $2.6 million and the $4.2 million write-down of inventories from restructuring in Q4 2023. Adjusted gross margin¹, excluding depreciation expenses, was 21.7% in Q4 2024, compared to adjusted gross margin¹, excluding depreciation expenses and the write-down of inventories, of 15.9% in Q4 2023. The increase in adjusted gross margin¹ primarily reflects increased profitability of the Company’s international operations.

General and Administrative expenses were $4.0 million, or 8.9% of revenue, in Q4 2024, compared to $5.1 million, or 10.9% of revenue, in Q4 2023.

Adjusted EBITDA¹ totalled $6.4 million in Q4 2024 compared to $1.8 million in Q4 2023. The increase primarily reflects growth in operating earnings from the Company’s international operations. Net loss for Q4 2024 was $1.2 million, or $0.04 per share, compared to a net loss of $4.1 million, or $0.11 per share, in Q4 2023. The net loss in Q4 2024 was primarily attributable to the $5.2 million effect of the substantial modification of a receivable and expected credit loss, as discussed above.

Fiscal 2024 Results

Revenue in Fiscal 2024 totalled $181.2 million, a decrease of 9.8% compared to $201.0 million in Fiscal 2023. Canada revenue totalled $132.6 million in Fiscal 2024, a decrease of 12.8% compared to $152.1 million in Fiscal 2023. The decline was primarily attributable to customer decisions to temporarily suspend or reduce drilling activity on certain projects throughout the first half of Fiscal 2024. The Company gradually resumed operations on the drilling projects that were temporarily suspended or reduced, and all of these projects had fully resumed by January 2024. International revenue totalled $48.6 million in Fiscal 2024, a decrease of 0.4% compared to $48.9 million in Fiscal 2023. The decline was primarily due to a reduction of drilling activity in Guinea, Burkina Faso and Guyana, partially offset by increased drilling activity in Chile.

Gross profit for Fiscal 2024 was $20.4 million, or 11.2% of revenue, compared to $18.3 million, or 9.1% of revenue, in Fiscal 2023. Depreciation expenses of $9.9 million are included in cost of contract revenue for Fiscal 2024, compared to depreciation expenses of $10.1 million and the $4.2 million write-down of inventories from restructuring in Fiscal 2023. Adjusted gross margin¹, excluding depreciation expenses, was 16.7% in Fiscal 2024, compared to adjusted gross margin¹, excluding depreciation expenses and the write-down of inventories, of 16.2% in Fiscal 2023.

The increases in gross profit, gross margin, and adjusted gross margin¹ primarily reflect increased drilling revenue in Chile and the cessation of drilling activities in West Africa, partially offset by the decline in drilling activity on certain projects in Canada during the first half of Fiscal 2024, as discussed above.

General and administrative expenses were $15.6 million, or 8.6% of revenue in Fiscal 2024, compared to $16.4 million, or 8.2% of revenue, in Fiscal 2023.

Adjusted EBITDA¹ was $ 14.4 million for Fiscal 2024, a decrease of $4.7 million compared to adjusted EBITDA of $19.1 million in Fiscal 2023. The decrease reflects the reduction of drilling activity in Canada due to project suspensions or reductions during the first half of Fiscal 2024, and the costs related to retaining key personnel on these projects and then ramping them back up. The Company also had a $3.0 million negative variation in foreign exchange. These negative factors were partially offset by the positive variation in the profitability of the Company’s international drilling operations.

Net loss for Fiscal 2024 was $1.3 million, or $0.04 per share, compared to a net loss of $0.7 million, or $0.02 per share, in Fiscal 2023. The Company’s net loss in Fiscal 2024 reflects the reduction of drilling activity in Canada due to project suspensions or reductions during the first half of the year, costs related to retaining key personnel on these projects and then ramping them back up, a $3.0 million negative variation in foreign exchange, and the $5.2 million effect of the substantial modification of a receivable and expected credit losses on the sale of assets located in West Africa, as discussed above. These negative factors were partially offset by the positive variation in the operating earnings of the Company’s international drilling operations and a $3.7 million income tax recovery in Fiscal 2024, compared to a $1.1 million income tax expense in Fiscal 2023.

Liquidity and Capital Resources

The Company repaid a net amount of $0.7 million on its Credit Facility in Fiscal 2024, compared to $9.3 million in Fiscal 2023. The Company’s long-term debt under the Credit Facility, including US$3.0 million ($4.1 million) drawn from the US$5.0 million revolving credit facility and the current portion, was $21.5 million as at June 30, 2024, compared to $22.2 million as at June 30, 2023.

As at June 30, 2024, the Company’s working capital totalled $48.9 million, compared to $50.4 million as at June 30, 2023. Orbit Garant’s working capital requirements are primarily related to the funding of inventory and the financing of accounts receivable. As at June 30, 2024, Orbit Garant had 37,372,756 common shares issued and outstanding.

Orbit Garant’s audited consolidated financial statements and management’s discussion and analysis for Fiscal 2024 are available via the Company’s website at www.orbitgarant.com or SEDAR+ at www.sedarplus.ca.

Conference Call

Pierre Alexandre, President and CEO, and Daniel Maheu, CFO, will host a conference call for analysts and investors on Friday, September 20, 2024 at 10:00 a.m. (ET). To join the conference call without operator assistance, you can register and enter your phone number at https://emportal.ink/3T744zY to receive an instant automated call back. Alternatively, you can dial 437-900-0527 or 1-888-510-2154 to reach a live operator that will join you into the call.

A live webcast of the call will be available on Orbit Garant’s website at: http://www.orbitgarant.com/en/events. The webcast will be archived following conclusion of the call. To access a replay of the conference call dial 289-819-1450 or 1-888-660-6345, passcode: 17693 #. The replay will be available until September 27, 2024.

RECONCILIATION OF NON – IFRS FINANCIAL MEASURES

Financial data has been prepared in conformity with International Financial Reporting Standards (“IFRS”). However, certain measures used in this discussion and analysis do not have any standardized meaning under IFRS and could be calculated differently by other companies. The Company believes that certain non-IFRS financial measures, when presented in conjunction with comparable IFRS financial measures, are useful to investors and other readers because the information is an appropriate measure to evaluate the Company’s operating performance. Internally, the Company uses this non-IFRS financial information as an indicator of business performance. These measures are provided for information purposes, in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS.

|

EBITDA, adjusted EBITDA and adjusted EBITDA margin: |

EBITDA is defined as net earnings (loss) before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of (i) the write-down of inventories from restructuring in Burkina Faso and of (ii) the effect of the substantial modification of a receivable and expected credit loss. Adjusted EBITDA margin is defined as the percentage of adjusted EBITDA to contract revenue. |

|

Adjusted gross profit and adjusted gross margin: |

Adjusted gross profit is defined as gross profit excluding depreciation and write-down of inventories from restructuring in Burkina Faso. Adjusted gross margin is defined as the percentage of adjusted gross profit to contract revenue. |

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

Management believes that EBITDA is an important measure when analyzing its operating profitability, as it removes the impact of financing costs, certain non-cash items, income taxes and restructuring costs. As a result, Management considers it a useful and comparable benchmark for evaluating the Company’s performance, as companies rarely have the same capital and financing structure.

Reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

|

(audited) (in millions of dollars) |

Q4 2024 |

Q4 2023 |

Fiscal 2024 |

Fiscal 2023 |

Fiscal 2022 |

|

Net loss for the period |

(1.2) |

(4.1) |

(1.3) |

(0.7) |

(6.6) |

|

Add: |

|||||

|

Finance costs |

0.8 |

0.9 |

3.5 |

3.4 |

2.2 |

|

Income tax expense |

(1.2) |

(2.1) |

(3.7) |

1.1 |

3.2 |

|

Depreciation and amortization |

2.8 |

2.9 |

10.7 |

11.1 |

11.2 |

|

EBITDA |

1.2 |

(2.4) |

9.2 |

14.9 |

10.0 |

|

Write-down of inventories from restructuring in Burkina Faso Effect of the substantial modification of a receivable and expected credit loss |

– 5.2 |

4.2 – |

– 5.2 |

4.2 – |

– – |

|

Adjusted EBITDA |

6.4 |

1.8 |

14.4 |

19.1 |

10.0 |

|

Contract revenue |

45.3 |

46.8 |

181.2 |

201.0 |

195.5 |

|

Adjusted EBITDA margin (%) (1) |

14.1 |

3.8 |

7.9 |

9.5 |

5.1 |

|

(1) Adjusted EBITDA, divided by contract revenue X 100 |

Adjusted Gross Profit and Adjusted Gross Margin

Although adjusted gross profit and adjusted gross margin are not recognized financial measures defined by IFRS, Management considers them to be important measures as they represent the Company’s core profitability, without the impact of depreciation expense. As a result, Management believes they provide a useful and comparable benchmark for evaluating the Company’s performance.

Reconciliation of Adjusted Gross Profit and Adjusted Gross Margin

|

(audited) (in millions of dollars) |

Q4 2024 |

Q4 2023 |

Fiscal 2024 |

Fiscal 2023 |

Fiscal 2022 |

|

Contract revenue |

45.3 |

46.8 |

181.2 |

201.0 |

195.5 |

|

Cost of contract revenue |

38.0 |

46.2 |

160.9 |

182.7 |

181.7 |

|

Less: depreciation write-down of inventories from restructuring in Burkina Faso |

(2.5) – |

(2.6) (4.2) |

(9.9) – |

(10.1) (4.2) |

(10.0) – |

|

Direct costs |

35.5 |

39.4 |

151.0 |

168.4 |

171.7 |

|

Adjusted gross profit |

9.8 |

7.4 |

30.2 |

32.6 |

23.8 |

|

Adjusted gross margin (%) (1) |

21.7 |

15.9 |

16.7 |

16.2 |

12.2 |

|

(1) Adjusted gross profit, divided by contract revenue X 100 |

About Orbit Garant

Headquartered in Val-d’Or, Québec, Orbit Garant is one of the largest Canadian-based mineral drilling companies, providing both underground and surface drilling services in Canada and internationally through its 188 drill rigs and approximately 1,000 employees. Orbit Garant provides services to major, intermediate and junior mining companies, through each stage of mining exploration, development and production. The Company also provides geotechnical drilling services to mining or mineral exploration companies, engineering and environmental consultant firms, and government agencies. For more information, please visit the Company’s website at www.orbitgarant.com.

Forward-looking information

This news release may contain forward-looking statements (within the meaning of applicable securities laws) relating to business of Orbit Garant Drilling Inc. (the “Company”) and the environment in which it operates. Forward-looking statements are identified by words such as “believe”, “anticipate”, “expect”, “intend”, “plan”, “will”, “may” and other similar expressions. These statements are based on the Company’s expectations, estimates, forecasts and projections. They are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Risks and uncertainties that could cause actual results, performance or achievements to differ materially include the world economic climate as it relates to the mining industry; the Canadian economic environment; the Company’s ability to attract and retain customers and to manage its assets and operating costs; the political situation in certain jurisdictions in which the Company operates and the operating environment in the jurisdictions in which the Company operates, as well as the risks and uncertainties are discussed in the Company’s regulatory filings available at www.sedarplus.ca. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, a forward-looking statement speaks only as of the date on which such statement is made. The Company undertakes no obligation to publicly update any such statement or to reflect new information or the occurrence of future events or circumstances except as required by applicable securities laws.

SOURCE Orbit Garant Drilling Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/19/c0286.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/19/c0286.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.